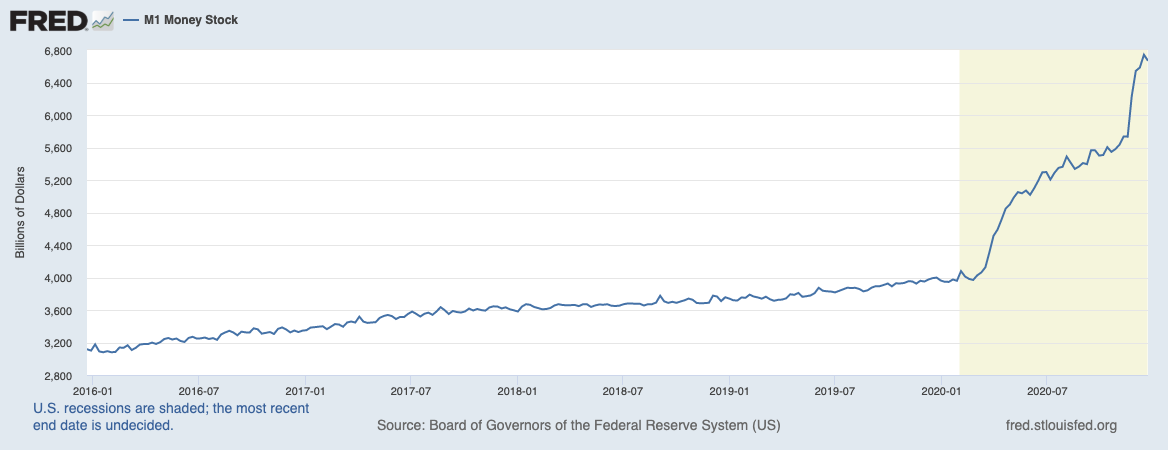

The mainstream financial press is talking about what might be the single most important chart from 2020, which is above. The U.S. money supply increased dramatically in 2020.

CNBC talked about it:

“It’s fair to say we have never observed money supply growth as high as it is today,” Morgan Stanley chief U.S. equity strategist Mike Wilson wrote this week.

When even the mainstream media is talking about it, you have to think there’s something really going on. I know for a fact that a number of hedge fund managers I’ve spoken to in the last few months are putting their money into things like bitcoin and gold… and these are some of the smartest guys in the investing world.

So just how high are we talking?

Oh boy! US M1 Money Supply growth has accelerated to a whopping 66%. pic.twitter.com/WANvg0yU6P

— jeroen blokland (@jsblokland) December 22, 2020

That’s money supply growth. A different chart shows that 35% of all US dollars ever were created in 2020:

ever been*

— Calliope 彡 #BoycottTurkey (@Calliope_Greece) December 19, 2020

I do think this is likely the most important chart from 2020, especially for real estate, since the industry is 100% dependent on macroeconomic factors.

That Explains a Few Things….

If you recall, when COVID hit, there was widespread panic across the country… and also within the real estate industry. Some of it had to do with draconian lockdown measures that simply prevented buyers, sellers, and real estate agents from doing anything at all. Remember all the angst around Pennsylvania not classifying real estate as an essential service?

But then, things turned around and quickly in Q2 and Q3. I think when we see Q4 numbers soon, we’ll see that it was a record breaking Q4 as well. All of the conversations I’ve had with brokers and agents around the country suggest as much. Home prices are headed to the stratosphere, and what homes were available (with a few easily explained exceptions) were snapped up left, right and center.

Here’s some data from Altos Research, and I have to agree with Mike here. The real estate data is in fact insane.

But COVID only partially explains the ultra restricted supply and super high demand. I think the other part of the explanation is that money became very, very cheap in 2020… because we printed so much of it.

Is You Is or Is You Ain’t My Inflation?

Former NY Fed President Bill Dudley made waves back in December with an article in Forbes title, “Five Reasons to Worry About Faster U.S. Inflation.” One of the five reasons was fiscal stimulus brought on by COVID:

Fifth, the government is much more likely than it used to be to support the economy with added spending. Fiscal orthodoxy has shifted: Instead of worrying about rising federal debt burdens, economists now see much greater scope for aggressive action to offset significant shortfalls in demand. As a result, the government probably won’t want to remove fiscal stimulus as quickly as it did after the 2008 financial crisis (a move that led to a disappointingly slow recovery).

Economics being what it is, Dudley’s article was countered immediately by other economists, for example, the in-house economists at CoStar (reprinted here):

Worrying about inflation is generally a luxury of a booming economy. Which means that we, your authors, currently aren’t worried about inflation. Given a demand shock as severe as 2020’s, inflation may actually be the last of our concerns.

Even with the $1.8 trillion federal coronavirus relief act, though not fully utilized, and a $3 trillion increase in the Federal Reserve’s balance sheet, inflation remains at about the average level over the last decade. Consumer price index data for November, released last week, showed that headline inflation hit 1.2% year over year. Core CPI, stripping out volatile food and energy prices, was 1.6% year over year. Higher, sure, but remains well below the Fed’s target.

Given that I am not an economist, despite looking a lot like one, I’ll defer to the actual experts on the dismal science to weigh in on what the huge increase in the money supply really means for real estate. But there is some interesting data from CoStar:

Second, housing costs are a big driver of inflation measures. CoStar rent data has proven quite useful for projecting the CPI shelter component, as you can see in the chart below. CoStar clients are likely well aware that multifamily rents are under pressure in many areas of the country, particularly the large and densely populated cities. With rents being the most important input to price baskets, the next six to nine months are likely to see inflation fall further.

That strikes me as… quite a compelling argument why we won’t see inflation in 2020, never mind hyperinflation.

But I think there are three things to note here for our purposes.

One, the CoStar data is for rent, particularly in major urban areas. Those are specifically the areas from which people are fleeing because of COVID and because of work from home policies.

Two, how much impact did the anti-eviction measures that local and state governments put into place because of COVID have on the rents being down?

Three, home prices have been on an absolute tear in 2020. Maybe rents are down statistically speaking, but the underlying value of the home being rented is through the roof.

What it means to me is that looking at general inflation is interesting, but not all that useful for the real estate industry. What makes more sense is to look at what some have referred to as the asset bubble.

The Asset Bubble and Real Estate

A good definition of the term comes from The Balance:

An asset bubble is when assets such as housing, stocks, or gold dramatically rise in price over a short period that is not supported by the value of the product. The hallmark of a bubble is irrational exuberance—a phenomenon when everyone is buying up a particular asset. When investors flock to an asset class, such as real estate, its demand and price increases.

During a bubble, investors continue to bid-up the price of an asset beyond any real, sustainable value. Eventually, the bubble “bursts” when prices crash, demand falls, and the outcome is often reduced business and household spending and a potential decline in the economy. Understanding the causes and historical trends of asset bubbles can keep you from contributing and falling victim to a future one.

What causes an asset bubble? The Balance says it’s three things:

- Low-interest rates: They make it easy to borrow money cheaply, which boosts investment spending.1 However, investors cannot receive a good return on their investments at these rates, so they move their money into higher-yield, higher-risk asset classes, spiking asset prices.

- Demand-pull inflation: This occurs when buyers’ demand for an asset exceeds the available supply of that asset. As asset prices rise, everyone wants to get in on the profits.

- Asset shortage: This is when investors think that there is not enough of a given asset to go around. Such shortages make asset bubbles more likely because the imbalance between supply and demand leads prices to appreciate beyond the asset’s value.

And The Balance mentions the 2005 Real Estate Bubble as an example. But the 2005 Bubble resulted from bankers fucking around with mortgages to create securities for investors. The current housing market might not be an asset bubble per se, because it’s resulting from consumer demand rather than investor demand. COVID and Work From Home have made a lot of urban dwellers realize that living in a 900-sq. ft. condo in downtown Megalopolis ain’t all that it’s cracked up to be.

One explanation, and the one that sounds the most convincing to me, comes from an unreliable source: Tim Pool. I’m not going to embed the video because it is far more politics than economics, but at the end, there is a guest who talked about how most of the money printed went to rich people, and what rich people like are luxury goods, stocks, bonds, and real estate. And the price of all of those is through the roof… assuming you can find any for sale at all.

I think there’s some truth to that. Why?

Yes, a big chunk of the money went to individuals in the form of $1,200 checks and higher unemployment benefits. But $1,200 gets you precious little, and anybody who is unemployed and drawing unemployment checks is not buying houses. Plus, that was only about a quarter of the $2 trillion spent in 2020.

The real beneficiary of the money are large companies (and their employees), small business owners (and their employees), and state and local governments (and their employees). Those people can and do buy houses. Many of those people can and do work from home, and many of those people are suddenly able to move out of cities and keep their jobs.

Of course, interest rates have been kept at historic lows… which is a condition for an asset bubble. And as those of us in the industry have known for years, homebuilding has simply not kept up for a whole variety of reasons (most of them local regulations).

Inflation, thought of as CPI (Consumer Price Index), might not be here and may not ever get here. But asset prices? It seems logical to believe that the run up in home values in 2020 was connected to massive injection of money into the economy, and that with new packages passed and signed, there’s no end in sight there.

How It Might Play Out for Us

The short answer is, I don’t know. Because everything is dynamic, everything is interconnected, and everything is crazy. But we could speculate somewhat based on logic and reason.

Logic and reason dictate that if you increased the supply of money by 66% (or 35%), but did not increase the supply of houses by the same amount, price of houses have nowhere to go but up.

There is zero sign that the Fed will raise interest rates. That was one of the reasons Dudley provided in his article:

Fourth, the Fed has revised its long-term monetary policy in a way that allows for more inflation. Previously, the central bank aimed to hit its 2% target regardless of how far or how long inflation had strayed from that objective in the past. Now the Fed wants inflation to average 2%, which means it will have to exceed 2% for a significant time to offset the chronic downside misses that have accumulated over the past decade.

Specifically, Fed officials have said that they won’t raise short-term interest rates until employment is at its maximum sustainable level, and inflation has reached 2% and is expected to go moderately higher for some time. This means they’re unlikely to respond to any inflation uptick until they expect it to be both persistent and sizable.

Since CPI itself might not be heavily impacted, at least for a while, there is no reason to think that we’ll see mortgage rates spike up.

However, it also seems reasonable to think that so much money being printed cannot but help have an impact on CPI inflation at some point. Maybe not soon, maybe not in 2021, but at some point. Because again, we didn’t produce 66% more stuff; just 66% more money. People who are wealthy enough to think about buying houses in the first place are also usually smart enough to make financial decisions based on what they think will happen.

Sunny and I recently had this exact discussion: is it still smart to save? Or do we want to buy more “assets” like houses, stocks, bonds, gold, etc.? I suspect we’re not the only people having that conversation over dinner. Normally, smart people avoid debt; with what’s happening in the money supply, is it perhaps stupid to avoid debt in 2021 (with a fixed interest rate)?

The reasonable expectation, then, seems to be that home prices will continue to rise rapidly. In fact, as the increase in money supply filters through the economy, they’ll skyrocket.

The number of transactions, however… might be a problem. Short of medical emergencies, I can’t imagine why anyone would need to sell a house in the current market. The inventory crisis should worsen, not improve. New construction would take months and even years to come on market, and those will not be in established neighborhoods with good schools that most people want.

The biggest unknown X-factor is likely unemployment, as there is a pretty good chance that will spike up once small businesses that have been hanging on throughout 2020 decide to give up the fight. But most of the employees of small businesses weren’t buyers anyway. So we’ll have to see how much of that cascades up to the large corporations and government jobs… and I think that will take a couple of years.

The second biggest unknown X-factor is politics. If homes truly become unaffordable, since wage growth outside of the top X% is not happening, then political pressure to do something about home prices and housing affordability becomes immense. It will likely start with rentals but I can’t help but think that politicians will want to do something to make buying a home something that average Americans can in fact hope to do.

Nobody Knows, But Everybody Should Care

Again, I’m not an economist. Hopefully, the actual trained economists will have their insights and thoughts for us all. But in the meantime, I think it’s safe to say that nobody actually knows what’s going to happen. That’s why economics is called the dismal science.

On the other hand, everybody should care about the most important chart of 2020. Even if we can’t predict precisely what is going to happen, I don’t think it’s reasonable to believe that increasing the money supply by 66% will have no impact whatsoever, especially for assets such as housing. The question is, how does that affect you and your company specifically?

For example, if the housing market is higher price but lower transactions… how does that affect most brokerages? Most MLSs? Tech vendors?

We start 2021 off with thinking through strategic issues… and as I’ve often said, antifragile has to be the key concept as we head into unknown waters. Be not afraid, but… things are going to change in 2021.

-rsh