I’m deep into writing the October Red Dot, but Andrew Flachner of RealScout sent me a personal email this morning with his Open Letter to the industry attached. He’s spoken to me before about this initiative, and asked if I would write about it.

Well, the Open Letter is now published, and Inman News has the story about its subject with the title “NYC brokerages unite to launch ‘game-changing’ data platform“:

A number of leading residential brokerages in New York City are banding together to offer a new level of transparency to the way consumers and brokers search and transact property. The effort is being called a “game-changer” by high-ranking executives involved in its launch.

Brown Harris Steven, Halstead Real Estate and Douglas Elliman are among a slate of top-tier residential real estate brokerages spearheading the launch of NYC Buyer Graph, a platform powered by real estate technology company RealScout that gives buyers, sellers and their agents exclusive data and consumer-friendly technology to collaborate on property transactions.

After asking Andrew if he’s sure about my writing about NYC Buyer Graph, since well… he’s a friend of mine and longtime readers know how I tend to do things like product reviews… I decided to write this because I thought there is something important here to point out.

One can never tell with these things, but NYC Buyer Graph strikes me as a very good way to buy yourself a bunch of legal bills when the various state and federal authorities get all kinds of interested in it. I think that the NYC brokerages who are involved in this — as well as RealScout the platform vendor — are doing a dangerous thing.

So on the one hand, congratulations to Andrew Flachner and the team at RealScout for putting together this historic collaboration. Hope they’re making a fortune from this venture, and I wish them the best. On the other hand… /cringe

Let’s get into it.

About the NYC Buyer Graph

Let’s start with what this actually is. Inman describes it as a platform that gives buyers, sellers and their agents “exclusive” data and consumer-friendly technology. The story quotes Andrew:

“These leading brokerages have incredible access to data, people, and expertise – an irreplaceable competitive advantage which, for the first time, can be leveraged by buyers and sellers through the application of RealScout’s platform,” said Andrew Flachner, RealScout’s co-founder. “We’re confident this group of pioneering brokerages, with their dominant market presence, coupled with our technology, will redefine the real estate process in New York and set the standard for the rest of the country.” [Emphasis added]

Hm, dominant market presence, you say? Would that be something like market power?

Further on, the article notes:

“RealScout’s Buyer Graph brings unprecedented sophistication and coordination among member brokerages and agents, while fully ensuring consumer privacy,” [Richard Grossman, president at Halstead Real Estate] added. “This is a game-changer.”

While the platform is launching with the seven initial partners, it’s currently welcoming additional brokers in the city to join. The NYC Buyer Graph promises brokerages that their clients will enjoy access to the group’s technology, network and home buyer demand data. The more brokers that join the ranks, the stronger the platform’s reach and influence.

The platform will not be consumer-facing, so buyers and sellers will only be able to gain access by working with a member brokerage or one of its agents. [Emphasis added]

Huh. Coordination among member brokerages and agents, you say? Would that be a different way to say “acting in concert” involving an agreement?

And then we have this from the NYC Buyer Graph website:

Then from Andrew’s Open Letter (which I’m sure will be published soon enough):

The NYC Buyer Graph brings together seven of the largest NYC brokerages, enabling them to:

- Lock down their buyer data by engaging consumers on the brokerage’s own branded home search experience

- Utilize that data for better deal-making within their brokerage companies

- Begin to collaborate, for the first time, with other brokerages around securely shared, anonymized demand insights at the market-level [Emphasis added]

Is that so? It seems very… ah… striking to me that this open letter is actually entitled “An open letter to brokerages facing pressure from disintermediary technology and alt-brokerages.”

I do believe you’re getting a good sense of where I’m going with all this.

May You Attract the Attention of People in High Places

I’m sure you know about the ancient Chinese curse: “May you live in interesting times.” Less well-known is the second part of that curse: “May you attract the attention of people in high places.” Even less well-known is the third curse: “May you find what you are seeking.”

As I’ve said, it’s always dicey to prognosticate on government action, but if there’s a regulator awake somewhere in Washington DC, or someone on the staff of the NY Attorney General’s office in Albany, then the NYC Buyer Graph is likely to attract the attention of those people in high places. Good thing real estate is such a boring topic.

– Makan Delrahim, Assistant Attorney General, DOJ

Wait, the FTC and the DOJ are indeed very much awake and investigating the real estate industry, you say? And a prime focus of their attention has to do with data availability, you say? At least one influential think tank has published a paper on this very topic, you say?

If this isn’t an attempt to attract the attention of people in high places, it’s hard to imagine what would be.

Let me see… the seven largest and most powerful brokerages in NYC who have significant “market power” have combined, agreed, coordinated… one might even say conspired (a term filled with legal meaning under the Sherman Antitrust Act)… to create a “groundbreaking cooperative” that will be a total game changer. One of the explicit promises, a core value proposition, of this cooperative is that it will “lock down” buyer data and prevent “leakage” into the portals.

No, that doesn’t sound problematic at all, said no antitrust attorney ever who wasn’t paid to say such a thing.

May You Find What You Are Seeking

Let’s think through this for a moment.

So seven of the largest brokerages, who collectively have what Andrew calls “major proportion of New York City’s real estate market,” have come together, agreed, coordinated, and collaborated to create this data platform. We don’t know yet who controls this platform. The website is by RealScout, but knowing real estate as I do, I highly doubt that Andrew gets to make all the decisions. Presumably there is some sort of a Board of Directors or a Board of Advisors or some kind of a governing body over NYC Buyer Graph that is comprised of representatives from the Majority Seven.

The website plainly tells visiting brokerages to “Request Membership.”

What are the rules governing said membership? Who grants membership? What are the conditions? We don’t know yet, but… what happens when Redfin applies for membership?

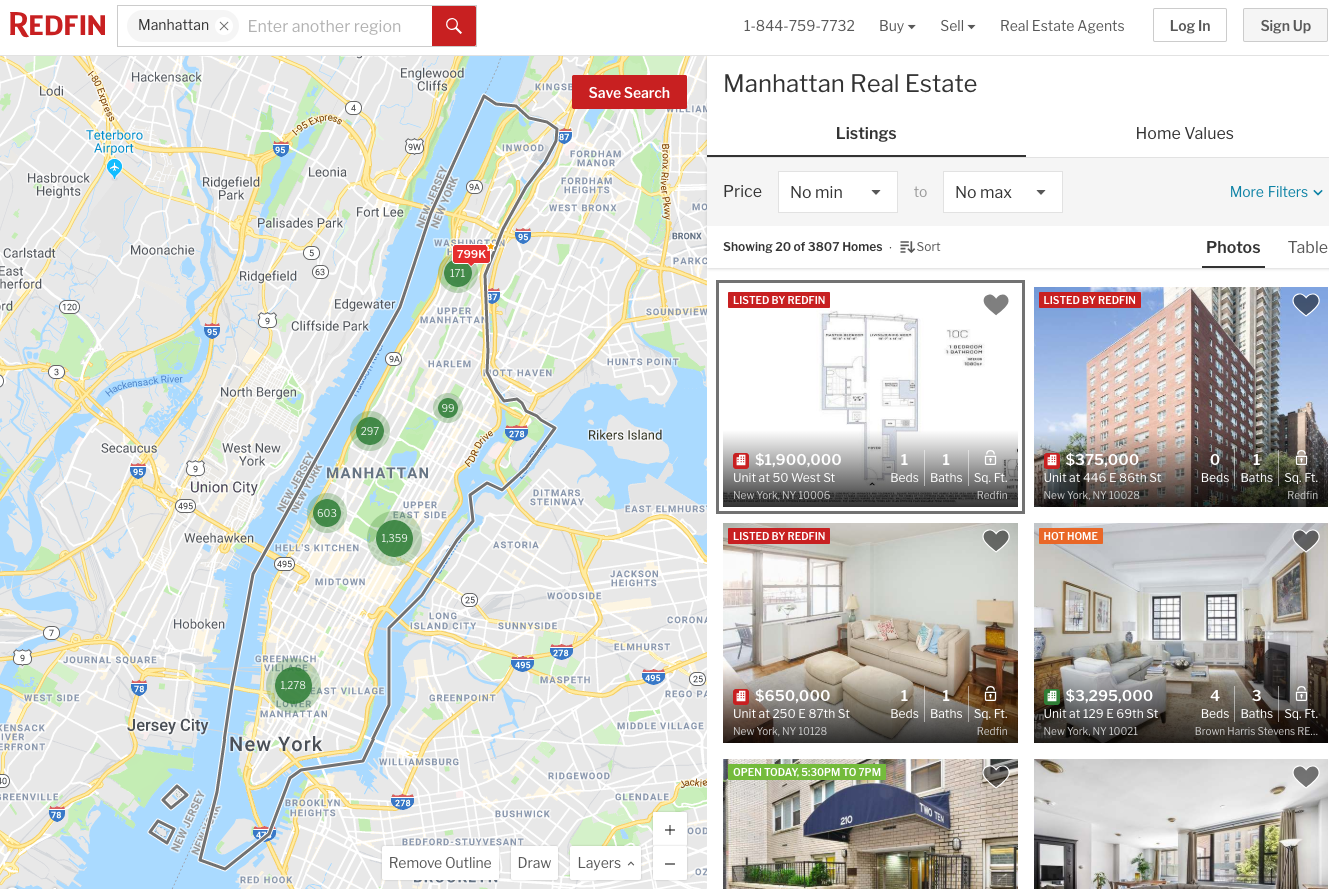

Redfin is, after all, a brokerage with agents on the ground and listings as well, right there in NYC:

Isn’t Redfin precisely one of those “disintermediary technology and alt-brokerage” things that are putting all this pressure on brokerages, including the Majority Seven? Plus, last I looked, Redfin was very much a “portal” with well over 26 million monthly unique visitors — third behind Zillow and Realtor.com. Wasn’t the whole point of NYC Buyer Graph to prevent “leakage” of this data into the portals?

What now?

Even more interesting, it turns out that Zillow is now a brokerage. Sure, they might have no plans to represent buyers and sellers, but boy, do they have plans to gather up buyer demand data.

What happens when Zillow requests membership in NYC Buyer Graph?

They’ll share their buyer demand data, sure, since they have the consumer traffic and the Majority Seven do not. Redfin is already on record as saying they want all kinds of changes to listing attribution rules, because they have the engineers, the SEO experts, and the money to take advantage of those changes while the traditional brokerages do not. So that’s a trade these guys and other “disintermediary” forces would make every day and twice on Sunday.

Now what?

If either of these companies are granted membership, then what was the point of the NYC Buyer Graph in the first place? If they’re denied membership, then you can bet your ass that the people in high places are going to get all kinds of interested… especially after Glenn Kelman and Spencer Rascoff pick up their phones and place a few key calls. A more explicit formation of a cartel is going to be difficult to find.

Is this really what you were seeking?

There’s Network Effect, and Then There’s Horizontal Restraints

Now, the argument can be made that there’s no antitrust problem here because there is still huge competition between the “brokerage community” and the Zillows and Redfins of the world.

For example, Andrew writes in his Open Letter:

The Buyer Graph is a classic example of a network effect, where the entry of a new participant increases the value of a platform for all participants by increasing the transparency and data for every member. By kicking off the initiative with substantial scale, the Buyer Graph will be the leading platform in New York City, and will continue grow as it attracts and welcomes more and more members.

Of course, the power of network effects isn’t lost on companies competing with the traditional brokerage model. An explicit network-effects-driven strategy is at the core of almost every alt-brokerage and disintermediators. Often, the hundreds of millions in capital raised by these companies are deployed in an attempt to kick-start their network effects. But with the reach the NYC Buyer Graph has already achieved, no single startup or alt-brokerage can simply manufacture or purchase the network-driven value of the NYC Buyer Graph.

He is correct, of course, insofar as what network effect is, how important it is, how powerful it can be, and so on.

What he’s forgetting is that “network effect” (a) usually refers to consumers, and (b) usually happens organically. If Douglas Elliman started doing this buyer demand data thing, which led to far better service from its agents, which then led to sellers flocking to Elliman, which then brought buyers to Elliman, which then brought more agents to Elliman, which then brings more buyer demand data… hello, virtuous feedback cycle!… all in an organic fashion, well, that’s how network effect is supposed to work.

When you have, as in this case, seven of the largest and most powerful brokerages getting together in a conference room, then agreeing to combine their efforts to “jump start” a network effect, you have a pretty strong case of horizontal restraints:

It is illegal for businesses to act together in ways that can limit competition, lead to higher prices, or hinder other businesses from entering the market. The FTC challenges unreasonable horizontal restraints of trade. Such agreements may be considered unreasonable when competitors interact to such a degree that they are no longer acting independently, or when collaborating gives competitors the ability to wield market power together. Certain acts are considered so harmful to competition that they are almost always illegal. These include arrangements to fix prices, divide markets, or rig bids. [Emphasis added]

That paragraph is written right on the FTC website under “Anticompetitive Practices”.

But forget Zillow and Redfin for a moment. They’re public companies worth billions. The real issue is going to be the small mom-n-pop startup brokerage in Flatbush who charges 1% listing fees and $2,000 to represent a buyer. I would classify that as an “alt-brokerage”, wouldn’t you?

Are they allowed into the network?

Furthermore, even once they’re in the network, keeping in mind that the NYC Buyer Graph is “not consumer-facing, so buyers and sellers will only be able to gain access by working with a member brokerage or one of its agents”, how competitive are they going to be against the Majority Seven? Those guys have market power, after all; Mr. Flatbush Brokerage does not.

Keep in mind further that the entire “power of networks” thing is based on Andrew Flachner’s thesis about competitive advantage:

It’s been almost 2 years since I began speaking to the industry about the power of networks in securing a broker-centric real estate future. I argued that brokers and agents are drastically under-valuing their most important asset: their network of clients. By collecting and leveraging that network, and the data it generates, brokers and agents will secure a powerful and evergreen competitive advantage.

Many of our brokerage partners have embraced this thesis, implementing RealScout as a way to lock-down their buyer data and leverage it for better deal-making within their brokerage. By doing so, these brokerages are taking the critical first steps toward securing their market dominance in the face of disintermediary technology and alt-brokerage models. [Emphasis added]

Sure, in theory everybody in the network is on the same competitive footing. And that would work if men were angels and every real estate agent in NYC is a paragon of virtue who would never dream of withholding important buyer demand data from Mr. Flatbush Brokerage or other discounters.

But more fundamentally, who is this “powerful and evergreen competitive advantage” against? Who are these brokers and agents competing against? The website that doesn’t go on listing appointments and doesn’t show houses? Or is it Mr. Flatbush Brokerage who offers a discount?

In reality, how in the world is anybody going to police this cooperative to make sure that some big brokerage doesn’t incentivize its agents to keep deals in-house? Does anyone reading this right now think this conversation would never happen?

“Hey, before you respond to that agent from Mr. Flatbush Brokerage, who is a dirty discounter, why don’t you check the NYC Buyer Graph to see who in our brokerage has a buyer that is perfect for your listing?”

May You Live in Interesting Times

Taken altogether, this venture strikes me as one that will help NYC brokerages and RealScout live in interesting times. Because it really isn’t boring when the FTC and the DOJ Antitrust Division and the NYS Antitrust Bureau start demanding copies of email correspondences, come into your office to look through your files, or interview your senior executives. It’s a lot of things, but boring isn’t one of them.

I’m not one to stop people who want to lead interesting lives and live in interesting times, so… do what you want. But if one of my clients wanted to join this network, I’d ask him to make sure he has reserves set aside for legal bills. Just in case. And to not delete any emails or correspondences, because that could be an obstruction of justice charge.

And government agents are only fun in movies, y’all.

-rsh

PS: Please note that Andrew Flachner has penned a response and posted it right here on Notorious. You can find that here. I recommend reading his response before forming your opinion.

8 thoughts on “Seven NYC Brokerages and RealScout Do A Dangerous Thing”

I’m always leery when companies proclaim a “game changer” of being nothing more than hype to garner sales. If RealScout is making money, God bless But is still seems like hype.

Rapid Listing Alerts – Doubtful it’s faster that any MLS alert directed from an agent.

Safe Search & Protect Your Data – These don’t sound very different from the platforms offered by HAR and Broker Public Portal/Homesnap.

Property Comparison – Meh… Maybe. But it sounds gimmicky.

For Web & Mobile – Holy shit grandma! Hold me back! Really??

Integration – Remains to be seen.

If they have really killer data analytics available to the public, that would be cool. Or if the analytics give some super duper CIA like advantage over the competition.

I didn’t pay much attention to this on Inman because well it sounds sketchy and sounds like a lot of noise from noisy brokers.

Hi Roland. You’re smart for being skeptical. Let’s connect, would love to share more about what we’re building. Just pinged you on Facebook.

It’s about time the FTC pays attention. Most industries have regulatory boards (that actually regulate), like FINRA for the Finance industry. Has real estate become like the wild wild west as competition heats up? How did their in-house legal department approve this agreement?

“Exclusionary or predatory acts may include such things as exclusive supply or purchase agreements; tying; predatory pricing; or refusal to deal. These topics are discussed in separate Fact Sheets for Single Firm Conduct.”….”Obtaining a monopoly by superior products, innovation, or business acumen is legal; however, the same result achieved by exclusionary or predatory acts may raise antitrust concerns.”

Hi Patricia. Thanks for your comment. RealScout is an open platform that any broker can join, so there’s nothing exclusionary about it. Please see my response to Rob’s article here: https://notoriousrob.com/2018/09/an-open-invitation-to-the-nyc-buyer-graph-a-response-to-rob-hahn/

Fact. This industry continues to operate its data management functionality based on the rules, policies and procedures as have been scribed on granite tablets based on a prehistoric, archaic industry called the MLS. That is an issue. Forefront and etched into these tablets is the notion that, “thou shalt always agree to cooperate and compensate your competitors.” That in itself is an outdated, insane demand. If anything what RealScout is doing frees these brokers to manage their own data as they see fit at least in part signaling that this mandated assumption is no longer valid. Or at the very least, it is quickly marching to the tarpits.

If BMW were to agree to allow Mercedes salespeople to sell its vehicles no laws would be broken and Hyundai would not be filing a complaint with the government. That is for certain why? Because companies and industries with their own product have all the freedom provided in a free enterprise system to sell what they make or own. Listing are no different. They are the creative works of the listing broker representing the Seller. So why is real estate any different?

The fact is that it is NOT different.

It is clear that membership organizations like the NAR and the MLS have existed from day one to level the playing field in order to promote their membership objectives. And in doing they have been designed with the objective to provide an unfair competitive advantage to its members by shielding the obvious competitive differences of each of its members. Now, more than ever, that game is over.

The brokers as industry participants are weighing in and are free to align in order to create and provide transparency that highlights their clear competitive advantages. Exactly like any hotel chain, any vehicle manufacturer, all airlines or any other business in the Country does now.

It is that simple in the real estate industry and it is that comparable. It’s way past the time for industry participants to realize and message their very different and clear competitive advantages. And moreover, to be able to apply the necessary strategies that may emphasize these advantages to the consumer as they see fit.

As long as the MLS exists, no one will never disrupt this industry. NAR and the MLS are here to make money on the back of hard working agents, period!

As for this Realscout platform, it is not a network. How can it be if the consumer can only grant an access from their agents?It is a brokerage centric platform and nothing more.

@Andrew – This seems like the start of a Black Swan event. I’ve been wondering how those will take shape in the industry. Could Compass command so much market share that they can exclusively retain listings to develop a competitive advantage? What if the largest 50 national franchises banded together to take on Zillow?

The problem with it all is the ultimate end-user is mis-assigned. Here, it’s the brokers, when it needs to be the consumers. Exclusives, sneak-peeks, etc. all benefit the brokerages and the intended transparency is only visible to the aforementioned, not their clients.

Real estate technology that is coming on fast with the goal of disintermediating the agent misses the boat as well, placing their technology > agents > consumers. RealScout gets this. Not everyone does.

Let’s connect and bring it offline, would love to learn more.

Hi Austin. Happy to chat. aflachner [at] realscout dot [com].

Comments are closed.