A reader sent me this provocative article in The Atlantic, with the provocative title, “The Homeownership Society Was a Mistake.” At first, as I read through the damn thing, I was concerned that the writer had tapped into something real in the psyche of younger Americans who are getting royally screwed by the economy generally, and housing in particular.

At the same time, I marveled at the quality of argument the author, Jerusalem Demsas, was putting forward. Marveled, that is, in the sense of, “What do they teach young people these days in all those years of schooling?” Even as a piece of polemic, a piece of propaganda put together for the World Economic Forum, the piece was lacking. As a piece of “journalism” published in one of our most prestigious publications, it was merely evidence that The Atlantic probably should stop publishing.

There is good news, however. It turns out that average people are smarter than this writer for The Atlantic. Demsas did not tap into some seething anger about homeownership or housing policy; if anything, she revealed herself as a purveyor of elite opinion held by the NPR crowd in the coastal Acela corridor. (Demsas lives in Washington DC.)

So, what was going to be a much longer analysis of the piece can be a much shorter celebration of the common sense of the common masses.

The Argument, Or What Passes For It

Let’s at least give Demsas the courtesy of outlining the argument. The basic one is this:

The consensus that homeownership is preferable to renting obscures quite a few rotten truths: about when homeownership doesn’t work out, about whom it doesn’t work out for, and that its gains for some are predicated on losses for others. Speaking in averages masks the heterogeneity of the homeownership experience. For many people, homeownership is a largely beneficial enterprise, but for others, particularly young, middle-income and low-income families as well as Black people, it can be risky. This critique isn’t new (not even at this magazine); in fact way back in 1945, the sociologist John Dean summed up many of my concerns in this quote from his book Homeownership: Is It Sound?: “For some families some houses represent wise buys, but a culture and real estate industry that give blanket endorsement to ownership fail to indicate which families and which houses.”

Homeownership doesn’t even consistently deliver on the core promise of providing financial security. And, crucially, pushing more and more people into homeownership actually undermines our ability to improve housing outcomes for all.

Essentially, homeownership is good for most, but for young, poor and Black people, it’s not good. Or… rather, it’s “risky.”

What follows is a series of self-righteous bullshit that doesn’t make sense on its face. For example:

“Buying low and selling high” when the asset we are talking about is where you live is pretty absurd advice. People want to live near family, near good schools, near parks, or in neighborhoods with the types of amenities they desire, not trade their location like penny stocks. [Emphasis in original.]

What changes with this equation with renting is unexplained; indeed, it is unexplored. Are renters somehow more able to live near family, near good schools, near parks, or in cool neighborhoods?

What about the observation that most of wealth gains from homeownership is not from “forced savings” but from home price appreciation, which is not under the homeowner’s control? Do tell, what accounts for the wealth gains from renting; I’ll wait.

Or, since Demsas makes such a major point about how wealthy people own stocks and index funds and such, has she never lived in a world where “equities and mutual funds” do not result in gains? For example, a young person who had put her life savings into Facebook at the start of 2022 lost nearly half of it by the end of the year. Let’s talk more about how it’s risky for young people and Blacks to own a house instead.

I ignored the “Blacks get screwed in homeownership” stuff because, well, it’s already been covered in actual books by actual scholars and we all know about the historical roots of redlining, blockbusting, and the like. What seems bizarre to me is the idea that someone will argue against Black homeownership, when it is plainly obvious that Blacks have gotten absolutely screwed by the racist policies of the past that made it impossible/difficult for them to own a home.

Therefore, Demsas wants the government to do something about it:

I should be explicit here: Policy makers should completely abandon trying to preserve or improve property values and instead make their focus a housing market abundant with cheap and diverse housing types able to satisfy the needs of people at every income level and stage of life. As such, people would move between homes as their circumstances necessitate. Housing would stop being scarce and thus its attractiveness as an investment would diminish greatly, for both homeowners and larger entities. The government should encourage and aid low-wealth households to save through diversified index funds as it eliminates the tax benefits that pull people into homeownership regardless of the consequences.

Entirely missing from this paragraph is any acknowledgement that housing would remain attractive as an investment… if you are the landlord. Indeed, the value of real estate as an actual cashflow-generating asset would increase if Demsas gets her wish. She wants government policy to treat housing as consumption, not investment, like a TV or a car or any other expensive purchase. Except that housing is consumption in the way that food is consumption; it is not optional. People who are not drug addicts or mentally ill must have a roof over their heads, just like they must eat. So housing is a special category of consumption.

If you can’t “consume” housing that you own, then you must “consume” housing that someone else owns.

She thinks she’s handled that angle by idiotic social justice signaling:

If we are interested in helping low- and middle-income people live well, we need to fix renting. Some potential policies include increasing oversight of the rental market, providing tenants with a right to counsel in eviction court to reduce predatory filings, advancing rent-stabilization policies, public investment in rental-housing quality, and, most important, building tons of new housing so that power shifts in the rental market from landlords to tenants.

Missing from this litany of talking points, of course, is exactly who will be building these “tons of new housing” and owning and operating them. The government? Because public housing is so desirable that we see swanky writers for The Atlantic clamoring to get rid of their condos to move into one? Oversight of the rental market is mealy-mouthed, general bullshit — just straight up say you don’t want landlords to be able to charge rent and be done with it.

Now, who builds and maintains these rental units that you can’t make any money on is a big question, but I’m sure it’s one that Demsas and her ilk have an answer for. It’s just the same answer to any problem anywhere: the government. Everything in the State, nothing outside the State, nothing against the State. Sounds familiar.

Again, when the rich and powerful and the highly educated start abandoning their palatial spreads to move into public housing, I’ll take this line of “argument” seriously. As I have learned over the years, one should always do as the Elites do, and never as the Elites say. If they buy houses, you should too. If they move into the projects, then you should too.

The One Valid Point, But….

The most valid point Demsas makes is that for homes to build wealth, it necessarily means that homes have to become less affordable:

One final inequality that often flies under the radar is generational inequality. When Americans buy homes under the expectation that values always appreciate, that’s an expectation that someone else will pay that increased price. In 2018, writing for City Observatory, the author and housing expert Daniel Kay Hertz aptly described homeownership as a Ponzi scheme: “It is, in other words, a massive up-front transfer of wealth from younger people to older people, on the implicit promise that when those young people become old, there will be new young people willing to give them even more money. And of course, as prices rise, the only young people able to buy into this ponzi scheme are quite well-to-do themselves.” [Emphasis in original]

Yes, that is true to some extent. Or at least, it has been true to some extent due to historical factors… the most important being demographics and the onset of the American Empire after World War 2. It is not so clear that demographics are favorable for home price appreciation going forward, especially as America loses its preeminence as the imperator of the world.

Thing is… Demsas (and others who take this view of housing) have an incomplete picture of what was actually going on for most of the 20th century. There was and is generational inequality, yes, but not because home values “always appreciate” because “someone else will pay that increased price.”

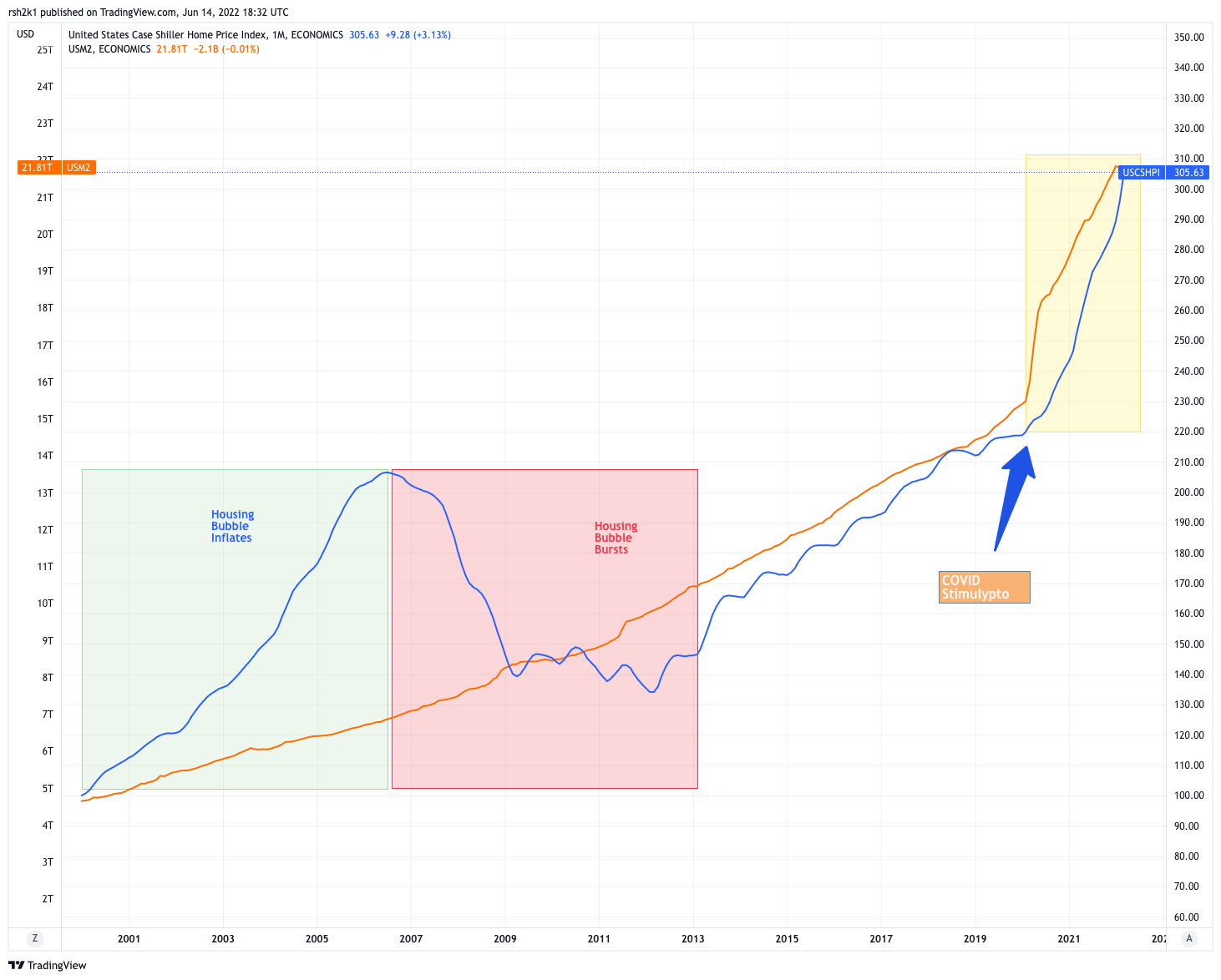

Here’s a chart I have used time and again on this blog and in presentations:

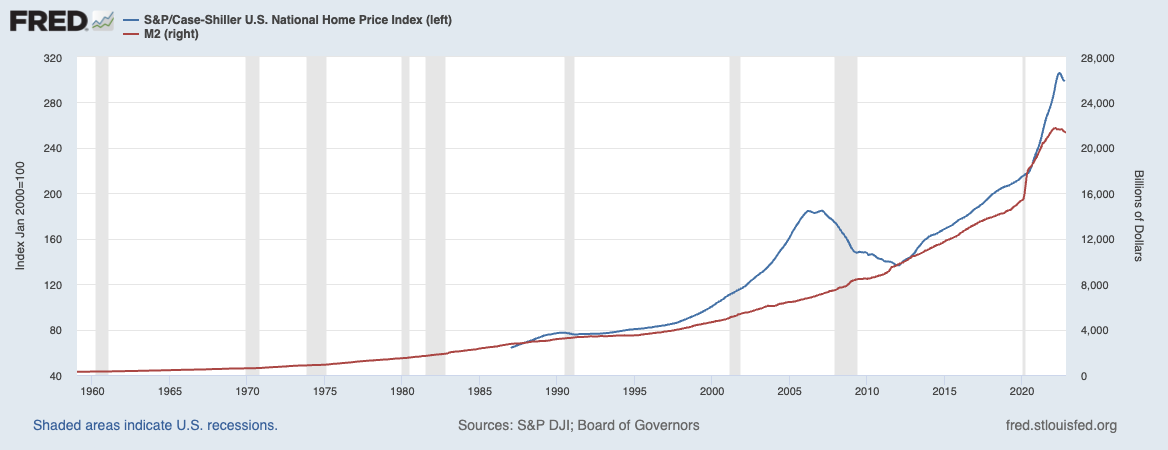

That was me charting the Case-Shiller Home Price Index to the US M2 money supply. On TradingView, the Case-Shiller index went back only to 2001. On FRED, it goes back to 1988 but we can see a close correlation between home prices and the money supply — including the crazy Bubble Years reflected above:

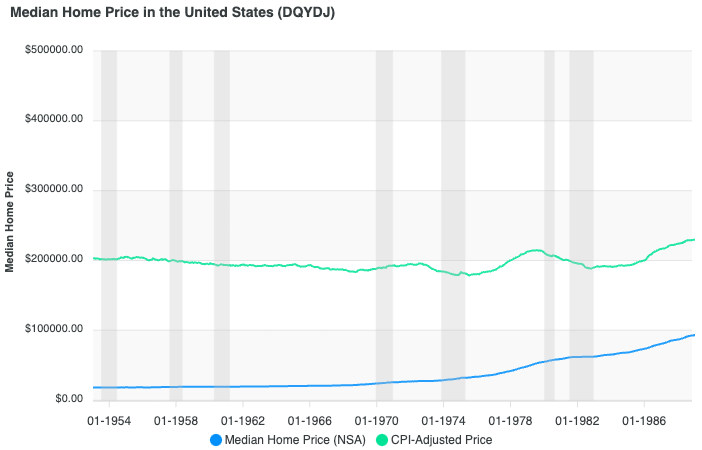

Indeed, while not the Case-Shiller, here’s a chart of the historical median home value from 1954 to 1988 or so:

Basically, home prices were flat from 1954 to 1974 — a 20 year period. That happens to be also when the US money supply was flat as well.

In other words, home values did not go up. I don’t know that home values ever went up. Instead, the dollar was devalued.

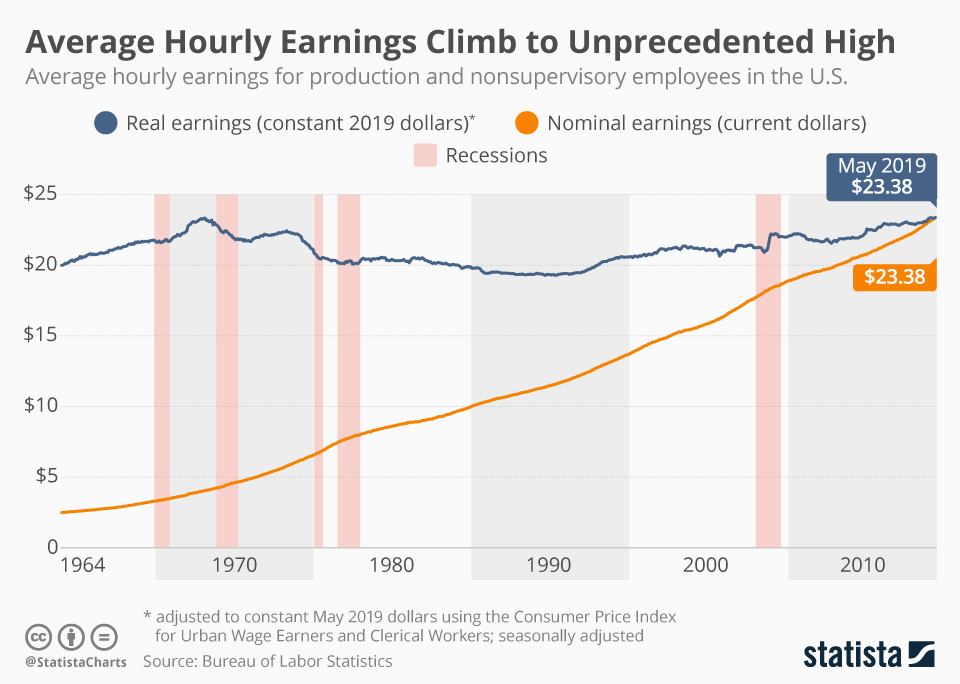

Why is this important for us and even for Demsas? Because of this chart:

In real inflation-adjusted terms, the American worker has not gotten a raise since sometime in the late 60s. We printed money like crazy since 1975, but most of that did not go to workers. It went to people closer to the printing press, what’s known as the Cantillon Effect. So while the dollar was devaluing from the 70s onward, people’s wages did not increase to keep pace with dollar devaluation.

Homeowners benefited, since homes were assets and as the dollar got devalued, their home’s value went up. It wasn’t because workers were making more money and younger people wanted to pay more for houses. Equity owners benefited, as they had assets. Everyone who had real assets denominated in dollars “benefited” since their asset prices moved upwards as the money supply increased.

Not workers though.

The generational inequality that Demsas points to is real, but it isn’t from housing or homeownership. It’s from the devaluation of the currency not being reflected in wages for workers, and younger workers got screwed harder and harder as the years went by. The Boomers had it good, since they started working before the dollar devaluation really went nuts. Gen-X got hurt, coming into the workforce in the 90s, but it is Millennials and now Gen-Z who are getting absolutely FUCKED because of the money printing since 2000.

Home prices and home values are merely a reflection of the devaluation of the dollar. When home prices fall, it will be because the dollar is getting more valuable thanks to monetary tightening… until the Fed stops and pivots, and then home prices (in dollar terms) will go up again.

Because, simply put, The Fed can’t print more houses.

The Good News

Enough of beating up on a young clueless “journalist” living in Washington DC where she has precious little chance of owning a home. I said there was good news. Indeed, there is.

I went looking for Jerusalem Demsas, as I wanted to know a bit more about her perspective and frankly, where she lived. She lives in Washington DC, and is a young black woman (judging by her profile pic and pronouns in her Twitter bio). And on Twitter, she posted a lengthy thread about this article.

Oh, but the responses from the Twitter. Here are a few of my favorites:

David MacLean on Twitter: “*Someone* is going to own the home regardless.I’d prefer it to be me. / Twitter”

Someone* is going to own the home regardless.I’d prefer it to be me.

Mark G. Sheppard on Twitter: “For all the difficulties that owning a home can pose, it’s still preferable to the indefinite threat of homelessness which comes with renting. / Twitter”

For all the difficulties that owning a home can pose, it’s still preferable to the indefinite threat of homelessness which comes with renting.

Ben Anderson on Twitter: “Ah another media elite telling people to not aspire to home ownership and make the corporations and land lords rich with over inflated rent. #fraud / Twitter”

Ah another media elite telling people to not aspire to home ownership and make the corporations and land lords rich with over inflated rent. #fraud

There are hundreds more responses in that vein. Some more insulting, others more rational.

Now, I would never claim that Twitter is representative of the average American. If anything, Twitter is nothing like average America. But even there, the fact that blue checks and non-blue checks alike are taking Demsas to task for mostly right reasons (pointing out that the alternative to homeownership is homerentership is the big one) is reason for hope.

That almost all of those responses came from individuals, instead of from REALTORS or real estate interests, is reason for hope.

The good news for the residential real estate industry is that people want to buy homes, no matter the psyop from the Elites and their handmaidens in the media. Being a homeowner is not about “investment” or “consumption” — anyone who actually owns a home understands that in a deep fundamental way. Some of it is financial (no one to raise my rents) but a lot of it is psychological. I wrote about this last year when I reflected on a horrible year and said that one of the things that helped me navigate the insanity that was the COVID lockdowns was the fact that I own a home. There is an ultimate safe space for me, my own little piece of the earth. It isn’t merely financial; it’s something more.

And no amount of gaslighting, bad arguments, and elite propaganda can change any of that.

Just because #renternation is coming doesn’t mean we need to celebrate it and welcome it in. We should fight it as best as we can, even if it ends up a futile fight against macroeconomic forces.

Are there major problems with housing today? Of course there are. Do we have to address the affordability problems? Of course we do. NIMBYism and government regulations and economic collapse and currency devaluation and plain old human greed all play into things, and yes, we have to do more as a society, as a country, as an industry to make homeownership easier to attain and easier to maintain. We have a lot of work to do, yes.

But homeownership society was no mistake. It might have been one of the best ideas of this young nation. That we have screwed up the implementation, that we have many many problems with achieving it on an equal and fair basis, that we fall far short of the ideals of the homeownership society are no reasons to reject the ideal itself.

The good news is that most of us recognize that truth.

-rsh