Back in 2019, I wrote a post titled Pass Clear Cooperation Policy, But Address the Gaping Loophole. In that post, I pointed out that because of the office exclusive loophole, Clear Cooperation Policy creates bizarre new incentives:

In the FAQ that accompanied Policy 8.0, we are told that this policy does not affect “office exclusive listings” at all. From NAR’s webpage on Policy 8.0:

Does Policy Statement 8.0 prohibit office exclusives?

No. “Office exclusive” listings are an important option for sellers concerned about privacy and wide exposure of their property being for sale. In an office exclusive listing, direct promotion of the listing between the brokers and licensees affiliated with the listing brokerage, and one-to-one promotion between these licensees and their clients, is not considered public advertising.

Common examples include divorce situations and celebrity clients. It allows the listing broker to market a property among the brokers and licensees affiliated with the listing brokerage. If office exclusive listings are displayed or advertised to the general public, however, those listings must also be submitted to the MLS for cooperation.

It’s important to recognize that the office exclusive is actually a brokerage exclusive; a brokerage with 10 offices can aggregate all of the exclusive listings and take advantage of that. Further, note that office exclusives are not subject to the MLS rule requiring mandatory submission of the listing to the MLS.

That loophole not only preserves most of the value of exclusive inventory strategies, I argue that it creates a new safe harbor for such strategies.

Here we are in 2021, and Clear Cooperation Policy is mandatory “law of the land” in MLS world. So what has been the result?

Some Data from Redfin

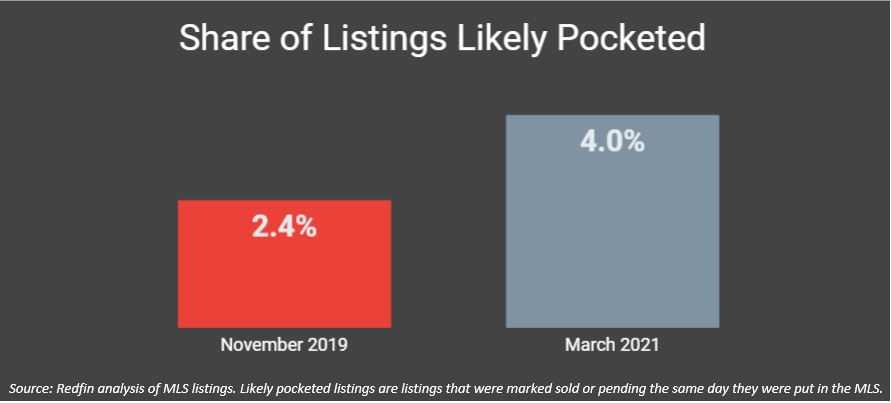

According to a post by Glenn Kelman on Redfin.com, “pocket listings” are up 67% from 2019 to 2021:

It turns out you can put a number on whether the housing market has gotten more or less fair to people of color; it has gotten much less fair. In a November 2019 fair-housing initiative, the National Association of Realtors moved to ban so-called pocketing listings, where real estate agents tell only a select group of buyers about a home for sale. But since then, the number of homes sold without being marketed to the public has increased 67%, from 2.4% to 4.0%, and may still get worse; the rate risen every month in 2021.

In Some Markets, 10% of Listings Are Pocketed

In markets with a long history of exclusive neighborhoods, like Chicago, or markets where one brokerage has significant share, like Minneapolis or Columbus, the largest brokerages are pocketing more than 10% of their listings. One in ten homes may not sound so bad, but the problem is that the homes being sold in secret are often the ones everybody wants, often in mostly white neighborhoods.

Now… Glenn Kelman frames this as a fair housing problem, as a racial discrimination problem, but frankly, that’s both confusing the issue and obscuring the real problem. In fact, I think using the phrase “pocket listings” obscures the real problem, because office exclusives are not pocket listings. No, office exclusives are sanctioned by the Clear Cooperation Policy rules by name.

Once you get past the distracting rhetoric about race, it turns out that Clear Cooperation Policy is a disaster in the making. So I do support what Glenn suggests, which was my original recommendation back in 2019: close the office exclusive loophole.

NAR Can Give Its Pocket-Listing Ban Teeth: The National Association of Realtors has already banned agents at different brokerages from sharing pocket listings with one another via Facebook groups or email lists. But this well-intentioned policy had the unintended consequence of creating a monopoly on a monopolistic practice, favoring the big brokerages who can still pocket listings within their own brokerage, in what are known as “office exclusives.” The big brokerages could end pocket listings today, just by looking for the offices selling a large number of listings that are never marketed to the public. At its November conference, the NAR could support these brokers by closing the office-exclusive loophole industry wide.

With the crazy seller’s market we are now in, and I think will be in for the foreseeable future, unless this loophole is closed, we can expect more double digit YOY increases in “pocket listings.”

Why Pocket Listings Will Rise

As I wrote in previous posts on the subject, office exclusives will go up over time because of the incentives. It has little to do with double ending deals, it definitely has nothing to do with racism, and it has everything to do with the realities of brokerage operations. Here’s what I wrote in 2019:

What so many people have missed about exclusive inventory strategies is that they are not about doing deals. At the level of the individual agent, or the not-so-sharp brokerage operator, these strategies might actually be about double-ending transactions, but for smart brokerages, exclusive inventory strategies are about creating a FOMO (Fear Of Missing Out) effect in consumers and agents to create competitive advantage.

Buyers sign up for your emails out of fear that they might miss out on an exclusive. You use this database of buyers to recruit agents, who fear that they might be missing out on leads and worry about competing against your agent who can walk into a listing appointment talking about the 5,000 buyers you have in your database. Those agents bring listings with them, which you use to begin the cycle again. This “network effect” is the superpower that Andrew Flachner so eloquently outlined in his post about using buyer data and exclusive listings to gain a competitive advantage.

And just in case you can’t connect the dots, the brokerages who can most effectively use Office Exclusives as a competitive lever are the big brokerages with lots of agents and lots of listings. The small independent is screwed. The boutique brokerage? Screwed. The small 3-person brokerages that makes up the vast majority of the Participants in any given MLS? Screwed. Nobody really cares about your seven Office Exclusive listings, not when the top five Big Box Brokerages in town have several thousand. Oh by the way, your IDX feed is now short several thousand listings.

Given the desperation of buyers today, do we really think they’re not signing up for those emails? If they start signing up for those emails, do we really think that the brokerages aren’t going to use them for a competitive advantage in recruiting, in getting listings, in everything else?

Exclusive inventory –> exclusive buyers –> exclusive sellers –> recruiting advantage –> exclusive inventory. FOMO and the beneficial cycle of the network effect gets going. This was quite literally Compass’s business plan a couple of years ago, and I suspect that it remains an important part of their now-public business plan. And if Compass saw the benefits, then so did every other big brokerage in the country.

I’m actually a bit surprised that Redfin said only 10% of transactions in Minneapolis and Columbus are being done as office exclusives. I would have thought it would have been higher.

Glenn is correct that big brokerages could end the practice today; I just don’t see why they would.

Glenn might be correct that NAR could end the practice by closing the office exclusive loophole… but that’s a bit of a dicier proposition… since big brokerages could theoretically just leave REALTOR MLSs in response. Commercial real estate has operated for centuries without NAR and the MLS… and CoStar is in the game now.

Maybe that’s why Glenn talks so much about race, to pressure big brokerages to do something that is so clearly against their self-interest.

Disaster in the Making

So, I now believe that as currently written and adopted, Clear Cooperation Policy is a disaster in the making. It limits marketing options for brokers and agents by basically eliminating Coming Soon, but incentivizes the pursuit of office exclusives… which might be worse. The policy has created a clear safe harbor for that practice, which is in the best interests of brokerages to pursue.

FOMO and network effect are powerful things, and brokerages who are suffering from decreasing profitability year after year would be fools not to look to take advantage of those. That doesn’t make them racists; it makes them businesspeople trying to stay in business.

But that doesn’t change the fact that the current Clear Cooperation Policy will lead to more, not fewer, “pocket listings” as time goes on. Give it enough time and runway, and it will eventually become far more than 10% of transactions. How long can the MLS wait before it is rendered irrelevant? 30% of transactions? 50%? 70%? You don’t have that much time.

Until a more permanent solution can be found, I agree 100% with Glenn that NAR should remove the office exclusive loophole as soon as possible. At the very least, that loophole should be made an optional provision, rather than a mandatory one. If the industry is going to go against exclusivity, then it needs to go against exclusivity… then deal with the issues that will arise from that change.

-rsh

JEON SOMI (전소미) – ‘What You Waiting For’ M/V

JEON SOMI – ‘What You Waiting For’ available on all streaming platforms ▶ https://smarturl.it/SOMIWYWF JEON SOMI – What You Waiting For 너 땜에 그래 애꿎은 전화기만 미워지잖아 잘해주지나 말던가 남 주긴 아깝지만 갖긴 싫은지 굳이 이해는 안 할게 날 향한 미소가 야속해 자꾸 그렇게 쳐다 보지 마 오늘은 애써 모른

What’s best for the consumer or what’s best for big brokerage? I’m starting to think NAR enjoys litigation. They truly are their own worst enemy. Even if you are an agent “buying” into this BS (bc you, Agent, work for a big firm and you drink the kool-aid or benefit from this “policy”), it makes the industry look even worse (how low will the reputation go?). You (agent) want to be taken seriously by the general public? Then start caring. Consumers are *pissed* who miss out on homes because it’s sold within 5 mins of hitting the “open” MLS so-called “market”. This is not a free and open market. This policy is not working for everyone. Consumers are not stupid. They can also realize the benefit of dual sides or an in-house sale.

Does NAR and their Realtor own MLSs believe they are FINRA? Everyone needs to remember they are a trade organization with self interests yet they make up the “rule” of the RE land? Seriously, WT….H.

Here are a few examples of how screwed up this “policy” is:

If a big financial firm was paid on stock trades a “commission” and said: “hold up Mr. Client, I know you want to sell 200 shares of XYZ stock, but I think you want this to be private. I’m going to float it out to all the buyers of this stock in-house 1st instead of an ‘open market order'”.

Financial brokerage obtains both sides of commission trade. Increases market share. It’s *always about market share*. R.E. is a cost of services business. So it’s a huge recruiting tool to have more listings. Insiders and execs know having these “secret” listings helps recruiting. More recruits, more market share= more $$$.

Another example: If Amazon was an actual exchange for goods (they practically are), the government would lose their sh*t if Amazon floated “exclusive goods” of Amazon to consumers for a “1st look” OVER all the other independent/3rd sellers on the Amazon platform.

How is this any different on MLS? NAR is allowing an exclusion of other small brokerages to participate in what should be an open and free market. And the buyers represented of these small brokerages are being royally screwed. The tech software companies (many on non-profit board RESO) are pushing out exclusive listings to areas with brokerages who have an office in almost every town. Hello monopoly? Sherman Act? Antitrust?

If I was a small real estate brokerage, you bet I would be teaming up with other small brokerages. I’d be boycotting NAR and starting my own trade association (and hiring a lawyer to fight this policy).

But keep paying those dues bc…..

“But now you do what they told ya

Well now you do what they told ya”

…….

“Some of those that work forces

Are the same that burn crosses”

-Rage Against the Machine.

Good stuff, Rob.

You may recall my position when CCP was passed. I haven’t changed course much since then. Fundamentally, CCP was aimed at driving off-market listings back into the MLS under the banner of fair housing; something we can all get behind. However, the first indication that CCP was way too broad and way too vague was in the conception phase. As with most policy NAR feels will make a lot of people angry, CCP emerged from an inherently opaque decision-making process and was hastily presented as a fully formed concept without adequate feedback from those the policy would effect most directly.

Namely, MLSs (and the brokerages they serve) with market-level standards where off-MLS listings simply weren’t an issue. Places where pre-marketing existed, but wasn’t controversial. Where smart policy was already in place and working. NAR branded these MLSs and brokerages tacitly supporting anti-consumer behavior and declared CCP as the only answer.

The result created an overnight binary that forced brokerages to put clients interests in front of MLS loyalty. As you say, this was never about double-ending deals or gaming the system somehow (the vast majority of Coming Soon listings were/are co-brokered). But that didn’t matter. The wave of outcry surged and everyone just got out of the way or risk being accused of arguing against a fair housing.

Fact is, brokers have and will always sought creative ways to attract clients, ways to serve with custom services and build a unique value prop. That’s just smart business, regardless of the marketplace. CCP declared the most recent pursuit of unique services as anti-consumer and anti-cooperative. Undeterred, many brokerages still seek ways to separate themselves from their competition with branded, non-traditional service offerings. One wonders how successful the next generation of services will be before they are also targeted by policy to realign the marketplace to remain homogenous?

Again, I’m completely pro-MLS. I’m absolutely behind the assertion that every listing ultimately belongs in the MLS. In this way, CCP could’ve been a homerun. It could have been an opportunity for NAR and its MLS and broker members to align and re-affirm the commitment to serve both client and the community of competitors who thrive in a healthy MLS environment. It was halfway there, in my opinion. But that other half may be impossible to fill in.