I’ll be honest. I didn’t know about this critical case on dual agency in real estate, originally filed in 2014. The case is Horiike v. Coldwell Banker and in all likelihood, most of you already know about it being the Best Informed Readers in Real Estate. But a reader sent the case to me along with the note that oral arguments in this case in the Supreme Court of California has been scheduled for September 7th. Apparently, it’ll be live-streamed so if you’re really bored or something, I guess you can tune in….

Thing is, if I didn’t know about this, I’m willing to bet that at least a few of you didn’t either. I guess possibly it’s because everyone was waiting for the Supreme Court to rule before really talking about it.

So let’s talk about it, including a related-yet-separate complaint by buyer agents contained in an amicus brief from NAEBA (National Association of Exclusive Buyer Agents). And then, like we do here, let’s go on a fantastic (meaning, based on fantasy, rather than reality) journey into the future!

For the TL;DR folks:

- Fiduciary duty is at the broker level, not the agent level.

- There is also a transparency problem, according to NAEBA.

- That could change a whole lot of practices currently widespread in the industry, such as the agent team.

OK, let’s get into it.

Summary of Horiike v. Coldwell Banker

The facts of the case are as follows:

- In 2006, Chris Cortazzo, an agent for Coldwell Banker Residential Brokerage Company (“CB”) in California, listed a property for sale in Malibu.

- The building permit has the total square footage as 11,050 sq. ft.

- The MLS provided Cortazzo, the listing agent, with the public record, which stated that the living area was 9,434 sq. ft.

- Cortazzo’s original listing for the property, however, stated that the property has “approximately

15,000 square feet of living areas.” The flier for the property also cited the 15,000 sq. ft. of living area phrase. - In 2007, an unnamed couple made an offer. They asked Cortazzo for verification of the 15,000 sq. ft. living area. He provided a letter from the architect stating the size of the house under a current Malibu building department ordinance was approximately 15,000 square feet.

- Cortazzo also suggested the couple hire a qualified specialist to verify the square footage.

- The couple requested the certificate of occupancy and the architectural plans, but no architectural plans were available.

- In the real estate transfer disclosure statement, Cortazzo repeated his advice for the buyer to get their own expert to verify the square footage of the home, stating that the broker did

not guarantee or warrant the square footage. - That deal fell apart because the couple wanted an extension to verify the square footage; the seller refused, so no deal.

- Enter Hiroshi Horiike, a wealthy international businessman, who was working with one Chizuko Namba as a buyer agent. Namba was also a CB agent. Namba showed Cortazzo’s listing to her buyer, with the flier that showed “15,000 sq. ft.” Cortazzo sent a copy of the building permit and other documents, but critically, failed to provide either Horiike or Namba with the handwritten note advising them to hire their own expert to verify the square footage.

- Horiike lives in Hong Kong, only speaks Chinese and Japanese, and had been working with Namba for four years for a luxury property in Southern California.

- Namba was with the Beverly Hills office of Coldwell Banker, and Cortazzo was with the Malibu office. The two had never met before this transaction, when they met each other at the showing.

- During the house tour, Cortazzo handed Horiike the buyer the flier and the MLS listing printout. That and the very brief “conversation” (which was probably more like “Hi, how are you?” and that’s it, since Horiike didn’t speak English and Cortazzo didn’t speak Japanese or Chinese) are the full extent of contact between Cortazzo and Horiike.

- Horiike bought the house, closed escrow, decided to do some home improvement work, started reviewing the permit, documents, etc. and… obviously ran into the fact that the house wasn’t 15,000 sq. ft. of living space. It was more like 11,000 sq. ft. according to his expert witness.

Horiike signed the agency disclosure form required under California law. And California law allows for three kinds of real estate agency:

- Seller’s agent under a listing agreement;

- Buyer’s agent acting for the buyer only; and

- Dual agent, representing both the seller and the buyer. This is obviously the kind of relationship we’re talking about here.

Cortazzo, the listing agent, always signed the disclosure form as the “listing agent” and Namba, the buyer agent, always signed it as the “selling agent”.

At the Trial Court

The trial court had ruled for the defendants, under the prevailing theory of agency that is commonplace in the real estate industry:

After the presentation of Horiike’s case to the jury, Cortazzo moved for nonsuit on the cause of action for breach of fiduciary duty against him. The trial court granted the motion on the ground that Cortazzo had no fiduciary duty to Horiike. Horiike stipulated that he was not seeking recovery for breach of fiduciary duty based on any action by Namba. Therefore, the court instructed the jury that in order to find CB liable for breach of fiduciary duty, the jury had to find some agent of CB other than Namba or Cortazzo had breached a fiduciary duty to Horiike. The court granted Horiike’s request to submit an additional cause of action to the jury for intentional concealment against both defendants. [Emphasis added]

In plain English, the listing agent Cortazzo said, “Hey, I’m the listing agent; I owe a fiduciary duty to the seller, not to you, Mr. Buyer”. The trial court agreed. Then, since Horiike hadn’t claimed any breach of fiduciary duty by his own buyer agent (Namba), the court told the jury that they had to find somebody other than Cortazzo (who owed no duty to the buyer) and Namba (who Horiike hadn’t sued) who worked for CB to find CB liable for breach.

The semi-amusing thing here is that the jury came back with conflicting findings:

The jury returned a special verdict in favor of Cortazzo and CB. The jury found Cortazzo did not make a false representation of a material fact to Horiike, so there was no intentional misrepresentation. However, the jury made a contrary finding in considering the claim for negligent misrepresentation, finding that Cortazzo had made a false representation of material fact to Horiike. There was no liability for negligent misrepresentation, because the jury found Cortazzo honestly believed, and had reasonable grounds for believing, the representation was true when he made it. The jury found no concealment, because Cortazzo did not intentionally fail to disclose an important or material fact that Horiike did not know and could not reasonably have discovered. Lastly, the jury found that CB did not breach its fiduciary duty to Horiike.

So, on the one hand, jury says Cortazzo didn’t lie to Horiike. But the jury also says that Cortazzo did unintentionally “make a false representation of material fact” to Horiike. Then again, since Cortazzo honestly believed the false material fact, no liability for negligent misrepresentation, and no intentional concealment. And of course, CB breached nothing because the jury didn’t find anyone other than Cortazzo (the listing agent) and Namba (the buyer agent) who worked with Horiike.

I know, confusing as hell, right? It’s OK, because none of those end up being all that important.

The Court of Appeals Says, Nyet!

In its brief opinion, the Court of Appeals pretty much nullifies that whole line of reasoning, because it announces/clarifies/enunciates an interpretation of dual agency that goes completely against the real estate industry’s commonplace understanding of agency. (And according to CB’s lawyers, goes completely against statutory intent and rules of statutory construction, but… that’s legal geekery beyond the scope of my blog.)

In its brief opinion, the Court of Appeals pretty much nullifies that whole line of reasoning, because it announces/clarifies/enunciates an interpretation of dual agency that goes completely against the real estate industry’s commonplace understanding of agency. (And according to CB’s lawyers, goes completely against statutory intent and rules of statutory construction, but… that’s legal geekery beyond the scope of my blog.)

The Court held:

Horiike contends that Cortazzo, as an associate licensee of CB, owed a fiduciary duty to him equivalent to the fiduciary duty owed by CB. We agree.

The duties of brokers and salespersons in real property transactions are regulated by a comprehensive statutory scheme. (Civ.Code, § 2079 et seq.) Under this scheme, an “agent” is a licensed real estate broker “under whose license a listing is executed or an offer to purchase is obtained.” (Id., § 2079.13, subd. (a).) An “associate licensee” is a licensed real estate broker or salesperson “who is either licensed under a broker or has entered into a written contract with a broker to act as the broker’s agent in connection with acts requiring a real estate license and to function under the broker’s supervision in the capacity of an associate licensee.” (Id., subd. (b).) “ ‘Dual agent’ means an agent acting, either directly or through an associate licensee, as agent for both the seller and the buyer in a real property transaction.” (Id., subd.(d).)

“The agent in the real property transaction bears responsibility for his or her associate licensees who perform as agents of the agent. When an associate licensee owes a duty to any principal, or to any buyer or seller who is not a principal, in a real property transaction, that duty is equivalent to the duty owed to that party by the broker for whom the associate licensee functions.” (Civ.Code, § 2079.13, subd. (b).) [Emphasis added]

The Court therefore concludes that the agent here is Coldwell Banker, and the two listing and buyer agents are “associate licensees”. Ergo, the Court concludes:

The duty that Cortazzo owed to any principal, or to any buyer who was not a principal, was equivalent to the duty owed to that party by CB. CB owed a fiduciary duty to Horiike, and therefore, Cortazzo owed a fiduciary duty to Horiike.

Obviously, the defendants have appealed that decision to the highest court in California, and we’ll have oral arguments on the 7th, and a decision in the next few months. We’ll talk about consequences below, but first…

Here Comes NAEBA

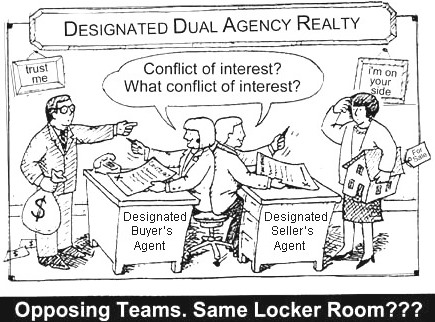

One of the more interesting related issues comes from the amicus brief filed by NAEBA. To say that NAEBA has a vested interest in this case is to suggest that perhaps public unions have a vested interest in voting. In any event, NAEBA attacks the lack of transparency in the industry:

What is really at stake here is transparency, which is far too often lacking in the real estate industry. Even when agents comply with statutory disclosure rules, most buyers and sellers remain unaware they are dealing with agents who have dual loyalties. Most people think that “their” “agent” – the associate helping them find a home – represents them exclusively. That is rarely the case.

In fact, until the 1980’s, it was never the case, because the associate “helping” the buyer did not represent the buyer at all. He or she represented the seller under a system known as “subagency.” While subagency is no longer common (although it remains legal in California), it has yet to be replaced with a system that in line with consumer expectations.

NAEBA goes on to say that the agency disclosure forms do nothing to help consumers understand what’s going on and what dual agency means and who owes them what duty:

In sum, the consent form serves to protect the broker rather than educate the consumer. Real estate “disclosure statements are bewildering, ignored or overlooked” during the often emotional and confusing process of buying a home.

They quote from a law review article which says:

They are usually written in small print, buried among voluminous pages of form papers describing the property, often called the ‘disclosure package,’ and consumers are usually not trained to read the fine print. … [E]ven trained consumers will have paper fatigue in reading every single page of the disclosure package, especially after an exhausting and possibly whirlwind home search. If a consumer asks the agent to explain the disclosure statement, the agent may be (1) similarly bewildered; (2) or wary of losing a client if the explanation is too clear.

Pretty damning, if true. And I think it’s pretty close to the truth. I mean, who the hell reads every single word of every single form in a real estate transaction, especially in a place like California that has a bewildering amount of paperwork.

As to the chaos that would result? NAEBA’s position is that that’s just too bad for those brokerages who practice dual agency, quite unlike its members, who only practice buyer agency:

Any practical difficulties are the price of dual agency, a practice that brokers seek to protect because it is extremely lucrative for them; indeed, brokers who are dual agents reap a double commission from the sale of every individual home (because each associate owes his broker a portion of his commission), to say nothing of the additional double commissions they obtain from affiliated title and escrow officers.

Well… you kinda have to admit the NAEBA folks have a point, no? Not sure I’m getting on their train but I can see where it’s going….

Consequences?

Let’s suppose that the California Supreme Court upholds the ruling of the Court of Appeals. What happens then?

In this context, it’s worth reading the Opening Brief and Reply Brief from Coldwell Banker’s lawyers. Some of the consequences they cite are:

- Consumers could “lose” the exclusive representation they thought they were getting “midstream” because the agent on the other side happens to be from the same brokerage.

- Agents would be forced to disclose sensitive information to the other side, because they owe a fiduciary duty to both the buyer and the seller. For example, the listing agent would have to tell the buyer (and the buyer’s agent) that the seller is desperate to sell, or the buyer agent disclosing to the seller that the buyer has completely fallen in love with that property and doesn’t want any other.

- Agents would be forced into dual agency just because the agent on the other side happens to work for the same brokerage, and face the possibility of getting sued no matter what.

There are some other nightmare scenarios, and the Briefs touch on one with the lightest of touches:

The chaos that would exist under the Court of Appeal’s construction would trigger an explosion in litigation and liability exposure, and concomitant increases in insurance premiums. Transaction costs would rise, harming consumers. And some brokerage firms might forsake intra-firm transactions altogether, further harming consumers. Reducing the availability of intra-firm transactions would mean “buyers are limited in their market choices because they have fewer homes to choose from, and sellers are limited in their market exposure because their home is shown to fewer buyers, which translates into lower selling prices” (Agency/Disclosure Act, supra, 48 Ala. L.Rev at p. 295.)

Let’s dismiss as legal advocacy the language about buyers and sellers becoming more limited in their market choices and market exposure because Large Brokerage Firms decide to prohibit intra-firm transactions. Something like 85%+ of Participant Brokerages in any given MLS is a 5-agents or fewer “mom-n-pop” shop. It ain’t like buyers and sellers are going to have any trouble finding or selling homes.

But the impact on brokerages would be… catastrophic.

Death of Large Brokerages

I say the above is the lightest of touches because, well, what will not be happening is some brokerage firms forsaking intra-firm transactions. No, what would really happen is that large brokerage firms would cease to exist in California. And by “large” I mean any company over… say 50 agents? If you have 50 agents, are you so sure that none of them will ever bring a buyer to a listing held by one of your own?

Furthermore, if the CA Supreme Court sides with the Court of Appeals, the obvious thing for any listing agent to do is to leave the large brokerage and either (a) join a tiny brokerage that specializes only in listings, or (b) become a broker herself. Keep in mind that the person who got sued here is not the buyer agent, but the listing agent, by a guy whom he met once very briefly, whose language he doesn’t speak.

“I’m an expert negotiator, and I’ll get the highest price for your home… unless the buyer is represented by another REMAX agent, in which case I’ll have to look out for their interests as well.” Can you even imagine saying that in a listing presentation? Think that’ll go well?

Brokerage Specialization

While large brokerages (100+ agents? 50?) would likely cease to exist, smaller boutiques would have to make a choice: specialize as listing brokers or specialize as buyer brokers, and refer out the rest.

NAEBA thinks that result is a wonderful thing, of course, since it would mean that brokerages would divide clearly between Listing Brokerages and Buyer Brokerages, and its members are Exclusive Buyer Brokerages who do not take listings. (I assume NAEBA members refer out listings?)

To be fair, that is how law firms tend to work. Every law firm, small and large, has to do a conflict check before taking on a client, and if conflict exists, they have to refer the client to another lawyer at another law firm.

In rare cases, law firms might setup a “Chinese Wall” if it’s worth the trouble and the cost. If you’re interested, take a look at something like this to see what the hell lawyers have to go through.

In real estate, I can’t see the cost or the hassle or the potential liability being worth it unless we’re talking about a rare signature property (think eight instead of seven figures) with the attendant commissions.

Death of the Agent Team

I have long posited that the real future of the industry is the Agent Team, under the Keller Williams model, of a brokerage-within-a-brokerage.

The whole economic engine that makes agent teams work is that you have a Lead Agent (or Team Owner) who is a very strong listing agent whose listings generate buyer leads, which she then refers to buyer agents on her team, for a very high split (50/50 usually).

Thing is, every one of those agents on that Team are agents under the same brokerage. Ergo, under the Court of Appeal’s holding, every single one of those would be a dual agent owing a fiduciary duty to the seller and the buyer when dealing with the team’s own listings (as well as any listing held by another agent in the same brokerage, or dealing with a buyer represented by an agent in the same brokerage).

There is no scenario I can think of under which that model of the Agent Team can survive if Horiike’s holding is upheld.

Open Houses? What the Hell For?

Similarly, there would be very little point in holding open houses. No respectable listing agent I know personally holds open houses to sell that house. Listing agents have said for years and years that a vanishingly small number of properties sell because of an open house. MLS, yes; Internet, yes; Open House? No.

No, they hold open houses to meet potential buyers, and if they’re unrepresented, to try to sign them on as buyers. The whole reason why an agent would even work an open house is that she might pick up some buyer leads which she can keep for herself, while the listing agent gets someone to do the tedious work of sitting an open house.

I suppose that in theory, I could imagine a scenario where agents from different brokerages work with each other to staff open houses…. So a KW listing would have REMAX agents working that open house, and vice versa, but have a KW agent work a KW listing and you’re signing up for dual agency and all that that implies.

Portal Advertising Changes

I also imagine that the Ten Year War against the portals would come to a complete halt. Brokers and agents get pissed off at Zillow, Realtor.com, and other portals because other agents are “buying placement on their listings”. They feel that they should get the buyer leads from their own listings without having to pay for them.

Should Horiike go the other way… why bother? You can’t do squat with those buyer leads anyhow, except refer them out to a friend at another brokerage. You certainly don’t want to bring that buyer lead to your own listing, since you’re definitely in the dual agency zone then. But sending that buyer lead to someone on your Team (see above) no longer makes much sense, and you definitely don’t want to talk to that buyer about your other listings.

In fact, the only thing that sorta makes sense is to buy placement on listings that belong to other brokerages since you can represent that buyer on that home he just inquired about. Maybe listing agents from different companies end up entering into a partnership agreeing to automatically route all leads on their own listings to each other — like, make sure all of the phone numbers and contact info on your Zillow listings are of Your Pal’s and vice versa.

Oh, and IDX ought to be fun — you’re going to want to have your IDX feed filter out all of the listings that are with your broker.

No Conclusions Yet

Because the oral arguments have not yet been heard, none of us know yet which direction this is going to go. I think Coldwell Banker and CAR and those against the Court of Appeal’s ruling have pretty strong arguments (legal geekery; if you’re interested, contact me for a separate, private convo) but then again, Horiike’s people and NAEBA and others also have decent arguments to make as well.

Plus, I want to think about this some more. There are at least a few related-yet-separate issues to be considered here. I’ll post about those in future days and weeks.

For now, since most of you will read this on Monday… Ain’t this a wonderful start to your work week? Fear, loathing and paranoia are just such bracing wake-me-ups with your morning coffee, no?

As always, your comments and thoughts are welcome.

-rsh

45 thoughts on “Dual Agency in the News: Horiike v. Coldwell Banker Goes to CA Supreme Court”

That is a lot of legal stuff to take in, but at the surface it sounds like Coldwell deserves this lawsuit. The bottom line the house was much smaller than they represented it to be.

I don’t think they will eliminate dual agency, but giving the accurate square footage is important with or without dual agency.

It is known in home building that square footage of home building plans include everything under food. Covered patios and garages are calculated in the square footage. Selling per foot always creates problems. It would like buying a car per pound!! Mercedes vs Prius

I like ok forward to the conclusion of this case.

Dual agency, in my humble opinion, is nothing more than a complex scheme devised by real estate organizations, to defeat long standing statutory laws in every state regarding Agency that apply to every business and person other than the real estate business. Go figure. Frankly I view it as a carefully concocted complexly worded legal scam in which a brokerage (and I am one for many years) can double transactional income by making vague verbal assurances and loyalty promises to both sides of the same transaction [read:opposing parties] while handing out voluminous disclosures to the contrary that are not understood by the public at all or even read, and rarely understood by the brokerage employees [agents] themselves. No self-respecting attorney would ever represent both sides of the same law suit [and the ABA would not permit it] because of the obvious conflicts of interests and I maintain ditto to the real estate business. Just common sense. It’s no wonder the public does not view real estate brokers and agents high on their trustworthy list- why would they with this kind of carefully calculated positioning, with complexly worded disclosures that bury the client in legal terms and verbiage they cannot understand and which undermine the true meaning of “fiduciary”- watering it down to meaningless existence. Oh yes, they may “like you” personally, being the wonderful person that you undoubtedly are, but they sure as hell don’t trust you. In my view a brokerage, like an attorney, should take one side or the other, should be restricted to either listing or BB where the same client or closely related parties are involved. I know those of you who profit from behaving otherwise will take issue with my view, but in doing so you are being driven by purely personal economics [greed, avarice, the client being your patsy] and not by the otherwise [nearly] universal laws of agency that are on the books in every state in America [fact]. I hope the CA supreme court confirms. This is a situation that is long overdue to be corrected. When it is our prestige and reputation will only grow and the public begin to trust us. And, BTW, better act soon as a Digital Storm approaches. New technologies are rapidly being developed that will make agents, brokers and even real estate commissions irrelevant within the next 7-8 years. Never thought the incandescent lightbulb would disappear, or God forbid, the fluorescent tube, [LED’s have taken over], or that self-driving cars would become commonplace [Ford is making BIG plans for 2021-2022, many cars/trucks without steering wheels or pedals] – I know you think all this is not so, but you have your head in the sand, ask yourself what happened to entire industries- travel agents, stock brokers, [and now] banks and bank loan officers? The internet. Its real. It’s far bigger than the real estate industry. You cannot stop it’s coming. It has not even scratched the surface of real estate but thats all about to change [ever hear of Block-Chain Technology, coming to a property near you and will revolutionize this business. Revolutionize it]. Its on the viewable horizon. Soon to be at a door near you. The real estate transaction itself is not going to change, the transaction paths are going to change [read: no agents, no brokers]. The internet cometh. The smart ones in this business already know it and are quietly making plans to take advantage of it in some manner or move on. Your job has an 80% ++ probability of disappearing altogether. [2014-15 Oxford University widely published [Business Week] study of the impact of computerization on future jobs] Before long your real estate fees will be measured in basis points, not percentage points. You heard it here first folks. Read it and comprehend it or take issue with it but I am spot-on target. It’s only whether you can see the handwriting on the all that is at issue.

Kodiakjack – I’m not sure who or why real estate agents are held to such a high standard. The basic theory – in my humble opinion -was set up with an eye to past history of slavery. What industry requires their income producers – workers – to pay their own fees, provide their own vehicle, pay their cell, e&o insurance, gasoline,auto insurance, no social; security split and all the other expenses and that agent getting nothing in return.

it’s a one way street. The broker owns everything.

An agent gets a listing, but the broker owns it. Give me a break.

One day this will stop. When the banks get brokerage ownership this system will collapse.

DUAL AGENCY – Who put all this responsibility on agents? Who decided that we have these fiduciary duties? We are just sales people selling a product. Hell, we are selling a product. We are sales people. All you ego maniacs who think real estate agents are responding to some high calling, get off your throne and remove your crown because you are not special, you are just salespeople.

A law older than principal/agents – the one about caveat emptor. Why are our duties any higher than caveat emptor?

Never mind. I’m just a renegade who does not like the way the industry is set up. Enjoy it while you can, because things are changing, and Rob’s latest offering is the beginning point.

With the business continuing to inform buyers as to the details of a home/property through Internet print; it seems that Illinois may be ahead of the curve? Because of the nature of our business where most buyers are able to represent themselves in a deal (we essentially sell surveys) we always use MRED’s “No Agency” Agreement. If the lawyers did their job properly it should protect the listing agent from liability. Maybe The “No Agency” Agreement, or something similar, should be a part of every purchase and sale?

ILLINOIS ASSOCIATION OF REALTORS® NOTICE OF NO AGENCY RELATIONSHIP

Name of Licensee: _________________________________________________________________

Name of Sponsoring Brokerage Company__________________________________________________

Property Address___________________________________________________________________

NOTICE OF NO AGENCY RELATIONSHIP (Check here if you represent either seller or buyer)

Thank you for giving Licensee the opportunity to (Insert description of work, i.e. showing property of a FSBO)

________________________________________________________________________________

in regard to the above mentioned property.

Licensee’s Sponsoring Broker has previously entered into an agreement with a client to provide certain real estate brokerage services through Licensee who acts as that client’s designated agent. As a result, Licensee will not be acting as your agent.

THIS NOTICE OF NO AGENCY IS BEING PROVIDED AS REQUIRED BY STATE LAW.

Brian – are you saying that in Illinois, you effectively have eliminated buyer agency? So buyer agents work under the “No Agency” agreement as you’ve posted?

ROB, I believe he is referring to a transaction where only one party is being compensated in the sale, which is how we use this form. In other words the buyer (or seller, often used with FSBOs) is given the form prior to the contract being written, informed the broker is only working for one party (not them) and they are willingly entering into the contract with no broker. But, in Illinois, all board contract and the vast majority of all contracts, allow for attorney review in a specified period of time before the parties are bound to them. The normal time frame is 5-7 business days. We are always reminding brokers that cooperation and compensation are two different aspects of a transaction, something they and customers often forget.

In Illinois there is buyers exclusive, listing exclusive, and dual agency. There is also a form that a listing agent can have a buyer they attracted sign which says that they, the buyer, is working without rep if the LA does not desire or have permission for dual.

My opinion is this is a ridiculous law suit. Buyers agent is responsible to the buyer regardless of brokerage affiliation! Buyers agent should have ensured square footage was as advertised I.E. it is buyer agent responsibility to advise buyer regarding inspections, location (attending desired schools), condition, size. She should have insured this was done……Yes in the end the sponsoring broker can be sued as well as the agent however not as a DUAL AGENCY but as inadequate representation.

I think the lawyers for CB would agree with you 110% 🙂

A few things here:

1. Square footage. In California there is no recognized standard for determining square footage of a residential building. Most agents default to the local tax records. Appraisers measure the outside, but that isnt a reflection of livable square footage. Some agents provide sf per builder brochure that often differ from local tax records, but builders rarely explain how that number is determined. The seller and the listing agent should have given the same disclosures to Horiike that the listing agent provided the previous buyer. If he had done that, there would likely be no case. Dual agency or not, most agents would expect that CB and the seller would be sued given the screw up on the part of CB to accurately disclose the square footage.

2. Agency and fiduciary. I agree with the contention that the Agency Disclosure can be hard to understand. Ask an agent to explain the difference between agency and fiduciary. Most would struggle to properly define either. Ask a principle what it means. You will get a deer in the headlights. Add dual agency and heads of both agents and principles start to explode.

3. Juries. This case demonstrates the need to eliminate juries, as the Court of Appeals noted they got it wrong.

4. Franchises vs corporate owned brokerages. The one point I think you missed in an otherwise stellar article, is the use of KW and ReMax as examples. Unlike ReMax and KW, In So Cal, CB offices are almost all corporate owned. In other locations like Washington State, they tend to be franchises. The odds of a ReMax or KW agent in an office in Beverely Hills being under the same broker license as an agent in a Malibu office are almost non-existent.

Great write up.

Excellent point about CB all being NRT!

And now I have yet another arrow for my quiver supporting the use of attorneys in RE transactions (Illinois, home of both myself and Mr. Hickey have and encourage their use).

Regardless, it only applies to California, and a couple of tweaks to license law makes the whole thing go away.

What a red herring the paperwork argument is. Gee, lets just scratch out a note on a napkin and call the most expensive monetary transaction in most people’s lives done. At the end of all of it I am left wondering why the buyer takes no ownership for their actions, starting with who they chose to represent them, and ending with their willingness to spend a great deal of money with little or no research on what they were buying. It is good to see they are proponents of the legal system here and the use of a lawyer, it would have been far less expensive for all if they had engaged one in the transaction.

Very interesting to an Arkansas broker in a one-man firm, who also earned a law degree waaay back in the past century.

In about 40-50% of my closings I am a dual agent and never show other agent’s listings.

I am always scrupulously honest with all sellers and buyers. I tell the seller I will disclose every negative factor of which I am aware to every buyer. I tell buyers the same thing.

But, there is the thing about “selective memory. Sellers and buyers can conveniently “forget” so, I have decided that I am going to have every one and their 17th cousins sign a representation form issued by the state. And, I have a second form I drew up several years ago that pretty well covers every minute detail, also to be signed, even other agent’s buyers.

DEATH of Dual Agency in California?

Since Dual Agency is legal in California- I don’t see the dire outcome you predict if the ruling is upheld- California’s Purchase contract already includes a “possible representation of more than one buyer or seller disclosure and consent” form PRBS- a required disclosure by most brokers.

Did I misread the article?

It does not appear that this ruling eliminates Dual Agency.

Current law states….AGENT REPRESENTING BOTH SELLER AND BUYER

A real estate agent, either acting directly or through one or more associate licensees, can legally be the agent of both the Seller and the Buyer in a transaction, but only with the knowledge and consent of both the Seller and the Buyer. In a dual agency situation, the agent has the following affirmative obligations to both the Seller and the Buyer:

(a) A fiduciary duty of utmost care, integrity, honesty and loyalty in the dealings with either the Seller or the Buyer.

(b) Other duties to the Seller and the Buyer as stated above in their respective sections.

In representing both Seller and Buyer, the agent may not, without the express permission of the respective party, disclose to the other party that the Seller will accept a price less than the listing price or that the Buyer will pay a price greater than the price offered.

The above duties of the agent in a real estate transaction do not relieve a Seller or Buyer from the responsibility to protect his or her own interests.

There isnt a ruling yet. The Court wont strike down dual agency in this case. That isnt the argument the Court is hearing. This is about the scope of duties owed the buyer in a dual agency.

What is ironic here is that the last big court case to be decided in California regarding dual agency also involved CB. The PRBS form is a result of that case.

As Bob said above, the Court did not and will not strike down dual agency. What I’m saying is that dual agency will effectively die… along with large brokerages and agent teams and open houses and… so on and so forth.

No broker anywhere, and very very few listing agents anywhere, wants the possibility of getting sued for violation of fiduciary duty (which is far, far, FAR higher than normal duty-to-disclose type of thing) to a client. When dual agency is imputed “down” from the Broker to the individual Salesperson, you have de facto shut down dual agency at the broker level. The company would have to refer out either the listing or the buyer to other companies if they don’t want to find themselves in a tricky situation.

I’ve always found this phrase in the California agency disclosure statement which you cite particularly intriguing:

“In a dual agency situation, the agent has the following affirmative obligations to both the Seller and the Buyer:

(a) A fiduciary duty of utmost care, integrity, honesty and loyalty in the dealings with either the Seller or the Buyer.”

“Either?” Which one receives fiduciary and which one doesn’t? How is it determined? Does anybody involved in the transaction know their status?

This disclosure was crafted by politicians and the language created more confusion than anything else. A true disclosure would tell people that they have fiduciary representation or they do not, why they do or don’t, and what their options are.

And speaking of disclosure, let it be known that I am a NAEBA member.

In SC, it would not be dual agency unless both agents were from the same office (with same b-i-c). If two offices have separate b-i-c’s, it doesn’t matter if they are under the same name.

Once again, the real estate industry over complicating itself. Look at any other business that represents both the seller and the buyer, they are plentiful and none of them represents that they represent any single party. They simply do not recognize dual agency or a fiduciary responsibility to one or another party to the transaction. Is the Supreme Court ruling over all of the Mercedes or Lexus dealers who openly and forever have bought and sold vehicles representing both sides of the transaction? And is an airline required now to have third-party represent the passenger to sell its tickets for seats on its airliners? Blatant misrepresentation is very different from transactional representation. In almost all the cases of a messed up business practices residential real estate takes the prize. But it is rarely the prize that goes along with a blue ribbon.

Ken -I agree. Far too much responsibility is placed on brokers and agents. What ever happened to due diligence on the part of the buyer?

We are dealing with adults. They should act like adults. About all we know about a property is hearsay. Only the things we can see are true facts for the broker.

And whatever happened to inspections and appraisals? They are supposed to verify information. Why does everything fall back on the broker’s plate?

There are many checks and balances.

Those businesses operate in the salesperson mode with no regard to fiduciary duties. No licenses are required for anyone with an expertise a consumer wishes may hire them as their “agent” even orally. Legal definitions of agency include loyalty and confidentiality as basic duties of agency.

The Real Estate industry adopted “agent” as opposed to salesperson do represent itself as more “professional” in 1913 with the advent of the NAR code of ethics. Most brokerages since had an “agency” policy of representing only sellers as “agents” but treating buyers as just customers with no fiduciary duties. This was the office agency policy when I was first licensed as a salesperson in 1987.

A sufficient number of buyers realized this un-even playing field in their representation for the most expensive purchase the majority make. NAR recognized the problems in a 1993 agency guide publication. CA legalized “dual” agency at the broker level in Jan,1988. That adoption and lack of transparency regarding the inherent conflict of interest results in loss of confidentiality and loyalty to both real estate buyers and sellers.

In Virginia, we have designated agency, which is representation of Buyer and Seller by different agents within the same brokerage. This is the Coldwell Banker law suit situation. We also have DUAL agency. Dual agency is when ONE agent represents both the buyer and the seller in a single transaction. Now I feel like that is an insane conflict and asking for trouble. But it is legally permissible in Virginia.

With respect to Virginia designated agency/Coldwell Banker “dual agency,” so long as the appropriate waivers are given by both the buyer and the seller, I don’t see what the problem is. If RE/MAX Agent A represents the seller and RE/MAX Agent B represents the buyer, there is no reason those agents cannot protect the confidential information of their respective clients. Heck, I don’t even know many, if not most, of the RE/MAX agents in my brokerage. Why would I share my seller’s confidential information with the buyer’s agent, just because we both work for RE/MAX? The only issue is that under agency law, the knowledge of the BROKERAGE is imputed to both of those agents. While imputed knowledge is accurate legally, it’s not accurate practically, esp. in large brokerages. I think ACTUAL KNOWLEDGE is or should be the consideration.

Now, I do think it gets messy when you have teams, and Team Agent A represents the seller and Team Agent B represents the buyer. In that situation, it is quite possible that the buyer’s agent on the team may have ACTUAL confidential information, usually about the seller. In those situations, I believe the most prudent course of action would be to refer the buyer to another agent outside of the team – not necessarily outside of the brokerage.

So I think the issue of actual vs. imputed knowledge, and how that works with big brokerages, is worth more discussion. I think what muddies the water and creates problems for consumers is the intra-team transactions.

As an aside, I’m a licensed attorney, and although I do not practice now, I used to practice in a Top 20 firm by size in the U.S. With all due respect, this statement is inaccurate:

****

To be fair, that is how law firms tend to work. Every law firm, small and large, has to do a conflict check before taking on a client, and if conflict exists, they have to refer the client to another lawyer at another law firm.

In rare cases, law firms might setup a “Chinese Wall” if it’s worth the trouble and the cost. If you’re interested, take a look at something like this to see what the hell lawyers have to go through.

****

Chinese walls are not rare. Big law firms set up Chinese walls all the time. You may have a firm representing Company A on a real estate matter, and their adversary/opponent, Company B, on a products liability matter. So long as both parties agree to waive the conflict – which is only a conflict because the knowledge of all lawyers within the firm is imputed to the firm, and the engagement is with the firm – the law firm can represent Company A and Company B. Conflict waivers are very common. Happens ALL the time in large law firms.

To me, the designated agency disclosure and waiver of conflict by a buyer and seller represented by real estate agents is the exact same situation as a Big Law Firm Chinese wall. And absolutely fine. But that’s just one woman’s opinion. 🙂

Hi Melissa, thank you for your comment — really, really great and in-depth. 🙂

A couple of things. First, since this case is based on the language in CA real estate law, it may be that VA simply won’t face the same issue.

Second, take a look at the Briefs from CB’s lawyers. I find them fairly compelling, and yet worth discussing (esp. with another lawyer) because it feels like the Court applied the law firm model of imputed/actual knowledge instead of the real estate model. The major problem, as the CB lawyers see it, is that the Court imputed duties “down” from the Brokerage to individual Salespersons, instead of duties flowing “up” from the Salesperson to the Brokerage. They think this is all kinds of bad law.

Thing is, duties/knowledge flowing “down” is the norm for law firms, and I think that’s sort of how the Court dealt with this here. If my firm has IBM as a client, then IBM is “my client” as well even though I’m not on the account, and do no work for IBM because duties flow “down” from the firm.

BTW, yes, with Big Law, Chinese Walls are not all that rare… but I submit that the reason is that Big Law never takes on clients and matters unless they are big dollars. 🙂

Also, waivers from all clients is not a Chinese Wall (unless I’m totally out of date and mistaken). Chinese Wall implies no waiver from the clients, requiring a strict segregation and quarantine of “knowledge” to insulate the different departments/lawyers from each other.

Great stuff from you! 😀

http://www.demonofmarketing.com/my-listing-my-lead-my-folly/

What happened to ‘Caveat Emptor’,worked well for a couple of thousand years.

In Colorado all real estate agents are brokers in relationship to their individual clients and we owe them all a fiduciary duty as described in our state approved agency contracts. We don’t use dual agency, but transaction brokerage (which still affords fiduciary responsibility without advocacy).

The system works well and we don’t have to have attorneys at our closings. Making the individual “agent” responsible a fiduciary would seem to make this question moot.

If CB loses and dual agency is eliminated from California, it could set up for new Real Estate Broker business model.

Like in Colorado everyone becomes a licensed Broker. Brokers become loosely affiliated with a large company as a licensed broker. They would pay a membership, monthly fee or per closing to be a member affiliate of the “Broker” with all the benefits that that broker provides without having to be under that broker for Agency.

Mike Cocos, California

That is a distinct possibility. 🙂

I tell buyers and sellers before they sign a contract with me that one of the advantages of working with my company is that dual agency is very rare because we are so small. I generally do everything I can to avoid dual agency. I don’t want the exposure.

In NY the broker is the default agency not the agents. When a listing agent and a buyer’s agent of the same brokerage are in a transaction it is a dual agency with designates sales agents. It’s disclosed and all parties sign. We can also be a listing/seller’s agent that can sell our listing to a direct buyer customer with no fiduciary duty to buyer. Fiduciary duty is to seller but in dealings with buyer listing agent treats them fair and honestly and in good faith discloses all know facts materially affecting the value or desirability of property and exercises reasonable skill and care in performance of agent’s duties. There are a lot of buyers out there (thanks zillow, trulia, streeteasy et al) that don’t want or need a buyer’s agent and prefer dealing only with listing agents.

While I’m not a lawyer and NY has very different laws than California particularly one of the guiding principles of NY Real Property law is Caveat Emptor, IMO in NY this case would simply be non disclosed dual agency albeit with designated agents but never the less both agents did not disclose their true agency relationship dual agent with designated agents although that currently is not an option under CA agency law.

it’s an interesting case but I don’t see it having any widespread significance outside CA or states with similar agency. Florida is a transaction state an agent doesn’t need to have a fiduciary duty to either party in the transaction. If any thing it will may diminish the need for buyer’s agents hence the NAEBA brief.

Mr Rob,

Once again you have a most interesting presentation here and lots of good comments. In WA. State, we have The Law of Real Estate Agency, a 7 page pamphlet that you are *required to provide the customer at your first meeting. There is an acknowledgement receipt of form required.

The Purchase and Sale agreement has a Agency Disclosure check box for whom each agent is representing. Then CB Bain has yet another form whereas the seller and buyer can be notified and acknowledged by signature of representation.

So agency is spelled out over and over and over.

Buyers have options and in our state Dual Agency is where a single agent represents both the selling and purchasing parties. I have done that many times; I get to work with an excellent agent, have control of all parties and I have never had anything but happy clients! I recognize that role is not for every agent or every client. You have to disclose to all parties and have permission from all parties.

This case in CA. is more about the old problem of “misrepresenting sq.ft.” than agency, in my opinion and grasping at straws to find someone to pay. Of course only in CA. would this case go forward and a court conflicted but moving forward.

I truly pray CB wins because of the far reaching ramifications within our industry!

One of the problems in this case is that you also have a seller agent that is a bit sleazy in his dealings. If you do a search on Chris Cortazzo, you’ll see some things in his history that are not normal dealings in real estate. He is being sued right now for fraud in an estate sale where he was the seller, http://www.canyon-news.com/malibu-couple-sues-star-realtor-for-3-3-million/55078

WI has similar agency laws. It’s really quite antiquated. The consumer automatically assumes the agent they’re working with is working in THEIR best interest and doesn’t understand the differences even when explained properly. Regarding the sqft issue here—where’s the liability of the buyer to do their own investigations? Assessors, municipalities, agents do make mistakes. What was the sqft listed by the buyers appraisal?

One more comment: open houses do sell the homes—you never know where and when that buyer of any home SAW it at an open house OR online advertised open and told their agent about it. I disagree with your “open houses don’t work” comment.

Fair enough re: “open houses don’t work” — I’m just relating what I hear from experienced top producing agents. 🙂 People may jump in with their views.

I did my only open house many years ago. It was a REO and the asset manager required it. I just wish agents would be honest with sellers and tell them the truth that open houses are nothing more than a way for agents to meet prospective buyers and tell the owner that the open house probably will not get their house sold. But expecting agents to be honest and truthful is a giant leap.

No experienced top producing agent in Manhattan or Brooklyn would ever say “open houses don’t work”

In fact an agent that doesn’t do open houses or have some one to do them wouldn’t last very long here.

Real estate is local. Open houses may not work in rural, suburban or secluded areas but they sure do sell properties in Manhattan and Brooklyn at all price points.

Sunday open houses in Manhattan are a tradition like the Sunday brunch. When I started 15 years ago buyers carried the NY Times real estate section on Sunday with open house classified ads circled.

Today thanks to the internet open houses are more attended then ever. Most New Yorkers work Mon- Friday, many 12-14 hour days. Sunday is the day to buy a home here. What better way to get 50-100 buyers to view property in 2 hours then an open house.

Disclaimer – I am a commercial broker and have never represented myself in the sale of a residential property. I have always engaged the services of a residential specialist, even though the disclaimer is made to all parties (in writing) that the seller (me) is a licensed broker in two states. I’m not sure what that buys me other than increased liability.

We (commercial brokers) represent the seller under an exclusive listing agreement and the buyers often represent themselves without a broker on their side. Enough of that – now to my comments regarding this case.

Notwithstanding all the previous discussions regarding representation, agency, seller/buyer representation, dual agency, fiduciary duty, ad infinitum; it seems that the subject of Disclosure should have been part of the discourse.

Was the listing broker (Cotazzo) aware of, or at least had some suspicion, as to the possible existence of a square footage discrepancy? Let’s review the available information: 1) the building permit listed 11,050 sf, 2) the MLS listed 9,434 sf – derived from public records, and 3) Cotazzo’s marketing material claimed “approximately 15,000 sf of living area. That a 30% change (15,000 vs. 11,050). If I were selling an income property, that difference is significant. Of course, the value of an investment property is predicated on its income, which is usually not the case with a private residence. Notwithstanding those differences between income and residential properties, a major metric used to compare (and set values) for residential sales is Sales $/Square Foot. I didn’t see the sale price for the property, but if we estimate the property sold for $3.5M, the $/sf is $304 ($3.5M/11,500 sf) vs.$233 ($3.5M vs. 15,000 sf). You can apply your own estimate as to the sales price.

There’s enough of a difference to have caused Mr. Cortazzo to raise the question with the seller as a potential issue and, if the seller insisted on 15,000 sf to be included in the listing, he (Cortazzo) must be very very careful to provide the same sort of written advice to verify the square footage to all potential buyers as he did with the first potential buyer. Did Cortazzo’s experience with the prior unsuccessful buyer have anything to do with his failure to provide the same information to Mr. Horiike and his agent, Ms. Namba? What would the court’s ruling have been had Mr. Cortazzo provided the same written advice?

I’ve always held to the maximum that anything that would, or could have, changed the decision to proceed with a transaction, is required to be disclosed. We call it a “Material Fact”. Would the square footage difference, had the buyer received written advice to verify (by either Ms. Namba or Mr. Cortazzo) made a difference in his decision to purchase the property? Too late now! In my view, both agents failed in their duty to their respective Clients.

There is one truth which I believe unassailable when dealing with the court system. It doesn’t matter what the plaintiff(s) and/or the defendant(s) claims, it only matters what the court(s) decides.

Final note – The September 7, appeal in front of the CA Supremes is supposed to be streamed live. That’s one I’m watching! How about you?

In Vancouver Canada I would not dream of taking a listing without having a professional measuring company do a floorplan.This runs about .10cents a square foot.I also automatically have the property scanned for undisclosed/unknown oil tanks.Caveat emptor(buyer beware) was dropped a long time ago here.The result…a huge drop in buyer complaints and the steady rise of our reputations.Not to knock the listing agent in this case but he would not last long on the West Side market of Vancouver.

Hey John Tobin – Who pays for this stuff? I really think this is going overboard and pissing away lots of money. If this is standard practice in Vancouver, I am glad I am in Arkansas.

Are your buyers so stoopid that they do not know how to use a tape measure? And using technology to search for objects under gtound/ What if a body is discovered.

If I encounter a buyer who wants this stuff done, I’ll just tell’em to hire their experts as part of their inspection.

Texas recognized that “Dual Agency” is not possible. “No one can have two masters.” It is referred to as an intermediary relationship. Statutory disclosure form link below, is to be tendered at first substantive contact, and pretty clearly spells out everything I think that California must not:

http://www.trec.texas.gov/pdf/contracts/IABS1-0.pdf

Rob, in the article above you stated that Namba referred to herself as the “selling agent”. That, to me, means subagency. Did you mean buying agent?

And this is 9/11 – NEVER FORGET

The Amicus brief (friend of the court brief) filed by CAR.org correctly said:

“If the members of this Court were to read only Horiike’s Answering Brief, they would probably come away with the impression that this case is about disclosure of material facts. It is not. Horiike already tried that case in court . . . and lost. This case is about fiduciary duties. And before you can have a fiduciary duty, you first must have a fiduciary relationship.”

The CA State Supreme Court issued their decision today. In your opinion, what happens next? How does the industry change?

http://www.courts.ca.gov/opinions/documents/S218734.PDF

Comments are closed.