First of all, congratulations to Pete Flint and the team at Trulia for their successful IPO. Trulia is now TRLA on the NYSE. The environment wasn’t necessarily looking friendly for a real estate related IPO, but Pete and crew navigated it. So a heartfelt congratulations to you all.

Second, the thing that’s great for a blogger/commentator/bigmouth like me about Trulia going public is that we now have some real data to compare the three major portals on. (Well, sort of… see below for details.) Public companies have to make public filings, and tell the world how they’re doing. So I decided to take a look at some topline numbers, without a whole lot of detail, looking into the discussions, etc. There are some interesting things that pop up when you compare Move, Trulia, and Zillow across the board.

Key Metrics a la Notorious

Of course, I don’t own any shares in any of these companies, unless one of my mutual fund managers bought some. So an actual investor might have different key metrics than I do. But I looked at these five things as the key indicators of where things are and where they might be headed:

- Revenues

- Operating Income

- Traffic

- Subscribers

- Technology Development Expense

There’s tons of detail, of course, but I look at those five because for a consumer web-based business in real estate, given what has been going on for the past few years, I figure those are the most important stats. I went with Operating Income instead of EBITDA or Adjusted EBITDA or whatever out of convenience: all of the SEC filings of all three companies use and report on that term.

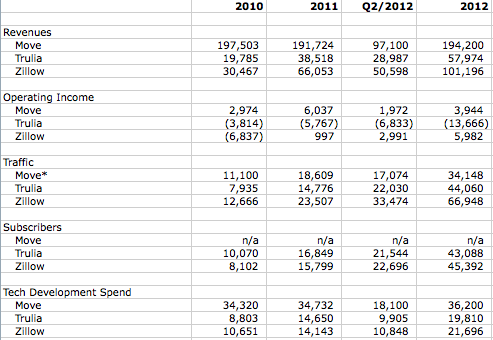

Here’s the chart:

A couple of notes.

Move’s annual and quarterly reports do not contain a traffic chart. So I used the NAR report for June, 2012 and December, 2011 monthly traffic data. The 2010 data, I got from the Annual Report.

Also, the “2012” column is obviously wrong in big parts. I just doubled everything from the Q2 reports. Clearly, that’s not how it’ll be. Trulia has a loss of $6.8M over first two quarters, but it seems unlikely they’ll just double that loss. But it does give an idea in some parts — revenues, expenses, etc.

What I Make Of This: Four Curiosities

Since nobody is paying me to render buy-side analysis, this will be with an eye towards what it all means for the real estate industry.

The first curious thing, for me, is the disparity between the Big Three on Technology spend. Move spent almost double the other two. It’s not entirely clear without diving more into the filings, but I’m guessing that has to do with the Top Producer division. But note also that Move is spending roughly $35 million on an annual basis and that’s been flat from 2010 through Q2/2012, while Trulia went from spending $8.8 million per year to being on track to spend nearly $20 million per year. Zillow went from $10.6 million a year, and they’re on track to spend almost double that amount by end of 2012.

The second curious thing is the traffic. I just don’t get it. Realtor.com actually lost traffic from end of 2011 to June of 2012, while Trulia and Zillow grew monthly traffic by 69% and 76% respectively. Most of that traffic growth is coming from mobile, but it isn’t really clear how the split works out since the none of the traffic services track mobile separately. Zillow and Trulia claim something like 300% growth year over year of mobile traffic, for what that’s worth.

Third, Move doesn’t have “subscribers” at this time — their business model is about featured listings and such. But Trulia and Zillow both rely heavily on subscribers (“Premium Agents”) for revenues. I was actually somewhat surprised by how close those numbers are. At the end of 2011, Trulia actually had more subscribers than Zillow: 16,849 to 15,799. In Q2 of 2012, Trulia boasts 21,544 to Zillow’s 22,696 subscribers. One question that occurs to me if the degree of overlap between the two: how many brokers and agents subscribe to both Trulia and Zillow? And spend money on Realtor.com? I don’t know of course, but my gut tells me it’s quite a bit of overlap: productive agents likely spend money everywhere, no?

Finally, the Operating Income line is… something else. Notice that Move nearly doubles Zillow and triples Trulia in revenues. But Zillow’s Operating Income is tracking to be 50% more than Move’s? Of course, Trulia hasn’t posted a profit yet, but… that’s a bit odd also. In June of 2012, the data available from Trulia’s S-1, Trulia claimed 22M monthly uniques, 21,544 subscribers and had $6.8M in operating loss. At the end of 2011, Zillow claimed 23.5M monthly uniques, 15,799 subscribers, and had 997K in operating profits. What’s up with that? The only conclusion that could be reached is that somehow, Zillow is super-efficient and great at sales.

Trends and Random Thoughts

The biggest trend, of course, is the traffic growth of both Trulia and Zillow. It’s puzzling why we’re not seeing the same traffic growth for Realtor.com, but I have a theory that I’m going to test out at HearItDirect on October 1. I have heard one consumer say that she didn’t go to Realtor.com, because she didn’t trust “official REALTORS” as much as she did a “neutral third party”. Yes, clearly she didn’t know the details… but consumers often don’t know the important details. The other possibility is that Trulia and Zillow get a ton of traffic from stuff that Realtor.com does not have (possibly because of the NAR Operating Agreement prohibits them from having them, and possibly because they don’t want things like Trulia Voices and Zestimates.)

The other trend is the disparity between revenues and profitability among the three. If Zillow keeps blowing out its financial results as it has been, and the other two don’t step up their games… let’s just say going public isn’t the end of the game, but the start of the game. Just ask Move, who’s been public for years and years now. I expect that Move will focus on operating efficiency, while Trulia will focus on sales and efficiency. I mean, if Move can get its profit margins anywhere near Zillow’s, they should see a massive increase in shareholder value.

The couple of random thoughts.

1. Collectively, these three guys are on track to spend over $77 million in 2012 on technology and product development, after spending about $63 million in 2011, and some $53 million in 2010. That’s almost $200 million in developing their websites, data technology, and mobile apps over three years.

So if you’re a brokerage and you’re doing your own technology development, and think of these companies as “competitors”… you really have to ask yourself “Why?” I don’t see it. It’s like Yale’s football team thinking of itself as a competitor to the Green Bay Packers.

2. But given all the spending on technology and product, it’s not clear to me that it’s having an impact on traffic and revenues. Looking at the discrepancy between the three, there isn’t a clear correlation between dollars spent on technology and traffic and subscriber count. I’ll be watching that a bit, since Realtor.com has made some really cool moves on their mobile app, while Zillow’s recent acquisitions and on-record statements about CRM and other stuff are all worth watching.

Anyhow, we’ll see how things develop. But it really is nice to be able to see some real numbers from all three of the Big Portals.

-rsh