I’ve been thinking about this topic for a few years now, but felt motivated to write on it after reading Ryan Gorman’s Medium post announcing what he’s working on now with btcRE. Gorman as the former CEO of Coldwell Banker understands real estate better than most people, and yet… there was something I felt was missing in his analysis of the causes. Here’s what Gorman wrote:

For those of limited means, an inability to fund minor repairs while they remain minor often leads to major health and safety risks and even foreclosure or eviction. Inefficient construction drives up energy bills and adds to climate chaos. Unbalanced transportation infrastructure investments create a cost chasm between home and work, school, or services. Too many choose monthly between rent and groceries… or medicine.

Barriers between housing needs and availability grow daily. Common sense approaches have been rendered impractical — as the places we love most are now illegal or infeasible to recreate — and the negative consequences are far-reaching. New approaches are needed.

We at btcRE are excited to bring expertise in site redevelopment, transactional complexity, legislative and regulatory work, coaching and mentoring, stakeholder conflict resolution, and community collaboration to bear on such a massive — and massively important — challenge.

We will redevelop properties to create housing that is affordable in every respect, including access to efficient energy, transportation, and even grocery alternatives. We will accept advisory appointments, investment opportunities, and even speaking engagements with housing organizations that share our values to forward the mission. We will be vocal and relentless advocates for logical policy improvements that transcend politics to deliver on the promise of shelter for all.

He’s not wrong about any of this. He is 100% correct. And I’m excited to see him take the lead on advocating for logical policy improvements.

So why this post?

Because underlying Gorman’s view is the narrative of enormous demand chasing insufficient supply. We did not and do not build enough housing because of bad policies, lack of access to efficient energy, transportation, groceries, etc. etc. If we can build more houses, then prices will drop and housing will be affordable once again. That’s the supply and demand narrative.

What if that’s wrong? What if the problem of affordability has nothing to do with supply and demand?

Economica on Twitter

I say this because there have been and still are a few voices in the financial analysis/economics spheres who disagree that housing affordability is because of a mismatch between supply and demand. To be sure, these voices are in the minority. The bulk of opinions in the housing and real estate economics more or less mirrors NAR’s position: we did not build enough houses for years, and therefore home prices have skyrocketed.

One such minority opinion I saw recently is from an account called @Economica, operated by someone named C. Hamilton. Other than the fact that he lives in Oregon, there’s not a lot about him in the bio section or whatever. But he put out a tweet thread recently, which he then backed up with additional material, that suggests there is no supply-demand problem with housing.

Here’s the tweet:

CH on Twitter: “Total housing units (millions, black line) vs 25-54yr/old population (millions, blue line), and 25-54yr/old employees (millions, green line). pic.twitter.com/bX1mFze45R / Twitter”

Total housing units (millions, black line) vs 25-54yr/old population (millions, blue line), and 25-54yr/old employees (millions, green line). pic.twitter.com/bX1mFze45R

What this data suggests… nay, shows… is that we built more than enough houses from 1975 onward. There has not been “underbuilding” relative to population.

Maybe the second graph understates the problem since there are millions of Americans 55 and over. Fine. But the top graph still shows that we have more housing units than ever, and that we have more housing units per capita in 23 years. Plus, those who are 55+ are not suffering from housing affordability crisis; many of them have already paid off their houses. If they’re buying a new house, it’s to retire in… and they have all of the equity from their current home to afford what they want.

Housing affordability hits the working-age population, particularly young people who are having things like job relocations, babies, and so on happen to them. Not a lot of 51 year olds are having babies and needing to move to a bigger house, y’all.

One response thought maybe it’s a “geographic mismatch” — meaning, national data is not that useful because people are moving to cities and areas with jobs. Economica’s response:

Since YE ’19…

- South +2.2million housing units vs +867k employees

- West +1 million housing units vs +200k employees

- Northeast +500k housing units vs -764k employees

- Midwest +300k housing units vs -590k employees

It makes little sense that there would be such a drastic supply-demand mismatch in the Northeast for example when 764K jobs were lost (or those workers moved elsewhere) while 500K new housing units were built. Even the redhot South has far more housing units that were built vs. how many new jobs (and therefore new people relocating for those jobs) were created.

Demographics, or The Era of Lonely Singles

One argument made by @BGradeNate is that there actually is a supply-demand problem because what a “family” or a “household” means today is very different from what it meant in the 70s or even in the 00s. This tweet encapsulates the point, I think:

BGradeNate on Twitter: “Divorce of course contributed to this trend as a family defined by 2 can include parent and child, the other gene contributor still has to live somewhere. Marriage rates are down, and divorce is declining as the young marry less. Independence costs more housing demand. pic.twitter.com/vy97gF9gxU / Twitter”

Divorce of course contributed to this trend as a family defined by 2 can include parent and child, the other gene contributor still has to live somewhere. Marriage rates are down, and divorce is declining as the young marry less. Independence costs more housing demand. pic.twitter.com/vy97gF9gxU

So the general idea is that from the 70s through 2000 or so, a family meant a married couple and their kids. But with marriage being so passe, divorce being so common, there are far more “households” that are nothing more than a single man or a single mom with her kids. Or even without divorce, there are millions of never-married men and women who still need a place to live.

Using @Economica’s numbers, maybe 116 million housing units in 2000 were enough for 282 million people because a huge chunk of those 282 million people were married with children. But 144 million housing units in 2022 is entirely insufficient because most of the 334 million Americans are now living alone. Hence, home prices are going to be high as demand outstrips supply.

That is a possibility. Doesn’t seem particularly compelling though.

It isn’t as if the number of divorces spiked during 2020-2022, but home prices did. It isn’t as if the Age of Loneliness is some new thing in 2021 and 2022, but home prices went up 20-25% YOY during those periods. That cannot be explained by supply and demand dynamics, especially if housing units per capita has never been higher.

What could explain why housing affordability is so crap when there appears to be plenty of housing supply? I think there are two possible answers.

Home Prices Are Not Housing Supply

First is what I’ve mentioned on these pages and elsewhere: the home purchase market is not the housing market. Housing market includes rentals.

It could be that while housing units are up, homes for sale are not. Tons of builders put up apartment buildings and garden complexes, but fewer put up actual homes or even condos that people could buy. So using @Economica’s numbers, if in 2000 there were 116 million “housing units” and in 2022 there were 144 million, but out of the additional 28 million units, 20 million were just for rent… then perhaps there could be a supply-demand imbalance such that home prices would skyrocket while rents flounder. People want to buy a house, not rent an apartment so building additional apartments did nothing to tamp down home prices.

Except that rents also skyrocketed in recent years. If there truly was a housing supply vs. housing demand imbalance, then both sale prices and rents would have gone up, but the data isn’t showing this lack of housing units.

Housing Affordability Declined Because the Dollar Declined

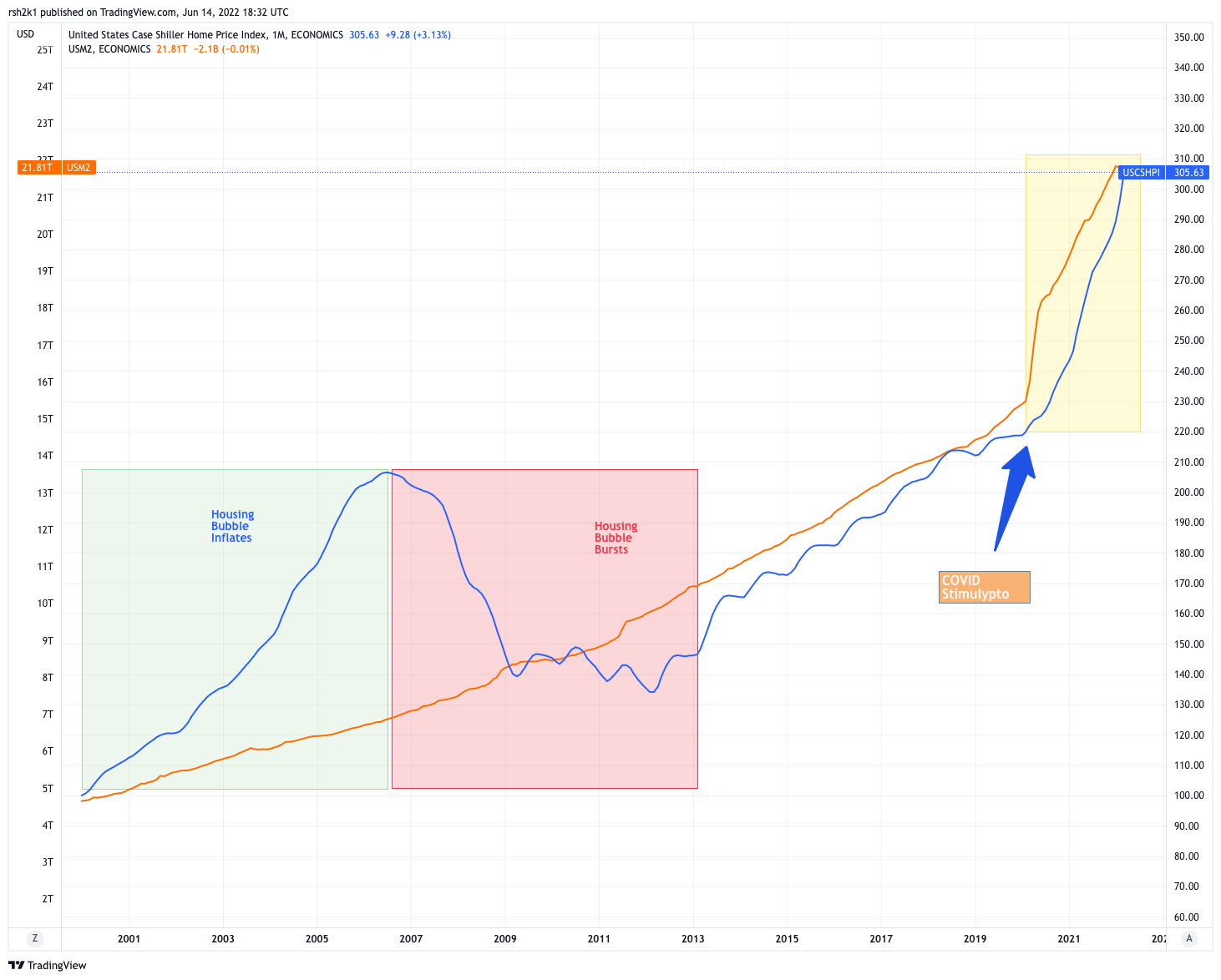

Second answer is my preferred answer. It makes more sense to me. I’ve mentioned this over and over again, so here we go with my favorite chart:

That’s home prices vs. US M2 money supply. It tracks nearly perfectly, except during the Bubble Years.

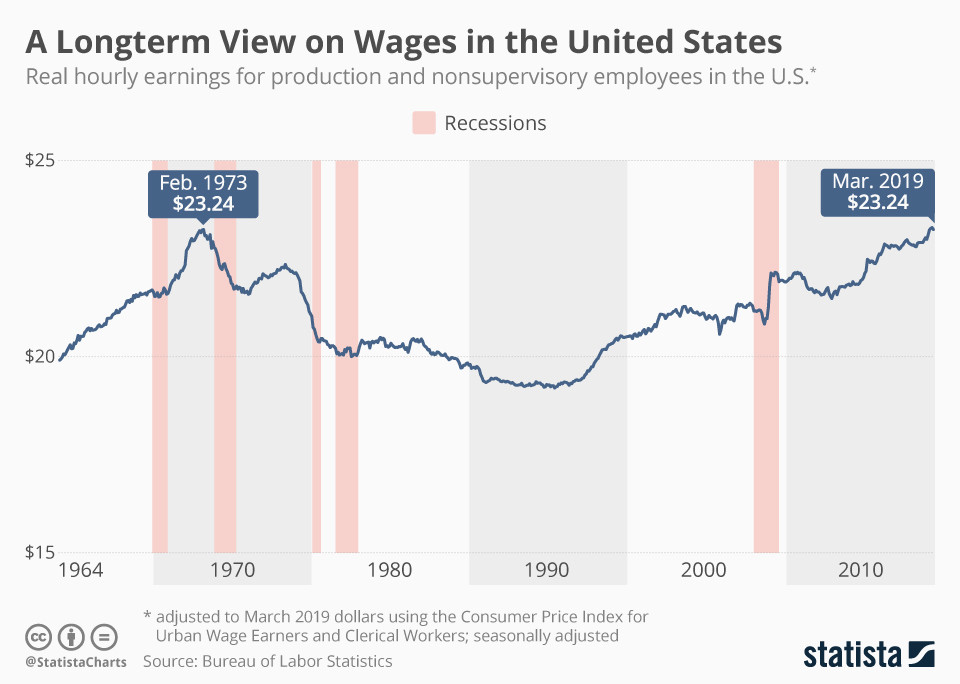

I think housing affordability has plummeted not because of supply-demand dynamics, but because of monetary policy dynamics. The money printer go brrrr has benefited asset owners, while hurting wage earners. Due to monetary inflation, the average hourly earnings in the U.S. did not improve one bit from 1973 to 2019:

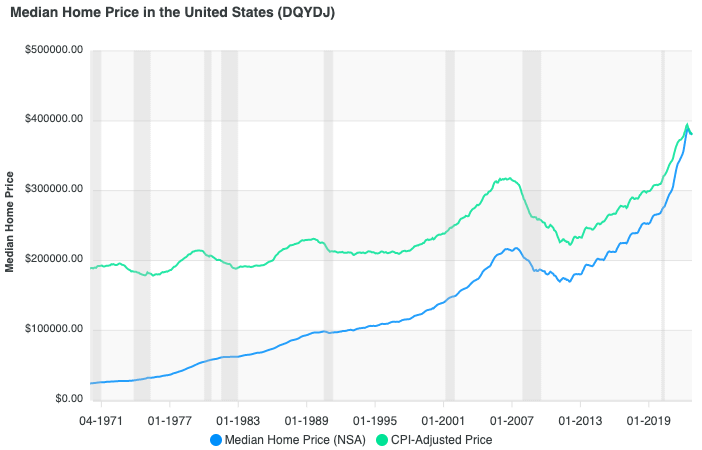

During the same period, home prices nearly doubled even taking inflation into account:

That explains why housing affordability is such crap despite there being more supply of housing than ever. Demographics might play a role of course, and there may be something to the idea that not enough for-sale units were built versus for-rent units. But this explains the housing affordability problem better than any other I’ve seen to date.

It isn’t that housing has become unaffordable, but that the dollar has become worth less. Far less. Deflationary pressure from technology in other consumer goods has largely hidden the fact that the dollar is devalued, but with housing, there has been far less deflationary pressure from technology because technology isn’t as core to building homes as it is to building computers.

The Solution

If the problem is not supply and demand, but devaluation of the dollar, then the solution can’t be about “logical policy improvements” as Ryan Gorman wants to pursue. The solution can’t be about building more houses with access to energy and transportation and groceries. The solution has to be about the dollar’s buying power and how many dollars people actually get.

In 1973, the average median income for a family was $12,050. We know that this was when the single breadwinner was the norm; you did not typically have both parents out working to support the family. The median home price in December of 1973 was $28,558, or 2.4 times median family income.

So families in 1973 were able to buy a house on a single earner’s income. What does that mean for today?

In October of 2022, the median home price was $380,279. The median income of a single earner would need to be $158,449 in order to compare to 1973. Instead, in 2022 the median American worker earned $54,132. Double up and have both parents work, and we’re at $108,000 — still below what one person working in 1973 made.

Is it any wonder that housing is unaffordable?

Sadly, even understanding the true cause of housing affordability crisis does not lead to easy answers. Sure, we can mandate some minimum wage such that the average individual worker makes $158K a year… but that would just be the same as printing a bunch of money. The dollar would get devalued even more and home prices would triple. The real answer has to be that somehow, the American worker has to become three times as productive as he is today, or the price of the median home must fall to $129,916 — that is, by two-thirds.

I could think of scenarios where home prices fall by two-thirds… but not one of those are actually desirable.

A Viable Solution

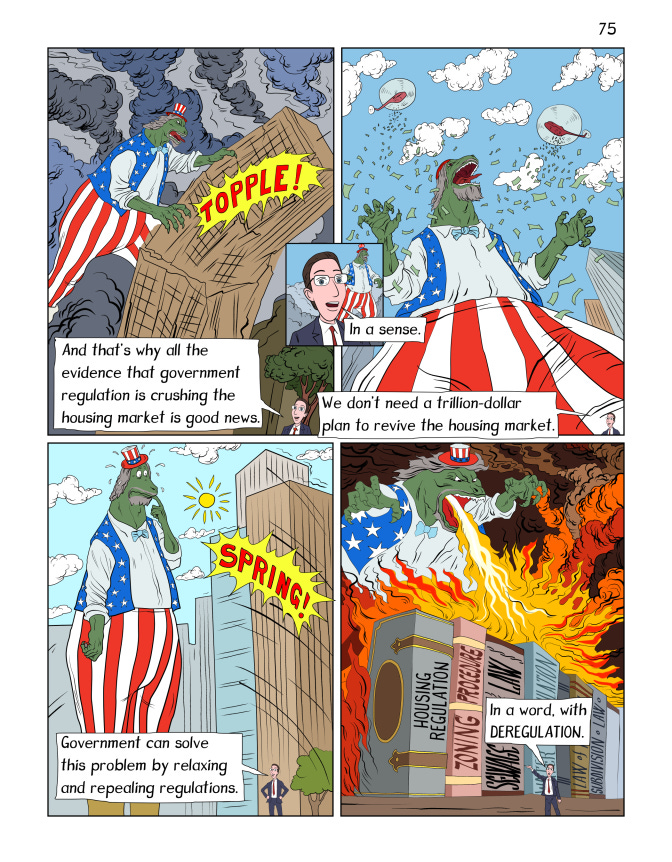

Let’s not leave on a note of despair. I recently read a proposal that might actually prove to be a viable solution to our housing affordability nightmare. It’s from the economist Bryan Caplan of George Mason University, who writes on the Bet On It Substack. He has a graphic novel coming out soon called Build, Baby, Build: The Science and Ethics of Housing Regulation. This comes from a sneak peek he published on his Substack.

It has the advantage of making the supply-is-too-low crowd happy as well as the dollar-is-devalued (smaller) crowd.

The basic idea is that by deregulating housing as much as possible (I think Caplan would want all the regulations gone), we would add millions of new construction jobs and trillions of dollars in additional GDP every year:

2. Immigration researchers find truly enormous economic benefits of full deregulation; roughly speaking, open borders would double Gross World Product. HM’s results aren’t quite as dramatic, but in absolute terms they still boggle the mind. Their conservative estimate is that moderate housing deregulation [the study hypothesized what would happen if the Bay Area and NYC only had as much housing regulation as the rest of the U.S.] would increase US GDP by 14%. Their corresponding optimistic estimate is +36%.

3. In both cases, we’re talking trillions of dollars of annual gain, implying an astronomical present value.

Caplan believes that one of the key benefits of housing deregulation would be to “encourage workers in low-productivity regions to move to high-productivity regions.” Moving from inner-city Baltimore to the Permian Basin or Dallas-Ft. Worth might be an example. So those workers would end up making more money because they can be more productive in high-productivity areas. That plus all the construction jobs get us a pretty long way towards that $168K median income figure.

Housing prices would fall in a deregulated housing market, but it would happen slowly over time because the enormous supply of housing would be offset by higher incomes from American workers who now can think about buying a house.

We don’t need “reasonable housing policies” — we need NO housing policies. If Gorman’s btcRE can lobby not for smarter policies, but for complete deregulation, and succeed… that is the kind of change we need.

Of course, I would add an additional element beyond just deregulating housing. If housing affordability crisis is not about supply and demand but about dollar devaluation… then we need to move off of the Federal Reserve fiat-currency system. Move the Dollar either back to a gold standard or forward to a Bitcoin standard, and we instantly stop all of the pernicious effects of the money supply on home prices and on wages. We don’t need more money or less money; we just need the same amount of money for the next 30 years or so.

Given that this solution of total deregulation and abandoning the fiat money system is viable, it won’t happen until we have no other options left. Nonetheless, the problem of housing affordability is not impossible to solve. White pill moment.

I think that’s it for now. Have a great week everybody.

-rsh