Recently, I saw a thread on Facebook that referenced this post from TheStreet.com, in which Jim Cramer and Marc Chaikin just trash Zillow:

Marc Chaikin, founder and CEO of Chaikin Analytics, compared the company to a “landmine” in his webinar with Jim Cramer Wednesday, Nov. 7.

Cramer jumped in and said, “if you have Zillow in your portfolio, it’s going to ruin you.”

Those are some pretty strong words coming from two stock market veterans. Chaikin defended himself by saying that he’d rather bet on Sam Zell than Zillow.

Cramer said that the reason that the stock is suffering–it’s down over 26% year-to date–is because it’s desperate. Chaikin said the company’s “business model is ridiculous.”

Since I don’t own any ZG stock, and generally don’t care that much about financial markets, this is a non-issue for me. Except that last statement that the company’s business model is ridiculous is something I care about, because what Cramer and Chaikin were talking about is Zillow’s foray into iBuyer, in which the company would buy homes from sellers directly, then resell them.

Now, a few days earlier, I was involved in a conversation on Facebook again, where Brad Inman of Inman News predicted that iBuyer would have 20% market share by end of 2019. My response was something along the lines of “I don’t know about 20% by end of 2019, but I wouldn’t be surprised at 60% by end of 2024.” More than a few people expressed shock and amazement. Which is hardly the first time I’ve gotten that reaction.

I thought it would be fun to make the case that iBuyer will become the default way that Americans buy and sell houses within the next five years. That doesn’t mean it’s going to happen, obviously. Nor does it mean that I’m predicting that will happen. If I knew the future like that, I’d be a stock picker, not a consultant. But in making the case for why iBuyer would be the default, it lets us all take a look at some fundamental trends and factors in the residential real estate industry, and that could be fun and edifying at the same time. Edutainment!

Chaikin and Cramer and Doubters All

First, let’s make sure of what is being called a ridiculous business model. Chaikin says, “You just can’t be in, well, here’s the thing: it was so obvious their business model is ridiculous. They’re buying and selling houses….”

Cramer exclaims, talks about how Zillow went into Phoenix and Denver, bought 130 houses and sold thirty at the hottest markets (Denver) at the top. They then wonder “What was Spencer doing?” and say “This was crazy. It was such a bad idea.”

Well, that piqued my interest, seeing as how I wrote a giant paper in August literally called “The Truth About iBuyers“. As far as I can tell, Cramer and Chaikin are making the exact same mistake that every doubter seems to make when it comes to iBuyers: they think of iBuyers as investors, house flippers.

To quote Jules Winnfield from Pulp Fiction, “Allow me to retort.”

iBuyer is Not Real Estate Investing; Real Estate Investing is Not iBuyer

I’ll just quote liberally from my August Red Dot here:

One reason for framing the iBuyer as a tech-enabled investor is that the impact of house flippers and investors is relatively limited. Just a tiny percentage of homeowners ever sell to an investor or to a house flipper because their circumstances dictate a need for cash fast, or because their houses are in such poor condition that only an investor or a house flipper would buy them.

…

Having said all that, my overall hypothesis is that this framing of the iBuyer as a tech-enabled house flipper with tons of capital is incorrect. That may turn out to be the ultimate end, since intentions and reality have a way of conflicting, but it ignores some important truths about iBuyers. Those truths are not about iBuyers per se, but about the reality of the broken process for selling and buying homes in North America today.

And that reality has a far greater potential impact than house flipping ever has or ever will on the industry.

And to bolster my argument that iBuyers are not investors, let me quote Spencer Rascoff from his Q2/2018 earnings call:

To address the investor concern or media concern about this overall business expansion, I think it is a gross mischaracterization and misunderstanding to call this a flipping business. Flipping requires distressed homes and distressed sellers, people that are selling their home under duress, and it only applies to a very small segment of the market. Most people are not willing to sell their home to a flipper because their home doesn’t meet that type of criteria. They’re not desperate. They’re not willing to sell it for 20% or 30% below market.

What we’re doing at Zillow Group appeals to a much, much broader segment of the market. It appeals to anybody that values speed, certainty, ease, convenience, the ability to sync up the timing of the sale of their home and the purchase of the next home. That is appealing to a much broader swath of consumers. Arguably, most people need to lighten up the sale of their home with the purchase of the next home. So you can think of it as a service for which we charge a fee. It is not a flipping business.[Emphasis added]

So what comes to my mind when I hear Cramer and Chaikin, two incredibly smart guys with far more experience in betting on companies, is a question: When was the last time either of them bought or sold a house?

And perhaps more importantly, what was the experience like for a couple of extremely wealthy financiers?

The Issue of Pain

I don’t know either of their situations, but these guys are worth tens or hundreds of millions, if not billions. I seriously doubt that a primary residence is the most important asset they own. I wouldn’t be the least bit surprised if they owned multiple homes around the world, because, well, Lifestyles of the Rich and Famous, no?

Do rich people like them ever find a house they want, and put in an offer contingent on if their current home sells? What about mortgage contingencies? Do they even do anything personally besides touring a home with a top notch luxury REALTOR, nodding and appreciating gorgeous lake views, professional-grade appliances, saying, “We’ll take it; take up the details with my accountant/personal assistant/valet” and going to lunch?

I don’t know. I’m going to guess not, because their time is better spent making additional millions than in filling out mortgage application forms.

An anecdote, which is not evidence, but it’s also not nothing. I did know one certifiably rich guy in New York who sold his company for several hundred million dollars to a much larger competitor. I was on a consulting gig with him way back in the day. While we were working on stuff, he was buying a new house. Well, “house” is not what I’d call a 40-acre estate in the Hamptons, but anyhow…. I believe the price was something like $30 million. I distinctly remember him telling me that he was getting a mortgage for $1 million. Why? Because he said that the bank would then do all the due diligence on the house, its valuation, its condition, etc. without him having to deal with it. He’d pay off the loan the week after the closing.

As you might imagine, that is not the experience for the vast majority of people buying and selling homes.

I’ve pointed this out time and again when talking about iBuyer, but real estate agents and brokers often forget just how annoying and painful and uncertain it is to buy or sell a home in America today. And that pain has nothing to do with the real estate agent. You could have the most wonderful, most professional, most knowledgeable REALTOR on the planet, but that doesn’t change the mortgage process, doesn’t change staging a home, doesn’t change having to update the home, keeping it clean, enduring showings, etc. etc. and so on and so forth. Your amazing REALTOR can’t make the bank approve the loan for the buyer, while you wait and wait hoping and praying that the buyer gets the Clear to Close, because boy it would suck to have to relist the home for sale and go through that whole process all over again.

Maybe the rich and famous can’t understand why a company like Opendoor and Zillow and Redfin would take on balance sheet risk and get involved in buying and selling houses, because buying and selling houses is just such an easy, breezy, simple thing for them: find a house, buy it, move in, sell the old one. What’s the problem?

Speed, convenience, certainty — that’s what the iBuyer programs are all about. In a way, it’s giving the average consumer the experience of what it’s like to be a super rich guy like Jim Cramer and Marc Chaikin.

Growth of Better Mousetraps

Let’s assume that you’re convinced that iBuyer is not about buying low and selling high, but about providing a service that delivers speed, convenience, and certainty for a fee. If you’re not, feel free to read my August Red Dot before continuing.

So if iBuyer is a ‘better mousetrap for a fee’ then there are two questions.

First, how much is the fee? Because yes, sure, speed, convenience and certainty are all very nice to have, but as Spencer Rascoff himself pointed out, people aren’t going to pay 20% of the value of the home for those things.

Second, assuming that the price comes down, how fast do such ‘better mousetraps’ grow?

The Price of Convenience

So the first place we start is with the price of iBuyer service. Unfortunately for us, that price is very hard to figure out because (a) the whole iBuyer thing is pretty new, and (b) nobody publishes them.

One source of information we do have is the invaluable work done by Mike DelPrete. That post is a bit dated (it’s from end of 2016, and only on Opendoor) but it’s really good stuff. So we know that Opendoor charges a fee of 9% (or did in 2016). Mike also wrote this post for Inman digging into Zillow Offers, and found that at least for Q2, Zillow’s price appreciation (difference between what it paid and what it sold a house for) was 3.3%. I don’t know what Zillow charges the seller in fees. But let’s say it’s another 9%, like Opendoor. Mike also told me for my August Red Dot that Opendoor’s price appreciation was below 5% in April from around 8% in May of 2017. (Please note that Opendoor disputed those numbers, but did not provide its own.)

So for the sake of discussion, let’s say that it costs a homeowner 12% to use iBuyer services. That’s a lot of money. On a $250K house (which MikeD points out is about the median for Opendoor in Phoenix), that’s $30K. But then again, selling with a REALTOR would cost you 6% so… the real price to the homeowner is 6%, or $15K. Still a big chunk of change. Of course, you don’t have to do any repairs, put in any new carpets, new paint, etc. but let’s leave that out because it’s really impossible to figure that stuff out until one of the iBuyers releases real data on how much they spend to fix up a house, etc.

At that kind of a cost, I think most critics are right that iBuyer is a niche product for a niche marketplace: people who value speed, convenience and certainty over $15K.

Here’s the thing: that price will drop. It’s not a question of IF but of WHEN.

Every single new service or product ever in the history of services and products drop in price as the company providing it gets better and better, more and more efficient, and wants to compete.

I don’t know what the tipping point is. I assume we’ll find out as iBuyer companies mature and get better and better. But let’s say it’s 2% over using a REALTOR. That’s $5k on a $250K house. How many more people will say, “Hell, it’s only 5 grand — screw it, let’s just sell to Opendoor”?

You can do the mental exercises yourself. What if it’s the same cost as selling with a REALTOR? What then? What if it’s 3% more? And so on and so forth.

My point: we can easily construct a case for iBuyer to hit 20% of the market if it only costs 2% more than using a REALTOR.

What If iBuyer Costs LESS?

But… what if using iBuyer costs LESS than using a REALTOR?

Of course that’s really difficult to imagine, especially since all of the iBuyers have pivoted to using agents on buying and selling houses. Zillow has done that from the beginning. Redfin has done that from the beginning (albeit, only Redfin agents as far as I know). Opendoor has pivoted to using agents on their deals. Those agents have to get paid.

Well, for one thing, it’s possible that the iBuyer companies get so efficient, so good at buying, repairing, then selling houses that they can charge 4% to the seller, pay the agents 1% each (a figure MikeD cites, and is not uncommon for institutional clients), and still make a profit on the remaining 2%. That’s possible.

There is another possibility, which comes to us courtesy of Zillow (Q2 earnings call):

Thanks, Tom. We think we can make a lot of money in the buying and selling of Homes business by charging sellers a fee, doing a light remodel, paying agent commissions in the transaction and training our capital 4 or more times a year, so having a pretty short hold time. So we’re very comfortable having agents in the transaction. We think most other iBuyers are also paying agent commissions in the transition. But I can only speak to our unit economics, which are attractive at, albeit at a low margin, high-volume game. The mortgage business provides an opportunity to monetize the Zillow Offers business even further. So just what we intend to do here is, on a Zillow-owned home, when we’re reselling that to a consumer, we will provide mortgage origination for a homebuyer of a Zillow-owned home through MLOA, which we’ll rebrand post-closing the Zillow Mortgages.

So just to give you some napkin math for a second. About 400,000 homes sell a month in the United States. If Zillow Offers is buying and selling, say, 10,000 homes a month, that’s about 2.5%, 2% or so of the market. If we’re doing that type of home buying and selling volume, homebuilders typically have a 75% attach rate on their in-house mortgage of homes that they’re selling. At a 75% attach rate on 10,000 homes a month at 9,000 in revenue per mortgage origination, that’s $67 million a month of mortgage origination revenue or about $800 million a year. So for anybody who is wondering why we just bought a mortgage lender, just to hit some of those numbers again, at a mere 10,000 homes sold a month from Zillow Offers, a 75% attach rate gets to over $800 million a year of revenue opportunity for mortgage origination. In addition, it allows you to sell the home faster, which, as we’ve talked about extensively with investors, that’s critical to improving the return on equity of the Zillow Offers business. And then the final piece I just want to point out on Zillow Offers is the opportunity to create a listing lead generation business for our Premier Agent is significant. So take a step back. We think the core Zillow Offers business can be profitable with commissions. We take the mortgage origination opportunity as large. We think the sell-side listing lead generation for Premier Agent opportunity is large as well. And I’m very, very pleased with the progress we’ve made so far in Zillow Offers after just a couple of months. [Emphasis added]

As many of us who have worked with or bought from new home builders know, the homebuilders have such high attach rates because they offer sweetheart deals. I know when I last bought a new home from a builder, I think I received $5,000 from using their in-house mortgage… it might be more, I can’t remember.

There is absolutely no reason to think that iBuyers, like Zillow, wouldn’t offer the exact same kind of concessions and price breaks to consumers who sell to (or buy from) an iBuyer directly and also use them to get a mortgage.

Let’s do some napkin math, shall we?

Assume that Zillow Offers improves to a point where it’s only 2% over using a REALTOR. On a house that ultimately sells for $250K, selling with a REALTOR the traditional way would cost the homeowner 6%, or $15K. Selling it to Zillow, with the fees and lost opportunity for gain, would cost the homeowner 8%, or $20K. The difference is $5K.

But if the seller uses Zillow Mortgage to buy their next home (which could be a Zillow-owned home, or could be some other home), Zillow stands to make $9K from the mortgage business. Knowing this, Zillow offers to charge only 4% as a fee to sell the home to Zillow, if the homeowner would use Zillow Mortgage for his next house.

So now, the homeowner sells to Zillow for $250K, pays 4% in fees, which is $10K. Now selling to Zillow costs the homeowner less than using a REALTOR. But Zillow ends up making an additional $9K on the mortgage, for a total of $19K in income from that coupled transaction. The consumer doesn’t care, because he has to get a mortgage from somebody at some point to buy his new home. Might as well be Zillow and save $5K (or make $5k more on the sale of his old home).

To review, then:

- Sell with REALTOR: $250K – 6% ($15K) = $235K

- Sell to Zillow: $250K – 8% ($20K) = $230K

- Sell to Zillow, but use Zillow Mortgage: $250K – 4% ($10K) = $240K

Now what percentage of consumers would use iBuyer?

Let’s Not Forget About Seller Leads

Finally, as I point out in my Q1 report on Zillow (June Red Dot), Zillow Offers is going to create a waterfall of money just from selling seller leads:

Fact is, Zillow’s Homes segment (which is what they’re calling their iBuyer program) is going to make a fortune just from listing leads.

Here’s Spencer from the earnings call, once again:

Eventually this we believe will become a large listing lead generation business, which will benefit IMT on the Premier Agent side. We aren’t ready to announce how to actually monetize that. Whether it will be through the seller boost ad products where we are already selling ad product that generate listing leads on not-for-sale homes, whether it will be a brand new products, whether it would be sold at auction, through the agents, through brokerages, et cetera, there are a lot of ways that we can monetize this.

But if you just look at the data that we have on our funnel of how much consumer demand there is for instant offers, we know that we can build a big business that generates listing lead opportunities for agents and brokers from Instant Offers.

That Homes would become a ginormous waterfall of cash from the sale of listing leads should be obvious to anyone who understands the real estate industry.

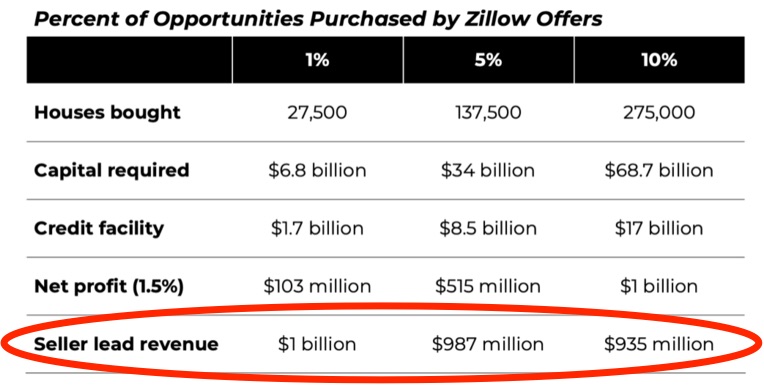

Mike Delprete concurs in his latest post, and put some numbers on the listing lead opportunity:

As a point of comparison, Zillow’s revenues for 2017 across all lines of business was $1.07 billion. If Mike is correct, the listing leads that come off of Zillow Offers alone could be the equal to all of Zillow’s revenues from Premier Agent, mortgage leads, rentals, whatever for all of 2017.

What that says to me is, Zillow would not be crazy to pay market price for homes, charge the seller nothing if the seller also uses Zillow Mortgage, then monetize the hell out of listing leads… and still come out ahead. At that point, using an iBuyer is 6% cheaper than using a REALTOR, and all of the annoyance, uncertainty, and delay of the traditional process is removed.

Now what percentage of consumers would use iBuyer?

So… How Fast do Better, Cheaper Mousetraps Grow?

It is very hard to say how fast such a model might take hold, since each company is different, each product is different, each situation is different. Housing isn’t the same thing as smartphones or internet access or hotel rooms or taxicab rides. As I’ve said from the start, this is more of a fun exercise in making the case that iBuyer will become the default way to buy and sell homes in America rather than a prediction that investors should take to their stockbrokers.

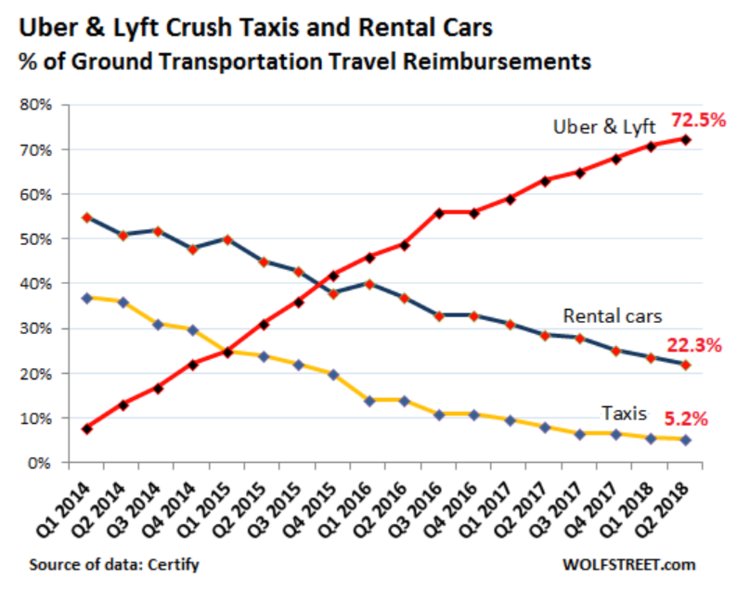

Nonetheless, with that spirit of $#!%s and giggles in mind, take a look at this chart:

That chart comes from this article on Business Insider titled, “Uber and Lyft are gaining even more market share over taxis and rentals.”

According to that article, Uber/Lyft went from single-digit market share to 60% market share in three years: Q1/2014 to Q1/2017. It is still trending upward, to 72.5% in Q2/2018.

Yes, again, I realize that ridesharing is not the same thing as housing. But the point is that Uber and Lyft are (a) more convenient, (b) less expensive, and (c) usually a better experience than hailing or riding in a cab. Even if you’re skeptical, as I was when I first tried Uber, once you experience just how much better it is than standing on a street corner in the rain with your hand in the air, you won’t be going back.

Just think how fast we all went from “Are you nuts?” to “You still take cabs?” when it comes to Uber and Lyft.

That’s the power of convenience and a better experience at lower (or even roughly equivalent) cost.

60% Market Share by 2024

I could go on and on, actually, on this topic (and have). We could get into all kinds of related and marginal topics, like inventory management, financial risk, etc. etc. But let’s not, because this post is already 3,700 words long.

Suffice to say that given the above, I’ll make the case (not a prediction!) that iBuyer could hit 60% market share of home buying and home selling in five years. Uber/Lyft did it in three, so five years doesn’t seem insane to me.

The inventory risk doesn’t bother me. Cramer made a big deal of the fact that Zillow bought 130 homes in Phoenix and sold 30. MikeD says Zillow’s average purchase price was $324,000. Well, those homes haven’t gone anywhere. They didn’t evaporate. They’re still there. Zillow can hold a firesale and dump them at a loss if they wanted to.

So let’s say Spencer and Co. lose their ass on those 100 as-yet-unsold homes, and take a 20% loss, that’s $64,000 x 100 homes = $6.4 million. Last I checked, Zillow was sitting on $1.5 billion in cash or cash equivalents. And as the market fluctuates, iBuyers would simply adjust their bid and ask parameters and try to avoid losing their ass.

I can’t see that as such a big deal for the business model as a whole, nor a reason to think it is “ridiculous”.

As a final note, if iBuyer doesn’t get to 60%, but only to 20% in five years, that’s not a reason to relax either. Look ye upon Amazon’s market share:

Your thoughts and critiques are welcome, as always.

-rsh

29 thoughts on “The Case for iBuyer Becoming the Default”

The reason I don’t believe in this is because the NAR and its subordinates are adept at creating regulatory hurdles to ensure their position. So, while the economics may be sound, we can never bet against “pull”.

ROB,

Let’s fast forward to 2024 with 60% of the business going to iBuyers. That means there’s a ton of players chasing the space, which will by definition mean that it’s “every iBuyer for themselves” – an unorganized market. Not that there’s anything wrong with that except it sets up the winner – the organizer – the guys at the top of the food chain.

As an experienced user of: “sell as-is, no clean ups or fixes, cash buyers, convenience, expertise”, we know the value proposition is effective. However, the current iBuyer attributes leave out things that sellers will want as this selling strategy and model grows: low transaction cost for sellers and competition from the buyers.

IMO, the winner of the space will be the one that organizes the iBuyers: “when (i)buyers compete, you win”. That means the seller makes one phone call to one entity and after competition from the iBuyers achieves better terms and results for their sale.

Selfishly, the iBuyer fascination is the best thing to happen to our business – confirmation of viable alternatives for selling and buying. But that would change quickly if the iBuyer strategy could figure out how to do its business in markets with prices above their current threshold. So, for now our space and anyone else who does business in the high-end of the market is safe – IMO.

We’ll see 🙂

Thanks,

Brian

Why, Brian, it’s as if you need to read my Red Dot on The Platform. 🙂

Reader’s Digest version available? 🙂

Rob,

Really enjoy your thoughts.

Mr Rascoff has said that Zillow entering the Ibuyer is like Netflix entering the Original Content area. I see this, however, one difference I see is that Netflix is paying for the product and the consumer is paying Netflix to access the product. In Zillow the consumer without Ibuyer pays nothing, the one that pays Zillow is the one producing the content, the agents. The new Ibuyer model would make the consumers pay Zillow more directly; eventually likely skipping the original content producer or paying them a very reduced rate to become more efficient. The key difference from the way I see it is that the people paying Netflix were not at a loss, they were gaining additional content. In the Zillow example the people paying Zillow, the agents, are at a loss and that is why Zillow needs to put the appearance that the agents will be gaining; when as you discuss, agent gain is an unlikely scenario when the Ibuyer is run through a middleman like Zillow.

The only downfall to Zillow’s plan would be if agents (the content producers now) realize that this path leads nowhere good for them in the hands of Zillow or other middlemen. When they realize this they need to find ways to access the consumer quicker and more effectively than the middleman to connect with leads and offer their services or their versions of the Ibuyer. I read somewhere that Las Vegas recently reduced the ease to which Zillow accesses agent’s content; if this trend develops quickly it will put Zillow in a dangerous position, they rely on the content of the people that currently pay them. Zillow is banking on what they have always banked on, that agents are disbanded and will look at the shorter term gain rather than the longer overall outlook because agents are fragmented micro companies even when parts of larger franchises set to compete with one another.

Santiago

Thank you Santiago.

Look, who knows what will happen ultimately? It’s difficult to say. But the Netflix analogy breaks down quite a bit when you get into it.

The essential fundamental truth that people have to recognize is what I wrote above (and throughout my talk about iBuyers): the current process of buying and selling a house, even with a great agent, is a pain in the ass. That has very little to do with “producing content” or whatever.

So to me, it’s very simple: the process sucks ass, and the company/people who make the process suck less will win. The iBuyer is one such way of trying to make the process suck less. It’s not clear to me that brokers and agents have come up with a way to make the process suck less; maybe someone will.

And again, some people see that as meaning the agents suck. NO — the agent can be absolutely FANTASTIC and the process (mortgage, the wait, etc. etc.) could suck. Focus on that, and the rest is much easier to analyze/think about.

Just here to throw a couple of wrenches…

“Every single new service or product ever in the history of services and products drop in price as the company providing it gets better and better, more and more efficient, and wants to compete.”

Counter-point: I paid more for my house, my car, dining out, dry cleaning, etc. this year than last year. Providers may get more efficient, but it doesn’t always translate to price drops. Commodities can increase (and decrease) and that gets passed on to the the consumer.

Regarding builders: “There is absolutely no reason to think that iBuyers, like Zillow, wouldn’t offer the exact same kind of concessions and price breaks to consumers who sell to (or buy from) an iBuyer directly and also use them to get a mortgage.”

Here’s one reason: Builders mostly give $5000 concessions (retail) on upgrades for which they pay wholesale, and, if they meet performance targets, additional rebates that further reduce their costs. iBuyers may get to that level with vendors, but it may take some time.

I think these thoughts might put a little pressure on your math but the transaction costs should go down.

With heated competition, some iBuyers will (are?) cutting their margin to get traction and deal counts up. I’ve seen some Tampa area iBuyer transactions where the buy/sell spread was under $10k. That doesn’t leave much room for repairs, closing costs, commissions or profit.

Rob,

What happens when these markets unwind. Many of these markets(Phoenix, Las Vegas) have historically had a boom/bust cycles. Have we already forgotten? How do you make an offer/bid when the market is declining rapidly. What about foreclosures? Are you a flipper/investor or ibuyer. All these new models will be tested when in the coming years as real estate cycles apply pressure. I haven’t seen anyone present ideas/models that work with ups and downs of the real estate market or it just a zero sum game.

Bob

Always appreciate your insight!

Hi Bob –

Like I said in the post, if Zillow loses 20% per house, and do a firesale on the 100 remaining houses, they lose $6.4 million. They can take the loss. It’s really not a big deal to them.

How do you make an offer when the market is declining rapidly? Well, you offer less, I suppose and see if it takes. That’s no different than anybody else looking to buy in a declining market, right?

Curious your thoughts. Is there ever going to be a scenario where they will ever make 20% on a sample of 20 or 50 or 100 homes?

Although losing 6.4M $ to Zillow is not a huge or perhaps meaniful loss monetarily. The optics of doing a firesale on 100 houses would cause mass panick among investors in regards to the long term outlook of their business model & would cause Zillow to lose a massive amount of value in terms of market cap. This is the negative of being a public company w/ quarterly reports. They must execute well and quickly if they want investors to buy in to this new business.

@Drew –

Trying to understand your question… do you mean Zillow could make a huge profit on houses? Of course. I was just trying to point out that this is a game of capital, and the iBuyers have it.

Did I misunderstand your question?

Yes, my question is how much profit could Z reasonably make on an aggregate of 50 or 100 houses. How much would the market have to appreciate, and how quickly, for Zillow to make 20% per house? It costs money to hold the houses on their books, so it’s not a direct 20% appreciation = 20% profit (unless massive appreciation happens literally overnight, which we all know will never happen).

Another solid post Rob (not surprising I might add)..

If it’s a choice between your forecast and Brad’s, I’ll gladly take the former as should the latter have been correct all these years us Realtors would have been relegated to unlocking doors for spare change or seeking gainful employment in the retail sector. What can I say? It sells media subscriptions (and I’m a subscriber).

There’s little doubt we will witness the impact of the IBuyer platforms and sooner rather than later, but to your point it won’t be a seismic shift and there has to be a larger play here than the real estate to justify share. The whole premise, which has been repeated time and time again, assumes that the fear of the real estate process is more powerful than the fear of leaving dollars on the table. We are dealing with human emotion here, and sometimes it’s painfully obvious that money doesn’t always follow the fundamentals of this business.

I continue to look for the spotlight on the people doing 98% of the business the “old fashion” way with just enough technology and capital to help them be better humans and advocates for buyers and sellers!

Thank you Budge – your balanced wisdom is always appreciated. 🙂

In a way, it’s unfortunate that the real point is being missed. I might have to do a separate post and make it explicit, but it’s exactly what you end with:

“I continue to look for the spotlight on the people doing 98% of the business the “old fashion” way with just enough technology and capital to help them be better humans and advocates for buyers and sellers!”

What I’d like to do is to encourage the people doing 98% of the business the “old fashioned” way to think really hard about how THEY could make the process less annoying and less uncertain and less time-consuming. Because that’s really what it’s about.

Great real estate agents help clients navigate a painful process; could the industry other than iBuyers do something, anything, to make the process itself less painful?

No doubt possible Rob, though that’s where the industry as we know will struggle and probably not drive anything meaningful. While there have been subtle improvements focused on the consumer experience over these last years, the reality is that people in this business are increasingly aligning themselves with business models where a defined,, elevated, and consistent consumer experience is an afterthought and any mention of standards and accountability (which would be required) an invasion on individual rights and personal freedoms! Indeed, real change will probably be imposed, and hopefully the response will be adapting to win rather than merely adapting to survive.

Excellent post Rob – thank you for taking the time and sharing!

I always love your post-Rob. I want to share something with you concerning your calculations……. I’ve run multiple Opendoor, Offerpad and Knock ibuyer’s request on different homes. The offers I received were anywhere from 6% to 12% less than true market value. Then they add their fees. When comparing the realtor vs the Ibuyer route there’s a much larger delta on the sellers net than you’ve shown. So when you use the $250K model comparison I understand the math, but as of now none of these 3 ibuyer’s are offering close to the actual market value of what a home is truly worth in the beginning. A better comparison would be to list the realtor home at $250K and the ibuyer home say at $230K – $235K then do the math. I’m also finding it interesting that over the course of about 10 months I’ve received new buy-out offers and they seem to keep increasing their offer in a market with flat appreciation. Not one of the ibuyer listings I’ve personally viewed did proper repairs, they were actually horrible, lipstick on a pig quality. I know ibuyers aren’t going away, but not all will survive. Right now they are competing more with each other than with realtors in my market. I think in the end many well known national real estate firms will partner or also become an ibuyer. This arrangement makes more sense to me and will allow ibuyers to reach their profitability expectations by having a local expert setting ibuyer offers. I always get a chuckle anytime a tech person tries selling something. Cheers!

The capital markets so far are extremely skeptical of Z at this point. (stock price mid $60’s June 15 and now $28.41 today) What has happened since June? Buy, some may say overpay for a mortgage company -( margins shrinking like crazy), buy homes-(prices dropping currently) 4 billion plus market cap haircut.

One thing I have seen in real estate the past 29 years is when the market is great, the whole world gets in, they suddenly are killer salesmen and women, the discounters come in too and they have the business model of the future. Then the market takes a downturn and they all disappear. I would wager before you see 60% ibuyers you see a bunch of crying investors who poured money into a low margin, money burning business, instead of just buying a tax free bonds and going golfing. How profitable have any of these guys been? Zillow, Redfin even Realogy?

The real estate industry needs to get way better at what it does there is no doubt about that. Fees may change, no doubt. At some point the robots will take over and they will be running Zillow and writing blogs too, in the end we will be left with red pill or blue:-) I liked the post Rob.

On the topic of seller leads & $$, Mike Del Prete says “A more realistic target would be to only purchase around 1 percent of requests.”

Let’s put my seller hat on. If I know there is a 99% chance that Zillow will NOT buy my house, why exactly would I wasting my time with it? That screams bait and switch. I don’t see any consumer experience with a 99% rejection rate standing the test of time.

Excellent point! Time will tell what the right balance is for the iBuyer crowd.

Comparing to an unprincipled “Not For Profit” like Uber?

Priceless.

More on point: To ruinous pricing calculated to gain market control before venture capital runs out, with a long game of increasing prices to profitability?

This is not admirable activity.

As I stated on LinkedIn …

Another 20k word post from Robert Hahn ? Yet, he makes some amazing points! Great Read

Let me say, what Rob will not (or can’t)

1) iBuyers are a real threat

2) Their costa are secondary to the Seller Leads they will generate from the Referral fee they will get from the (Zillow Premier) Agent who sells it for them

3) The revenue they will gain from additional Premier Agent sales who want to get in on the boom ?

4) The pending marriage of iBuyers and Blockchain that will streamline costa and allow for a safe and secure 7 day transaction with all the traditional aspects of today’s transactions

“Wake Up” Real Estate Industry .. It’s coming and you can’t stop it

Those with their heads planted firmly in the sand right now will be trampled and become ghosts!

That is All ?

You reminded me those comments I read 20 years ago came from “wise” people who love to predict the future who said that, the MLS will die and the use of a real estate agent will not be needed anymore. You really made me laugh.

Bundling services such as mortgage allow Zillow to do what many brokerages are doing by making money in affiliated businesses. Lowering the transaction cost for consumers and adding certainty to the closing of a house is a winner. As a broker I can tell you that way too many deals fail the week before closing and that is not something most seller/buyers can financially tolerate.

The seller who is also buying is the target audience. I have a thoughts for a solution- how about a lending system which offers alternatives to a bridge loan. The

ability to avoid two mortgage payments while a seller’s house goes under contract and closes would really disrupt the iBuyer movement. It would also alleviate the pressure to have simultaneous closings which are a nightmare for agents lenders and closing companies.

I see iBuyer taking a swath of the easy and normal transactions out of the market and leaving the overpriced listings and difficult seller’s to the remaining agents.

While iBuyers provide the convenience of selling quickly, 90% of sellers who engaged in instant offers platforms decided against the iBuyer offer and chose a traditional agent instead.The iBuyer business model can not be a solution to the traditional way, of we buy and sell homes.It can be only another option for the consumer.Nowadays the cost to the seller to sell a home with an iBuyer business model, is more expensive than going the traditional way.The iBuyer business model causing sellers to lose money and in some cases lots of money. As a seller who is in a default in mortgage payment and trying to avoid foreclosure or to save his/her credit score, and some other abnormal cases, an iBuyer is the way to go. But it definitely will not replace the traditional way since, many sellers do not want to lose money.

Rob, I enjoyed reading your blog on Zillow. As a 17yr Mortgage Loan Originator, I see similar trends and challenges to my profession too.

There is no reason to assume the cost of flipping will ever go down because flipping is a risk-heavy proposition that requires to hold the property, time and energy, adds costs into acquisitions and future sale. The assumption that flipping is here to compete with a 6% commission is flawed, its here to compete with reliable commission savings models that bring competitive agents fees closer to 1%. Flippers cant compete with that sort of value on a mass scale, they can only flip so many homes at any given time. I’d like to point out the final flaw of this argument – car hailing companies have never invested into boots-on-the-ground approach, these are all Internet companies. Zillow Group has made a major mistake by delivering itself away from what is essentially a media company into a broker model – house-flipping requires brokerage license and so as collecting referral fee kickbacks, such as OpCity/Realtor model. Open marketplace will crash these much sooner than 2024, in fact, by the end of 2019 no sane VC will ever place their cash into hands of a house-flipper or a referral fee middle-man broker such as OpCity.

Why is everyone starting their own iBuyers? Why doesn’t Opendoor reach out to someone like Realogy and offer to whitelabel their iBuyer service to Realogy? Or Realtor.com? Then, Opendoor has all the benefits its currently lacking that Zillow has, plus Realtor.com doesn’t have to try to figure out how to set up flipping operations in 100 MSAs. Is there a reason we aren’t seeing more cooperation?

Comments are closed.