In my consulting work, I often say that strategy is 18-24 months, because things change too fast to make any reasonable plans past that point. It isn’t simply black swan events like the pandemic either; just the pace of technology change is that fast, and if the strategy worked, then the organization should be in a very different place in two years. Anything past 24 months is fiction: entertaining, often filled with interesting observations about true reality, but not something you want to base operational plans on. And anything past 5 years is science fiction.

Nonetheless, for leaders who are tasked with looking over the horizon, it is useful to take fiction and science fiction into account for adjusting their long term outlook on business, on the industry, and on society as a whole. I don’t often get to present on topics in the fictional and sci-fi realms; when I do, they’re often called “black swans of real estate” (though I think they’re more like grey goose, since at least I can paint a scenario involving them).

Recently, I had the opportunity to do a presentation precisely on that topic: science fiction level futurism on real estate in 10 years plus. And that experience, as well as the preparation for the presentation, got me thinking about a couple of Really Big Trends that are wildly speculative, but happening today nonetheless. I thought it might be entertaining to consider two of them: demographic shift and money.

Demographic Shift

Longtime readers know that I’ve been talking about #GenerationScrewed for about a decade now. This post titled “Do We Believe in Millennials?” was from March of 2010, for example. That was near the start of the industry’s obsession with Millennials, filled with hope in these digital natives. But I wrote then:

Once the Millenial finds the condo of his dreams on his 4G iPad and contacts the realtor via Twitter, we may find that due to his lowered earning potential from the lingering effects of the Great Recession of 2009-2014, combined with the fact that he’s paying 65% in combined local, State and Federal taxes, not to mention the banks refusing to lend to anyone who can’t put down 30% and has a FICO above 750, he can’t actually qualify for the mortgage.

Lower your sights, young man. That New Urbanism looks fantastic, and it’s the lifestyle you really want, but sadly, all you can afford is a $200,000 fixer-upper somewhere in the shadows of Giant Stadium with a 45 minute commute to your not-so-grand job in some corporation you used to rail against as a college student as evil, greedy corrupter of the environment.

So here we are over ten years after that post. Which seems to have come true in the sci-fi predictions from 2010?

Then in 2011, I pointed out something that has been something of an obsession of mine for a decade: Millennial family formation.

So the news is wonderful if you’re a female professional competing in the labor market. In the eternal back-and-forth between men and women, it is clear that American women have won the battle, and pretty decisively. Economically, Millennial men are at a disadvantage compared to Millennial women in pretty much every conceivable way.

It turns out, however, that male disadvantage has real consequences to women… at least the ones who actually like men and want to marry one of ’em one of these days.

Here we are ten years later, and my sci-fi musings (which included the half-joke that polygamy will be legal by 2040) have held up how?

Here’s some mainstream media on the subject. First, The Hill with the provocatively titled “The end of marriage in America?” which says:

Throughout the 20th century, the annual U.S. marriage rate was generally no less than eight marriages per 1,000 people. The marriage rate also varied considerably over the years of the past century. It declined to around eight marriages per 1,000 population at the time of the Great Depression and peaked at more than 16 marriages per 1,000 at the close of World War II.

Since the start of the 21st century, the U.S. marriage rate has declined from more than eight marriages per 1,000 down to six marriages per 1,000 population in 2019. That marriage rate is the lowest level since the U.S. government began keeping marriage records for the country in 1867.

Also, 70 years ago a large majority of U.S. households, approximately 80 percent, were made up of married couples. In 2020, the proportion of households consisting of married couples fell to 49 percent.

The reason? This is The Hill answering my question from a decade ago:

Some of the major factors behind the long-term decline in the marriage rate have been female education and labor force participation, women’s economic independence and gender equality.

And here is Prof. Scott Galloway of NYU Stern answering my question from back then on CNN. The whole video is worth watching. The commentariat wants to talk about why boys and men are such losers, which is fine and dandy, but as Prof. Galloway points out, that doesn’t matter since we have mating inequality happening that poses an “existential risk.” As he says, “The reality is, college graduate women aren’t interested in mating with men who don’t have college degrees.”

What is great for women’s careers has turned out to be not so great for women’s marriage prospects.

Plus, it turns out that fewer marriages do mean fewer children. The US birth rate in 2020 was a record low:

The number of babies born in the U.S. dropped by 4% in 2020 compared with the previous year, according to a new federal report released Wednesday. The general fertility rate was 55.8 births per 1,000 women ages 15 to 44, reaching yet another record low, according to the provisional data.

“This is the sixth consecutive year that the number of births has declined after an increase in 2014, down an average of 2% per year, and the lowest number of births since 1979,” the National Center for Health Statistics said.

So… 2020 was a record low, but 2019 was the previous record low, and 2018 was the record low before that… huh.

Brookings Institute studied this and says fertility ain’t coming back:

This analysis implies that U.S. fertility rates are likely to be considerably below replacement levels for the foreseeable future. This is driven by more than a decade of falling birth rates and declining births at all ages for multiple cohorts of women, not simply the aftermath of the pandemic-induced reduction in births. Furthermore, the simulated fertility rates we report in this essay are similar to those observed in virtually all other high-income countries. This evidence leads us to expect that U.S. birth rates and total completed fertility rates are not likely to rebound any time soon. Further research is needed to better understand the reasons for the long-term decline and what, if any, policy responses are warranted.

So. Leave moralizing and politicking to the side for now. What will be the impact of such demographic change on housing and real estate ten years from today? I mean, we saw how the trends from ten years ago have manifested today; what will the trends of today mean by 2030?

Keep chewing on that thought, while we turn to…

Money

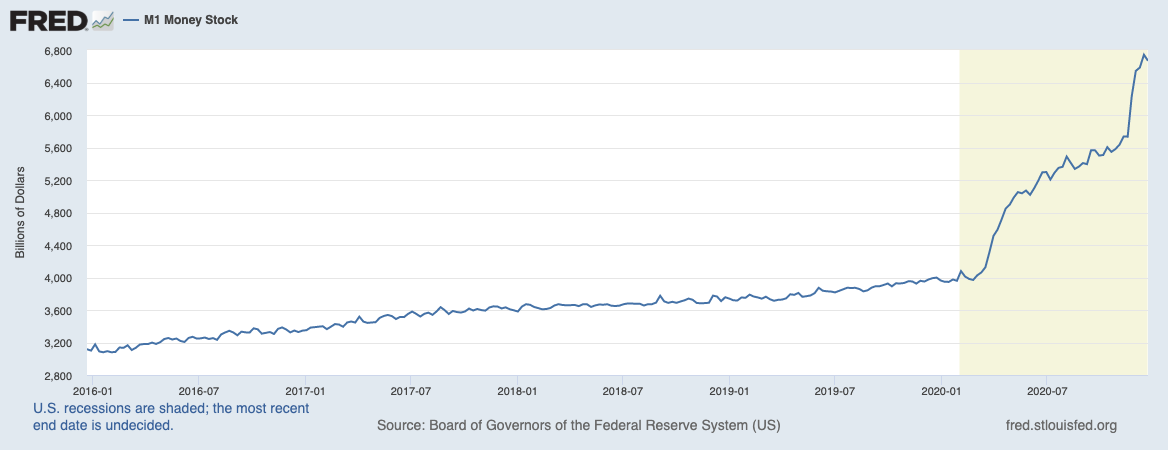

It continues to surprise me that people are surprised at what I consider to be the Most Important Chart in the past 18 months:

By some measures, The Fed has printed some 35% of all US Dollars in existence since the start of 2020. Trillions of dollars have been created out of thin air with the stroke of some keys on the central bank’s computer system. And the US is far from alone.

The gold bugs have been talking incessantly about fiat currency and hidden inflation for at least ten years. They are now joined by the crypto bulls. But far more worrisome for us is that more and more of the financial elites are joining them.

Ray Dalio: It’s pretty crazy to want to own cash or bonds

shorts #RayDalio #Bridgewater #billionaire Billionaire and co-Chief Investment Officer and co-Chairman of Bridgewater Associates Ray Dalio discusses the economic stimulus, inflation, and why he thinks it’s crazy to want to own cash or bonds.

Dalio has been warning about this for a few years now. More and more people who make big financial decisions are listening to him.

Consider this story from 2020 that more and more institutional investors are getting into the crypto market:

Since at least 2013, the Bitcoin and cryptocurrency space has seen an increasing number of institutional investors and large “smart money” players accumulate BTC. This phenomenon has accelerated over the past few years — with the industry noting the rise of institutional investment each time another well-known fund joins the bandwagon — growing hand in hand with the rise of the Bitcoin derivatives market.

In May 2020, the “institutions are here” narrative was bolstered yet again when well-known macro investor Paul Tudor Jones announced that his fund would be investing in BTC futures as a hedge against inflation. The story was strengthened further by the news that Nasdaq-listed, $1.2 billion business intelligence company MicroStrategy acquired 21,454 BTC — worth over $250 million, at the time — in an effort to defend its reserve treasury against fiat inflation.

Well, let me just say that one of my best contacts in the fun with crypto is a hedge fund manager who personally invests in crypto and has convinced his multi-billion dollar firm to get involved. That was in 2021 and is ongoing. Here’s one source, who manages $3.8 billion crypto hedge fund, talking about the shift in institutional appetite for crypto.

The trend to watch, however, isn’t simply the price of Bitcoin, the most well-known cryptocurrency. The trend to watch is DeFi. I’ve linked to this video in the past, but let’s do it again because I think it’s interesting and important because Jim Bianco comes from traditional finance:

“I Try to Tell People About DeFi; It Will Come Here and Completely Flatten You:” Jim Bianco

Jim Bianco has decades of experience as a macro markets researcher. He’s been leading his firm Bianco Research since 1990, which has family offices and traditional money managers as clients. He was at UBS and Lehman Brothers before that. He’s as TradFi as it gets, but recently, he’s been falling down the crypto rabbit hole -hard.

This isn’t some twentysomething crypto anarchist who wants to see the monetary system brought down. This is a sober Wall Street analyst.

So what the hell is DeFi and why should we care?

Here’s a really solid video explaining what DeFi is:

What is DEFI? Decentralized Finance Explained (Ethereum, MakerDAO, Compound, Uniswap, Kyber)

DeFi or decentralized finance is a movement that aims at making a new financial system that is open to everyone and doesn’t require trusting intermediaries like banks. To achieve that defi relies heavily on cryptography, blockchain and smart contracts. Smart contracts are the main building blocks of defi.

The growth of crypto markets and the growth of DeFi suggest that more and more people are at the very least aware of the fact that modern money is simply a creation of governments and their central banks. But what is at the heart of the trend in this growth?

I submit that it is decentralization. People no longer trust institutions as much as they once did. That’s been going on for a while now, but COVID and institutional responses to COVID such as lockdowns and vaccine mandates are ramping things up quite a bit. Not only that, but the clear data coming out now showing that COVID has led to the big getting bigger (e.g., Amazon) while the small get crushed (e.g., small retailers) is building up more and more resentment to centralized authority and centralized institutions.

Whither Trends?

Before we dive into sci-fi futures, it is worth considering whether these trends could be reversed. Because if they can be reversed, then 2030 will go back to looking more like 2000 than 2010.

I personally just don’t see it. You might have a very different opinion.

I just don’t see the social or political will to change the 60/40 split between women and men in college (headed to 66/33). Trying to imagine affirmative action for college admissions favoring men is… well… even my fervid imagination fails.

I also don’t see millions of college-educated women choosing to mate with men who don’t have college degrees, which is what Prof. Galloway said. Since that motivation is based on evolution (i.e., hypergamy), that doesn’t seem likely to change in a mere decade. Maybe in a few thousand years, things will be different, but not by 2030.

Similarly, I don’t see a move away from fiat currency by the world’s governments and central banks anytime soon. If anything, we’re seeing Central Bank Digital Currency (CBDC) projects proliferate — cryptocurrencies controlled by the same people who control fiat currency today.

Except if the real trend underneath crypto is resistance to centralization, then it isn’t at all clear to me that people will abandon open, permissionless, transparent crypto systems for one that is controlled by Janet Yellen.

I also don’t see the governments of the world embracing anti-inflationary policies until they are absolutely forced to do so. But our friend Ray Dalio has some really great (and really dark) writings on what happens. If you dislike sleeping peacefully, you could try starting here. Basically, countries have to choose between printing money, embracing austerity, or defaulting to deal with debt; they always choose to print money. That leads to all sorts of problems, but for our purposes, I think it’s sufficient to say that it is very, very unlikely that we get a repeat of the Paul Volcker Fed and start doing 21% interest rates, recessions, and mass unemployment.

So… for the next 10 years at least, absent more black swan events (another pandemic, actual revolution, secession, civil war, etc.), we have to assume that demographic trends will keep going the way they are with fewer marriages and fewer kids, and that high inflation and fiat money devaluation will be the New Normal.

Science Fiction: Real Estate and Housing

Extend those trends out another decade and what we get is… revolution. Well, that’s a grey goose type of event, so let’s pretend that we don’t get there. We won’t have secession and civil war and all that fun stuff, because if we did, none of us would care that much about what brokers and agents have to do to deal with the changing industry.

Even without those major disruptive events, simple demographic shift combined with trends in money suggest that real estate would look nearly unrecognizable in a decade.

The Dystopia

First, fewer of the 21 year olds graduating college in 2021 will be married and have kids in 2031. Since being married is highly correlated to homeownership, and the size of the home required is closely related to how many children a family has, that suggests a dramatic change in the demand for the kinds of housing the future buyers will want.

I mean, do a lot of single childless women want 4 bedroom colonials out in the suburbs?

Second, even for those increasingly smaller percentage of young families who are married, and who do in fact have kids, and who do want to buy that home in the suburbs… will they be able to?

We know wages haven’t been growing at 15% a year the way home prices have been. If that 15% a year in home price appreciation is not because of supply and demand (like NAR says it is), but because the dollar is devaluing by 15% a year, could the young family purchase at all? When that family goes to compete against institutions paying cash (because they don’t want to own cash or bonds when inflation is at 15% a year), how will they do that?

For that matter, one has to ask whether banks will keep making mortgages at 3% interest rates, if nobody wants to buy their MBS bonds (see Ray Dalio above) since they’d actually be losing money holding bonds that don’t beat true inflation.

Both of those combine to suggest that by 2030, we might really see the end of homeownership society in America. The American Dream could become exactly that: a dream only. #HomeownershipMatters, unless you can’t even dream of owning a home in your lifetime, in which case the new hashtag will be #RentControlMatters instead.

The Brighter Side of Things

Third, however, on the brighter side, if the DeFi trend keeps going the way it does, we’ll adapt to a new way of doing things. And it just so happens that it isn’t the sixtysomething retirees who are excited about DeFi, but the twentysomething whole-life-ahead-of-me types who are.

Here’s the thing about DeFi: I don’t think it will ever become mainstream until somebody develops two products: mortgages and auto loans. Because homes and cars are the two things are what most people borrow money to buy.

Ergo, in sci-fi land, someone will develop DeFi mortgages and DeFi auto loans. If it has to be, then someone will make it so… in sci-fi land.

That in turn has significant implications for the industry since DeFi mortgage is impossible without very rich reliable data being fed into the smart contracts that power DeFi protocols. Turns out, technology can do a whole lot, except reliably verify reality… at least until we get real AI and full on Isaac Asimov robots and so on.

Then we have to think about how the transaction changes once DeFi mortgage — which by definition will have no underwriter approval, no banks, no CFPB regulation, and no permission from any centralized authority — becomes mainstream.

DeRe: Decentralized Real Estate

In the sci-fi land, I can easily imagine the rise of DeRe: Decentralized Real Estate. It will need to come into being to go with DeFi.

My first thought is that the nature of DeFi means that every offer on a house will be cash. The protocol either gives you the loan, or it doesn’t. There isn’t some human loan officer who has to sign off, then get approval from some committee or another. The smart contract works however it works to transfer the money (crypto?) into the buyer’s wallet, or it doesn’t.

For those few GenZ couples who do want to buy a home, they will be on a more even footing versus the institutions.

Maybe homeownership won’t be dead; maybe DeFi mortgage will save it.

My second thought is that the transaction will be nowhere near as painful, bureaucratic, red-tape filled, and annoying as it is today. It can’t be, because DeFi mortgage is impossible if the transaction remains mired in form after form, one legal regulation after another. Yes, that requires massive overhaul of our legal and regulatory framework, and it is difficult to imagine all those municipalities giving up on the money and the power that comes from land and title registries.

Then again, in 2019, I could never have imagined municipalities ordering lockdowns and business closures, and their citizens obeying. So when it comes to politics, who knows?

My third thought is that a smart contract that is able to make mortgages automatically, relying on whatever data is fed into it from oracle networks, is probably sophisticated enough to make title transfers happen without legions upon legions of human clerks. That in turn suggests that much of the value of the real estate agent today could be replaced by very sophisticated smart contracts.

You can’t replace professional advice. You can’t replace psychological counseling. Humans needs other humans to approve of major decisions; that’s hardwired into us from an evolutionary standpoint. But you can replace the project management value that an agent brings to a transaction. You can replace much of the negotiation that happens (or doesn’t happen) today. You can replace a lot of the offer management process. And you don’t even need smart contracts to replace the “I need the agent to let me in to tour the house” value; August locks will do that today.

Fourth, taken to the logical conclusion, it isn’t at all clear that buyers and sellers would need a real estate agent to do a transaction. “Need” is not “want” so they might want professional assistance; the Lord knows I could use professional assistance in deciding which liquidity pool to put my UNI and wETH tokens into. But just like I don’t need some agent to engage in yield farming, I might not need an agent to sell my home in 2030.

Instead, we might see decentralized exchanges for real property rise up to go hand in hand with DeFi mortgage, decentralized title registries, and decentralized advisory services. That’s DeRe. It might not happen, because we’re in sci-fi land now. Then again, it just might.

The Value of Sci-Fi for Strategy

Let me wrap up by noting that while this whole post and sci-fi thinking in general are not immediately useful to anybody today… there is some value to engaging in it.

Like I said, strategy is 12 to 18 months out. Anything beyond that is fiction and science fiction.

But in 2004, when I started working at Cendant (now Realogy), there were brokers and agents who were engaging in a bunch of sci-fi thinking around this new phenomenon called the internet. They did not immediately abandon what was working for them in their day to day business. But they did take some steps to explore and take advantage of the new technology. As someone who came out of that new world (I had my startup in 1999), I tried to assist them in that work.

I went to a lot of blogging and social media conferences in those early years in the industry. And some people and companies were slowly figuring out what worked and didn’t work. They were making investments in 2010, learning skills in 2010, making mistakes to learn from them in 2010.

How’d that work out?

Maybe blockchain and crypto are just fads, like Beanie Babies. Maybe there is no reason at all for sober businesspeople in real estate to waste one minute thinking about them. Maybe the demographic trends are interesting, but useless, and brokers and agents need merely to think about how to ramp up their presence on TikTok for more marketing. Maybe NAR needs to keep boosting startups whose whole mission in life is to keep the REALTOR at the center of the transaction.

Or maybe, just maybe, it’s worth making some small investments, doing some small learning, learning a few skills using sci-fi thinking as background. Sometimes, there is real value in science fiction even for strategy.

We’ll see in another ten years, I suppose.

-rsh

Zager & Evans – In the Year 2525

Here’s a music video I cut together with footage from the classic apocalyptic sci-fi film Metropolis, combined with sci-fi folk song In The Year 2525 by Zager & Evans. I really found them fitting together in a dystopian transhumanist meets Aldous Huxley’s Brave New World kind of way.