Move (NASDAQ: MOVE) has just launched MortgageMatch.com — a consumer-facing application that Move spokespersons say is the most important thing they’ve done since… well, acquiring ListHub. I’m writing this while sitting on the webinar/teleconference where they’re unveiling it, so… my thoughts are likely to be somewhat scattered.

Once the announcement is made, and a few other thoughts are heard, I may revisit this topic again, but my initial impression is that this is a very nice piece of software likely to cause a bit of a kerfuffle due to some interesting business decisions.

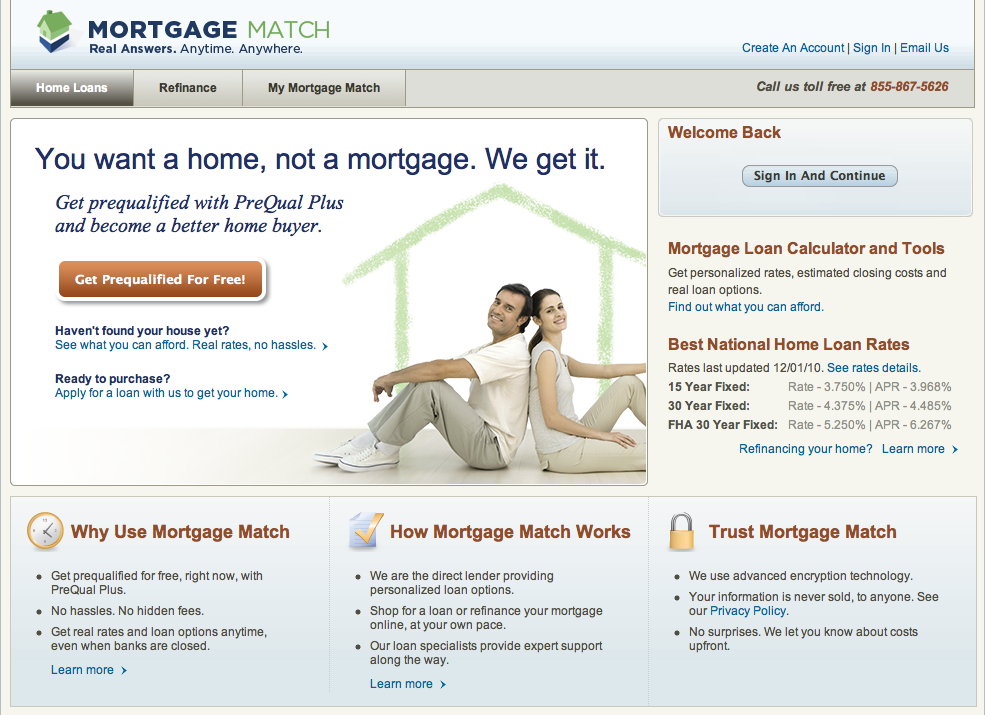

The MortgageMatch Engine

Sue Stewart, the executive in charge of this program, repeatedly calls MortgageMatch a “decision engine”. Sitting on the demo, it’s pretty slick. You put in some real basic information, anonymously to start, just to see what the loans available are, at what rates, at what kind of points, and so on. The UI is clean and friendly, and there’s a lot of explanation — what the monthly payments include in terms of principal, interest, taxes, etc.

Then, because you have to put in the zip code of the place you’re looking to buy in, you can do a one-click search for properties that you qualify for (based on the anonymous information) on Realtor.com. Seems like a nice cross-sale device.

That’s what anyone can do without registration, without any real information, just sort of put in your criteria and see what the system pulls up.

The next step is to actually put in real info, and get pre-qualified. Again, the UI is clean, easy to understand, and Move is pretty excited about how they’re making public a lot of the information that loan officers would have used. With more detailed info, the loans available to you become more specific, and more become available. Not really sure why that is, but it is. And the system will spit out a form pre-qualification approval letter for you so you can take that and go shopping for a home.

The whole thing can be saved to the consumer’s profile, assuming he registers on the site, and viewed anytime.

Of course, you can actually fill out an application right online, but we didn’t get to see that in the demo.

The cool thing about this is that the “proprietary software” really does show mortgage data in realtime, or pretty close to it. I imagine the matching algorithms are taken right from the system that the loan officer would use (more on this below), so the consumer is actually seeing what the loan officer/mortgage broker would see. By adjusting the criteria, you can see instant changes to the results, at least at the anonymous and the pre-qualification stages.

As a piece of web software, the whole thing looked pretty slick and elegant to me, at least on a webinar. Kudos to the Move team for getting it done and out the door.

Move mentioned that MortgageMatch, through its partner, offers loans from all of the major banks (BofA, Wells Fargo, etc.) as well as FHA and VA loans. That partnership will be the focus of some… ah… energy, I think, so we turn there next.

Partnership With Cornerstone

Perhaps one of the most significant things about MortgageMatch is that it is something that Move is doing in partnership with (it is unclear whether this is a joint-venture, or just a contractual relationship) Cornerstone Mortgage Company, a mortgage banker based in Houston, TX. The business terms or the model underlying this partnership was not disclosed, but I imagine one could look that up in Move’s next SEC filing. If it’s material, it has to be disclosed.

But what we do know is that Cornerstone is the originator for all of the mortgages that will be processed through MortgageMatch. It appears that Cornerstone will offer its own capital, as well as loans from larger banks such as Bank of America and Wells Fargo. We know that this “partnership” (Move’s words) is exclusive, at least for now, but that Move will be looking to expand participation sometime in the future — strongly implying that the exclusivity is term-limited (perhaps 2-3 years?).

Move made a point of saying (in response to a question by yours truly) that MortgageMatch is not an “auction site” — meaning Zillow Mortgage Marketplace and others like it. Move will not sell the customer’s information as a lead to mortgage brokers and mortgage banks. Well, since there’s only one possible lender, I suppose an “auction site” makes little sense as well. The implication is that Move will take some piece of the revenues from the loan origination activity by Cornerstone, either by way of equity ownership in a JV, or a revenue share agreement — although it is possible that Move simply gets paid on a per-lead basis by the partner.

With some research, I find this partnership to be somewhat puzzling. From contacts in the mortgage side of the industry, I have heard great things about Cornerstone, that it is a well-respected company, known for strong customer service. But Cornerstone is hardly the largest mortgage operation in the country, and on its own website Cornerstone lists only 15 states where it has offices. In the Internet age, not having an office in a state doesn’t necessarily mean a company can’t write a mortgage there, as long as it is licensed in that state, but it is odd, isn’t it, for a company like Move, a public company, the operator of Realtor.com, to be entering into such a significant partnership with a relatively small operation like Cornerstone? [Plus, this is snarky, but Cornerstone’s website makes it look like a fly-by-night operation. Now that it has partnered with one of the leaders in real estate technology, maybe it should consider putting some money into its web presence….]

Brokerages With Mortgage Operations

One of the questions I asked on the webinar/call was whether Move was expecting any pushback from brokers. Quite a few brokerages, especially the larger operations, have an affiliated mortgage company. In some cases, the real estate brokerage operations is merely a loss-leader that generates deal flow to the far more profitable mortgage operation.

The answer was, yes, Move is concerned, and mentioned that it spoke with and worked with a number of the brokerages to ensure that MortgageMatch would be welcomed, rather than reviled. For example, Move is offering a free banner ad on their listings to brokerages with mortgage operations, and mentioned something about suppressing the Rates link from listings, which will switch over from Bankrate.com to MortgageMatch sometime in December. Honestly, I’m blase about the details because I don’t think they’re going to work.

If you own a mortgage operation, MortgageMatch is not good news. It would be easier to swallow if your own operation can participate, but as we saw, the Cornerstone partnership is an exclusive for now. There will be no auctioneering, no selling of consumer leads. Presumably, with it being promoted all over Realtor.com, a brokerage should see a significant increase in number of buyers who are going to come looking for properties with a mortgage pre-qualification letter from MortgageMatch already. From there to actual application is a single online step.

To think this won’t have an impact on the business that local mortgage companies (owned by brokerages) won’t be affected is… well, I suppose it is easy to do if you think MortgageMatch will be a gigantic bust.

Individual mortgage brokers are likely in for a world of pain as well, at least if MortgageMatch is successful at all. I rather think Zillow might be ramping up its marketing to independent mortgage brokers (if any are still left standing, that is). I’m already seeing some signs of displeasure from independent mortgage brokers via email and social network channels.

Short Term Pain, Long Term Gain?

In the short term, say at least until the Cornerstone exclusivity runs out, I don’t know that MortgageMatch will deliver more in benefits versus controversy, anger, and pain. But over the long haul, this may work out to be a strong play once other mortgage originators are allowed to participate directly in the system.

The key, perhaps, is the “proprietary software system” that Move is so proud of. Let’s make a bunch of assumptions, a lot of “IF” statements.

If the “decision engine” really is something new — because Cornerstone itself likes to talk about its Automated Pricing Engine technology — instead of some white-label version of whatever Cornerstone had;

If this new decision engine is simply heads and shoulders above existing products;

If Move owns the intellectual property to this decision engine outright with no encumbrance by Cornerstone or anyone else;

If Zillow or some other competitor does not release its own, superior decision engine while the short-term pain is causing issues for Move;

Then Move could use its market leadership position to be an extremely strong player in mortgages, and possibly make quite a lot of money by selling its decision engine to mortgage banks, brokers, underwriters, and so on.

Time will tell if all of those IF statements all work out to reach the payoff. For now, MortgageMatch reminds me a little bit of RPR: a slick piece of software that will generate a lot more controversy than profits for a while.

I’d love to hear from my readers in the mortgage side of the biz on what they think of this.

-rsh

4 thoughts on “Move, Inc. Moves Into Mortgages”

Based on what I know of the local big brokers and how they view their affiliated lending operations as a core business function, I can’t imagine this will go over well with them.

Kerfuffle? I love it!

I think the exclusive arrangement with Cornerstone Mortgage Company is out of the box thinking on Move’s part. It cuts through all the challenges of delivering a consist mortgage experience with offer integrity (ask LendingTree for a comment on this nightmare).

I also think bringing the automated underwriting/decision engine right up to the consumer and direct on the Web is long overdue. I agree with you–it is slick technology execution.

However, the real tale will be told based on the customer experience offline. How will Cornerstone and Move execute in partnership to deliver a Wow! experience all the way to the closing table?

The make or break of this one (I think) is going to be in the offline business execution.

I’m curious to see if listing agents will trust the automated pre-qual letter.

Unless I’m missing something, it seems like the borrower is responsible for providing their own accurate information.

From the press release:

“This seamless online automated process is intended to help buyers avoid delays that may cause them to miss out on a property purchase, or a homeowner interested in refinancing their current loan to miss out on low interest rates.”

In my experience, most of the “Delays” with true mortgage approvals result from the lender and / or borrower not asking enough of the right questions during the loan application process.

Employment gaps, bank deposit history, credit discrepancies, confusion over income / tax returns, down payment sources…. are just a few topics that require an experienced loan officer to sort out.

However, I’m sure Cornerstone has already considered this into their approval filtering system, which basically makes their program a smarter, shinier lead capture tool. = cool.

So, from a mortgage / real estate lead gen perspective, I’m interested to see how the industry evolves to keep up.

As far as empowering the borrower with a “fast, reliable, easy to navigate and understand online mortgage solution” to create a “seamless” process, good luck.

If it’s that simple, then I’ll probably just focus on selling real estate instead, and send my borrowers to their computer for mortgage financing.

Either way, congrats to Cornerstone for the new partnership. I’m still wondering when Zillow is going to become a bank.

Move, Inc moves into mortgages on Notorious Rob, things continue to change pretty quickly.

Zillow should be very concerned. Bank of America should also.

In house lenders better sharpen their pencils and become competitive.

Things should be better by dragging them into the light of day…hopefully.

Comments are closed.