In my post about the likely impact of the commission lawsuits against NAR and four corporations, I mentioned that I had a conflict of interest when it came to the issue of real estate auctions because I had been working on an auction-related initiative for a while. I had kept the initiative relatively quiet because it’s early stages, but the court kind of forced my hand. Fairness dictates that I give you all at least an idea of what I’ve been doing so you can evaluate my opinions on Notorious ROB appropriately.

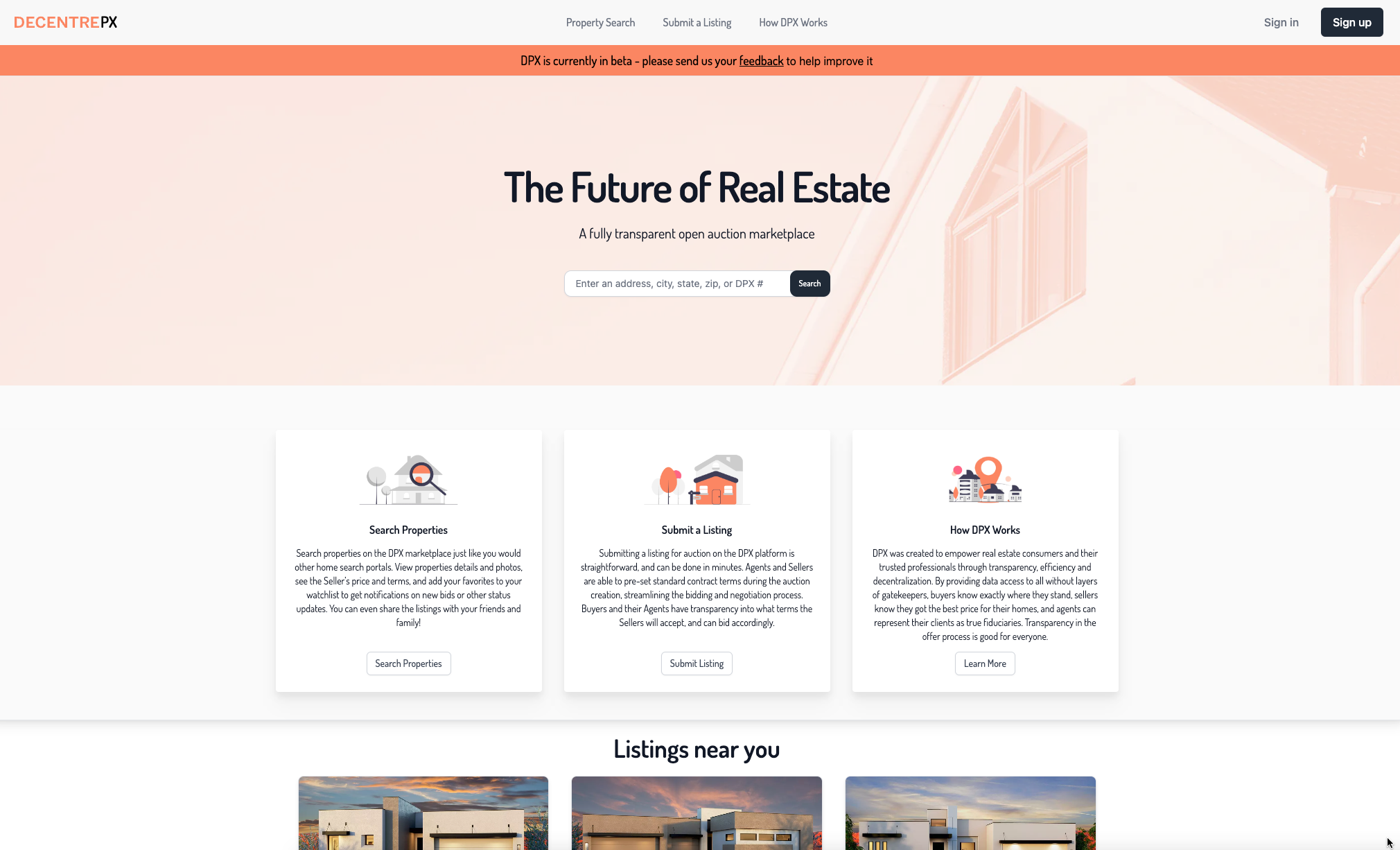

Let me tell you about Decentre Property Exchange. I’ll try very hard not to make this a total sales pitch and shameless plug, but… I make no guarantees on that front. DPX has been my passion for over a year now.

Decentre Property Exchange

Fundamentally, Decentre Property Exchange (“DPX” for short) is an online marketplace for real estate.

Anytime you buy or sell something, there are three processes that have to happen:

- Execution: the buyer agrees to buy and the seller agrees to sell.

- Clearing: all of the steps necessary for settlement, such as negotiation or proof of quality.

- Settlement: actual exchange of money or something else of value for what was purchased.

For real estate, the Execution step is when a Sales Contract is signed — that’s when a seller agrees to sell and the buyer agrees to buy the property. The Clearing step is the contract-to-close phase when numerous details are verified, negotiations happen, and everything is made ready for the Closing. The Closing, when wire transfers happen, documents and signed, and keys handed over is the Settlement step.

In our view, a marketplace must at the very least match the buyer and the seller. DPX matches buyer to seller using the ideal method for non-commoditized unique items: transparent open auction.

This post would get far too long, far too academic, and far too detailed if I get into why open auctions are the ideal way. There will be future posts either here on Notorious, or on the Decentre blog dealing with that topic. For now, let me say that we truly believe that open auctions deliver transparency, highest price for a property, efficiency, faster transactions, and most importantly, a better consumer experience.

What Makes DPX Unique?

It isn’t as if real estate auctions have not been tried before. They’ve all run into major challenges, and the remaining few have pivoted to be more of an offer management platform rather than an actual auction site.

The obvious question here is why DPX would succeed when numerous others have not. I don’t know for a fact that we will succeed because we’re a new startup; but we have designed some unique features into DPX to set it up for success.

DPX is an MLS

The first and most important differentiator is that DPX is a Multiple Listing Service.

It turns out that you cannot build an open auction platform on top of the traditional MLS. There are simply far too many rules and policies that make auctions difficult, if not impossible, to conduct. Many an MLS, for example, simply do not even allow auctions to be listed. Others have various hoops to jump through.

Fundamentally, the MLS is built on the current offer-and-acceptance system. Its rules and policies and systems are built to support that process, not an open auction process. Plus, there are hundreds of MLSs all with their own rules and policies, some of which conflict with each other, and it is an administrative nightmare for a tech company to try to comply with all of them.

Our solution is not to build on top of existing MLSs, but to build a new kind of MLS that is less of an alternative to and more of a complement to existing MLSs.

No Commissions, but Compensation Guaranteed via Buyer Premium

The second biggest differentiator is that DPX does not have the unilateral offer of compensation like the traditional MLS. In fact, we do not have commissions at all. Any seller executing the transaction on DPX pays 0% in commissions at closing.

And yet, we guarantee compensation to the agents involved in the transaction. How do we work such magic?

As an auction platform, we charge a Buyer Premium to the winning bidder… like every other auction platform in existence today. Take a look, for example, at Concierge Auctions or Bring A Trailer. DPX charges a Buyer Premium that is equal to the prevailing commission rate in the market; nationwide, that is about 5%.

DPX charges the winning buyer the Buyer Premium, which is added to the winning bid price to make the final sale price in the contract. The buyer can finance that full amount so it isn’t as if they have to come out of pocket with extra cash. (Read the Fannie Mae Conforming and High Balance Program Guidelines for more.)

We split the Buyer Premium between the listing broker/agent and the buyer broker/agent, thereby guaranteeing compensation. There is no unilateral offer of compensation, no wrangling over how much is or is not offered, and no sweat, no fuss, no muss. We pay the agents involved in the transaction equally.

DPX makes money from a platform fee charged to both sides (0.25% each, which can be discounted further).

Easy to Join, Free to Use, Non-Exclusive

Because of our business model, DPX is entirely free to join, to use, to list, to bid.

There are no lengthy application forms necessary. We don’t have application fees. As a matter of fact, we don’t have concepts like “Broker Participant” because we are not about offers of cooperation and compensation. We need the brokerage to join both because the brokerage owns the listing agreement, and because under state law, we have to pay the brokerage (who then disburses payments after the split to the agent)… but there are no fees, no requirement that every agent in your brokerage must join, nothing.

This means that we do not need nor do we want you to join DPX and leave your MLS. We are a parallel platform, not a competitor to the MLS. Since we’re not charging you any dues or fees, all of our brokers and agents risk nothing by using DPX in addition to their local MLSs.

I will get into rules and compliance in a later post, but let’s just say that we have far fewer rules than the traditional MLS and yet, we do engage in data compliance. It’s a bit more complex than that, so like I said, future posts.

We do enforce all laws and regulations, of course, because those are laws. So for example, if you want to represent someone on a transaction, you must have a valid real estate license to do so. We take Fair Housing and discrimination very seriously. Fraud is illegal whether you do it on an auction platform or in the traditional MLS.

Sidebar: Buyers Won’t Pay Extra to Use an Auction…

By far the most often heard objection to DPX’s system is that buyer will not pay a 5% Buyer Premium on top of the sale price. We agree… if they are paying a Buyer Premium on top of the full commission-included sale price. On Concierge Auctions, for example, they spell it out: “Buyers pay a Premium on the high bid amount and any applicable transfer fees. Sellers pay broker commissions.”

On DPX, there is no commission paid by the seller, which means there is no overpayment. We all know that in the current system, while the seller pays the commission, the buyer is the only one bringing money to the table. The seller and the listing agent look at the net sheet, taking the commission into account. Buyer agents all know this, and many buyers also know this.

Our system simply makes transparent who is paying the commission. It is fully financeable, unlike buyer agent commissions today. There is no downside to the buyer for using DPX, and plenty of upside from the radically increased transparency.

The Relevance to Commission Lawsuits

There are, to be sure, other unique features and unique differentiators that we are bringing to the table with DPX. But as I said, we will have plenty of time and opportunity to discuss all of those either here or on the future Decentre blog.

Judge Woods’ ruling on the class action status of Moehrl raised an incredibly important point, which led me to conclude in my post about impact that auctions will become popular:

Real estate auctions are quite likely to take off, because the order from Judge Woods specifically exempts consumers who used a real estate auction to sell their homes. The rationale is simple: in an auction, the whole cooperation and compensation thing is far less of an issue. Very often, the auction seller doesn’t pay a commission, and the buyer doesn’t either; the buyer might pay a fee to the auction house, but the whole “NAR Rules and Conspiracy” thing is entirely missing. So in copycat lawsuits, other judges are likely to follow suit. Not only will auction consumers be left out of any class action, they likely don’t have much of a claim.

Going forward, if you are a brokerage that hasn’t been sued out of existence as Realogy (now Anywhere), HomeServices of America, RE/MAX and Keller Williams are about to be, you are going to want to think real hard about moving transactions to auctions just in case.

We designed DPX with an eye towards potential disruption in agent compensation models. Judge Woods understood that the issue in the trial is the unilateral offer of compensation that all brokers are required to make, and all MLSs are required to enforce. With DPX auctions, that issue does not exist. But with current crop of auction platforms, brokerages are not out of the woods (heh) yet.

Every current real estate auction platform, for example on Concierge Auctions, charges a Buyer Premium but the seller is still required to pay the commission as per her listing agreement, enforced by the local MLS. As a brokerage, you could list and sell a property through auction, but the seller can still come after you for the commission part of the transaction.

With DPX, we think brokerages are clear of this liability because there are no commissions on DPX. Every broker and agent and buyer and seller agree to our Terms of Use that if a transaction is done on DPX, they will waive all other commission claims in exchange for having DPX compensate the brokers and agents involved. Under all of the legal theories of current cases, if there is no commission, then there can be no liability.

The Buyer Premium is not set by a committee of brokerages meeting at NAR conferences. It is set by a company that decides on the cost to charge for its auction services. There is no conspiracy, no coordinated action, no agreement verbal or otherwise, between competitors.

We think that many of you reading this right now, if you are a brokerage of any size in your local market, should be investigating DPX as another tool in your belt. Because the copycat lawsuits are quite possible, and the liability is real.

Now… with regulators and lawyers… one can never be certain of what the future holds. But we are confident that what we have built is immune from the current crop of antitrust lawsuits and commission-related regulatory actions.

Buyer Agency Compensation

The mega impact of these commission lawsuits, obviously, is on buyer commissions going poof. It is hard enough to get buyer agents to talk to their clients about an Exclusive Buyer Agency Agreement; the challenge of having them tell their clients to come out of pocket if the seller doesn’t voluntarily offer enough compensation is a stark one. And that is assuming that the courts and regulators allow for sellers to pay the buyer agent at all, which is not guaranteed.

And as many agents on social media have pointed out, making buyers responsible for the buyer agent commission puts additional financial burdens on buyers at a moment in time when they are least able to come up with cash. Many have speculated that we will have to change mortgage rules to allow buyer commission to be rolled into the mortgage.

DPX solves those problems today, without any regulatory or banking reforms.

Buyer agents do not need to have any conversation with the buyer about compensation, other than, “DPX is going to pay me if you win the house through their auction platform.” If you help that client buy a house through DPX, we will pay you.

The GSE’s already allow for auction premiums to be rolled into the final sale price, which can be a conforming loan. Yes, the property has to appraise… but that’s no different than today when the property has to appraise at a higher price that includes the commission the seller has to pay.

When the dust settles, we think that we will be offering buyer agents and listing agents the security of knowing they will get paid for their hard work representing their clients, no matter what the various courts rule in the lawsuits going on right now.

Wrapping Up

This introduction comes early — far earlier than I had planned. We are still just a baby of a company, and our product is still very much in beta test with bugs and fixes and improvements we need to make. But when Judge Woods pronounced her ruling and there is such an obvious exemption to liability, and I have to discuss it… I felt ethically bound to tell you all about DPX.

Transparency, after all, is what DPX is all about. How could I not be transparent about my interests and my biases?

So, DPX is currently live in beta-testing in Phoenix, and we have some New Construction properties in Albuquerque, NM. We do plan to launch additional markets soon; Nashville and DC Metro are on deck, as are others. If you are a brokerage or an agent interested in being considered as a launch partner when we come to your market, please let us know by going to joindecentrepx.com/vip and filling out the form. We will contact you as we prepare to expand into your area.

If you are a brokerage or an agent and just have questions, as I imagine you might, feel free to reach out and contact me directly. Y’all know how.

Thank you,

-rsh

Jason Mraz – The Remedy (I Won’t Worry) [Official Video] [HD]

My new album ‘Mystical Magical Rhythmical Radical Ride’ is out on June 23! ✨ Pre-order/save now: https://jasonmraz.lnk.to/MMRRRalbumID Jason’s first studio album, Waiting for My Rocket to Come, features the Top 40 single “The Remedy (I Won’t Worry)” as well as fan favorites “You and I Both,” “Curbside Prophet” and “Sleep All Day.”