The Bipartisan Policy Center — a think tank based in Washington DC once described as the place “where moderate Republicans go to embrace their inner liberal” — has released a new study in conjunction with NAR, the Urban Institute, and USC that is worth reading in full if you’re interested in topics like future of housing. Entitled “Demographic Challenges and Opportunities for U.S. Housing Markets“, it is a thoughtful academic treatment of the impact of demographics over the next couple of decades.

The key takeaways:

- There will be a lot more old people in the next 20 years.

- Old people sell houses

- Young people buy houses, but current crop of young people (Millenials and younger) are suffering

- Black and Hispanics hardest hit

Most of the paper, actually, is restatements of the obvious, such as “Over the next two decades, the U.S. housing market will depend on Echo Boomers”. You don’t say! Since Gen-Xers like me are in our 40s, 20 years from now, we’ll be in our 60s and looking forward to retirement (if such a thing exists by then). Who knew that the largest cohort since the Baby Boomer would be important to housing?

Nonetheless, the study concludes, “Notwithstanding predictions of a coming “rentership society,” however, none of the scenarios indicates a reduction in the overall U.S. homeownership rate below 60 percent before 2030.” (p. 18) The authors project that somewhere between 21 million and 25.5 million new households would form between 2010 and 2020:

The range of estimates in these scenarios can be attributed to different rates of household formation for Echo Boomers. Under the low scenario, people between 15 and 34 years old in 2010 (a span that includes Echo Boomers plus five years of the Baby Bust generation) would form 15.6 million new households between 2010 and 2020. Other cohorts would account for the formation of an additional 5.4 million households over the same time period (Figure 1). The medium scenario would result in 17.1 million new Echo Boomer households and 6.1 million other households. The high scenario, finally, yields 18.8 million new Echo Boomer households and 6.7 million new households from other generations. (p. 15)

And homeownership rates among these new households, the authors figure, would range from a low of 40% to a high of 67%, adding anywhere from a low of 3.8 million new homeowners to a high of 10 million from 2010 to 2020. (p. 16)

Although the authors do not make any recommendations for policymakers, it does seem to me from the overall narrative — the elderly will need lots of help, the young are being crushed financially, and black and Hispanics were hardest hit — that the paper is intended to spur government action to subsidize housing. Which, as a fan of the industry and all, I’m happy to consider, of course.

But there are three trends and factors that are simply not discussed in the paper, all of which have been much in the news of late. That glaring oversight makes me wonder if these projections are not wildly optimistic. Since I’ve been dabbling in the whole demographics angle — especially of Millennials — I figured, I should point those out and see what people thought.

Gender Disparity and Household Formation

As regular readers know, I’ve been pointing out that the Millennials are facing something we as a nation (and for that matter, any society ever in human history) have never seen before: overwhelming dominance of women, and the decline of men. But this disparity between Millennial men and women is something that mainstream scholars, as well as writers and journalists have been talking about for a while now.

Kay Hymowitz of the Manhattan Institute is just one scholar who has written a book on the phenomenon: Manning Up: How the Rise of Women Has Turned Men into Boys.

Kay Hymowitz of the Manhattan Institute is just one scholar who has written a book on the phenomenon: Manning Up: How the Rise of Women Has Turned Men into Boys.

Mainstream media has been all over this issue in the past several months. William Bennett wrote about the phenomenon on CNN.com, exhorting American men to “man up”. Hann Rosin’s widely cited piece in The Atlantic, “The End of Men“, was then followed by the widely read and oft-criticized “All The Single Ladies” by Kate Bolick.

In a Wall Street Journal post discussing the phenomenon, entitled “American Shengnu”, James Taranto draws the connection between gender disparity and family formation:

But this is no laughing matter. The disparity–which the BLS report says is likely to persist beyond age 24, as roughly equal percentages of men and women that age are enrolled in college–ought to alarm anyone who cares about America’s future.

Why is that? Taranto references the work by Charles Murray, whose new book Coming Apart describes an America where the gap between the elites and everybody else continues to grow. He then points out that Murray might have been overly optimistic even about elite, college-educated America:

Murray’s concern is that Belmont is increasingly isolated from Fishtown–that America is coming apart, as his title has it–and part of the reason has to do with patterns of marriage and fertility. Belmont perpetuates itself via homogamy. College graduates tend to marry other college graduates (educational homogamy), and, since contemporary higher education does such an efficient job of sorting people by intelligence, high-IQ women tend to marry high-IQ men (cognitive homogamy) and to bear them high-IQ children–the Belmonters of tomorrow.

Most of Murray’s data are for adults between 30 and 49, so that today’s 24-year-olds won’t even register unless he publishes an update in 2018 or later. But what will happen to Belmont–the subpopulation consisting of college graduates–when its female population starts to outnumber the males?

The answer, it turns out, can be found in China of all places:

Roseann Lake reports for Salon.com that something very similar has already happened in the Chinese counterpart to Belmont. “With 63 percent of GMAT takers in China being female, they’re attaining MBAs with a ferocity that’s making the boys blush,” she reports. The result: “As these women age, their marriageability plummets, and they acquire a snazzy new name: ‘shengnu.’ Used to describe an unmarried woman ever so precariously teetering near the age of 30, this word literally means ‘leftover woman.’ ”

That Chinese women have trouble finding husbands may seem counterintuitive. After all, the brutal one-child policy has led to widespread abortion and infanticide against girls, which means that for young ladies lucky enough to have survived infancy, “China’s male to female ratio is seriously skewed in favor of the fairer sex,” as Lake puts it. But the disproportionate number of female high achievers makes it difficult for them to find men who meet their standards of marriageability.

Hence, the title of the column: American Shengnu.

We have not yet seen the impact of the 3:2 ratio of women to men earning college degrees (and therefore, better, high-paying jobs) in family formation. Many of those who are products of the new gender environment are in the early 20’s today; they’re not ready to be settling down in any event, particularly the highly educated, ambitious, career-minded young women.

Given that this trend has been much discussed in the media, and in academic literature, I have to ask why the researchers who put together the Bipartisan Policy Center/NAR/Urban Institute report utterly failed to take that into account. Instead, they assume that the family formation rates in effect in 2000 will simply be held more or less steady over the next twenty years.

At a minimum, shouldn’t such projections — especially as they pertain to homeowners (aka, individuals who earn enough money to consider homeownership in the first place) — take into account the possibility that we’ll see hitherto unseen low rates of family formation and at later and later ages given the disparity between young women and young men?

Instead, the authors blithely recite, “The growth in female educational attainment may also portend higher levels of household formation if it results in greater gender equity and gives women more financial independence.” This is the purest form of wishful thinking, completely divorced from reality on the ground and from all available evidence.

So, Question #1 for the authors is: Why do you believe that using 2000 rates of household formation to project from 2010 – 2030 is justified in light of these trends?

Whither Employment? Or, The Education Bubble

The second major trend that the report’s authors missed completely is the widely discussed phenomenon of the “Education Bubble”. Google the term and you’ll see 125,000,000 results, including articles by respectable publications like The Economist and US News and World Report.

Sample passage:

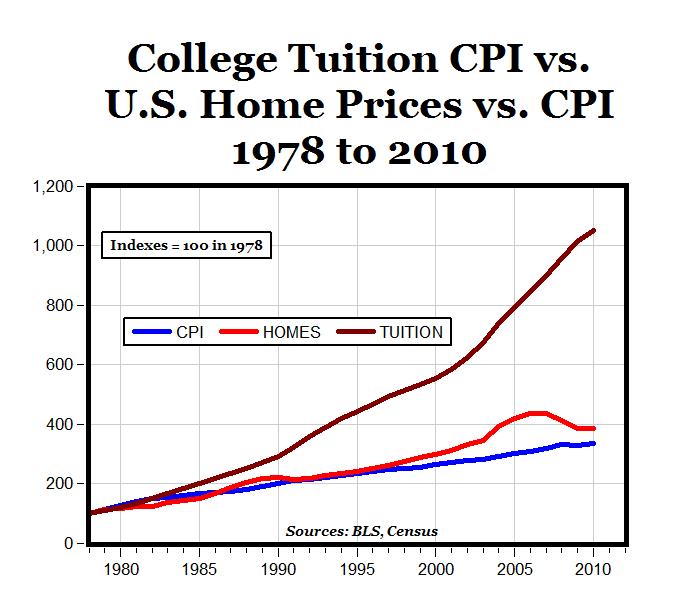

Reminiscent of the recent stock market and real estate bubbles, escalating college prices are continuing to reach new heights. According to the National Center for Public Policy and Higher Education, average tuition in the past 2 ½ decades has risen by 440 percent, which is more than four times the rate of inflation.

While higher-ed costs remain untethered to economic realities, students with college loans to pay off continue to graduate into abysmal job markets.

And there are literally hundreds of stories out there on the Internet of young people who have done everything they were told they needed to do to find career success, only to find out that their college degrees can’t get them jobs, and that even their law degrees are useless. But their student loans are still due nonetheless.

As a matter of fact, no less a personage than President Obama has gone on the record pushing colleges to lower costs, which led to pushback from college administrators:

President Barack Obama’s new plan to force colleges and universities to contain tuition or face losing federal dollars is raising alarm among education leaders who worry about the threat of government overreach. Particularly sharp words came from the presidents of public universities; they’re already frustrated by increasing state budget cuts.

Whodathunk that the famously liberal/progressive college bureaucrats would suddenly find that there is such a thing as “government overreach”?

In any event, given the coverage of the issue, shouldn’t the authors of the BPC/NAR paper have considered the impact of the education bubble?

In any event, given the coverage of the issue, shouldn’t the authors of the BPC/NAR paper have considered the impact of the education bubble?

For example, in their low/med/high analysis of homeownership rates, shouldn’t some attention have been paid to what percentage of these Millennial cohorts they think will be so burdened by education debt that they could not or would not be able to purchase a home, even if they wanted to, even if the retiring Boomers were ready to sell? Even if we assume that some Millennials would actually marry each other, if the two of them are carrying $150K in student loans between them, how likely are they to be buying houses?

A deeper, more profound trend that the authors could have considered (and I would argue, should have considered) is that the nature of employment itself has changed and is changing rapidly. There is some evidence out there that suggests that Millennials are not waiting for jobs to become available: instead, they’re starting companies, or doing more freelance work. In fact, given the work preferences of Millennials, it may be that they’re ideally suited to going out on their own, rather than having a boss. (You can call it the entitled mindset, or the ‘wont-settle’ mindset, but they certainly do have it.)

In fact, the shift away from the Organizational Man mindset of the 40’s and 50’s towards the Dotcom generation mindset of independence might be something happening across the entire economy. More and more companies are choosing to hire contractors for specific projects, rather than hiring fulltime staff for a variety of reasons. And more and more people are electing to become independent contractors or self-employed entrepreneurs than going to work that corporate job. Even in more traditional workplaces, the rise of technology and cheap communications means that even fulltime workers become more and more like freelancers. Many of them telecommute, or work from home, without a manager watching over them, without face time, without status meetings and such.

Which means that more and more workers are not commuting to the office. And more and more “workers” are in fact mini businesses on projects from clients, rather than from employers.

This megatrend will absolutely have an impact on housing decisions of the Millennials — the generation that the authors of the BPC/NAR study say is the future of real estate. All of those homes that are being released into the housing stock by Boomers… they were built in the age of the commute. Their value is based in significant part on distance to the nearest metropolis where the big office buildings are.

Since we’re projecting 20 years out, shouldn’t the authors at least have considered the possibility that in 2020, the big office buildings will be as rare as the huge automobile factories are? Shouldn’t they at least have wondered about the changing nature of what “a job” means to the younger generation?

So… Question 2: In estimating homeownership rates, did you take into consideration the enormous student debt load carried by the Millennials graduating into a work environment where education no longer appears to have much of an impact on employment? And in estimating the absorption rates of housing released by the Baby Boomer generation, did you consider the possibility that they would be unappealing to the Millennial self-employed lifestyle?

Fiscal Constraints, aka, The Pension Bomb

And of course, we have the incomprehensible overlooking of the big honkin’ 800-lb gorilla in the room: we’re broke. In fact, the United States is the brokest nation in human history, owing some $15.5 trillion as of this writing. And there appears to be no end in sight to growing debt.

But that $15.5 trillion is just the debt we know about. Bill Gross of PIMCO, not some crazy lunatic Tea Partier, has said our unfunded entitlements (Social Security, Medicare, Medicaid, etc.) amount to $100 trillion. Various state and local governments have unfunded pension liabilities estimated at $4.4 trillion; California alone is said to have shortfalls that could be as high as $500 billion.

What is driving all of this, of course, is the very demographic shift that the BPC/NAR authors are talking about: the aging of the Baby Boomers, and the rise of the Millennials. The authors even point out that as the Boomers get older, they’re going to need more help:

Affordability is a serious problem for seniors, especially for renters. According to a U.S. Department of Housing and Urban Development (HUD) report to Congress earlier this year, 1.33 million elderly renters (where the householder or spouse is age 62 or over, with no children under 18 present) had “worst case” housing needs in 2009. This meant that they earned less than half their metropolitan area’s median income, received no government housing assistance and either paid more than half their income for rent, lived in severely inadequate housing, or both.

That was in 2009; the first wave of Baby Boomers started retiring this year. We haven’t seen anything yet.

Have I mentioned, by the way, that one survey showed that 35% of people have saved nothing towards retirement? As in, not one dollar. They will absolutely be relying on Social Security, if that still exists.

I bring this up because the point of the BPC/NAR study are that the current policy regime remain in place, or is strengthened:

This fluidity [of demographic trends] and uncertainty mean, together, that decisions about the shape of housing policy in the U.S. – especially the finance system and tax incentives for owner-occupied and rental housing – stand to have a potentially large effect on the shape of the future U.S. housing market. Housing policies will likely affect individuals’ decisions about whether, when and with whom to form households. Even more, the housing policies that emerge by the end of the 2010s will influence whether many households buy or rent, where they decide to live and whether houses currently owned by Baby Boomers are sold, rented or leave the housing stock entirely. Whether for newly forming households or long-established ones, therefore, housing policies that emerge by the end of this decade have the potential to affect significantly the wealth portfolios of tens of millions of American families. (Emphasis added)

This would be far more compelling if the authors might have mentioned the fact that the current system of mortgage finance is almost entirely dependent on the public treasury, which just so happens to be $16 trillion in the red, with another $100 trillion in unfunded entitlements that might determine not just where grandma gets to live, but whether she gets to eat (Social Security) and live or die (Medicare).

A responsible analysis of a 20 year projection, in my mind, would have incorporated at least on the “low” projections the idea that hey, maybe the U.S. wouldn’t actually have the money to keep sending to Fannie and Freddie and the FHA, not because the policymakers don’t want to keep bribing us, but because they’ve finally run out of people and nations willing to keep lending us money so we can make sure the 34-year old single female PR executive can buy a condo with 3.5% down on a FHA loan.

And if the US can’t borrow the money anymore, but wish to keep spending it on things like Medicare and Fannie/Freddie, shouldn’t the authors have made at least an attempt to calculate what the tax rates would have to be in order to pay the Baby Boomers their entitlements plus the housing-related subsidies? And then estimate how much the taxes would be on the then-at-peak-earning-years Millennials, which in turn might suggest what sorts of down payments those guys can make to buy all this housing coming on the market from the Boomers?

So, Question 3: Did you even consider the possibility that the United States would not be able to keep borrowing the money to keep this whole debt-driven deal going?

Narrative vs. That Whole Inconvenient Truth Thing

I understand why these august think tanks put together that paper. Bipartisan Policy Center obviously wants to be some sort of a player in housing policy. NAR’s motivation is fairly transparent. And the Urban Institute’s raison d’etre is to holler all the ways in which blacks and hispanics are hit hardest by things like world wide economic crisis.

I get that the point is to convince various Congresscritters that they need to keep voting to shovel money at Fannie Mae and Freddie Mac, and to keep the dollars flowing to the FHA and to keep the mortgage interest deduction intact. I understand better than most people how these things tend to increase the incomes of real estate brokers and agents.

But at some point, doesn’t the narrative have to take those damned inconvenient facts into more of an account? Wouldn’t people start dismissing your conclusions out of hand if the assumptions are divorced from the reality of what’s going on in their lives?

I find the report disappointing, since obviously brilliant people collaborated to produce something that could have been tremendously influential and helpful in trying to figure out what demographic trends mean for housing. But I rather think they started with the conclusion and went searching for data/facts to fit it, rather than starting with looking at the actual demographic trends and thinking about what those mean.

Can you guys give it another try?

-rsh