I’ve been in the mountains of North Carolina the last couple of weeks with intermittent internet service and zero cell coverage. So obviously, blogging was nonexistent. I barely responded to emails, to be honest.

One interesting conversation I had with Sunny around the campfire, though, was whether investor offers are always and everywhere worse than traditional sales. Yeah, we’re real estate nerds, so yeah, we talk about that stuff around campfires toasting smores.

What if investor offers are not that much worse than selling your home through an agent, the traditional way?

What if… investor offers are better? By a lot?

The Assumption

Throughout the whole Opendoor and Zillow Instant Offers brouhaha, a consistent theme from brokers and agents was that most people wouldn’t take the loss to sell to an investor. The investor would charge 9% in fees, and underbid the property! Who the hell would leave so much money on the table?

Problem is, I’m not seeing the evidence that traditional sales is always and everywhere better than taking an investor’s offer. I have seen some suggestion of evidence (although clearly biased) that maybe it’s the other way around….

Start with this article from a personal finance site, Nerdwallet, with no real dog in the real estate going ons. It says to plan on 10% of the price of the home for the cost of selling that home.

Even Realtor.com — which we can all agree is in the back pocket of the industry — says that sellers should plan on 8% in straight costs of selling the home. (6% commissions + 2% closing costs.)

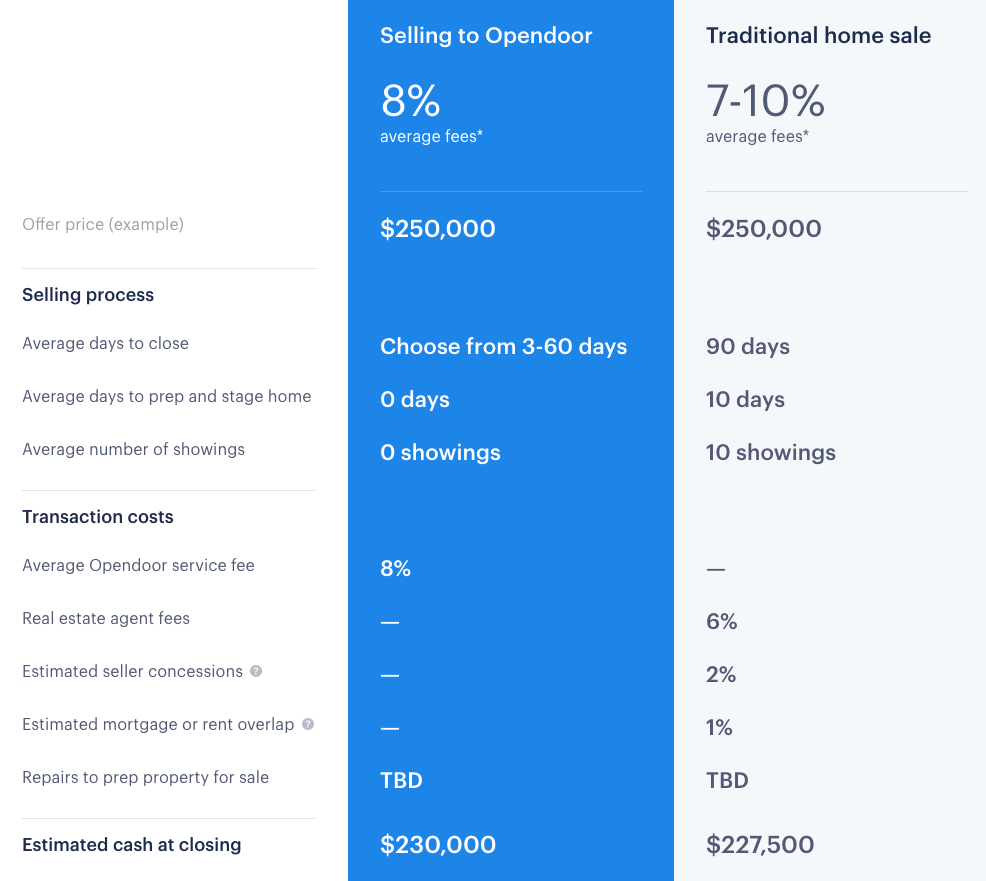

Now look at this from Opendoor:

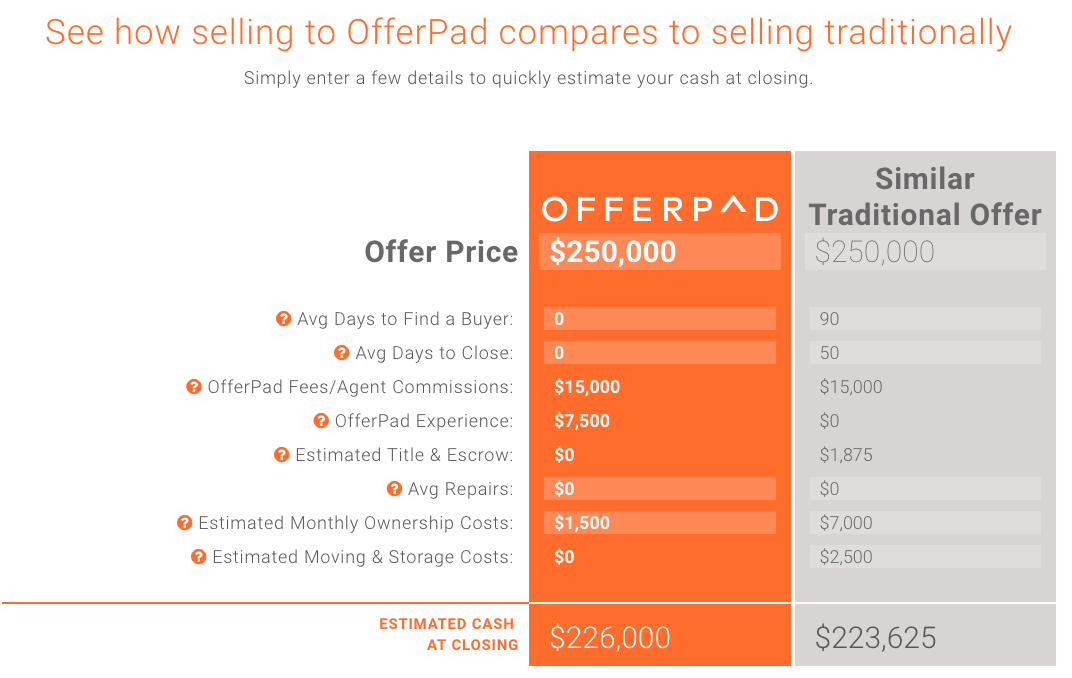

And from one of its main competitors, who is participating in the Zillow Instant Offers trial, Offerpad:

Obviously, both Opendoor and Offerpad are making assumptions to make their numbers more attractive. But still, it does raise the question of why the industry thinks that the traditional sales process always nets more money to the seller.

I mean, seriously, if even Realtor.com is saying that the total cost of selling a house will be about 8%, and these investors are charging about 8%… it’s a wash, isn’t it?

The Agent Will Get More for Your House

The big X factor is the assumption that using an agent will get a higher offer for your house than an investor will offer. That is, even if the cost of selling the house ends up being about the same, the real estate agent will get a far higher offer for your house than the investor will offer.

The biggest source for this claim I’ve been able to find is this one, from NAR, talking about FSBO vs. assisted sales in which NAR notes, “The typical FSBO home sold for $185,000 compared to $240,000 for agent-assisted home sales.” Obviously, $60,000 is a lot of money — it’s almost a third more than the FSBO home.

But that statistic has already been debunked by none other than a Realtor who happens to be an economist. This is from 2015, but as far as I know, the basic points he’s making have not been countered anywhere in my research:

In the post that accompanies the video, John Wake explains:

The whole geeky truth isn’t that real estate agents can sell homes for more money, it’s that FSBOs tend to be more popular with inexpensive homes (mobile homes, manufactured homes and condos) and in inexpensive areas (rural areas, small towns and the Midwest).

His takeaway from all of this?

Hiring a real estate agent doesn’t make you money, it saves you a lot of work and worry.

Now, I’m not an economist. If you want to argue that he’s wrong, please argue with John Wake at Real Estate Decoded.

But my takeaway is that the idea that an agent will get you more money for your home is… well… unsupported by the evidence. After all, a home isn’t worth what a real estate agent tells you it’s worth: it’s worth what someone is willing to pay for it. That could be a lot more, or it could be a lot less.

What If the Investor Offer is Better, By A Lot?

The final piece of this that no one else is talking about is the possibility that investor offers could be significantly better than anything that any buyer in the traditional open market process. How could such a thing happen?

Longtime readers know that I think the most interesting possibility is that companies like Opendoor, Offerpad, and others are looking at revolutionizing the home financing process by offering direct seller financing to buyers. That was premised on the idea that these guys would resell their loans as private label RMBS.

What if they figure out a way to just hold on to the loans and service them directly in some fashion?

Just for fun, I ran some numbers for the $250,000 house above on mortgagecalculator.org with 20% down payment. (And let’s face it, 20% down payment is more than what most buyers can afford.) Here’s what I came up with for a 30-year loan for $200K at 4% interest rate.

- Monthly Payment: $1,298.58

- Monthly Taxes: $260.42

- Monthly Home Insurance: $83.33

- Total Interest Paid: $143,739.01

Oh my. See that interest paid number?

If that’s the kind of profit you’re looking at, why bother lowballing or even fairballing the offer? Just go over asking, sell to a buyer on a seller financing basis, and make your profits from the loan. Screw the real estate; who cares about that when you’ve got the loan and the interest income?

Maybe the flip investor would never overpay for a property, because his profit will come from the sale of the house. We might be looking at a different kind of an investor here, who doesn’t care so much about the property, except as a way to generate a mortgage. Those guys might be willing and able to pay way above what Mr. and Mrs. Joe Buyer can and will.

Something to Think About…

I know many of you are already horrified and fascinated, but… there’s one more thing to just consider.

There is today a bipartisan push to do something about the GSEs — Fannie Mae and Freddie Mac. Who the hell knows if anything will ever happen when we’re talking about something so big and so complicated in Washington DC?

But, one of the ideas often floated is the notion that the government should get out of backstopping the home financing system and allow the private market and private money to do all of that, and just subsidize home purchases by lower income families.

Why would the direct-purchase-and-seller-financing model be a bad one for Fannie Mae and Freddie Mac, once they are fully privatized? Especially if they put in place some sort of a direct subsidy program for low-income buyers (lower rates, lower down payments, lower the price of the home itself, whatever) to get the Federales to let them out of conservatorship?

None of this is likely to happen, of course, but it’s something to think about.

The core of the question is the assumption that a homeowner always and everywhere loses money by selling to an investor. Maybe that assumption is valid, but… why? Inquiring minds want to know.

-rsh

10 thoughts on “Are Investor Offers Always Worse?”

Agree it’s a flawed premise that selling with an agent will always net more than to an investor (aka NOT a fact). I’m surprised CityBldr hasn’t come up in more of the discussions on this topic. Their main value prop on the home page –> “Your home could be worth more. See what a builder or developer would pay for your property – up to 89% more than leading market valuations”

Distressed property value plummets after great recession while REO inventories ballooned. Investors expected 25% roi for buy and hold. The market created “wholesalers” and institutional investors. Now that REO rate has stabilized while investors still buying despite single digit returns. It was crazy to think the creative investors soliciting sellers would pay close to market with so many other deals to be had on open market from 2008-2012ish. Now that it has turned to favor sellers, investor buyers are paying prices like the roi a non factor. Warren Buffet started the insanity in 2012 cause everyone regrets second guessing him, now crazily enough investors absolutely compete with owner occupied buyers. In my market anyway…

Nice thought Rob. NAR membership better wake up before the industry, better yet the US homeownership culture, goes the way of the dodo bird.

The core of the question is the assumption that a homeowner always and everywhere loses money by selling to an investor. Maybe that assumption is valid, but… why? – says ROB.

We’ve been selling property/homes with opportunity to investors for 16 years – it’s all we do.

In the higher-end markets investors bid like any other buyer. When there is adequate exposure and competition fair sales prices are achieved. Selling to an investor in these type markets does not result in lower than market value prices.

What I see here is the pursuit to value a home in Orlando from an office at Goldman in NY. It that possible? Yes, if the home is commodity-like and located in lower priced communities. These “new” models are proving it. How many home sellers in those markets value convenience over sales price….I guess we will find out.

From where I sit (higher tier market) it’s hard enough just coming up with a decent price range for a suggested list price…and I’ve walked the property! 🙂

Thanks,

Brian

The vast majority of the traditional brokerage companies use a “contingent sales methodology.” In other words, the sale is conditional on multiple factors that are determined AFTER the “final” sales price has been negotiated. Like inspections, appraisals et al. So what do the seller and buyer incorrectly assume in this case? That the home is sold when the purchase agreement is signed (not), that the price is the final sales once it has been negotiated upfront (not) and that the deal will close without further negotiation (not). Investors do things differently. And some would argue, better. In most cases they assess the risk, condition and determine all the variables that could impact the sales price BEFORE they agree to purchase a property. And they make any needed adjustments upfront. So the net amount they offer is usually very close to the same net amount that the seller gets and the buyer pays “eventually” using a traditional agent. It just happens upfront and it presents a much improved process of determining the true and present value of a property. So if for some odd reason the conditional sale was ever thought to be great way to sell a property, these investors are exposing it for all it NEVER was. So is an improved consumer real estate experience evolving? I say yes, but I say that knowing that sadly, and once again, it was not the revelation of the traditional brokerage industry.

Ken –

Is there anything that stops the broker from stepping in, being the middleman-market maker, and removing the “contingent sale” from the equation for the seller? That is, list the home, get an offer, then just buy the house at the agreed price and remove the “contingency” factor for the seller. Obviously, you charge a fee for this risk-shifting service, but why not?

Investors seeking to make a profit on a home and they don’t pay retail. Investors also do not get emotion with the property.The numbers need to make sense. A lowball offer from an investor is very common and should not surprise anyone. This Zillow instant offer will not work in a seller’s market. Sellers do not need Zillow and their investors in such a market. This Zillow instant offer coming from investors will work only when many homeowners will be underwater and in my own opinion it’s coming up. Zillow did not wake up one morning and decided on this instant offer thing. Smart people are running Zillow and they know what I know and what the FED knows. The real estate industry is in a bigger bubble than it was ion 2008.

If we ignore the irrelevant Zillow bashing here…

A lowball offer is common from every buyer, isn’t it? It’s not like investors have a corner on lowball offers (at least when the buyers are Chinese, Korean, Indian — people from “haggling” cultures….)

But what’s interesting here is the idea that the numbers need to make sense for an investor, but not for a normal buyer. Why do you think that? And if that’s the case, does the buyer agent always explain that the buyer is overpaying out of emotion or “I gotta have it!” feelings?

Finally, I’m not saying you’re wrong — I am saying that I’m not seeing the evidence that investor offers are always low, always “below-market”. Biased sources like Opendoor and Offerpad have at least put out some numbers suggesting they’re not low. Apart from the debunked NAR study, what else is out there showing that investor offers are always low?

“If we ignore the irrelevant Zillow bashing here…”

Where in my comment you see I was bashing Zillow? I wrote: “Smart people are running Zillow”Does this mean bashing Zillow?

Rob , you are getting to emotion here with your Zillow Lover.

Now to your serious questions:

Experience is everything.I have lots of experience with Multifamily Apartment buildings investors.Investors always compare other investments opportunities to gain the most for their money.Many investors are sitting on the fence now, not buying anything because it doesn’t make sense to buy an apartment building at 3%-4% cap or even a SFR.

Investors are not buying in a seller’s market period!Only those who must buy like in a 1031 situation will buy.

“A lowball offer is common from every buyer, isn’t it? ” NO!

A buyer is not necessarily an investor.

“It’s not like investors have a corner on lowball offers (at least when the buyers are Chinese, Korean, Indian — people from “haggling” cultures….)” The differences between these cultures you mentioned to the western culture is: 0 when it comes to invest money on Real Estate. I have some western culture investors who are bargaining on every $1 and will not buy if they do not get their price.

“But what’s interesting here is the idea that the numbers need to make sense for an investor, but not for a normal buyer. Why do you think that?” A buyer is not necessarily an investor as I said before.A regular home buyer will buy from many emotional reasons. The wife loves the kitchen, the kids love the pool etc,,.An investor will not buy because of those emotional reasons.

If I was Zillow I would not use the word investor! The ordinary homeowner does not like and fearing from, an investor is coming to buy my house.The word investor rings on homeowners mind as someone who is coming to slaughter me.Using the word buyer sounds more human.

Rob, I can only give you anecdotal evidence from my own experience but having sold thousands of homes to investors, and having purchased hundreds of homes as an investor, I can state factually that Investors do not pay retail, and that sellers that can sell to the retail market will get more money. There are factors that you haven’t thought through (including being impressed that a $250,000 investment will generate $143,739.01 IF the homeowner doesn’t move or pay the mortgage off by refinancing some point – Dude, 30 years is a long time to tie up your cash, and an aggressive real estate investor looks to make far more money in a shorter period of time- even investors that buy rentals to operate look for higher rates of return) but basically real estate transactions consist of both terms and price and these models would have consumers believe that isn’t the case. Typically the faster sale means a lower price – the sale where the terms favor the buyer (based on speed or lack of complexity) lead to prices that favor the buyer. So a seller with a “normal” property, not pressured to sell quickly, would be usually be better served by exposing their property to the marketplace to achieve a higher sale price.

That was an oops – terms favor the seller, price favors the buyer 🙂

Comments are closed.