I was going to start the transition to the new approach to Notorious ROB in the new year. But frankly, there’s just too much to talk about and I can’t wait that long. So just imagine that this was posted on New Year’s Day of 2022 and we’ll both pretend that the transition began then, okay?

In 2021, I began investigating the topic of blockchain and real estate much more seriously. In this post from June, I laid out why:

If this blockchain technology is the future, then it will come to pass. And we all need to be prepared for that day, based not on hopes and dreams but also not dismissive of it. Clear eyes, full hearts, can’t lose.

I’ve interviewed some of the leaders in the real estate industry who are involved with blockchain technology, and spent quite a few hours digging deep into the technology of blockchain, the business culture that is growing up around it, and where we are.

This is a technology that I wrote off two short years ago in 2019. And now, I find myself believing more and more that the future will be written on the blockchain.

So this post is a sequel to the original post in June; please go back and re-read that as I include some of the basics about blockchain and why it’s getting so much attention.

A Bit of Context, to Demystify

I think it’s actually useful to spend a few paragraphs discussing the context of this explosion of interest in the blockchain, because there’s entirely too much mysticism around blockchain and entirely too much dismissal of it. Blockchain is neither a silver bullet that will solve all of our problems nor a passing fad like Beanie Babies.

Rebellion, The Core Ethos

First, it is necessary to realize that the ethos of blockchain is rebellion.

The very first block ever mined on the very first real blockchain — that of Bitcoin — by the pseudonymous creator Satoshi Nakamoto says, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This was a reference to a bailout of UK banks by the British government during the Great Recession, caused by the collapse of the American housing bubble.

In a very real way, the American real estate industry is the proximate cause for the development of Bitcoin and the blockchain revolution that it spawned.

The entire motivation behind Bitcoin was to eliminate all financial intermediaries, including those who were doing things like bailing out big banks.

Bitcoin and blockchain have been embraced mostly by libertarians first, and those who are coming to the party after bring a streak of anti-authoritarian libertarianism within whatever political identity they might have. Liberals and progressives embracing blockchain look to it as a counter to Big Corporations and the Rich. The conservatives who embrace blockchain think it’s a hedge against Big Government and the loss of personal property rights.

Since then, there have been dozens of new blockchains and thousands of coins created. Some of them are more pro-incumbents, pro-corporate, pro-banking… but most share the anti-establishment ethos of Bitcoin.

This lengthy video from Robert Breedlove is a pretty good explanation of this anti-establishment, anti-authoritarian ethos that infuses the blockchain world:

STOP SAVING MONEY! How To Invest In Crypto & Avoid The DOLLAR CRISIS | Robert Breedlove

Join our Discord community so you don’t miss out on all the amazing things we are working on – http://impacttheory.com/discord. Here you will get direct access to Tom and the team PLUS exclusive content, offers, and so much more. Jump on in and get started on becoming legendary!

There’s Bitcoin, And Everything Else

Second, quite a few critics of blockchain technology like to point to shitcoins like Dogecoin and Shiba Inu and any of the thousands of weird-ass coins as why Bitcoin is a piece of crap, and why the whole thing is just a ponzi scheme.

Where I am now is that there is Bitcoin, and then there is everything else — often called altcoins.

Bitcoin could be thought of as digital gold; the arguments for Bitcoin as a digital asset are made by people like Breedlove above, and in a way more comprehensible by Michael Saylor:

No Title

No Description

Saylor is what we call a Bitcoin Maximalist, so he has no use for any of the altcoins. There is a fierce debate within the crypto community about this exact topic, but for our purposes, it is enough to debunk the idea that blockchain is all the same, that Bitcoin is the same thing as Dogecoin which is the same thing as an NFT which is the same thing as a DAO governance token, and it’s all just a massive tulip mania.

Blockchain As Computing Platform

If Bitcoin is digital gold, then Ethereum (the second most popular cryptocurrency) is something else altogether.

It is important to distinguish between those coins/tokens that are trying to be either assets or currencies, and those that are trying to be a SCP (Smart Contract Platform). Ethereum is the most important of the SCPs but there are dozens of others that are now competing for that.

Quick aside: smart contracts are just pieces of code. Don’t overthink it. They’re basically software programs that execute on a blockchain. We can get into those in depth in the future.

Where the real innovations and the real excitement in blockchain and Web3 worlds are happening is on the SCPs. The idea of creating software in the cloud that relies on an open, transparent blockchain is what is driving all of the energy. Again, you can see the anti-establishment ethos at work, as programmers want to create software that doesn’t rely on Microsoft, on Apple iOS, on Google, or on Amazon AWS. They want to operate in a decentralized, permissionless, trustless environment.

The Killer App of Blockchain

With that context, it is truly important to understand what the core value proposition, the “killer app” if you will, of blockchain technology is.

It is, in a word, decentralization.

Fact is, blockchain technology is slow, unwieldy, and inefficient. To do anything on a public blockchain requires consensus of the majority of the computers that are running a copy of the ledger. That in turn requires a “consensus protocol” that is slow, energy-inefficient, and time-consuming. It is why Bitcoin and Ethereum can never be a global currency as they exist today. (Again, we can get into layer 2 solutions and such later.)

For comparison, Bitcoin can process 7 transactions per second (“TPS”). Ethereum can do 25. Paypal is at 193 TPS and Visa is around 24,000 TPS. For any kind of data-related activity, there is no distributed blockchain-based data storage that is faster or more efficient than a decently built centralized database on MySQL.

So why would anyone want to use a less efficient, slower, and more expensive programming platform?

The only reason to do so is decentralization. The only reason to use the blockchain at all is to get away from being controlled by a few big companies, a government, or a few wealthy individuals.

The other benefits of the blockchain, such as immutability or transparency, can be duplicated. Nothing stops any company from putting all of its data and processing all of the transactions through a private blockchain that is centrally controlled. IBM’s HyperLedger is exactly that kind of a private blockchain, and that can do up to 20,000 TPS.

Big corporations, organizations, and even an MLS (Toronto) is using HyperLedger for their blockchain-based products. And power to them!

But of course, these private blockchains lack the defining value proposition of blockchains: decentralization.

Revisiting, Revising, and Reimagining Blockchain in Real Estate

With the above in mind, I think that there isn’t a single company or organization in real estate that is actually doing blockchain projects.

Propy, whose CEO I interviewed extensively for my investigation, is one of the foremost promoters of blockchain in real estate. It has sold a condo as a NFT, has transparent offer management platforms for real estate agents, and a few other projects besides. But it remains very centralized and looks and acts like a typical real estate technology vendor.

TREB, whose CEO I interviewed, is implementing a blockchain-based solution for its very large MLS. But TREB is using HyperLedger and remains firmly in control over the MLS, over the technology, and over the blockchain. TREB wants to take advantage of some of the benefits, like immutability, without decentralizing.

If the killer app of blockchains is decentralization, then there isn’t a company or organization in real estate as yet who is seeking to do just that. And for good reason.

Real Estate is Deeply, Deeply Centralized

Fact is that the real estate industry is highly centralized. It might be the second most centralized industry after banking, and certainly less transparent than banking is as it is less heavily regulated. For now.

The government remains in firm control over anything to do with property records, through the land and property registry systems. It will not simply give up control over that, and it likely cannot, because to be a government at all means to control a geographic area. To control land.

A mix of the government and big banks control mortgage today. Fannie and Freddie are quasi-governmental organizations, as is the Federal Reserve. Federal agencies, state regulators, and local city councils also have a lot to say about mortgages as well.

Title is centralized, with three big players who aggregate all of the title information from the government, then offer title insurance on that information.

The MLS is centrally controlled at multiple levels, from NAR down to the local Board of Directors.

The transaction is centralized. Think about the rallying cry of NAR and big brokerages and franchises: keeping the agent at the center of the transaction.

The web is centralized. Zillow controls the traffic of the real estate web for all intents and purposes, but even if you try to go outside of Zillow, you run into big companies like Realtor.com, Homes.com, Redfin, not to mention Facebook and Google.

Technology is subject to all of the centralized control, by the MLS, by regulators, by banks, by local, state and federal authorities.

To buy and sell a home today is to get involved in a series of centralized loops of control.

Why We Should Care

To some extent, it is easy to understand why the people in real estate look at bitcoin, crypto, and the whole web3 phenomenon as a joke. It’s easy to see why so many REALTORS think Bitcoin and NFTs are digital Beanie Babies.

If you work in an industry that is as controlled and as centralized as real estate is… the entire idea of decentralized money, decentralized computing, decentralized business is beyond silly. It’s actually insane.

People might trade NFTs and cartoonish “real estate” all day long in their virtual market stalls in the Metaverse… but they still need a physical roof over their physical bodies in the real world. So it’s easy to dismiss all of this blockchain stuff as hype and mania.

So why should any of us in real estate care?

Blockchain Will Eat the World

I believe that blockchain will eventually be the dominant software platform. This is an extension of the famous “Software Will Eat the World” prediction by Marc Andreessen, co-founder of Andreessen Horowitz, one of the most successful VC firms in history.

When Andreessen wrote that essay in 2011, he was speaking of how traditional industry after traditional industry was being disrupted by software companies: Amazon in retail, LinkedIn in recruiting, Netflix in video, etc. He spoke about how agriculture is more and more reliant on software, and even how the soldier of 2011 was enveloped in a “web of software that provides intelligence, communications, logistics and weapons guidance.”

That was in 2011.

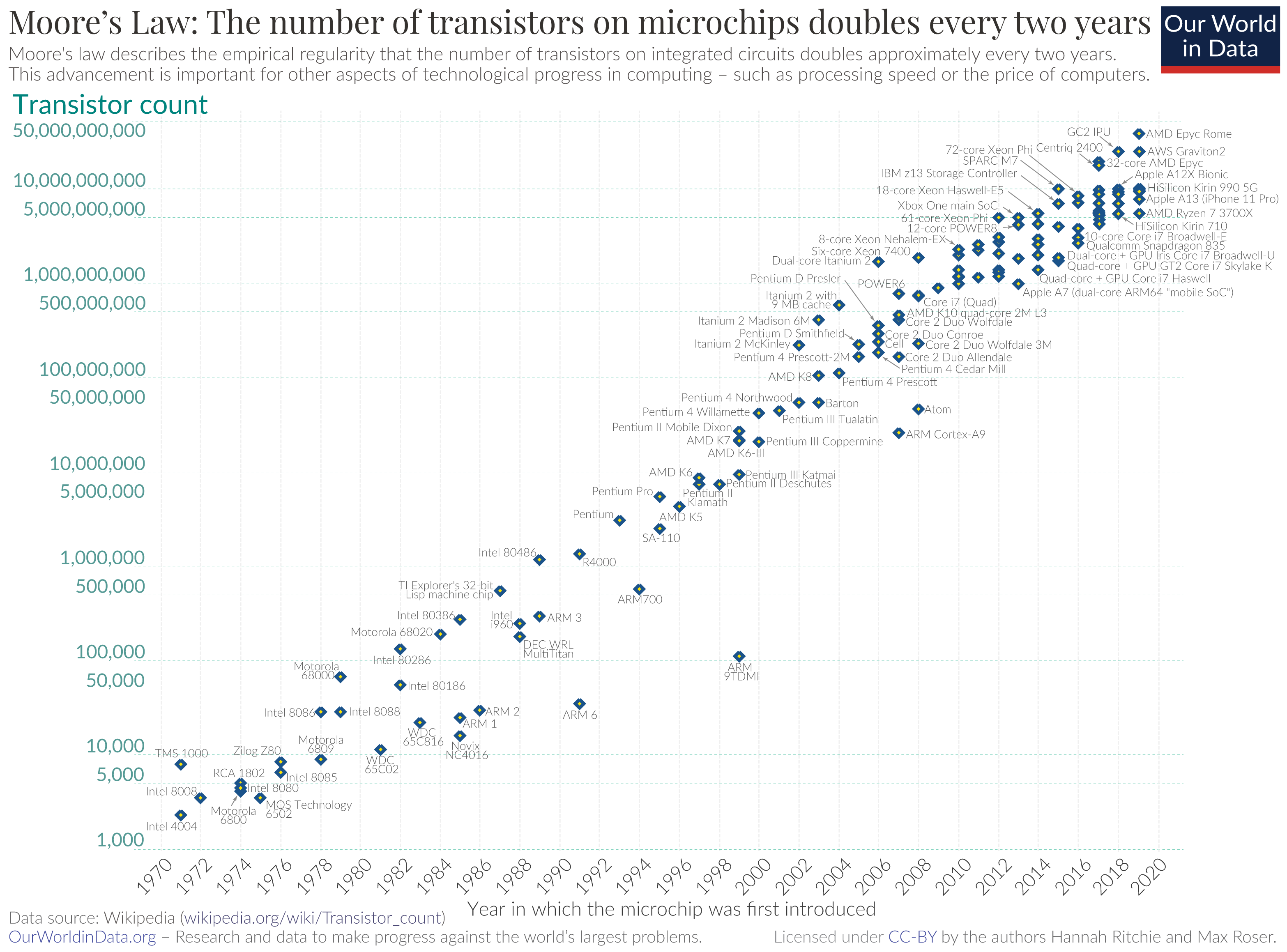

When he wrote that, the most powerful microprocessor had 4.3 million transistors. In 2020, we hit 50 million transistors.

I was alive and an adult and working in 2011. I remember what our computers and cellphones looked and felt like. Because it was a slow evolution, we don’t really think about how much technology has changed until we pause and look back a mere ten years.

I remember the iPhone 4S released in 2011 with an astonishing 8 MP camera, 64 GB of storage, and 512 MB of RAM.

The iPhone 13 Pro in my pocket right now has a 12 MP camera (actually three of them, including a telephoto lens), 512 GB of storage (I chose not to go for 1TB), and 6 GB of RAM. But of course, that’s not the full story since the iPhone 13 Pro is many, many times more capable than the iPhone 4S, has 5G, a brighter, sharper screen, shoots 4K video, and so on and so forth.

That was just ten years.

Blockchain technology is software enabled by the technology of today, and represents the next evolution of software that is still eating the world. We don’t see it yet, because it is still very much in the early stages.

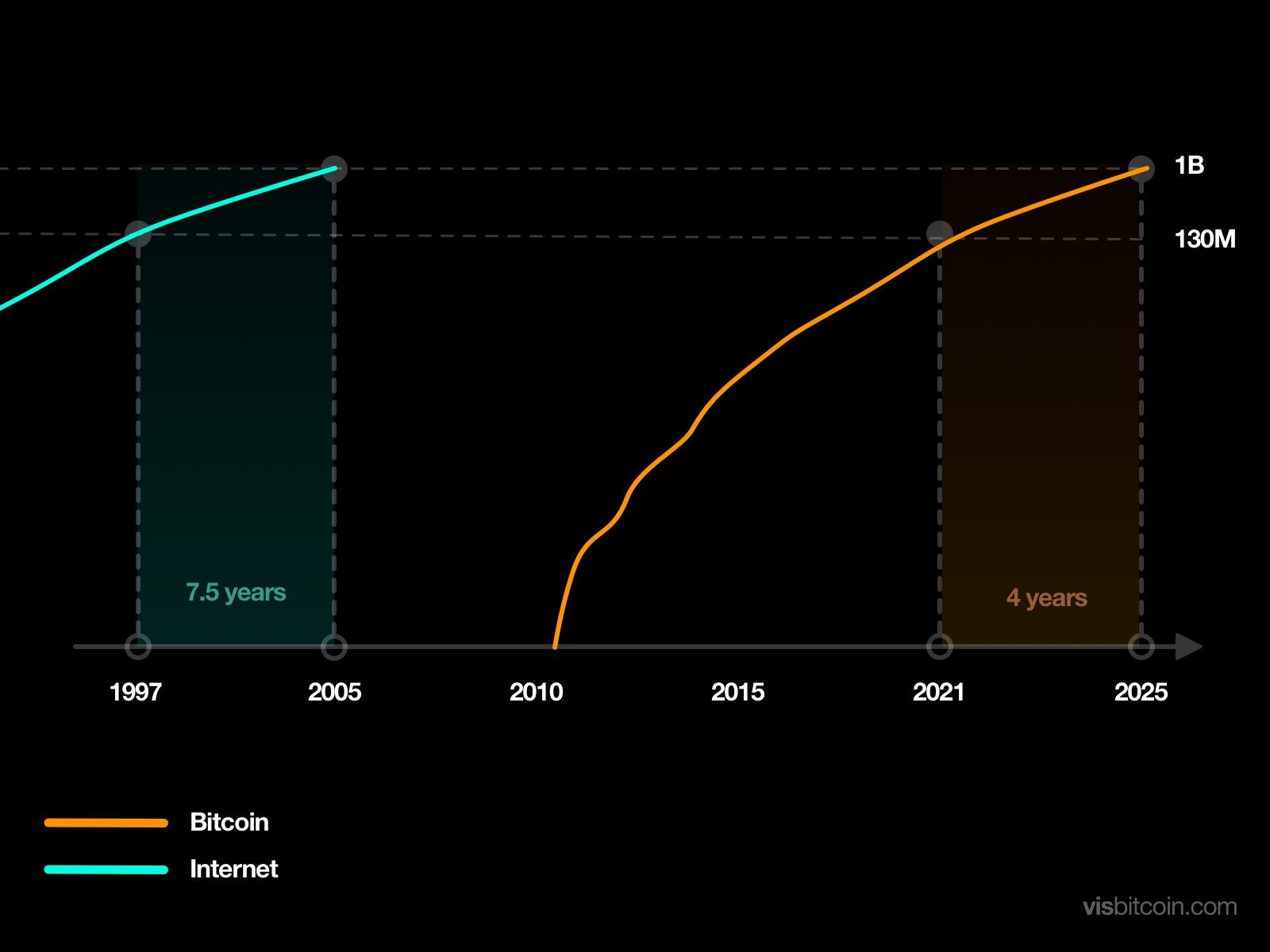

Bitcoin adoption looks like the internet circa 1997, you know, when most people thought this internet thing was a fad… except that it is growing faster than the internet did:

Go spend some time on Reddit, Twitter, Instagram, maybe even TikTok or wherever it is that young people congregate and see what the computer scientists and programmers and coders among them are excited about.

There’s not a lot of energy and excitement from the young computer geniuses about going to work for Facebook or coding the next generation of mainframe software. No, instead, they’re all talking about blockchain, web3, distributed computing, decentralization.

What I believe now is that blockchain technology will continue the software eating the world trend for at least another decade, and profoundly change the world we live in.

It might not be through Bitcoin or Ethereum. But it will be through the technology of decentralized, distributed smart contract platforms, resistant to censorship, and subject to no authority of a single company, government, or a small group of elites.

Canary in the Coal Mine: Finance

Because Bitcoin was the first blockchain, and because most of the energy today in the crypto/blockchain world is focused on finance, I think we will see this play out first and foremost in the world of finance.

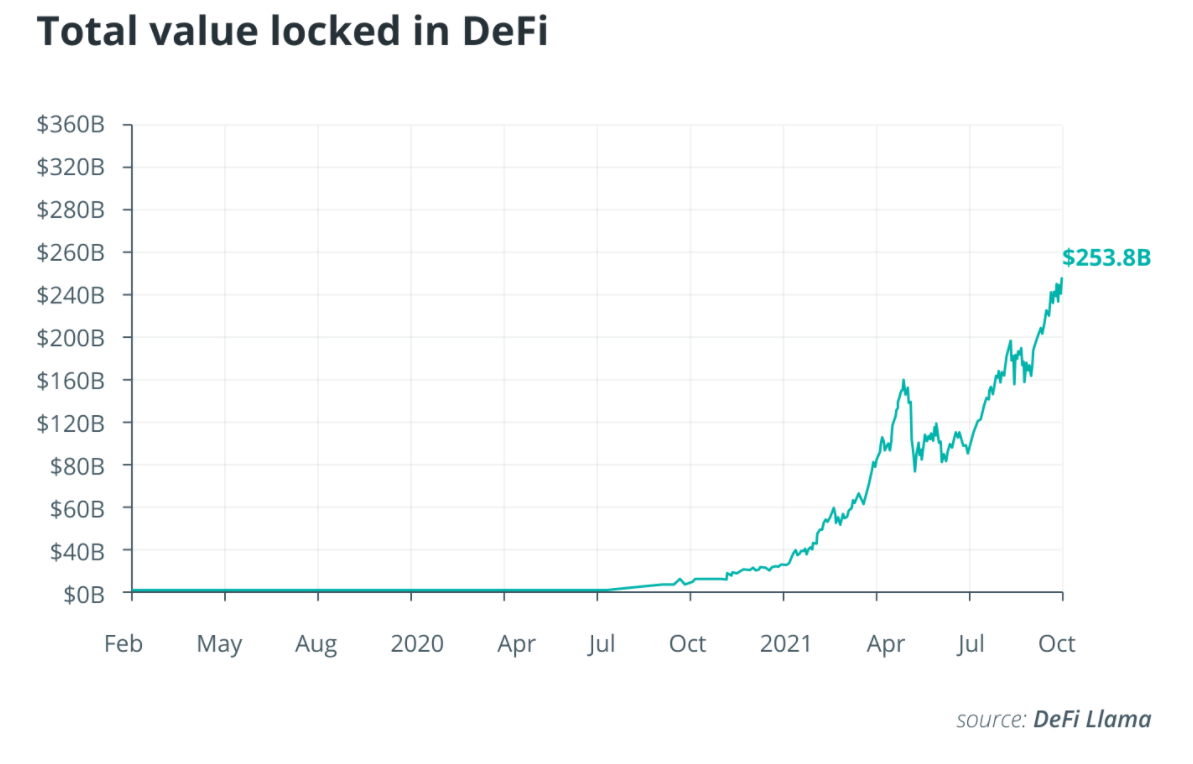

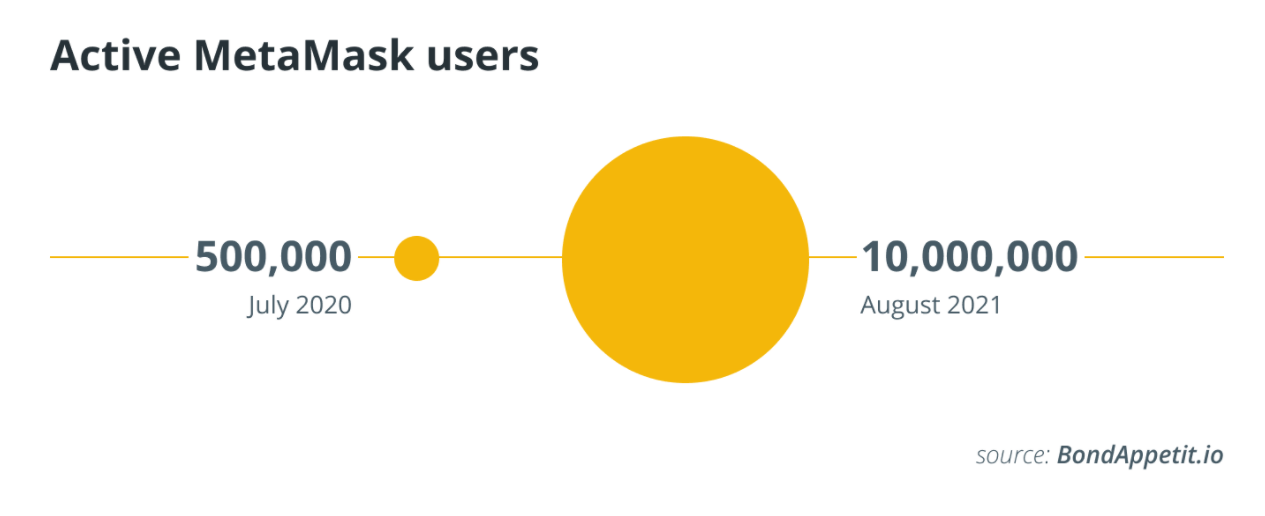

I won’t get too much into detail here, as we are going to spend months and years talking about finance and DeFi (decentralized finance), but suffice to say that DeFi is the hottest topic of discussion and the fastest growing sector in finance already.

One DeFi website thinks that DeFi is only at 0.1% of its potential and could grow 100X its current level over the next 5 years:

It still pales in comparison to traditional finance, but that kind of growth over roughly 18 months is… impressive.

It still pales in comparison to traditional finance, but that kind of growth over roughly 18 months is… impressive.

Remember, Bitcoin today is where the internet was in 1997. DeFi is even earlier in its lifecycle, and its growth is nothing short of exponential:

That’s in just over a year. Project that trend out another year, or three, or five.

Real Estate Is An Extension of Finance

If you think about it, real estate is just an extension of finance.

Yes, in theory, buying and selling a house doesn’t require finance. A cash buyer could just bring huge bags stuffed with $100 bills, and the seller could just hand over title. But in the real world, we know that banking, insurance, derivatives (RMBS? CDS?) etc. are what enables homes to change hands.

There is no scenario where the real estate industry remains as it is today if finance becomes decentralized.

And there is no plausible scenario where finance does not become decentralized over the next decade, if not sooner.

Ergo, there is no plausible scenario where real estate does not become completely disrupted and decentralized.

We may not know what that looks like, and we may not know what the future holds, but we do know that it won’t look anything like what we know today. Everything is subject to change.

And that is why we should care. Because no one — and I mean no one — in real estate is ready for that disruption today.

Take Blockchain Seriously

I don’t really have a point here, other than to say that we as an industry should take blockchain seriously. It’s one thing to dismiss crypto currencies; it’s a whole different thing to dismiss decentralized computing technology. The fact that crypto is driving innovation in blockchain is material, partly because changing money changes everything, and partly because real estate is an extension of finance.

But the killer app of blockchain is not immutability, or transparency, or coins that 100x in a year. The killer app of blockchain is decentralization. That is the important concept to understand and focus on.

If you have any questions or disagreements, please let me know in the comments so others can benefit from the discussion.

-rsh

The Notorious B.I.G. – Things Done Changed (Official Audio)

Official Audio for The Notorious B.I.G. – “Things Done Changed”. The Notorious B.I.G. Ready To Die 25th Anniversary Edition 7-inch boxed set, limited, numbered, with two bonus tracks is available now https://rhino.lnk.to/ReadyToDie25 Subscribe to the channel https://Rhino.lnk.to/YTBiggieSubID Stream or download The Notorious B.I.G.

1 thought on “Blockchain and Real Estate: Revisiting, Revising, Reimagining”

Comments are closed.