Realogy reported its Q2 results last week, and on balance, it was a very nice quarter. The highlights of the presentation are improved profitability, strong cash flows, paying down debt, and a narrative that the broken fundamentals at the NRT are changing. Or trending like it’s changing. Maybe it’s more of a looking like it’s changing. At a minimum, it wasn’t as bad as it could have been and as many people expected it to be.

As longtime readers know, I started my career in real estate at Realogy. I know many of the executives there, and they’re absolutely fantastic people, starting with Ryan Schneider at the helm, but the entire organization is filled with top notch operators who are smart, driven and classy. I really, really want to love Realogy.

Yet, I find myself thinking of the Madonna song, Justify My Love. I have to say I need to understand some discrepancies between the optimistic outlook and the results on paper, as well as what I hear from brokers and managers and agents on the ground. It is more likely than not that Ryan Schneider’s optimism is fully justified, but looking in from the outside, I need a little bit more.

So let’s talk about those things.

The Numbers

As always, we begin with the numbers. They were quite solid, beating expectations. Now, whether that speaks to the expectations or the performance… you’ll see what I mean.

So, despite all the naysaying about Realogy, all the dark clouds, and all the “When is Warren Buffet going to buy Realogy?” stuff out there… Realogy delivered $1.735 billion in revenue, and $97 million in pre-tax income. I mean, that’s pretty rocking.

Both Schneider and Charlotte Simonelli, CFO, were justifiably excited about $245 million in operating EBITDA and $147 million in free cash flow and paying down $113 million in debt. Those are real numbers, and really quite impressive. And Simonelli pointed out that Realogy is making massive progress in its cost cutting measures, hitting 60% of the $70 million target. That’s not easy to do either.

Just as a point of comparison, the company that is dominating the narrative about the real estate industry today, Zillow, posted $2.3 million in Adjusted EBITDA, which is probably different from Operating EBITDA, but still… we’re talking 1% of what Realogy posted in Q2.

But as readers know, we’re primarily interested in the brokerage component of Realogy, because it is the only traditional brokerage that actually reports numbers. I have long used Realogy’s public numbers as a guide to how traditional brokerages are doing. Here are those numbers:

Well, despite the cloud of negativity surrounding it, the NRT unit still turned in 95,251 transactions for $51.5 billion in sales volume. I’m computing $1.310 billion in total GCI from the NRT. Those are monster numbers.

However… this is where I start to ask questions. Something is not really adding up. It’s probably my mistake, but I’ll put it out here so y’all can tell me where I goofed… Because I can’t find the mistakes.

Please Publish Agent Splits, or Just Commissions Paid

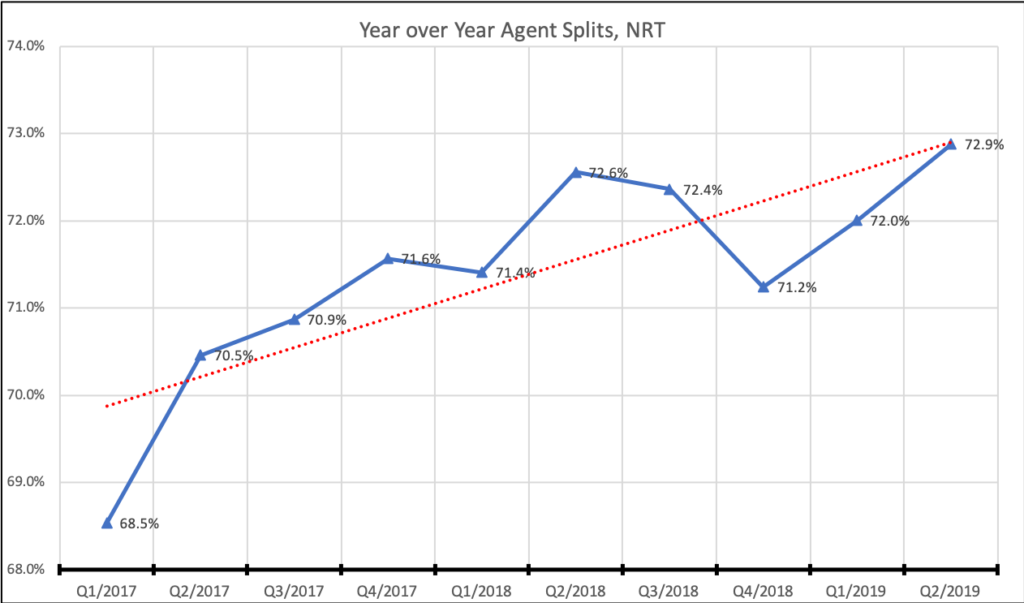

For starters, everybody and his cousin knows that the key metric for Realogy is agent splits. Schneider once called it where the “violence in the P&L” is. In the press release, Realogy claimed “Continued moderation in commission split pressure, up only 21 basis points year-over-year.” So I went to look for commission splits. And I can’t find it actually published anywhere.

My calculations, in the table above, are showing a 32bps increase in agent splits YOY, not 21bps. That being a 50% difference, I’d kinda like to know what I’m missing.

Furthermore, in the earnings call, right after talking about the 21bps rise in agent splits, Schneider says

This is by far our best result in 12 quarters. We now have 2 quarters in a row of much better results on this metric, and we expect the upward pressure on commission splits to be less than we told you about earlier in the year. We now expect it in the range of 50 to 70 basis points for the full year of 2019.

I’ve been keeping track of Realogy and NRT key metrics for a while now. And I don’t see how this is the best result in 12 quarters. Agent splits actually dropped 32 bps from Q4 of 17 to Q4 of 18, for example. Also, I need to understand how Realogy is expecting the total agent commission split to be up only 50 to 70 bps for the full year 2019, when I’m seeing that it’s already up 170 bps from the end of Q4: 72.9% in Q2 of 19 vs. 71.2% in Q4 of 19. Unless we see splits drop in Q3 and Q4, which… is possible but not likely, it won’t be 70 bps but more like 170 bps.

In all likelihood, the problem is that Realogy doesn’t provide split data, nor actual commission paid to agents (despite my label above). It provides a line called “Commission and other agent-related costs” which likely includes a bunch of things that aren’t commission, such as recruiting costs or marketing allowances or free office space. It also doesn’t provide Q4 information by itself, which forces me to try to calculate it using the annual numbers.

But it’s what I’ve got, so it’s what I have to work with. I’m just glad that somebody is publishing numbers.

What I’d like to ask is for Realogy to publish the actual commission paid numbers, and actual agent splits numbers. I know they have no reason to care what I think, but I’m asking anyhow, because this is not a happy chart for the NRT and therefore, Realogy:

Maybe if I had more accurate data, the chart would look better? I don’t know, but I’m just sayin’

Now, why do I care about such an arcane little number that Realogy doesn’t think is a metric worth publishing? Because it goes to the heart of the strategy outlined by the management at Realogy: provide greater value to agents as a full-service brokerage, so they’re willing to pay more.

I know some Wall Street analysts are VIP subscribers. Maybe if y’all asked Realogy it might have more of an impact?

Can We Talk About Productivity?

Anyhow, the value proposition of Realogy includes increased productivity. The idea is that agents will pay a higher split to stay with the NRT because of all of the wonderful tools and technology and leads and training and so on, because it’s worth paying a 70/30 split to do 2-3 more transactions thanks to all the support they’re getting from the brokerage. Schneider has stressed this point over and over again in every earnings call.

So let’s look at two little details from the earnings call.

New Initiatives Drive Growth, Improve Margins

First, Schneider spent quite some time on the call on new products and initiatives, like the TurnKey Amazon partnership. That section is worth reproducing in full:

Second, we’re delivering new products, partnerships and technology and data offerings to improve our value proposition. While much of the discussion we have had is around how improving our value proposition will help us better recruit and retain agents, I want to emphasize today how it also helps drive growth and in some cases, improves margins in the business. In Q2, we have a number of new proof points to share.

First, our Listing Concierge product, which provides a great integrated marketing package for agent listings is now live in about 60% of our markets. Today, agents using Listing Concierge get a good higher commission rate on average. We are very excited to help agents win more listings and drive growth of this product, while demonstrating that we can actually add margin back into the business.

The marketing product we launched in partnership with Facebook and Instagram in Q1 named Social Ad Engine continues to get traction with thousands of marketing campaigns launched that already delivered over 85,000 leads for our agents. This product is only available through Realogy and is another innovative product example designed to drive greater volumes.

We recently launched TurnKey, a collaboration with Amazon to create fantastic home-buying and move-in experience for the consumer. The program has the potential to generate high-quality leads and drive growth for Realogy owned brokerage agents and franchisees. TurnKey transactions are expected to drive greater margins, and it is just beginning. We launched in July and are only in 20% of the U.S. market today.

Our capital-light iBuying partnership continues in 3 cities. We’ve expanded our early efforts to now include select franchisees, and we like our early learnings and look forward to moving to additional cities soon. [Emphasis added]

All of this sounds absolutely fantastic. Like the Millennials say, cool story, bro.

NRT is Growing

Second, Schneider said that NRT is growing for the first time in a while:

Finally, we have grown our owned brokerage agent base for the first time in a while. This growth has occurred and accelerated in the past four months because of the combination of our new commission plans and our value proposition changes. Our NRT agent base is up about 2% from Q1, and we like our recruiting momentum…. We’re creating products and partnerships designed to drive growth and to add margin back into the business.

That is interesting news indeed, so an analyst asked about it. He wanted to know if that was new agents or better retention or what? Schneider says in answer:

And look — and we think it’s kind of the combination of bringing some of those new commission plans and make it more attractive. I would say, most of the growth is the combination of kind of new agents joining at a higher rate and then kind of keeping about the same level of retention as we had in the quarter before. But with different things, like TurnKey or Listing Concierge, etc., we’re now delivering better leads and more high-quality leads for agents. We’re doing things that in turn are enhancing the value proposition. I think that helps a lot, and then it’s funny, so the 2% is 2% compared to a year ago, it’s 2% compared to the start of the year and it’s 2% compared to the start of Q2. So we gave the 2%. And so we kind of have been going down for a while, then we were flat for a while, and now, we actually have a data point going in the direction that we’re all rooting for.

Okay, that seems really positive!

So Where’s the Beef?

If we combine the two, the narrative emerges that these new products are driving leads, driving volume, improving margins for agents (Listing Concierge) and improving margins for Realogy (Amazon Turnkey, with its Cartus-level referral fees), and making agents more productive. Plus, the NRT’s new big data, machine learning, high-tech compensation plans grow the agent base while controlling commission splits.

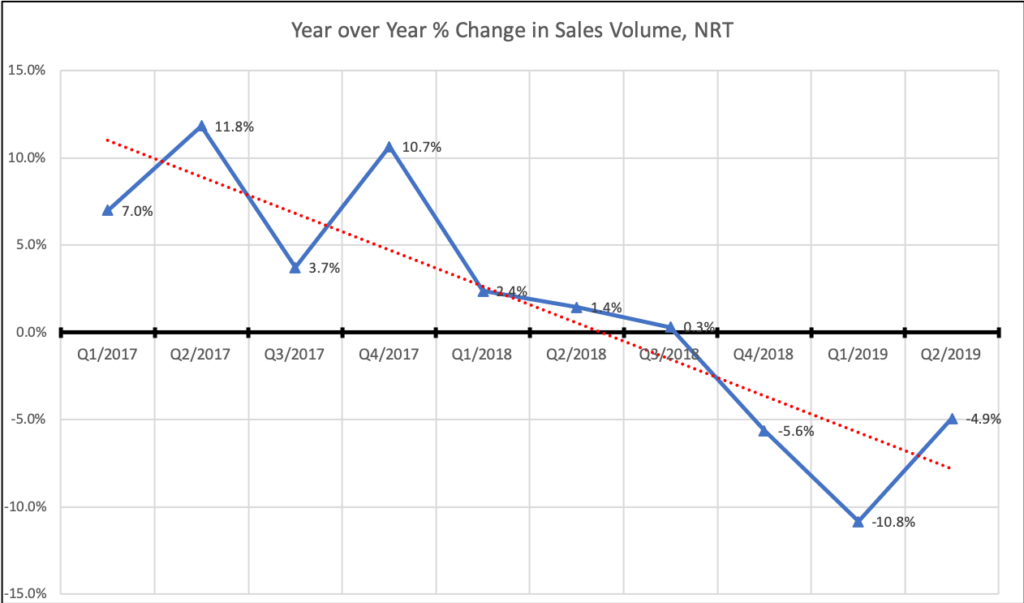

Except… NRT transactions and volume are both down YOY, (5.5%) and (4.9%) respectively. GCI per side is down slightly by (0.3%) for the year. And splits went up 32 bps; better than expected maybe, but it still went up not down. NRT Company Dollar went down, not up.

Apparently, the 85,000 leads that Social Ad Engine drove to agents didn’t help that much. (Unless it did; see below.)

Listing Concierge is supposed to help drive margins not just for the NRT, but for the listing agent. Schneider said agents using Listing Concierge get a good higher commission rate on average. But Avg. commission rate is down from 2.43% to 2.41% YOY.

Turnkey, the partnership with Amazon, is far too new so we won’t be judging that program yet.

And adding 2% to the NRT agent base is great. Now, since as far as I know, Realogy does not publish how many agents are actually at the NRT except once a year in the NRT About Us page, I’m just going to have to assume that 2% is on a base of 50,227 which is where the NRT ended 2018. That seems fair since Schneider kind of said that. So that’s about 1,232 new agents at the NRT in Q2.

By my calculations, that means that per-agent productivity has dropped consistently YOY:

- Per Agent Transactions goes from 2.0 to 1.9;

- Per Agent Volume goes from $1.08 million to $1.01 million;

- Per Agent GCI goes from $27,814 to $25,579;

- Per Agent Company Dollar goes from $7,634 to $6,938.

Tell me why this is good again? Please?

Because Charlotte Simonelli in going over the financials says:

Total expenses for the second quarter of 2019 decreased $8 million compared to the second quarter of 2018 primarily due to a $54 million decrease in commission and other sales agent-related costs primarily as a result of the impact of lower homesale transaction volume at NRT. [Emphasis added]

So… if I’m interpreting this correctly, then a lot of the improvements in cost savings in Q2 is the result of fewer homes sold, for fewer commission dollars (because home prices were up YOY), which means obviously that NRT didn’t have to pay as much in commissions. That’s one way of thinking about it.

The other way, which I think is the true way, is that NRT agents are independent contractors who essentially operate their own small businesses. So the reality is not that the NRT paid the agents a commission split, but that the agents paid NRT a commission split. Less business = less income and less revenue for the NRT, not greater cost savings.

And that’s exactly what the numbers are showing. Look at the tables above at the Segment Results of Operations. NRT has lower revenues, lower EBITDA, fewer transactions, lower ABCR, lower GCI per side (despite higher average home price), and… more agents?

Tell me why that’s good news for Realogy again?

Wasn’t As Bad As It Could Have Been

The explanation offered by Realogy is that the NRT is concentrated in certain markets where the housing market is tough, tough, tough. Here’s Schneider from the earnings call:

Our transaction volume trajectory is improving. Our Q2 transaction volume declined 3% year-over-year. This is a substantial improvement compared to the 9% year-over-year decline in Q1. At the business unit level, our franchise business was down 2% in the quarter year-over-year, improving from an 8% decline in Q1. Our owned brokerage business was down 5%, an improvement from its 11% decline in Q1. We faced similar pressures in Q2 as we shared in Q1, specifically the competitive environment and our geographic concentration in California. We are forecasting positive transaction volume in Q3 with sequential improvement in Q4.

I guess we’ll see when Q3 and Q4 numbers come out, but there is some sense in what he’s saying.

The idea appears to be that these initiatives and cost cutting measures and what-have-you prevented a disaster. So while the actual numbers in terms of transaction volume, margins, agent splits, etc. aren’t great, they’re far better than what they would have been without said initiatives.

Those 85,000 Social Ad Engine leads might have prevented a 10% drop in volume, for example, so the 5% drop posted in Q2 is really excellent news!

I guess… I mean, that’s a little bit like claiming that your new defensive scheme led to dramatic improvements where you only lost by two touchdowns instead of the customary four. It’s an improvement, and a moral victory… but you still lost.

Take a look at this chart:

If by “improvement” we mean that Q2 is better than Q1, yes, that is absolutely true. But over the past 10 quarters? That’s not a happy chart for Realogy. Q3 and Q4 had best show some volume improvement. Q3 and Q4 had better show some improvements that show up in the numbers.

The narrative of Q2 is that these products, these tools, this growth, and all the new initiatives have turned a horrible situation into merely a bad one. That may very well be true, and it might be a fair representation of what happened and what to expect.

But that doesn’t change the obvious fact that Realogy is still in a bad situation. At some point, Realogy actually has to show that it is in a good situation. At some point, Realogy has to far exceed low expectations and show real positive numbers.

The key metric there is a simple one: agent splits.

At some point, Realogy CEOs have to stop coming on earnings calls and talking about how commission pressure is moderating. Because both Richard Smith and Ryan Schneider have been talking about pressure moderating for quite a while now. Meanwhile, as the chart on commission splits above shows, Realogy went from 68.5% agent splits to 72.9% agent splits in 12 quarters. I don’t know how much longer the NRT and Realogy can handle such moderation.

So when I ask, “Where’s the beef?” I mean that all these initiatives and all these partnership and all these narratives have to show up in the numbers at some point.

Optimism Without the Daring

Let’s try to wrap this up.

I really like the leadership at Realogy. Ryan Schneider and John Peyton in particular are super smart, driven, strategic, and really good people. I’ve heard wonderful things about Ryan Gorman, and many of the brand leaders like Simon Chen and Sherry Chris are just wonderful people I’ve known for years. I can’t help but love Realogy as a company, since that’s where my journey in real estate began.

I like the results in Q2 overall: very strong profitability, free cash flow, paying down debt, growing NRT numbers, etc. are all really fine results. The initiatives they’ve launched are… well, at least interesting and we’ll see what they will do.

So on the whole, I think Schneider’s optimism is justified. Maybe things are on the upswing after a long drought. Maybe the culture changes that he has put into place are finally starting to pay off. Maybe the machine learning, Big Data compensation system, which I dwelt on when Schneider first took over, is starting to show results. Optimism is warranted.

But you know, there’s just no daring there at Realogy right now. Every initiative launched is “capital light” and “trial with partners” and so on. There’s a lot of cautiousness, lot of cost cutting, focusing on profitability and paying down debt. That might be the smartest strategy, if you’re a believer in Jim Collins’s work in How the Mighty Fall, which cautions against Grasping for Salvation:

The cumulative peril and/or risks gone bad of Stage 3 assert themselves, throwing the enterprise into a sharp decline visible to all. The critical question is: How does its leadership respond? By lurching for a quick salvation or by getting back to the disciplines that brought about greatness in the first place? Those who grasp for salvation have fallen into Stage 4. Common “saviors” include a charismatic visionary leader, a bold but untested strategy, a radical transformation, a dramatic cultural revolution, a hoped-for blockbuster product, a “game-changing” acquisition, or any number of other silver-bullet solutions. Initial results from taking dramatic action may appear positive, but they do not last.

At the same time, Compass raised another $370 million and is now worth almost 10x Realogy’s market cap. Rich Barton at Zillow is pushing all of his chips to the middle of the table. eXp is continuing its explosive growth. Keller Williams has made some recent announcements (more on this in another post), and RE/MAX is… well… RE/MAX has booj?

Maybe grasping for salvation is a bad bad thing, but shouldn’t there be something with a dash of daring to Realogy’s strategy? A small acquisition that has the potential to change the story, like a Knock or a Flyhomes? A trial that could have profound implications, like a Redfin Direct? Something?

So here I am, after all these years, still wanting Realogy to succeed, loving on so much of what makes Realogy great, but still wanting, waiting, needing for Realogy to justify my love.

Here’s to hoping that Q3 does just that.

-rsh