I’m on the road so don’t have a ton of time to be doing a long post, but a reader emailed me a post by Barry Ritholtz of the Big Picture Blog that was an Op/Ed in the Washington Post. It’s worth reading in full, so go check it out here.

I thought I’d try to add one tiny little piece of data to a specific point that Ritholtz raises:

Regardless of the asset class — stocks, bonds, commodities, houses, etc. — assets do not merely stabilize. We have never seen a stock market run up into bubble territory and then revert to fair value. Instead, we careen wildly past that level, to deeply undersold and exceedingly cheap.

That is the marvelous mechanism of markets. It is how assets are repriced, distressed holdings liquidated, capital markets stabilized, fools revealed, speculators punished — and money returned to its rightful owner, the prudent investor.

For a lasting recovery, we need to see houses cheap enough that they fall into “good hands” — long-term owners who can afford their mortgage payments.

First of all, I happen to agree with Ritholtz 100% on this point. No asset bubble inflates and then simply reverts to the mean. It goes deep into negative territory, and then bounces back to the mean (i.e., “fair value”).

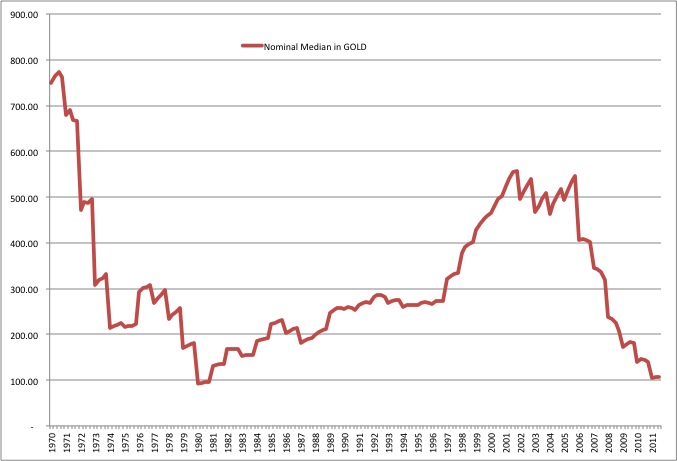

But I do wonder if we haven’t hit that point of housing being deeply undersold and exceedingly cheap. I suppose the definition of cheap depends on the buyer’s perspective, but the graph above is one from a post I wrote a while back looking at the price of housing in terms of gold — that ultimate holder of value, the non-fiat money in this world of fiat currency.

According to that chart, housing prices in 2011 were down to 1980 levels at least in terms of gold. 1980 was the absolute depths of the Jimmy Carter Malaise, when annual inflation was 13.5% and mortgage interest rates were around 18%. (Reagan didn’t take office until January of 1981, and you can see home prices recovering by 1982.)

The question is whether 1980 price levels are “deeply undersold and exceedingly cheap”, especially when rates are at historic lows thanks to the printing presses of the Fed going full speed. If you have the cash or the gilt-edged credit to get a mortgage in today’s environment, it may just be that prices have tumbled to “exceedingly cheap” levels thanks to unreported devaluation of the dollar.

I’ll have more speculating to do later on Ritholtz’s fantastic series on housing, but I did want to add this little tidbit for now.

-rsh