I’m busier than a one-legged man at a butt-kicking contest… but I wanted to get this post up as the folks over at BrightMLS (Thank you, Rene! Thank you, Elliot!) were kind enough to chat with me on Friday. It will necessarily be short… well… short for me.

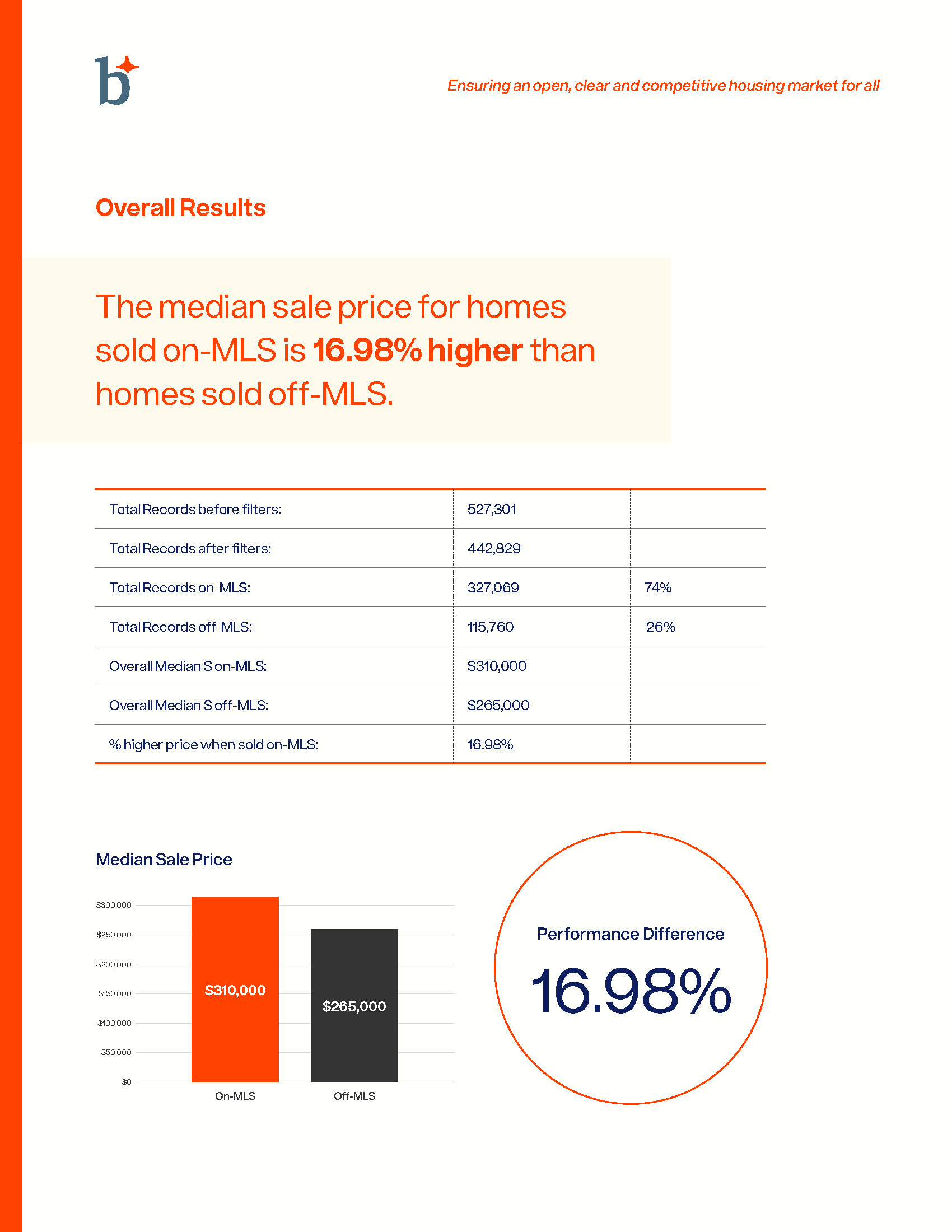

In case you missed it, BrightMLS recently published a study with the headline “On/Off MLS Study: Homes marketed through the MLS sell for 16.98% more.” Now that’s all kinds of interesting, isn’t it? Hells to the yeah, I said.

Since this is the first real study of its kind that I’ve seen, I thought it worth reading in full. I think it’s worth you checking it out in full. I’ll even embed it below.

Well, having read it, I think the headline is a bit… overstated. Thanks to Rene Galicia, the newly minted EVP of Customer Advocacy, I spoke with Dr. Elliot Eisenberg the lead advisor on the study. So they both know what I’m going to write here already; this ain’t an ambush y’all. I wouldn’t do that to my friends over at BrightMLS trying to do their best.

So let’s get into it.

The Study Details

Right off the bat, when I read that this study shows such a major difference, I got excited. Then I read the study.

I got less excited.

See, the issue is overstating the conclusion based on rather thin and problematic data. Here’s the overall conclusions page:

Simply put, there is a large discrepancy in the median sale price between On-MLS homes and Off-MLS homes. However, that’s difficult to call a “performance difference.”

Really, the only conclusion one can actually draw from that data is that On-MLS homes have a higher median sale price compared to Off-MLS homes. But consider the possible reasons:

- A seller might do Off-MLS for run-down handyman special homes.

- Investors might sell their properties Off-MLS for a variety of reasons.

- The wealthy tend to use an agent, which means On-MLS.

And so on and so forth. The ultimate sale price tells us nothing about “performance” of one method of marketing over another.

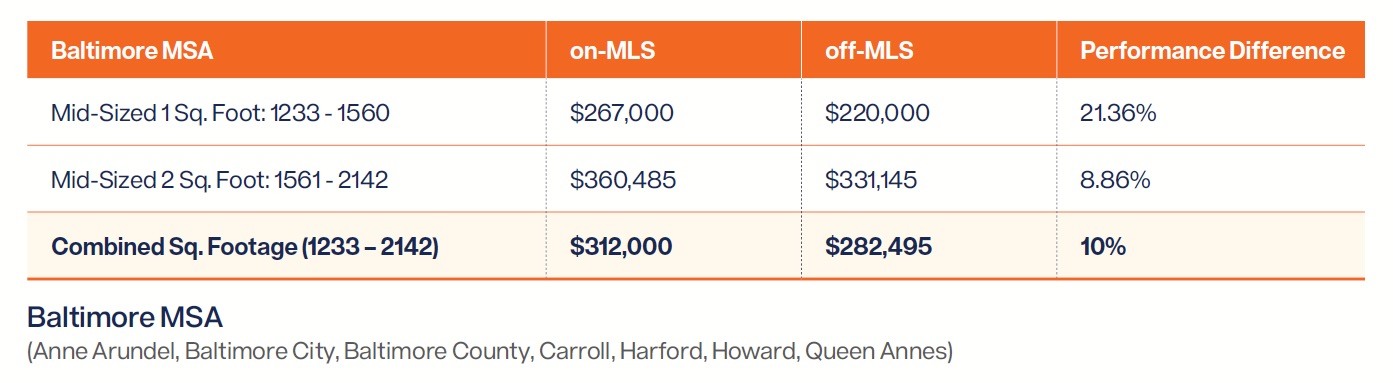

In fact, some of the sub-data presented could constitute bad news for real estate agents. Take this chart for example:

So for “mid-sized 2” properties ranging between 1,561 sq. ft and 2,142 sq. ft, the difference in median sale price is only 8.86%? Except that the On-MLS properties likely paid around 6% in REALTOR commissions, so $21,629, for a net of $338,855. Sure does make Off-MLS even more appealing, no?

That can’t be the right conclusion.

While we’re at looking at the data, where’s the data for Low and High square footage homes? For some reason, the study only gives us “Performance Difference” for Mid-Sized 1 and Mid-Sized 2. What were the numbers for Low and High square footage homes?

In any event, what would constitute actual “performance” data?

What We All Need: List-to-Sale

In speaking with Dr. Eisenberg, it became very clear what the challenge was.

You see, in order to really measure performance, what we really need is the List-to-Sale ratio. If the On-MLS properties showed a List-to-Sale of 99.2% versus the Off-MLS properties showing a List-to-Sale of 80%, then we have a true measure of performance. That really can tell us that marketing a home on the MLS results in higher sale price compared to what might have been.

The problem is that Off-MLS properties have, as you could imagine, no List Price. Public records data does not contain any list price, any reductions, any WEST (Withdrawn, Expired, Suspended, or Terminated) data, etc. It only has the final sale price.

Where We Might Get That Data

One of the things I discussed with Dr. Eisenberg is where they could get some data that shows real performance difference between On-MLS and Off-MLS properties.

Go back to 2019, prior to NAR’s Clear Cooperation Policy being passed. Back then, Zillow wasn’t a brokerage participant of the various MLSs either. Which means that a number of off-MLS sellers, especially those doing Coming Soon and other off-MLS strategies, were advertising them on Zillow before putting the homes into the MLS. For companies like Compass who were bypassing Zillow, but using their own websites, go ahead and scrape those.

There’s your List Price for off-MLS homes right there. Every single one of those has a street address, which is replicated in public records data. So it’s simple to get List-to-Sale ratios for properties prior to 2020.

Since those websites are probably not showing old listings from 2019, Dr. Eisenberg and team might want to look into Archive.org and see if that has old webpages. If not, it’s quite possible that someone like say Google which scraped every single one of those listing pages might have historical data. I mean, does a company like Google throw out anything data-related?

And of course, since BrightMLS is one of the largest MLSs in the country, it could reach out to its brokerages and ask them to provide list prices for all of their off-MLS properties back in 2018 and 2019. There is no real good reason for any of those brokerages to withhold that data from BrightMLS in 2021. If they do withhold, then we all can assume that they’re trying to hide something… which is not great news in the era of FTC and DOJ investigations into brokerage and listing practices.

Some Other Takeaways from the Study

There are, however, some other eye-opening takeaways from the BrightMLS study. I’m not sure that they wanted these takeaways but… hey, here we are.

First, am I the only one surprised that more than one out of four properties sold in the giant footprint that is BrightMLS sold off-MLS?

Second, the study says:

While we do not have access to all off-MLS transaction data, as those occur outside of the BrightMLS system, we were able to analyze Office Exclusive data for the 2020 calendar year, which reflected 4,423 Office Exclusive records.

· Office Exclusives make up a small percentage of total transactions

· 2,799 or 63% ultimately ended up being promoted on-MLS

This was in 2020… when inventory shortage was a major issue, as it has been for quite some time now. And this was under the CCP-allowed Office Exclusive loophole.

Am I the only one who thinks 4,423 listings being held as Office Exclusives represents quite a sizable chunk of inventory? I know the study says it was a small percentage of the total, but in a low-inventory environment, 4,400 listings strikes me as quite a few. I can imagine the competitive advantage that gains for the brokerages who are engaging in Office Exclusive strategies.

Furthermore, the fact that 63% of those Office Exclusives ended up on-MLS strikes me as a mixed bag of sorts. I know BrightMLS would like to focus on the 63%, but I can’t help think about the 37% that did not end up on-MLS. So basically, one-third of the time you do an Office Exclusive, you can double end that within the same brokerage? (And likely that means within the same agent team….) That seems like a bad strategy to you? Because it seems like a great strategy to me.

Imagine that I had a consulting strategy that will double your commissions a third of the time. Um, that strategy represents a 66% increase in your GCI. Wouldn’t you want to call me to find out how to do such magic?

The downside? Supposedly it takes longer to do off-MLS:

Time Comparison Findings

Homes entered on the MLS from the start went under contract faster than properties that started as an office exclusive and then were marketed on the MLS. Listings promoted on-MLS from the start went under contract in an average of 11 days compared to Office-Exclusive listings that eventually ended up being promoted through the MLS, which took a combined average time of 31 days to get a contract.

Except that this is the 2/3 of Office Exclusives that didn’t sell off-MLS. So the agent/broker had 20 days to try and sell it privately, off-MLS. Once that period was done, then the agent listed it… and went under contract in 11 days… for a total of 31 days average vs. 11. Because once a property is on the MLS, it’s on the MLS, right? So there’s no reason why 123 Main Street that was previously an Office Exclusive would be treated any differently from 456 Jones Avenue.

Based on these findings, I think I’m prepared to declare that any brokerage who does not engage in Office Exclusives is engaging in suicidal tendencies. That broker is simply skipping over a 66% increase in GCI for… what exactly?

Let’s even assume that going off-MLS means a 17% decrease in sale price. We know that conclusion is not supported by the data, but let’s go with it. Take a $300K house @ 6% commission rate. A broker who puts that on Office Exclusive and sells it for $300K and pockets both sides: $18,000 in GCI. Put that on the MLS and the seller would get $351K, but the broker would only get half of the $21K in commissions for $10,530 in GCI. Yes, fiduciary duty, REALTOR Code of Ethics, yadda yadda yadda… but you know, human beings have always been, are and will always be human beings: imperfect creatures who respond to incentives.

Conclusion: MLS Might Be Valuable, But Office Exclusives IS For Sure Valuable

The bottomline is that this study is a great first step. It is a legitimate attempt to leverage the data that BrightMLS has as the largest MLS on the Eastern seaboard. However, the data cited simply do not support the conclusion drawn:

Real estate agents and brokers depend on the MLS every day to accomplish their important work, and this study clearly shows the power of the MLS network of real estate professionals. The substantial difference in prices between homes marketed on-MLS and those that are not is evidence that the open, clear, and competitive marketplace of properties through the MLS most often provides the best financial outcome for sellers. Additionally, that result is achieved fastest by working with a real estate professional who markets the property by harnessing the full power of the MLS.

Why do I find it hard to write the next line? Oh, I want the truth to be said.

None of that is actually supported by the data. I’m the biggest fan of the MLS around, and even I can’t justify any sentence in that paragraph based on this study. It does nothing to “clearly show” the power of the MLS network. The substantial difference in median sold price for Mid-Sized Homes is evidence only that the median sold price is different; it says nothing whatsoever about open, clear and competitive marketplaces. Even the claim that on-MLS is fastest turns out not to be quite so… accurate since the data only comes from Office Exclusives.

In fact, the only conclusion that this study and the data supports is that brokerages would see a 66% increase in GCI income by embracing Office Exclusives as a strategy. It’s actually worse than that, once you take the broker splits and such into account. If you do that, it turns out that a brokerage will actually make more money post-split from the 37% of the transactions that it did as an Office Exclusive than it will from the 63% that it did as a cooperative on-MLS deal.

That might not be the point of this study, and yet… there it is. I know this much is true.

I look forward to version 2.0 of this On-MLS/Off-MLS Study that incorporates listing data from Zillow, Compass, and elsewhere to see what the actual List-to-Sale ratios are between the two strategies.

-rsh

Spandau Ballet – True (HD Remastered)

Official video of Spandau Ballet performing ‘True’, the title track from their 1983 third album ‘True’. 40 Years – The Greatest Hits out now @ https://lnk.to/SpandauBallet-GH40 Spandau Ballet are one of Britain’s great iconic bands having sold over 25 million records, scored numerous multi-platinum albums and amassed 23 hit singles across the globe since their humble beginnings as a group of friends with dreams of stardom in the late 1970s.

Good stuff, Rob.

Déjà vu.

How does this bode for MLSs and Fed Probes? Referencing any defense of a value for MLSs and just replacing/enhancing it with a regulatory body?

It sounds like the larger brokers could prohibit some of the performance data from being public (data internally produced)….. while at the same time, CONTROL a large piece of a market in a region. MN is a good example of a small group of broker brands pretty much owning a region. They’re also the same group (Northstar/Brokers) that get hit with Class Actions…..

Rob. The sales data needs to be archived with a city/county/state government body. Days-on-Market ect, ALL of it. Perhaps there is a time gap( 45 days ), of it being released to the general public, to be able to preserve the competitive advantage of the broker generating the sales data. But in some short amount of time, the MLS/broker performance data needs to be public domain.

I say ” MLS/broker performance data needs to be public domain” because of something you touched on in this article “scraping it from Compass”. Yup, it’s perfectly legal to scrape listing data in 2021, as long as it’s not behind a portal wall…. (seriously, what is a portal stopping, in the larger scheme…..). Sure, its legal to scrape where you find it facing the internet. When they choose to put it behind a portal or paywall, not so much.

If MLS data is open enough to the public to be scraped, it can be stored with a local gov entity at the very least. It’s clearly public domain, when a broker splashes pictures and prices to the internet.

Who would also be a consideration to get data from is the Builder Groups, which I did not see you mention. They are obviously a larger % of sales in the last 18 months, but still credible.

You might want to start reaching out to builder groups Rob, about ‘open, clear and competitive marketplaces’. I think what you will find is that many are voicing angst when it comes to a client (builder) stipulating that they DO not want a home listed….. Due to Clear Cooperation, and the assoc’s and MLSs are still coming around AFTER the sale and demanding fee for a buyers agent, even though the homes we not listed. Because a builder is a member of the MLS. Why pay a realtor, when there is an endless line of people for a NEW home? Builders need to create their own listing platform, if this continues. (Hey builders, the largest NONrealtor groups use Matrix, Dontcha know)

Builders are being strong-armed into paying fees, AFTER the fact, with the threat of losing Association or MLS membership.

Because Association or MLS membership is AT WILL, They can remove you at any time.

Talk to the larger and regional builder groups Rob. There’s a bombshell bigger than the series that you started with the Class Actions and Fed probes.

If you have any contacts at these larger builder groups, I’d be interested in speaking to them. 🙂

Interesting… yet not surprising. Thanks Rob! G

Sent directly through ‘contact me’ on the site.

During the now easing sellers’ market here*, we have seen a lot of activity (no way to quantify it, though) through Exclusive listings. In fact, there are dedicated Realtor facebook groups dedicated to publishing and promoting these types of listings on a Realtor to Realtor basis.

Creative marketeers have used this to both “double end” sales but also generate buyer leads by promoting privileged access to the “exclusive listing”. Most are not truly “exclusive” however in the that any Realtor with a buyer can show and sell them, they are just not published on the MLS. The motivation of buyers and buyer agents is enhanced, as they know that they are getting an early opportunity to see the property, potentially compete with fewer competitive buyers and perhaps beat the MLS listing and holdback of offers and resulting multiple offer situations.

No way of knowing, if the seller actually does better with this kind of marketing but we have concerns that it does weaken the MLS and may not generate the best results for the seller vs the wider exposure on MLS. At the end of the day, however, any marketing strategy/tactic a seller agrees to with their listing agent is their own prerogative and if they are satisfied, that’s all that matters.

Gord McCormick, Broker of Record

Oasis Realty Brokerage

Ottawa, Ontario, Canada