From Attom:

Total mortgages drop at fastest pace in three years

Banks and other lenders issued 3,266,907 residential mortgages in the fourth quarter of 2021. That was down 10.7 percent from 3,656,892 in third quarter of 2021 and down 13.5 percent from 3,775,894 in the fourth quarter of 2020.

The quarterly and annual declines were the largest since the first quarter of 2019 or the fourth quarter of 2018, respectively. The latest total also was 18.1 percent less than the peak hit in the first quarter of 2021.

The $1.06 trillion dollar volume of all loans in the fourth quarter was down 9 percent from $1.17 trillion in the prior quarter and 6.5 percent less than the $1.14 trillion lent in the fourth quarter of 2020.

This news is unsurprising. And yet, it raises a lot of questions.

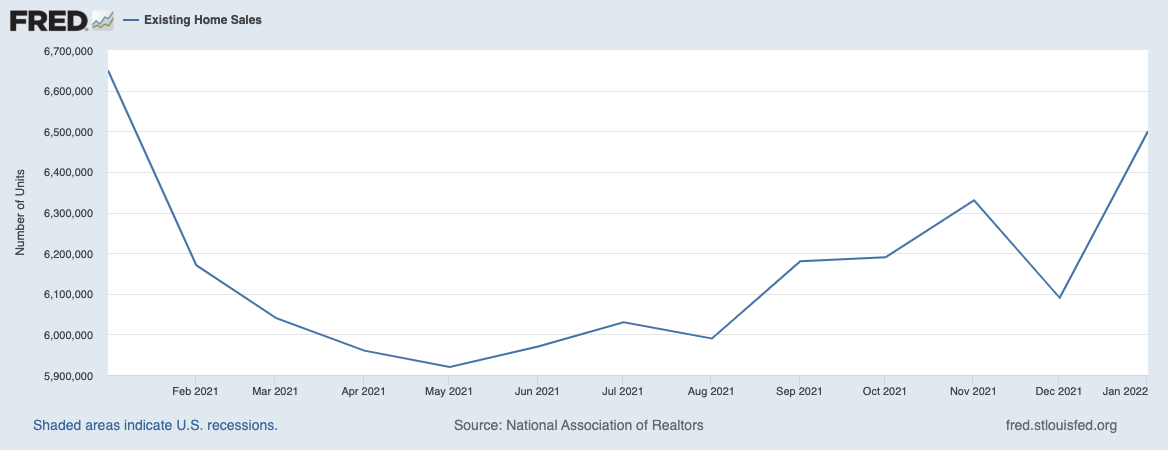

For one thing, Q4 sales were very strong:

That’s seasonally adjusted annual rate, and October and November were higher than the entire year (other than January) and even the dip in December is way above spring and summer selling season numbers. And we already know that home prices in Q4 of 2021 hit record highs.

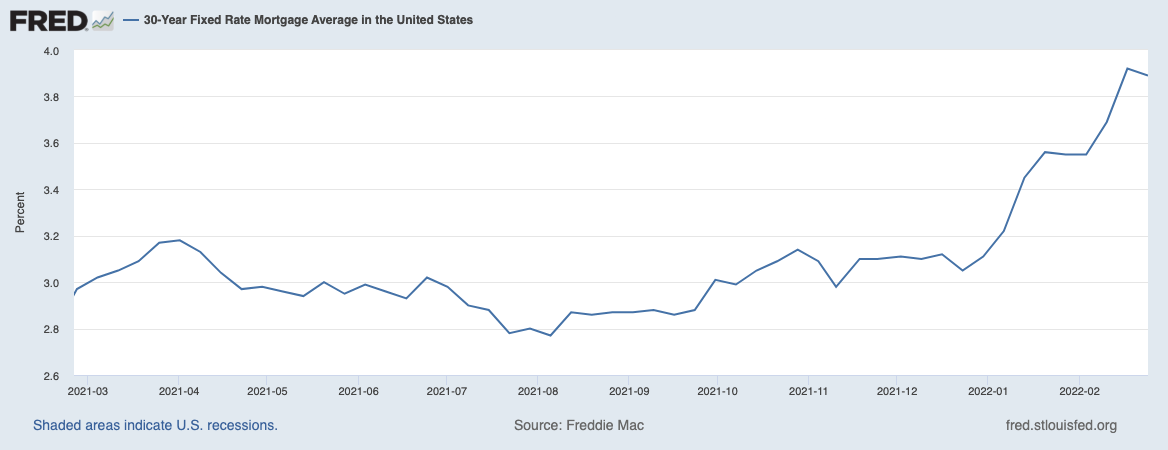

Furthermore, mortgage rates had not started its upwards climb after the Fed announcements in December:

If mortgages were decreasing so quickly in Q4 of 2021, we can expect them to plummet in Q1 of 2022 with far higher rates, far higher prices (remember, January posted a 19% YOY price increase).

The only way to square this circle is to think that most of the purchases are being done by cash buyers… namely investors. And that fits right in with what Ivy Zelman has been saying for quite some time now: that almost all of the demand now is coming from investors.

This can have real unexpected consequences. I have to think about how this impacts the industry as a whole.

-rsh

1 thought on “Purchase Mortgages Plummet in Q4 of 2021”

I’m coming out to Inman Connect in July. Make sure you have the city sanitized form the Corona Virus by the time I get there! 🙂

Comments are closed.