I spent Sunday morning cleaning up some crap in my office. I threw out a bunch of old papers, crap I didn’t even know I had (how does this stuff just accumulate?), and then listed a couple of things on Ebay that I couldn’t bring myself to throw out. (If you need a cheap 1080p HD webcam, look here.) Those were items I didn’t need anymore, but they work perfectly fine, and someone somewhere probably could use them. So I put them up for auction.

That reminded me of this conversation with Jim Klinge of Bubbleinfo.com, a broker and agent in San Diego area. Watch the whole thing if you haven’t seen it yet:

Notorious POD Ep. 33: End of Buyer Agency with Jim Klinge, Bubbleinfo.com

In this episode, I chat with Jim Klinge of Bubbleinfo.com about his prediction that the end of buyer agency is nigh *without* government action. Jim has been a real estate broker in the San Diego area for decades and has seen the industry change from the ground up.

One of Jim’s biggest points is that the market is naturally leading to more and more pocket listings and off-market activity. Most agents are using the Office Exclusive exemption to the Clear Cooperation Policy, but I suspect that more than a few people are simply starting to ignore CCP altogether.

Towards the 30 minute mark of the conversation, Jim says, “All we need to do is to go to an auction format. That’ll solve every problem that is wrong with real estate.”

Obviously, my putting items on Ebay brought that comment back to mind. So let’s think about that together.

Pocket Listings Are More Prevalent

First, I don’t think I need to prove this with most of you, since most of you are from the real estate industry, but… as Jim said, off-market and pocket listings have exploded since the start of the pandemic. Like every other trend, COVID accelerated existing trends by orders of magnitude.

Just in case, for the non-industry readers, here’s the New York Times from 2021 directly addressing the issue of pocket listings:

Pocket listings, the practice of brokers selling a home through private networks rather than on the open market, have skyrocketed during the pandemic. One analysis from Redfin put the increase at 67 percent, and in some markets, it’s estimated that as many as 20 percent of all listings are now available only to buyers with the connections to hear about them in the first place.

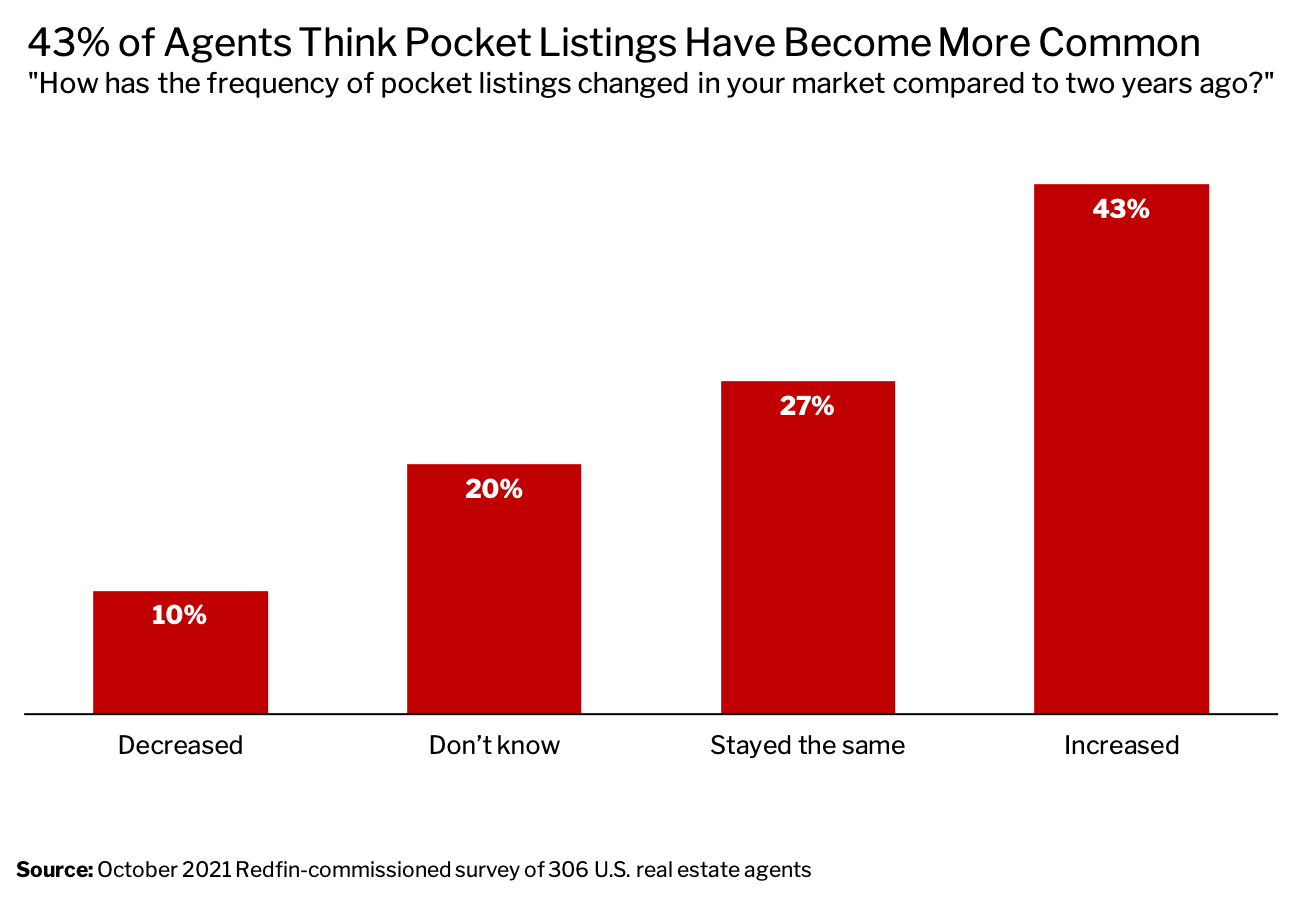

And here’s Redfin updating the analysis in December of last year. That post notes how almost half of the real estate agents think pocket listings are more common now:

Redfin also provides some stats, showing that pocket listings and off-market activities are down slightly from earlier in the year, but up overall from 2020 and pre-pandemic levels:

In the third quarter, 2.3% of homes listed were marked sold or pending on the same day. That’s down from a peak of 3.2% at the start of 2021, but still higher than the 2.1% level we saw in the third quarter of 2020 and the 1.5% level in the third quarter of 2019. Redfin’s same-day sales data goes back to the first quarter of 2012.

…

The share of homes that sold without being listed on the MLS—another measure of potential pocket listings—also fell in the third quarter. It dropped to 21.4% from a peak of 23.9% at the start of the year. Still, that’s higher than the 20.4% level we saw in the third quarter of 2020 and the 21% level in the third quarter of 2019. Redfin’s off-MLS sales data goes back to the first quarter of 2012.

The shocker though is the Metro Level Summary that Redfin provides. I won’t embed the whole thing, so go read the post on Redfin’s blog. But some standouts:

- Allentown, PA: 1.3% Same Day Sold and 29.1% Never Listed. So almost a third of homes sold in Allentown were pocket listings.

- Birmingham, AL: 1.5% Same Day Sold and 26.5% Never Listed.

- Knoxville, TN: 0.8% Same Day Sold and 24.4% Never Listed

- Jacksonville, FL: 4.0% Same Day Sold and 20.3% Never Listed

It goes on and on.

Controversial, But Doesn’t Matter

Obviously, we all know just how controversial pocket listings have been in the industry, continue to be, and will be. As the New York Times points out (quoting people like Glenn Kelman of Redfin), these private listings might violate fair housing, certainly hurts industry cohesion, screws buyer agents who aren’t “in the know”, and penalizes smaller brokerages. We all know this.

We know that NAR passed CCP specifically to deal with this growing problem. Doesn’t much matter. From the New York Times story:

Not all brokers agree that pocket listings represent unfair competition or are damaging to minority groups.

“I let all my agents know that as long as you’re not advertising the property to the public, you’re good to go,” said Sharelle Rosado, a broker in Tampa. At her brokerage Allure Realty, she said the use of pocket listings has increased 40 percent since the start of the pandemic. She leans on connections with both sellers and developers to build her pipeline of potential off-market sales. They are particularly helpful, she said, when working with high-income buyers looking for homes in the $10 million range, where inventory has always been tight.

“A lot of people are not for pocket listings, but it helps our clients, and it’s beneficial to both sides,” she said. “And I don’t have to split the commission.”

Pocket listings can appeal to sellers because they allow for home transactions without multiple showings, and the specter of strangers marching through their rooms. Many brokers tell their clients that pocket listing a home is a good way to test the market before officially setting its price. [Emphasis added.]

I added the highlights, because those lead to what we want to think about here. But the evidence is now in, I think, that real estate brokers and agents don’t much care what NAR decrees. They’re finding ways around it, most prominently the Office Exclusive loophole. I specifically called that out in my 2019 post urging NAR to close the loophole:

As currently written, Policy 8.0 sucks for consumers, sucks for small brokerages, and sucks for the MLS. The outcome will be the exact opposite of what proponents of Policy 8.0 want. Instead of ending fragmentation and dark pools of information, Policy 8.0 will end up fracturing the market further, decrease the inventory in the MLS instead of increasing it, and force the MLS into impossible enforcement conundrums. It has to be changed.

Well, last week, I spoke to a friend who is a very large broker. He’s no fan of NAR’s Clear Cooperation Policy, but he’s also not an idiot. He recruited over 25 highly productive agents in the past few months because he’s the largest broker in his market, and he can use the Office Exclusive loophole to recruit them. Yes, that screws the smaller brokers whose private/internal networks cannot be as large. As he put it, he didn’t make the rules, but he’d be a fool not to use what NAR handed him. Jim Klinge in the video above mentioned how he’s now a Compass agent, after having been a small independent for years, because he’s also not a fool.

And where brokers and agents don’t take advantage of the giant loophole, they’re simply ignoring NAR. New York Times quotes someone who ought to know:

“Since the pandemic, real estate professionals have found ways around the policy,” said Matt Lavinder, president of New Again Houses, a home-flipping company. Brokers are using WhatsApp, Discord and Telegram chats to privately share listings as well, he said. “This has become a secondary market.”

The president of a home-flipping company buys far more houses than the average family; he’s likely plugged in, and gets access to the private networks of brokers and agents. He ought to know.

Maybe all of those agents using WhatsApp, Discord and Telegram are being compliant, by adhering to the “one business day” exemption. But if they’re not… we run right into the difficulty of enforcement. From my earlier post:

Enforcing some of the provisions is going to prove tricky at best, and require litigation at worst.

For an example of the former, I wonder how exactly an MLS is going to monitor email between an agent and her database of clients and potential clients to determine whether that email is public marketing or private one-to-one communication. Is the MLS to create fake “secret shopper” accounts to monitor emails? Demand random access to an agents private email account to periodic audits? Use secret surveillance technology?

That was with email. Now do Discord and Telegram. Now do that when you’re a 600-person MLS with a CEO and one part-time admin.

NAR could lecture its members all it wants. The MLS can threaten all it wants. Maybe the Feds can get involved directly, prohibiting private listings in the name of Fair Housing and racism.

The market is smarter than any organization, any government, any authority. Buyers and sellers and their agents will figure out a way around all of these decrees. Push comes to shove, they’ll ignore the decrees and dare the authorities to enforce their will.

Could Pocket Listings Be the Future?

In my presentations, I like to point out that if the FTC, the DOJ or the private anti-trust civil lawsuits going on right now have their way, mandatory offers of compensation will not be long for this world.

As Sharelle Rosado, the broker quoted in the New York Times story, made clear, not sharing commissions is a big motivation behind the rise of pocket listings. Well, that might happen across the board. Now what?

Well, the world without compensation looks a whole lot like commercial real estate, where pocket listings are not the exception, but the norm. Fair Housing will be an issue, of course, but… pocket listings would just be the norm rather than the exception.

Auctions As the Solution

Would auctions be the solution, as Jim Klinge suggests? No one actually knows of course, but I think it could be.

The seller’s motivation for agreeing to pocket listings is (a) privacy, (b) fewer strangers marching through their homes, and (c) testing the market.

The privacy thing really only applies to a tiny, tiny fragment of sellers. We’re talking about celebrities or the uber-wealthy, basically. If you have not appeared on the cover of a magazine or a supermarket “newspaper” in the last five years or so, then chances are that nobody cares that you have listed your home for sale. If you have fewer than 100,000 followers on Twitter or Instagram, I think you can relax with that whole, “I don’t want the unwashed masses to know I’m selling” thing.

Having fewer strangers marching through your home can be accomplished even in an auction context, since (1) a seller could require far higher qualifications to tour the home than to bid on it, (2) a seller could authorize tours only for top 3 or top 5 bidders, and (3) a seller could just slap a Buy It Now price on the home and reduce the walking through to a single seller. Don’t forget that a real estate transaction isn’t done just because a sale contract is signed; it’s only done when the closing happens and the exchange of keys for funds is completed.

That leaves testing the market. Here’s where the auction truly shines. It completely eliminates the need to test the market at all. In an open, transparent auction, the market will tell you with 100% certainty what the price of the home is. The listing agent doesn’t need to work arcane magic to try and figure out a listing price; just pull a reasonable CMA, set the reserve price (or not), and start the bidding at $1. The buyers will bid that to the market clearing price, as buyers do in every single open auction market in existence.

If you eliminate the seller’s motivations to do pocket listings — except in the rarest of rare circumstances — then that gets rid of the excuse proffered by agents who want to do pocket listings for the client’s benefit. Pocket listings then go back to being used only in special circumstances that truly warrant the practice.

Fair Housing and Auctions

It is also a major advantage that open auctions eliminate any fair housing concerns, since the property is actually on the market for everyone to see and to bid on. Everyone can see the winning bid. There are zero questions as to which buyer agent is friends with the listing agent, zero questions as to whether “buyer love letters” violate fair housing or not, and zero questions as to whether the seller chose an offer from the Smith family over an offer from the Abdulrahim family.

If you didn’t get the house, it isn’t because you’re black, or gay, or Muslim or a conservative. It’s because you didn’t bid high enough.

Sure, you can still point to generational gaps in wealth and homeownership, problems with mortgage, etc. but you can’t point to real estate brokers and agents manipulating the market to shut you out. The auction market is open, transparent, and only cares about numbers.

Benefits the Agent

I also see how going to an open auction ends up benefitting both the listing agent and the buyer agent.

The listing agent benefits from not having to do complicated listing price strategies, from not having to sort through dozens upon dozens of offers, presenting offers, making counteroffers, and accepting offers. All of that is taken care of by the market.

Perhaps more importantly, the listing agent doesn’t have to have some of the weird and painful conversations with the seller. “We need to reduce the list price” conversation is not something most listing agents love to have. With an auction, maybe you have the “We need to reduce the reserve price” conversation, but at least there are actual bids on the property you can point to. That’s not your opinion, which the seller might look at with suspicion, but the market telling your seller loud and clear what it thinks the home is worth. The listing agent never has to have the seller wonder if she pushed him into an off-market arrangement for some reason other than the one provided. And the client never has to wonder if he should have kept the house on the market for another week or two instead of taking the “highest and best” after three days of showings; the market will tell him loud and clear that he is in fact getting the highest and best offer, especially if he puts in anti-sniping rules (extends the auction if a bid comes in during the closing minutes).

The buyer agent also benefits, especially if compensation goes bye-bye. The buyer will still need and want advice on how much to bid on a house, and many will willingly pay for that. Even if there is cooperating compensation involved, the buyer has far less reason to wonder about his agent’s loyalty when he’s the one pushing the Bid button to beat the current highest bid, instead of his agent telling him to go $50,000 over list price on an offer. There are no offers to write up, so that saves hours and hours of work, followed by calling the listing agent to find out if the offer has been submitted, to see if there are counteroffers, and so on. Since pocket listings should go way down, buyer agents don’t have to freak out about having to tell their clients that they’re plugged into some super secret cache of off-market listings.

And both listing and buyer agents still have a ton of negotiation and transaction management work after the winning bid is accepted, and the post-contract work begins. They still add value in bringing that transaction to a close.

Right now, I’m not seeing much of a downside for real estate brokers and agents by moving the transaction to an open auction system. If you do, let me know.

Auctions: Fair… and Sometimes Harsh

Let me wrap up by noting that while I was writing this post, I got a bid on that webcam. For $13. A year ago, you couldn’t find Logitech webcams for under $130. I might have paid $150 for it, and the webcam still works perfectly.

Doesn’t matter. The market is sometimes harsh, but in an auction system, I can’t question the fairness. If the market says my webcam is now worth $13, then it’s worth $13. Period, end of story. And no agent had to tell me that my webcam is an ugly baby, making me resent her; the market told me that in no uncertain terms.

By the same token, maybe I’ll list some Magic: The Gathering playing card, and find the market say it’s worth thousands of dollars. Doesn’t matter that I got the card out of a $1.95 booster pack in 1998, and it’s just a piece of cardboard. It’s worth what the market says it’s worth.

We could use that beautiful, sometimes harsh and sometimes generous, and always fair mechanic in the real estate market. I think it benefits brokers, agents, buyers and sellers. It largely avoids most fair housing issues. Seems like a win to me.

-rsh

John Michael Montgomery – Sold (The Grundy County Auction Incident) (Official Music Video)

Official music video for John Michael Montgomery – “Sold (The Grundy County Auction Incident)” originally released from his self-titled album (Atlantic – 1995) Listen to John Michael Montgomery’s full discography here: https://JohnMichaelMontgomery.lnk.to/discography John Michael Montgomery has turned an uncanny ability to relate to fans into one of country music’s most storied careers.