It’s been over a week since I thawed out from the polar vortex that was Inman Connect NYC. I realize that people in Chicago and elsewhere in the Midwest would have loved mere 10 below zero temperatures, but for this now-southern boy, that week came with a religious awakening: hell won’t be hot, it’ll be cold.

In any event, I missed the showdown between Robert Reffkin of Compass and Ryan Schneider of Realogy on Inman stage, being interviewed (and poked and prodded) by Brad Inman himself because of meetings. Thankfully, Inman recorded the discussion and has made it available, at least to Select members. Watch the whole thing here. (I would embed the video for you, but I see no way of doing that.)

I came away marveling at the intelligence and poise of both Reffkin and Schneider, both men of enormous talent whom I respect immensely. But I also came away marveling at the negative spaces in the conversation. The real story of that discussion about the future of brokerages were written by omission and silence, by the things that were not said, and names that were not mentioned.

As Martin Gore once sang:

In a manner of speaking

I just want to say

That I could never forget the way

You told me everything

By saying nothing

The General Themes

Although the discussion jumped around quite a bit, there were a few general themes that both Reffkin and Schneider sounded throughout.

- It’s all about the agent

- Brokerage value proposition, value proposition, value proposition

- Data and technology will be key

- Bad Zillow Bad

Watch the whole thing obviously, but my general takeaway is that both men feel that the future of brokerage is in using data and technology to empower the agent to be more successful. The brokerages that survive will be those who have a value proposition at a price point that is acceptable to more agents than not. And Zillow is bad because it hurts agents.

There were many, many other things that were said.

Some were interesting and amusing, like when Reffkin flat out said that brand doesn’t matter, and Schneider said it did to legitimize the agent, then added, “I love all my children equally” referring to the many brands under the Realogy umbrella.

At least one was incredible, in the sense that I couldn’t believe it was being said on a national stage. This is when Reffkin talked about one national MLS, as well as one single technology system that the industry would all contribute to and collaborate on and control. All I could think was, “I really hope the boys and girls at the Department of Justice aren’t watching this.”

But on the whole, the real story was written in omissions.

Financial Pressures

At one point, Schneider talked about how the industry is in flux because of financial disruption: all of the shifts and changes are about finding a new equilibrium between brokerage value proposition vs price (read, splits). And throughout the discussion, it was as if Reffkin and Compass were somehow disrupting the equilibrium.

As far as I know, based on conversations with people who do know (including Compass agents), Compass doesn’t have particularly aggressive splits. It offers signing bonuses, and sweetheart deals for a limited time, but after that, the splits are far more traditional. I’ve heard 85/15 in the Los Angeles area, and as high as 70/30 in other markets. If there’s a cap, I haven’t heard of it.

Sure, Compass is giving traditional brokerages fits with its aggressive recruiting, including rumored bonuses and guaranteed commissions and stock options and benefits out the wazoo, but it isn’t an eXp or even a Keller Williams.

What Compass, KW, and eXp all have in common is that they are definitely not in the fastest growing segment of the brokerage business. How in the world do you have a 30 minute conversation about financial disruption, pressures on margins, and brokerage value propositions versus “market clearing price” and not once mention HomeSmart, Realty One Group, Fathom Realty, JP & Associates Realtors, Charles Rutenberg, Benchmark Realty, and literally hundreds of other smaller local and regional players who are all pursuing the time-tested and proven 100% commission transaction-fee business model? I mean, HomeSmart is the #5 brokerage by Transactions and #8 by Volume on RealTrends 500. These are not unknown companies.

At one point, Reffkin sort of nods that way, talking about “landlord-tenant DIY brokerages” but only mentions KW and eXp, who are split-based brokerages. In one migration report I’ve read, KW got its rear handed to them in San Diego by a 100% shop called Big Block Realty from a recruiting standpoint.

It was an odd omission, but not the biggest absence from the discussion. Not by a long shot.

The Glaring Omission

At one point, Reffkin says that in the future, there will be four models of brokerage:

- DIY shops, who do nothing for the agent and have a landlord-tenant relationship with the agent, such as KW and eXp;

- Do it All For You companies, like Compass, who will do everything for the agent so the agent can get clients, work deals, and do their thing;

- Seller-Owners, who have a hundred agents underneath an active agent-broker who uses them to “get more business for themselves”; and

- Real small boutiques, who don’t want to be a part of any of that, will make less money, but they’ll be okay with that.

Schneider didn’t necessarily agree, but launched into a speech about how all of that is because the disruption today is financial disruption that messes with brokerage margins and pricing for value proposition (read: splits). Then he went into a Zillow Bad moment, which was interesting.

Here’s the thing about Robert’s four models: how in the world do you not mention Redfin?

We still haven’t seen the final FY 2018 earnings report from Redfin (that will come on Valentine’s Day). But based on the first nine months of 2018, here’s what we have so far:

- Transactions: 33,132 (on pace to break 43,000 for the year; and tack on another 8,856 Partner transactions)

- Sales Volume: $20 billion (on pace for over $25 billion)

- Revenues: $363 million (on pace for over $480 million)

- Gross Profit: $93 million (on pace for over $120 million)

- Gross Margins: 30% in Q3

In 2017, the last year for which we have RealTrends data, Compass was #6 by Volume with $14 billion, and #45 by Transaction Sides with 10,543. That same year, Redfin posted $21.3 billion in Volume and 35,038 in Transaction Sides (with an additional 10,755 transactions in Partner business). Redfin did that with 1,023 full-time Lead Agents, which translates to an average of 34.3 transactions per agent.

Redfin isn’t a flash in the pan anymore. It’s a public company that has been around for more than a decade. They report their numbers every quarter and have earnings calls with Wall Street analysts. That business model is not part of the four that survive in the future?

Data and Technology? Seriously?

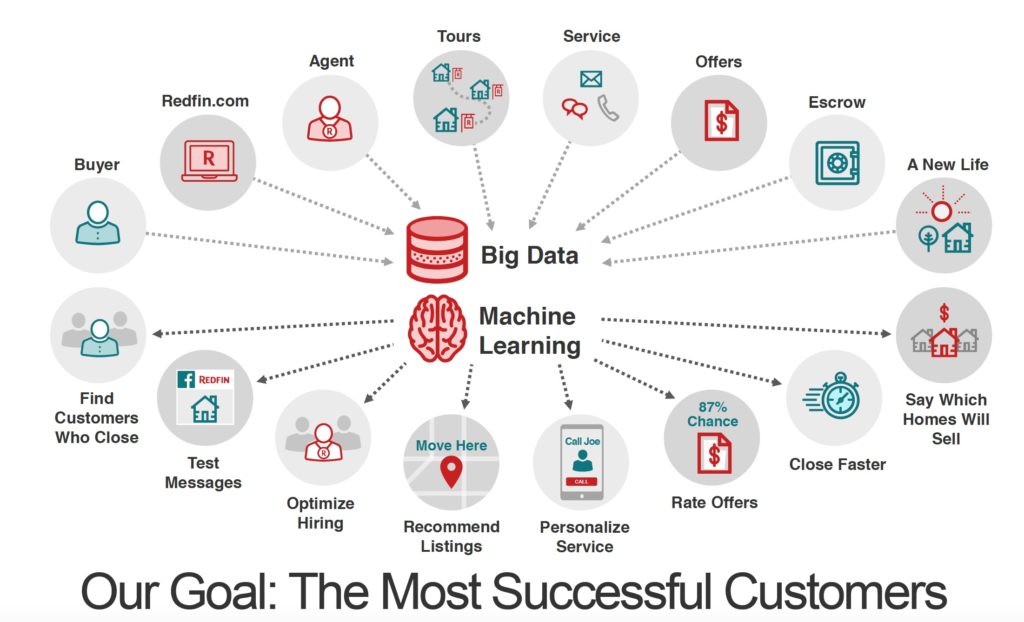

Worse still, how is “data and technology” one of the major themes of the discussion and not one person on stage mentions Redfin even once?

Do we even have to talk about how far ahead of every other brokerage company in the world Redfin is in terms of technology and data science?

Here’s one example: Schneider talked about a few data tools Realogy has announced. One is a predictive analytics tool for marketing spend, another is to help agents prioritize leads, and another is to help franchisees figure out which agents to recruit. Reffkin kind of dismissed the whole thing, saying that he’s never once talked about data. He then says, “What really matters is listings” and that technology is below that and is the most overrated thing that people are talking about now. What Reffkin thinks agents really need is a single sign on, or in the alternative, all of their technology tools in one place, built by one company.

In contrast, here’s Glenn Kelman from the Q4/2017 earnings call:

Our goal overtime is to convey a competitive advantage, not just to Redfin but to our home buying customers who should never have to wait on an agent hot listing. This commitment to speed is why we’ve also invested in our own offer-writing software which lets our agents put together data in a few minutes.

In the fourth quarter, we expanded the markets the software supports from Chicago, DC and Virginia to Maryland. The localization involved for each market is extensive. Different states, counties and cities require different forms and local customs around earnest money amount and other deal terms require different default values for the form.

In Maryland alone, we have to support 30 addenda. For these reasons it will take us years to adapt our offer-writing software to every major US market. But as we do we believe we will be able to move faster than any other broker at lower cost and with comprehensive data about what it takes to win in each neighborhood.

Redfin’s offer-writing software utilizes machine learning and AI to tell the agent what blend of terms from price to contingencies to whatever else they have is most likely to have the offer accepted. That software is mobile, so the Redfin agent can submit an offer from the car as they are driving away from the listing.

It’s really not close today. Single sign on versus automated offer writing. Analysis of leads versus the above. It’s not close. Maybe it will be some day as Compass and Realogy pour money and attention and focus into technology and data science, but it isn’t as if Redfin is going to kick back and lounge. It isn’t as if the data scientists already at Redfin are going on an extended sabbatical.

It’s like nobody wanted to mention the elephant in the room. Strange.

Agents vs. Companies

What kept coming to mind for me as I was watching the video was the Alex Rampell video from a16z Summit, which I mentioned in The Machine and the Real Estate Agent post. It’s worth watching in full, so let me embed it for you again.

Both Reffkin and Schneider kept talking about the agent, the agent, the agent. Rampell predicts that the real estate agent isn’t going away, but the agent will work under the rubric of a company. Why?

Because answers. Rampell talks about how individual agents really can’t answer simple questions such as:

- How much should I list my house for?

- When should I list my house?

- Should I stage my house?

- Should I buy ads in the newspaper, Facebook, Google, etc.?

Companies have an advantage in doing data analysis and data science over individual agents. They can provide answers to questions like the above based on actual data, rather than intuition or conjecture without proof.

I kept wondering how the future of brokerage, as painted by Mssrs. Reffkin and Schneider, where the sun in the brokerage universe is the real estate agent, competes with these new breed of Companies whose sun is the consumer.

iBuyer? Brad Inman brought it up. Reffkin dismissed it saying that no agent has come to him to ask him for iBuyer services. Schneider said they were experimenting with iBuyer to ensure that the agent is involved in the purchase of the home and the sale of the home. Huh, that sounds just like Zillow’s iBuyer program, and it’s certainly Redfin’s iBuyer program in which an agent is involved in the purchase and the sale of the home. She just happens to work for Redfin.

One interesting observation, before we close, as this is getting long.

One of the major themes of the discussion from both Reffkin and Schneider is how everything is about the agent and making the agent more successful, is how much the agent is making as an independent operator versus “under the rubric of a Company.”

According to LinkedIn, the total compensation for a Realtor at Compass in the Greater NYC area is $122,000 a year, with a range of $78K to $248K. Who knows how they compiled that data, and it may be wholly inaccurate, but it is what we have unless Compass wants to disclose some data. But given that Compass agents are real estate agents, I imagine they have a few expenses to pay from that “total compensation”.

Nationally, according to Payscale.com, the average REALTOR salary (which one assumes would include everyone who works for a Realogy brokerage or branded franchisee) is $53,711.

According to a detailed blogpost by Redfin itself from a year ago, the median compensation for Redfin agents in 2017 was $90,166. The 85th percentile made $153,017, which I imagine compares pretty favorably to the kind of agents that Compass tends to recruit. Then add in another $20,000 or so in benefits, and factor in the fact that Redfin agents do not have business-related expenses.

Could it be that if brokerages really cared about the agent, they should start copying Redfin?

The Future is Written in the Negative Spaces

Some of you have heard me speak on what I think is the future of brokerage. The heir apparent, then next wave, is the 100% low-cost brokerage. I wrote an entire Red Dot on the subject. But what also comes is the institutional brokerage, the Company. I wrote an entire Red Dot on that subject as well. I watched the video hoping to learn something new that might help me change my mind. Maybe these two brilliant and accomplished leaders would provide some insight that I had hitherto missed.

What I got instead was further confirmation that the future belongs to Next Generation Brokerages and the Institutional Brokerage Companies. That story was written in the negative spaces, in the omissions and silences. Like Voldemort, they cannot be named.

And that silence and that omission give me the words. They give me the words to tell you everything.

-rsh

19 thoughts on “Negative Space: Reffkin and Schneider on the Future of Brokerages”

The future of real estate is the consumer and not agent.

Real estate agents can no longer control their audience.They need to serve their audience where they are, with what they want, when they want it. If you are a real estate brand selling real estate exclusively on your website, you must reconcile that home-buyers don’t care. If a home buyer is looking for homes on other sites, they have made a choice to shop on those sites.The reason doesn’t matter. If they’re looking for homes but you’re not there, they’re going to end up buying a home from some other agent. As a real estate agent, you have a responsibility to serve your customer on whatever platform. As a real estate agent you have a responsibility to reach audience where they are, not where you want them to be.

Nice job Rob. That was an interesting chat at ICNY, indeed.

What the industry seems to be struggling with now is being able to truly discern the future from the past. Companies like Realogy and Compass have somehow arrived at the conclusion that what the agents of the past will somehow be accepted by the consumer in the future. And that, I’m afraid, is fundmentally flawed assumption.

This fight is not based in the attraction of agents, it is vested in doing something different and better to attract the consumer.

In truth, it is a company like Redfin that is proving the value of a more formatted, duplicatable experience through the use of employee agents – not random consumer experiences generated by Realogy and Compass agents. And the a lesser extent, but still extremely relevant, the iBuyers are also proving that the consumer will pay even more just to avoid the “root canal experience” delivered by the typical independent contractor agent today.

These are the models to watch and these are the best measure of the trends in consumer preferences for an improved real estate experience deliverable.

Overall, as crazy as it may sound, our industry really needs to pay attention to the consumer, not to the consumer as served by the agent. Research has proven over and over that the consumer has little regard for the agent or the real estate experience as it is today and that they are “in search” of alternatives to what the same agents currently provide.

Opinion. If your business has vested its entire future on that agent, and the continuance of a more controlled, formatted real estate experience, you may have a rude awakening “coming soon to your business” in the not so distant future.

Nowadays, the consumer is in the driver seat.These two leaders choose to invest in their agents and not in the consumer and this is their business model.WRONG!

Bingo.

What in the world is Reffkin talking about when he’s talking about a single national system? It sounds like he’s talking about a lot more than just a single MLS.

As if MLSs weren’t dysfunctional enough, we’ll create a single, un-innovative, immovable monopoly controlled by the government or something?

I don’t understand what he is thinking here.

In the Data Track he was clearly referring to a single, national data system aka an MLS. He could not understand why there were so many MLSs and commented that if they were consolidated, there would be so much more capital to hire engineers and innovate new tech things.

ROB,

How do brokers improve the consumer experience if they all do the same thing? I did not watch the interview, but does Compass have competitive advantage over Realogy? Does Redfin have advantage over ReMax? Do any of the big guys have an advantage over the other?

IMO, as long as the trades clear through the MLS, the consumer will not see the variety of value propositions they deserve – at least from those stuck in the MLS bucket.

That pie can only be sliced so many times before it’s all gone….

Thanks,

Brian

Redfin has an advantage over everybody right now.

Why?

Sorry ROB….my bad.

Unless I’m missing something, I believe I know your position on Redfin…

https://www.youtube.com/watch?v=VrbybKWwb7c

Thanks,

Brian

The MLSs and their agents do not want to act in full transparency.They believe that acting in full transparency will weaken their position in the industry.This industry operates behind the curtains for too long. They want to have a full control on their data and Mr Reffkin proves that by saying he wants to have one MLS nationwide.

What data? the listings? Why the consumer needs to suffer from this stupid war? The consumer dose not care on this war, who will have the control on the listing data.Many agents keep complaining about Zillow and how it is so bad and harming the industry.They hate Zestimate. LOL,, many brokerages sites that I have seen have their own estimates so why not Zillow or any other portal.

The irony, most of the complainers having their listings, profiles and reviews on Zillow and on many other third party portals.When you ask those complainers so why are you having your listings and profile on Zillow, they blame their MLS to syndicate their listings into Zillow. Wait a minute here, so the MLS makes money out from fees that agents pay and from Zillow who probably paying them some money to get the listings.

So why agents should continue to pay to an organization that stopped protecting them long time ago. As an agent you really do not have many choices, you stuck with a system that was founded 200 years ago a system that will make you obsolete in time.

On the Redfin pay, if agents were getting paid what Redfin claims it would be an easy choice for any licensed broker. However, Redfin sections licensed ‘agents’ into three groups, Agent Support, Associate Agents and Real Estate Agents. When they are saying that their Real Estate Agents are making $90,166, that is true but the Real Estate Agent at Redfin is one that is basically a team leader of a large team; the team members, Agent Support and Associate Agents, are nowhere near that $90,166 amount. As they compare those earnings with licensed brokers everywhere they are mixing the licensed support staff as well as the team leaders that make quite a bit more. This would be something to compare, Team Leaders at any company compared to Team Leaders (that Redfin calls Real Estate Agents) that are producing similar volume in sales. I feel this would be a more true comparison and that the numbers would show Redfin actually pays less and as the production increases, much less, for the amount of work expected to sell that much volume.

Where Redfin pay is good, it is with the type of agents that are more like the tradesman sales agent, the team member. In some situations with a secure income rather than relaying on the teams’ success those types of agents may have a better quality of life at Redfin. One issue to consider at Redfin is that as their licensed agents outside of their Team Leaders gain more experience but are unable to move up the ranks for more money due to static market share or lack of the skill level to manage a team selling at high volume, they will seek opportunities in successful teams outside of Redfin where their earning potential has less of a solid cap than at Redfin.

Redfin started with the technology first and started developing the agents later, that is why there is usually no known real estate sales talent going into Redfin, unless it is to head a huge department. Having an Agent First Model and building the technology around that agent, ensures the agent, making the ability to scale initially easier as those agents come with business already.

So Redfin is good for the agent when you take the lowest common denominator of agents; if saving the middle production agents and lower half production agents is the goal, giving them reliable incomes, benefits, etc then yes; Redfin is better. Redfin is better for the vast majority of people that hold a real estate license. It comes at a cost to the top 10% or maybe even the top 20% though. When it comes to those higher producing agents, producing at the top (in net income), usually as team leaders (What Redfin would call Real Estate Agents) Redfin would be like taking a manager’s job at McDonalds when you have the culinary expertise to open your own highly reviewed restaurant and be profitable at it. In our minds we all think we have the potential to be the latter, at least most of us, and therefore the difficulty with the Redfin model. When it comes to income, the Agent First model is selling a dream, Redfin sells reality.

I think you’re mostly correct. The one thing missing, though, and it’s something I’ve heard time and again from former Redfin agents who left for “unlimited income potential” is that Redfin does almost all of the lead generation even for the top tier “lead agents”. Team leaders at other brokerages have the burden of lead generation. Many are really great at that, and that allows them the eye-popping income numbers. It obscures the extent to which those top agents at non-Redfin brokerages have to (a) spend on lead generation, and (b) work at lead generation.

Yes, the net of both time and money is definitely the comparisons to be made!

The boss calls one of his commissioned salespeople into his (her) office. The boss tells the salesman; “let’s go buy a new car”. The salesman, all excited about being with his boss and watching him negotiate a new car sounded great!

They get to the dealership and the boss said he wanted to see a really nice BMW. They both decide which one they liked and proceed to try and buy it. Once in the dealerships office they start to draft the paperwork. The car-dealer, assuming the boss was the buyer, hands the papers over to the boss. The boss says; “the car is not for me it’s for my salesman here”.

The salesman screeches; “I can’t afford a new car”.

The boss responds; “if you can’t afford a new car then I can’t afford having you work for me”.

Maybe real estate isn’t a sales job after all…..

😉

I’m sure you’ve heard this a million times, but I think your writing is f***ing awesome. Great work Rob.

Fantastic write up. I feel like modeling how you think the world is going to look like by making assumptions based on what your competitors will do is a pretty risky game to be playing. Especially if you’re one of the big players involved.

“DIY shops, who do nothing for the agent and have a landlord-tenant relationship with the agent, such as KW and eXp;

Do it All For You companies, like Compass, who will do everything for the agent so the agent can get clients, work deals, and do their thing;

Seller-Owners, who have a hundred agents underneath an active agent-broker who uses them to “get more business for themselves”; and

Real small boutiques, who don’t want to be a part of any of that, will make less money, but they’ll be okay with that.”

I keep hearing people making these types of predictions. As if you can throw 1 ball in the air at the same time as 20 others and accurately predict where everyone else’s ball will land. I’ll make a prediction… Everyone will do their best to most closely resemble what works the best once that model shows its dominance.

Don’t forget to add the models that are removing the worst part of the buying/selling experience. (the other person). Great insights as always.

My first question is, what’s wrong with a national MLS? Financial securities trade over regulated (federally and by the company who owns the exchange, like Standard & Poor’s) and it tends to work extremely well due to ‘free’ flowing data, liquidity, access, and transparency. The problem seems to come down to ownership – brokers feel entitled to own the “listing” which is nothing more than 1s and 0s – they should care more about the consumer/client relationship, which technology in this space woefully underserves (not Zillow, though!).

Perhaps if brokers focused less on control and a shroud of secrecy approach as a means to protect their jobs, consumers would better understand their value-add and commissions. There continues to be too much “agent-this” and “agent-that” technology, and far too few options that treat the consumer as the end user – this is why Redfin should scare the shit out of everyone.

Regarding data – is it better gathered and retained by one firm (a la Keller being able only to leverage data from its own agents) or a third party software firm that can collect from all players, normalize, and share? Would a rising tide lift all boats for the betterment of the industry if there was more ‘coopitition’ at the brokerage level? MLSs? This is exactly how agents work – they have their professional spheres in which they share info, referrals, pocket listings, etc. Why can’t this model be applied to the industry as a whole, to the betterment of the most important player – the consumer?

Well, I wrote a post a while back on the National MLS: https://notoriousrob.com/2013/06/why-a-national-mls-is-quite-unlikely-the-road-trip-edition/

Comments are closed.