Starting a few years ago, I’ve been hearing a lot about how the Gen-Y or Millenials (people aged anywhere from 18 to 30 today) are going to change everything — but particularly in real estate.

A random sampling of opinions about how the Millenials will affect real estate, from a Google search I just ran, turned up these recent posts and articles:

MILLENNIALS – The New Face of Real Estate:

Text messaging, email, IPods, Facebook and being mobile as ever is a part of the new generation, the Millennial. The Millennial are the young workers ranging in age between 21 to 29 years old. They have the potential to create a lasting change in the real estate workplace because of the way they live, communicate and more importantly, the way they view their jobs.

80 Million Reasons to start changing your marketing….Millennials.

What do you think , will typical marketing work to attract someone that is buried in a laptop, ipod, FB, Twitter etc.. and values friendship more than work?

“Real estate agents may wonder why they should care about the Generation Y age group, ages 18 to 30,” Jessica Lautz, a senior research analyst at the National Association of Realtors, wrote on the organization’s website in 2008. “These unique home buyers are the youngest of the home buying segment and are the most likely to purchase a home in the next two years in comparison to any other age group.”

Sustainability, Urbanity, and You: How Millenials will Change the World (and Architecture)

Millennials grew up in suburbia; bland environments dependent on others for mobility. They are entering the adulthood seeking lifestyle: vitality, diversity, and community. But, Millennials are not the only ones who will be driving this sea change from suburban to high quality urban environments. Baby Boomers will soon be retiring by the boat load. Retirement communities in their current form resemble warehouses more than they do the most desirable of retirement “villages”—real communities where retirees can be independent and empowered, such as the Upper East Side and Key West.

And so on and so forth. If you cared to, I’m sure you can find dozens, hundreds of other musings on the Millenials and how they force real estate professionals to be ever more online, ever more sensitive to these 80 million strong “Generation We” people who care more about walkability and lifestyle than large colonials on three acres, and so on.

The whole drive towards social media’s ascendancy in real estate was fueled in part by the insight — as is clear in the ActiveRain post above — that these Millenials are the FaceBook generation who are natives of the digital realm.

But a couple of recent articles make me wonder just how the Millenials will impact real estate; it may be rather different than what we imagine today.

Millenials: Will They Have The Money?

The first article is a column in the Washington Post by Robert Samuelson, titled, “Will Millennials become the chump generation?”:

The deep slump has hit Millennials hard. According to Pew, almost two-fifths of 18- to 29-year-olds (37 percent) are unemployed or out of the labor force, “the highest share . . . in more than three decades.” Only 41 percent have a full-time job, down from 50 percent in 2006. Proportionately, more Millennials have recently lost jobs (10 percent) than those over 30 (6 percent). About a third say they’re receiving financial help from their families, and 13 percent of 22- to 29-year-olds have moved in with parents after living on their own.

The adverse effects could linger. An oft-quoted study by Yale University economist Lisa Kahn found that college graduates entering a labor market with high unemployment receive lower pay and that the pay penalty can last two decades. Writing in the Atlantic, Don Peck argues that many Millennials, overindulged as children and harboring a sense of entitlement, are ill-prepared for a “harsh economic environment.” They lack the persistence and imagination to cope well. That indictment may be unfair. My own experience is that Millennial co-workers are diligent, disciplined and determined in the face of frustration.

Regardless, more bad news may lie ahead. As baby boomers retire, higher federal spending on Social Security, Medicare and Medicaid may boost Millennials’ taxes and squeeze other government programs. It will be harder to start and raise families. (Emphasis mine)

You know what else is going to be harder to do? Qualify for mortgages and buy houses. And in case you think our current recession is just a little trough and we’ll get through it and out the other side with enormous growth… well, here’s the Atlantic for you with this cheery article titled, “How a New Jobless Era Will Transform America“:

But in fact a whole generation of young adults is likely to see its life chances permanently diminished by this recession. Lisa Kahn, an economist at Yale, has studied the impact of recessions on the lifetime earnings of young workers. In one recent study, she followed the career paths of white men who graduated from college between 1979 and 1989. She found that, all else equal, for every one-percentage-point increase in the national unemployment rate, the starting income of new graduates fell by as much as 7 percent; the unluckiest graduates of the decade, who emerged into the teeth of the 1981–82 recession, made roughly 25 percent less in their first year than graduates who stepped into boom times.

But what’s truly remarkable is the persistence of the earnings gap. Five, 10, 15 years after graduation, after untold promotions and career changes spanning booms and busts, the unlucky graduates never closed the gap. Seventeen years after graduation, those who had entered the workforce during inhospitable times were still earning 10 percent less on average than those who had emerged into a more bountiful climate. (Emphasis added)

Hmm… so 2 out of 5 of the Millenials are unemployed, 13% are living with Mom and Dad, and 6 out of 10 don’t have fulltime jobs. And that gap is going to follow them through their entire life.

The recession we’re in now is looking like it’ll make 1981-82 look like the Roaring Twenties. Our financial system is still in shambles, housing market is nowhere close to being out of the worst of the worst with anywhere from 1.7m to 7m in the “shadow inventory” while banks play “extend and pretend” games, private sector hiring is basically zero, and the real unemployment rate might be closer to 15% than it is to 10% once you take into account (a) those who simply have given up looking for a job, (b) the underemployed forced into part-time and temp work, and (c) the Census Bureau related hiring that won’t last past mid-2010.

For a generation raised in an era of 5% unemployment, bombarded by ads like this one from CareerBuilder, the new reality of employment in the ’10s is going to be a harsh one.

Forget buying a house; I don’t know if the majority of the Millenials can afford to rent an apartment.

Millenials: Stuck With The Check?

Add to that dismal news the undeniable fact that as the Boomers retire, the nation is going to have to confront some serious issues with entitlement spending. Robert Samuelson is being cute when he writes “As baby boomers retire, higher federal spending on Social Security, Medicare and Medicaid may boost Millennials’ taxes and squeeze other government programs.” There ain’t no “may” about it; it’s gonna happen, barring some miraculous unforeseeable event.

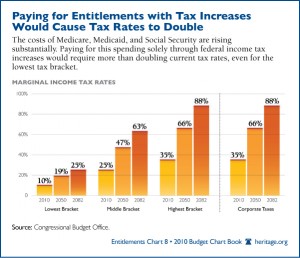

The Heritage Foundation estimates that tax rates would double by 2050 under current law, even for the lowest level. Here’s a handy graphic:

Let’s assume anyone in the lowest bracket isn’t going to be buying houses anytime soon, unless we return to the days of the NINJA mortgages… which we’re probably not going to see again in our lifetimes.

So today’s unemployed and underemployed Millenials, who are going to make less money over time, will also face rising taxes. This being 2010, the 20 year old college junior isn’t thinking about buying a house. By 2025, the 35 year old newlywed might be. 33% over 40 years at the top bracket… let’s just say it’s a 8.25% per decade increase? So they might be looking at 47.4% in Federal taxes alone if they’re in the top bracket?

And that’s without any other government spending programs between now and 2025, like nationalized healthcare and Cap & Trade — both of which Millenials support, generally speaking.

Well, People Will Buy Homes

Of course people will buy homes. The economy will eventually turn. Today’s slackoisie Millenial will learn some hard lessons about life, and become productive hardworking thirtysomething, get married, have kids, and think about buying a house.

When they do, we all assume that they’ll be flocking to the Interwebs, to Facebook, to Twitter, to social engagement, to their 4G wi-max third-generation iPads, to find that eco-friendly green condo in the cool “community” areas like the Upper West Side of Manhattan (as the AIA post above suggests), and so on. And some will, no doubt.

But the gloomy economic picture suggests an alternative impact of Millenials on real estate.

Once the Millenial finds the condo of his dreams on his 4G iPad and contacts the realtor via Twitter, we may find that due to his lowered earning potential from the lingering effects of the Great Recession of 2009-2014, combined with the fact that he’s paying 65% in combined local, State and Federal taxes, not to mention the banks refusing to lend to anyone who can’t put down 30% and has a FICO above 750, he can’t actually qualify for the mortgage.

Lower your sights, young man. That New Urbanism looks fantastic, and it’s the lifestyle you really want, but sadly, all you can afford is a $200,000 fixer-upper somewhere in the shadows of Giant Stadium with a 45 minute commute to your not-so-grand job in some corporation you used to rail against as a college student as evil, greedy corrupter of the environment.

And realtors everywhere may suddenly discover the incredible allure of Gen-X and the Post-Millenials….

On the Other Hand…

Detroit and Camden may be revived thanks to Millenials! They’re walkable cities with cheap housing available.

So there is that.

I know, I know — I’m being entirely too gloomy and pessimistic. But tell me, from the evidence we have to date, what gives you such optimism about the Millenials as the Future of Real Estate?

-rsh

Edit: Replaced a broken image link on 3/13/10.

15 thoughts on “Do We Believe in the Millenials?”

Since Millennials are my primary market I would love to give you my 2 cents on working with them. IF they have a good job and income they are pretty quick to purchase a home. I have found them them to be fairly easygoing about the whole process. They are surprisingly serious and forward thinking in their choices. My clients who are Xers, like myself, often become paralyzed by analysis and fear of commitment. I don't see that with the Millennials.

I agree with your points about the economic challenges they face. My guess is that they are up for the challenge. Maybe I am just an eternal optimist.

Thank you for the thought provoking post, Rob.

Carolynn

Please allow me to ramble, as a Millennial…

First, I'm disappointed to see “facts” from the Heritage Foundation 🙂

Here's the synopsis of my adult life:

Go to school for degrees in Finance, Management, Marketing and Computer Information Technology set to graduate in 2003. Heads of departments are amazed at the combination and “promise” six figure starting pay. Spend first 2+ years living with mom and dad working crappy jobs. Buy a house in 2006 even though my finance degree told me not to, but I bought into the realtor hype that it was a great investment. Get a decent paying job that bores me to tears. Dad gets laid off, dies a couple of years later with nothing left behind to help mom, so I get to foot the mortgage to the tune of middle five digits. Mom is now working the same crappy job I worked right out of college because it has health benefits. I have multiple job opportunities, all paying better than my “with honors” friends from college are getting (thanks interwebz). I hate my cookie cutter house I bought and have enough income (and low enough debt and high enough credit score) to buy a nicer, more expensive house, but not two houses. Since my house value has depreciated 20+%, I can't refi, I can't sell and I can't help move the economy by buying a larger/better house that would require I pay more in taxes. I buy the gadgets I want, I go on several trips per year. With the background out of the way….

I think the “problem” realtors will see with Millenials is that they're seeing through the BS of housing. Take Ramit Sethi (I Will Teach You To Be Rich) and JD Roth (Get Rich Slowly) who attract a TON of Millennial and X-ers and they point out (validly) how owning a home IS NOT a good investment. I appreciate owning my home because I can do whatever I want with it. I hate having to do repairs a landlord would do. I hate saying “I paid thousands over what I could have rented for, but hey! I got this nice refund on my taxes!” Some of the job opportunities I have require relocation, but that would mean a $20+ thousand dollar hit, just to take a new job since my house has depreciated and I value my credit.

Our society has a huge problem with many facets that somehow all need to be addressed. For the real estate professionals, figure out how to make quality housing affordable since I doubt student loan amounts are decreasing much. Make a house feel like a home, not a trap.

I'm not sure the solution, but this is one Millennial who breaks the income/employment mold (as do the majority of my Millennial friends) but has lost interest in real estate (just like most of my Millennial friends).

Ramble finished 🙂

Now I know what a “Millenial” is. That's not very comforting is it? No one owes you anything. We all just have this one life and we all want to value fun and friendships but work is a great place to find both. Our government needs to go after fraud, waste and inefficiency. Fraud, waste and inefficiency our the enemies of us all. People who have studied harder, worked harder, and practiced longer are the ones that will have the fullest and most rewarding. People will sometimes get lucky however my dad always said, the harder you work the luckier you seem to get. All I can say to those 3 out of 5 that don't have a job is don't let life pass you by. Go out now and make stuff happen. Go and get an internship by offering to work for free. I think that they'll suprise you and end up paying you if they like that free work that you're doing with a full time paid position.

Ages 18-30 are too diverse of a group to put under one banner.

I'm 32 and have seen this real estate and political landscape significantly change in the past ten years that I've been in the mortgage business.

I was able to put myself through school @ $3000 / semester (not including books), and it took me a few extra years because I worked full-time. Partied a little too, but life was good and the world wasn't in foreclosure or bankruptcy.

The Internet was new. It's funny, I started an online coupon company in 1998 and was pitching to local businesses that there would be 50 million Internet users within a few years. Now, American Idol gets that many votes in a night. Crazy.

I participated in the Subprime, Alt-A and “got a pulse, we'll finance you” mortgage market, which was perpetuated by the government and Wall Street. That eventually turned into a big #fail. Unfortunately, we're probably going to spend at least the next three years playing the blame game until everyone gets a free home.

Money was made, and lost… But, I'm old enough to believe that everything I am, was or could be is my choice.

However, college grads today are entering a world of debt, government spending, bailouts and political spin.

The line between our Constitutional Rights and Privileges is blurred, and it's unfair to the next generation that the grownups are setting a precedent that it's OK to demand the government take care of everyone.

We have suffocating industry regulations prohibiting anyone from having to make responsible decisions or live with the consequences.

I actually don't anticipate the First-Time Home Buyers between the ages of 18-24 to do much research at all about their options, simply because they're being groomed to despise real estate professionals and just trust that the regulators are there to protect them.

And, as Nick mentioned, the Millennials are probably going to spend the next 10 years taking care of their parents and cleaning up the mess that everyone created anyway.

For the kids ages 25-30, they've at least had an opportunity to see the power of true entrepreneurship in action. I don't think they'll feel out of place taking on a free internship to further their education or learn real life lessons about a particular career choice. Well, provided they can figure out a creative way of affording it. (Goes back to the entrepreneur culture)

One thing is for sure, real estate professionals have a challenging road ahead of us to earn back the trust of our clients and referral partners. If the Internet Generation is our target audience, then they're going to know how see the BS, regardless of how cool your online presence looks at first impression.

Either way, I hope the Millennials can weather this storm and make our country a better place so that my daughter and new twins on the way have an opportunity to enjoy the same rights that I do as a citizen of the United States of America. (not the United World Community)

Thought provoking. Frightening. Insightful. I think startlingly accurate and an excellent prediction. Rob you may want to become a professional prognosticator, although I think you already are.

Sometimes being right isn't that much fun is it? I work with/have worked with a lot of millenials, and I see many of the points cited in your post, and the sources quoted. I have a great fear of what is coming on July 1 of this year, it is about to get a LOT worse. My recommendations to anyone in the Real Estate industry right now – save your pennies for a rainy day, and buy a few extra umbrellas.

The next sign I plant might well be in my own front yard as I decide which Island nation I am moving to, and on which beach I will be starting my coconut farm.

Mahalo nui loa.

“seeing through the BS of housing.” Doesn't Nick's comment say it all!! The younger generation doesn't have the same idea of family life that many of us in RE did/do. They've seen the rampant hypocrisy, not only of housing and cookie cutter developments, but of the American dream as well.

Rob, your posts are always brilliant and insightful, and the comments you inspire are delicious.

I believe in Millennials. They are going to have to be creative to make money. But I don't mean creative as in artsy, I mean they will take the jobs that GenXers thought they were “too good” to do and some actually will be creative in what the “next job” is to them. Many of my clients last year were Mellennials, one was an engineer, one an office manager, another was a financial something, etc. in other words, they all had corporate type jobs. All of their boyfriend/girlfriends/spouses were entrepreneurs…mostly internet based.

They all saw opportunity not only in our real estate market but the job market. My experience with GenX over the past few years seemed to be “entitled” to everything that seemed just out of their reach (in some cases this proved to be fruitful).

The banks will just have to figure out how to make it possible for the non-W-2 income to qualify to buy a house again. They have always wanted to run real estate and will continue to be our enemy some years and some years be our best friends. I just hope it doesn't take as long to adjust as this last adjustment, but change will be continual and there will be another set of reasons to buy and influences like credit scores may not even have the same meaning in a few years.

Just because the Millenials brains work different from ours and they have a whole different set of influences that we didn't have doesn't mean they aren't smart enough to figure out how to push the changes that need to be made for their survival. They are making my real estate life better because of all this online marketing, contracting, searching, etc. I have faith.

I'm thanking who ever thought up paperless! What generation was that? My grandfather the editor and printer of the town newspaper would be crushed that about 5 years ago I figured out how to never have a newspaper in my house but still read the headlines. Don't you remember your grandparents thinking we would never understand the value of a nickel? I think we all understand the value now don’t you?

From an optomistic born GenXer and mom of a Millenial,

Had to link to this comment on a blogpost I read recently from a 20-something:

The “Lost Generation”… wow… quite a different ring than the “Millenials” eh?

Had to link to this comment on a blogpost I read recently from a 20-something:

The “Lost Generation”… wow… quite a different ring than the “Millenials” eh?

Comments are closed.