Once in a while, realestistas get around to discussing tame, non-controversial topics. And as any regular reader of this blog knows, I am simply allergic to controversy and disagreement. I am glad, therefore, that people are talking over at Agent Genius about the entirely boring and controversy-free topic of dual agency.

As it happens, I happen to have a view or two about dual agency, and figured I’d meditate on a few unrelated (or maybe related) topics as follows. Most of them are inspired by the comments to the AG post:

- Dual Agency and #RTB

- Dual Agency and Brokerage

- What Dual Agency Says About Agent Value

Twitter version: Dual Agency is a symptom of so much that is wrong with real estate today. Long version follows after the jump.

On Dual Agency and #RTB

#RTB of course, is the hashtag for “Raise the Bar” — the current obsession of many of the RE.net. The goal of the RTB movement is to make it more difficult for people to become real estate agents so as to raise the standards of professionalism within the real estate industry.

The practice of dual agency makes a mockery out of the notion that real estate is a profession, period.

The duty of loyalty is one of the strongest elements of what makes someone a professional as opposed to just a businessman. We expect the used car salesman to try to rip us off; we don’t expect our doctors to try to rip us off because we expect that the doctor owes us a fiduciary duty of loyalty.

The responses (from the comments on the AG post) are interesting, to say the least. A few examples follow.

“The law in my state allows it.” Congratulations, you’re not a criminal. Do you want a medal or a statue? The law in my state may not require that I pay child support for an illegitimate child; that doesn’t make it ethical not to do so. The law establishes the floor, not the ceiling, of ethical behavior. Just because something is legal doesn’t make it ethical, any more than something being illegal makes it unethical (see, e.g., Jim Crow laws).

“The parties want to do a deal, so there’s no problem.” The idea that dual agency is okay because buying and selling a house is not an adversarial situation, but one where the parties want to reach agreement, is an interesting one. By that token, when you go to negotiate an employment contract, you should have no problem using the lawyer who represents both you and the company. And your financial adviser should be putting you into those stocks his investment firm is getting paid to market. After all, the parties want to agree; it doesn’t have to be an adversarial thing.

“Dual agency is okay if it’s disclosed to everybody, and all parties agree.” Frankly, this is a variant of the “it’s legal so it’s ethical” argument. On the surface, it’s a strong argument: the seller’s okay with you representing him and the buyer, and the buyer’s comfortable with it. What’s the problem? The problem is that disclosure and agreement are the absolute bare minimums that society expects of a so-called fiduciary. Put another way, disclosure and agreement by the principals are factors that excuse behavior that would otherwise be a breach of duty. Homicide is also justifiable in some circumstances, but we don’t go around celebrating taking of human life as a wonderful thing.

During the recent real estate bubble, there were a number of mortgage brokers who engaged in practices that were entirely legal, like selling interest-only ARM loans to people who were ah… “unsophisticated”. Disclosures were fully made. The client agreed fully to those disclosed terms, supposedly fully aware of the disclosed risks. Nonetheless, can we agree that the actions of the mortgage broker were far from ethical?

So to my friends in the #RTB movement, I say unto thee, if you’re serious about improving professionalism in the industry, relax the clamoring for higher educational requirements and apprenticeships. Agitate to eliminate dual agency instead.

Dual Agency and Brokerage

One of the more interesting insights into a fundamental issue with the real estate industry today is what dual agency reveals about the role of the broker.

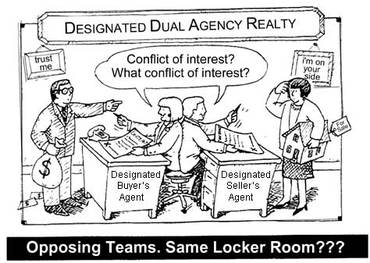

“It isn’t really dual agency if I’m representing the seller, and another agent in my office is representing the buyer.” The idea is that Agent Jones represents the seller 100%, and Agent Smith represents the buyer 100%, so even if it’s dual agency to the brokerage, it isn’t really dual agency. Single-agent dual agency is a no-no, but with two agents, that isn’t really a conflict of interest.

This is, frankly, the strongest argument for a form of dual agency: dual agency at the brokerage/company level, but not at the agent level.

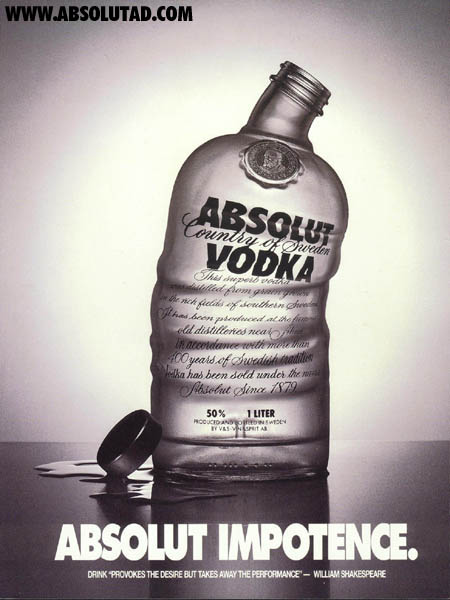

The trouble is, more than just about any other issue in real estate, this form of dual agency reveals just how impotent and unimportant brokerages have become in our industry.

In theory, when I go to list my house, I’m not listing it with Agent Jones; I’m listing it with Broker Jackson who has employed Agent Jones to be his representative. The fiduciary duty actually accrues to Broker Jackson, and Agent Jones acquires it by being Broker Jackson’s agent. In reality, I don’t know Broker Jackson, never met the man, couldn’t care about him, have no idea what the name of the brokerage is, and only know Agent Jones. My relationship is with Agent Jones, and Agent Jones and Agent Jones alone considers herself any sort of a fiduciary to me.

Is it any wonder that brokerage brands are so meaningless today? That consumers couldn’t tell one brokerage apart from another?

Sure, broker dual agency is more or less the norm in the industry. Sure, it’s not likely to change anytime soon. But as brokers move further and further away from seeing themselves as having real clients, as having real duties to real consumers, and see themselves more as recruiters of agents and renters of desk space, their importance and value continue to plummet.

Dual Agency and Agent Value

Dual agency also goes to the heart of what the value of a real estate agent is in a transaction.

“As long as disclosure is made, there’s no problem.” This is an interesting perspective. The comment is worth quoting:

However, it is legal in PA if both sides agree and it is disclosed, and I have closed transactions as a dual agent. You must take special care with it, and be super diligent in your documentation to be able to prove you have not favored one side or the other. (Emphasis mine.)

If I’m hiring someone to be my agent in any other situation, I’m not looking for a dispassionate referee who doesn’t favor one side or the other. I’m looking for someone who is 100% in my corner, advocating for my interests and my interests alone, and trying his damnedest to favor me in the deal. Isn’t that at least a part of why I’m paying you?

At least Florida has recognized the situation and created the “transaction broker” who owes no fiduciary duty at all to either party. Their duties are spelled out in statute; they are entirely creatures of legislation, rather than of common law or of long-standing principles of Anglo-American tradition.

Of course, whether the transaction broker is as valuable to the consumer as the more traditional fiduciary broker is for the consumer to decide. I know where I fall on that question (less valuable) but the market dictates value. And of course, it’s difficult to consider the “transaction broker” as any sort of a professional. I don’t consider Ebay to be a professional services company either.

In an era where realtors are struggling to define their value to the consumer, as realtors are trying to be taken seriously as knowledge experts, trusted advisors, and advocates for clients, the practice of dual agency drags them back into being classified as glorified price-transmission systems.

Guess what? There are things that are far better than real estate agents at transmitting prices to principals.

The Solution?

There are two possible solutions that I can think of to the dilemma of dual agency.

One is the transaction broker, as in Florida. Drop the pretense to being a fiduciary to either party, and go with being a guy (or gal) who just facilitates the transaction. No loyalty is owed to anyone, and everyone is acting ethically as long as the law is followed.

The other is to enforce fiduciary responsibility at the broker level, whether through legislation or through ethical standards. This is my preferred option, as it has the benefit of bringing the brokers (and brokerages) back into the business of having clients as opposed to the business of having a stable of agents who have clients.

All of my little pet causes — enforcing brand standards, having enterprise CRM, discipline and education, etc. — are advanced by brokers taking a far more active role in serving clients. Those in turn help reestablish the value of a brokerage, and the importance of the company. It will also likely lead to greater specialization amongst brokerages, and a proliferation of number of brokerages. Both of those things strike me as something that may be beneficial to consumers on balance.

And it would go a long way towards establishing the real estate broker as a true professional, a fiduciary worthy of trust:

“The distinguishing or overriding duty of a fiduciary is the obligation of undivided loyalty.” ASIC v. Citibank, 62 ACSR 427.

-rsh

25 thoughts on “Random Thoughts on Dual Agency”

Hey Rob-

Can't say I disagree with anything you're saying here. In my state (NJ) dual agency is legal when fully disclosed and agreed upon by the parties. Its ethics remain debatable. As you properly noted, the “legal standard” is the MINIMUM standard deemed acceptable in any society. The ETHICAL standard is what we aspire to as professionals. If we want to be taken seriously as professional Realtors (and I am a huge fan of the #RTB movement), then I agree it's important to tackle this issue head on. I know of no other profession where it is “legal” for a fiduciary to “share their allegiance” with adverse parties…consent or no consent.

I know of a couple brokers in my state who will only work as transaction agents for buyers of their own listings. They'll facilitate the transaction for them, but will maintain their agency relationship with their seller clients. Until something happens on a legislative level in NJ, this may be the wisest course of action.

Um…what he said.

Rob, I think this is a great post about dual agency. I've made it quite clear that I don't like it as a theory or practice when it falls under single agent dual agency. I love the example not paying your child support as a case for why the “it's legal” argument doesn't work.

Rob, Bravo!

Ah, the once per year dual agency post and resulting rhetoric.

All this #RTB discussion through the RENET and Twitter in my opinion is laughable when dual agency continues to thrive. Yet powerful forces exist to protect the status quo with only a small minority taking a stand against the practice. The consumer looses and continues to hold us in low regard.

Interesting to note that the upcoming revision of the California Purchase Agreement has moved agency confirmation to the first page. This is a state where Agency is almost never disclosed when legally required.

The common practice of brokers using the Dual Agency Consent Form is almost universal in California and if Clients took a few minutes to read it and understand it, would they really agree and sign it? Why opt for crappy representation?

You simply cannot serve two masters.

Coming from a Broker's standpoint when I managed over 175 agents, there was never a more stressful moment than when a transaction spun out of control with threats of lawsuits, only to find dual agency rear it's ugly head. The legal department scrambles to solve the issue quickly before the whole mess is dragged into the light of day. The company certainly does not want to see the inside of a courtroom.

Most laughable to me is the partner or married agents claiming each of them will represent the other side. Full disclosure, I have actually done this 10+ years ago in my career – but have repented. Is anyone really naive enough to believe this is an effective strategy?

The solution for dual agency is don't do it. PERIOD.

If a Broker or agent needs to deal with both a Seller and a Buyer have one of the parties execute a Non-Agency Agreement. The agent and broker is free to fully represents the interests of their Clients with a fiduciary responsibility without offering agency to the other party. Solves the “can't we all just get along so the seller can save some money” argument and works for those parties that are savvy enough to represent themselves. Most folks when faced with that choice decide they want representation.

I would hate for the solution to be the removal of the fiduciary nature of our relationship with Clients. Going down that road will lead the industry to nothing more than glorified salespeople only out for their individual interests. That will be a sad day and you might as well auction your home on e-Bay.

Alas, this conversation will go on for a bit with all the usual arguments and then peter out as the next hot topic hits the network. Shame that we don't have more voice against dual agency and until that day comes don't talk to me about raising the bar.

Rob, thanks for the great read, let's see if the #RTB folks are really committed to making a substantial change in our industry or they just want to argue about digital photographs, MLS remarks, and 2 day designations.

I don't like it and not sure why dual agency is still allowed. The argument that if disclosed it is legal brings up another point to me: Is it ethical? Can something be legal but not ethical? Excellent article!

Rob,

You beat me to the punch on this.

I've written but not yet published a blog post (“Dropping the F Bomb;” the “F” stands for fiduciary) at P1Fran.com which deals with the basic overriding point that you are making here, which is that “fiduciary” and “dual agency” are two ideas that don't co-exist very comfortably.

In fact, this opens the door to a much larger point (which is more the topic I'm driving at in my blog post), which is this: how can you have a company that is based on SELLING as much as possible (the goal of just about every real estate company) and SERVING (the fiduciary issue) at the same time?

These objectives would *appear* to be in direct opposition to one another. At a minimum, there is certainly the appearance of a conflict of interest. At best, these are awkward stablemates.

I've been selling real estate for nearly two decades, and I've done everything in my power to avoid dual agency transactions. I think I've *maybe* done two, and even though I've never had a problem, I held my breath from start to finish because the risk is so much higher simply because of PERCEPTION. Even when you handle these sales PERFECTLY, the concern always remains that one – or, forbid, both – clients will feel the OTHER CLIENT somehow got more favorable treatment. Truly, it is impossible to serve two masters.

Real estate companies, coaches and trainers who preach “getting clients to quick decision points” and “convert your clients faster” and “how to juggle hundreds of clients at once” certainly are not preaching a message of “undivided loyalty,” are they?

Stated differently, you cannot serve the almighty dollar AND the client at the same time.

THIS, in my mind, is the biggest Achilles heel of our industry: this disjunct between SALES and SERVICE.

This is NOT to say that all Realtors who handle a lot of clients are shirking their fiduciary responsibilities – of course not. This IS to say that MANY agents are ALL ABOUT THE DOLLAR, and the industry in total walks a very fine line between serving its' collective clientele and serving itself.

Keep on writing thought provoking stuff, Rob. I love it.

Best,

Michael McClure

And just to stir the pot a bit more read this about Dual Agency in NC http://www.inman.com/news/2010/02/18/nc-realtor…

Good post for discussion. Designated agency has solved many problems in this respect here in Michigan and we still have disclosed dual agency. Disclosure is the golden thread combined with following the golden rule of course.

My take on dual agency is very simple.

(1) Anything that takes 1-3/4 pages to be explained is probably not worth doing.

(2) As a lawyer once told me, “I can't sue myself.” The only person that's happy in dual agency is the agent — cause s/he got paid.

Big boxes forgot the CLIENTS ages ago.

Dual agency is in the best interest of the agency, not the client.

North Carolina doesn't want full disclosure of all the $$ they make for a double-header.

NAR is encouraging agents to add another 2-day 'expert' title … for $175 or $350 … and the flocks are fluttering to the courses.

Who is protecting the clients??

Don't think I'm not posting a link to this post on my blog.

My argument against dual agency comes straight from the title of the dual agency disclosure form in Arizona:

CONSENT TO LIMITED REPRESENTATION

Enter into dual agency, and your representation is limited. Period. Says so right there on the form.

A short sale is the only situation where I can see single-agent dual agency probably doesn't matter. The seller CAN'T net a dime, and there are really three parties in a short sale — buyer, seller and the lender(s). Sadly, it's really the buyer and seller vs. the lenders. If one agent represents both the buyer and seller in a short sale situation, so what? The agent can work to get the buyer the lowest price possible, and the seller won't care as long as the sale gets approved. Sure, maybe the bank loses out a little. Ask me if that bothers me.

As for intra-brokerage dual agency, that's a tricky one. In a brokerage like mine, with only 18 agents, it can be avoided. The brokerage's with hundreds or thousands of agents becomes problematic. If one of my agents had a buyer and another had the seller in the same transaction, I am *completely* confident that each of their clients would be fully represented. How a broker with 2000 agents could have that same confidence is beyond me.

I'm not sure what the solution is. I take my fiduciary responsibility to all of my brokerages clients very seriously. But you can't legislate ethics and fiduciary responsibility, so I'm not sure what the answer is. Transaction brokerage would work, but in my opinion that's a lame solution and doesn't do what is best for the real estate buyer and seller.

And here's part of Virginia's section about Dual Agency's limitations.

Because of the Broker's dual representation in such a transaction, Buyer understands that Buyer and the seller have the responsibility of making their own decisions as to what terms are to be included in any purchase agreement. Buyer should be aware of the implications of Broker's dual representation, including the limitation on Broker's ability to represent the seller or Buyer fully and exclusively. Buyer understands that Buyer may seek independent legal counsel in order to assist with any matter relating to a purchase agreement or to the transaction that is the subject matter of a purchase agreement. Provided Broker has acted in accordance with its obligations under this Agreement, Broker shall not be liable for any claims, damages, losses, expenses or liabilities arising from Broker's role as dual representative. Buyer shall have a duty to protect its own interests and should read any purchase agreement carefully to insure that it accurately sets forth terms Buyer wants included in the purchase agreement.

Hey Jay –

I think one possible solution is for all clients to be the broker's clients. So for example, what you wrote would be more or less impossible: “If one of my agents had a buyer and another had the seller in the same transaction, I am *completely* confident that each of their clients would be fully represented. How a broker with 2000 agents could have that same confidence is beyond me.”

That would be rewritten as, “I have XX clients, with 18 agents to assist me, and I have to avoid conflict of interest.” I know for a fact that you take your responsibility very seriously, and that you tend to be on the side of brokers who are in the real estate business, rather than the recruiting business. But that has consequences.

The megabrokerages could find a way. They could, for example, simply refuse to do buyer *agency* deals altogether; their buyer agents should be considered as 'salespeople' in much the same way that when you walk into a Mercedes dealership, those helpful people are not representing your interests. Customer service still matters to those salespeople who are trying to convince you to make a very large purchase. In fact, you could show houses, advise buyers, and so on, without taking on the *agency* relationship that results in fiduciary responsibility. As long as the buyer knows that, I don't see a problem. If the buyer wanted professional representation, he can always go hire a buyer's agent out of pocket.

-rsh

“I think one possible solution is for all clients to be the broker's clients.”

In California the client does belong to the broker. That is why dual agency is alive. It allows the broker to have two different agents represent two different principles in the same transaction.

Jay, making an exception for a short sale isn't a good idea depending on the state. If the seller is facing a deficiency, then the listing agent should be trying to get the highest price possible, not the lowest. You cant do that and represent the buyer adequately in that scenario.

I dont have a problem with dual agency as it applies to the broker as long as one agent isnt representing both sides. I know that flies in the face of JD's point, but that means that brokers need to hire better with regard to both agents and management.

Agency and fiduciary are not that difficult to get right. Its simply a choice to do so.

Thanks for this post. The real estate industry desperately needs this conversation to be more in the public eye. I'd like to share this link I wrote on the subject for our firm: http://www.hawaiilife.com/articles/2008/09/the-… Aloha, Matt

I do know that the http://www.altisourcehomes.com employed brokers can not take the buy side and is often commented with more satisfaction during the home sale process. If both sides are taken, it can be a slippery slope but in the times of new services for buyers, agents/broker seem to need to re-invent themselves.

Aloha R.O.B, We're a big fan of this article over at Hawaii Life.

Aloha R.O.B, We're a big fan of this article over at Hawaii Life.

Awesome article. I actually learned a few things, and various points of view.

I guess one of my issues with the strong language against dual agency is the idea that all Realtors are corrupt and without morals. I have no issues disclosing the rules to both sides, how much money I’m getting paid to represent one or both parties, and making both parties understand that in a dual agency scenario, no one side will have the advantage.

This is the major difference with two-brokerage representation vs dual agency. Usually one agent has an upper hand in the negotiating arena. Someone usually feels like they “got the better deal”. In dual agency, money is the bottom line with the brokerage usually taking a “hit” in terms of the final commission.

Comments are closed.