I am not an economist, and I don’t play one on TV, and I didn’t stay at a Holiday Inn Express last night… but I kinda look like one. Plus, Seth Price of Placester isn’t an economist either as far as I know, although he’s a good friend who is not only brilliant but good looking to boot. So I figure, I’m gonna have some fun with a blogpost one of his guys (Colin Ryan, who also doesn’t appear to be an economist) recently wrote on the Placester blog (BTW, Placester is our web designer for HearItDirect). Think of it as sending them linklove with some fun economic/politics debates.

Colin thinks that QE3 — the plan by the Federal Reserve to buy $40B worth of mortgage bonds every month for the foreseeable future — is a wonderful thing for the housing market. He writes:

[I]f we’ve learned anything from all the measures the Fed and the government have taken to mitigate this recession, it’s that recovery will come not immediately, but gradually. As far as that goes, the Fed’s plans come with promises to extend near-zero interest rates well into 2015 and continue buying bonds aggressively until recovery is “well established.”

These promises say two important things to consumers. First, the kinds of assets that caused the housing collapse in the first place, long labeled toxic, are safe again. Indeed, by buying mortgage-backed securities the Fed—an authority when it comes to risk—is suggesting that they’re not only safe, but valuable.

Second, by committing to the long haul, the Fed is providing a safety net that will encourage optimism, coaxing consumers out of hiding. “Go ahead,” the Fed is saying, “buy/sell/build that home. We’ll be here to support you.”

So, in the short-term, this buying-up-of-bonds won’t necessarily have an effect on housing, but in the long run, Colin believes that the Fed will stimulate the housing market.

Where to begin… Well, let’s begin at the beginning.

The Idea Behind QE3

Colin starts by suggesting that the reason for QE3 is to keep housing affordable. That’s true, as Bernanke in his announcement specifically said that the Fed wants to keep the recovery in housing going. But the real reason for the program is to try to do something about unemployment. The Fed figures that by keeping interest rates low, businesses will borrow more money to start stuff and hire workers. Builders might get into more construction, etc. etc.

The trouble for me is right here:

The idea, of course, is to create a ripple effect that encourages more risk, starting with banks. Buying tons of mortgage bonds drives up their prices, which earns money for banks. In turn, banks can risk more money on loans, for which more buyers will qualify. Finally, buyers will benefit from lower interest rates, enabling them to purchase more home for their dollar, which will then help boost the prices sellers can fetch.

The issue is the assumption that banks will turn around and put the money they got from selling their mortgage bonds to the Fed out to businesses. Two reasons why.

First, Bernanke specifically said that the Fed would buy “agency-backed MBS” — that is, only those mortgages that are Fannie/Freddie insured, or perhaps FHA loans. My issue is that by the time a mortgage gets packaged into a MBS, we are several steps removed from the local bank that is lending to families.The money from the Fed, then, has to go through the same amount of filters on the way down to the street. The big Wall Street banks that do the packaging of these MBS are the first to get paid. Perhaps they will buy more bonds to meet the Fed’s demand, since Bernanke pretty much just guaranteed them a profit on any agency-backed MBS. Or…

Second, little noticed in the mainstream news is this:

While the spread had been tumbling in anticipation of Ben’s great save, the move from yesterday’s announcement is stunning as the already record-low levels have been halved leaving mortgages now under 28bps from being ‘as safe as Treasuries’.

Since a bp (basis point) is 1/100th of a percent, what the above means is that if US Treasuries are trading at 2% (as of 9/14, the yield was 1.88%), mortgages will be at 2.28%. The question for the big Wall Street banks is whether the extra .28% of return on the money is worth the risk, as US Treasuries are defined as being risk-free. 0.28% is 280K on a billion dollar loan. I don’t know about you, but if that were my money, I wouldn’t take any risks for 0.28% extra.

The Big Assumption

But that’s relatively minor. The really big assumption behind both QE3 and Colin’s post has to be that there’s all this pent-up demand out there, and if only banks had more money to lend out to excited homebuyers, they would line up in droves to put their John Hancocks on the purchase contract for the home of their dreams.

So let’s go back to the big quote.

These promises say two important things to consumers. First, the kinds of assets that caused the housing collapse in the first place, long labeled toxic, are safe again. Indeed, by buying mortgage-backed securities the Fed—an authority when it comes to risk—is suggesting that they’re not only safe, but valuable.

Well, first, saying that the Fed loves them some more mortgage bonds doesn’t say anything to consumers, since consumers never own any mortgage backed securities directly. What it says to the institutions and professionals who do trade in MBS, however, is that the Fed is suggesting that MBS is safe only because it will buy them up, and valuable, but only to the tune of less than 1/3 of a penny (28 basis points over riskless US Treasuries).

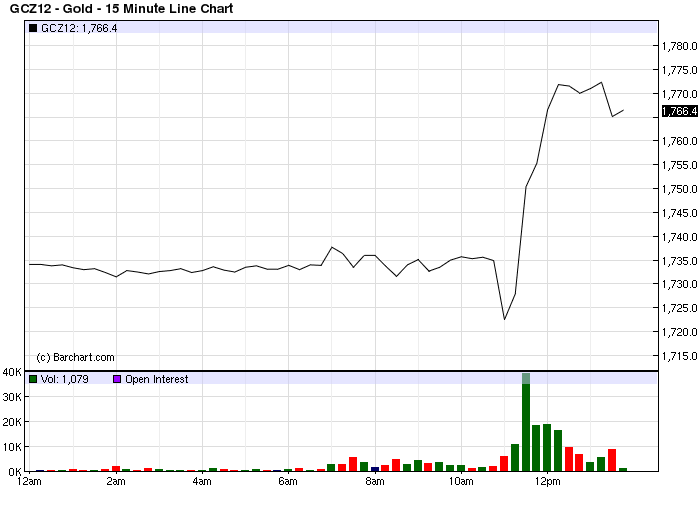

How do we know this? Because immediately following the announcement of QE3, those same institutions and professionals to whom Bernanke was suggesting stuff bid up the price of gold and silver.

And as regards this:

Second, by committing to the long haul, the Fed is providing a safety net that will encourage optimism, coaxing consumers out of hiding. “Go ahead,” the Fed is saying, “buy/sell/build that home. We’ll be here to support you.”

I’m curious if there is a consumer in the entire country who has held off on putting down a 20% down payment, entering into a 30-year loan, and make the biggest financial commitment of their lives because they didn’t feel that Ben Bernanke really had their back. I’m trying to imagine the conversation at the dinner table.

“Honey, you know we’re expecting our second child soon, and this apartment just isn’t big enough,” she said to her husband. “I think we should buy a house. Rates are low, you’ve got a great job, unlike 23 million other Americans, and we can afford the $60K in downpayment, unlike 90+% of Americans. The landlord just increased our rent again for next year, so it’s cheaper to own than rent. Why don’t we buy?”

“Baby, sweetheart,” he said. “I know it makes sense, and I know we can afford it, but… I just don’t think Ben Bernanke has my back. I don’t know that I want to buy a house without knowing if the Federal Open Markets Committee is going to support us, you know?”

As Cris Carter would say, “C’mon, man!” What safety net? Is the Fed proposing to pay off your mortgage if you lose your job? No. The $40 billion a month isn’t going into an insurance fund. It’s just going to Wall Street. How that creates a safety net for families isn’t clear, or explained.

And as finance types might say:

Despite trillions of dollars of liquidity, support programs and “forgiveness” for every criminal act in the book, there has yet to be a real recovery in housing. The most recent upticks, primarily due to speculative investor demand for rental properties, will rapidly dry up as rising interest rates makes buying much less attractive. It is important to remember that people buy payments – not houses. The lack of employment, lower incomes, excess debt and poor credit history will keep a large chunk of the remaining population from qualifying to buy for quite some time. If you couldn’t spur a massive house buying binge with the lowest mortgage rates in recorded history – what will another quarter point, or so, actually accomplish?

Ain’t happening. Renter Nation marches on, inexorably.

The Long Game

As the above gold price chart shows, the long game isn’t going to be Bernanke and the Fed nurturing “the hopes of homebuyers, sellers, developers, and brokers, turning them into something more: transactions.” The long game, as it turns out, is quite likely to be “Hello, Inflation!”. That’s not some crazy blogger talking. That’s Bill Gross of PIMCO, the largest bond fund in the world. Then there’s Marc Faber, who bought Kazakhstan bonds because “Kazakhstan is economically sounder than the United States.”

Look, QE3 is really just a fancy way of saying that the Fed is going to print some more money. Maybe there are reasons to do some moneyprinting. Maybe there’d be no problem with devaluing the US Dollar for the strongest economy in the world. But… Left/Right/Center, inflation is inflation. It’s not like Democrats pay one price for electricity and Republicans pay another. (Although… wait a minute… there might be a business model there….)

So it’s quite possible that the no-fixed-end QE3 could prop up housing prices… in nominal terms. So the seller could sell for a higher price, and REALTORS could make more commissions. In nominal terms. But that extra few bucks in the seller or REALTOR pocket will be erased by higher prices at the gas station, higher prices at the grocery store, and all around higher prices. So I don’t quite know who this helps.

There is something else to consider. That $40 billion a month that the Fed is printing creating out of the digital ether with a few keystrokes on a computer? The folks currently lending the United States some $1.6 trillion per year might get a wee bit suspicious, wouldn’t you think, of such magical acts of wealth creation? After all, when they decide to lend $100 billion to Americans, they get paid back in US Dollars. I assume they expect to get paid back in dollars that isn’t worth half tomorrow what it is today.

Suppose a few of them decide… y’know, I’m not real comfortable lending you money at these low interest rates if the money is going down in value. Yeah, so much for that low interest rate environment, huh.

Optimistic?

Are your hopes feeling more nurtured by the Fed’s actions? Feeling optimistic? Awesome! Don’t wanna rain on your parade, although I sure would like to know what makes you feel nurtured and optimistic. Feel free to write me, comment, or whatever.

As for me…

Mine eyes have seen the glory of the rising of the gold

Fed is trampling out the vintage where the dollar’s worth was stored

Ben hath loosed the fateful lightning of his QE3 program

RentNation’s marching on!