Okay, so just had an exchange on the Book of Faces with my good friend, James Dwiggins, the CEO of NextHome. He’s really one of the smartest and nicest guys in the business, and it’s always fun to talk industry issues. And I started to write a response and thought, why not, a short blogpost.

So, James and I now have a bet for dinner at some industry conference we find ourselves at in the spring of 2025. Because we’ll need the full year sales stats from 2024 to settle the bet.

The bet is that 60% of all home sales in the U.S. will involve an iBuyer either as the buyer or the seller by the end of 2024.

James thought I was breaking the law in South Carolina, although not in Colorado, Washington or California, by smoking the devil weed. I thought it’d be fun to make the case for him, and for the rest of you.

I’ve already made the case in these pages, but let’s pull it all together. Here’s how it happens.

Speed of Adoption

First, please refer to the post I wrote way back in which I made the case for iBuyer becoming the default. What I wrote there is that if iBuyer services only cost 2% over using a REALTOR, then it’s not difficult to make the case that 20% of home sellers would opt to pay the 2% fee to skip the pain and hassle and delay of the traditional process.

I then wrote:

But… what if using iBuyer costs LESS than using a REALTOR?

Of course that’s really difficult to imagine, especially since all of the iBuyers have pivoted to using agents on buying and selling houses. Zillow has done that from the beginning. Redfin has done that from the beginning (albeit, only Redfin agents as far as I know). Opendoor has pivoted to using agents on their deals. Those agents have to get paid.

I constructed some scenarios under which the iBuyers can bundle services, like mortgage and title, and drive the cost of iBuyer services even lower.

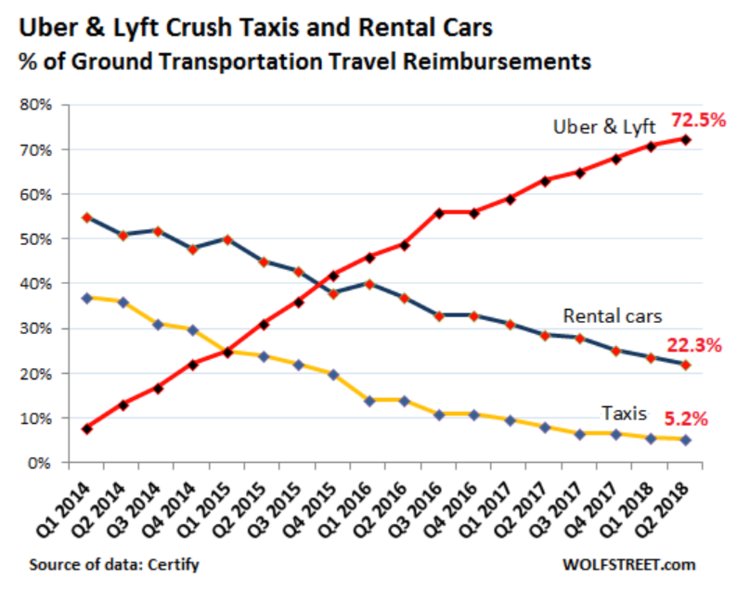

After such flights of fancy, I posted this chart of Uber and Lyft’s growth:

In just over four years, Uber & Lyft went from less than 10% market share to over 72.5% market share. I noted that this is the sort of growth curve if you can solve consumer pain and do it for less than the traditional ways (taxis and limos and rental cars).

Unit Economics Favor iBuyers

Now, jump ahead to my more recent post about Zillow’s unit economics. I found that home sellers likely net more money selling to Zillow than they do using a REALTOR to list their homes. As yet, no one has shown me the numbers under which that is not true.

Here’s what I wrote there:

Some reasoning here is necessary.

- Sale price. There is absolutely no logical reason to think that she would get more in the open market than Zillow would, since both are represented by a REALTOR. Zillow has said from the very inception of Zillow Homes (then Instant Offers) that they, unlike competitors, will use a REALTOR to list and sell the homes in their inventory. I realize someone is going to claim that they would have sold that house for $300K; all I can say is, give Zillow a call, because they sure would like to list their homes with you.

- Renovation and holding costs. Similarly, I see no logical reason to think that an individual would somehow spend less on renovation and holding costs than Zillow would. In fact, an individual’s holding cost might be higher than Zillow’s, since Zillow doesn’t have to pay a mortgage every month; its interest costs are calculated into the unit economics above. I’m willing to bet good money that Zillow gets a better interest rate on its corporate bonds and credit facilities than an individual homeowner would on a mortgage.

- REALTOR commissions at 6%: I know some would argue that prevailing commissions are lower, but I’ve actually looked for information on what the average commission in Phoenix (the ground zero of iBuyer activity) is… and I’m finding 6%. If you know differently, please let me know.

Yeah, that’s right. Her expected net selling with a REALTOR is $244,496 vs. $245,645 selling to Zillow.

If it turns out to be true that homeowners can expect to make more money, net of transaction costs, by selling to iBuyers versus listing with a REALTOR and going down the time-tested traditional path, then all bets are off.

Or more accurately, my bet with James (and others) is on.

Now Layer on Mortgage, Title, Etc.

In my first post, I said that the way that iBuyers could get to driving the cost below the traditional cost threshold was by bundling mortgage, title, insurance, etc. etc. That all remains true, even though the unit economics without that bundling is superior.

I’d have to do some real work researching RESPA, but I imagine that smart lawyers and businesspeople can figure out a way to offer discounts to consumers for bundling, in much the same way that Geico and USAA and all the other insurance companies offer you discounts for bundling home and auto.

Eric Wu of Opendoor.com is on the record as saying that he wants the home sale experience to cost nothing. Zero. Nada. That’s removing friction, all right.

So, let’s say that through the magic of bundling, selling to an iBuyer represents a 3-4% gain over listing with a real estate agent. On a $300K house, that’s $9-12k in the pocket of the homeowner. The game is over at that point. Only those whose homes have been rejected by iBuyers, or whose local markets do not have an iBuyer, will go down the traditional path at that point.

The Question of Money and Volume

One of the points that James raised was where the money to do all this buying is going to come from? After all, Rich Barton at Zillow has said his goal is to buy 60,000 homes within 3 to 5 years. But there were some 5.4 million homes sold last year. 60% of that is 3.24 million. Even if we assume that these homes are all $300K, that’s $972 billion.

CRAZY TALK! says James.

Yeah, if you look at it that way, it seems crazy. But that’s the wrong way to look at it.

iBuyers are not investors. They’re not doing the buy-and-hold thing. They’re not looking for asset appreciation. They’re looking to solve consumer pain, and charge a fee for convenience. So they’ll be turning that inventory as quickly as they can.

Meaning, the 3.24 million homes sold is actually 3.24 million homes bought by an iBuyer, and then 3.24 million homes sold by an iBuyer within 30-90 days. I assume that those companies are going to get much better, much more efficient, and much more expert at buying, doing light renovations, and then selling those properties.

3.24 million annually works out to 270,000 monthly. Suddenly, the capital required is a far more muted $81 billion, per month, spread across multiple companies all doing the iBuyer thing. It isn’t one company, or even four or five, but more like dozens of companies who see the opportunity and jump in.

This capital will turn relatively quickly. Sometimes, the iBuyers will lose money, and other times they’ll make money, just like any large market maker institution does in stock markets or bond markets or commodities markets: you win on some trades, and lose on others, and just hope that at the end of the quarter, you’ve won more than you’ve lost.

Sure, the iBuyers have inventory risk, and if things really crash and wipe out 50% of the value of the homes in inventory, they’re all screwed. But honestly, if 50% of the value of American housing were to get wiped out, none of us are going to be worrying all that much about macroeconomics or iBuyers, because we’ll be too busy scrounging for food and defending our water from bandits, Venezuela-style.

Where Will All This Capital Come From?

It’s sometimes amusing to me that people in real estate are often not fully aware of the size of the U.S. housing market.

Just as a point of reference, according to SIFMA (Securities Industry and Financial Markets Association), in February of 2019, a total of $96.6 billion in MBS (Mortgage Backed Securities) were issued between Agency (Fannie, Freddie, Ginnie Mae, etc.) and Non-Agency. Yes, some of that was likely CMBS (commercial mortgage backed securities) but the lion’s share is home mortgages. That’s one month, and a short one at that.

For the full year 2018, SIFMA reports that a total of $1.9 trillion (with a T) was issued in MBS. $972 billion is less than half of that amount.

Who’s buying these MBS? Pension funds, sovereign wealth funds, insurance companies, etc. etc. who need stability and income.

When the iBuyer engine really gets going, that capital is going to turn and turn quickly, and the end result is actually a mortgage assumed by a homeowner and held by a bank. Think about it.

iBuyer buys home from Seller. iBuyer is out cash, Seller is up cash. Seller pays off his mortgage, celebrates, and then goes shopping… turning into a Buyer. iBuyer gets a piece from its fees.

Buyer then buys a home from an iBuyer. To do that, Buyer puts cash down as down payment, and assumes a mortgage. The iBuyer gets a piece from the lender, probably, but the capital for the mortgage is going to be come from some kind of a lender. The lender is down cash, up a mortgage note, and the iBuyer is up cash.

Naturally, the lender would sell those mortgages into the secondary market, the aforementioned MBSs, and voila! More capital!

The iBuyers Create Transactions

Now, note that the bet is for iBuyers to be 60% of home sales, not transactions. The reason is that iBuyers will increase the number of transactions, by two, in all of their deals.

Today, a transaction is seller to buyer: two sides, one home. Tomorrow, the transaction is seller to iBuyer (two sides), iBuyer to buyer (two sides). Double the transaction count. Same number of homes sold, but instead of 10.8 million transaction sides from 5.4 million homes, we’re looking at 17.28 million sides.

Plus, there’s the possibility that Americans will start moving more if they can buy and sell houses the way they can buy and sell cars: quickly and over the Internet, with easy financing available.

Ergo, 60% in 5 Years

That’s why I made the bets I did.

IF (and that’s a big if, but the data so far suggests it is) selling to iBuyers nets homeowners more money than listing with a real estate agent, then that will very quickly become the norm. See, Uber & Lyft.

In that scenario, the iBuyers are going to get better and better and more efficient and cheaper, and start bundling services to drive costs down even lower. 60% is not crazy.

The capital will be available, because the end product is a mortgage note, and we have long since figured out how to make capital flow with mortgages and MBS notes.

Q.E.D. Or as Blackpink might say, Boombahyah! 🙂

Now, to find some great restaurants in Washington DC… or Las Vegas… or popular conference cities where I might see James….

-rsh

25 thoughts on “60% of Home Sales by 2024 Will be iBuyer: For My Friend James Dwiggins”

Great article!

Another great article furthering clarifying the potential enormous size and fast pace of the inspiring I-buyer model. I see gargantuan sized challenges for specifically Zillow as they would have to completely change there business model from a media company to a company who is deep down the funnel as a brokerage, mortgage originate, home flipper and title company.

If Zillow was successful at changing quickly and boldly, At that point, the major differentior between Zillow & Redfin would be Redfin agents are employed & contractors (see Remax/Redfin partnership) & Zillow would need to enormously change. They’d have to go “all in” on I-buyer and use 1099 or partner agents to buy and sell the I-buyer homes. Isn’t this a competitive advantage for redfin, using in house agent teams with in field brokers to sell a bundle style package? It “should” allow Redfin to charge a smaller fee.

Won’t aggregator websites develop to cost compare/price of Redfin, Zillow, Opendoor, Knock, etc. and present the best I-buyer number to the consumers like similar industries.

If this plays out, I agree with your prior article about pairing Opendoor with Zillow which would make all the sense in the world.

But who, would buy who? Zillow Enterprise value is currently 7B . Opendoor last rounded of funded had it worth 2+ B. One could argue that if we are discussing a 60% I-buyer world, Opendoor business model is the originator of the I-buyer as we currently know it. Would they be willing to take less than 51 % controlling rights of Zillow? Remember Zillow thus far hasn’t been profitable with their primary business the premier agent. I’m not so sure Opendoor doesn’t but Zillow, not the other way around!

I think you’re correct. ZG would have to transform; it’s what I wrote about in the December Red Dot where I said that Zillow is transforming. I just didn’t think it would transform so quickly, and so decisively.

And I further agree that it gives Redfin a competitive advantage from an operational standpoint; it’s what Glenn Kelman touted every time iBuyer comes up in an earnings call. But I wouldn’t count out ZG, especially with the new talent they have in-house now from Invitation Homes and elsewhere.

I also think a “Kayak” for real estate would develop, yes, and in fact, have given presentations in the past talking about how real estate agents might change to be something more like insurance brokers: getting quotes and terms from the actual underwriters/iBuyers.

In terms of who buys whom, if ZG and Opendoor got married? I mean… I guess it would still be ZG buying OD today, but that could change. The big difference between the two is that ZG has essentially zero cost of customer acquisition; they said as much on stage at Clareity MLS Executives Workshop. Opendoor has a non-zero cost there. But in my personal judgment, Rich Barton taking over at CEO gives a greater chance of that marriage happening, because I think he and Eric Wu & Keith Rabois have similar missionary mindset about this industry. Not that Spencer wasn’t a true believer; he very much was. But Rich is a different kind of cat, imho, with a different kind of track record.

Great points. Rich Barton’s return is very significant. My skepticism in Z is the large shift in the business model w/o a profitable primary business as a publicly traded company. If they weren’t scrutinized every 3 months, my feelings may be different.

Full disclosure: I’m long Redfin.

The caviar of Food For Thought! Thanks for posting. And this article doesn’t even factor in the massive revenue stream created by listing leads for the homes they don’t buy being sold to Realtors. And what about when the IBuying companies get big enough to negotiate massive discounts at Lowe’s and Home Depot for materials!?? And what if the IBuyers take ownership of the construction Companies doing the repairs? There are so many streams of potential income to drive down the cost of selling. I don’t know if 60% will happen by 2024 but I have no doubt that this model will quickly gain market share. Very interesting.

Rob,

I had NextHome agents from around the country go to OpenDoor and request offers on their homes or send me deals that closed with OpenDoor the past two weeks. This is just a small sample size I’m posting below from Phoenix, Socal, and Florida. I’m tracking more over time. The first number is what the house is worth or actually sold for. The second number is what OpenDoor offered, and the third is obviously the difference. This averages to 8.24% below market before OpenDoor’s 7.5% service charge, and repair costs. From what I can tell, the repair costs is where the seem to really screw everyone. I’m hearing and have verified from one MLS 33% of their deals have a price reduction once they quote out what needs to be repaired in order to close. They also use the cheapest possible labor and product to fix the house – again stretching their margins.

Actual Value OpenDoor Home Value Difference

House 1 $250,000 $243,900 -$6,100

House 2 $440,000 $378,100 -$61,900

House 3 $550,000 $485,600 -$64,400

House 4 $408,000 $386,500 -$21,500

House 5 $350,000 $333,000 -$17,000

House 6 $287,500 $274,500 -$13,000

House 7 $560,000 $536,700 -$23,300

House 8 $290,000 $249,000 -$41,000

I would also pay close attention to what people are saying about them. If your company reputation only 4 years into the business is this bad, at a certain point you’ve pissed off enough people to have them sour on your company and turn people off to the idea. I’m going to keep collecting data like you are, but I just don’t see it ever being 60%. I’m still sticking with 30% of the market and in 10 years – not 5. They have to have a margin in there for a profit and downturn that will eventually come. I just don’t see most people taking this kind of a hit on their net proceeds.

https://www.highya.com/opendoor-reviews

https://www.bbb.org/us/ca/san-francisco/profile/real-estate/opendoor-1116-539425/complaints

https://www.indeed.com/cmp/Opendoor/reviews

This is fantastic stuff, James. 🙂 You da man, moving the conversation forward.

The only caveat is that I used Zillow’s Unit Economic numbers, because that was in their public filing. Opendoor is obviously not public and not releasing any of their unit economic numbers. By all this information, it does appear that Opendoor’s unit economics are nowhere near competitive.

Is there a way you can do this for Zillow Offers?

I don’t think ibuyers are nearly proven enough to consider them a real threat. If you look at other industries that offer some sort of “online offers” it always ends up coming at a significant cost to consumers and I don’t see this being any different. Looking at some cherry-picked numbers from Zillow won’t convince me otherwise.

Furthermore, we’re totally ignoring the fact that the real estate landscape could completely shift. Even if ibuyers provide some sort of value compared to traditional realtors what’s to stop a new model emerging, for example, something like what purplebricks does or a professional services model, where agents are paid per diem instead of on a commission basis. A professional services model would significantly lower costs for anyone who is serious about selling and prices their home appropriately. It’s not difficult to imagine such models also offering consumers cost savings through bundling.

Finally, another point is that if ibuyers are only making less than 1% on a flip (in the example provided I believe Zillow made something like .5%) it really doesn’t even make much economic sense. I mean Zillow would need something like 25-30% market share just to replace the close to 1 Billion in revenue they make from premier agent and I don’t really see both ibuyer and premier agent programs existing happily together at scale. Ibuyer programs will cannibalize premier agent revenue.

The iBuyer business model promises convenience for the seller to close the transaction fast.But after reading all of the bad reviews, I am not sure that this business model will survive and be able to cover the huge investment.

Yes, there is a very small market for this business model, but the majority of sellers will not want to lose money.Many new business models pop up in this industry, promising the consumer that miracles do happen, and they make predictions that this business model, will become the industry standard by 2024. I predict that Zillow and OpenDoor will be out of business.

The main questions are, can this business model make money and become profitable enough to justify its massive valuation? is this model definitely the next step for residential real estate?

In my own opinion the main barrier for this business model is cost.

https://www.inman.com/2019/03/20/opendoor-nabs-additional-300m-at-a-reported-3-8b-valuation/?utm_source=inbriefselect&utm_medium=email&utm_campaign=inbrief&utm_content=725254_textlink_0_19691231

Zillow – 5,000 homes a month in 3-5 years. OpenDoor did 36,000 last year (unverified). No way 3.2M homes in 5 years is ever going to happen, my friend.

I’ll take A-5 Wagu in Washington with an aged Château Lafite Rothschild. I’ll figure out the vintage when I get closer to the dinner. 🙂

😀 A-5 Wagyu does sound pretty good….

60% – that’s a pretty big matzo ball you have hanging out there. Good thing there is only a dinner riding on it. I would say lucky to get 20% in 5 years.

As John Gruber of Daring Fireball likes to say, this will make for good Claim Chowder down the road.

Rob, I think you will win the bet. Here’s why: because of the power of women (I’m female, so pulling the gender card). I see many of the comments here focused on the value of monetary (quantitative) savings when it comes to real estate transactions. However, many extremely intelligent and real estate savvy women do not place profit as the first priority when it comes to a home sale or purchase.

You term selling a home the traditional way as “consumer pain” while I, and many of my highly accomplished female Clients would call it “sheer hell,” “beyond stressful,” “horribly disruptive to the family and our schedule,” and “not worth keeping the damn house spotless.” If they can afford it, women will happily pay more for Amazon to deliver whatever to our front door or magically bring us an overpriced dinner via Uber Eats. Why? Because we are often over-worked, emotionally exhausted, professional women, and/or mothers, or community leaders, and/or caregivers for special needs children, and/or spouses and/or elderly parents.

Bottom line is we often need RELIEF. And, when it comes to buying and selling homes many of us don’t mind paying more (or not making as much) IF we can diminish that pain. AND the men in our lives who love us dearly know making us happy is a VERY beneficial move! For most women, “a house sale” is not just a quantitative, but a qualitative transaction. iBuyers fulfill our deepest needs because we generally care a great deal about a happy “home life” and not as much about making a hefty profit from a “house sale.”

WOW! You channeled my wife. Spot on observation.

The biggest constraint I see is market expansion. I could see them at 60% in the markets they are operational in, but they won’t be serving 100% of America, even in 5 years. Then, even in the markets they are in, they are declining a significant fraction of homes that don’t suit the business model. So – 60% market share in the markets they serve is doable. 60% of the US housing market at large would be immense.

Excellent point. I do wonder where the home sales really happen though. Not a lot of rural family farms changing hands every few years, right? I imagine most home sales are concentrated in and around major metropolitan areas.

I can only speak from personal experience in which my mom has bought and sold far more rural homes than I have. She moves all the time. I’m sure someone has that data already nicely bundled for our consumption? Now I’m curious…

But also, there is the question of “what is rural”. I live in an MSA of 450,000 people outside Austin that is not on any iBuyer’s radar.

Nice job Rob. Always needs to be said because it is true.

So I look at this from the consumer’s perspective. Overall, I think the consumer is tired of playing the role of the iBuyer. That’s right, if you think about it, today the consumer as a buyer is the entity that is assuming the role of applying their cash, financing the balance of the buy, purchasing the “used property”, fixing it up and holding it for some amount of time. The consumer is taking the risk of tying up capital and carrying the property until an eventual sale.

And you know what? My bet, or more of a sure thing, is that they are sick and tired of it.

So along comes a different option that removes them as the iBuyer and places them in the role of a true buyer. That is the buyer that was once a seller and now makes the choice to buy the revamped property owned by the iBuyer turned, iSeller. That property is in move-in condition, can be purchased instantly, is a completely known commodity, might even have a mortgage on it, the title has been cleared, the property might even be warranted, and best of all – they are able to avoid the typical, outdated randomly served resale real estate consumer experience.

What the brokerage industry refuses to admit is that this is and will be a preferred way to sell and buy properties as you predict here. And why do I think that? Because this industry has historically spent the majority of its time “loving to hate something” rather than to learn from those things that they hate.

And the result? This industry is ripe for being impacted by certain and continued change that will most assuredly continue to erode what we know today as this old and tired thing called the traditional brokerage model.

The road to a “free” transaction isn’t as long as people think.

The iBuyers get extremely valuable data to trigger advertising/marketing events. It takes the concept of MLS ad targeting to a whole new level, and without restriction. By restriction I mean, for example, that certain MLS vendors know which properties are most likely to list based on member activity. The vendor would never (or at least shouldn’t) do anything with that data because it would be a major breach of contract.

The iBuyers, however, just have a click-through agreement that most likely would allow them to target buyers and sellers with their own solutions and/or share that with marketing partners.

If an iBuyer has data suggesting that a $300,000 4bd FL home with no change of ownership for 20 years is about to go on the market, they could sell that information 50+ times to a wide variety of eager buyers willing to pay exorbitant rates for the chance to sell them something.

Lenders, title, movers, painters, furniture stores, new home communities, retirement communities, insurance companies, investment firms will crawl all over each other for those leads. Even with a single, preferred partner in each category the revenue potential is there to get the overall transaction cost on the path to zero.

And that’s just one way way to monetize the information, I’m sure they are looking at many more.

The poor reviews of Opendoor are significant. I see lawsuits on the horizon, from both employees and consumers. Experience is a great teacher and the internet even better where people can share their experiences, good and bad.

Plenty of Realtors with poor reviews. I know a few in jail.

Opendoor’s bar is pretty low on the “good reviews” issue.

Also their model is almost identical to Homevestors, and you don’t see class action lawsuits or prison sentences for those folks (generally, anyway).

I have been trying to communicate this basic idea (not to this extent or detail) to fellow brokers and agents for a while, no one seems to get it or buy it. In 1999 got car insurance, car loan, and a car online during my lunch break for gosh sakes………1999! Honda civic, I realize you cannot go wrong with a low mileage Honda and homes are much more complex, but to think the principle of increasing efficiency in the home transaction process will not happen is dreaming. Market trajectory and respa type laws and steering might be challenges, but it will happen.

I do not necessarily believe it will reach 60% within 5 years, but it will be moving in that direction. As a home owner and a realtor, this appears to be a better mouse trap. I feel like an agents primary job is to ease the seller/buyer through the process because it is stressful and complicated. The ibuyer method basically removes the need for the agent because the complexity and stress are pretty much wiped away. My question is – how do I get ahead of, take advantage of this coming future? Because, as a new realtor, I can already see my coming obsolescence .

Another couple of things:

First, if our job is to work in the best interest of our clients, I can easily see myself recommending a seller to go the ibuyer route (i.e. if they are in a rush, if important repairs are beyond they’re budget, if the idea of getting their act together for showings is too stressful, if stress in general is one of their big concerns, just to name a few things off the top of my head).

Second, as pointed out by Rob, convenience is becoming more and more important to today’s clients there is a reason those great small personable shops are shuttered, and internet shopping and walmart-like businesses are King. I know I love the idea of a homey downtown, but do I shop there regularly? Now, the quick rebuttal will be that house purchasing and selling can not be compared to everyday shopping – but, I disagree. Convenience does not have a price ceiling. The idea of wealth, if nothing else, is self-determined time. Convenience’s seduction, is the time it affords. No matter who you are, you want your time. When convenience is visibly and understandably offered (i.e. how Amazon Prime took off once it hit that tipping point), no matter what the object, and no matter your financial position, it will most often be chosen. I believe that unfortunately, how great and personable an agent you are, will not really factor, if you don’t make the right moves in the next decade (or less, if Rob is correct). You will become that quaint downtown shop that sees it’s inventory and clientele dwindle until your doors will necessarily be shuttered. As an agent, what are those moves? I wish I knew.

Comments are closed.