Since publishing the Strategic Analysis on Zillow, Trulia, and Move — as well as prepublication, from comments — I’ve gotten some further information and clarification from all three companies that could be useful and interesting to consider. They “add color” in the language of Wall Street analysts.

I don’t believe that this new information changes the major conclusions of the Report, but they might provide you with further things to consider. Let’s get into it.

Traffic: Quantity vs. Quality

This was one point that both Move and Trulia raised. The key metric of Traffic is certainly important, but Trulia and Move especially felt that it is a mistake to just look at the numbers, which strongly favor Zillow.

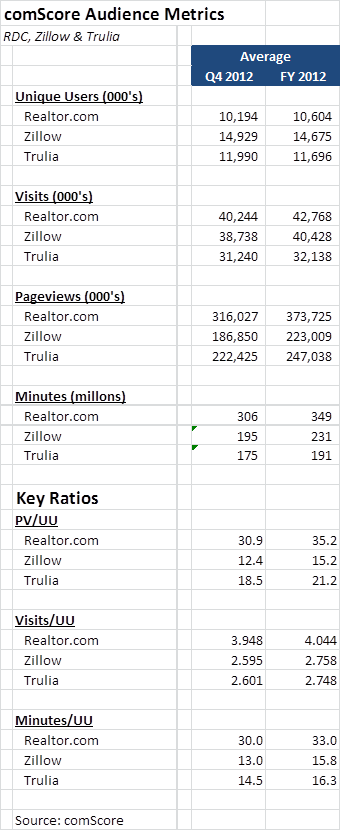

For example, here’s a chart that Move sent me:

Move raises two key points:

1. The three companies are much closer on comScore than are on self-reported figures (Zillow uses Google Analytics).

2. Move has far higher quality of traffic. Here it’s worth quoting Move’s response:

Even more important is the relative engagement metrics. You can see we lead the way, DESPITE the higher traffic for our competitors on both pageviews and minutes. 95% of our pageviews come from FOR SALE listings, testimony to the fact that our audience represents a very high value, serious home buyer or seller.

What’s interesting is that Trulia raises the same points, but without a chart. Here are Trulia’s claims taken from an email:

- Trulia not only focuses on attracting a large consumer audience, a high quality one focused on consumers who are transaction-ready i.e. consumers who are ready and able to move in the relative near term

- Data from our IPO roadshow: of the consumers surveyed, about 3/4 (75%) were looking to move in the next 6 months, and almost 90% needed an agent

- So this is an audience that is highly attractive to RE professionals

- Another key point to note is that we have grown our audience organically – the growth has not been driven by paid marketing or acquisitions.

- It has been driven by our focus on building the very best products for consumers, that deliver insights – not just data – that help people find the right place to live. We do that through our user-generated content and rich data visualization, such as crime and commute maps.

As I mentioned in the original Report, traffic is one of the key metrics that is most difficult to assess properly. A unique user is hardly the same thing as an individual human being. Different methodologies yield different results.

So for the sake of discussion, let’s just say that the comScore data is the correct one. Because I have little interest in getting into the arcana of details about methodologies and what’s correct and what’s not correct about web and mobile analytics. There are technology guys who write books on such topics. My interest, and I hope your interest, is in discerning the strategic issues that flow from the argument raised.

Defining Quality Traffic

The first question I have is whether for real estate companies, especially online real estate portals like Zillow, Trulia and Realtor.com, “quality” of traffic should be defined as “transaction-ready” consumers.

The answer, I think, depends on what your view of an online portal is. Indeed, it depends on your view of online marketing strategy itself.

Consider a typical website for a business, not just real estate, but general business. Most of them aren’t for simple lead generation. They also serve a branding purpose, provide customer service information, perhaps contact information, and so on. For products and services that tend to be bigger ticket items, they also provide information to allow the DIY customer of today to do research.

The ultimate goal is to control the customer relationship throughout the entire purchasing cycle and beyond it. The popularity of things like company blogs is in recognition of changes in consumer behavior since the Internet changed it forever.

This does not mean, of course, that Move and Trulia are wrong. Because in real estate specifically, most brokers and agents want that control over the customer relationship to happen on their websites. For them, portals like Zillow, Trulia and Realtor.com are valuable only to the extent that they drive raw traffic to their own websites, so that they can take over the customer management from there.

Given the transactional nature of real estate generally, I suspect that most brokers and agents do subscribe to the idea that “quality” is hot-to-trot, transaction-ready consumers. What is unclear is whether that idea is the best definition of quality, as we discuss below.

Is Engagement Quality Traffic?

Even if we accept, again, for the sake of discussion, that quality traffic means transaction-ready consumer, it isn’t clear to me that web engagement metrics are a good stand-in measure.

In the instant case, let’s assume that the comScore data should be what we use. Are engagement stats such as visits per user, page views per user, or time on site is really a good measure of transaction-ready?

First thing I notice is that it’s difficult to reconcile Trulia’s claims with Move’s assertions. Trulia claims that its audience is high-quality, transaction-ready consumers, but also that it provides them with insights like crime stats and commute maps. Its engagement metrics aren’t much different from Zillow’s: 21.2 PV/UU vs. 15.2 PV/UU, 2.748 Visits/UU vs. 2.758 Visits/UU, and 16.3 Minutes/UU vs. 15.8 Minutes/UU. Move trumps not just Zillow but Trulia as well on all three metrics with 35.2 PV/UU, 4.0 Visits/UU, and 33 Minutes/UU.

Furthermore, as Move points out, 95% of its traffic comes from listings for sale. Let’s assume Move means “Pageviews” by this. So some 355 million pageviews for Realtor.com is coming from listings for sale. Neither Trulia nor Zillow break out its Pageviews like that, but given their emphasis on User Generated Content and related business segments (rentals, mortgage, Zillow Digs, etc.) respectively, one could assume that much of their pageviews are on things other than for-sale listings.

Trouble is, of all the stats that are most easily manipulated, pageviews is at the top. The design and user interface of a website directly impacts pageviews. The same can be said for minutes on site. I can break up posts on Notorious into a new page for every 500 words or so and probably triple my pageview count and substantially increase minutes on site as people wait for page reloads and such.

True Measure of Quality Traffic

The real measure of quality traffic, then, is one that none of the companies make public: leads per unique user.

Whether the consumer is ready-to-buy or earlier in the homebuying cycle, the assumption that brokers and agents want them to either (a) make an inquiry, or (b) visit the broker or agent’s own website is a solid one. I’m willing to define “leads” broadly to include all those users who were sent to a subscriber’s web presence.

This is the stat that would clearly distinguish the three companies in traffic quality analysis. If Move sends 70 leads per 1,000 unique users, while Trulia sends 50 and Zillow sends 25, then we can actually make substantive statements about the quality of traffic.

Absent such a measure, it is unclear just how anyone could evaluate the quality of traffic.

What the Traffic Debate Says About Strategy

The discussion of traffic quality, while interesting in and of itself, really merely sets the stage for what the three companies’ response suggests about their strategy.

First, it is worth noting that Trulia confirmed my strategic analysis, that they may simply be focusing on nose-to-the-grindstone execution:

Priorities for 2013-In 2013, we’re heads down focused on executing. Key areas of focus will continue to be:

- Building the very best products to attract transaction-ready consumers,

- Extending our leadership in and driving user engagement through in user-generated content

- Investing in mobile applications for both consumers and RE professionals

Strategically, though, the traffic discussion confirms rather than undermines my conclusions.

Zillow’s aggressive push into mortgage, rentals, home improvement, and other areas to draw visitors in + their stated intent to become the central hub for real estate + their newly stated ambition to build a “massive enduring brand” = Zillow wants to control the customer relationship throughout the entire real estate lifecycle from the first time someone moves out from mom’s house to the last time he sells the family home to retire to Florida.

This isn’t to say that Zillow doesn’t care about transaction-ready customers; I’m certain that they do. But it is to say that Zillow aims to incubate consumers in those long stretches of time when they’re not in the market. They want Zillow to mean Real Estate in the minds of consumers who aren’t anywhere close to being transaction-ready.

Trulia, on the other hand, wants to be the Director of Marketing for real estate brokers and agents. Again, taken from their email:

RE Professionals

- On the other side of our marketplace, we are focused on connecting RE professionals with transaction-ready consumers

- By doing this, we deliver a highly attractive Return On Investment (ROI) for agents (during the IPO roadshow, we stated that from the agent survey we conducted, agents are averaging a 10x ROI from the dollars they spend with Trulia).

- Given the value we provide to agents, we have been able to steadily increase our prices. This is evident in the fact that as while we grew our subscriber base by almost 50% year-over-year by the end of 2012, we have also achieved 12 consecutive quarters of ARPU expansion

Trulia also notes that while they have significant opportunities for growth in areas like rentals, mortgages, and whatnot, they feel that it’s very early in each of those areas. They plan to focus on refining the user experience in those, and then monetize slowly.

Well, the issue isn’t going to be that those areas exist, since they so obviously do. The issue is how Trulia could play in those spaces while keeping to their core strategy of delivering ROI to real estate brokers and agents.

Taken as a whole, one can detect a definite strategic lean from Trulia away from Zillow and towards Move. They would like the industry to consider replacing the old warhorse of Realtor.com/Move with the new star rookie in Trulia as the red-headed stepchild of a second cousin family member.

Move, on the other hand, is all but forced into the high-quality, transaction-ready box because of its tenure in the industry (let’s not forget that Move isn’t a new startup, but an established force in the industry for over a decade) and because of its relationship with the industry, exemplified by the partnership with NAR.

As we noted in the Report, Move’s business model is listings-dependent in ways that Trulia and Zillow’s businesses are not. Move’s new Co-Broke Connection product helps alleviate that to some degree, but even that is a bit of a zero-sum game: the more listing agents subscribe, thereby getting the leads from their own listings, the less inventory there is to sell to Co-Broker Connection customers.

For Move, shut out politically from doing things like Premier Agents, at least for now, and not experiencing the kind of traffic growth of Trulia and Zillow, ensuring that their traffic is the highest quality (defined as hot-to-trot, ready-to-go) is absolutely essential.

To the extent that traffic quality as discussed above matters to brokers and agents, then, Move should understand that Zillow is no longer the real competition. Trulia is. Zillow may not care all that much, because Zillow is playing a slightly different game now.

Why Quality Traffic May Not Be the Best Idea

There is at least one reason why Move and Trulia’s focus on delivering the highest quality leads to brokers and agents may not be the best idea in the world. It is one of the reasons why I said that CRM is the next battlefield for these guys in the original report. I should surface that now.

The reason is that far too many agents suck at responding to consumers in a timely manner.

According to one study done by PCMS Consulting in 2011, 75% of online leads went unanswered. Zillow’s own internal metric shows that 30% of their leads receive no response at all from the agent. Trulia declined to provide unanswered leads number, as it isn’t public. Realtor.com has not responded at time of writing.

While there are brokerages that have created entire divisions concerned solely with handling and processing these online inquiries, the vast majority of customers for Zillow, Trulia, and Realtor are individual agents or small brokerages that do not have such an “e-leads” team. A common complaint by consumers about real estate agents is that they do not return phone calls and do not respond to inquiries.

The agent-centric model of most brokerages means that enforcing some sort of lead-response discipline is a difficult proposition for everybody up and down the chain. Listing agents typically want all the leads from their listings sent to them, either to send to a buyer agent they work with, or to refer out, or simply to answer questions about the property. Start being too strict with lead response discipline, and those valuable listings agents may walk.

One possible solution — one that many brokerages and team leaders embrace — is to take on the task of lead incubation and lead qualification until the consumer is literally ready to buy. By that point, the consumer is truly “transaction-ready”, and because the company has spent time and effort incubating and pre-qualifying that lead, it has a freer hand in how it gets distributed. (That is, it becomes a “broker lead”.)

All three companies face the same problem: how to get brokers and agents to respond to inquiries in a timely fashion. For Trulia and Move, who focus on lead quality to the broker/agent, the issue is critical. The consumer, after all, doesn’t care about any of these internal problems; she just wants someone to call her back and help her buy or sell a house. Their solution will have to revolve around working with brokers and agents to improve their internal order processing. They can send all the high-quality leads as they generate, but if the response rate from the broker/agent is poor, then overall consumer experience cannot help but be poor as well.

For Zillow, whose strategy now appears to be to own the consumer relationship, and to create the massive enduring brand, the challenge is a little bit different. For them, the challenge isn’t necessarily to help brokers and agents improve their internal order processing, but to get brokers and agents on the Zillow platform itself so that every step of the process from incubation to transaction can be monitored and managed by Zillow. In a real way, Zillow has to look to replace the “broker lead” concept with a “Zillow lead” concept.

For example, Zillow might have a consumer who spent years on Zillow Digs just doing one home improvement project after another. Zillow owns that consumer relationship. Zillow can then send that consumer pre-screened, pre-qualified, and ready to do business, with rich, fairly detailed history on that consumer during the period when he wasn’t in the market, to brokers and agents for service. Under this strategy, the “low-quality” traffic is just as good as “high-quality” traffic. Such consumers are merely on a different part of the transaction cycle, and if Zillow intends to incubate them for its paying customers, so much the better for Zillow and for its customers.

To even get close to achieving any of this, a centralized CRM platform is a necessity. Top Producer isn’t quite it; it’s more of a personal CRM for an individual broker or agent. Tiger Lead also isnt quite that either. Zillow’s CRM, as we saw, is not ready for primetime. Trulia, if it really wants to be the market partner to the real estate industry, has to have some sort of CRM solution (even if it’s via integration) to deal with the problem of responsiveness.

This is one of the reasons why CRM is the next battleground for all three companies, whether they want to or not. And this is why the focus on quality traffic over quantity of traffic may not be the best idea in the world after all.

Should brokers and agents take on the task and responsibility of responsiveness, and the bigger task of maintaining the customer relationship throughout the lifecycle, then Move and Trulia stand to benefit enormously. Should that not be the case, then Zillow stands to benefit by filling in that gap in longterm customer relationship management.

Conclusion & Takeaways

So what could be conclude taking the additional information from the companies into account?

- Traffic analysis is a headache wrapped inside a migraine.

- The real metric we need for “quality traffic” analysis is leads per unique user. Maybe one day, the three companies will release that information.

- Looking at how the companies think about quality traffic confirms the strategic analysis from the main Report: Zillow wants to own the consumer lifecycle, Trulia wants to be the Director of Marketing for real estate industry, and Move remains the incumbent but tied down by some legacy issues and the dilemma of its NAR relationship.

I still end up thinking that CRM will be a central battlefield for all three companies in 2013 and beyond.

Thank you, as always.

-rsh

Next planned update is after the 10-K’s are released, to double check the numbers and assumptions.