As some of you know, I attended an event at Inman Las Vegas a couple of weeks back on Blockchain and Real Estate hosted by Propy. Unfortunately, I couldn’t stay for the whole thing, but I did stay and listen to the speakers with great interest, because I really wanted to learn more about blockchain and its applicability to real estate.

And I ended up becoming a bit more confused. The technology of blockchain is fascinating, but I couldn’t help but wonder… so I asked one panel, “What problem are you trying to solve?” I know some people thought that was me just stirring the pot; it wasn’t. I was genuinely trying to figure out what problems in real estate Propy and other blockchain proponents were trying to solve. Blockchain felt a lot like a cool technology solution in search of a problem.

Well, I put that on Facebook, and Stephanie Rall saw it and connected me to the folks at ShelterZoom, a real estate technology company that uses blockchain to (in their words) “bring you the most secure and transparent real estate tools in the industry.” Wanting to learn as much as I can, I spoke to Chao Cheng-Shorland, one of the co-founders of ShelterZoom.

I can now say I know more about blockchain, know more about ShelterZoom, and wanted to share my takeaways.

TL;DR: Blockchain might be the future, but it isn’t the present or the near-future of real estate. There are no real problems in real estate that it solves today. However, real estate should think very carefully about what happens in the long run if blockchain does become fully realized and implemented in real estate.

Be careful of what you wish for, as you just might get it.

Blockchain and Real Estate

I’m not even going to pretend I’m an expert on this, because I’m not. I know just enough to know that I know next to nothing. But here’s an article from someone who might know a lot about the topic. The writer, Hunter Perry, is the Senior Manager of Strategic Growth at Compass. I imagine that if anybody understands blockchain and real estate, he has to be among that number. Here’s what he says in part:

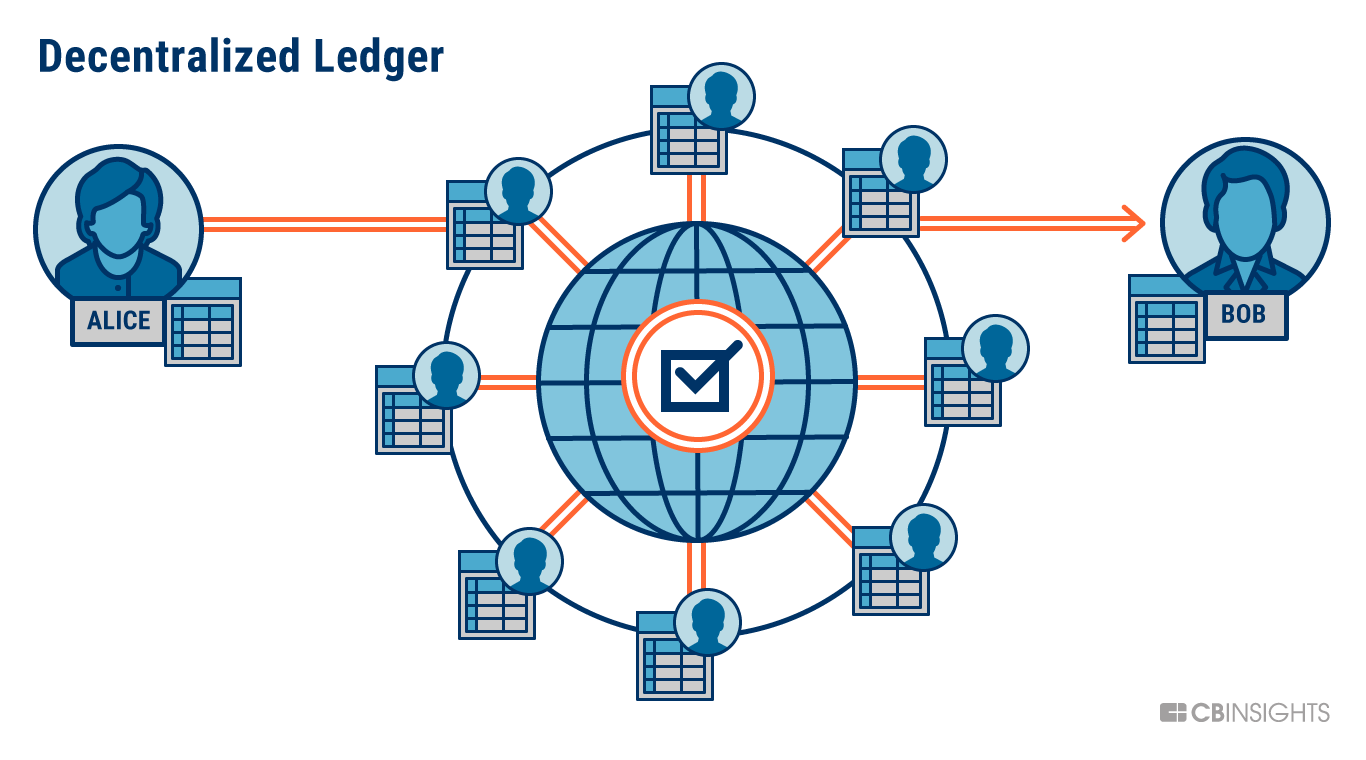

In its most basic form, blockchain makes it possible for the first time ever for people and companies to make major transactions without going through an intermediary. Intermediaries like credit card service companies, stock exchanges, banks and governments can make transactions expensive, slow and illiquid and may open opportunities for fraud or crime.

Access to deals, the amount of time it takes to close, property title mistakes, high fees and fraud bog down the real estate industry. It is the largest asset class in the world and has had minimal innovation in the way of increased efficiency during transactions. Blockchain poses major opportunities for innovation in real estate.

The three innovations Perry mentions are tokenization, smart contracts, and property title. I’m going to focus on smart contracts, because the other two seem pretty far out in the future. Tokenization allows people to “securitize” a building, like a hotel or a commercial office tower, without having to go through the traditional securitization of a mortgage. I’ll be interested when that becomes more of a reality, but I just don’t see tokenization really affecting the homebuyer or the home seller who just wants to buy a house to live in. Using blockchain for property title makes all kinds of sense, but first, you have to convince a thousand local boards of aldermen in small New England towns to migrate to blockchain technology for their county clerk’s offices that have been using more or less the same system since 1652. Good luck with that, and get back to me once that’s been done.

I should note that any futurism on my part is a big giant shrug, since I could be 100% dead wrong when it comes to blockchain and real estate. Five years from now, I could be held up as an example of old guys who didn’t see technology coming, like Thomas Watson of IBM, who said in 1943, “There’s a world market for maybe five computers.”

That leaves Smart Contracts, so let’s talk about it.

Smart Contracts

This appears to be where the current crop of real estate blockchain companies, like Propy and ShelterZoom, are focusing. Here’s Perry explaining what a smart contract is and why it’s cool:

The current state of property agreements have a lot of moving parts and middlemen. A transaction using a smart contract is completed entirely between the buyer and the seller (or renter and landlord) and has no human interaction.

Transactions can be done in far less time with far less chance of fraud. The seller includes all of the details of the property and the buyer puts all of their necessary information on a 100% encrypted and secure block. Computer protocols check the legitimacy of the transaction and no agreement can be completed until all of the terms are met.

I spoke at some length with Cheng-Shorland of ShelterZoom about this. And the conversation was somewhat frustrating, until I realized something. Let me explain.

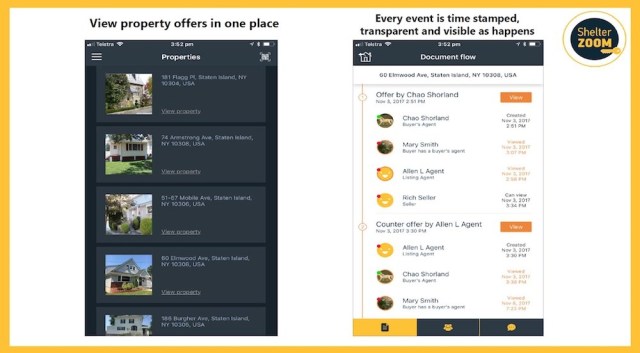

Here’s one example of what ShelterZoom offers with its smart contract platform:

I thought, okay, this actually solves a real problem in real estate: listing agents often do not present all of the offers to the seller, despite that being against the law (fiduciary duty) and against the Code of Ethics. Buyer agents and their clients often have no idea what is happening with their offers.

This platform solves that problem. It’s fantastic. Really, if you’re a broker or agent, you should consider using ShelterZoom or something very much like it. It is a wonderful platform, really.

Here’s the issue: I don’t see what blockchain does for this platform, at least today. What we have here is a private deal room type of a thing, which has been around for years and years in real estate. Few people use them, but they’ve been around a while. What’s important from a business standpoint is the (a) status and (b) timestamp. What users really want to know is (a) did the seller see my offer? and (b) when did the seller see my offer?

Having a webpage with timestamps and registered users is more than enough to communicate that to buyer agents and their clients. Why do we need blockchain to do this?

Cheng-Shorland tried to explain it to me, about how blockchain is not hackable, it is completely secure, how it uses distributed ledgers, etc. etc. We got pretty deep into how any list like this made using blockchain is guaranteed to be genuine and the truth, so if there’s a dispute, there are no questions about who actually saw the actual document at what actual time.

Now, she’s right in every technical way that matters. I won’t deny that. The problem for me is twofold.

First, we’re talking about some pretty extreme outliers here. For something like this issue (“Did the seller see my offer?”), we’re talking about some situation where the buyer feels so aggrieved or the seller is so pissed off at not seeing an offer, that one or the other or both bring a lawsuit alleging some kind of wrongdoing that caused harm. I asked Cheng-Shorland just how many times that happens. She didn’t know. I don’t know. I do know it’s not that common.

Second, even in that rare situation where someone sues an agent for failing to submit an offer, blockchain becomes relevant only to prove that the status updates and timestamps are legitimate. In other words, we have to have a situation where the defendant (say it’s the listing agent) has to say, “I did present the offer! But obviously, someone hacked the system and changed the status to say that I didn’t!”

Honestly, y’all, how often does that happen?

Low Trust, High Risk vs. High Trust, Low Risk

I have no image or screenshot of ShelterZoom’s actual contract editing/negotiation piece. It’s pretty cool, and looks like two contracts laid side by side, and any changes made by one side is instantly reflected on the other side. It’s a bit like collaborating with someone on a Google Doc document.

But that’s exactly the problem here.

Google Docs exists. Microsoft Word with Track Changes has been around for a decade or more. The real estate industry uses Docusign and Dotloop and e-signatures every single day without a single case of any court anywhere refusing to acknowledge the resulting contract as genuine because it didn’t have the super-duper extra secure, distributed ledger, unhackable blockchain technology behind it.

In the real world, in the real court systems, lawyers and judges look at printouts of emails all the time and simply accept them as evidence. And there is more or less zero security on those. I am not aware of a single case where a judge refused to accept things like emails or contracts written on Google Docs because they were not on blockchain, but did accept others because of blockchain. Not one. I asked Cheng-Shorland if she was aware of any such a case; she was not.

And this is the essential problem with blockchain and real estate. There is no doubt that blockchain offers security, transparency, accountability, etc. etc. No doubt about it at all. But that is completely unnecessary and irrelevant in 99.99% of the real life scenarios. You literally have to come up with some storyline involving hackers in order for blockchain’s value proposition to make sense.

In Fintech, it’s a totally different story; I completely get that blockchain could be amazing technology for banks, for wire transfers, for earnest money deposits, online payments, etc. I get that when sending, receiving, transferring actual money is involved, we’re in a pretty low trust environment. How do I know that the person I’m sending money to is actually who he says he is? And the risk is very high, as we have seen with wire fraud in our industry.

But two REALTORS negotiating a sale contract using forms and e-signatures? Negotiating over inspection periods and defective ceiling fans? That seems like a pretty high trust, low risk environment to me. Even in the extremely unlikely event that some Ukrainian hacker got in there and modified the seller’s disclosure statement… what’s the risk? During the closing, one of the agents goes, “Wait a minute! This isn’t what we agreed to!” and the other agent goes, “Holy crap, you’re right! I must have gotten hacked by the Ukrainian mafia! Let’s revert back to the last version and redo some work.”

And that’s the issue with blockchain and real estate. The security, the transparency, the accountability, etc. and all of that is real, and it’s true, and the technology is better, and maybe one day, the entire world will operate on blockchain technology the way it operates on TCP/IP today. But we’re not in that future today, and won’t be without massive changes in our legal, regulatory, financial, and political systems.

I feel pretty certain that ShelterZoom, Propy, and whatever other smart contract technology would be just great, make agents more efficient, help solve the “did the seller see my offer?” problem, and all of that without a shred of blockchain anywhere.

Having Said That…

There is, however, one near-future application of smart contracts and blockchain technology. And Perry mentions it (and Cheng-Shorland confirmed it in our conversation). Let me refresh your memory from above:

A transaction using a smart contract is completed entirely between the buyer and the seller (or renter and landlord) and has no human interaction.

Real estate agents imagine — and the vendors sell their platforms to real estate brokers and agents premised on — that the efficiency gains of blockchain will come from minimizing the role of lawyers, appraisers, mortgage consultants, and the like.

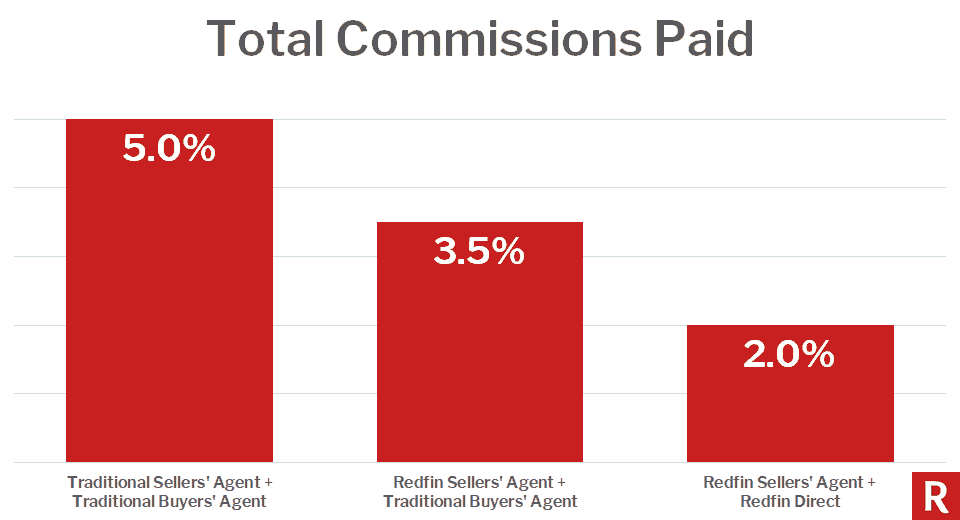

Actually, the biggest middleman in the transaction is the real estate agent. She is also the most expensive middleman in the transaction. A real estate attorney costs a couple of thousand dollars. An appraiser might be a few hundred dollars. The agent is 5-6% of the sales price of the home, which could easily be tens of thousands of dollars.

Blockchain technology does allow a buyer and a seller to (a) verify the identity of the person they’re dealing with, (b) negotiate the contract without anybody else using standard forms, and (c) do it all with 100% peace of mind.

At least Perry from Compass has an answer:

Real estate purchasing can be a very emotional decision for people. I believe that middlemen such as brokers and attorneys earn their commissions for people making potentially the largest financial decision of their lives. While smart contracts are currently being built to replace middlemen, I believe this technology will ultimately be utilized to make advisers in this space more efficient.

That’s pretty vague. But what it means is fairly simple and straightforward. If blockchain-enabled smart contracts really take over, the real estate agent will have a role only insofar as she can advise buyers and sellers making the largest financial decision of their lives. The rest of the transaction will be digitized, including much of the negotiation. And it also means that the way that agents get paid will fundamentally change.

Redfin Direct is Real, and It’s Here

Sellers are happy to save the commission; buyers are not as incompetent as many in real estate believe. They too would be happy to save money, as the sellers would pass on the savings. This is no longer conjecture; we have actual evidence before us. It’s called Redfin Direct.

In the Q2 earnings call, Glenn Kelman said:

While we expected many of the Direct offers to be ludicrous or half-assed, the Direct offers have in fact been more likely than our brokerage customers offers to be cash offers with no contingencies. Most Direct offers are within 5% of the asking price.

Encouraged by the results so far, Redfin plans on rolling out Redfin Direct to the rest of its markets and hopes to sell 10% of its listings through this program. John Campbell, an analyst with the investment firm Stephens, thought Redfin Direct was a real game changer, writing:

As we have highlighted in past notes, we believe that the Company’s Redfin Direct business stands out as one of the most compelling LT opportunities yet we feel that it is still underestimated by most investors.

Redfin Direct is working with just an online form, supplemented by the years of experience Redfin has plus local data that can guide the buyer to write up his own unrepresented offer. I think it’s important that Redfin stands behind the program, and that the seller is represented by Redfin. The buyer has assurances that the home actually exists, that the seller actually has the right to transfer it, and that the description of the property is actually what it says, because if not, he can always sue Redfin. The seller can relax when an offer comes in via Redfin Direct, since he can rightly assume that Redfin checked it out and the offer is legitimate. In a way, Redfin is guaranteeing the accuracy, transparency and accountability of the Redfin Direct offer.

With blockchain smart contracts, the buyer and the seller don’t need any of that. The seller can FSBO on Zillow, the buyer finds it, they go into a blockchain contract system and work it all out. The whole time, they know that everybody is who they say they are and everything is on the up and up. Sure, they might seek advice from a really experienced real estate agent, in the same way they might seek help from an attorney to understand the contract. And Perry says as much.

But are they going to pay $30,000 on a $500K house for that advice? In what world?

Strikes me as a pretty large blind spot to me. YMMV.

The Future is Not Now

The good news for real estate brokers and agents is that they don’t need to lose any sleep anytime soon about the prospect of blockchain disintermediating the living daylights out of them. Like I said, blockchain has real value in solving real problems in the world of finance and banking. It has real value in low-trust, high-risk environments where fraud is a real problem, perhaps something like healthcare. It likely has real value in other countries whose legal and banking systems are not like ours.

But in residential real estate, in North America, here and now? It remains a solution in search of problems to solve. There are enormous legal and political barriers for blockchain to overcome, before it becomes the default way we do things. Other industries will go before we do and figure out a bunch of stuff first.

That doesn’t mean that blockchain isn’t the future; it very well might be. I’m just not seeing it yet.

On the other hand, I might be the Thomas Watson eating my words in a couple of years. If I am, well, it’s a good thing my words tend to be well-seasoned. 🙂

-rsh

https://youtu.be/GllSfiwCEtY

I read most of this and decided it is much ado about nothing. And Rob’s early comment that these folks have a solution and are looking for a problem.

“Send them your money, and they will make you rich”. BS!

Everyone and their 15TH cousin are trying to find a way to get a piece of the real estate pie.

I get stuff every day with that premise. I hit “unsubscribe”.

Agreed. Here and now, there’s not much. There is no problem. I’m still crazy bullish on the long (and I’m talking, LONG) term potential for fractional homeownership. What if every home was as liquid as a stock, for as many owners as wanted to participate? What if I could buy .05% of a house in Cleveland or .075% of a home in Orlando? It’s not happening anytime soon, but someday, I look forward to that becoming a reality.

Drew, take a look at IMBYX.com, from Steve Jagger in Canada.

Yup, I have. I like the space he’s working on.

Yeah, in the LOOONG run, I could see blockchain and tokenization enabling some kind of a microfinance system for homeownership where a buyer would essentially offer “shares” in his house rather than borrowing from a bank. But before that could become reality, we’d need a revolution in Property Law and probably in title and deed and mortgage (if any) recording system.

How much fraud are they going to solve? How many mistakes are being made?

It would seem that someone who wanted to do a smart contract fraudulently wouldn’t be stopped by a smart contract.

Nice job Rob.

Something I have noted in life. Everything that is eventually of substance always begins its journey in this world as something thought to be of much less substance.

And then suddenly . . . . .

I think blockchain is simply one of the many things that are being evaluated now by those in this industry that may not fully understand the extent of the challenges that exist. Or that are just around the corner.

As you point out, distributed ledgers require difficult changes, but I am condifent that efficiency wins in the end. The interim period, when both approaches need to coexist, is where investments will have the highest rate of return. Picking winners is risky, but not as risky as betting against innovation.

It will take time to change paradigms, but not as long as many think. In 2002, I held up a Danger HipTop and took an audience comment that mocked my belief that the pager would become obsolete. The device was termed a “toy that looked like a video game controller”. The iPhone came out five years later and the rest is history. The implementation was different, but the effect was the same.

Distributed ledgers approach problems differently than current technologies. Today, we capture information in centralized repositories and create ways to distribute the information. Distributed Ledgers move information by design; everyone who should have a copy has one without loss of fidelity.

Our businesses depend on the centralized model we use today. We accept copies being out sync and the associated fragile distribution mechanisms because there is enough money in the system to cover the costs of their flaws. It is hard to imagine doing business any other way. Distributed Ledgers pose a challenge to this thinking.

What we are seeing is innovation being presented in the current frame of reference. The underlying shift in thinking is not apparent and is being judged by today’s standards. In 1914, Union leader Nicholas Klein said, “And, my friends, in this story you have a history of this entire movement. First they ignore you. Then they ridicule you. And then they attack you and want to burn you. And then they build monuments to you.”

There many applications of distributed ledgers that are coming. Judge with an open mind and think of the wellerism “I see said the blind man as he picked up his hammer and saw”.

Thanks Mark –

Like I said, I think I’m convinced that blockchain — or some kind of similar distributed ledger system — is the future. It’s just that future is a bit more distant than people think, unless we have a revolution in all of the legal and regulatory and financial systems we have today.

The other issue frankly is that the juice isn’t worth the squeeze, just yet. Other revolutionary technologies like the railroad or the telegraph or lightbulbs or the internet all addressed a real problem that people had. Even something like Uber is one of those, “OMG, can’t believe how much better this is!” situations.

As yet, blockchain doesn’t have that. Using blockchain-enabled virtual deal rooms feels exactly like using a no-blockchain virtual deal room. And in 99.99% of the scenarios I could come up with, there is no downside to using a no-blockchain virtual deal room, because nobody is going to be suing anybody else. Now, in that .01% (or less) situation where you DO have a dispute, yes, blockchain would be awesome.

But again, that awesomeness relies on the courts refusing to accept non-blockchain documents and emails and messages as evidence, while accepting blockchain documents and emails. We’re just not there yet. Not saying we won’t get there; just that we’re nowhere close to that environment.

Distributed ledgers and so on have enormous value for low-trust, high-risk environments like banking. But in real estate?

I mean, let me ask you this: what specific pressing problem of real estate today that everybody feels cannot be solved except by application of blockchain technology? I couldn’t come up with one.

I don’t think this is betting against innovation; it’s just having realistic expectations of innovation.

You are right. I will not be able to come up with “specific pressing problem of real estate today that everybody feels cannot be solved except by the application of blockchain technology”. I rarely come across positions that have 100% agreement. I only wanted to point out that the arguments you are making are within a narrow set of applications and are being judged using today’s paradigm.

Here are a couple of additional thoughts:

1) We are very close to the point where users (agents, brokers, or common folk) will expect control of their information. Legislators and regulators will be on the consumers’ side on this. Because distributed ledgers are designed to move information they have a built-in tracking mechanism that can report and control usage. Once you control usage, you have a basis for compensation. There is a good book on the topic called “Radical Markets” by Eric Posner. In this book, Chapter 5 Data as Labor discusses this kind of control. This does not disintermediate real estate practitioners and is not confined to real estate.

2) Good implementations of distributed ledgers will be invisible to the user. I would not expect users to be able to directly manipulate blockchains just as I would not expect users to manipulate SQL against databases. The interfaces are getting easier to use. A couple of years ago, it was still a challenge. Everyone benefits from simplicity.

3) Continued creation of layers on top of today’s name/password systems can be simplified, but the change will be painful. The concept is called “decentralized identifiers” and results in individuals controlling of their identity. Identity affects much more than financial transactions. What, where, and when I do things is information I want to control. Again, this is not confined to a real estate only problem.

I agree that adopting this technology will be painful and take time. I only disagree that improvements to information control, interaction simplification, and identity are far off, distant events. At least we have some common ground:)

If I might add on, because I hit Post Comment too fast…

From where I sit, the pressing problem that everybody feels that cannot be addressed without blockchain is direct consumer-to-consumer transaction. Redfin Direct, or FSBO, or some kind of self-service on Zillow. That’s because the consumer would dearly love to not pay 6% of the sale price of the home to someone they think does little other than put a sign in the yard, or open a lockbox. (Because most consumers have NO idea what a good real estate actually does behind the scenes.)

If that’s the first innovation of blockchain and real estate, is that something the industry is prepared to deal with?

I agree that it is not something we are ready to deal with. Instead, we should help the new technology folks to the industry because a) they can benefit from the education about good real estate practice and b) we might be holding our pre-conceived notions of implementation too tightly.

Rob,

Excellent post. I agree that tokenization, smart contracts & title will improve the transaction in terms of ownership, security, and recording. I also agree it will take time for some of these elements to be ubiquitous instruments that the real estate industry uses in their daily workflow.

Of the three, I beleive smart contracts will be one of the first infrastructure tools to become widely adopted. As you know, wire fraud scams have increased something to the tune of 1,000% since 2015. Some states even mandate buyers to sign a wire fraud statement which illustrates that it’s an escalating problem. Adding smart contracts to deal rooms provide security and redundancy. The buyer will have the ability to submit escrow/deposits and decide when the funds should be withdrawn and who needs to approve the withdrawals. Now, if a hacker wants to intercept the funds, they have to infiltrate the buyer’s account in addition to two or three others.

One topic that does not get much exposure is the transformation the industry will go through as it relates to data. I would argue that the digital listing process is broken. First, I as the agent/broker lose control of my listing as soon as it leaves my computer. This loss of control results in me having to pay for access to my own listing data and the leads they generate. Often enough, there are inconsistencies in price and other property attributes because of slow third party updates or because they are pulling my data from each other instead of me. Blockchain gives me the ability to store the listing in one central place where I control distribution. Now, the application providers are pulling from one single source of truth (which is me). In addition, they are *listening* for property updates as opposed to pulling data which means these updates are in real-time. It also means if I control my data and distribution I control my leads. Next, the blockchain plays a pivotal role in establishing a property’s digital address. Today, you can have a single property listed on multiple portals with conflicting information. Why? Because there is no digital link connecting the property’s data across the disparate portals. With the blockchain, we can comingle a property’s data across these many different portals and start to resolve these conflicts. The result? Better property information for the agent and consumer.

I think one of the most important things to highlight is that, while the blockchain is an exciting new tool, its just technology. Soon (sooner then people think) they will be transacting using tools that are unpinned with blockchain but not even know it (or care). I don’t care that this website is using the HTTP protocol so that I can post on your website. I just care that when I click submit, my post shows up so I can participate in the conversation. The same thing rings true for blockchain. Those who are out consistently praising it to be the industry’s end-all solution to everything are probably the ones spending the least amount of time building value that will truely progress the industry forward.

Thanks Rob,

Stephen King