I have to go back to work on a number of projects, but… I had to puzzle this out with you all in public.

The latest Redfin report on the housing market is… weird. The headline is “mortgage payments hit all time high” as the Fed keeps hiking rates. So the recommendation is for sellers to get realistic about pricing. This is very true, of course, but there are some details that raise questions.

First, you have leading indicators:

- Fewer people searched for “homes for sale” on Google. Searches during the week ending September 24 were down 33% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other home-buying services from Redfin agents—was down 13% year over year and fell below the level at the same time in 2020.

- Touring activity as of September 25 was down 18% from the start of the year, compared to an 8% increase at the same time last year, according to home tour technology company ShowingTime.

- Mortgage purchase applications were down 0.4% week over week, seasonally adjusted, and were down 29% from a year earlier during the week ending September 23.

Then you have lagging (aka, data from the past 4 weeks) indicators:

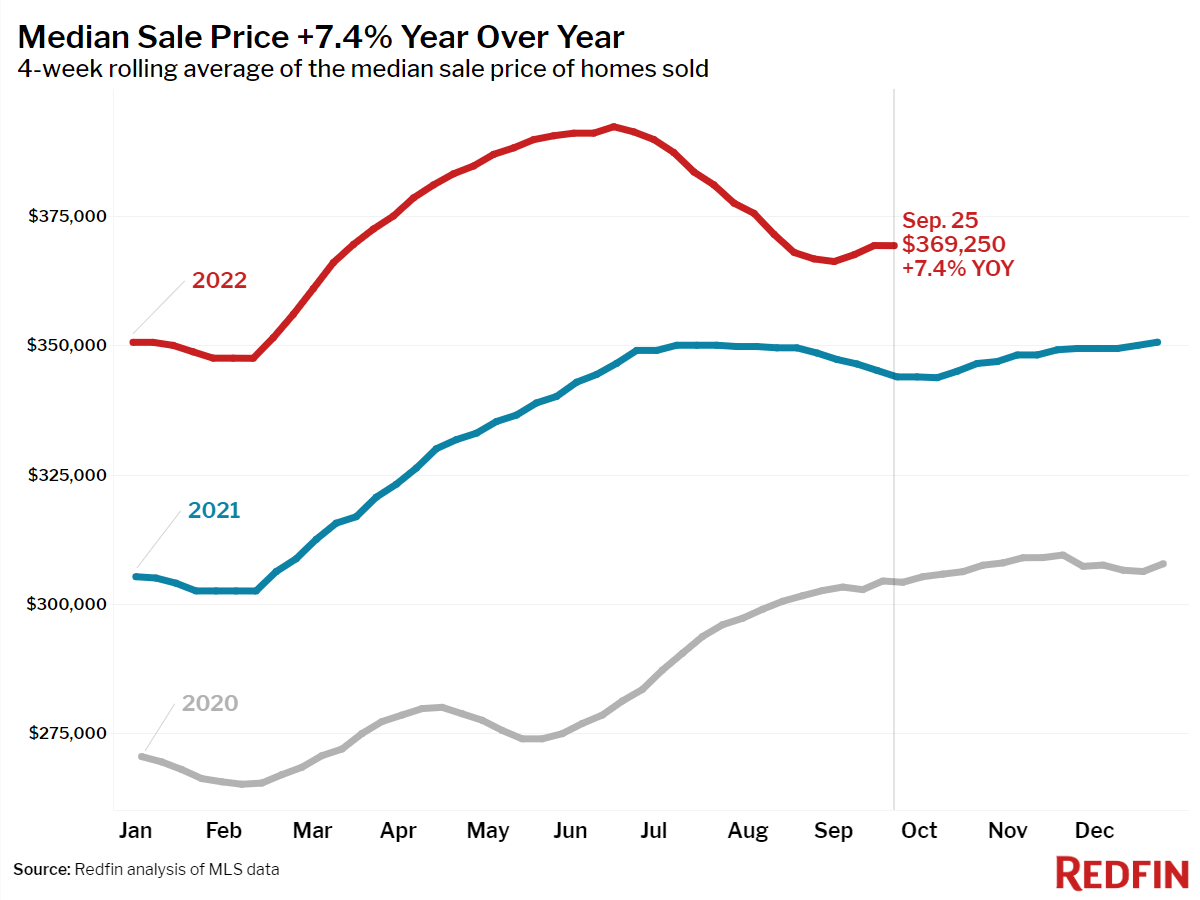

- The median home sale price was $369,250, up 7% year over year. Prices have climbed 1% since the beginning of the month, after 11 weeks of declines.

- The median asking price of newly listed homes increased 10% year over year to $384,750.

- Pending home sales were down 21% year over year, the largest decline since May 2020.

- New listings of homes for sale were down 14% from a year earlier.

- Active listings (the number of homes listed for sale at any point during the period) fell 0.8% from the prior four-week period. On a year-over-year basis, they rose 6%.

- Months of supply—a measure of the balance between supply and demand, calculated by dividing the number of active listings by closed sales—increased to 3.0 months, the highest level since July 2020.

- 35% of homes that went under contract had an accepted offer within the first two weeks on the market, little changed from the prior four-week period but down from 40% a year earlier.

- 24% of homes that went under contract had an accepted offer within one week of hitting the market, little changed from the prior four-week period but down from 28% a year earlier.

- Homes that sold were on the market for a median of 31 days, up a full week from 24 days a year earlier and the record low of 17 days set in May and early June.

- 32% of homes sold above list price, down from 46% a year earlier and the lowest level since February 2021.

- On average, a record high 7.6% of homes for sale each week had a price drop, up from 3.8% a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, fell to 99.2% from 100.8% a year earlier. This was the lowest level since February 2021.

So all of the leading and lagging indicators suggest a housing market in freefall, right? Except one:

I guess the only “good” news here is that 7.4% YOY is below the 8.3% CPI in September so in real terms, home prices are falling. But we’re still talking about median home prices at $370K. And still up over the crazy housing market of 2021.

Plus, new listings are down 14% YOY, while those who are selling are getting homes sold in 2 weeks 35% of the time and in 4 weeks 24% of the time, and 32% of the sales were still over asking. Yes, all three are down YOY; comparing them to the insanity that was 2021 is useful but I’m not sure it tells us a whole lot about what’s happening in the market.

At the same time, the rental market is weakening:

Jay Parsons on Twitter: “The rental market of 2022 looks nothing like 2021.With Q3 almost in the books, the preliminary numbers for apartment demand look wayyyyyy weaker than expected.We’ll release final numbers next week, but this could be the downside scenario we warned about earlier this summer… / Twitter”

The rental market of 2022 looks nothing like 2021.With Q3 almost in the books, the preliminary numbers for apartment demand look wayyyyyy weaker than expected.We’ll release final numbers next week, but this could be the downside scenario we warned about earlier this summer…

Jay Parsons has been a rich fount of data and information about the rental market, and he’s saying that demand for apartments and rentals generally is softening because consumers are out of money and worried about losing their jobs.

Plus, he wrote this RealSure article disputing the idea that higher mortgage rates do not mean increased rental demand:

Let’s walk through these factors in a little more detail, starting with some myth busting. There is no evidence of an inverse relationship between demand for rentals and for-sale homes. They don’t really compete with one another in real life. Demand for all types of housing tends to ebb and flow together. All housing feeds off the same core demographic and economic drivers.

Low mortgage rates in 2020-2021 certainly didn’t weaken demand for rentals. So why would high rates boost demand for rentals in 2022? And inflated home sales in the mid-2000s housing bubble didn’t slow down rental demand, either. Why would slower home sales boost rental demand?

Yes, some renters will stay in place longer because home purchase is less accessible. That boosts retention somewhat, but it doesn’t create additional renters – and the underlying driver behind higher rates (inflation) could actually reduce household formation, which feeds housing demand.

Okay, that makes sense too.

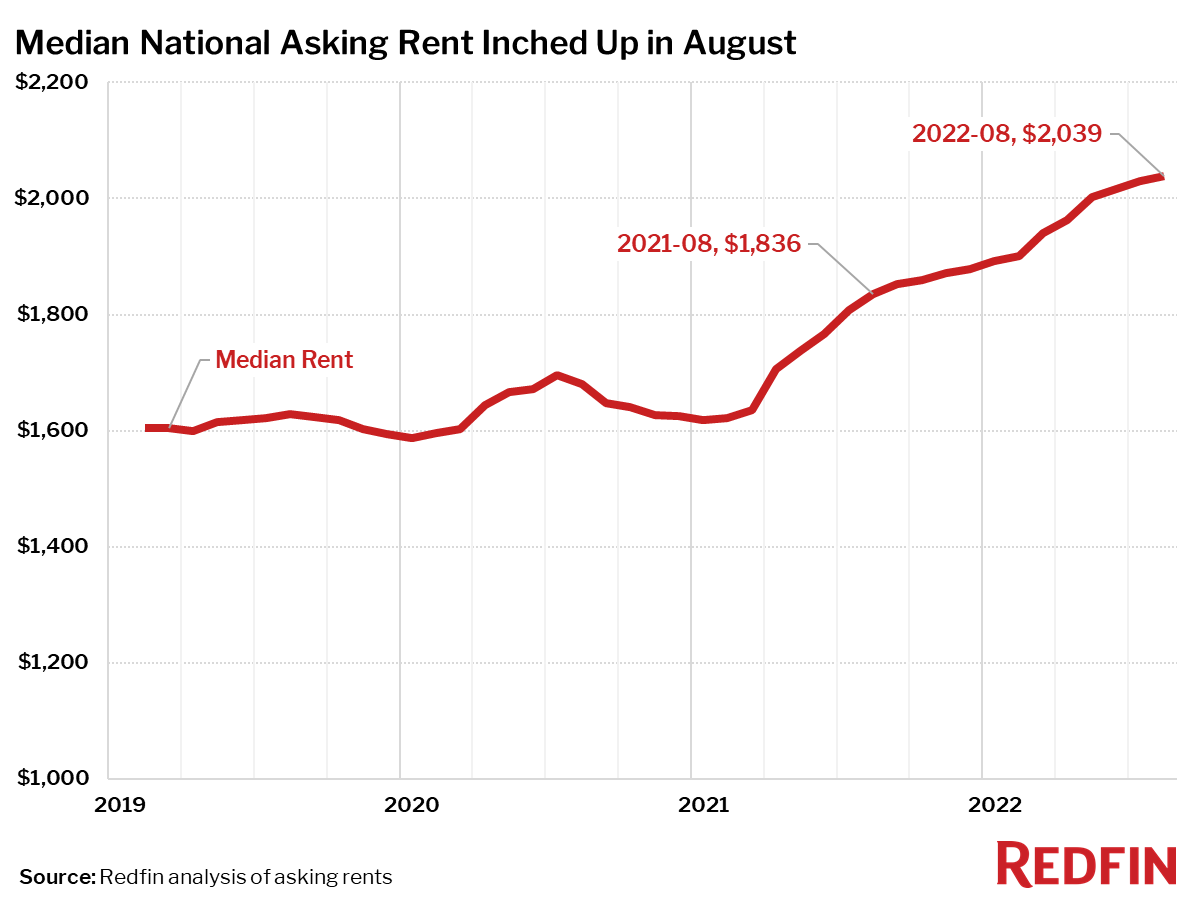

Thing is… while new renter demand appears to be slacking, actual rents are rising. The headline today is that rents have declined for the first time in two years:

One-bedroom median apartment rent is on the decline in several markets for the first time in many months.

More than half the cities on Zumper’s list show month-over-month decreases in median one-bedroom rent.

Except that tiny decrease (like 0.1% month over month) is small comfort to most people who are looking to rent, since rents have spiked sharply over the past two years:

If median rent went from $1,600 a month to $2,039, then September saw it drop to $2,019… I don’t quite know we can say that good times are here for renters and landlords are screwed.

What doesn’t make sense, what I’m trying to understand, is where all these people are living.

Van Down By the River Is Not an Option

The data says buyer demand has been crushed. The data suggests that rental demand is getting soft. Okay, so… like, where are people living?

Housing isn’t an NFT. It’s not a luxury handbag. It isn’t an optional purchase. Housing, like food and energy, is a necessary good for survival. The only options for having a roof over your head is to buy a place, or to rent a place. I honestly do not think squatting in empty abandoned crack dens is a viable housing strategy. So where are these no-longer-buying and no-longer-renting people actually laying their heads at night?

The statement from Jay Parsons that some renters will stay in place longer suggests that “rental demand” might mean only new rental demand: new applications, as opposed to renewals. So maybe that’s one answer: more people will just choose to stay in their current rented place, rather than moving to a better apartment/house or buying one. So retention will be up.

But landlords can raise rents at lease renewal as well, which is the horror story we’ve all been hearing for a while now. “My landlord doubled my rent! I have to move now!” is a common theme out of places like Austin and New York.

Okay, so where are those people going? They can’t buy, they can’t rent… van down by the river is not an option… so… what’s up?

Young single people can move back in with Mom and Dad, I suppose, but a young family is going to find that to be quite a hardship. So where are these people living?

Do Sellers Have to Reduce the Price?

The other mystery is who in the world is selling into this market today. The short answer is, “Those who have no choice but to sell.” Think deaths and divorces. I’m guessing those sellers don’t really care all that much about reducing price to get the damn thing sold. Everybody else?

I think that’s what the 14% decline in new listings suggests. If you don’t have to sell, if you’re worried about your job, and you were hoping to move up to a bigger, nicer home… those plans have been skotched.

The group I am most curious about are the longtime owners, who perhaps have owned their home for 10-15-20 years, and are looking to maybe downsize or retire to sunnier climes. They have massive amounts of equity — 40% of all homes in the U.S. are owned free and clear. They can afford to sell the house at $400K instead of $500K, because they bought the place in 1995 for $100K. However… why sell?

If they bought it for $100K, and rents keep rising… why not rent it out at “below-market” and use that money to move into whatever they’re looking to do next? Those people could undercut every investor landlord who needs to get $2,000 a month in rent to make the numbers works, because they can make the numbers work at $1,000 a month. Wait a couple of years for the Fed to start easing again, then sell. Why not?

No Answers, Just Mysteries

Anyhow, that’s it for now. I don’t have any data or any answers to my own questions. But I am puzzled by this housing market, quite a bit. I could understand buyer demand getting crushed leading to rental demand; but if rental demand is also falling, then the mystery deepens.

Where are people living?

-rsh

P.S.: Back to back Wu-Tang is not a bad thing.

Wu-Tang Clan – Da Mystery Of Chessboxin’ (Official HD Video)

Official HD Video for “Da Mystery Of Chessboxin'” by Wu-Tang Clan Listen to Wu-Tang Clan: https://Wu-TangClan.lnk.to/listenYD Watch more videos by Wu-Tang Clan: https://Wu-TangClan.lnk.to/listenYD/youtube Subscribe to the official Wu-Tang Clan YouTube channel: https://Wu-TangClan.lnk.to/subscribe_YD Follow Wu-Tang Clan Facebook: https://Wu-TangClan.lnk.to/followFI Instagram: https://Wu-TangClan.lnk.to/followII Twitter: https://Wu-TangClan.lnk.to/followTI Website: https://Wu-TangClan.lnk.to/followWI Spotify: https://Wu-TangClan.lnk.to/followSI YouTube: https://Wu-TangClan.lnk.to/subscribe_YD Lyrics: My peoples, are you with me?