For the second time this week, I’ve had the topic of AI (Artificial Intelligence) come up vis-a-vis the real estate industry. The first time was when Aaron Norris of The Norris Group asked me about it on an upcoming radio show. The second time was today, when I saw this interesting article on Inman by Russ Cofano. Its title, “Upstream or MLS? The essential brokerage utility for the 21st century” is a bit misleading because the article is really about AI and “cognitive computing” (which will be defined below).

There must be something in the air. So in the interests of trying to figure out what I think about AI and cognitive computing in real estate, let’s write about it, and figure it out together.

Russ Cofano’s Thesis About Cognitive Computing

Let’s start with the written word, because it gives us a place to discuss things. Cofano’s article is a great place to start.

Specifically, we begin with Cofano’s description/explanation of what cognitive computing is:

So what is cognitive computing? It is a form of data analytics that goes beyond telling us what happened or what might happen. It actually can learn based on all the data it has at its disposal.

Through this learning process, the system makes inferences about the data it is analyzing. In other words, it starts to think, and the more it thinks, the more it learns. And the result is that it can help us decide on what to do next. Not to displace humans, but to make human decisions even better by analyzing more data than a human could ever do.

The application to real estate, he thinks, is that cognitive computing will take in, analyze, and provide insight into all kinds of non-listing data so that it can help real estate professionals make better decisions and better recommendations to clients:

So here’s the question. What if cognitive computing enables agents to be better professionals and make better recommendations to their clients? What if access to cognitive computing power, and the data necessary to power it, becomes the 21st century equivalent of the MLS utility?

Step aside from your business for a moment. If you could choose between a doctor who had access to a Watson-like system that provided that doctor with insight into data that he or she could never assimilate on his or her own or one that didn’t, which would you choose? What about your lawyer or accountant? In a cognitive computing world of real estate haves and have-nots, who will be positioned to deliver a better value proposition to their buyers and sellers?

Of course, he goes on to say that Upstream with its emphasis on non-listing data is the more likely candidate for harnessing cognitive computing than the MLS, but that gets us sidetracked into the “MLS vs. Upstream” and “RPR is the DEVIL!” type of stuff that doesn’t help with our core inquiry: impact of AI/cognitive computing on the industry.

You and I, we’re not gonna talk about MLS/Upstream. We’re only going to talk about the technology itself and its likely impact.

Back in the Day…

AI and cognitive computing have been topics I’ve touched on both here and in my speaking presentations over the years. Back in 2011, I wrote this post titled Watson, And the Future of Real Estate Technology. In it, I speculated that a mature AI system like IBM’s Watson would be an assault on the value of a REALTOR:

From where I sit, so much of the value of having a realtor is replaced by something like Watson. Of course, there’s the irreplaceable human element — the emotional support, the counseling, and having someone to make sure the transaction is going to close — but so much of what a realtor does for the consumer is answering questions. Replace that, and one wonders what the value would be.

…

But if I can get truly accurate pricing, backed up with evidence and confidence scores, from Watson; if I can get all my questions about neighborhoods, local restaurants, zoning regulations, HOA rules, and so on and so forth answered by Watson; if I can have Watson pull together all of the available economic data and market data from throughout the country and in my local marketplace, weigh the evidence, analyze for reliability, and provide me the answer to “How’s the market doing?”… let’s just say that my good friends with whom I have strong relationships would need to adjust their expectations on what I’m willing to pay in commissions.

And I’m just about the most industry and realtor-friendly consumer you’re going to find.

The point was to ask the all-important question: What are you doing now so that your service will be relevant years from now?

I further pointed out that all that it took for IBM’s Watson to become Jeopardy champion wasn’t any fancy new technology, but simply improvements in hardware and storage:

All that was necessary for Watson to become reality is “enormous speed and memory”. Ferrucci jokes in this TED panel about Watson that the Power750 chips that power Watson is “off the shelf” and he can get you a price for that.

Add in Moore’s Law and it was inevitable that Watson would become more and more powerful, more and more capable, and more and more valuable. As Russ points out, in 2011, Watson won Jeopardy, a TV quiz game show. In 2016, Google’s DeepMind beat the world champion in the ancient Chinese game of go — a feat that was once considered unthinkable because of how complex the game is compared to something like chess. What happened in five years? Hardware got a whole lot better and a whole lot cheaper. That’s it.

AI/Cognitive Computing as Expert Systems

The one thing that the folks in the AI world, and of course Russ Cofano in our industry, seem to agree on is that computers and systems like Watson and DeepMind are going to enhance the professional, rather than replace them. From the article on DeepMind and AI linked to by Russ:

A recent report by the Pew Research Center revealed that two-thirds of Americans expect robots or computers within the next half-century to take over many of the jobs now performed by humans. This is not how IBM sees it. “This era of cognitive computing will augment and expand human intelligence, not replace it,” Green said. “We do not see Watson as a job killer. In the man-versus-machine narrative for us, humans are the only heroes of this story.”

The idea is that these AI systems will just analyze the enormous amounts of data, provide insights to the human user, who will then have to use his/her judgment on what to actually do with those insights. Watson will be an assistant, not the main actor.

This is disingenuous propaganda by the proponents of AI, because they don’t want to freak us out. Why? The examples provided in which a computer is merely an assistant usually involves rarified jobs and professions, such as medicine or high-level engineering or scientific research. Even Russ Cofano uses examples of doctors, lawyers, and accountants:

If you could choose between a doctor who had access to a Watson-like system that provided that doctor with insight into data that he or she could never assimilate on his or her own or one that didn’t, which would you choose? What about your lawyer or accountant?

What this line of argument ignores is that there are a whole lot of jobs that human beings do today that do not require years and years of sophisticated training and difficult judgment calls. Show up at your doctor’s office with a rash in your armpits, and it might be poison ivy, allergy to your deodorant, or Hailey-Hailey disease. A Watson or DeepMind can only be an assistance in that situation (probably), and the doctor will need to make the correct diagnosis.

In contrast, I have to wonder what job in the typical Dept. of Motor Vehicles cannot be replaced by automation.

We already know that all of the so-called service jobs in fast food can be automated. And thanks to the new $15 minimum wage law signed by Gov. Brown in California, we’re all about to see the future arrive before our eyes.

Hook up these McDonald’s terminals to Watson or DeepMind, couple it with being able to identify you (facial recognition? signal from your iPhone?), and we may have order takers who know exactly how you like your Big Mac and fries before you even step up.

The $6 billion question is where real estate brokerage services fit in the spectrum of services if we put McDonald’s order-taker on the one extreme and the Chief Engineer of Nuclear Fusion Reactors on the other extreme in terms of specialized skill and knowledge.

I think most of my readers know the answer. Real estate is far, far closer to McDonald’s than it is to McDonnell-Douglas. (See, for example, hours of education necessary to acquire a real estate license vs. a cosmetology license in all 50 states.)

In fact, here’s a story from the Indian IT industry that ought to have real estate people thinking long and hard. Key graf:

Automation mainly occurs with work that involves rote procedures and manual inputs, paving the way for next generation Intelligent Process Automation technology to drive greater savings and efficiency .

So, how fast is automation setting in in the software business and what does it signify for the thousands of graduates churned out by India’s engineering colleges annually? “With cloud computing and analytics taking over, the need for people is coming down. A basic BTech degree may no longer suffice to survive. Engineers will have to be upskilled and focus on niche areas or be equipped to handle smart systems,” said a TCS executive on condition of anonymity. [Emphasis added]

These are IT professionals and computer programmers we’re talking about here. Even there, rote procedures and manual inputs are being displaced by technology. Why would it be any different for the rote procedures and manual inputs in the real estate business?

Answer: it won’t.

Those real estate agents who survive will have to be “upskilled” and focus on niche areas or “be equipped to handle smart systems.”

Enter the 1099 Dilemma

That last phrase about handling smart systems may provide a hint as to where things are headed. Russ Cofano imagines a future of real estate haves and have nots in which some brokerages have the power of cognitive computing behind them and others do not. I imagine a future in which no brokerage has anything at all. Why? Because of the pernicious 1099 independent contractor issue.

This isn’t a new problem. Brokerages routinely spend millions of dollars (even hundreds of millions) to purchase a technology system that they believe will provide a competitive edge to their agents. And 90% of the agents promptly ignore said technology system.

Think about this: Realogy spent $166 million acquiring ZipRealty, in large part so it can get the Zap! platform. That was in July of 2014. It is now April of 2016, and Realogy is going on roadshow after roadshow trying to “rollout” the Zap platform. High level executives like Budge Huskey, CEO of Coldwell Banker, are getting on airplanes, going to hotel conference rooms, with the attendant glitz and glamor, to convince the agents to use the Zap platform. Oh, the time and the expense and the effort involved in just getting a tech platform deployed! By the time Realogy is finished with rolling out the platform, three years might have passed, and the Zap platform may be completely outdated by then. Technology moves a lot faster than do real estate brokerages.

The problem is that the agents are 1099 independent contractors, and the brokerage cannot tell them what to do, how to do it, and what systems to use. IBM doesn’t have that problem. Home Depot doesn’t have that problem. Hospitals don’t have that problem. They have employees, and if those employees enjoy collecting a paycheck, they’ll use the newfangled Watson-powered super-duper cognitive computing system that the company just spent $200 million to deploy.

Not so in real estate.

I wrote a post back in 2008 — full eight years ago — when I had just started this blog talking about the future of real estate technology. Back then, I was far more naive and far less understanding of the dynamics of the brokerage industry, so here’s what I wrote:

Concentration of power is inevitable. If Big Technology gains the power, then it will be able to displace existing real estate brands as the holder of the primary consumer relationship, and leverage the Home Depot Effect. If Big Brokerage gains the power, then it will be able to displace the technology providers as the provider of capital assets, and leverage the Home Depot Effect itself.

For what it’s worth, I believe the winner of this contest will be Big Brokerage — but only if the management of Big Brokerages understand the critical tasks at hand for them, and the major challenges facing them, in what is going to be an incredibly difficult economic environment. If they do not, then they will disappear as the “Real Estate 2.0” companies come to the forefront.

…

Concentration of power in turn enables the big firms to re-establish control over their brands, and reinforce the brand promise. That necessarily means that the agents and teams will lose power, in the same way that a local McDonald’s franchise has very little leeway when it comes to the golden arches brand.

Once big firms gain the power, and get ruthless about enforcing brand discipline, they simply cannot afford to have crappy agents ruining the brand experience. Macy’s spends millions upon millions of dollars trying to make me believe it will be pleasant to shop there; a single interaction with a Macy’s employee ruins the brand completely (for me) to a point where I simply refuse to shop there. This is what happens today far too often in real estate.

If you chuckled, you’re not alone. I just chuckled too. Oh, how little I understood about the relationship between brokerages and agents in 2008!

Big brokerages didn’t invest in technology at the critical juncture in 2008 (remember, Trulia and Zillow had just launched in 2007), not because they weren’t smart, not because they didn’t see what was coming, not because they didn’t want to, but because they knew better than I did that even if they had invested in technology, there was no way for them to get that technology actually deployed with a “workforce” comprised of people who simply do not listen to what their so-called managers are telling them. The only way to do so was to make agents into employees, and that was a business model change that no big brokerage can even think about making.

The rest of what happened with Web 1.0 and Web 2.0 in real estate is, as they say, history.

Is Cognitive Computing Different?

Now, one might say that perhaps cognitive computing and AI systems are different from CRM systems and IDX website platforms. Maybe there is something to a smart computer system that can provide actual answers to consumers such that brokerages will finally be able to exercise real control over their agents and convert to an employee model. Maybe.

Let’s take that notion seriously for a moment. What does an industry made up of large brokerages with AI expert systems and employee agents vs. small brokerages doing the current thing look like?

For one thing, the productivity per agent numbers at the AI brokerage would dwarf the best numbers of current brokerages. It has to, in order to justify the millions invested into technology. Furthermore, the current paradigm of 80/20 in which 20% of the agents do 80% of the business will be transformed. Why?

Because today’s top producers are top producers because they excel at lead generation; post-AI systems, the top producers have to be top producers because they have specialized skills (“upskilled”) or a niche expertise (“I know everything about B&B properties in Maine”) or the kind of skills that a self-learning AI computer system hooked up to every bit of data, structured and otherwise, cannot and does not have. (I don’t know what those skills are, but maybe it’s something like truly superior negotiation skills?) Because if cognitive systems can analyze all kinds of data to spot trends and make predictions, and the Watson interface provides specific answers to questions tailored to the person asking, then that system will take over lead generation functions from the individual agent working a farm or chatting up her sphere of influence.

No matter how you look at it, AI replaces labor — particularly the low-value rote procedures (doing a transaction) and manual input type of work. Get rid of that, automate that, and one skilled agent might be able to do 3-4 transactions a day.

There are only about 5 million homes sold in the United States in a given year, or 10 million sides. How many agents will the economy actually need if a single agent backed up with AI technology can do 150 a month? Do the math, y’all: it’s just over 5,500 agents for the entire country. Even if technology is only a third as efficient as I’ve outlined, we’re talking about 15,000 agents for the whole country, employed by a few large, technologically-advanced companies.

And this is before we contemplate the effect of cognitive AI expert systems on FSBOs….

Conclusion? Not Really…

As is not at all unusual, I don’t know that there is a conclusion per se to be drawn here. Well, maybe one: that worrying about whether the MLS or Upstream or some third party will dominate the AI/cognitive computing future might be losing sight of the forest for the trees….

If we take the impact of AI and cognitive computing seriously in real estate, the last thing we’re going to be worried about is who provides the technology. If AI truly enters the mainstream within five years, as Cofano suggests, then let me suggest that the younger brokers and agents who intend to be in business in five years start thinking really hard about those three things mentioned above: (a) being upskilled, (b) finding a niche, and (c) being equipped to handle smart systems.

And always be asking, what can I do that a super smart computer cannot? People, get ready. There’s a train a’coming.

-rsh

14 thoughts on “Taking AI Seriously in Real Estate”

Let’s go with your Matrix analogies that have been popular lately. Agent Watson downloads the basic transactional and marketing intelligence and says “I know Kung Fu.” Now everyone, via AI, has that ability at a very low price/adoption cost.

But to stand out and be exceptional, agent Neo has to know Kung Fu like Bruce Lee. That’s not something in a textbook or a database. It’s a set of specialized skills refined by testing them against the norm and specializing in the portions which go over and above the baseline of the rest of the competition.

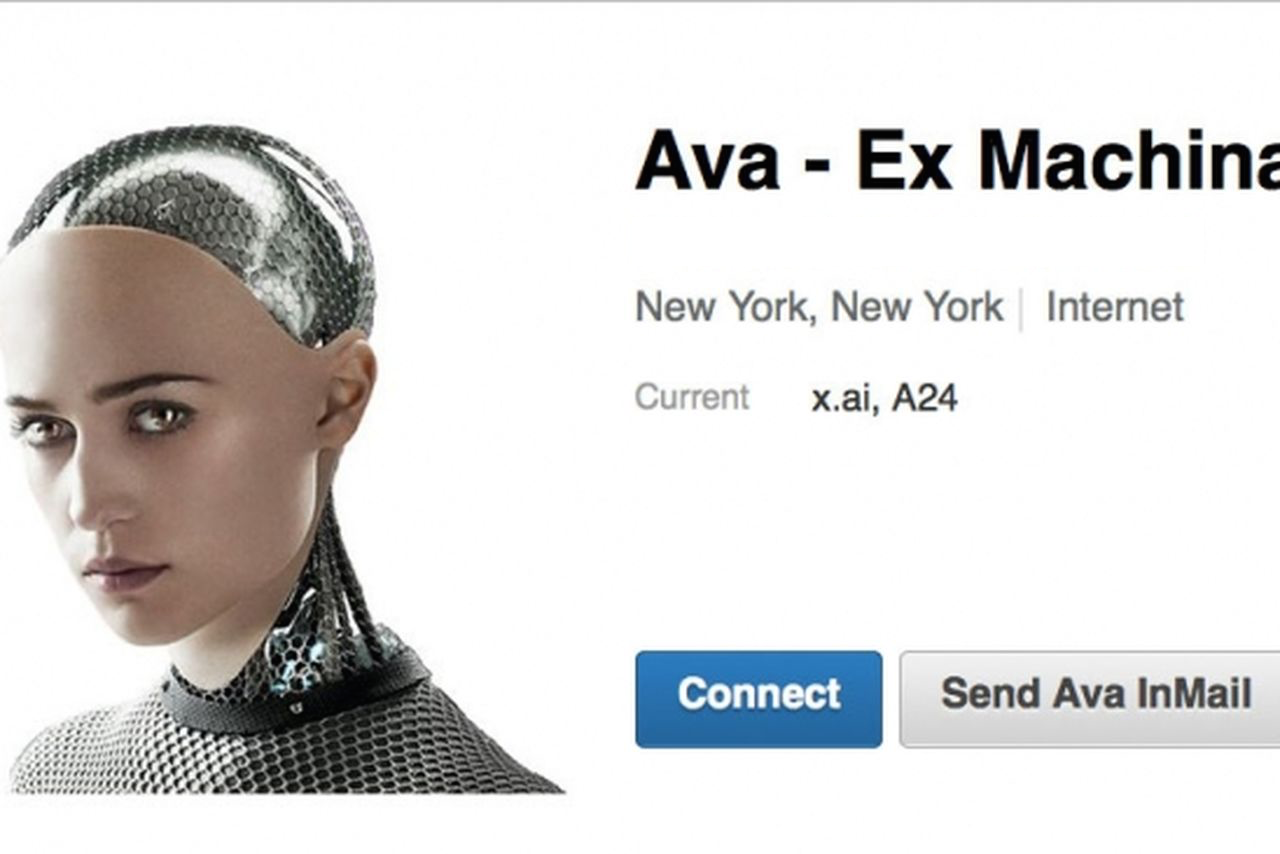

BTW, though we’ve never discussed it, I knew you’d be an Ex Machina fan–good image choice.

Sam – You had me at “Kung Fu.”

OK now think about how AI will affect those OUTSIDE of the real estate industry and what the impact could be on real estate, home ownership levels, society in general, etc.

I have a dark imagination, Mark. 🙂 So in brief:

– AI + robotic police force = totalitarian oligopoly that doesn’t need any pain in the ass stuff like democracy

– Basic Universal Income + Reality TV (bread & circuses)

– At some point, Skynet will become self-aware, and then it’s off to The Matrix with the rest of us bio-batteries.

😀

-rsh

Rob,

It is good that the discussion about cognitive computing in real estate is coming from multiple angles.

I disagree that the Upstream/MLS issue is a red herring in these discussions but for that we will need a bit more face time.

Your statement…”Those real estate agents who survive will have to be “upskilled” and focus on niche areas or “be equipped to handle smart systems.”…could not be more accurate.

And that is why I ended my piece with a statement that cognitive computing has “the potential to do for agent professionalism what no other initiative could touch.”

Talk soon…

Look forward to the face time, Russ 🙂 Always enjoy our talks.

I just thought the MLS vs. Upstream is somewhat irrelevant because whoever propagates cognitive computing will change the entire industry forever in a way that would wreck both the MLS and the business model of brokerages.

I’ll have more on this later. 🙂

-rsh

As always great stuff Rob.

fyi: Inman is doing a broker v. a bot contest, details will come out next week. Please check in everyone and tell us what you think.

Thanks

B Inman

I saw that contest 🙂 Can’t wait to see the results!

Ever faster processing and algorithms that learn will add value to the degree that the data from which they learn is accurate. Local and especially hyper-local accurate data remains in the experiences of expert local agents. Who will “teach” the algorithms the facts. And who will decide who qualifies as a trustworthy teacher? MLS local data is pretty poor. I offer for example, my own subdivision/neighborhood. Of the 100-plus listings in the MLS “claiming” to have been sold in my subdivision, more than half are outside of the subdivision. Indeed some of the listings claimed by MLS record to be in my subdivision are miles distant, with 3 to 4 “other” subdivisions in-between.

This is a great piece. In fact, the technology we are working on will never entirely eliminate real estate brokers (e.g luxury market) but the number of agents will be reduced to approximately 15,000 in the United States within the next decade.

Much like the stockbroker and travel agent were replaced to some extent during the 90’s, this is another industry ripe for technological innovation, and the folks that will be handling the vast majority of listings are not your traditional broker.

The costs to purchase and sell a home will also drop by 6 percent over the next decade as ai integrates the entire process. I will keep you folks posted on our progress.

Comments are closed.