Earnings Week content keeps rolling on! It’s time we took a look at Realogy, the bellwether for health of traditional real estate brokerage.

I wish I could report some joyful news on that front, but alas, I just can’t. Realogy is still profitable, generating good free cash flows, and still making some moves. It’s just that there is a contradiction at the core of traditional brokerage that Realogy has not resolved and doesn’t appear to have any plans for resolving. And if the talented managers at Realogy, with all of the financial resources at their disposal, can’t resolve that contradiction, then no one in traditional real estate can.

The headlines for Realogy’s Q3 are likely to be the big loss it printed, the changed competitive environment driven by something changing at Compass, and the sale of the relocation business out of Cartus. All of that is true, but I say we go behind the headlines and look at what’s really important for the future of Realogy and by extension, the future of traditional brokerage in North America.

The Numbers

Realogy’s Q3 numbers were quite bad, but not as bad as it seems at first glance, as much of the loss is attributable to a $180 million impairment charge against NRT’s goodwill.

As I said, the big red numbers are what they are, but most of it is because of the big impairment charge. As Charlotte Simonelli, CFO, explained on the call:

In the quarter we took a noncash impairment charge of $180 million related to our company-owned real estate brokerage services segment which reduced goodwill at NRT. Q3 2019 net loss was $70 million compared to a net income of $103 million in Q3 2018 due predominantly to the impairment charge increased interest expense of $25 million and the decline in transaction volume.

And the big jump in interest expense doesn’t mean that Realogy took on huge debt; it came from an interest rate swap that went against Realogy. So let’s keep things in perspective. It isn’t that Realogy suddenly forgot how to make money; most of the huge loss is noncash, it’s accounting, and while it’s not great news, it’s not the end of the world either.

The good news is pretty strong EBITDA at $245 million, and $174 million in free cash flow. That allowed Realogy to chip away at its debt to the tune of $163 million. Just to put that in perspective, at the end of Q3, RE/MAX had total debt of $223.5 million. So Realogy in just three months paid back 80% of what RE/MAX owes total.

Having said that, the real action for Realogy is in its NRT unit. So let’s take a look at some of the key metrics there:

To me, the sea of red here is far more concerning. It’s because I’m not a stock analyst, but an industry analyst. My obsession isn’t what Realogy’s target stock price will be, but what the NRT’s performance tells us about what’s going on with real estate brokerages.

Because the red here all show the core performance of the NRT declining YOY across the board.

Transaction sides are down, average home price is down, sales volume is down, average commission rate is down, GCI per side is down. EBITDA is down. The only thing that is up is agent split, which is up 48bps YOY. None of that is positive.

Ryan Schneider explained most of the decline in the NRT by referring to geography (NRT is disproportionately located in high-cost coastal markets, which have been struggling), and to competitive pressure:

Our own brokerage business was down 3% on volume year-over-year which improved from the minus 5% in the prior quarter. The decline was driven by continued competitive pressure in select geographies particularly in California. Another and new Q3 headwind was New York City, one of our larger markets, which was down substantially in Q3 consistent with other industry reports. Much of the New York City decline is attributed to recent tax changes, especially the new mansion tax. Just like in Q1 and Q2, we had a gap to NAR this quarter — approximately 700 basis points. While some of this is driven by the geographic mix of our business, e.g New York City, in Q3 the lion’s share is the competition for high volume agents that really ramped up in late 2018. Attrition of our high volume agents has gotten worse over this time. And while those agents contribute much less to profitability they do contribute a substantial amount to volume/market share. [Emphasis added]

And he goes on to make a statement that he will repeat throughout the earnings call:

This has been and will continue to be a market share headwind. Given the choice between profitability and market share we do choose profitability and you are seeing the market share impact of that choice in our results.

Here’s the problem with that explanation: EBITDA is down, way down. If Realogy had been choosing profitability over market share all along the way, and Ryan Schneider came into office saying just that, and if Compass was plundering some of Realogy’s high volume agents, then we should have seen lower numbers across the board… except in EBITDA. He said himself that those high volume agents contribute much less to profitability.

The numbers do not fit the narrative, unless the narrative is that the EBITDA losses would have been far worse had Compass recruited away the lower volume agents vs. high volume agents. But that’s not where the problem ends. In fact, that’s where the problem starts.

Changes at Compass and Focus on Profitability

The problem for Realogy, as it is for every single traditional brokerage in North America, is exactly what he said: high volume agents contribute much less to profitability than they do to volume and market share. Put differently, as I have elsewhere, brokerage make less money from their more productive agents. Residential real estate is unique in that particular problem, and it is the core contradiction that plagues the brokerage business.

So let’s start this analysis by focusing on the positive, as Ryan Schneider did:

Let me now turn to the biggest question that we’ve been getting recently, which is what is happening in the competitive environment? As we told you earlier this year the competitive intensity in agent recruiting and retention took a large step-up in Q4 2018 and continued through this past summer with August 2019 being one of the most intense months in the last two years.

This challenge has really been all financial disruption from one competitor not the technology disruption that grabs headlines. But then something happened in September. Investors seemed to start caring about profitability and it started to show up in the competitive environment. In both September and October we saw a substantial decline in agent recruiting intensity both year-over-year and compared with the summer of 2019 from our most intense competitor. And in our own brokerage business September and October were 2 of the 3 best months of agent growth for us in the last two years. And so while we cannot predict what other companies will do in the future this is by far the biggest change in the competitive environment to our benefit that I have seen in the last two years. During this whole time we’ve stayed focused on recruiting profitable agents and not making unprofitable decisions.

While big revenue headline numbers are interesting and no one has bigger revenue numbers than ours in our industry, we operate for profitability. [Emphasis added]

While he doesn’t name this one competitor, I will: Compass. As my recent public post on Compass touches on, the terms that Compass was offering top producing agents were just unbelievable. No wonder Compass has been having so much success recruiting some of the best agents in the industry away from competitors.

What happened in September? WeWork imploded in September. That likely resulted in emergency meetings at SoftBank and its Vision Fund, and those meetings likely resulted in communications to various SoftBank-backed companies, like Compass. It appears that Compass backing off has given Realogy quite a bit of breathing room.

One of the things Schneider mentioned is that NRT agent count was up 3% YTD, and 1% Q/Q. Okay, so understanding that Sept and Oct recruiting probably did not impact Q3 numbers, let’s take a look at something.

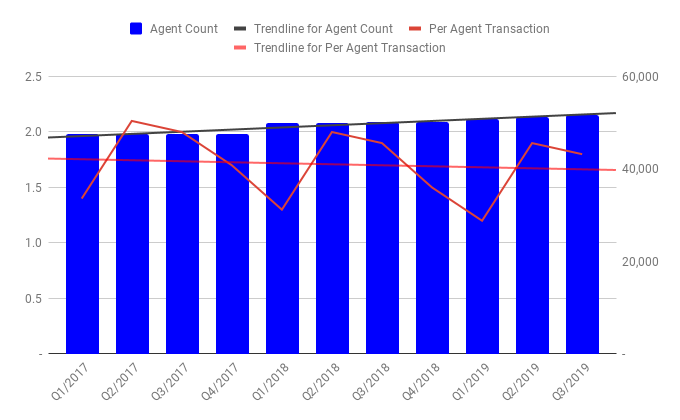

I’ve been keeping track of NRT Key Metrics for a while now. I’ve added NRT agent count, as best as I could figure, using official NRT sources wherever possible. Some of the numbers are guesses, but I do know that NRT ended 2018 with 50,227 agents, which means I can calculate agent counts for this year (3% YTD, 1% Q/Q). Here’s what it looks like if I chart Transactions per Agent vs. Agent Count:

Those two trendlines are widening, not closing up. NRT is slowly but steadily adding people, but the per-person transaction is steadily heading down.

But the focus is not on transactions per agent, right? It’s on profitability. After all, NRT can lose high volume agents who do a lot of deals, but don’t contribute much to profitability. And Realogy has been recruiting profitable agents “during this whole time,” which is the last couple of years.

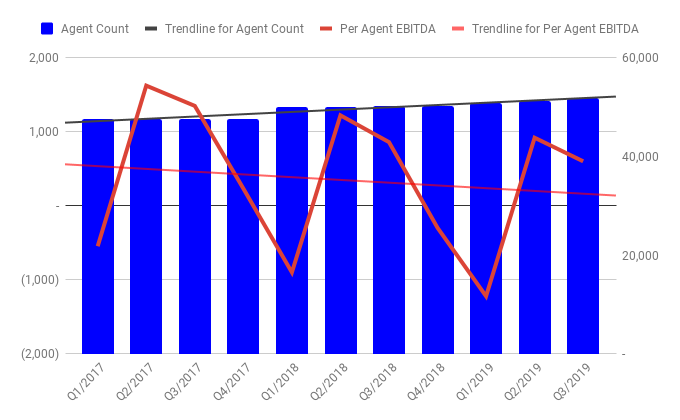

So let’s look at agent profitability:

Since real estate is seasonal, we’re going to see peaks and valleys. That’s normal. But what this is showing is that each peak is lower than the one before, and each valley is deeper than the one before. The trendline here is decidedly not good.

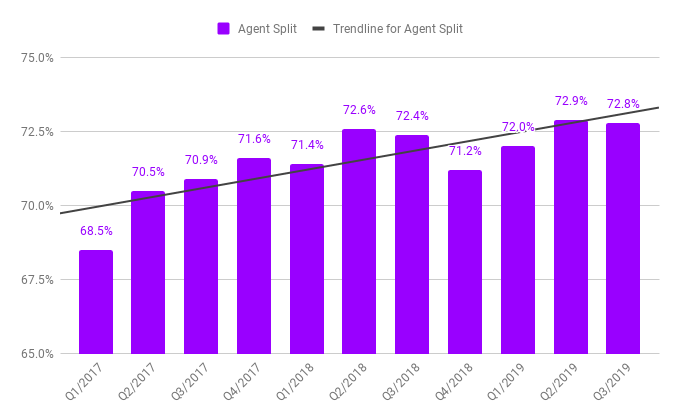

Finally, the chart that all Realogy watchers should find completely unsurprising: Agent Splits.

If the focus at Realogy has been on profitability all this time, it’s fair to ask whether any of that is working, at least at the NRT, which is where, to quote Ryan Schneider, the violence in the P&L is. Everybody knows it.

The competitive headwind, Compass with its unsustainable SoftBank-fueled incentive packages, is now gone as of September of this year. NRT has had its best months of recruiting and retention. So won’t these trends reverse themselves?

I don’t think so. Let’s delve into why.

The Realogy Strategy: Make Agents More Productive

Because the focus has been and is on profitability, Realogy’s strategy is not to go after the high-volume agents, but to go after profitable agents and then make them more productive. This is the key exchange in the earnings call:

Anthony Paolone — JPMorgan — Analyst

Okay. And then just one last one if I may shifting gears over to NRT and the recruiting there. How should we think about the growth in agents and headcount versus growth in revenue and growth and profit? Just trying to understand the nature of the recruiting. I don’t know if those things all match perfectly one to one.

Ryan M. Schneider — Director, Chief Executive Officer and President

They don’t. Let me just give you a few thoughts and then we are going to have the detail that you’re like looking for. So first off when we recruit agents and we talk about agent growth, they’re profitable. So we’re in the business of recruiting profitable agents and especially try to grow agents here, something we’ve done for a long time and will continue doing. We are not out making negative offers to agents just to bring in volume. So that’s one thing that you should keep in mind. The second thing you may want to think about there is that we don’t do a lot of the whale hunting. We don’t pay 7-figure bonus right? We like to bring them in and grow them as I kind of said. The second thing though is we are fighting the cumulative effect of some of the past competitive things which is if you lose an agent in Q1 of 2019 you’ve lost their volumes kind of going forward and it shows up in your Q3 Q4 kind of numbers.

You bring an agent in who may not be as big of a whale at the time, it takes time to actually grow them. So there’s a little bit of a timing thing there. But growing the profitable agent base clearly is a good thing to be doing. We believe kind of making or keeping unprofitable people is just not the right thing for the company. And we’re going to keep choosing profitability over market share. [Emphasis added]

So Realogy doesn’t go whale hunting; it recruits profitable agents and then grow them into whales. Growing profitable agent base is clearly a good thing to be doing, and Realogy does not believe that keeping unprofitable agents is the right thing to do. And they’re going to keep choosing profitability over market share. It sounds reasonable and logical and yes, growing a base of profitable agents is good for the company.

The problem with this whole strategy is that once a profitable agent becomes a productive agent, she is no longer a profitable agent for long. She qualifies for higher split levels, and eventually becomes desirable enough that competitors come knocking offering packages that make her unprofitable for Realogy. It’s not just Compass; take a look at what eXp offers its agents.

And without production, profits have nowhere to go but down. We see that when we compare Q2 to Q3. Agent split in Q2 was actually higher than in Q3 at 72.9% vs 72.8%. But production was way lower because sales volume was lower by some $4.5 billion. That translates to $16 million less in EBITDA despite having more agents and despite having slightly better splits.

The Profitability Conundrum

So we come to the nub of the matter, which has always been the nub of the matter for Realogy and for all traditional brokerages.

Without production, you lose money. Recruiting a million agents who do no deals means no money for the brokerage. But once an agent gets productive, they become less profitable. In Schneider’s words, they contribute to volume but not to profits.

There is an exceedingly narrow window between unproductive and whale, and Realogy is trying to go for that sweet spot, which also happens to be the sweet spot that every single brokerage in North America is going for: productive, but not productive enough to demand higher splits and better terms and eat into profitability. And with low cost competitors on the rise, that sweet spot is getting smaller and smaller by the day.

Compass hunted whales; losing them hurts, but not that much if you’re managing to profitability. Realogy’s profitability woes tell me that they’re not losing just the whales; they’re losing plenty of agents in that sweet spot to competitors as well.

And as of Q3 of 2019, Realogy has not yet figured out how to reconcile the contradiction.

All the Initiatives

Actually, that isn’t fair. Realogy knows that there is only one way to reconcile the contradiction between production and profitability: leads. So it has been working on a number of new partnerships and new initiatives to generate leads.

That took on some new urgency after USAA dropped Cartus. So Realogy announced a flurry of new programs and partnerships, like Listing Concierge, Social Ad Engine, Realogy Military Rewards, AARP, RealSure, etc.

I thought about discussing them, but frankly, given the core dilemma of profitability vs. production, I thought it not really worth doing. If those programs start generating a flood of leads, we’ll see it reflected in future earnings.

There is, however, one program Realogy just announced that is worth a mention, as I feel certain we’ll be discussing it in the future: Exclusive Look:

In Q3 we launched Exclusive Look a new marketing product available to all of our 47,000 Coldwell Banker owned brokerage agents share and search new listings before they are available to the broader market via public websites. Given the size and scale of our business this is a unique competitive advantage. Exclusive Look should be national by the end of the year and expanded to our Coldwell Banker franchisees and their approximately 40,000 domestic agents in 2020.

This is a variation of the exclusive inventory strategy that Compass, Howard Hanna, and others have been pursuing for a while now. I’ve written about such strategies extensively, but with MLS Policy 8.0 looming, we’ll revisit this topic soon. (As of this writing, MLS Policy 8.0 has passed Committee but not the Board of Directors, so it is not yet official.)

A bit of a look forward into that revisiting: if MLS Policy 8.0 passes as currently written, Realogy might want to rethink its abandonment of the “tuck-in” acquisition strategy. There could be a serious wave of rollup coming in real estate brokerage.

Conclusion

My Q2 writeup of Realogy was titled, “Justify My Love.” I can’t say it has in Q3.

It’s not for lack of trying; the financial performance of Realogy as a whole is solid, given what it had to work with. The management deserves much credit for delivering strong overall EBITDA and free cash flow numbers, and all of their hard work in cutting costs is laudable. And Realogy is making moves upon moves upon moves.

But the violence in the P&L continues, and Realogy still hasn’t figured out the profitability vs. production conundrum. It’s great that profitability is a focus over there, and it’s sort of good news that Realogy is having a much better time with recruiting and retention, but… I can’t get over the fact that the reason why Realogy is having a better time isn’t because Realogy itself became far more attractive, but that Compass scaled back its (unsustainable) incentives in recruiting.

It’s a little bit like the hottest girl at the club just walked out. That makes it easy for everybody else, but it’s far from clear that Realogy becomes the new #1 in the club as a result. There are plenty of competitors who have always given Realogy trouble; remember that Keller Williams was a major thorn in Realogy’s side before Compass came along.

Managing to profitability is a great philosophy, but in real estate today, profitable agents are necessarily less productive agents. Make them more productive, and guess what? Others are sidling up to that agent trying to seduce them away from you.

Without some major changes, either at Realogy itself or in the overall industry landscape or in the real estate environment, it’s hard to see how the trendlines in the charts above reverse direction.

-rsh