Inman News has a couple of articles on the RE/MAX Broker Owner Conference going on right now. The first is on Dave Liniger, the founder of RE/MAX and first ballot Hall of Famer, giving advice on surviving recessions, and the second is on Nick Bailey, Chief Customer Officer, talking about how real estate is in a “race to the bottom.” You’ll need Inman Select to read either one.

[Full disclosure: I was invited to the BOC, then disinvited after my last couple of posts on RE/MAX. It’s unfortunate, but it is what it is. I still love RE/MAX and love Adam Contos in particular (seriously, he’s such a great guy and a great leader), but I get why they did what they did. 🙂 Sometimes, in an industry obsessed with spin, speaking your mind and calling it like you see it has consequences.]

If you missed my thoughts on RE/MAX today, go read the VIP post on RE/MAX’s Q2. For what it’s worth, RE/MAX didn’t like that I didn’t talk more about how they had cut fees significantly in Q2 because of COVID. Well, I apologize for not stressing that, but that still doesn’t explain why RE/MAX lost 1,444 agents since the end of Q4. So consider it stressed: a big part of why RE/MAX lost so much revenue and cash flow in Q2 is because they chose to charge less to their franchise owners and agents. Of course, Zillow also cut ad fees by 50%, but hey, two different companies….

But what I read from Inman raises even more questions.

Mystery #1: Cash Management

In his session about surviving recessions, Liniger said:

“We started in a recession in 1973 — it was modest, it wasn’t terrible, it was the first oil embargo — but over the next 50 years, we’ve been through seven of these,” Liniger said. “What it taught me is that you’ve got to have cash, you can’t just spend every dime you’ve got thinking it’s never going to end because the business cycle continues to happen.”

RE/MAX brokers that didn’t have cash on hand were, “absolutely hammered,” during the Great Recession because they expanded too fast, had too many offices or refused to close unprofitable offices.

Liniger also talked about how some small business — including brokerages — only had three weeks of cash on hand, and they went belly-up. So his thought is that healthy brokerages have to take advantage:

There’s also opportunity in downturns, Liniger said. The brokerages that were short-sighted or undercapitalized are paying a terrible price, which means that, while other brokerages are pulling back, the ones that positioned themselves well should be getting greedy.

Well… how in the world did RE/MAX have any brokers that didn’t have cash on hand?

As Liniger said, RE/MAX itself was started in a recession in 1973. RE/MAX has been through seven recessions. Presumably, the lesson of having cash on hand was hammered into RE/MAX franchisees? I’m pretty sure RE/MAX does extensive training for its broker owners since I’ve met the executive in charge of said education, and she’s incredibly competent. I’ve been to their in-house education center and it’s very impressive.

I am forced to conclude that cash management was not (and maybe it still isn’t?) a part of the RE/MAX franchise agreement, since a franchise can require a franchisee to have a certain amount of cash on hand. Given the history that RE/MAX is now bringing forward, I can’t help but wonder how that happened. Liniger knew that cash on hand is critical; Liniger and the RE/MAX executives have been through seven recessions. How does RE/MAX have any brokers in its network without cash on hand, or expanded too fast, or had too many offices?

I know, I know — “independently owned and operated” but there are franchises even in real estate that will not have franchisees without cash management discipline. How is RE/MAX not one of them?

But when he talks about now being the time to get greedy, the mystery deepens.

Mystery #2: Taking Market Share

The second mystery is from this:

“Now is our time to take more market share,” Liniger said. “Our agents are extremely well-trained, they’re experienced, this is the time to take business away from people who aren’t as well-prepared.”

“There is enough business for some,” Liniger added. “We just have to take more than our fair share.”

He’s absolutely, 100% correct. I’ve written about that, and speaking to brokers and agent team owners, the ones that have cash are on an acquisition binge to grab market share.

The mystery is why RE/MAX Corporate has not mentioned a single program to help their good franchisees take market share. Listen to the Q1 earnings call and the Q2 earnings call. See if you hear RE/MAX say anything about providing funds (or making sure franchisees have their own funds) to do acquisitions. I haven’t.

One would think that a publicly traded company, who believes that now is the time to take more market share, would get on an earnings call and say something like, “Now is our time to take more market share. So we are announcing a $100 million program for our franchisees to acquire these small brokerages who only had 3 weeks of cash on hand.”

If RE/MAX corporate saw such opportunity to gain market share, why not require that the reduction in franchise fees (that led to such a terrible Q2) be used to gobble up these brokers that were short-signed and undercapitalized? Wouldn’t that be a good use of the roughly $12 million in revenues that RE/MAX gave up in Q2?

Of course, since RE/MAX brokerages are (or should be) positioned well, and should be getting greedy, why did they need their fees cut?

I don’t get it. ‘Tis a mystery.

Mystery #3: About that Culture of Recruiting….

I already wrote about this in my Q2 analysis (which got RE/MAX pissed off at me):

Which would explain why we get this from Nick Bailey in this earnings call:

However, the one thing to note, though, we are not the home for every real estate license. We are known for having top producing, full time real estate agents. And so, we’re not known just to warehouse non-producing agents. And so, as the level of uncertainty, especially the first part of the second quarter, affected the decisions of where people — where agents hung their real estate licenses. We’re thrilled with the fact that now how we’re executing on all of the recruiting strategies is showing that, as the certainty returns at some level to the real estate industry, we’re seeing that stabilization that we can move forward on from June, July.

Huh. So what are we to make of this? That the 1,444 agents who left RE/MAX since January are non-producing agents? Or that RE/MAX in Q3 and Q4 went out and recruited a bunch of non-producing agents?

Plus, since RE/MAX’s business model is primarily based on per-agent fees, why does RE/MAX care if their agents are producing or non-producing? They make the same amount whether the agent is doing 1,000 transactions or 1 or zero.

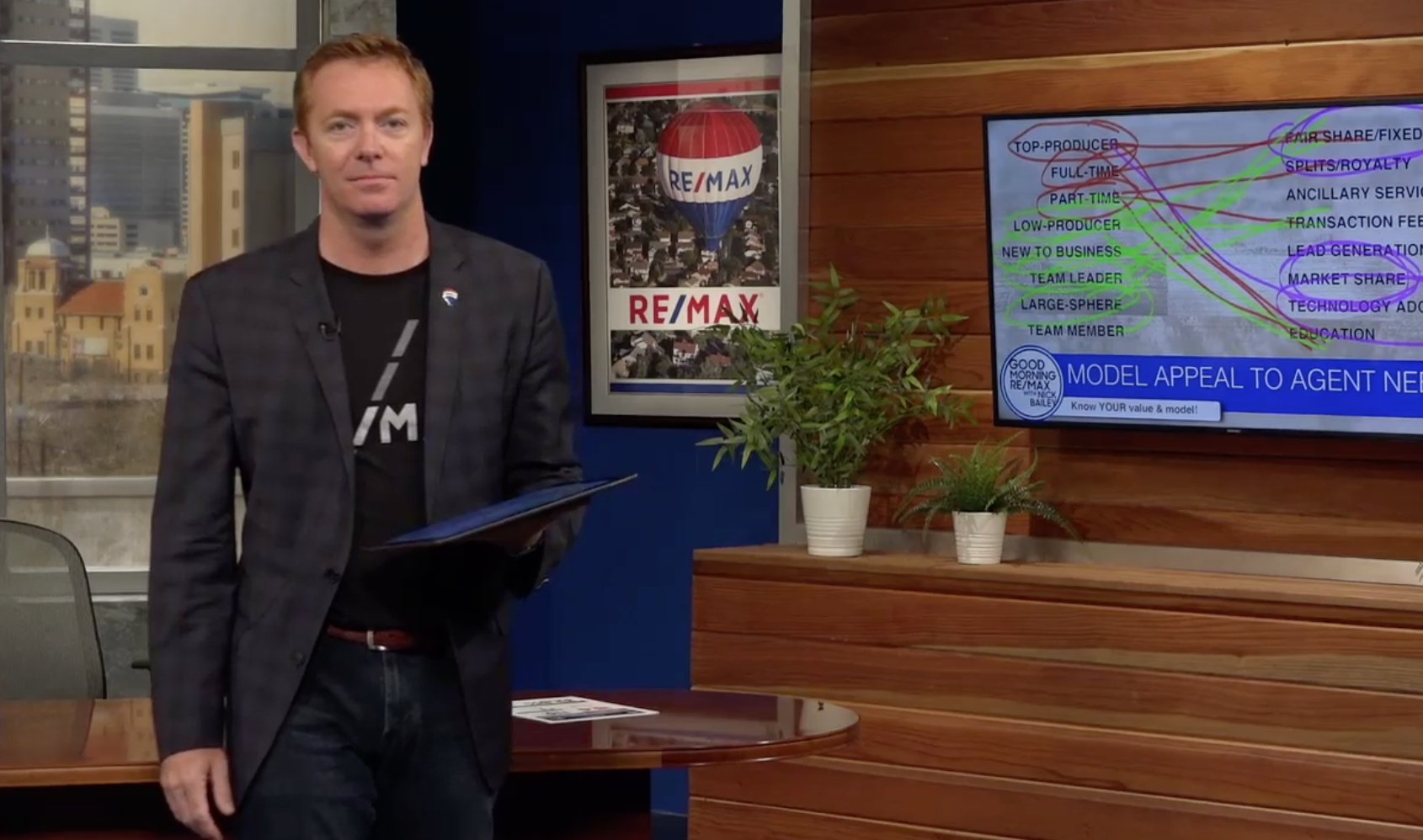

So Nick Bailey starts walking back the culture of recruiting stuff, and starts talking about not warehousing non-producing agents in the earnings call. Then at the BOC event, we get this:

Bailey made the comments during a presentation at RE/MAX’s virtual Broker Owner Conference. The presentation began with Bailey recalling how some brokers have raised frustration with the company’s fixed-fee model and claimed it’s a deterrent for recruiting agents. Such frustration sometimes translates into arguments that RE/MAX’s model is “broken.”

But Bailey said the problem actually lies in the way the industry is telling agents to think about money.

“This industry is experiencing right now what I call a race to the bottom,” he said. “The industry is just absolutely telling agents, go somewhere you can save $12. Go somewhere you can save $35.”

So the problem isn’t that RE/MAX charges too much in fixed fees, but that the industry as a whole is telling agents to save money. Right.

That sounds suspiciously like… Realogy. Or HomeServices of America.

But it’s not at all like Realogy, because according to Bailey, top producing agents should welcome the fixed fee model of RE/MAX:

During his presentation, Bailey argued that fixed fees can be more financially attractive during a time of significant price inflation. If home values are skyrocketing — as they have in recent years — royalties also go up. Fixed fees, on the other hand, are more constant during times of inflation.

I mean, he’s right. Fixed fees are more constant. That’s true. The split-based model is really unattractive when home prices are going up 5% per month (July numbers). But… wait a minute….

This commission plan comes straight from Re/MAX Real Estate Center, a franchise in Massachusetts with dominant market share in its local area:

95/5

The 95/5 Agent is one who doesn’t mind paying a monthly Desk Fee, as they have budgeted accordingly, and recognize the advantage of a high payout with a monthly fee.

This is the commission plan that RE/MAX became famous for. Enjoy the highest split available, with a monthly Desk Fee. On this plan you will receive the largest commission payouts for each closing.

What is this Desk Fee? I couldn’t find it for RE/MAX Real Estate Center, but here’s some information from Clever:

Desk fees can range anywhere from $300 to $2500 depending on which perks are provided and may include space in the office, advertising, business cards, broker fees, etc.

I’ve found references that many RE/MAX agents are paying something on the order of $1,000 per month ($14,000 a year for one person). Or you can get on RAPP (RE/MAX Alternative Payment Plan) which starts at 60/40 and has a high of 80/20 with a cap of $23,000 (for RE/MAX Real Estate Center) after which you go to 95/5.

That’s not really a fixed fee model, is it? 95/5 is a split, at least according to the laws of math in the universe I live in. Do $1 million in GCI, and you’re coughing up $50K to the broker. That seems like real money to me, primarily because a nice Genesis G70 3.3t AWD luxury sports car costs about that and I really like what I’m hearing about that car. But whatever, let’s be generous and call it a fixed fee model.

The problem is that there are models that are orders of magnitude cheaper than RE/MAX. Take eXp as an example: $16K cap, then 100% thereafter. (Plus various fees, but they don’t appear to add up to 5% of the GCI on a typical $300K house.) That’s the race to the bottom that Bailey was referencing, because if you make $1 million a year in GCI, refusing to buy your broker a Genesis G70 3.3t AWD every year is like trying to save $35.

So the argument ultimately comes down to, “You get what you pay for.” So paying Re/MAX is worth it, because you get so much more.

I suppose. People do buy $150,000 luxury cars when a $20,000 car would just as easily get them from point A to point B. People buy far more expensive things than they need to because they see the value. I do it, you do it, we all do it. My dress shoes and tailored suits are a great, and now completely useless in the Post-COVID world, example.

So if some agents want to pay $1,000 per month plus 5% because they see the value, that’s great for them and great for RE/MAX.

But you know what that is most definitely not? A Culture of Recruiting. Instead, I think we can think of the New Post-COVID RE/MAX as one that is putting in a Culture of Exclusivity. RE/MAX brokers can stop going after the agent with 6 transactions a year, because Nick Bailey has made it clear that RE/MAX is not for her:

Bailey also said that RE/MAX’s model is specifically best suited for full-time, top producing agents.

“I believe RE/MAX is the country club not Sam’s Club,” Bailey added. “It is not for everyone.”

The country club, not Sam’s Club, son. RE/MAX is tired of justifying its high cost; it is saying that it’s no Honda Civic, but a Mercedes S-Class, and priced accordingly. That’s a valid strategy. But there’s a major problem with that strategy in real estate of 2020.

Mystery #4: Honda on a Mercedes Budget?

The major problem is that if you want to charge Mercedes S-Class prices, you actually have to deliver a Mercedes S-Class, and it has to be obvious from the outside that you’re looking at a Mercedes S-Class. That last part is what bedevils real estate brokerages and franchises.

With real estate brokerages, there are no test drives. You either join, or you don’t. If you join, the switching costs are high enough that it’s a big risk. So agents interview brokerages and franchises all the time to try and figure out which one looks and sounds like it might work for them. Because from the outside, every brokerage and every franchise claims the same thing: we’re awesome, we give you so much value, we have the strongest brand, the best training, the best education, the strongest marketing platform, the best technology!

For every booj and First, you have KW Command and Coldwell Banker CBx Suite and HomeSmart RealSmart Agent and… do we need to go on? From the outside, everything looks the same. And that’s only from the brand. In the wider world, there is no shortage of technology vendors eager to sell your their platform that is supposedly life-changing and 10x better than the “mass market stuff” that the big companies offer.

So from the outside, every brand, every brokerage looks like a Honda Civic. And one wants to charge you Mercedes prices, while another doesn’t.

Hard sell, that.

Especially when the numbers don’t appear to backup the assertion that you’re buying a Mercedes S-Class: transactions, volume, listings that I’ve been tracking for RE/MAX are all middle of the pack.

And the sell is even harder when it comes to teams. Because their needs are so different from the needs of individual agents that they might as well be two different market segments.

So now, not only do you have to sell what looks like a Honda Civic from the outside at Mercedes S-Class prices, you have to sell it to people who actually want a helicopter.

How does this work, exactly? Nick Bailey thinks it’s about reputation:

Ultimately, Bailey argued that brokerages struggling with recruiting may actually be struggling with things like their reputation in the market. And he said RE/MAX brokers should not “let the competition tell your story louder than you tell it.”

So if you’re a RE/MAX broker, if you can’t recruit full-time, top producing agents to your company, it’s your fault for having a crappy reputation in the market. It’s your fault for letting the competition tell your story. It has nothing to do with the fact that RE/MAX charges $1,000 a month desk fees plus 5% of the agent’s income. Because you’re a country club, and those are exclusive and expensive, get it?

To Summarize…

My takeaway from these two articles is that RE/MAX is now talking up its exclusivity. It’s not for everyone. It’s only for the top producing, full-time agents. And since RE/MAX has the best agents in the industry, they should go take greater market share. But RE/MAX itself doesn’t have any kind of a formal program to grow market share, like an acquisition fund or some in-house cold callers or a giant media advertising spend or anything like that. As far as I know, all that RE/MAX has done in this time to take market share is cut fees to franchisees.

It’s something, I guess.

But at the same time that RE/MAX is telling us that it’s only right for full-time, top producing agents, because you know, it’s really kind of expensive, they have announced nothing that specifically caters to agent teams — who are the best agents in the industry who are taking greater market share. And since what they have been offering to date is not yet showing up in the production numbers as any kind of a real competitive advantage for said teams, we have a disconnect. I admit that maybe I’m wrong; maybe if we only looked at top producers, we’d see that booj and First are doubling their production. Maybe RE/MAX can produce some stats.

At the same time, literally every other company in real estate is going after the full-time top producing agents. There isn’t a single company, franchise or otherwise, who says, “You know, let’s make sure we only go after non-producing agents.” We know from examples like Compass that many might say they’re an expensive split-based brokerage, but offer sweetheart deals to top producing agents that are hard to turn down.

But if you fail to recruit more of these top tier agents, RE/MAX broker, know that it’s your fault for having a bad reputation in the market and allowing your story to be hijacked by competitors. I’m sure that will fire up the various broker owners attending the virtual event, but maybe not in the way corporate thinks it will?

So we have the mystery of chessboxing here. It’s rough, I know. I don’t feel great about that since I’m not looking to hurt anybody, or embarrass RE/MAX which remains one of the great companies in real estate, and led by one of the truly good guys in the industry in Adam Contos. They have so much potential to be amazing, but keep on keeping on with the same old, same old.

But I owe it to you, the VIP reader, to give it to you raw, with no trivia. If that shocks and rocks the nation, like the Emancipation Proclamation, well.. so be it.

-rsh

Great post, Rob. A couple questions for you. Regarding desk fees, it is not RE/MAX corporate that charges the fees but is instead the broker who charges these fees, correct? If I’m not mistaken, this is a primary means of revenue generation for many RE/MAX brokerages. Also, in a post-COVID world, are agents still willing to pay these desk fees when they would probably rather work from home? Curious how you think agents evaluate the value proposition.

My understanding is that the broker charges these fees because of the fees they have to pay to RE/MAX corporate in turn. The money has to come from somewhere after all. 🙂

As for the post-COVID world… well, I guess some are. But the decline in agent count in the U.S. suggests that at least 1,444 were not.