Brokerages and national franchises partnering with big money companies to offer iBuyer services appears to be all the rage these days. Realogy was first, partnering with Home Partners of America, for its cataLIST program. Redfin was next, partnering with Opendoor… while saying that they plan to compete head on against their partner in overlapping markets.

The latest such partnership is the announcement that Keller Williams, the largest real estate brand in the world with 160,000 agents, is teaming up with Offerpad. From Inman News:

Keller Williams Realty and Offerpad have entered into a game-changing new partnership that will place the Arizona-based iBuyer at the center of the Texas-based brokerage’s rapidly growing iBuyer platform, executives told Inman.

The deal, announced Wednesday, will allow Keller Williams agents to act as listing agents for various Offerpad-owned homes while shifting financial obligations onto Offerpad’s shoulders for the homes Keller Offers buys in 10 markets, effectively handing the iBuyer access to KW’s army of 160,000 agents.

But this partnership is different from the first two in at least one important way. I really wish Keller Williams would revisit this partnership and soon, because that difference is a major flaw that pushes this program over the line. That flaw transforms what others have used as a way to do listing lead generation into an enormous conflict of interest that simply cannot be explained away or overcome. It is too clever by half, and ultimately counterproductive and harmful to the industry.

I know far too many good people at Keller Williams to think that they intended for this result. It has to be an unintended consequence that came out of Gary Keller’s deep desire to protect and take care of his agents. It has to be.

I strongly urge the leadership at Keller Williams to modify this program as soon as possible to correct this mistake for their sake, for the sake of the rest of the real estate industry, and most importantly, for the sake of the consumers. Failure to correct the error would force us all to conclude that perhaps it wasn’t a mistake at all, but fully intended as a strategy.

That would be a sad day for the industry and for Keller Williams, one of the greatest brands in the history of real estate. I sincerely hope that day never comes to pass.

Correct this mistake, Mr. Keller, before it’s too late.

A Big Step Too Far

What is this major flaw that pushes the new Keller Offers program over the line into unethical (and likely unlawful) areas?

This, from Inman, quoting Gayln Ziegler, Director of Operations for Keller Offers:

“Agents will be paid on the front end and they’ll be paid on the backend because they’ll re-sell the property, and their sign will also stay in the yard.” Ziegler said. “They can work out any agreement they want with the seller because that is their relationship with the seller, it’s not ours or anyone else’s to dictate that.” [Emphasis added]

Time out. Wait. What? Their signs will stay in the yard? The agent will be paid on the front end and also on the backend? What?

I did some quick additional research, to make sure I wasn’t misreading this, or that Inman wasn’t misquoting Ziegler. Well, The Real Deal has a different story:

According to Ziegler, Keller Williams agents will complete a training program to participate in Keller Offers. Any of those agents can request an offer from Offerpad on behalf of their seller. If they choose to sell through Offerpad, the iBuyer pays the agent 1 percent on the front and back ends of the deal.

“The [agent’s] fiduciary responsibility is to the seller. They still only represent the seller,” Ziegler said. “The beauty of this scenario is the Keller Williams agent gets paid on the front end, back end and their sign will stay in the yard.” [Emphasis added]

Okay… maybe not that different since she does say here as well that the agents get paid on the front end, back end and their sign will stay in the yard.

Keller Williams Responds

So I reached out to Keller Williams with questions, and got some answers straight from Gayln Ziegler. I would like to reproduce the whole thing so as to avoid any appearance of misquoting or quoting out of context or any such thing. I will however insert further questions and commentary where necessary.

Question 1: If the seller accepts the Offerpad offer, and is under contract with the KW Listing Agent, does the seller still pay the listing commission as per the listing agreement, or is that waived since the listing agent will get paid by Offerpad?

ANSWER: The listing agreement is a contract between the seller and their KW Agent. Neither Keller Offers nor Offerpad will dictate that agreement, nor should we. The seller will sign a document before receiving an offer, acknowledging their understanding that the buyer will be paying 1% to the KW Agent at closing. As with everything we do, keeping the consumer informed is of paramount importance. Additionally, it is key to note, the KW Agent will be representing only the seller. We feel it is extremely important that no seller should ever have to pick between an iBuyer offer and representation.

I’m not sure what “sign a document” here means, but it doesn’t sound like a listing agreement. It sounds more like some kind of acknowledgement of notice, which is probably a form letter of some kind. Without more detail as to the form, as to what kind of communication by the KW Agent is required, etc., it is difficult to say whether that document is enough or not.

What seems like a critical omission here is that there is no suggestion that this presentation of the Offerpad offer will only be at the listing presentation, prior to entering into a fiduciary relationship with the seller.

And I sincerely question the whole “listing agreement is a contract between the seller and their KW Agent” and that KW should not dictate that agreement. The listing agreement is actually between the seller and the broker, not the sales agent. KW can absolutely dictate what it wants to in light of the potential for conflicts of interest. It is choosing not to.

Question 2: The Real Deal story suggests that the KW agent will receive a total of 2%: 1% from Offerpad for referring the acquisition to them, and then 1% from Offerpad as the listing agent for Offerpad. I just want to make sure that is how it will work. If it is, again, back to #1, if the KW agent has an existing listing agreement with the seller, what happens? Is that listing agreement automatically canceled? Terms waived?

ANSWER: See response to number 1 above.

Question 2(a): Same question, but with Keller Offers instead of Offerpad, since the Curbed story suggests that if Offerpad won’t make an offer, then Keller Offers will.

ANSWER: Same answer as number 1 above.

I don’t see how the answer to #1 is an answer to these questions. I wanted to know what happens if the KW agent has an existing listing agreement and is therefore a fiduciary of the seller. I think the idea here is that as long as the seller signs some form acknowledging that the buyer can pay the KW Agent, all is well.

Question 3: The stories all suggest that the KW agent bringing the offer will be paid by Offerpad. But Ziegler’s quote is very insistent that the agent’s fiduciary duty is to the seller, and still only represent the seller.” How does that work when the listing agent is being paid by the buyer? Seems like a clear conflict of interest but maybe I’m missing something. Also, same question, but for Keller Offers.

ANSWER: The seller is made aware of the buyer’s compensation to the KW Agent before requesting an offer. All parties understand the KW Agent’s fiduciary is to the Seller. The KW Agent will be there to guide their Seller through their options and assist them, from a granular level, in making an informed decision about this most important asset. (Same answer for Keller Offers)

I cannot agree that the fiduciary duty of loyalty can be so waived by the seller simply by signing a form, and then the KW Agent remain “to guide their Seller through their options and assist them.” I’ll get into this in greater depth below.

Question 4: If the seller on his own contacts Offerpad to request an offer, while under a listing agreement with the KW agent, what happens then? Is Offerpad required to notify the listing agent? How would Offerpad know that the seller is working with a KW agent or not?

ANSWER: This partnership allows consumers to have much-deserved representation. As with any partnership, we will work together for the benefit of the consumer.

This is not an answer, but a series of platitudes.

Question 5: If the seller requests an offer from Offerpad, while under a listing agreement with an agent not from KW, what happens then?

ANSWER: We are not involved with the process between direct consumers and Offerpad. If a non KW Agent’s seller goes to Offerpad that agent will need to address that with Offerpad directly. A better option would be for them to come to Keller Williams so they have the training and tools in order to drive their business to the next level.

Again, not an answer, but it appears that Offerpad will not pass on the information about the offer and the house to a KW Agent.

Question 6: The quote from Ziegler suggests that the original agent who brought the deal to Offerpad/Keller Offers will automatically be the listing agent when it comes time to sell that house. I’d like to confirm that is how the program works.

ANSWER: Yes, this is how it will work. Again, the seller on the acquisition is informed of all of this before they request an offer. We believe an informed seller, with KW Agent representation, is a happy seller.

Wow. Really. So it’s true then….

Question 7: Is there any detail available for the Keller Offers Certified iBuyer certification program? What is taught in it? What must the agents know, or show, or prove in order to be certified?

ANSWER: The training program addresses this industry trend, marketing to it, speaking to consumers about it and how to utilize the program. Keller Williams has always believed in providing outstanding training to KW Agents so they are informed advocates for the consumer, Keller Offers believes in this too. The Keller Offers program will be available to all KW Agents when we enter their market and the KW Agent completes the training program. We do not have “Preferred Agents”, we prefer that all KW Agents have access to this tool so no seller has to pick between an iBuyer offer and representation.

Not an answer, but that’s okay. Wasn’t really expecting one.

So, now… with the responses from KW in hand, we can start to draw some conclusions.

Keller Offers is A Problem

Let me start. I am forced to conclude, based on the news reports and the answers from Keller Williams, that Keller Offers is a major problem. It may have been a well-intentioned program, but because of its central flaw, Keller Offers is little more than a massive conflict of interest that cannot be explained, cannot be overcome, and will result in litigation for Keller Williams (and Offerpad) as well as a permanent black eye on the real estate industry.

The reliance on “informed consent” is, I think, entirely misplaced. But I’m willing to have that debate with lawyers who can cite case law to me.

There are certain fiduciary duties that cannot be waived, or at least cannot be waived easily, even by the principal/client. The duty of loyalty is one of those. For two centuries, it has been understood that the duty of loyalty is “immutable”—immune to private efforts to dilute, tailor, or eliminate it.

Let me point you to the influential Oregon Law Review article on Fiduciary Duty as Default Rules, cited 203 times. In relevant part, Prof. Frankel writes:

First, entrustors must be put on clear notice that, with respect to the particular duties that they waive, they can no longer rely on their fiduciaries; instead, the entrustors must fend for themselves. Second, the fiduciaries must provide entrustors with information acquired by virtue of their position as fiduciaries to enable entrustors to make an informed independent decision regarding the waiver.

The reasons for this procedure stem from the unique nature of fiduciary relationships and the law governing them. In varying degrees the relationships expose entrustors to extraordinary risks. Entrustors must entrust power or property to the fiduciaries because the fiduciaries could not perform their services effectively otherwise, yet this exposes entrustors to the risk that the fiduciaries will appropriate the entrusted property or interest, or misuse the power entrusted to them. The appropriation or abuse of power can result in a loss that far exceeds the potential gain from the fiduciaries’ services.

In addition, entrustors become dependent on their fiduciaries and may not be able to monitor the quality of their services because: (1) the skills involved are not easily acquired or understood; (2) the cost to entrustors of monitoring and evaluating such services would undermine the utility of the arrangement; and (3) there exists no other effective alternative monitoring mechanism. In sum, fiduciary rules reflect a consensual arrangement covering special situations in which fiduciaries promise to perform services for entrustors and receive substantial power to effectuate the performance of the services, while entrustors cannot efficiently monitor the fiduciaries’ performance.

Despite some academic literature talking about corporate opportunities doctrine arising out of corporate law, fact is that when dealing not with sophisticated investors but with average individuals trusting their most valuable asset to a real estate agent, the idea that the duty of loyalty can be waived away by signing a form is… well… guess we’ll see.

But here’s the more important point: even if legally speaking that signed form is enough to shield the KW Agent from charges of breach of fiduciary duty, it would be incredibly short-sighted to do so. Keller Offers crosses the line. It takes one step too far into the abyss. Its departure from past practices seems small at first, but it is a dramatic one, with consequences.

RedfinNow, cataList, and Zillow Offers

To understand just how big a departure this is, we need to look at the other “sell or list” programs of other major companies. Now, as a threshold matter, we don’t know all of the details of Redfin Now and of cataLIST, but I do imagine that if those included “signs stay in the yard” we would have heard about it. I do have information on that from Zillow.

RedfinNow

RedfinNow is a straightforward proposition. The agent present two options at the listing appointment: list with Redfin in the traditional way, or sell to Redfin directly via RedfinNow. Should the agent get the listing, there is no word about later selling the house to RedfinNow, because Redfin says over and over again that the traditional way will put more money into the seller’s pocket.

Plus, there is this from the Q2 earnings call:

In April, we changed our website to let homeowners ask for a RedfinNow offer and a listing consultation in one meeting, training our listing agent to present the RedfinNow offer. Previously a separate RedfinNow employee presented the offer in a separate appointment.

Asking the listing agent to present the RedfinNow offer alongside Redfin’s listing pitch can lower our costs and let us expand more quickly. Since RedfinNow employees more than 500 sellers agents, that’s better for consumers who can discuss our cash offer with a local Redfin agent and compare it to the proceeds from listing their home.

Up until April, if a homeowner requested a RedfinNow offer, someone other than the listing agent presented the offer. And keep in mind that Redfin listing agents are W-2 employees on a salary, so they get paid whether they get the listing or not.

After Redfin made the change to allow listing agents to present both the RedfinNow offer and try to get the listing, Kelman makes clear that it hasn’t been easy:

And today, we don’t have many returns from this integrated listing consultation, it used to be that the RedfinNow offer would hit and then a few days later we talk about listing the property. But now it should be one meeting where we can say, look, this is what we will give you for the house now in cash, but we think we can sell this house for more money and put more of it in your pocket. And that should be a more complicated conversation. And I think the customer should view it as a benefit. Certainly it has already helped RedfinNow offer acceptance to have a real estate agent present that offer and say look, I know the market is a good offer or it’s not.

Elsewhere, like in the Q1 earnings call, Kelman has stressed over and over again that the point of RedfinNow in his book is to help the seller get liquidity so she can buy the home of her dreams that she just found. Maybe Redfin can help her buy that house as a buyer’s agent, but the goal is to provide liquidity:

So it’s one thing to build a business, where you make money on one transaction trying to flip the house, there’s a lot of capital risk and low margins on that, but if this provides the crucial lubrication, the crucial liquidity for someone who’s been searching for months and suddenly realizes, oh my gosh, I see the home that I have to have but haven’t figured out how to sell my old place or someone who lists and then three days later realizes they don’t like people tramping through the living room, that is really powerful.

The point of RedfinNow is to benefit the consumer who is in need of liquidity to move up and buy her next house. It isn’t to get listings (in fact, Kelman says it hurts Redfin’s ability to take the listing after having called the homeowner’s house “an ugly baby”) or to buy more homes at a discount, but to provide liquidity to a homeowner.

cataLIST

I was… underwhelmed by cataLIST when it was announced in 2018 and I remained even less impressed in April when Ryan Schneider talked about it in the Q1 earnings call. Here’s what I wrote in the April Red Dot:

HPA is fundamentally more of a real estate investor who buys a home to rent it out, then sell for a guaranteed gain (under the standard HPA agreement), than it is a real iBuyer.

And cataLIST itself is fundamentally an agent-centric program rather than a consumer-centric program. The name alone should betray the true intent behind Realogy’s so-called iBuyer program: it is really meant to be a listing tool, not a consumer-convenience tool. And as Schneider makes clear, Realogy’s iBuyer program is about making the agents more money, not making the consumer’s life easier:

As one more example, we like the early results of cataLIST, our iBuying product with Home Partners of America. We are live in 3 cities, and we plan to expand. Unlike most other iBuying products, with cataLIST, our agents are kept with a similar transaction, participating in both the purchase and the sale of the property. Data from agents are showing that cataLIST is helping agents get listing appointments and win listings they otherwise would likely not have gotten. [Emphasis added]

As a variation of the old “purchase guarantee” program that brokers and agents have been running for decades, Realogy’s iBuyer program is more or less a bait-and-switch on consumers. Those programs have not changed the fortunes of traditional brokerages. There is no reason to believe that Realogy’s cataLIST would have different results.

Having said, that, you know what cataLIST does not say? That the agent’s yard sign would remain in the yard. Because it is meant to help agents get listing appointments, not convert their listings into a fast sale to an institutional buyer who has guaranteed that they would be the listing agent in the subsequent sale.

Zillow Offers

What we know about Zillow Offers is that it has changed tremendously from its original trial. If you remember, Zillow Offers in the very beginning was a typical “connection” play that would connect the seller to real estate investors and other iBuyers (Opendoor was actually on Zillow Offers platform early on) as well as get a CMA from a Zillow Premier Agent.

Again, that was at the listing appointment. Once the consumer chose to list with the Premier Agent, that house was no longer on the Zillow Offers agenda.

Over time, it has evolved to its current form, where a seller requests an offer from Zillow, and Zillow sends an offer. Zillow as a buyer is represented by an agent, but the seller may or may not be. That agent who helped Zillow buy is also the agent who will represent Zillow when it sells. The ultimate buyer is represented by his or her own agent, and Zillow pays a full cooperating compensation fee.

Note that Zillow does not currently pay a referral to any agent for bringing them deals. With almost 70,000 requests for Zillow Offers in three months, I doubt they need to. They have more demand than they can handle without asking agents to send them leads on houses to buy.

Now, in May of this year, I discovered something interesting in the data that suggests the possibility of a conflict of interest and wrote about it. Go back and re-read that post if you’d like, and look at the image I included.

The issue was that the property was originally listed by the Laughton Team, then sold in dual agency to Zillow, and then the Laughton Team listed the home for Zillow. Nobody did anything wrong, no laws were broken, no ethical codes were violated. The seller requested the offer from Zillow, not the listing agent, as an example. Zillow paid asking price, or very close to it, and sold it for a mere 4.1% over the acquisition price after months of renovation and cleanup and maintenance.

I got a statement from a Zillow spokesperson that said:

Our internal policies prohibit the agent who represents us from also representing the seller. In this transaction, the seller’s agent and our agent were both members of the same brokerage, but each represented their own client, as is typical in many traditional transactions.

And yet, there was the appearance of impropriety.

Within hours of my post going live, I got a followup from a Zillow spokesperson who confirmed that to avoid even the appearance of impropriety, Zillow had instituted a new policy that if they acquired a home that was previously listed with their selected agent who was handling their Zillow Offers business, they would use a different agent to represent them when buying the property and the property would be listed by someone else for resale.

It’s a rare occurrence, and one that Zillow did not know about. Once they found out, they took steps to ensure that there is not even the appearance of a conflict of interest.

Keller Offers Encourages Conflict of Interest

In contrast, it is clear from the Ziegler quotes that not only is Keller Offers not trying to avoid the appearance of impropriety, it is embracing the kind of conflict of interest that is impossible to explain or overcome.

The “sign stays in the yard” clearly signifies that Keller Offers is not intended to be a tool to be used in the listing presentation, but a tool intended to convert existing listings into a sale to Offerpad. How would there be a sign in the yard in the first place if the KW agent didn’t have the listing to begin with?

Ziegler confirms that Offerpad will pay the KW agent a 1% fee for bringing that deal to them. The seller’s listing agent is getting paid by the buyer. Keller Williams apparently believes that getting the seller to sign a form acknowledging that is enough. I do not think so.

That’s bad enough, but immediately upon that sale closing, the seller’s listing agent automatically becomes the buyer’s new listing agent to sell that same house for more money. Keller Williams apparently believes that getting the seller to sign a form acknowledging that is enough. I do not think so.

To make things even worse, that agent will, and I quote, “will consult the seller on all their options, including listing on the market or accepting the offer. The Keller Williams agent will continue to guide the seller through the Offerpad process.”

Nowhere is it mentioned that after putting the waiver form in front of her client, the KW Agent will recommend to the seller that she find someone else to represent her interests, as the duty of loyalty would plainly demand. Nowhere is it mentioned that the listing agreement would automatically terminate upon the KW Agent bringing up the topic, to give the seller the opportunity to find un-conflicted representation elsewhere.

This has to be a mistake. This has to be some smart product guy or a Harvard MBA type with no experience in real estate over there at Keller Williams trying too hard to make things better for their agents coming up with a too-clever-by-half scheme without realizing what he’s setting up.

See This From the Seller’s Perspective

To illustrate just how bad this is, consider Keller Offers from the consumer’s perspective. I actually think fiction contains more truth than analysis in some cases.

So here’s a short story.

My wife and I think about selling our family home, where we raised our kids, buried four dogs, flushed one goldfish down the toilet, have years of happy and sad memories, fantastic dinner parties as well as lazy nights of takeout pizza. The kids are all off to college now, and the big old house is starting to feel lonesome.

So we contact an agent we have known for years, who has yard signs all over our neighborhood, and is a top producer with Keller Williams. She’s been dropping off postcards at our house for years, after all, and we had seen her at PTA meetings, soccer games, and at church.

Janine (made up name) comes in, charms us both, tells us how great her track record is, tells us our home is worth $450,000 based on her comps, gives us a rundown of the marketing plan, all the wonderful technology tools she has, and how her team is so efficient and productive. In fact, she is so confident that she can sell our house that if we don’t sell within 90 days, she will buy it from us at fair market value. Well, that’s reassuring and confidence inspiring. So we sign with her.

A flurry of activity ensues, and the house hits the market. There are some showings, and some lowball offers. We do a price reduction based on our agent’s advice; we trust her implicitly. She’s so nice and so sweet and seems so on top of everything. Why wouldn’t we take her advice? We’re down to $427,500, a 5% reduction. A couple more weeks go by with no solid offers. We have a difficult conversation (something we both learn later that KW teaches in its training programs and through its coaching) and reduce the price further, down to $400,000.

Six weeks in, our agent telephones us and says, “Hey, so the bad news is that there hasn’t been a lot buyer activity, because it’s August and people are getting ready for back to school, and it’s going to be tough to find families willing to move so soon after school starts. But the good news is that we don’t have to wait the full 90 days if you don’t want to; Keller Offers will buy your house for market value right now, today.”

That sounds pretty good, we say, suddenly encouraged. What’s market value now? Is it still $400K?

She tells us that she’ll get a solid offer in writing to us by tomorrow, but first, she needs us to execute some forms so she can submit the request. She’ll Docusign it over to us, and she tells us to read it carefully, initial each page, sign it, and return it to her tonight so she can get us a written cash offer tomorrow.

“Yet another form,” my wife sighs. “What is it with these REALTORS and their forms? They have so many of them!”

Just like we did with the 17-page Listing Agreement, the multi-page Coming Soon form, and the something disclosure form, and some other form, we skim the thing, click on the appropriate boxes on Docusign, and send it off to Janine. I mean, she’s our agent! We trust her.

Tomorrow comes, she shows up at our house dressed immaculately as she always is, driving up in her nice Mercedes SUV. She presents us with a cash offer from Keller Offers for $385,000. [My data shows that Offerpad typically sells for 105.9% of purchase price]. That’s lower than we expected, especially since Janine was so confident of the $450K list price, but it’s better than any offer we had seen so far, and it’s all cash, and we don’t have to keep the house clean, don’t have to endure more showings, and can go put an offer in on the downsized house we had been planning on buying.

Then we notice the 8.5% Convenience Fee — that’s over $32K! What’s this, we ask Janine. She tells us not to worry about it, that that’s just the fee that these iBuyers (a new term we had only vaguely heard about) charge to cover their costs, but it’s really not that big a deal since we don’t have to pay the 3% buyer’s fee.

That doesn’t feel right to me, but my wife is tired of the lack of activity on our house. We haven’t had a lot of action on our house in the last couple of weeks: no showings, and very few hits on all the websites according to the report Janine sends us. She just wants to get it over with. We begrudgingly agree.

Besides, we trust Janine; she’s the expert. And she seems so honest.

Over the next week or so, Janine is constantly with us on the phone, via email, by text, and often in person as we go through the process. We’re initially shocked by the $22,000 that Keller Offers (we learn from Janine that it’s really this high-tech startup called Offerpad) demands for repairs and renovations. We ask Janine about it, and she sorrowfully says, “I know, that’s terrible, but you know, your roof does need replacing and every other buyer is probably going to ask for the same, so I advise you to just take the deal since you’re going to have to either replace the roof yourself or give the same $22,000 to all other buyers.”

She’s the expert, we trust her, so we reluctantly agree.

At the closing, we ultimately end up with just under $320K after paying Janine’s 3% listing commission (“I worked so hard for you guys trying to market the house, and then negotiating against Offerpad on all of their concessions and terms and demands!”) and closing fees. It’s a far cry from the $450K we had once dreamed of, but… the market has turned. Janine told us that. She’s the expert and we trust her.

Two weeks later, we’re back in our old neighborhood to visit an old friend and neighbor. We see our old home, the place of so many memories. We’re surprised to see Janine’s yard sign still up on our front yard. I mean, we sold the place, didn’t we? We mention it to our friend, who is an investment banker, and he says, “Oh, you didn’t know about the Keller Offers program?”

“No, what do you mean?”

“I read about it in the WSJ and Business Wire — I think that program guarantees that the agent who brings the property to Offerpad gets to list it to sell it for them.”

“What? No, we didn’t hear anything about that,” my wife stammers.

“I thought she was getting just a finder’s fee from this Offerpad,” I say. “What do you mean she’s guaranteed? You mean she gets to sell our house to this company, collect $10,000 from us, and then turn right around and collect another ten grand from this corporation?”

“Yeah, I think that’s exactly what she gets to do,” our friend replies. “I think the story said something about getting paid on the front end, getting paid on the back end, and not having to change the yard sign. I’m pretty sure Janine’s got six other listings in this neighborhood for Offerpad; they’re her biggest client, don’t you know?”

Stunned, we pull out our iPhones, pull up the Redfin app, and we check to see the listing price on our old home: $407,500. [Again, my data shows Offerpad’s average spread is 5.9% from the purchase price, which does not include the Seller Fee or seller concessions.]

“We have to call Janine,” my wife says. “There has got to be an explanation for this.”

“Hell with that,” I reply. “I’m not calling Janine; I’ll never call that lying two-faced [expletive] again. I’m calling Bob, our lawyer. We got took, baby, we got took.”

The End.

Or rather, the start of something wholly different and entirely unpleasant for everybody involved. That story will have words like deposition and subpoenas and civil judgment in it.

And now, replace the characters above — a well-to-do married couple with a house they thought was $450K — with an elderly widow, a Latina single mother, a working class black family trying to move up in the world. Replace my upper-middle-class characters with some of the most vulnerable in our society who most need a real advocate, a real champion, who will fight for them to help them achieve their dreams.

Tell me this is pure fantasy. Go ask your clients how they would feel. Try to explain to them how they ought to see it. Then come back here and tell me, tell all of us, how we should see it.

Injury to Consumers, Insult to the Industry

Keller Williams apparently believes that getting a signed form from the seller is enough to waive the duty of loyalty, the most fundamental fiduciary duty of all. It is not, but even if it is technically speaking, it violates the spirit of the client-agent relationship.

And it brings everything that happened and didn’t happen into question.

Now the seller has to question literally every piece of advice the agent gave him, every action she took or inaction she didn’t take and all the things he never saw her do.

In the story above, I now have to question if the $450K original list price was real, or if it was inflated so that Janine could manipulate us into accepting the offer from Offerpad. I have to question just how hard she tried to market our house. I didn’t follow her around to see if she made extra phone calls to other agents or not. I didn’t monitor her emails to see what kind of effort she was putting forth for us.

Did she give us good advice on staging? Or did she intentionally sabotage us so that we would have no choice but to sell to her real client, Offerpad? How would I ever know? I have to question all of her advice about the seller fee to Offerpad — was 8.5% really not a big deal? Or was she just setting us up as suckers for her real client, the big mega corporation with billions in cash? I have to question her advice about the $22,000 seller concessions. I have to question everything she ever told us, everything she ever did for us, and everything she failed to do for us.

The duty of loyalty is so important and so sacred because it is the basis, the foundation, for TRUST.

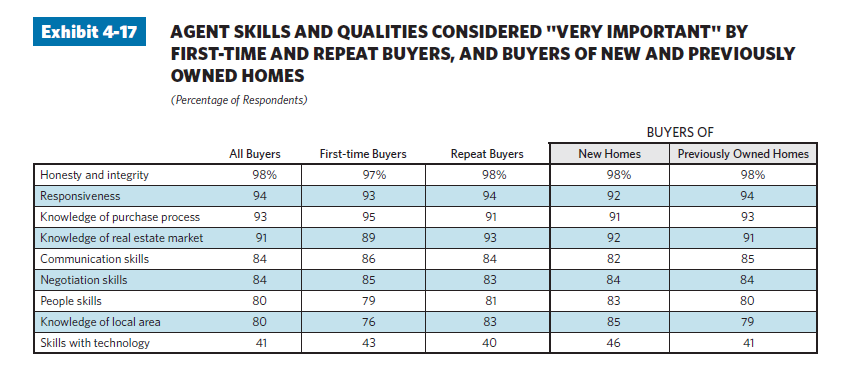

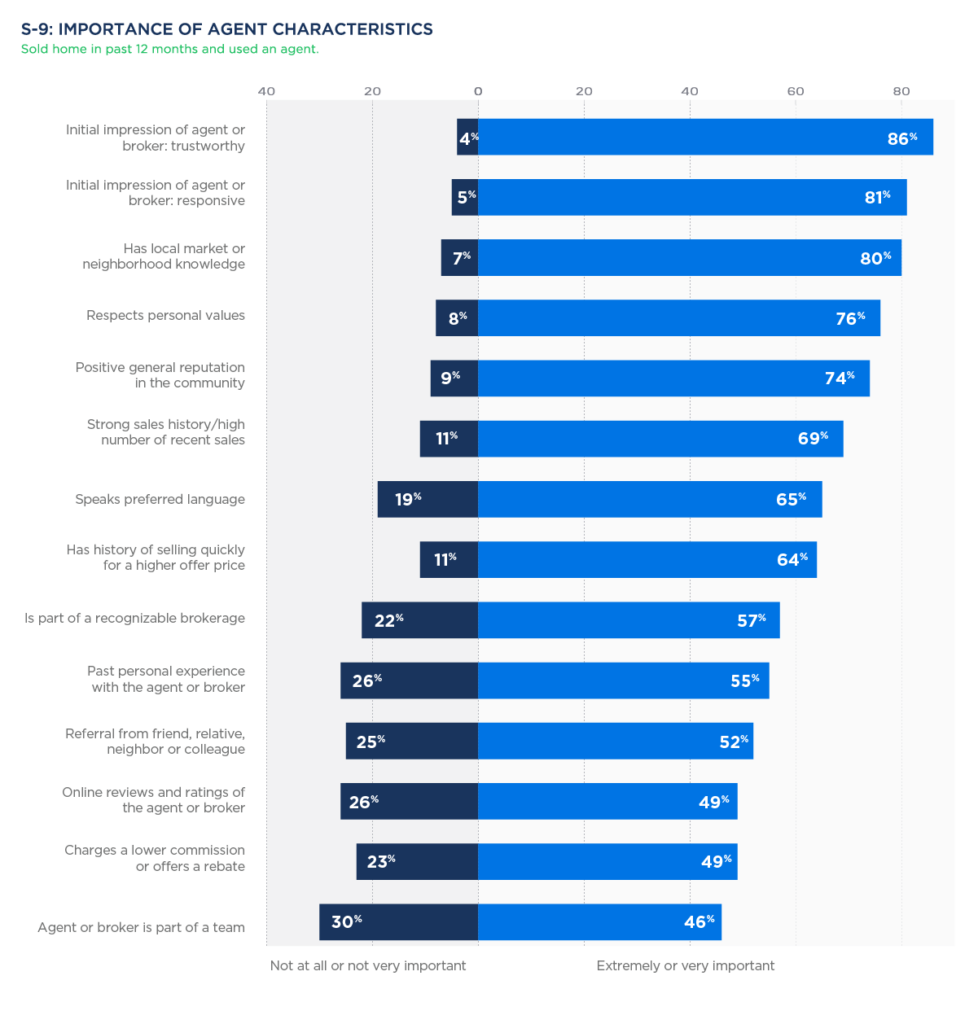

Trust is the most valuable coin of the realm for real estate. This survey was done in 2012, but I seriously doubt anything has changed:

Here’s more recent data from Zillow Group’s Consumer Housing Trends, 2018:

Ask yourself whether getting paid by the buyer, who immediately becomes the new seller, so you make money on the front end and on the back end, all the while you’re representing the old sellers and “guiding them through the process” so as to make sure they have “representation” tends to enhance trustworthiness, honesty and integrity… or the opposite.

The irony here is how Keller Williams is positioning this. Here’s Ziegler being quoted in The Real Deal:

“The [agent’s] fiduciary responsibility is to the seller. They still only represent the seller,” Ziegler said. “The beauty of this scenario is the Keller Williams agent gets paid on the front end, back end and their sign will stay in the yard.”

The first part and the second part of that quote are literally in conflict. They cannot only represent the seller when they’re being paid by the buyer and told that they would be the one selected to sell that home for the buyer… and the buyer isn’t some first-time homebuyer family that won’t be back in the market for another 7-10 years but a giant corporation with hundreds of millions in cash who will be back in the market the day after tomorrow. That just doesn’t pass the smell test.

“Informed consent” doesn’t wash away the stain unless that was real consent after real information, complete with the recommendation to the client that he seek representation from someone else who is not conflicted at all.

If the impact of this breach of trust, this obvious conflict of interest, were limited to Keller Williams… perhaps the rest of us can just sit back, make some popcorn, and wait for the legal festivities to begin. The problem is, this program will have far reaching consequences for every agent, every broker, and probably every iBuyer as well.

In the comments to the May post on iBuyers and fiduciary duty I linked to above, there was this gem from Mark Lemon:

50 years ago my father sold his first home. He later learned that it was purchased by his agent’s mother. To this day my father believes that the listing agent gave a low-ball valuation to get his mother a “good deal.”

Whether the agent actually did anything wrong is beside the point. No one will ever know. However, my father placed his trust in his first Realtor and never trusted any of them again. When it comes to RE sales, optics matter. [Emphasis added]

I can’t imagine how the optics of Keller Offers could possibly be worse.

If you think that the couple from the story above, or any real sellers who go through a Keller Offers process, is going to say to themselves, “I know we got burned by Keller Williams, but we can trust the agents with other brands,” then you and I just don’t see eye to eye on human behavior, human emotion, and human motivation.

Think about why we don’t trust used car salesmen. Is it because we have gone to every used car dealership in town and worked with every used car salesperson to know which ones are trustworthy and which ones are not? No — we had one bad experience with one guy at Big Joe’s Used Car Lot and have decided that all of them are liars and crooks.

It will be no different with real estate agents.

No, this cannot be. This must not be.

It’s Not Too Late, Mr. Keller

Look, I realize I might not be the favorite person over there at 1221 South Mopac Expressway where Keller Williams is headquartered. I know it stems from my critique of the pivot-to-tech strategy that KW announced a couple of years ago. But I’m asking, fairly begging, the powers that be at Keller Williams starting with Gary Keller to change this program.

I have said all along that Gary Keller is a first ballot Hall of Famer to the Real Estate Hall of Fame. Whatever he might think of me, when I think of him, I have nothing but admiration and respect for what he has done, for his vision, for his incredible talents, for his positive impact on tens of thousands of real estate agents, and for his contribution to the history of the industry. He is truly an innovator, a warrior, a teacher, a writer, and an incredible inspirational orator. He is a visionary.

But this… this is a mistake. It is a mistake for Keller Williams, it is a mistake for the industry, and it is a mistake for Gary Keller’s legacy.

Before this conflict of interest masquerading as a broker-iBuyer program, Gary Keller’s legacy is growing a small startup from Austin into a global powerhouse and the largest real estate brand in the world, the introduction of profit-sharing, of agent-centric brokerage management, of the importance of training and coaching, and the popularization of agent teams (with his best-selling book Millionaire Real Estate Agent). He is and will always be remembered as one of the great ones.

After this version of Keller Offers, his legacy can only be, “The man who destroyed trust in real estate agents.”

Because other brokers and agents have done some shady things in the past, and some still do, without impacting the rest of the industry at large. Gary Keller and Keller Williams are not other brokers and agents. They are such giants in the industry that this program, this step too far, cannot help but paint the entire industry with the same brush.

Today, I am choosing to believe that this feature of the program was just something that slipped through the cracks. I understand how it could be, since Keller Williams has always been focused on the welfare and the business health of its 160,000 agents. With all the threats and changes facing the real estate agent — for whose benefit Gary Keller has dedicated his entire career — I understand how this idea of “paid on front end, paid on back end, and keep the yard sign” thing could have made a lot of sense.

After this nearly 7,500 word essay, I hope I have made clear that it cannot “slip through.” If this program continues as announced, then we have to conclude that this is in fact what Gary Keller wants, and this is in fact the mission of Keller Williams as a company: helping agents make money at all costs, even if that means screwing their clients.

That is as close to predatory lending as I have ever seen a real estate company engage in. It might pass a legal test after being argued by sharp lawyers, but it doesn’t pass the moral test.

Thankfully, the program is announced, but not fully rolled out. It is not too late to make some key changes.

- Only allow the presentation of the offer during a listing appointment, prior to the agent becoming a fiduciary of the seller.

- Eliminate either the 1% fee from Offerpad, or have the listing agreement automatically terminate and the KW listing agent taught to strongly advise the client to hire an agent from a different company without any hint of a conflict of interest instead. Don’t hide behind that “listing agreement is between the seller and the agent” nonsense; the listing agreement is between the seller and the BROKER.

- If the seller wants an offer from Offerpad after the listing agreement is signed, make sure that there is clear education of the seller on the pros and cons, and clear convincing evidence that the seller understands what he’s doing, and that he is directing his agent to seek an offer on his behalf. Included in this must be strong advice to the seller from the KW Agent to seek another agent to represent the seller. Do not allow the KW agent to solicit an offer without that clear direction from the seller.

- If you’re going to keep the feature where the listing agent will automatically be hired to resell that house for Offerpad, then (a) disclose that fact fully to the seller, and (b) have the 1% fee from Offerpad go to the seller, not to the agent. In this scenario, the listing agent may keep the listing commission, and the seller saves on buyer compensation plus he gets a 1% bump from Offerpad.

Some of these can be stacked together; others cannot. There may be other improvements and tweaks to help avoid even the appearance of a conflict of interest.

The whole point of these changes is to preserve the all-important element in the client-agent relationship: TRUST. With it, almost all challenges could be overcome, and the agent can really take care of the client and win when the client wins. Without it, nothing works. Nothing ever could.

So please, Mr. Keller, make the changes. Call your team in and have a long talk about what it is you stand for, what it is that you want, and what the core values of the company you have created are.

Then do as your heart tells you. I know you will do the right thing.

-rsh

UPDATE: I just saw on Inman News (on 8/29/19) that Keller Williams has clarified many of the details. Read the whole thing. It seems to me that these changes go a long way towards making this program far less of a problem. Kudos to the team at Keller Williams for making these changes. I’d like to think that this post had some influence on their changes, and if so, something positive has come from it.

20 thoughts on “Keller Williams and Offerpad Partnership: A Step Too Far”

Dude,

I need a video rendition of this to fully process it

I hear ya, but I’m a writer, not an actor… but others are welcome to make videos of this topic!

Good stuff Rob, I wholly agree. I like the hint of Jerry Maguire’s “memo” The Things We Think And Do Not Say, to this plea, except you have the history of telling it like it is. Great write up.

Rob- thanks for sharing . The key is to always have the consumers best interest first . Give them all available options, run out side by side nets and disclose all facts then help guid your client through all their options. Full transparency. I have been in the trenches for the last 5 years since Opendoor launches in Az. Based on what we have learned and how to market and script we have put together the 1st training and education platform and certification for agents to better understand and serve in the new market . You can check it out at iRealEstatePro.com

Thank you Kenny. And yes, that’s exactly what I’d like to see happen here. Keller Offers would be a fine program with some changes to ensure that the agent would never lose the consumer’s trust.

Good stuff Rob, I wholly agree. I like the hint of Jerry Maguire’s “memo” The Things We Think And Do Not Say, to this plea, except you have the history of telling it like it is. Great write up.

ROB,

Read the whole thing….good catch!

You know after all this ibuyer excitement I have never seen the market size posted anywhere. Today, I believe the target markets for this model are communities with somewhat commoditized housing structures within certain price parameters in specific locations. I understand this business model is meant to expand into other more diverse markets – but for now those are the markets where this is being rolled out.

Not even considering those that would or wouldn’t utilize this selling process – just how big is this market? How many homes qualify as an ibuyer target now? Maybe it’s huge, I don’t know. But with all the attention, at least it should be common knowledge of exactly what is being so aggressively chased.

Anyone?

Again, great work Sherlock 🙂

Thanks,

Brian

Rob, simply a great post. Sorry to see my KW friends strapped to the log headed for the buzz saw of lawsuits headed

their way. It appears the Peter Principle is in full force at KW HQ.

Rob, your first bullet point at the end (present at listing consultation) is how I understood the program to work.

Then how do you understand, “Your sign stays in the yard”?

How is there a sign in the yard in the first place if you haven’t already taken the listing?

I did not read the whole thing and stopped in my tracks where the KW agent will NOT be representing the buyer, but yet the buyer will pay the agent some amount, ONE%?! WHAT??? That buyer needs to jump ship and find an agent who will represent them. And, how much will the buyer’s agent be paid? What kind of commission is the list agent going to put in the listing contract?

Other than the 1%, will the KW agent get 1+1%, or if the listing is 5%, how is that split between the seller’s agent and buyer’s agent.

Rob – There is sooo much damned greed in this business. I really want banks to be able to have real estate brokerages. This is one thing, among others, where I vehemently oppose NAR’s position on things. I bet no agent at KW will answer these questions.

I will say this, Any agent who pulls that crap on one of my listings, will receive cooperation from me, …. grudgingly. Seems like I am soooo busy that I do not have time to return calls nor emails.

Brilliant.

Very well written article!

It is very clear that no one here really cares on the consumer but on their own commission fees only.The main purpose of any real estate brokerage is how to get more commission and they do that by taking a ride on the back of the consumer, who knows nothing about real estate.The average consumer has no idea how the process of selling and buying a home works.How can an agent have a fully fiduciary to the seller when the buyer will pay him/her a commission? I think Mr Gary Keller should answer this question.

6 times too long

Sounds biased against K-W (I am at RE/MAX)

As if you are SJW for “everybody” (who are fools and/or simpletons)

Excellent post. In AZ we use a Consent to Limited Representation which really puts the dual agent into a position more of mediator…not putting the interest of one party above the other. I’m certain that whatever the form says, it cannot remove the appearance of impropriety. Charlie Keating rode this same horse…

Hi, Rob, Thought provoking post. I think it may be a little early to criticize how this program will be implemented In practice as there are a lot of unknowns. There are many ways it can be done without creating conflict of interest. You point out several yourself in your bullet points at the end.

If you think about buyer agency It has been clear for many years that paying compensation does not create agency. In many if not most transactions these days the Sellers pay the commission received at settlement by the buyers agent. That buyers agent still has their only fiduciary duty to the buyer, and not to the seller who writes the check. In fact buyer agency only took off in the early 1990s when compensation and fiduciary duty were decoupled.

Worth keeping our eye on iBuyers as this segment of the industry evolves.

Thanks Jon.

You know, your point about buyer agency and compensation is well-taken. I’m not sure why this feels different though, even though like you said, buyers know that their agents are getting paid by the seller. Hell, many agents advertise that as a reason for buyers to use them. (Now, the commission lawsuits going on now might be a problem, but that is in the future.)

So I’m not sure why this feels different, but it does. Anybody else feel the same way?

Is it because for a seller there’s more emotion of fear and loss vs. joy/excitement of “New home, yay!”? Is it because buyers instinctively kinda know that their agents are working for the seller, like back in the sub-agency days? I don’t know, but curious what others think.

This is why the people don’t trust buyers agents. The agent may say his fiduciary duty is to the buyer.. but how many customers actually believe that?

this is not a new market, this is a desperate attempt by a desperate brokerage… everyone just needs to sit back and watch…”just sayin”

sad attempt to rescue a brokerage in trouble…. don’t bite on this, or it will bite you back for sure!

Comments are closed.