One of my pet hobby topics is to fret about the Millenials (the twentysomethings of today). I’ve written about this “largest demographic group like evah” here, here, and here — as well as peppered throughout this blog for a while now. A lot of people — especially in real estate — like to point to the older reaches of the Millenials (the young 30somethings) and think that they are the future of the industry.

Well, to be sure, from pure demographics standpoint, the Millenials do point to the future of the industry. But you should worry about that. A lot. My opinion about the Millenials is that they are the most Screwed Generation in American history who have had their initiative beaten out of them by overprotective parents, teachers and “safety” bureaucrats; their future mortgaged by irresponsible politicians of both parties with full-throated support by the Boomer Generation; their expectations of what is a good life totally unmoored from reality by Hollywood; their options foreclosed by a college-industrial complex that burdened them with absolutely unsustainable student debt (that is not dischargeable in bankruptcy); and of course, they screwed themselves with their attitude of entitlement and superiority complex based on nothing more than the fact that they know how to text message real fast and post pictures to Facebook.

It appears that even the dinosaurs over at the LA Times have noticed that the Hopeychange Generation is actually the Totally-Screwed Generation:

Call it Generation Vexed — young Americans who are downsizing expectations in the face of an economic future that is anything but certain. Career plans are being altered, marriages put off and dreams shelved.

Welcome to the real world, LA Times. Jump right in, the water is freezing.

Generation Screwed

LA Times notes that the unemployment rate for people aged 16-24 is 17.4% (!!!). But that’s the official number. What’s the real number, including those who have given up on looking for a job, or seriously under-employed? As the paper itself notes, a whole lot of recent grads are working at McDonalds and at Home Depot with their $80,000 degrees in Sociology:

LA Times notes that the unemployment rate for people aged 16-24 is 17.4% (!!!). But that’s the official number. What’s the real number, including those who have given up on looking for a job, or seriously under-employed? As the paper itself notes, a whole lot of recent grads are working at McDonalds and at Home Depot with their $80,000 degrees in Sociology:

But older workers are staying longer in their jobs, forcing twentysomethings to fill up retail, fast-food and other part-time spaces that traditionally give teens their first paycheck.

Can’t really blame the old guys, can you? Their savings have been wiped out. Their retirement dreams are now perma-deferred, which means you young whippersnappers will have to step over some dead bodies to get that “midlevel” job you desperately need to marry that young sweetheart of yours. And of course, since all these 23-year old Psychology majors are working fulltime at Best Buy stocking shelves, all you teenagers can kiss any thought of getting even a part-time job goodbye.

Meanwhile, an employer looking to fill an open position has to consider something important. Say it’s me looking to hire someone to do entry level work of filing, answering phones, and such.

I could hire a 40-something mother with three kids, whose husband was recently laid off, and is looking to get a job to help make ends meet. “Help make ends meet” in this context means stuff like paying the mortgage, putting food on the table, keeping the family minivan fueled up, and making sure the kiddies have clothes for school.

Or I could hire a 20-something youngster who wants a job so she can go clubbing with her friends on weekends, or pay for the awesome new iPad 3 she just absolutely has to have.

Which person, do you suppose, would be more motivated to work her ass off? Which person would be more focused on getting her work done in as short a time as possible, to be as efficient as possible, so she can attend to her personal life?

Now… ask yourself, which of the two is more likely to whine about how the culture of the company is broken, how management just “doesn’t get it”, or believe that if only she were given the chance, she could totally revolutionize the whole industry overnight? Which of the two is more likely to believe that I need to “coach them instead of managing them” and have to cater to their needs for expressing creativity and such?

I’m sure there are numerous young people who don’t have this enormous sense of entitlement and generational superiority complex. I’d like to meet a few of them so I can think about hiring them. But they’re gonna have to go the extra mile to convince potential employers that they’re nothing like their spoiled delusional contemporaries.

Implications

I’m not going to rehash all of the implications of “career plans are altered, marriages put off, and dreams shelved”. I’ve written about all of those topics before, a number of times. But for those in real estate, the topline is this:

The future of real estate is rentals.

The LA Times talks about how these kids are gonna stay away from the stock market, having seen their parents’ 401(k)’s implode. That just shows how out of touch the LA Times is. No, what these kids really saw was their parents get financially ruined because of their mortgages, and they will stay away from homeownership in droves.

Think about it. The 401(k) is a retirement account. It is not mandatory to contribute to it. If you lose your job due to the recession, you can elect not to contribute anything to a 401(k) (of course, you can’t contribute to a 401(k) if you’re unemployed… but you get the idea — ALL retirement accounts are elective.) But mortgages are debts. You have to pay, or else. Lost your job? Too bad, so sad — pay up. Or we’ll be foreclosing on that house.

RealtyTrac says there are 1.6 million homes in foreclosure today. Plus, CoreLogic says there are some 3.8 million homes in shadow inventory (1.8 million that are not current on payments, but banks haven’t done anything, plus another 2 million homes that are underwater). That means some five and a half million families have seen up-close-and-personal the financial ruin that could be homeownership.

How many children, even college-aged children, might those 5.5 million families have? How many of their family, friends, and neighbors might have seen all this unfold second-hand?

Stock market and retirement accounts? Please… think more along the line of housing, mortgages, and debt in general. (Not that the college-grad Millenials with their mountain of debt thanks to college costs increasing by a whopping 300% since 1990 can afford to get mortgages anytime soon, but that’s a whole other story.)

The three factors mentioned by the LA times — careers on hold, no marriages, and ‘dreams’ shelved — all point to a permanent shift in how an entire generation will see housing. Without a longterm career — and as we’ve said, the Millenials got big problems in that department — you can’t buy a house. You may have to pick up and move across the country in pursuit of something other than checkout clerk at Costco. Marriages weren’t really happening anyhow for the Millenials, but the Great Recession makes that even worse. “Yeah, baby, so I’m livin’ at home with my mama at 25, but let’s get married and raise us a family,” isn’t likely to be a great offer even for the men with college degrees. Dreams shelved, yes, well… it’s arguable whether the iPad Generation even thinks of homeownership as the American Dream. Maybe for them, the American Dream is living the Gaea-centered life in organic communes in Oregon.

We’re seeing signs of this already on the Real Estate Web.

Here’s Hitwise’s Top 10 Real Estate Websites for July of 2011:

Here’s the same Hitwise chart for July of 2008:

Here’s the same Hitwise chart for July of 2008:

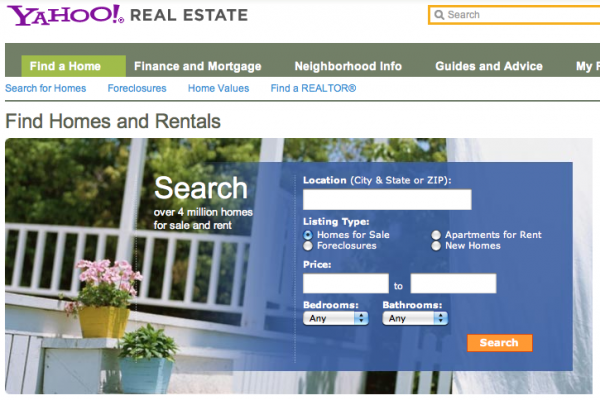

In 2008, only two of the top ten sites were rental-focused. In 2011, three of them are. But that’s not exactly on point, since the homepage of Yahoo Real Estate looks like this:

In 2008, only two of the top ten sites were rental-focused. In 2011, three of them are. But that’s not exactly on point, since the homepage of Yahoo Real Estate looks like this:

Why yes, the big-ass title does say “Find Homes and Rentals“. MSN Real Estate and AOL Real Estate are both optimizing like mad for rentals. Do a Google search and it’ll show you.

Now, even though the consumers — particularly that tech-savvy Millenial consumer that every social media guru is telling you to think about every single day — are expressing a distinct preference for rentals (as evidenced by traffic to the real estate category), the industry thinks of it this way:

One more note about the ‘top 20’ Experian sites – I would suggest not counting rental sites:

6. Rent.com – 2.23%

11. Apartments.com – 1.26%

9. Apartment Guide – 1.26%

20. Rentals.com – 0.83%Four of the twenty just don’t apply to the real estate ‘for sale’ market real estate agents are competing with for visitors.

True, as far as the market in which real estate agents are competing. But am I the only one thinking this is like buggy manufacturers wanting to compare themselves to each other, while the market literally drives away in the other direction?

It might be a problem if you’re only competing in the ‘for sale’ market, y’all.

Meanwhile, brokers, managers, and agent team leaders tell me every time the topic is raised (with a plaintive sigh, mind you) that they just can’t get their agents to care about rentals because of how little it pays.

Well, keep it up, since at this rate, they won’t have to worry about how little handling rentals pays agents. Someone else will be handling the burgeoning demand for rentals, don’t worry. And when that someone else has trained an entire generation of people to skip using real estate agents for renting (or putting properties up for rent), I’m sure that someone else would never ever dream of entering the ‘for sale’ market. Ever.