It’s been a minute or two since I posted; blame the mundane annoyances of moving. Yes, I’m one of those people who bought a house during the pandemic and managed to move, despite all of the problems with vendors and the like thanks to government limits. I’ve also been very busy with projects and have ignored some of the smaller news items until we have Q2 results. Speaking of which, earnings week is coming, so I expect to be very, very busy on VIP with all of the analysis on what the five public companies in residential real estate have to say.

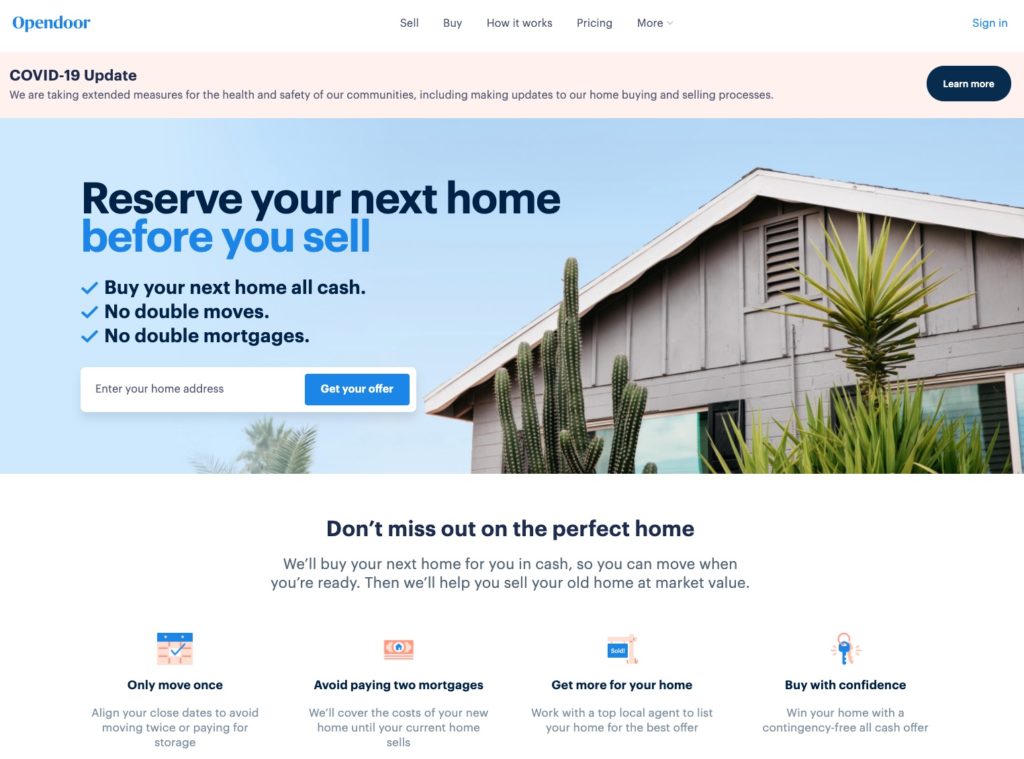

But this news from Opendoor, broken in a blogpost by Eric Wu, is a big enough one that it’s worth talking about even with earnings around the corner:

Today, we’re announcing three ways to help people buy and sell safely with fully-digital, contact-free experiences:

- Sell Direct:A contact-free way to sell instantly to Opendoor;

- Home Reserve:A new way to reserve and move into your new home while we list your current home;

- Safer Touring:The ability to virtually tour or self-tour homes to buy.

Sell your home direct: skip the stress, keep it safe

By choosing to sell directly to Opendoor, we give homeowners the certainty of a home sale without the headaches and hassles of listings, open houses or repairs. But most importantly, we’re providing a digital and safe experience for everyone involved. A direct sale to Opendoor now includes a virtual interior home assessment, eliminating any in-person contact.Our commitment to our customers is to be the safest, easiest, and most certain sale.

Reserve your dream home: move the minute you’re ready

For homeowners looking to buy and sell at the same time, we’re launching a new service, Home Reserve, so our customers can list their current home on the open market and buy their dream home without a double mortgage or a double move. With Home Reserve, Opendoor will:

- Purchase and reserve a customer’s next home on their behalf, all-cash;

- Enable the customer to move into the new home; and

- Safely list and sell their current, empty home on the market.

We love this because it enables buyers to shop the home safely, the customer to move seamlessly, and a contact-free experience for all.

Like many other companies, Opendoor is using the pandemic as a convenient public relations narrative to launch something it likely wanted to do anyhow. Quite frankly, that’s smart, because it gives the patina of social responsibility to something that is almost entirely a dollars and cents play.

Since I tend to believe that all things in residential real estate will eventually converge, that Opendoor is adopting the Knock/Flyhomes model is not particularly surprising. It is especially not surprising given that Opendoor has had to kill its hopes and dreams of contending with Zillow to be the Platform for real estate because of the cash crunch.

I think this evolution was inevitable, and COVID simply accelerated things, as it has so often during the last couple of months. What is interesting is what this means for the industry as a whole: Opendoor joins the ranks of tech-enabled companies that are converging towards brokerage, thereby shifting what it means to be a broker (or agent) in housing.

The Convergence

As I have said in my various writings on iBuyers, there are actually two flavors of iBuyer: the market maker and the bridge loan. Zillow and Opendoor fall under the market maker model: they buy houses for cash from sellers, clean it and paint it, then sell to buyers. Knock and Flyhomes (and other newer entrants) fall under the bridge loan model: they list the seller’s house, get the seller qualified for a mortgage, then pay cash for the seller-now-buyer’s new house, then market and sell the now-vacant home.

Knock has a great set of explanations on how it works. Go check it out if you need a refresher.

I call these companies “bridge loan iBuyers” because that’s kind of how it works. The seller-buyer is pre-qualified for a mortgage; Knock is almost guaranteed that its cash investment will be paid back. The length of time is not measured in months, but in weeks. The houses stay on Knock’s balance sheet for a fraction of the time that they stay on Zillow’s balance sheet, and for all we know, the contract between Knock and the seller-buyer ameliorates even that risk.

For a few years, I’ve been advising brokerage clients of mine to adopt the Knock model of iBuyer as soon as they could. I’m frankly shocked and surprised that companies like Realogy and RE/MAX have not launched such programs, but that’s a whole different story.

So Opendoor adopting this bridge loan model makes eminent sense: it was suffering a cash crunch, it had to lay off 35% of the staff, and it was (and likely still is) facing enormous potential payments to its lenders for houses that have aged too much. But it still has some working capital. It still has staff and resources and technology and capabilities. How best to leverage what it has?

Why, bridge loan iBuyer is how. There’s less capital risk, the holding periods are likely to be substantially lower, etc. etc.

But… it requires that Opendoor become a full-blown brokerage operation in some way… at least if it’s going to preserve any kind of margins.

Example: BHG Metrobrokers

There already are a number of brokers and teams that have been offering the bridge loan (or similar) type of model for a while now. In fact, I did a Notorious Interview with Jarred Kessler of Easyknock, who offers products to brokers and agents to do just this. But for this discussion, I wanted to pick a brokerage, and I found one in BHG Metrobrokers who has a program called Guaranteed Move.

It’s a very smart move by a very smart operator. Craig McClelland of Metrobrokers is one of the smartest young broker owners in the industry.

And he’s far from the only brokerage offering this kind of a service. The bridge loan model does offer much of the convenience that the market maker model provides, making the process far less painful. It does not offer quite the same level of certainty or liquidity, but at least you’re not having to deal with the pain of the sales transaction.

Now Opendoor is adopting this model. It means they have to be a brokerage in more than just name.

List and Sell the Vacant House

Metrobrokers and other brokerages can do the bridge loan program in part because it does not conflict with their core competency: recruit a lot of agents. They have a lot of agents, and every one of them wants to list and sell homes, vacant or otherwise.

Opendoor on the other hand has not yet been in the agent recruiting game, because it’s not really a brokerage. It is a brokerage on paper, and is a Participant in every MLS where it is active, and in fact tends to favor REALTORS… but it was functioning strictly as a market maker. Many of Opendoor’s records, for example, show a single listing agent from Dallas to Tampa, because it wasn’t the listing agent per se doing the marketing and selling, but Opendoor as a company making its inventory available.

Opendoor never had to worry about issues of fiduciary responsibility, because it was just selling homes that it owned on its own account.

All of that changes with the bridge loan model. Now, Opendoor’s agent is not just selling the company-owned inventory; she has to sell a home owned by a family, who expects to get maximum value in as short a period of time as possible. That is real agency, real brokerage. Opendoor now becomes a fiduciary to the seller.

This is a whole different ballgame than the one Opendoor was playing until now.

The good news is that many of Opendoor’s brokers came out of the traditional brokerage industry and have years and years of experience. Most are extremely well-respected. For example, Opendoor’s broker in Phoenix is one Jim Sexton, one of the most respected real estate professionals in the area, if not the country. Now, his title is “Broker Development” which implies that this move towards convergence was not created brand new in the aftermath of COVID… but I digress slightly. Diane Moore out of Houston, the broker of record for Opendoor there, is also similarly respected in the Houston real estate community.

Point is that Opendoor’s brokers have years of experience in recruiting agents to brokerages; they haven’t forgotten those skills. And they’re almost all respected in their various communities.

I assume that Opendoor will move to adopt the Redfin W-2 model for its agents, because it is unlikely to do the “you can do whatever you want as long as you pay the splits and fees!” deal that traditional brokerages do as that throws far too much chaos into the transaction process. That makes a job at Opendoor (working with a Jim Sexton or a Diane Moore or whoever else) a far more attractive a proposition for many a midlevel agent who knows how to do a transaction and provide client service… but was never great at lead generation.

Opendoor will soon be a bigger active participant in the MLS in all the ways that matter.

A Few Problems

This is not to say that the move is all sunshine and roses. There are some thorny problems here.

Fiduciary Duty

The first is the fiduciary duty element. Opendoor was always the counterparty, never a fiduciary, of the seller or the buyer. It had no duties whatsoever to look out for their best interests.

It isn’t clear how that works exactly under the new model. If Opendoor is merely supplying the “bridge loan” component in purchasing the new house for the seller-buyer, does Opendoor have the fiduciary responsibility to ensure that the buyer’s interests are protected? I would think so.

When Opendoor then lists the property for sale, even though its capital is at risk in the new house, does it have the fiduciary responsibility to ensure that the seller is getting the most money possible in the shortest time possible? I would think so… but again, Opendoor’s capital is at risk and interest is accruing with every passing day.

These are hardly insurmountable problems. Knock has been dealing with this since its founding. Flyhomes as well. And traditional brokerages like Metrobroker have experience navigating the fiduciary duty puzzle. But it is a problem.

Your Baby is Ugly

The second is a problem that Glenn Kelman of Redfin brought up in the Q2/2019 earnings call:

As for the upsell question, it’s such a good question. We know that most people turn down an offer and end up listing the property. The only challenge we have is if we come in with a low offer from RedfinNow, we tell them their baby is ugly and they’re less likely to turn that baby over to us for any other reason. So I think that we have to get better in that area. They often choose another broker instead of Redfin to list the house. And today, we don’t have many returns from this integrated listing consultation because it used to be that the RedfinNow offer would whiff and then a few days later, we’d talk about listing the property. But now it should be one meeting where we can say, “Look, this is what we’ll give you for the house now in cash but we think we can sell this house for more money and put more of it in your pocket,” and that should be a more consultative conversation. And I think the customer should view it as a benefit. Certainly, it has already helped RedfinNow offer acceptance to have a real estate agent present that offer and say, “Look, I know the market. It’s a good offer or it’s not.”

Opendoor will face the exact same problem. The consumer has two options: sell to Opendoor (market maker model) or list with Opendoor (bridge loan model). If the price offered by Opendoor as a market maker buyer is low, how then does Opendoor justify going to market with a listing price that is far higher? How does the consumer trust Opendoor to be an honest dealer and get it sold for $300,000, just after it told them that their house is only worth $250,000?

That could explain why Redfin kinda sorta exited the iBuyer business by partnering with Opendoor. Speaking of which….

Redfin Partnership?

How exactly does that Opendoor-Redfin partnership work now in the aftermath of this?

Glenn Kelman swore up and down that the partnership did not mean RedfinNow was on the backburner. He said it was because demand was so high they couldn’t meet it all, and asked investors to think of the partnership in exactly the same way that they think about Redfin referring buyers and sellers to Redfin Partner Agents.

I’ve already written what I think of that.

So now we get to see what that partnership looks like once Opendoor comes firmly into Redfin’s turf: listing and selling houses. Will Redfin continue to send the “extra demand” for RedfinNow to Opendoor, knowing that if the seller turns down the offer, Opendoor is quite likely to say, “Hey, I understand… but do you know about this Home Reserve program that we offer?”

I’m leaning towards thinking that lead flow from Redfin to Opendoor is about the dry the %&#$@ up, and vice versa.

For that matter… it’s not just Redfin, right? It’s every single Opendoor Agent Partner. How likely are real estate agents to be sending their potential listing clients off to Opendoor, knowing that if said client turns down the offer, he’s going to be pitched Home Reserve?

Maybe it all gets worked out with the industry-standard 35% referral fee in case Opendoor does get the listing… but that’s going to play havoc with Opendoor’s financials for Home Reserve.

Big Picture: Opendoor May Redefine Brokerage Service Entirely

If we zoom back up to the 30,000 feet level and look at what this could mean, I do think there’s a chance that Opendoor could redefine what brokerage service means entirely. Whether that happens or not depends largely on Opendoor surviving the cash crunch and managing to get more capital… but… say it does.

Now a real estate brokerage is far more than just somebody playing the middleman, helping buyers and sellers find the home of their dreams, providing advice, then helping with the transaction paperwork. It means there will be an element of underwriting the transaction involved.

Consider a future a few years out. Opendoor is now actively in the market not just as a principal, but as a brokerage.

You, the seller, can choose to list with Opendoor and have Opendoor underwrite your next home entirely in cash. That way, you get to move out, enjoy your new dream home, and all of the pain and hassle of buyers walking through your house, touching your pillows, sitting on your couch, etc. go away. And in these pandemic times, it means you don’t worry about some COVID Mary touring your home.

Or, you can list with some other brokerage and deal with the hassle of buyer tours, strangers walking through your home, touching your children’s door, and so on.

Remember that in both cases, you’re listing and selling your home for “full market value.”

It seems like a no-brainer to me.

Which means that all traditional brokerages have to adopt what Metrobrokers did with Guaranteed Move. They also have to offer, either themselves or through a financial partner, something like Home Reserve or Guaranteed Move or whatever-brand-name-you-want: underwriting the purchase of the new home.

If you don’t have access to capital, you can’t do this. You can talk up a great game about how wonderful your track record is, how you treat clients like family, deliver home-baked brownies, whatever — but you can’t underwrite the transaction. Then you can’t compete.

This was all visible in the trends anyhow, which is why I’ve been writing on it and talking about it and recommending it to brokerages everywhere. But the COVID crisis and Opendoor’s response to COVID crisis accelerates the timeline. Because despite being weakened, Opendoor is still a significant company with significant resources and significant access to capital.

Its problems are solvable, and once the crisis passes, will be solved fairly swiftly. Investors who saw the promise of Opendoor and believed in its mission to change how people buy and sell homes are unlikely to be scared off once the crisis passes and things return to semi-normal.

Which means wholesale transformation of the brokerage industry, as we redefine what it means to be a brokerage in the first place. Can underwrite? Brokerage. Can’t underwrite? Not a brokerage, and soon headed for the ashbin of history. So yo, protect ya neck.

The opportunities that arise from this transformation are… staggering and diverse. My head is spinning at the possibilities. If you want to talk about them, drop me a line. 🙂

-rsh