It’s New Year’s Eve, 2017. The champagne is chilling, dinner reservation has been made, and it’s quiet around here. Rare thing, this quiet.

In any event, on this last day of 2017 — a year filled with changes, both good and bad and in-between — I thought it’d be fun to take a look back at the top seven posts from Notorious ROB.

These seven were the most popular by traffic during the past 12 months, so I had nothing to do with selecting them: YOU did.

It seems clear that y’all were all kinds of interested in Redfin and its IPO, because three of the seven most trafficked posts were about that. Bob Goldberg’s appointment as the new CEO of NAR also drew a ton of interest, and Zillow-related rounds out the top seven posts. Not surprising, really.

I know most of you have already read these, but hey, it’s a Throwback Thur- er… Sunday!

Happy New Year, everybody! May 2018 be the best year of your life!

1. The Impact of Redfin Post-IPO: Part 1 – Brokerages

Since I wrote most of the last post about Redfin’s IPO off-the-cuff without thinking too hard, I promised I would have something more substantive on Redfin’s IPO and the possible impact. Well, as it happens, I’m writing up a fairly significant white paper on the future of brokerage and this goes right to the heart of it.

So first of all, if you’d like to get a copy of the brokerage white paper once I’m done, drop me an email and I’ll add you to the list.

Having said that… the Redfin IPO is one of two things.

It could be one of those moments we’ll look back on in 4-5 years and realize “that’s the moment everything changed” much like how we view Zillow going public back in 2011. Don’t forget, all you Zillow Haters, that few people paid much attention to Zillow back in 2010-2011.

Or, it could be a total fizzle like Ziprealty, which went public in 2004 and did precious little of anything until it was acquired by Realogy (where it still hasn’t done anything), and the industry will be emboldened in the status quo.

I am very much in the first camp, because Redfin is a contemporary of Ziprealty, and competed head-on with Ziprealty when ZIPR was a public company flush with cash. Redfin was gaining online when the competition was even fiercer with Trulia as an independent company.

So let’s assume that Redfin will successfully complete its IPO, raise $100 million, and be valued in the neighborhood of $3 billion. Let’s further assume that Redfin behaves like intelligent business people, as they always have, instead of buying private jets for Glenn Kelman or some such thing. (Which they won’t, since their S-1 stressed “frugality” as a virtue of and culture in Redfin.)

What are the likely consequences?

In this part, I focus on a couple of thoughts in the brokerage side of things.

For the TL;DR crowd, Redfin kills off any non-boutique large brokerage… unless they swallow their pride and go beg Zillow for help.

2. Random Thoughts on Redfin Going Public

I have been waiting, wanting, hoping for Redfin to go public for a few years now. For a bunch of reasons, mostly having to do with getting another company in real estate to have to report publicly about their operations and their numbers.

Well, my wish has been granted. Redfin just filed its S-1 to go public a couple of days ago.

I don’t have any strong opinions at the moment, besides wishing Glenn Kelman and crew lots of luck. But looking through Redfin’s S-1, I had a few random thoughts. I figured I’d share them with you all, taking a bit of a break from the internal machinations of NAR.

This is a game changer. The industry as we know it will never be the same after Redfin’s IPO. I’ll post on that later, but I wrote most of this before I started thinking harder, so I figure I might as well share this with you all while I work on the bigger piece.

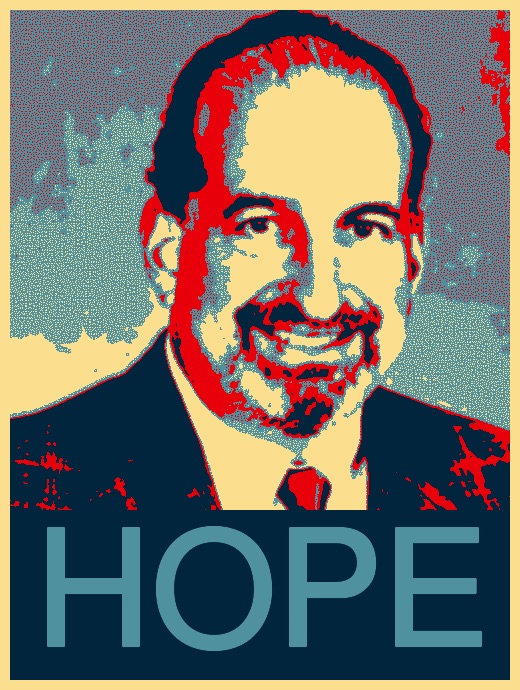

3. The Bob Goldberg Era Begins; Convince Me On A Few Things

In the middle of the afternoon on Friday, June 23rd — a curious time to be releasing such major news — NAR announced that it had chosen NAR Senior VP Bob Goldberg to be the next CEO, replacing the retiring Dale Stinton.

As you can imagine, I’ve had more than a few emails, text messages, Facebook messages and the like from all sorts of people asking my opinion on the selection. Why they care about the opinions of some consultant/blogger is a bit beyond me, and I am… how do I put this… “humbled and excited” to be asked.

I have a bunch of thoughts, many of them in conflict, and a few different emotions — a couple of those are in conflict as well. So in a way, this post may be my working out all of those different thoughts and emotions. Take the journey with me.

4. Zillow Fever Strikes Again! Instant Offers Trigger Insecure Agents

One of the more amusing things about the real estate industry in the 21st century is the extent to which Zillow triggers some folks to heights of lunacy otherwise seen only in the more extreme social justice warrior types. If Zillow bought Coca-Cola tomorrow, some people would immediately switch to Pepsi.

The latest fracas involving Zillow’s Instant Offer test is a good example. Inman News reported on it yesterday:

The new Zillow product allows prospective homesellers to receive all-cash offers from a hand-selected group of 15 large private investors along with a side-by-side comparative market analysis (CMA) from a local Zillow Premier Agent.

The way it works seems pretty straightforward. Some homeowner surfing Zillow fills out a form. That form is sent to well-heeled (institutional) investors. It is also sent to some agents who are asked to provide a valuation (CMA) and try to get the homeowner to list the home with them instead of selling to an investor. The homeowner can choose to (a) sell to an investor, (b) sell to an investor, but pay an agent to help, or (c) list with an agent.

Doesn’t strike me as being all that different from all of those “What’s Your Home Worth?” type of things we have seen on the real estate web since… well… the start of the real estate web. I distinctly remember Homegain doing that back in the day, and doesn’t anybody remember HouseValues.com?

And yet… the response from some (though not all) people has been… ah… striking. Y’all need to chill out. This isn’t anything more than Zillow trying to fend off real threats looming on the horizon in the form of Opendoor and its copycats. Yet, some of the same people who were pooh-poohing Opendoor as a We Buy Ugly Houses with fancier office furniture are losing their ever-loving minds when Zillow does something similar but with a benefit for agents.

If that’s not a symptom of Zillow Fever, I don’t know what is. Let’s explore this like rational people.

5. A Response to Bill Brown, 2017 NAR President

Usually, Notorious is what you might call an underground-yet-not-really phenomenon. That is, I know that almost all of the leaders of the industry read it, and I get emails, messages, and phone calls from them from time to time responding to one post or another. Very, very rarely do I get a public response from someone in a position of authority.

Well, in a refreshing change from the atmosphere of omerta that seems to surround organized real estate, 2017 NAR President Bill Brown posted a lengthy comment on my post about Bob Goldberg’s elevation to CEO. He corrects the record, and takes me to task on a couple of items. I thought it worth responding to him here, in a separate post, rather than in the comments section.

Seems to me that this is a rare opportunity for public discourse about an important decision that the organization has taken. I think it’s healthy for people who have the same ultimate goal — to save the Realtor Movement — to discuss things openly.

I’m going to quote parts of Bill’s comments, but I encourage you to read the whole thing. It provides real insight into the thinking of the NAR Leadership of today. This will be written as an open letter to Bill.

6. Does Fiduciary Duty Require Putting Listings on Zillow?

A really interesting discussion broke out in the comments section of my post last Wednesday titled “The MLS Is Not Doomed! But Most of Them Are.” A reader with the alias DeRidder LA Real Estate, LLC injected everybody’s favorite topic, Zillow, into the conversation:

Disallow compilations of your MLS data to be sent to Realtor.com, Zillow, or Trulia. Disallow your membership to post homes for sale on Realtor.com, Zillow, Trulia, or any other entity in the future that rises to threaten the profession. An MLS with brokers focused on protecting their market can keep ZTR out. Don’t believe me? I already see it being doing in 3 geographical markets, with two of them being fairly large markets.

All you idiots that posted homes for sale on Zillow and Trulia are the cause of this chaos, along with all you idiots that pay ZTR each month for advertising. Did you guys not see this shit coming 5 years ago? I guess not. I’ll admit I’ve been an idiot before. I have never purchased advertising from ZTR, but I have posted homes for sale there. I wised up though, and you should too!

Which then led to a remarkably civil discussion between DeRidder, me, and a couple others, which, in turn, ignited this question:

In 2017, does fiduciary duty require that the broker put listings on Zillow?

First, a few caveats. I suspect that people will disagree sharply here. But I really would like a civil, measured debate and discussion on this. So for this post, I’m going to warn everyone up front that name-calling, personal attacks, etc. simply will not be tolerated. I will delete the comment and consider banning you from the site if you go out of bounds. You can hate on Zillow the company all you want, but if say Jay Thompson comes by and you get into personal attacks (“shill!” and so on), I will excuse you from the grownup table.

By the way, I’m singling out Zillow upon request from DeRidder, who asked that we focus on Zillow instead of “good portals out there with buyer eyeballs who aren’t trying to take over real estate.” Because I’m a sweetheart, I agreed, although I disagree that Zillow is somehow different from portals like Realtor.com and Homes.com and Movoto and… you get the picture. Given Zillow’s vast lead over all the other portals, it’s fair in my eyes to cast Zillow as the representative of all the portals out there.

Oh yeah, disclosure time: I have a business relationship with Zillow, but of course, they do not control or even know what I’m writing about here — until they read it here like everybody else.

With those caveats in place, let’s get into it.

7. The Impact of Redfin Post-IPO: Part-2 – MLS & Associations

I have to be honest here. I thought this post would be easy to write after Part 1, where I talked about impact on brokerages. Turns out not to be the case.

There are several reasons why, but the biggest is that there are a lot of “if-then” branching scenarios that made me get into some game theory for a while. Plus, organized real estate is really, really complex. It’s not clear how the various players would react.

Nonetheless, in the vein of “crappy product shipped is better than perfect product on the drawing board,” I figured I should just think out loud with everybody and take my lumps where I’m just misguided or wrong.

So let’s do this together, shall we?

Farewell, 2017! Welcome, 2018!

Whew! That’s a lot of words! I didn’t keep track, so I don’t know how many pixels were murdered in 2017 with all of my ramblings and musings and even once-in-a-while brilliant insights. But to all of you who made the journey with me, I thank you. Not just because you’re the best informed audience in real estate, who likes to argue and debate and keep me from being complacent, but because you have the amazing mental fortitude to wade through 8,000 words on some arcane-ass esoteric topics.

I would also like to thank those who wrote guest posts on Notorious, from Sam DeBord to Sunny Lake to Chip Ahlswede. Your contributions enrich us all, even when (especially when) you don’t quite agree with my take on things.

I’m certain 2018 will bring more fun and excitement to us, at least, if you’re a real estate industry geek. I look forward to more intellectual journeys with you all.

Happy New Year! (Oh, and I found this leftover from my Disco edition of Seven Predictions….)

-rsh

1 thought on “The Top Seven Posts of 2017”

Rob, still possible to get that white paper mentioned in the Redfin Post-IPO part 1 post? Thanks.

Comments are closed.