It appears that Realtor.com has finally made a foray into the most important thing to happen to real estate since the invention of the 30-year fixed rate mortgage. And I can’t help but yawn.

So many phrases come to mind:

- What took you so long?

- A day late, and two billion dollars short.

- The Big Con is On!

- Copying what failed is the path to success!

And so on. But since it directly pertains to something I’ve been researching for three months now, I thought it might be worth spending a few minutes on the topic.

The News: Seller’s Marketplace

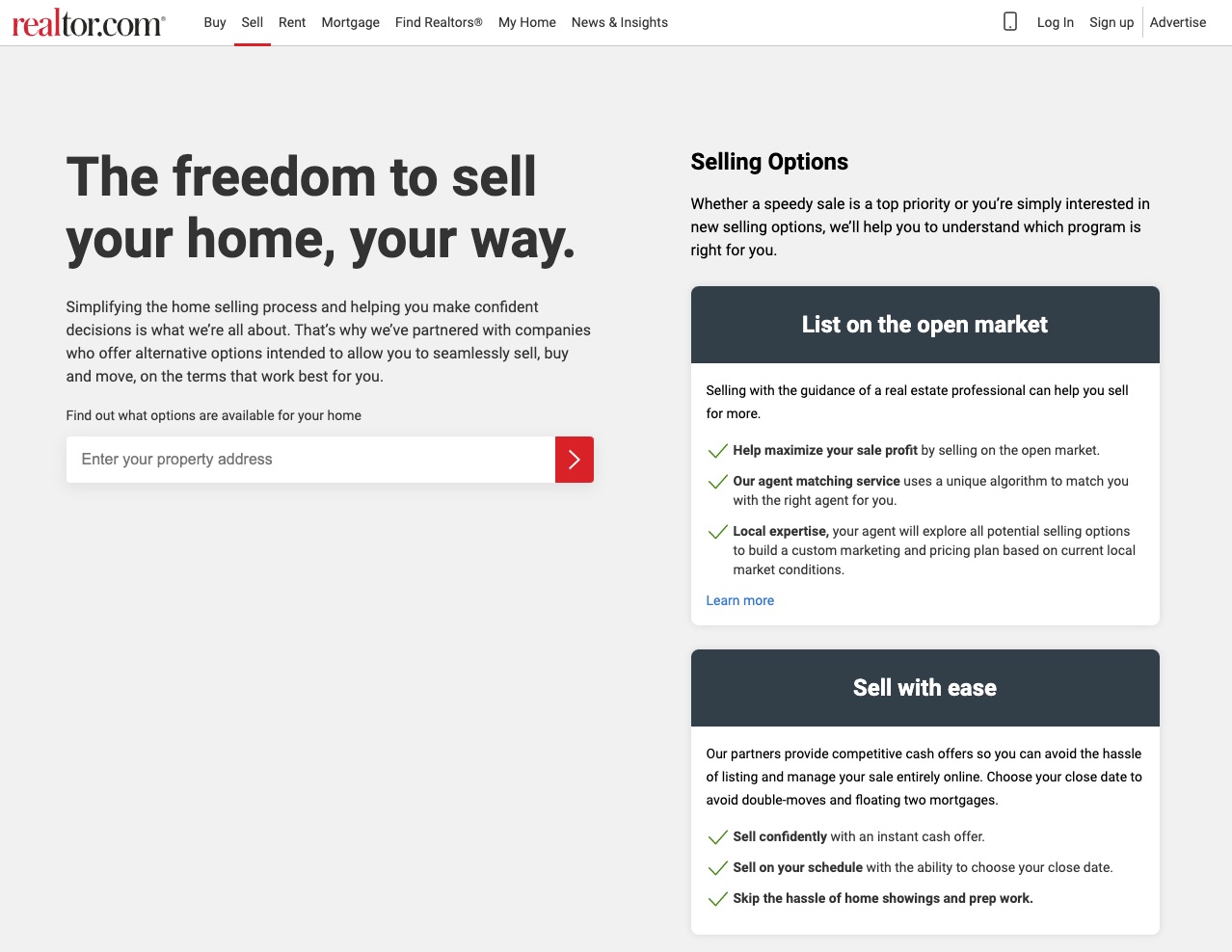

The press release is a masterpiece of message spin, as it is titled, “Realtor.com® Now Gives You Options to Sell Your Home, Your Way” and it states:

With more home selling options available than ever before, knowing where to start can be a challenge. Realtor.com®’s new Seller’s Marketplace empowers homeowners to sell their home their way and allows them to compare information side-by-side and choose the option that works best for their situation. At launch, consumers can determine availability and be connected with Opendoor, EasyKnock, HomeGo and WeBuyHouses.com, with more options coming soon.

Realtor.com® is the only national home search site to compare different selling options and enable consumers to determine the right fit with just a few clicks. Users simply provide basic information about their home and Seller’s Marketplace will present them with available options in their area. Homeowners will see side-by-side estimates for sale price, timeline and more with no upfront cost or commitment.

That sound is me stifling a big yawn.

Seeing as how Opendoor pioneered this whole space in 2014, it’s only taken Realtor.com six years to even dip a toe into the waters. And what a dip, and what a toe!

So basically, a potential seller can go on Realtor.com, put in a bunch of information and get “available options” with “side-by-side estimates.” Sounds good in principle, except there is no side-by-side estimate since there’s only one option for each model.

Realtor.com isn’t presenting Opendoor’s offer next to Zillow and Offerpad’s offers. It isn’t out there scouring the web to find out what all of the flippers and investors would pay to present that. No, you get three choices: Opendoor, HomeGo and WeBuyHouses.com (I’m assuming these are the fellows behind WeBuyUglyHouses.com and other “take it in the shorts to sell quickly” companies.) And at this point, I’m not even sure that Opendoor is a real market maker given its pivot to becoming a full-blown traditional brokerage.

Same thing with the bridge loan model: you get exactly one choice on Realtor.com: EasyKnock. (I interviewed EasyKnock’s CEO, Jared Kesseler, here, last year.) No FlyHomes? No “powered-by-Knock” brokerages like JPAR and Berkshire Hathaway HomeServices Arizona Properties?

It’s like going to Carfax.com, but only being shown Ford products and motorcycles. Here’s your MPG comparison between a F-150 and a Harley Davidson! I guess that’s a “comparison engine” if you squint real hard?

To be fair, the key phrase above is “at launch.” Maybe Realtor.com will add more and more partners and companies. But since Nancy Pelosi will give up ice cream before Realtor.com puts Zillow Offers on its website, or whatever Redfin comes up with as its bait-and-switch program, I’ll remain skeptical for the time being, thanks.

Then there’s the small matter of Realtor.com essentially copying exactly what Zillow did in its first foray into iBuyer space back in 2017: the marketplace idea. We’re just going to connect sellers with a group of partners and investors! Yeah! No risk to us! That worked out so well for Zillow that it abandoned the program less than a year later.

But hey, if you’re looking for a successful new program, the best place to look is other companies’ failures, amirite?

What’s Important Here

So why do we care at all?

We care for a few reasons.

First, I think this move (get it?) by Realtor.com showcases just how risk-averse they are. Six years after Opendoor pioneered market making, five years after FlyHomes and Knock pioneered the bridge loan model, Realtor.com decides to do the matchmaking thing that failed for Zillow. Given that Realtor.com is the American foothold for the multi-national powerhouse NewsCorp, one of a very few companies that could have matched Zillow in terms of financial resources, this says to me that Zillow has no threats on the horizon.

Now, it does make me wonder what NewsCorp is thinking, but that’s a whole different story.

Second, the more important thing here is that the narrative around “iBuyer” is getting set, and not by its fans. It’s actually getting to the point where consumer impression of iBuyer will be dictated by everyone who is not an iBuyer. WeBuyHouses.com is no more an iBuyer than a pawn shop is a market maker in gold. In fact, I think I’ll start referring to all of the flipper/investor types as “iPawnshop” going forward.

This means that the only real iBuyer left, Zillow, has a very serious messaging and marketing challenge on its hands. I go quite into depth on this in my soon-to-be-released Q2/2020 Report (contact me if you need more information on that), but suffice to say that I spoke with Zillow on this issue. Their answer is more or less, “The product speaks for itself.”

Except that the only place where the product can speak for itself is on Zillow.com, and everywhere else will feature iPawnshops and eventually burn into the consumer’s mind that “cash instant offers = 30% discount.”

Words aren’t everything, but they’re not nothing.

Third, the market opportunity this announcement does point out, however, is that there is a need for some kind of a meta search engine for instant offers. The comparison engines already out there like Zavvie and OfferBarn and others could potentially see a real uptick in traffic and interest. The problem, of course, is that the iBuyers and iPawnshops are all cagey as hell and keeping all of their data behind tall walls and deep moats. This simply isn’t like mortgages or even used car shopping. None of the principals involved want to make their data (and therefore, their actual offer estimates) available to anybody.

Part of the problem, of course, is that homes are all different, all in different conditions, and you just don’t know what you have until you’ve sent someone to put eyes on the property. But honestly, it’s 2020. Used car buyers, like CarMax and others, have similar problems… but they’ve overcome it: offers are conditional upon inspection, etc. etc. Hopefully, companies will step up and figure this out. Even if you’re providing a “range of prices,” it’s better than nothing.

Fourth, I assume this is all being done so Realtor.com can generate seller leads, which it can then sell through OpCity. Maybe it’ll work, maybe it won’t… but what occurs to me is that once Realtor.com starts monetizing its seller leads from this Seller Marketplace, it opens the door wide for Zillow to start selling its seller leads from Zillow Offers. Everyone has been expecting Zillow to do just that, and the seller leads are worth billions. But they haven’t yet.

Well, maybe like how Realtor.com’s acquisition of OpCity gave permission to Zillow to launch Flex, we’ll just see Realtor.com pave the road for Zillow to monetize its seller leads. After all, Realtor.com is the Official Website of REALTORS, right? I mean, if NAR is okay with selling seller leads, who can blame Zillow for doing the same?

Fifth, and finally, there is an outside chance (but a real chance) that this move will spark a real revolt from MLSs. Realtor.com has always had a special relationship with MLSs because of its relationship with NAR, and the resulting “putting REALTOR first” mentality. Well, this Seller Marketplace does kinda sorta insinuate that sellers don’t need to use a REALTOR; just sell to WeBuyHouses.com, right? That could impact how MLS Boards regard that “special relationship” going forward.

The politics will be interesting.

Takeaways

So, let’s keep it brief. The takeaways are, NewsCorp/Move/Realtor.com is dipping its toes into iBuying ever so gingerly. So gingerly, in fact, that I can’t see a real upside for anybody not named Zillow. Sure, it’s a lead generation vehicle, and maybe Realtor.com sells more leads. But I think all that does is let Zillow cash in its chips without the insta-wave of hate from the industry. The iPawnshops might get some more leads, but again, “product speaks for itself.”

Having said that, the messaging/narrative problem is real. And it’s getting realer by the week. We’ll see how Zillow addresses that in the weeks and months to come.

Does this move impact the other four public companies? Ehh… maybe. In the long run, I don’t see it affecting the other four much. I mean, it is a bit of a negative for Redfin, since Redfin would like to keep its version of iPawnshop on Redfin.com and getting more attention to WeBuyHouses.com and HomeGo.com isn’t great for Redfin. As for RE/MAX, Realogy, and eXp… I figure this just means all those guys will try to do the same thing and offer out “options” and “comparison tools” that inevitably showcase how much better it is to list-and-sell traditionally. It’s a bit of a negative, since those companies can no longer differentiate based on “examine all of your options” anymore. But it wasn’t as if that was a big strategic focus for any of them anyhow, so I don’t see it.

The MLS angle… is interesting, and I’ll have to see how my friends and colleagues in the MLS space regard this new move by the website that bears the REALTOR name. It might not be that big a deal since many of the larger ones have already begun to treat Realtor.com the same as they do Zillow or Homes.com… but it might be a big deal from a perception standpoint of some of the Board members. We’ll see.

Anyhow, just some quick thoughts on this Friday morning (for me). Hope everyone has a wonderful weekend!

-rsh