I realize I just posted on the future of the MLS, and normally, I’d let posts sit for a few days to “mature” but this is far too big an event and far too big a deal to wait.

In case you missed it, a class action lawsuit was filed with the United States District Court in the Northern District of Illinois (aka, Chicago) on Wednesday, March 6th. I think it will likely end up being called Moehrl v. NAR, et. al. It alleges that cooperation and compensation is an anti-trust violation that results in consumer harm, and seeks an injunction against forcing home sellers to pay the commissions of the buyer agent.

I know I’m accused of hyperbole by some, but I really don’t think I’m exaggerating when I say that this case could be a nuclear bomb on the industry. If the court rules in favor of the plaintiffs here, REALTOR Associations evaporate, the MLS likely dies off, and the entire infrastructure of residential real estate in the United States has to be remade. It could be Ragnarok, the final end of the world battle of Norse mythology. Hence the title of the post: twilight of the Gods.

A Bit About the Case

Moehrl is a class action lawsuit on behalf of “all persons who paid a broker commission since March 6, 2015 in connection with the sale of residential real estate listed on one of the Covered MLSs.” (From the Complaint.) The “Covered MLSs” in turn refers to:

- The Bright MLS (including the metropolitan areas of Baltimore,

Maryland; Philadelphia, Pennsylvania; Richmond, Virginia; Washington,

D.C.); - My Florida Regional MLS (including the metropolitan areas of Tampa,

Orlando, and Sarasota); - The five MLSs in the Mid-West that cover the following metropolitan

areas: Cleveland, Ohio; Columbus, Ohio; Detroit, Michigan; Milwaukee,

Wisconsin; Minneapolis, Minnesota; - The six MLSs in the Southwest that cover the following metropolitan

areas: Austin, Texas; Dallas, Texas; Houston, Texas; Las Vegas, Nevada;

Phoenix, Arizona; San Antonio Texas; - The three MLSs in the Mountain West that cover the following

metropolitan areas: Colorado Springs, Colorado; Denver, Colorado; Salt

Lake City, Utah; - The four MLSs in the Southeast that cover the following metropolitan

areas: Fort Myers, Florida; Miami, Florida; Charlotte, North Carolina;

and Raleigh, North Carolina.

As you can imagine, these are some of the largest MLSs in the country with hundreds of thousands of agents and millions of consumers and transactions over the past four years.

The named Defendants thus far are the National Association of REALTORS, Realogy, HomeServices of America, Re/Max and Keller Williams. The lawyers picked the top four largest real estate brokerages in their Complaint; I assume that they will quickly realize that Re/Max and Keller Williams are not brokerages, but franchise companies, and will either amend the Complaint to include some other large brokerages (Howard Hanna? Compass? HomeSmart? eXp Realty?) and/or other large franchisors (Realogy brands, Exit, NextHome, etc.).

The basic claim is that the MLS rule of unilateral offer of compensation is a violation of the Sherman Antitrust Act. From the Complaint:

Defendants’ conspiracy has centered around NAR’s adoption and implementation of a rule that requires all brokers to make a blanket, non-negotiable offer of buyer broker compensation (the “Buyer Broker Commission Rule”) when listing a property on a Multiple Listing Service (“MLS”).

The theory goes something like this:

- The MLS is a required utility for any brokerage who wants to be in business;

- The MLS is controlled by local Associations, who have to abide by NAR’s rules and policies, including the Buyer Broker Commission Rule;

- The four named brokerages/franchise companies require that their agents and franchisees belong to NAR;

- The Buyer Broker Commission Rule forces sellers to pay for the buyer broker’s commissions;

- The interaction between NAR, the local Associations, the local MLSs, and the defendant brokerages/franchises (and I’m going to assume many more defendant brokerages and franchises will be added to the list at some point) constitute a conspiracy in deeds and words;

- That conspiracy keeps brokerage commissions high — between 5 and 6% — which harms home sellers.

The lawsuit wants damages (of course) but importantly:

That the Court award Plaintiff and the Class a permanent injunction, under Section 16 of the Clayton Act, enjoining Defendants from continuing to require sellers to pay the buyer broker and from continuing to restrict competition among buyer brokers

Yeah. Kaboom.

This Is A Real Threat

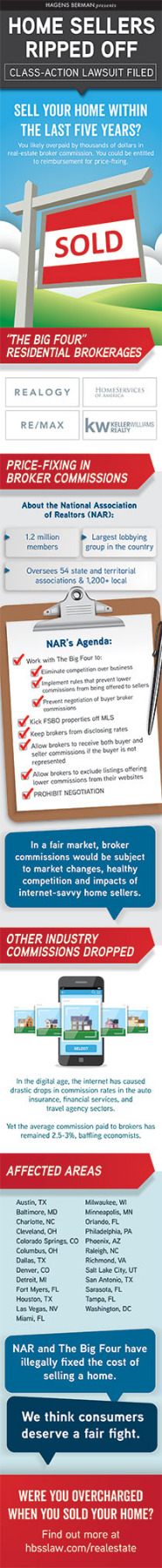

[To the right is the infographic created by Hagens Berman which is on the page where they’re soliciting class action members.]

[To the right is the infographic created by Hagens Berman which is on the page where they’re soliciting class action members.]

Already my Facebook thread on this case is abuzz with REALTORS playing legal counsel, opining that the case has no merit, that the lawyers are scum, and so on. Listen, have all the opinions you want, but could I suggest that you at least read the actual Complaint first before forming an opinion?

I have to think more about the claims made here, but at first glance, this is a serious threat. The lawyers here make a pretty credible claim of “conspiracy” (meaning, coordinated action) and there are a lot of economic studies on how cooperation and compensation affect commission rates in North America. I’ve talked about such studies in the past, but until something like this happens, academic studies are just that: academic.

Their facts are hard to dispute. NAR does have those policies. The MLS does have the unilateral offer of compensation. The brokers and franchises do require their agents to become REALTORS and join the local MLS. The MLS is an essential utility to be in business. None of that is really all that disputable.

So the issue will be whether subtle details about how cooperation and compensation really works will be enough to make a difference legally. I have no way of knowing how that plays out.

What should be concerning to MLS leadership, to Associations, and to large brokerages and national franchises is that the lawyers involved in this case are seriously scary dudes. In past legal actions against NAR, against the MLS, and against large real estate companies, the lawyers bringing the case tended to be small plaintiff’s lawyers seeking a relatively quick payday. Those smaller law firms can’t take on a protracted multi-year litigation with expert witnesses, motion practice, deluging the other side in paperwork and discovery requests and so on.

The two lead law firms in this case are Cohen Milstein Sellers & Toll and Hagens Berman Sobol & Shapiro. These are two of the most successful class action plaintiff’s law firms in the country. They both appear on the list of Law 360’s “Most Feared Plaintiffs Firms” with some significant victories over really significant companies.

Cohen Milstein beat on Apple, for example, in the electronic books antitrust lawsuit.

Hagens Berman is the firm that took a $1.6 billion bite out of Toyota for the “sudden acceleration” problem with some of its cars.

They have hundred of billions in victories between the two of them, quite a lot of lawyers in offices across the country, and a huge war chest for these kinds of complex class-action lawsuits. These are not your average ambulance chasers; these are the guys that cause tightened sphincters for the General Counsel at major corporations, banks, and institutions.

They can keep a lawsuit going for years and years if need be, as they have the capital to keep paying lawyers and expert witnesses and so on. This lawsuit is a serious threat.

And It Will Not Settle

Even at this early juncture, I can’t see how this lawsuit gets settled out of court.

First of all, the damages. I don’t have the stats handy on how many transactions across how many sellers we’re talking about here with the 20 MLSs named in the “Covered MLSs” market area. But we’re talking about some of the largest metro markets in the country: Washington DC metro, Orlando and Tampa metros, Dallas, Houston, Austin, San Antonio, Phoenix, Chicago, Minneapolis-St. Paul…. We’re talking hundreds of thousands, potentially millions of transactions.

Say the average sale price across those areas over the past 4 years was $300K. 3% of that (the buyer commission) is $9,000 per transaction. Antitrust law provides for treble damages. So we’re talking $27,000 in potential damages per transaction, multiplied by (conservatively speaking) 2 million transactions.

There isn’t enough money at NAR and the four named Defendants to pay that kind of damage award. What are these lawyers going to settle for, if the potential damages is $54 billion? $10 billion to make this go away? None of these companies or institutions have that kind of money, and their liability insurance is not covering $10 billion in legal settlement.

Furthermore, money is one thing. What the plaintiffs want here is an end to cooperation and compensation. That destroys the MLS, and if the MLS gets destroyed, it kills the REALTOR Associations. It might kill off a whole lot of brokerages as well, if their agents now have to try to get the buyers to pay them directly.

No, this will go the distance. There’s no settlement possibility here.

Whoever loses at the district court is likely to appeal to the Federal Court of Appeals. And then possibly from there to the Supreme Court. There is far too much money at stake and far too important an issue of survival for all of organized real estate for this case not to go all the way, as far as it will go.

Let’s Not Assume, But…

At this point, all that has happened is that a lawsuit was filed. It doesn’t mean they’ve won, or that the lawsuit will even go on. I’m sure NAR and its legal team are preparing a response, and I’m certain they’ll seek to have the case dismissed.

It is far too early to start making prognostications of what this case means for the industry, for business models, and so on.

However, this is a real case, filed by real lawyers with real money in the bank, who are playing for keeps and huge dollars. I would urge everyone to at least pay attention to the case.

If you are an MLS, a REALTOR Association, a large brokerage, or a large tech company in our space, I would suggest at least starting to think about the unthinkable: a contingency plan just in case.

Anyhow, that’s all I have for now. I’ve read the Complaint, I see what they’re alleging. I can’t wait to see how NAR and the defendants will respond. All I have to say is that this is a serious threat and everyone is well-advised to take it seriously.

-rsh

56 thoughts on “Gotterdammerung: A Very Serious Legal Threat”

“Listen, have all the opinions you want, but could I suggest that you at least read the actual Complaint first before forming an opinion?”

LOL. Expecting people to read before unleashing their JD with Honors from Facebook University. Really? Next you’ll ask them to not only read, but actually think critically AND comprehend what they are reading.

Such a silly boy.

Really interesting piece, Rob. thanks for your thoughts! I’ll admit, my first gut reaction was, “ambulance chasers.” This piece made me think…

Rob & Notorious-Readers,

Anyone want to take a guess at how they anticipate how the Real Estate Industry will look when the class-action is settled/won? I’m appreciative of any guesses.

Do the law firms take a couple $B$ from the MLSs/NAR/StateAR/LocalAR and somehow prohibit the regular practice of sellers paying buyer agents?

Honestly, as an old IT guy (since 70) and a small businessman prior to my 20+ years playing in RE part time (albeit with a team and paid staff), I’ve been amazed that this industry is able to charge 5%-7% of sales price — consistently without seller pushback. Probably because we all say “well, seller, this is just the way it is…pay or never sell.” And, it’s just not the actual pay – it’s the absurdity of the ultimate hourly rate and the non-disclosure of rookie-status. Who can easily verify that I’ve been in the business x-decades with x-hundreds of transactions? Or that I just started last week? I’m certain that I average between 10-20 hours actual client work for a typical $10,000 paycheck (100% broker at 5% split on $400k house). Even with my MSEE degree, I’m not “worth” $500/hour – no matter my experience. (For you math-challenged, that’s $1M/year if “full time.” Especially now with Zillow data and 99% standardized contracts.

I’m post-retirement with multiple pensions, so the money isn’t important. But I have several family members and good friends in the biz, so I’d like to start preparing for the future.

Thanks all. (Great stuff Rob – as usual)

Haven’t read it yet but I will. The only agreement to this piece at this point is that being from the Seattle legal community, I know of the Hagen Berman well and they are very credible and historically effective class action attorneys.

“Anyone want to take a guess at how they anticipate how the Real Estate Industry will look when the class-action is settled/won?”

Just take a look at how the real estate industry operates outside of North America. For example, here in New Zealand, we do not have an MLS … And there is really no such thing as ‘Buyer Agency’. On rare occasions a buyer wants the services of a ‘Buyer Agent’acting on their behalf – they pay for it (Not the sellers).

Interestingly, average commissions and the number of agents per capita/transaction is about half that of North America.

If you believe that you are either a newbie or you are a 1-2 homes per year agent.

First, the Seller pays the Listing Broker. The listing broker uses a predetermined amount of those earnings to pay the cooperative broker. (this is not my opinion it is spelled out in the wording of the listing contract) . It is agreed in advance that the buyers broker DOES NOT represent the seller so lets not go there. Not for nothing does the seller agree to this arrangement. Sellers understand that Buyers want/need to be represented. Sellers want as many potential buyers as possible, it is in sellers own best interest to create a bidding war and result in the highest net selling price possible. The argument that a seller should not pay the buyer broker fee is crap. Its in his own interest to do so and by doing so he profits greatly by establishment of a much larger pool of buyers and, in the end, a much higher selling price.

Proponents of the plaintiffs case would have you believe that a typical buyer would just pay their buyer broker out of their cookie jar before looking at homes and that the seller should reduce listing fees accordingly. Are these people asinine or just ignorant? Well, they are lawyers after all. LOL

PS, you do know that not all Brokers are REALTORS and nothing stops a seller from choosing a non MLS broker.

Very Very Interesting!

I have long believed that the buyer compensation would be the next battleground, but I thought that would be from consumer pressure…..not a legal battle!

OK Rob. I think you got everyone’s attention with this article. I won’t be playing legal counsel or opining that the case has no merit. I won’t even touch the lawyers are scum comments. Last time I checked, real estate agents, journalists, lawyers, and used car salesmen were all battling it out for the last place in public opinion polls.

To be honest, I find the lawsuit scary, yet fascinating.

Thanks for sharing Rob. Interesting thoughts on what may ultimately be a black swan event for the real estate industry.

Also, interesting timing with iBuyer programs gaining traction & Z announcing fundamental changes & this case…

I can’t speak to the merits of the legal side of this but let’s look at the consumer side… what if all of a sudden buyer co-op fees aren’t a part of MLS or that all sellers all of a sudden don’t pay buyer agents. The system currently works well – sellers have equity and can pay both agents. Buyers usually can’t afford to pay the agent. You can argue this isn’t fair but in the lifetime of a consumer, this balances out unless you sell more homes than you buy (which isn’t likely). Ignoring agent and brokerage business models, the consumer is harmed. If sellers don’t pay buyer agents and buyers can’t afford to pay an agent, the buyer will either need to use the listing agent or have no agent. If buyers start to work with listing agents and listing agents are acting as transaction brokers (neutral party and can’t give anyone advice)…. Listing agents are doing more work for less money (3% vs 6%) but still have to manage both sides of the transaction. Both buyers and sellers aren’t getting advice and consumers WILL be harmed from a lack of knowledge. To me, a consumer advocate should encourage the co-op system.

well put.

How about we think about the outcome as just changing the “Blanket offer of compensation”….

A buyer’s agent signs a buyer broker agreement with their client for 22 bananas as compensation. But, the buyer doesn’t have 22 bananas… so when they submit an offer, on a property found through the newly updated MLS that does NOT offer blanket compensation, the contract states that the Seller is responsible for contributing 22 bananas at closing in addition to any Purchaser’s closing costs that are requested. Compensation is just another closing cost.

There is nothing that says every buyer’s broker should get paid an amount determined by a listing agent. Plenty of brokerages have different models, and they already give commission back to the buyer at closing. This is no different. It’s just starting with “It’s up to you, Mr. (or Ms.) Buyer’s Agent to ensure your own compensation.” Novel. But it doesn’t destroy the industry.

I agree – fixing compensation has it’s downsides and we can run this with an open mind. My point is that both sides need an agent and creating a system where buyer agents don’t get paid will trickle down on the consumer – regardless of how it affects our business models.

Greg.. we’re in agreement 100% here. And the greatest impact will be on cash strapped buyers… which will have fair housing implications… and that Ironically hurts the consumer as much as the current perception of price fixing.

Well, if you’re concerned about cash strapped buyers, which has fair housing implications, couldn’t you do like lawyers do and offer pro bono representation? Seems like that sort of thing might help burnish the REALTOR brand among other things.

Regarding limiting cash-strapped buyers and fair housing, the fact that buyers making a small down or zero down payment can currently, since it’s part of the total price, also finance their buyer’s agent commissions has allowed prices to sky rocket thus making housing less and less affordable. Irony eh? Maybe that’s a good argument to get rid of buyer agency too.

There was a time in the not so distant past when there was no buyer agency in North America. The idea of buyer agency has caused all kinds of problems maybe this case being one of the contemporary arguments against it. On it’s face, buyer’s agents being compensated more when the buyer pays more is against the code of ethics and is happening all over the country as I’m typing this. In the past, buyers would contact the listing brokerage and the listing agent would facilitate the offer but not represent or advise the buyer in any way. For consumer advocacy, a lot of things can still be provided to the buyer as in the “Get A Home Inspection” disclosure among others.

First of all, I am not convinced that the continuance of “organized real estate” is in anyway linked to the continuance of real estate brokerage. I get where the parties that make-up organized real estate may have concern, but that is their own problem to figure out.

Now for the discussion of the neutered competitive nature of real estate brokerage.

Blanket policies that appear to be intended to provide business for those that do not have any business have always puzzled me in this industry. The MLS is clearly and “all in” offer of compensation and cooperation, but I do not think that the free market supports such a requirement.

Cooperation and compensation should be broker choices, not mandated policies.

Few if any other businesses or industries rely upon their competitors to sell their products. Mostly because it makes no financial sense to do so and also because of the pure insanity of insisting that an industry participant must in some way enable a competitor to survive by allowing then to sell your product in a very competitive business environment.

And then there’s this point.

If a party to a real estate transaction is incapable of selling what they list, this should beg the question of why then would you list with that party? Lexus does not depend nor do they allow BMW salespeople to sell their inventories. And Southwest Airlines allows no third party to sell their seats. If the brokerage you are listing with cannot sell your listing in this day and age, then maybe you need to find one that will.

Finally, there is the matter of consumer deception with regard to the fees charged for services. When Redfin posts bill boards across the Country claiming they will list your property for 1%, why are they not called out for deceptive advertising? This is clearly not the case when another broker – or even a Redfin agent – shows up with an offer and demands another 2 to 3% for their contribution of bringing a buyer to the sale.

Finally, in advance of writing this comment I anticipated no less than 700,000 outcries of outrage from buyer’s brokers and agents across the Country, but that’s OK. The fact remains in business that if you don’t have a product, and you are not somehow provided with the innate right to sell someone else’s product and then force them to pay you a greater portion of the sales commission, this makes no good business sense.

Sorry.

I guess that in this case if the Plaintiff prevails, this means we may soon have something like 400,000 or less Realtors in the U. S.? Now it gets interesting.

Well you have clearly shown how bright you are with your dazzling example of the airlines not needing a third party to sell their seats. Hmm, guessing all those travel agents should expect a class action suit soon ??

My MLS doesn’t allow me to put my name and phone number in my listing descriptions because getting inquiries directly would be antithetical to the rules of cooperation. Also, we can’t even show our sign in the yard in a photo of the house because someone might be inclined to call us directly. It’s ridiculous.

If the buyer’s agents didn’t exist, then buyers would have to call us directly about our inventory via the contact info contained within the listing. I could just have a licensed assistant facilitate their offers. Sounds good to me.

Oh, this was only in the making for some time! MLS’s are truly a monopoly. We within the industry know this! I’ve been at the top and I have a little 😉 experience within. This is going to catch the attention of many. Many as in a large number of the markets at this time are at and all time low of absorption rate. This can only throw gas on the fire that started a few years ago.

Wow I can’t imagine what this will turn into for the future of real estate as we know it. I picture salaried employees with the company taking in the money? Maybe the way cars are sold? I haven’t a clue….Dual Agency will become the way business is done?

Curious that there is no mention anywhere about the FTC (not just in this post, but in the few other posts I read about this there is also no mention of them). I suspect that this within their jurisdiction, not just some clever lawyers?

My question is: Does this have legal standing when the MLS allows for competing business models such as flat fee brokerages, 1% shops, or websites that list homes in the MLS for a small fee? By the fact that all commissions are negotiable, even if they remain fairly constant, doesn’t that mean negate the suit? Or will they have to prove the whole system is rigged which they would then have to sue on RICO laws? So many questions lol

Change is on the horizon. Agents you had a good run.

https://a16z.com/2018/11/29/software-real-estate-rampell-summit/

Thanks Rob once again you have us thinking about what is in the future! Change is coming and coming fast and we need to be prepared as and Association and MLS.

Thankfully, this one is probably 7-10 years out into the future, but the impact is so ginormous that it’s worth at least doing a contingency plan type of a thing.

In my 35 years practicing in real estate law, I have seen many sellers who never read the entire listing agreement. Those who did read it, don’t really understand the contract. Anyone who enters to a binding contract, should and must read and understnad what is there before signing.

“NAR’s adoption and implementation of a rule that requires all brokers to make a blanket, non-negotiable offer of buyer broker compensation”. Seller has the right not to sign. No one really is forcing the seller to sign.

In real estate, everything is negotiable and that means also “Commissions”. Plaintiff point of view is, why should the seller to pay commission to an agent (buyer agent) who does not have the best interest to the seller and actually going against the seller.Yes, make sense but, it is up to the seller to negotiate a listing agreement terms and commission fees.In a very highly competitive industry, there are many real estate brokerages who will take whatever they are offered.

Yes, I agree that this lawsuit can change the face of the real estate industry if wins in court.This is the system and to change the system in any industry especially in real estate, is almost impossible. 90% from all law suites are ending up in a settlement.The rest 10% who are going in front of a judge, stupid! Going in front of a judge is like flipping a coin. You have 50% to win the case.

Thank you for the information. I’m not a lawyer and certainly not qualified to make an informed opinion, but the NAR does have an undeniable track record. Thought I’d point out the final judgment in the 2005 anti-trust USA v. NAR case expired November 18, 2018. Coincidence? Timely? Regardless, consumers must feel they have been damaged, otherwise why the lawsuit? If this civil action goes as far as you say is possible, it could be a real game changer for all of us.

A property listed in the mls exists because an agent listed and sold it and received a commission. The commission was already factored into the sales price and provides a comparable for the next seller. We all know with lenders and buyers the appraiser will ONLY use comparables listed and sold through the mls. Property equity isn’t made from seller alone, it is the mls and compensation that has contributed greatly to seller prop equity.

Well Rob, you got me up before 730am on a Saturday to write about this — well done!

The reason these agreements exist in the first place is not so much to monopolize compensation for brokers, but to provide the ability for buyers to work with an agent throughout an emotional, complex, and incredibly financially important process.

If the world is willing to put full purchasing power in the hands of the buyer, it must be done so that it does not create an insurmountable barrier to buyer’s ability to seek advice and guidance from an agent. For this to happen, it means, again, buyer agent’s compensation has to change, payment structures have to get creative, or something else.

Here’s my thoughts on it all and some potential implications ranked from mild to armageddon: https://bit.ly/2NTbKmp

I hope they strike down the MLS/NAR cartel. MLSs should not make NAR membership required. That would be tremendous for our industry. Make NAR earn our money instead of hold us hostages.

This lawsuit will go no where as the MLS’s don’t regulate compensation or commission.

Its long overdue,where can I sign up great news for the RE industry,we have been compelled to operate for years as a part of a giant “shakedown racket”.

I knew you’d post on the topic – was waiting for this. Last week we listed a house from a repeat client. HE’s bought and sold several times with us. He listed a property and said NO MLS, no cooperation with other brokers. He told us to put it on FB and Zillow, and market it any way we want but no MLS. The backlash is crazy. First, we stated his wishes in the listing contract. Then he had to sign an opt out form with BRIGHT MLS which stated repeatedly that this may not be in his best interests. He was insulted at the implication he didn’t understand what he was doing, but he signed it because MLS rules require it. This seller knows what he is doing. HE is a sophisticated seller and knows what this means for him. No MLS and no co-broke means yes some agents won’t show it. But that is how he wants it. The MLS is a monopoly. It is a utility in my opinion, for what it is worth. This is a serious development.

Outstanding reporting. I’m curious about the Redfin model. Don’t they offer prospective buyers a competitively priced option, and an opportunity for the consumer to receive a lower commission in the form of a rebate?

I believe they do, but it’s unclear what those buyer rebates are in markets where Redfin is doing the 1% Listing Fee. Maybe a Redfin rep could comment?

I have a hard time believing this will go anywhere. I do think however that buyer brokers and their fees are where we’ll start to see disruption. Most of the extra fat in terms of excess fees are due to buyer brokers, and the lead selling scheme Zillow runs. Buyers that aren’t serious/motivated, as well as Zillow’s insertion of 3rd party buyer brokers into transactions, adds an enormous amount of unnecessary friction. Nowadays you really don’t need buyer agents at all. A buyer can find all the listing supply online and simply hire a good attorney while working directly with the listing agent. A buyer broker brings nothing to the table other than excess cost, and if you’re seriously concerned about negotiating the best price or something of that nature you might as well just hire a broker to negotiate on your behalf for a flat or hourly fee.

Directly from the Buyer section of the Redfin website … “Close smoothly and save thousands. Your agent will guide you through the closing process. And Redfin pays $1,700 USD on average toward your closing costs.”

Wouldn’t this suggest that Redfin – and similar firms – offers the buyer (in addition to the seller) a viable option to receive a discounted commission rate, in contrast with the conspiracy theory that brokerage commissions are inflated?

Yahhh I have been waiting for the development for a long time.

I work as a Buyer Broker.. yes, yes one of the “parasitic” brokers that do not list property. I just spend my time ferrying folks to 60 properties over a three day weekend, negotiating the deal and then making sure everything goes as it is supposed to… I know – I know, I am just consuming bon-bons while I collect my co-broke fee.

In all seriousness; I like working with buyers and choose this business model. I also thoroughly appreciate the hard work Listing Brokers do to promote and market their listings. But I do welcome this discussion, why?

Because I believe that Sellers should pay their Agent and Buyers should pay theirs… takes away any whiff of conflict of interest for the consumer.

But it is hard to get this accomplished. I always work with a Buyer Broker agreement where I discuss with the Buyer prior to looking at property how I get paid. I explain the traditional model and then also offer Buyers the option to pay me directly for my services – so they KNOW there is no possibility for a conflict.

Guess what… every one of them opts for the way things are currently done.

For obvious reasons, they don’t want to have to shell out any more cash at closing then they need to! But what if Buyers really understood that they are paying me anyway; the Seller has to get a higher price to cover everyone’s commissions so they pay more for the property.

I am not sure how the current model of compensation got its foothold. Probably back in the Stone Age, when Buyer Agents were sub-agents for the Seller, then it made sense that the Seller paid the Buyer Agent’s compensation – they were “working” for the Seller.

Things have changed since then. We don’t do sub-agency, we do Transaction Brokerage. But the compensation process is still the same.

I welcome the discussion – lawsuits not so much, lawyers are the only ones that win in that scenario. I just don’t see things changing a whole lot since Buyer consumers really don’t want the status quo to go! And if Buyers don’t want things to change, will Sellers want to rock the boat?

I agree that it would make sense for buyer brokers to be paid by the buyers, but expecting a buyer to pay a 3% fee out of pocket makes little sense. It may not seem like a huge sum, but when you consider the additional out of pocket costs for someone who might only be putting 10-15% down it increases their up-front costs dramatically. This is why the redfin and rebate models have taken hold. I’ve seen studies that show that traditional buyer brokers might be paying as much as 30% of their gross to Zillow to buy leads, so why not just build a site that competes with Zillow, a la Redfin, and offer a rebate. It’s a win-win as you give your buyers a great value proposition and save quite a bit of time. It’s far less likely to lose a buyer to another firm when you’re the one offering a rebate and if I were working with a buyer knowing I’d be giving up a significant portion of my commission, I’d sure as hell prefer to give it to my buyer over the bloodsuckers at Zillow.

Is Zillow behind this lawsuit?

Please tell me this isn’t a serious question.

I believe that this lawsuit will ultimately fail (barring some discovery of actual back room deals between brokerages and their MLS operators) since the premise is based on a clause in the NAR rules that has nothing to do with the amount of commission that the seller pays a brokerage.

According to the author of this article, the lawsuit is based upon the verbiage shown below:

“Defendants’ conspiracy has centered around NAR’s adoption and implementation of a rule that requires all brokers to make a blanket, non-negotiable offer of buyer broker compensation (the “Buyer Broker Commission Rule”) when listing a property on a Multiple Listing Service (“MLS”).”

This clause does not apply to a seller of a property. It applies to the other agents who bring buyers to a successful transaction. The amount of compensation listed in the MLS is a contractual agreement between brokerages within that MLS that each brokerage will honor the amount of compensation indicated in the MLS . It is a clause that is strictly enforced by my MLS primarily there to stop a listing agent from lowering the commission to the buyer’s agent as part of a negotiation tactic. The ultimate goal is to not put a buyer’s agent in the position were they must lower the commission they have been promised in order for the buyer they represent to have their offer considered by the seller which could ultimately harm the buyer’s chance of successfully reaching an agreement with the seller if the buyer’s agent does not agree to the reduction.

In the less than half of dozen times I have had to deal with this situation as a broker or an agent, the broker on the listing side of the process has always apologized for the situation and the promised compensation was delivered at the end of the transaction. The brokers generally all know that this is a promise to be honored.

I cannot speak for all MLS organizations, but my MLS has no clause that says that there is a minimum amount that all participants must offer other agents in a transaction, only that you must pay what you offer. In fact, I have seen offers of compensation to the buyer broker as low as $0, accompanied by the comment, “agent to contact seller directly to negotiate commission”, (a for sale by owner listing in the MLS).

As far as what an individual brokerage tells its agents what its policy on how much a seller must pay as total commission or the amount that is paid to a buyer’s broker/agent, that is well within their rights to do so. They are a private company. Just as Best Buy can set a price for a printer so can a brokerage set a price (and terms) for their services. If a seller does not like the price they are certainly free to go to another broker. Setting a price only becomes illegal when members of the brokerage conspire to set a price with one or more other brokerages. If this is actually part of the lawsuit then I applaud loudly any effort to stop such practices, but this seems to be a far cry from the clause noted as a basis of the lawsuit.

Just my thoughts:

The listing agent charges the seller ALL of the commissions and agrees with the the listing agent’s sharing of it with the buyer’s agent as incentive to bring their buyer. The seller therefore is not “paying” buyer’s agent’s commissions at all (on paper) but is permitting the listing agent to share his commissions to generate interest via cooperation.

Seems like there’s no case.

There was a time in the not so distant past when there was no buyer agency in North America. The idea of buyer agency has caused all kinds of problems maybe this case being one of the contemporary arguments against it. On it’s face, buyer’s agents being compensated more when the buyer pays more is against the code of ethics and is happening all over the country as I’m typing this.

It’s much.more than a fight over commissions, we agents and brokers obtain a,State License to practice our profession, so in order to show a listing on the mls we MUST be a member of an association ,a local connection to nar,no membership no showings, correct me if I am wrong is that step ,not extortion???,so I have been doing some business off the mls and using contract forms obtained elsewhere,it’s perfectly legal,but these folks have penetrated the Real Estate Boards at the State level,in Virginia they have succeeded in inserting the code of ethics in the state exams,code of ethics my……..

Here is a real scenario – buyer arrives in my town and doesn’t know anything about it. He has a tiny down payment but no more money than the absolute minimum to qualify for his loan. He needs a buyer’s agent to show him where the best areas are for his family to purchase a house.

But how will he pay a buyer’s agent if he needs one, unless the seller will pay this agent a commission?

As said above, this lawsuit hurts the poorest buyers.

Google “pro bono” if you are so concerned about the impoverished buyer.

Wow !!!welcome to the club,we a small group but growing,.

Years ago I made a comment in an MLS Committee meeting that we would all have to get really good a contracts with our clients AND compensation agreements and I was asked to leave the room. Literally scolded.

I’m thinking the same thing today. That’s all.

The “broker fee” is derived from the transaction as a whole. Not from the Seller or the Buyer alone.

Sure the Seller commits to paying the commission and agrees to the cooperation with the Buyer’s agent. Most Seller’s understand that without a Buyer… well there really isn’t a deal or any money to fight over. That Buyer wants representation and whether he agrees to pay an agent directly or it comes out of the transaction via a co-op agreement that agent probably won’t work for free.

So let’s imagine the Seller pays the listing agent only. Say 3%. The Buyer’s agent is on his own. His client, the Buyer agrees to pay 3% if he is in a position to do so. Likely the Buyer will make his offer with consideration of the 3% he must pay and the Seller will consider that offer subject to the 3% he must pay. Whamo! Once again the transaction is impacted by a 6% commission.

Yes the Seller agrees to pay the commission and agrees to a cooperation agreement. Who is writing the cheque though? Are the dollars fueling the whole transaction not flowing from the Buyer? The Seller signs the agreement because he’s the one selling. He agrees to cooperate with Buyer’s agents because he wants a buyer. Without the Buyer and his funds nothing is going to happen. The commission agreement roots itself in the Seller because that’s where the money, the banks money, ends up and where agents, lawyers, conveyancers etc. can easily take their share.

In Canada our MLS rules were challenged by the Federal Competition Bureau. Our national Association, CREA, ended up changing the rules slightly to allow all brokerage models including those who offer as little as 1 cent, one penny, as the cooperating commission. The rules say you have to offer something. They don’t say how much you have to offer.

Such business models are “mere posting” models and usually offer minimal services to the consumer. It’s just a cheap way to get on the MLS.

The Buyer’s agent must negotiate their commission and usually can negotiate with the Seller based on a slightly higher offer to cover the extra costs. The Buyer’s agent presents a non-representation commission agreement to the Seller prior to presenting an offer from his Buyer. The Seller’s net is usually similar in the end.

The money still flows from the Buyer to the Seller. Again that’s where the money, usually financed money will land. Is it not easier to take this money out of the mortgage funds than have it come out of the Buyer’s pocket? Until banks are willing to cover Buyer’s commission costs in their mortgages it is going to be easier to flow the money through the Seller side of the transaction.

These scenarios are rare because they are complicated and confusing for consumers. A simple, seller-side commission structure with a clear cooperating mechanism works well and is fair to all concerned when fully understood.

Proving damages in this lawsuit would be challenging if these scenario are taken into account. If there are 2 individual agents involved, neither of them are going to work for free. Let the market continue to set commission rates.

I think this lawsuit is just typical litigious mayhem.

All excellent points. I have commented elsewhere the simplicity of our compensation plan. What other industry does so much work, expels so much energy, emotion and knowledge with no financial gain until the transaction has successfully concluded? It takes weeks for most real estate transactions to come together. The pre-approval, the home search, the negotiation, the inspections, the survey, the repairs, the title search, you know the list! When a seller hires a firm to market their property they agree to a percentage of the gross sale price as fair compensation. The FIRM then decides how they will spend that compensation by cooperating with whoever brings the buyer. On paper it shows as a seller paid expense. To the buyer, it appears as a cost of representation that they have been allowed to finance, much like seller paid closing costs. ALL commissions are negotiable. Sounds like someone has a beef with NAR and MLS. For those of you running scared reach out to me and I will give you a Plan “B”, the rest of us have to get back to work!

Love the comments and the discussion—long overdue.

Most realtors work very hard and earn their fees, some just float on the surface and collect the crumbs. With 20 years of experience, I have also experienced working hard for months and collecting—nothing. This can happen on either side of the transaction.

Being paid for the actual time spent does not look so bad—

But then—this too would have to be somehow legally regulated!

Comments are closed.