Full disclosure: I have had a number of business relationships with HomeSmart in the past, hope to in the future, have spoken and will speak at some of their events, and I am friends with many of the people there. But they are not a client and I am under no confidentiality restrictions with them. I don’t think they know I’m writing this. I am also not an investment advisor, so this is just an opinion on their S-1 from an industry perspective.

ICYMI, the 100% transaction fee brokerage HomeSmart has filed its S-1 to go public. Seeing as how HomeSmart was one of the major sources of my 2018 Red Dot on NextGeneration Brokerage, and a real inspiration to write that paper, I thought it worthwhile to look through the S-1.

I have a few quick observations.

Rapid Growth….

The first observation is that HomeSmart should have done its IPO in 2015 or so. Why?

It is growing rapidly, and that’s really good:

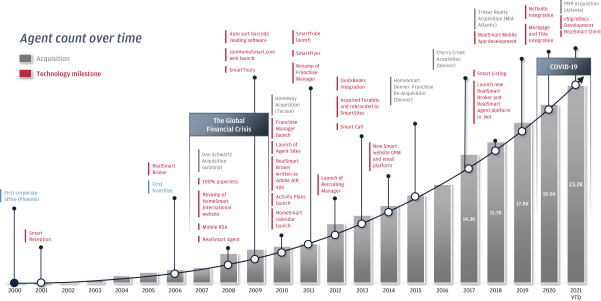

The image is from their S-1 and the size is the size. Hard to see, really. But fact is that HomeSmart has grown robustly over the years. HomeSmart ended 2015 with over 10,000 agents in the U.S. In the S-1, HomeSmart says they ended Q3 of 2021 with over 23,000 between the Brokerage and Franchise businesses. That’s solid growth.

Revenues, Transactions, Sales Volume all grew as well.

Consistently Profitable, But Low Margins

Other than 2021, when it looks like HomeSmart lost money because they spent millions with investment bankers and lawyers and the like to go public, HomeSmart has been consistently profitable.

On the other hand, because of HomeSmart’s business model, its margins can’t help but be low. Over the past seven quarters, we’re seeing 7.27% average quarterly gross profit margins and 1.53% EBITDA margins. Those aren’t… amazing.

Technology and Low Cost

The main narrative is that HomeSmart is a technology brokerage with very low cost for the agent:

HomeSmart is a revolutionary real estate enterprise powered by our proprietary end-to-end technology platform. We provide integrated real estate solutions to agents, brokerages, franchisees and ultimately consumers. Our cloud-based platform empowers our users to succeed by providing a full suite of technology offerings covering every aspect of the real estate transaction. The drive toward a seamless home buying and selling experience is the catalyst for our growth. Technology and automation are at the core of our DNA—grounded in fiscal responsibility and operational excellence. We have been developing our software in-house over the last 20 years and have a 100% adoption rate across our agents. All of our franchisees and agents are automatically added as users and all transactions are processed through our technology platform. Our technology platform is focused on scalability and automation to drive transaction velocity, volume and operating leverage for our brokers, franchisees, agents and consumers.

…

We have built a cost-effective, agent-centric real estate business model powered by our cloud-based, end-to-end platform encompassing all aspects of the residential real estate transaction. Together, our model and platform empower brokers, franchisees and agents with the ability to provide a seamless transaction process for consumers, while providing a flat transaction fee for franchisees and agents. Our RealSmart technology suite includes RealSmart Broker – brokerage and agent management; RealSmart Agent – business and transaction management; and RealSmart Client – buying and selling transaction management; through which franchisees, agents and consumers are connected and are able to conduct all aspects of the real estate process. Our RealSmart platform includes virtual tours, marketing, document management, process (sale, purchase, mortgage, title and escrow) tracking, education and training, listing management and more. Additionally, our RealSmart platform allows data to be aggregated for accurate insights, decision making, real-time reporting, business management and transparency for the consumer. We have used the power of our technology, the structure of our fees and our dedicated customer service team to create a technology-enabled model that drives the success of real estate professionals.

I think what sets HomeSmart apart from most of the others, including say Fathom which is already public, is that it claims 100% adoption rate for its in-house technology platform. That’s quite an accomplishment in real estate.

So by offering agents 100% of the commission, charging them a low transaction-based fee, and then using that growth to drive volume into affiliated businesses (where the profits really are), HomeSmart is painting a picture that’s a bit of a combination of EXPI and Compass.

Understanding the Numbers Better

Thing is this: the Income Statement is a bit of a mis-statement. I’m not saying HomeSmart is doing anything nefarious; I think this is more of a function of accounting and investment bankers advising an approach for IPO purposes. I know there’s nothing nefarious here because HomeSmart makes it very clear in the S-1 what their business model is:

100% commission based. Our primary model minimizes expenses for the agent through our 100% commission, flat transaction fee model. We believe this option provides agents with a greater share of the commission than traditional real estate brokerages, giving them the flexibility to invest back into their own business in the areas they determine are most important.

What means that HomeSmart’s real revenues are not the topline Commission revenues:

We have built a profitable business model with multiple revenue streams. We generate the majority of our revenue from the real estate transactions executed by our corporate-owned brokerages whereby our agents represent consumers buying or selling homes. Real estate commissions, or gross commissions, earned by our real estate brokerage business are recorded as revenue upon the closing of a transaction. In turn, we also recognize the commissions we pay to our real estate agents as commission and other agent-related costs. While part of our value proposition is for our agents to retain 100% commission, we charge various fees to our agents, which is recognized as a reduction to our Commission and other agent-related costs.

Those “various fees” are the actual revenues of HomeSmart. In my rough calculation, that means HomeSmart’s true gross margins are not 7.27% but more like 12.2% and frankly, removing the 2021 year with its heavy spend on professional fees to go public, we’re look at 29% average gross margins throughout 2020.

So I think the better way to understand HomeSmart is to think of it more as a low-revenue, high-margin business. In FY 2020 then, HomeSmart didn’t have revenues of $393 million; it had revenues of $30 million… but its margins were much, much healthier to the tune of 29.5% gross margins and 30% net income profit margins (they had some sizable Other income that year).

Maybe Wall Street needs to be impressed by nine-figure topline revenue numbers, and 20% YOY growth in that number… but with the economy potentially turning, I rather think a business doing 30% margins on rock-steady revenue is an attractive proposition. But hey, I’m no investment advisor; you do what your advisor tells you to do.

Should Have Gone Public Sooner?

I can’t help but feel that HomeSmart should have gone public sooner. Maybe 2015 or 2017 or so.

There is a compelling story here of providing in-house technology, that lets HomeSmart make fat margins on very low cost brokerage services offering to agents, which then leads to a rapidly growing top of funnel to drive profitability in title, escrow, mortgage and insurance. Trouble is, EXPI “went public” in 2018 when they started trading on the NASDAQ. (EXPI was already a public company, but it was on the OTCQB rather than on NASDAQ itself, which is why I think its “real” IPO was in 2018.) And EXPI is blowing the doors off of the rapid growth in agent count story.

And then Fathom, another 100% transaction fee shop, went public in 2020 sucking a bit of the wind out of the “low-cost” story. To make matters a bit more complicated, FTHM is more than 50% off its 52-week high as of this writing, which would make any potential investor in HomeSmart a bit skittish.

I wonder if things would have been different had HomeSmart gone public with its low-cost, high-tech story in 2017 or so. As I wrote in my 2018 Red Dot, these 100% transaction-fee only brokerages are, I think, the next generation of dominant models. And out of all of them, HomeSmart does in fact have the uniquely tech-focused story which it can back up. Raising capital via the public markets to reinvest into technology and growth could be a compelling story.

So I wonder if maybe HomeSmart is a bit late to the party. I hope not for all of my friends over there, and given that real estate will remain sizzling in 2022 (I’m betting), I hope investors will swarm all over the offering. We’ll see what 2022 brings.

-rsh

1 thought on “Quick Observations on HomeSmart’s IPO”

Rob HomeSmart is indeed late to the party.

We transitioned to Fathom from RE/MAX in March of 2021. In the short time we have been here, the in-house technology has improved considerably. We’re on track to launch the next iteration of intelliAgent, which we’re told will be an end-to-end, in-house transaction management platform complete with CRM and lead capture. While our transaction fee has gone up from $450 to $500, the stock incentives have improved so there’s been very little pushback.

I owe you a great deal of thanks for turning me on to Fathom. I had no idea they existed before becoming a Notorious subscriber.

Comments are closed.