I don’t know about you, but I love having Sam Debord as a regular guest on Notorious. Because we often disagree, but unlike our national politics, people can disagree while still being friends.

The latest example of such disagreement comes from Sam’s recent post, Triumph and the Molehill of Non-Realtor MLS Choice. Read the whole thing if you haven’t already.

For the most part, I agree with Sam’s analysis. I said as much in the original post. Where we differ, I think, is in prognosticating the future, which is admittedly, a losing proposition for me since I’m the one contemplating a future different from today. If you’re a betting man, bet on inertia. While past performance is no guarantee of the future, it’s more likely than not.

But there is something important to be teased out here, so I wanted to respond and highlight that importance.

TL;DR: Change is seldom gradual. It’s sudden, ignored and pooh-poohed, until it happens, catching the incumbents by surprise.

Let’s do it.

Sam’s Counterargument

I would summarize Sam’s counter as the following:

- There’s too much inertia in place and nothing will change.

- MLS of Choice was carefully researched and vetted and won’t result in any major shifts.

- Non-Realtor MLS will also have to grant waivers, so no competitive advantage there.

- Cheaper isn’t better; competing means providing value.

Therefore, Sam believes non-Realtor MLS will adopt the waiver policy similar to 7.43. He further states:

If you believe the future of MLS is cheaper, the flight from Realtor status is plausible. If you believe that the future of MLS is better, as I do, Realtor MLSs are on the right path to stronger relationships with their customers.

I happen to agree with Sam for the most part. In my original post, I said:

In most of the country today, this is simply not an issue. There are no non-REALTOR MLSs nearby. So it’s going to be one REALTOR MLS competing against another REALTOR MLS by expanding their service areas.

I also agree that non-Realtor MLSs will also grant waivers, even though they don’t have to, because the brokers want not to have to pay for agents who aren’t using that non-Realtor MLS. That’s just common sense.

And truth be told, there is no stronger force in real estate than inertia, so betting on nothing changing is always the smart bet.

Having said that, I find most of his counterargument to be persuasive and yet missing the point. It’s because Sam focuses on waivers (7.43) instead of the de-linking of MLS Service Area from Association Jurisdiction and the shift from exclusive franchises to open competition (7.42).

On MLS Competition; I Didn’t Make That Up

Just to be sure, let me make it obvious that the new policy change setting up competition isn’t my random opinion. Rather, it comes straight out of the revised language of Policy Statement 7.42:

The

jurisdictionservice area of multiple listing services owned and operated by associations of REALTORS® is not limited to the jurisdiction of the parent association(s) of REALTORS®. Rather, associations are encouraged to establish multiple listing services that encompass natural market areas and to periodically reexamine such boundaries to ensure that they encompass the relevant market area. While associations are encouraged to work cooperatively to establish market area multiple listing services, the absence of such an agreement shall not preclude any association from establishing and maintaining a multiple listing service whoseterritoryservice area exceeds that of the parent association(s) jurisdiction.Where the territory of an MLS exceeds that of the parent association(s), the authority of the MLS to require offices of a participant or a participant’s firm to participate in the MLS is limited to offices located within the jurisdiction of the association(s) of REALTORS® that own and operate the MLS or that are parties to a multi-association or regional MLS service agreement.MLSs may not,as a matter of local determination,requirethat eachother offices of a firm’s offices located within the jurisdiction of the association(s) that own and operate the MLS or that are parties to a multi-association or regional MLS service agreementto participate in the MLS if any office of that firm participates in that MLS. (Revised 5/02) M

As you can see, 7.42 used to say that the MLS could only require offices of a Participant broker within the “jurisdiction of the association(s) of REALTORS” that own the MLS. Now, the MLS cannot require any office or agent to participate in the MLS no matter what its Service Area (taking out the changes): “MLSs may not require other offices of a firm to participate in the MLS if any office of that firm participates in that MLS.”

On the other hand, the service area is not limited to the jurisdiction of the parent association(s) of Realtors. What does that mean? Well, the “Background on Changes” section announcing these changes spells it out:

Affect on Local Adoption (which must occur prior to July 1, 2018): Brokers and agents will be empowered with a nimble MLS service structure that allows for innovation and competition amongst MLSs. The new approach will allow agents a choice in subscribing to any MLS in which their broker is a participant, and it will require MLSs to only assess Brokers a fee based on their affiliated licensees who chose to subscribe to the MLS. However, MLSs will have the discretion to assess fees to agents affiliated with a participating office jurisdiction, if those agents have not subscribed to another MLS. This will result in a value-driven service structure that encourages competition amongst MLSs, responds to the evolving business needs and varied structures of brokerage firms, and, therefore, is in the best interest of brokers and their affiliated agents. [Emphasis added]

The whole point of 7.42 combined with 7.43 is to encourage competition amongst MLSs. This is a welcome and salutary change. But it is a change.

Entirely Foreseeable and Expected Changes

Let’s start with what these policy changes actively contemplate, encourage, and expect will happen.

These changes are clearly intended to drive MLS consolidation. The expected and encouraged change is that large, well-funded, well-run MLSs will start taking over their smaller, less-funded, less-professional neighbors.

Presumably, the larger, better operated MLS can offer more value to subscribers, which encourages defection from the brokers and agents who are part of the smaller MLS.

Large brokers, with multiple offices across multiple MLSs, can shift a number of their agents to a higher value MLS, starving out the smaller MLS, thereby driving consolidation. They can do this without worrying about having to pay for them because 7.43 requires the small MLS to grant waivers to their agents who have shifted.

You know what else was entirely foreseeable?

Loss of Associations Members Was Foreseeable and Expected

Lest you think yours truly is engaging in hyperbole, let me point you to the CMLS White Paper on the MLS Policy Statement changes. In it, we find this fascinating passage:

5. MLS and Association Revenue and Billing

It is possible that MLSs’ and associations’ revenue will initially be negatively impacted by an MLS of Choice Policy. New agents that do not yet have clients might delay joining the MLS and association until they have a transaction in sight. Part-time agents with infrequent transactions might choose to not maintain their participation on a consistent basis. Buyers’ agents may choose to utilize brokerage back-office data feeds or IDX/VOW sites in lieu of subscribing to an MLS.

As many MLS subscribers join the association only to gain MLS access, a decrease in MLS subscriptions might also result in a decrease or delay in association membership. Additionally, many MLSs bill subscribers on a wholesale basis, meaning the MLS bills its participating associations, and then the associations bill their members directly, based on a price set by each association. If not all association members were required to subscribe to the MLS, then associations would need to modify their member data and billing practices to account for a more complex fee calculation – each association would need to bill only for those members that selected the MLS.

The net effect is that MLS and association services will be paid primarily by producing agents as opposed to being subsidized by those with infrequent use. This could result in MLSs and associations raising their fees to cover losses due to diminished membership. [Emphasis added]

This is the same CMLS that Sam mentions participated fully in the research and vetting of the policy changes.

So from the start, losing Realtor members was contemplated, foreseen, and perhaps even expected from these changes.

Competitive Advantage of The Non-Realtor MLS

I have never suggested that the competitive advantage of the non-Realtor MLS is that it doesn’t have to issue fee waivers under 7.43. I suppose I took it as a given that they would issue waivers as well.

So to the extent that Sam’s conclusion is that non-Realtor MLSs will issue waivers, I agree 100%. But that isn’t where the story ends, or for that matter, where it begins. It’s entirely irrelevant.

Even if the MLS service is provided at the same cost, the non-Realtor MLS enjoys a significant price advantage over its Realtor MLS competitors because they’re not charging association dues. They can use that to offer a less expensive alternative to all of those new agents and part-time agents and buyer agents that the CMLS White Paper contemplates.

But Sam says price isn’t important; providing value is. OK, fine.

A non-Realtor MLS can price itself the same as the Realtor MLS plus Realtor dues, and spend that extra revenue on additional products and services that “provide value.” That would, to quote Sam, “provide more benefits to more customers.” An addition $600 a year or per subscriber so goes a long way towards creating value.

In fact, the non-Realtor MLS can do both: be less expensive than the Realtor MLS and provide more benefits to more customers. Instead of charging the full $600 per year that the Association charges, just charge an extra $300 per year and spend that on more products and services and better customer service.

Oh, and of course, the non-Realtor MLS will issue waivers if you, the customer, chooses to belong to a more expensive Realtor MLS. Now what competitive advantage does the Realtor MLS have?

Better products and services at lower cost. What’s not to like?

Differentiation?

One thing I have to mention here for the sake of completeness. Michael Porter’s classic work On Competition lists four ways for any company to compete: Cost, Differentiation, Focus-Cost, and Focus-Differentiation.

The MLS industry as a whole lacks true differentiation. Sure, there are minor differences between Matrix and Fusion and Flex and whatever else. But except to people who are tasked with selling those systems, there really isn’t much difference between them. It’s sort of like the difference between a Honda, a Toyota, and a Nissan: slight edge here and there, but no real difference between them. It is definitely not like the difference between a Honda and a Porsche.

There’s a very good reason for this lack of differentiation. The MLSs really haven’t had to offer differentiation because they were and are organic monopolies. Offer a piece of crap MLS front end, and your customers don’t have a choice but to suck it up — because you’re a monopoly. Offer a great MLS front end, and your customers are happier… but it isn’t like they have a choice.

The sole differentiator I can think of is HAR, which has a truly successful public facing website feeding leads to its members. But no one else has what HAR has, period.

The Differentiation of Realtor Membership

So when you get down to it, to believe as Sam does that the Realtor MLSs represent the future of MLS as “better” instead of cheaper, there has to be some differentiating value to the Association membership itself.

I hate to beat a dead horse, but… there is precious little evidence that the vast majority of Realtors themselves give a crap about the Association itself. Even those who bleed Realtor gold-and-blue like Sam himself, like most of my True Blue Realtor friends who spend thousands of dollars and hundreds of hours volunteering, recognize that a major challenge exists in proving the value of Realtor membership.

We all know this. And preaching isn’t the same thing as describing. I can preach the value of advocacy and professionalism better than most, but I do recognize that most so-called members don’t see the value. The true believers know that even as they preach the value of the Association, if the Association loses the MLS, they’ll see a dramatic drop in membership. (See, for reference, the CMLS White Paper above.) I don’t see the point in pretending otherwise.

That could change; it should change. Realtor membership should mean something serious and real. I work towards that goal in my own way every day.

But could and should are not synonyms of is and does.

Fundamentals Matter, and the Nature of Change

At the end of the day, I’m not predicting that Realtor MLSs will abandon Realtorness in droves. Inertia is strong in real estate. I am merely pointing out the fundamental competitive advantage of the non-Realtor MLS and taking that to its logical conclusion.

And when fundamental competitive advantage exists, it’s just a matter of when and where and who as to changes happening. It might not be today, it might not be anybody we know, such as existing broker-owned MLSs, but it will be someday and by someone.

Change is rarely gradual. It’s more of a staircase with sharp ups and downs followed by long stretches of the status quo. And until we all see the up or down, it’s very easy to ignore signs or pooh-pooh them as “it’ll never work.”

Digital photography was ignored and ridiculed for years and years. “That’s cute, but don’t tell anyone about it,” was Kodak’s response. Strange given that Kodak invented the technology in the first place. So the years passed. And then it wasn’t a molehill. Suddenly.

The MP3’s official birthday is July 14, 1995. The developers of the MP3 format warned the music industry about the dangers of MP3 in the late 90s but with predictable results:

“We tried to tell the people from music industry early on, and we tried to discuss possibilities how to react to this … The idea was that the music industry wouldn’t just be able to go on, they would have to adapt to the situation as well, and if we now look back these 15 years we have to say they finally did but it was too slow and some strategic errors in there.”

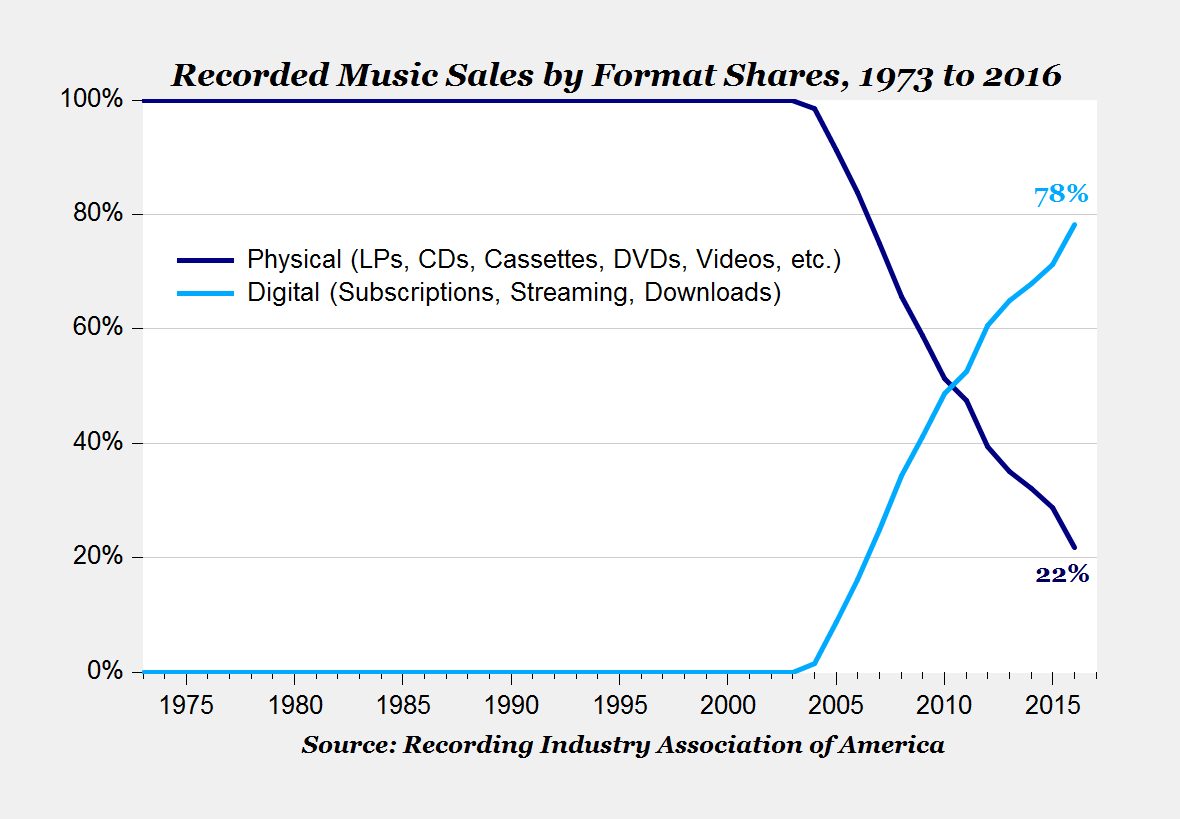

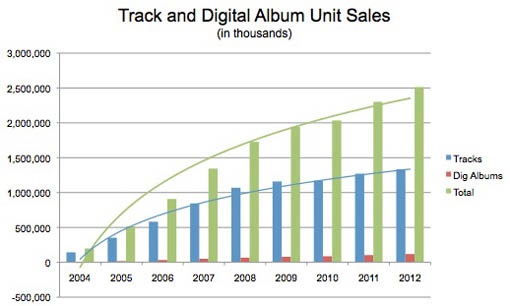

By the time Napster appeared on the scene, of course, it was far too late. The result?

My point is that predicting the future — in particular, predicting future change — is difficult at best and often foolish. So to some extent, I accept Sam’s criticism that the “Armageddon scenario” is unlikely to come to pass.

My point is that predicting the future — in particular, predicting future change — is difficult at best and often foolish. So to some extent, I accept Sam’s criticism that the “Armageddon scenario” is unlikely to come to pass.

At the same time, fundamentals matter. Gigantic differences in cost structure matter. Flexibility and nimbleness vs committee-driven association-style governance matters. And change, if it comes at all, tends to come quickly, suddenly, and after the incumbents have spent years ignoring it and downplaying it.

But hey, if you’re a betting man, bet on inertia. If your job is strategy, however, as opposed to defense of the status quo, then it might be worth thinking about cost, differentiation, and the nature of competition.

-rsh

8 thoughts on “It’s A Molehill! Until It’s Not… A Response to Sam Debord”

I think we are approaching a point where the MLS will be seen as a Utility. As software developers produce more “third party” products for agents to use, what will be the need for the native MLS software? All that is needed is to unlock the add/edit module. Even now the big vendors are offering up-sell modules to compete with the robust outsider products. MLS data exists in the Cloud and can be as equally inter-operable as a Sprint user calling a Verizon user.

If other states adopt laws like NJ that require compensation of all potential cooperating licensees there will be a seismic shift in the industry. Right now in NJ, an enterprising licensee that practices Buyer Agency can do quite well without joining any MLS. All the listing information is public, the listing agent must cooperate, share agent-only information about the listing, and make showings available regardless of MLS affiliation.

It was suggested in Chicago by the drafters of this policy that agents participating in a transaction without being subscribers of the listing MLS would be in violation of the policy. Not so here, properties are quite often co-listed by agents in different branch offices of the same firm so the property can be exposed on neighboring MLSs without the need for the named agents to join both. The listing is the property of the managing broker and can be assigned to any agent(s) in the firm.

As was admitted from the podium at NAR, the rules to back up the new policy will be a work in progress.

What a mess. Way past the time to simplify. So with that in mind, I think it might be noteworthy to comment that this “Armageddon” for the industry in question – namely the MLS – would likely result in the creation of a state of “Nirvana” for the real estate brokerage industry provided by the much-needed freedom from the industry’s current monopolistic state of “resentful MLS bondage.”

Thing is, Ken, if you read what Sam says, there is no “resentful MLS bondage” you keep referring to. Brokers are (apparently) happy with the MLS and want to preserve it as it is, with some minor tweaks.

He’s a broker. Shouldn’t we listen to what he says brokers want?

Rob, I am arguing only on behalf of the “silent minority of the brokers that do the majority of the business.” When in doubt, I suggest that you dial back the clock and review the Realty Alliance’s list of “demands on the MLS industry.” Pre-Upstream. The core of the essence of what the broker’s wanted in terms of change for the MLS – and the same demands the MLS industry simply ignored. Remember Craig being interviewed by Walt on-stage at CMLS in Huntington Beach? The deadline for action communicated on Inman News? I do. Just because the resulting Upstream project was bungled by too many parties to list and has now failed miserably, doesn’t mean that the original demands on the MLS industry communicated by “unhappy brokers” have somehow now magically gone away. Therein, you will find the core of the basis for my comments.

‘ And change, if it comes at all, tends to come quickly, suddenly, and after the incumbents have spent years ignoring it and downplaying it’

Loving this Gem of a blog you have, Rob.

Whenever a sentence starts with “Sam says…” I wince and buckle down for an exaggerated/oversimplified version of what I wrote. But it’s a great piece.

Strategy is more interesting than jaded complacency any day. 🙂

I think the most successful Non -realtor MLS will be a totally outside provider like Google, Zillow or Facebok. Any data-base provider can copy the Realtor MLS, including an offer of Co-op %. It also requires a lot of advertising to create a “World MLS” that the public will use. But once that is done, and the “World MLS” allows FSBO listings, and promotes it like Facebook does now in it’s Marketplace,

you may not see Listing Agents able to charge a high commission anymore. Other agents will see opportunity in supplying FSBOs with MLS pictures,a lockbox, and insertion into the World MLS. This direct approach is what travel agents and stockbrokers have already adjusted to.

“there is no stronger force in real estate than inertia, so betting on nothing changing is always the smart bet.”

I agree with you, but *Sigh*…

Comments are closed.