Redfin reported its Q1/2019 results earlier today… and it’s like one of those Russian nesting dolls, except it’s a bit of a mystery inside an enigma within a puzzle kind of a deal. For the first time in… well… ever as far as Redfin is concerned, I find myself not quite able to understand what is going on and what Glenn & Co. are actually doing.

That in all likelihood means that I’m missing something important, as Glenn Kelman is one of the smartest people in the industry. But it could also have something to do with the fact that Redfin tends to like flying under the radar, being semi-mysterious about its intentions in any case, and being transparent yet opaque. Then again, that’s always kind of been Redfin’s style under Kelman’s leadership.

This time, though, it goes beyond mere translucency into confusion. There are contrary indicators in the numbers, and then there are outright contradictions in the words by Glenn Kelman and Chris Nielsen, CFO, throughout the earnings call and between the words and the actions they discuss.

And for the first time ever since Redfin went public and started disclosing numbers and talking about themselves, I find myself wondering if their strategy is the right one. I think I’m still on the Redfin bandwagon, and still think Redfin is the most important brokerage in real estate, but Q1 makes me perhaps go from something like a BTS Army fan to something more like a New York Philharmonic fan.

Let’s get into it.

The Numbers

We begin, as always, with numbers. Since Redfin changed the way they report financials by dividing out Services and Products, I’ve had to try and rebuild my historical data to do some analysis. I think I got much of it, at least YOY, but until Redfin tells us otherwise, it’s difficult to know how past financials compare. Having said that, here are the numbers Redfin released:

The headline will be around a couple of items, as Redfin itself highlights:

- 37.9% growth in topline revenues, from $79.9 million in Q1/2018 to $110.1 million in Q1/2019.

- A 600% growth in the “Product” segment, which is basically Redfin Now, from $3.0 million to $21.4 million.

- Net loss widening by 84.4% from $36.4 million to $67.2 million.

- Continued strong traffic growth, by 20.5% YOY, to 31.1 million average monthly unique visitors.

I know some people will dwell on the gigantic loss but… that’s a mistake. Most of the loss was driven by a massive increase in marketing expenses, which Redfin told us about in Q3 of last year. They’re spending quite a lot of money advertising the Redfin brand and its low-cost value proposition.

On the other hand, Redfin Now drove most of the gains in topline revenue as well as a big chunk of the cost of revenue as well.

But frankly, I don’t care much about those. I care far more about what appears to be margin erosion in the core brokerage business, and Redfin’s seeming inability to have gross margins in Redfin Now.

What Is Going on with Gross Margins?

I talk about Redfin quite a bit. Both here, in long reports, and in person doing presentations. One of the things I like to point out is that Redfin’s gross margins are far superior to that of other brokerages. I like to compare to Redfin to an agent team, because its gross margins (roughly similar to Retained Company Dollar) look more like an agent team’s than it does a brokerage.

Obviously, the driver of that is the fact that Redfin’s agents are W2 employees who get a paycheck rather than 1099 independent contractors who only get paid when the transaction closes. Because Redfin isn’t paying out 80 or 90 cents of every dollar of commission income that it earns when a transaction closes, its gross margin should be rock solid… as long as the actual volume and frequency of transactions is high enough.

On the flip side, if Redfin agents aren’t closing deals, then Redfin has actual fixed costs in the form of salaries and benefits and taxes that must be paid even if the agent hasn’t brought in a penny of revenues.

Given that real estate is a cyclical business, with the high season from spring to fall, I’m not particularly bothered by the fact that Redfin’s gross margins in the core brokerage services segment is a paltry 5.9%. It’s Q1; money is going out the door while it isn’t coming in the door… yet. This is when agents and brokers both set things up for the spring selling season to lead into summer and fall. So Q1 margin numbers do not concern me.

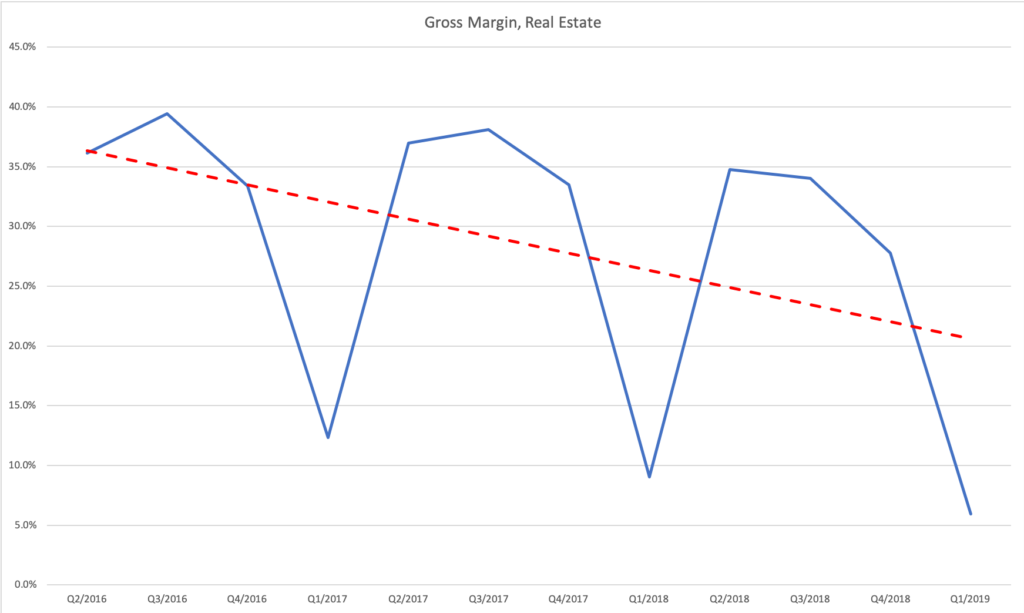

I am bothered, however, by what appears to be steady and continual erosion of Redfin’s gross margins in its core brokerage business. Here’s a chart of Redfin’s gross margins from core brokerage operations from Q2 of 2016 (which is the earliest data I have, since Redfin went public in July of 2017):

These numbers do not include the referral business — the Partner line — but unfortunately, Redfin does not break out cost of revenues between Brokerage and Partner. So there is likely some error going on there. But the trend line is unmistakable.

And that trend line should worry Redfin and Redfin investors. (I will note that the R2 value is low, so the trend line isn’t all that reliable… but it does seem pretty obvious.) Each trough is lower than the previous: 12.4% in Q1/17, 9.0% in Q1/18 and now 5.9% in Q1/19. Each peak is lower than the one before it: Q3/16 – 39.4%, Q3/17 – 38.1%, Q3/18 – 34.0%, and… we’ll see about Q3/19.

Reasons for the Decline?

In the earnings call, (transcript found on Motley Fool) there is an exchange specifically about the gross margins of the core brokerage business. And Redfin executives mentioned a couple of things related to timing, most of which was captured in this response from Chris Nielsen, CFO, to a question:

Yes. So we provide commentary on home touring and field expenses. As Glenn mentioned earlier, we’re seeing a lot of good top of the funnel demand activity. And that’s costly to us in the first quarter, meaning we’re taking customers on tours of homes. Those won’t pull through to sales necessarily in the first quarter and so that did have somewhat of a negative impact on the gross margin in the first quarter, but we know that’s the right thing to do in long-term to build customer relationships. And then I also provided a little bit of commentary with regard to earlier hiring of support staff. And that really is more of a Q1 impact than an impact through the rest of the year because that hiring was just earlier than we did in 2018, but really sets up the support teams to be in good shape to help the agents through the rest of the year.

Redfin typically spends quite a bit of resources in Q1 doing things to set up for Q2. Things like hosting buyer tours, going on listing appointments, driving people around, etc. all take money and time (which is money especially for Redfin’s W2 model). Redfin won’t see a lot of those revenues until the spring selling season when the work done in Q1 will pay off. So that’s one reason for the low margins. Same with hiring administrative staff who handles a lot of the grunt work in the transaction itself in Q4 and Q1 to get them trained up for the spring/summer selling season.

But there are two other things going on here that requires some reading between the lines, which are more interesting.

First, Glenn Kelman says during the call during a chat about market conditions and Redfin Concierge:

So, I think we’re really optimistic about the market and we’re also even more optimistic about our share of traffic and our ability to convert that into customers. The one counter-current to that, that we try to be clear about just in the spirit of candor is that, close rates have still declined. And if there were one area where we really want to execute better it’s on close rate.

If close rates have still declined despite all of the work done in 2018 to raise the close rate, that’s… problematic. Remember that the work involved included investment in sophisticated software, machine learning, big data analytics, AI-powered recommendation engine, changes to processes, as well as the decision to cut the number of customers that a Redfin agent can work with simultaneously. The thought was, in exact opposition to Jerry Maguire, “Fewer clients, more money.”

Second, and I think it’s directly related, it appears that Redfin suffered from some attrition because of its decision to cut back on customers for agents. Here’s Glenn Kelman:

As far as agent hiring and retention, I think the majoring insight we’ve there is that in 2018, when we lowered loads, it reduced the Company’s overall revenue capacity and Wall Street has definitely taken account of that, but it also reduced each agent’s personal income. Because so much of their pay is variable, they weren’t getting as many customers and that didn’t lead to as many closes, it actually affected our attrition. Not to a major degree. We obviously measure attrition compared to the industry and it is significantly better than any other brokerage. And the reason for that is pretty simple, if you take care of people with the salary and healthcare benefits and you have a modern mission, I think there’s something aspirational that really keeps agents here. But increasing loads this year has made for a happier workforce.

Obviously, even for a W2-based brokerage, losing experienced people hurts productivity. New agents have to get trained up on systems and processes and the like, no different than any business in any industry having to hire new people who are not as productive as experienced employees. Given that Kelman talked about attrition, I assume most of those agents were recruited away by competing brokerages. (Remember, the average Redfin agent did 31 transactions in 2018, which pretty much makes her a top producer in any other brokerage).

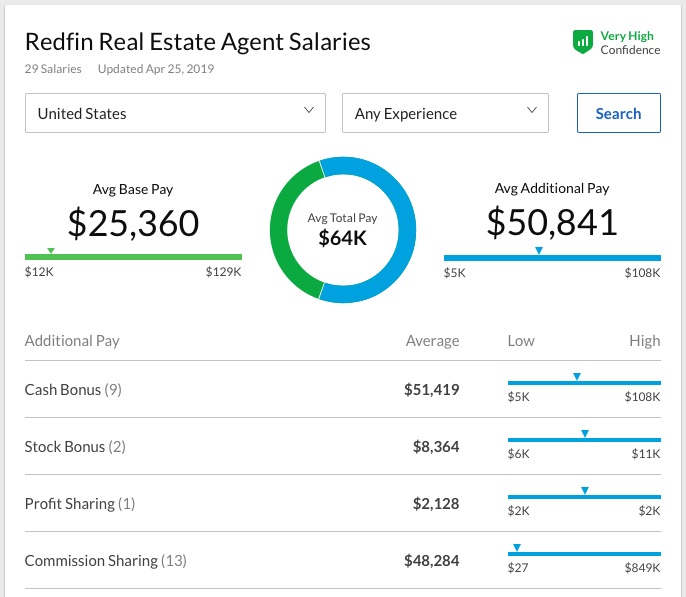

The somewhat surprising takeaway for me, however, was Kelman’s admission that “so much of their pay is variable.” We don’t know how much obviously, and the cost structure should still favor Redfin over other brokerages, but there might be more here to investigate. Just how much of an agent’s pay is variable? Are we talking 20% bonuses, or 80% of expected compensation? (Think about investment bankers and how they are compensated; annual bonuses could be 2-3 times what is a keep-the-lights-on base salary.)

If it’s more like the latter, we have an issue. Redfin claims that the median agent at Redfin makes about $90K. However, Glassdoor.com says that the average pay is $64K with a base salary of $25,360 with $50,841 in “Avg. Additional Pay”:

In particular, that “Commission Sharing” line interests me. The average is nearly double the base salary, which is just at the poverty line for a family of 4, and the high end reported to Glassdoor is an eye-popping $849K. The cash bonus is also almost double the base salary.

The strong implication here is that Redfin agents are on a de facto split. If that’s true, Redfin’s “brick outhouse” business model (Kelman’s words, not mine) is slightly less bricky and slightly more straw-y.

Tell Me More About “Follow Up”…

Finally, there is this passage from the transcript discussing close rate that is rather illuminating on a number of levels:

Well, first of all, we’re increasing the number of customers each agent supports and we’ve already seen a productivity gain. But we actually want to improve close rates so that for the same level of demand we can get more sales. It’s not just the labor cost, there’s also a cost associated with each opportunity, a reputational cost and a marketing cost. And our first focus was on meeting that customer, building relationships, sales training, things like that. Our focus going forward is just around follow up, really making sure that we capture personal details about the customer at every interaction. And then, if someone else is hosting a tour because the customer wants to meet late at night when that agent is at dinner with his family, the agent is still following up right away, saying, sorry, I couldn’t make it but here’s what we learned about you from that tour. Here are the homes that we want to buy or that we want to get more information on.

So we just need to make that team-based approach incredibly seamless and totally personal, but it’s going to be a slog. We are building a massive amount of software to improve the quality of the follow-up, to make the whole experience feel more personal. And I just think that it’s going to improve slowly over many months and years. Right now, our forecast is for agent productivity to increase, but close rate at least for home buyers to decrease in 2019. That’s our best guess as to what will happen, that our agents will get more opportunities and close more sales, but the rate of close will probably decline modestly. [Emphasis added]

What is illuminating about this passage is the glimmer of a hint that maybe, just maybe, Redfin’s agents were not good at “meeting that customer, building relationships, and sales” which is why Redfin did what it did in 2018. Going forward, Redfin agents are going to have to be focused on “follow up” and capturing more personal details about the customer. Redfin will build technology and software to help agents follow up, build relationships and convert leads into closed transactions.

In other words, Redfin is trying to train and incentivize its agents to behave like top performing 1099 independent contractor agents. Because what Redfin aspires to is more or less exactly how the top producers — the 10% or so of agents who do something like 80-90% of the business — behave.

Troubling Mystery

Combine all of the above and mix it in a pot like gumbo, and what you get is a bit of troubling mystery. Glenn Kelman said that the load on agents is 13% higher today than it was in 2018 when Redfin intentionally scaled back in order to improve the close rate, and agents are happier because of it, and more productive.

But in Q1/2019, Redfin’s lead agent averaged 5.6 transactions… compared to 5.5 transactions in Q1/2018. In Q1 of 2017, that number was 6.1 transactions per lead agent. Seasonality doesn’t explain that. Plus, presumably, Redfin was using the old not-so-great processes and methodology in 2017 where the lead agent was overburdened and had lower close rates… but they actually closed more transactions. Maybe 2018 was when things started changing, so the drop to 5.5 makes sense. But 13% higher load coupled to 2.2% increase in actual transactions closed is a bit troubling.

To be fair, it may be that we’ll see a far higher close rate in Q2 and Q3 when all this extra load in Q1 translates to closed transactions. Note that the average transactions per agent in Q2/17 was 10.1 vs. 9.2 in Q2/18, roughly a 10% drop. That matches up neatly with the reduction in agent load in 2018. With 13% more customer load, it would be nice to see Q2/19 numbers come in closer to the Q2/17 numbers. If not, one has to ask, what exactly did all of the work in 2018 accomplish?

Now, to be even more fair, it may be that Redfin simply can’t hit 2017 level of productivity because the overall housing market will decline. Most of the public companies reporting are cautiously optimistic, but seem ready for a flat or slight decline in the overall macro conditions. But I do think that Redfin itself has set expectations about the combination of technology, salaried business model, and low cost it has to warrant a higher expectation of productivity gains even in a down market.

On RedfinNow: Glenn Confuses Me

So the color around core brokerage services was a bit of a troubling mystery. When it came to Redfin Now, its iBuyer program, Glenn Kelman straight up confused me. I am no longer even sure that RedfinNow is an iBuyer program at all, instead of a listing lead generation tool like Realogy’s cataLIST or the new announced “iBuyer” tools like from Keller Williams and JPAR and others.

As I wrote in the VIP post, Don’t Tell Yourself Pretty Lies about iBuyers, I think true iBuyers are not brokerages or even real estate companies, but market makers. I don’t know that a market maker in pork bellies aims to sell pork bellies for the lowest fee at the highest price with the least hassle; I think they aim to make money by creating liquidity for sellers and buyers in the marketplace.

I think I’m going to have to hold off on a deeper dive until after I’ve had a chance to look at Zillow’s Q1 earnings, as Zillow posted unit economics for its iBuyer unit. So watch this space for a deeper post.

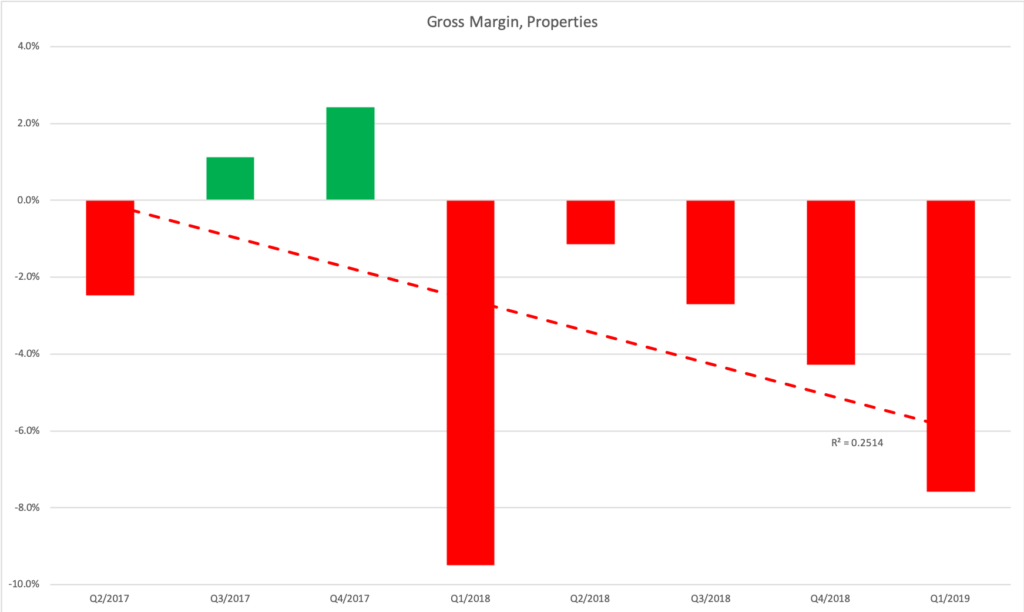

But I will note something odd: the gross margins of RedfinNow are getting worse, not better. Take a look at this chart of gross margins for the Properties segment since Q2/17, which is how far back the reported numbers go:

That’s not particularly encouraging. Especially if RedfinNow has to be a profitable segment in and of itself; it can’t be a “loss leader” to generate listing leads or mortgage or title or some other business. I say that because Glenn Kelman was asked about that specifically, whether running iBuyer as a break even proposition would be okay because of other business and he called that idea “untenable.”

And Glenn put a lot of stock in Redfin have over a decade of on-the-ground experience with buying, staging, renovating and selling homes for clients. So why are things getting worse? Is it just market conditions? Something else?

It’s an enigma for now.

This is getting awfully long, but I do have to touch on one more thing that came out of the earnings call, which is…

Redfin Direct

The most controversial part of the earnings call within the industry will be Redfin Direct. It is effectively an assisted FPBB program (For Purchase By Buyer) similar to a few assisted FSBO (For Sale By Owner) programs that have been tried over the years and still exist here and there.

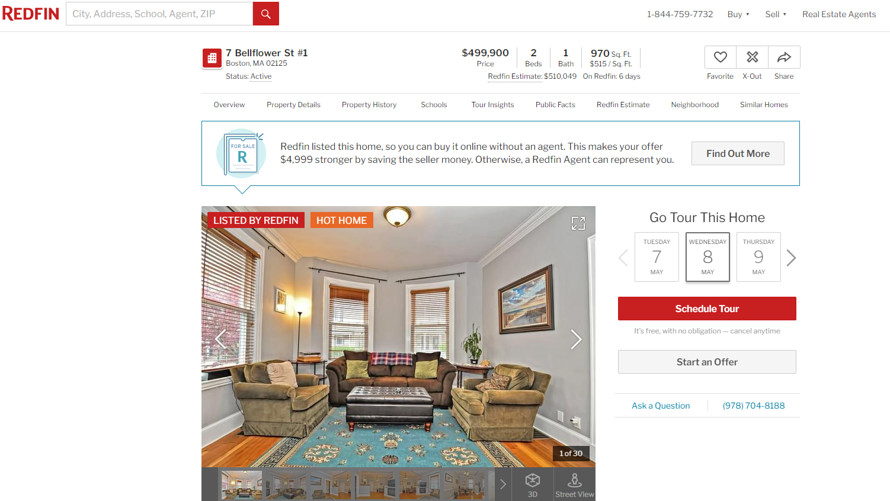

The gist of Redfin Direct appears to be that the buyer can save money on the price of the home, if he chooses to be unrepresented by another agent. But looking at the example posted above by CBS MarketWatch (Andrea Riquier is quickly becoming my favorite mainstream journalist covering our industry), the savings to the FPPB buyer is 1% ($4,999 on a house priced at $499,999). If the entire savings were being passed on, that should be closer to $15,000 (assuming 3% buy-side commission).

It turns out, as per Glenn’s explanation in the call, Redfin Direct charges 2% total to the homeowner (1% Listing Fee and a 1% fee for closing the transaction) if a buyer chooses to go this way. Simple math then suggests the seller stands to make 1% more:

2% total commission + 1% price reduction (3% total) vs. 1% to Redfin and 3% to the buyer agent (4% total)

Is that worth it? Maybe. For an extra $5,000 in my pocket for a $500K house, I suppose as a seller, I don’t care. As a buyer? Hard to say.

I was interviewed by Riquier for the story above, and I didn’t know she was talking about Redfin. But even if she had told me that, I still wonder just how many people really want to get into a 30-year debt without some kind of professional guide. A few, perhaps, but not many. That the company is Redfin, with its capabilities and its focus on consumers, and that the process is pretty involved suggests that maybe they’ll get more traction.

I will need to think about Redfin Direct further, and will probably write a longer post about this new initiative. But at this early juncture, I just don’t quite understand why Redfin is doing this… and the timing.

I do have a few theories I’ll share, and then perhaps flesh out in future posts.

Makes Redfin’s 1% Listing Fee More Attractive

I suppose Redfin Direct might help juice the gap between the traditional brokerage and Redfin’s 1% Listing Fee by making the comparison 6% vs. 3% instead of 6% vs. 4%. Maybe. But that makes me wonder if Redfin has hit some kind of a ceiling with its 1% Listing Fee, which would be far more strategically problematic for Redfin than any FPBB program it could launch.

Redfin Direct Flows into RedfinNow

Another theory is that Redfin Direct is a test designed to dovetail into RedfinNow. Perhaps one reason why RedfinNow has been consistently posting negative margins is the 3% buy-side commission. Redfin would much prefer if the buyer of a Redfin-owned property were to do FPBB (For Purchase By Buyer), take 1% in price reduction, and save Redfin itself 2% from having to pay a buyer’s agent.

It’s About Title and Mortgage

My money is actually on this one. In the earnings call, Glenn waxed poetic about title and mortgage, and maybe it was pure coincidence that it happened right after he waxed poetic about Redfin Direct. Some key highlights:

- Redfin plans to hire more mortgage advisors;

- Redfin Mortgage is less than 1% of revenues, but that small base quintupled YOY;

- Title Forward (Redfin’s title company) apparently had enormous demand in March and April.

As anybody in real estate knows, brokerage is not where other brokerages make their money. Brokerage is a break-even proposition at best. It is in ancillary services of mortgage, title, escrow and insurance where “real estate brokers” actually make the lion’s share of their profits. That was both made inevitable by, and enables, the pressure on commission splits from independent contractor agents.

A home buyer might have a mortgage pre-approval in hand in 2019; Rocket Mortgage, after all, is a thing. But I can almost guarantee that a home buyer does not have title and escrow picked out before going shopping for a home. If the buyer has an agent representing him, then I can also pretty much guarantee that that agent has title and escrow relationships, whether with her own brokerage’s affiliate or with personal relationships with title and escrow people.

So eliminating the buyer’s agent could mean Redfin has a far greater chance to capture ancillary revenues from that transaction. A buyer who is literally unrepresented is less likely to have the mortgage paperwork done, and will definitely not care who handles title and escrow. And frankly, the money is in ancillary services, y’all.

Conclusions

This got really long, even for me. It’s approaching Red Dot levels of length here. So let me wrap up and leave open questions for future posts.

My takeaway from Redfin’s Q1 earnings is a whole lot of bafflement. What seemed so solid strategically (“Close rate!”) appears to be on far shakier ground. The continual erosion on margins in the core brokerage business is concerning, and I’d like to see Redfin turn that around in Q2 and Q3 so we all can go, “Ooohhh, so that’s why Redfin took the hit it did in 2018!” If not, well, there will be more questions. RedfinNow seems like a program with an identity crisis of sorts, which isn’t great… but maybe it’s inevitable. After all, Redfin is trying to do something extraordinarily hard to do. Redfin Direct might be a tempest in a teapot that blows away after Zillow’s Q1 earnings call, or it might stick around a while. We’ll see.

However I keep looking at Redfin’s results, I keep seeing both the positive and the concerning. I see real reason for confidence, and some real reasons for doubt. I see super clear transparency, and then I run into a wall of darkness. It’s hard to make sense of Redfin right now, and it was never easy to do that.

Hmmmm…..

-rsh

2 thoughts on “[VIP] Redfin Q1, 2019 Earnings: Mystery Inside an Enigma Within a Puzzle”

“In other words, Redfin is trying to train and incentivize its agents to behave like top performing 1099 independent contractor agents. Because what Redfin aspires to is more or less exactly how the top producers — the 10% or so of agents who do something like 80-90% of the business — behave.” *** Yes! This is key.

Also, how does the Redfin Direct work (or not) with that referral program they are doing with ReMax? It could be I am confused on these programs.

Comments are closed.