Just watched a YouTube videos from Nicholas Gerli of Reventure Consulting that has me wondering about the housing market in the years to come.

The big question is, could investor demand alone sustain current (and future) home prices?

You can watch the full video below, but the fundamental take is that home prices will collapse, because consumer sentiment is against housing and investor demand can’t sustain the market:

While this investor demand is sustaining home prices in the short-term, I’m skeptical they they will in the long-run. Back before the last Housing Crash, in 2005, investor demand in the market surged just like today. Only to collapse by 80% in the coming years as the Crash took place.

If you do a bit more digging around the interwebz, you can find similar sentiments echoed by most housing market analysts, including Ivy Zelman, about whom I’ve already written. So my reaction to Gerli’s prediction of a market collapse is an extension of my disagreement with Zelman… but surely, I must be wrong given the weight of opinion on the other side.

Basically, if consumers think that housing is in a bubble, and housing analysts like Zelman and Gerli and others think that housing is in a bubble, then surely, housing is in a bubble and prices will collapse soon. Right?

Maybe. I mean… probably they’re right, but… what if they’re not?

So this is my attempt at thinking through their arguments in light of macro trends and macro factors.

The Housing Bear Argument

Fundamentally, the housing bear argument is that home prices have gotten completely out of whack with fundamentals like employment and demographics. And consumer sentiment is definitely against housing, as the video from Reventure goes into detail on:

Americans REVOLT against 2021 HOUSING MARKET

Americans are on STRIKE from the 2021 Housing Market! New data from the Fannie Mae Housing Survey suggests that 66% of Americans think it’s a BAD TIME to buy a Home right now. That’s a record high and reflects souring sentiment towards the 2021 Housing Market Bubble.

What makes his argument particularly strong, I think, is the fact that he’s looking at inflation adjusted numbers:

That’s according to data from the Case Shiller Home Price Index, adjusted for growth in inflation measured by changes in Consumer Price Index (CPI). The only other time home prices in America were even close to this high was 2005-06 – right before the last Housing Crash.

Nick criticizes other YouTubers like Graham Stephan and MeetKevin, as well as mainstream financial press, who are far more bullish on housing. In that, he’s in good company with Ivy Zelman who is also bearish on housing.

But fundamental to this bearish analysis is the premise that investor demand alone cannot sustain home prices. I’m wondering why not.

Housing Demand Is Not Buyer Demand

Let me reiterate the axiomatic assumption from my Ivy Zelman post: housing demand is not buyer demand, and buyer demand is not housing demand.

People might not want to buy a home today, because they think it’s overpriced, but they are sure as hell gonna want to live under a roof. No one, and I mean no one, is looking at prices for 1BR condos in Manhattan and saying to himself, “Those prices are ridiculous; I’m gonna live under the bridge.” No, they’re renting instead and paying through the nose to do it. Because… what choice do you have?

Homelessness is not due to high home prices; homelessness is due to mental illness, drugs, and at times, lack of safety in the home. Only politicians and their developer friends who want government subsidies pretend otherwise.

So I regard any consumer sentiment as fundamentally apples and oranges.

The question is, if inventory increases as more people want to sell, and consumer buyer demand is weak, would that result in a collapse of the housing market? History suggests yes, yes it will, as Nick points out. In 2005, investor demand surged, and then we had the Bubble pop.

2021 vs. 2005

Thing is, I think there are some key differences between 2021 and 2005.

In 2005, the “investor demand” was driven primarily by small investors and consumers who were getting NINJA loans and the like trying to cash in on an insane bubble. Banks were making loans that were stupid by any measure. This is ancient history now, and we all know this. Movies have been made about the insanity.

In 2021, investor demand is coming more and more from institutions like hedge funds and sovereign wealth funds. This has now been confirmed by Ivy Zelman herself, who called American residential real estate “the prettiest girl at the dance.” These investors are not your strippers in Vegas with 7 condos. These are some of the most sophisticated investors in the world.

Plus, if these investors are borrowing, they’re borrowing at favorable institutional rates, not at consumer mortgage rates. Consumer mortgages that are being made are not no-doc, stated income, low quality loans. All of the recent statistics show that consumer mortgages this time around are high quality; if anything, lending standards have been tightened due to regulation and such.

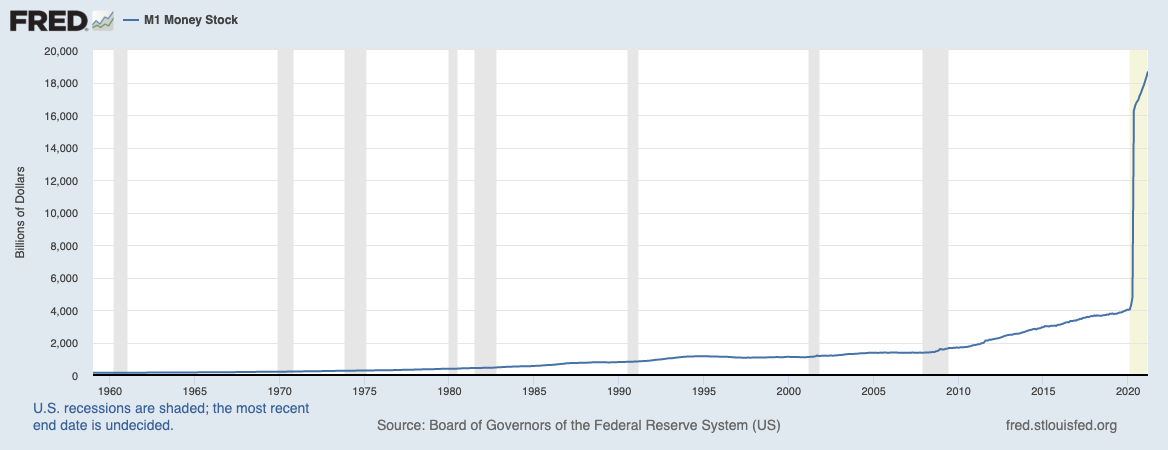

In 2005, true inflation (according to ShadowStats.com) was about 8-9%; in 2021, it’s closer to 15%. Why? Because The Fed printed some $8 trillion and injected that into the economy at the start of 2020. A number of investment analysts have pointed out that the stock market is up some 15% YOY… which is identical to the true inflation rate… which means that the stock market actually hasn’t grown at all.

Just look at the money supply in 2005 vs the money supply in 2021. I would suggest there’s a different macro factor in play today that just wasn’t there in 2005.

Interest Rates Cannot Go Up

Another major difference between 2005 and 2021 is that in 2021, interest rates simply cannot go up absent some major black swan-level socio-political event. In my Zelman post, I quoted Luke Gromen who pointed out that U.S. spending on interest payments (if you include the pay-go portion of mandates like Social Security and Medicare) is 111% of tax receipts.

The cure for inflation is to stop money printing, and to let rates go up. That cure is not one that our government can take, at least without massive social unrest, political violence, and the global economy going into the tank. I mean… just imagine no more food stamps or Social Security payments or Medicaid. Imagine millions of government workers being laid off, including teachers and cops.

I can’t see that happening. Rates will stay low, artificially, even if that means 15-20% annual inflation because the government has no choice.

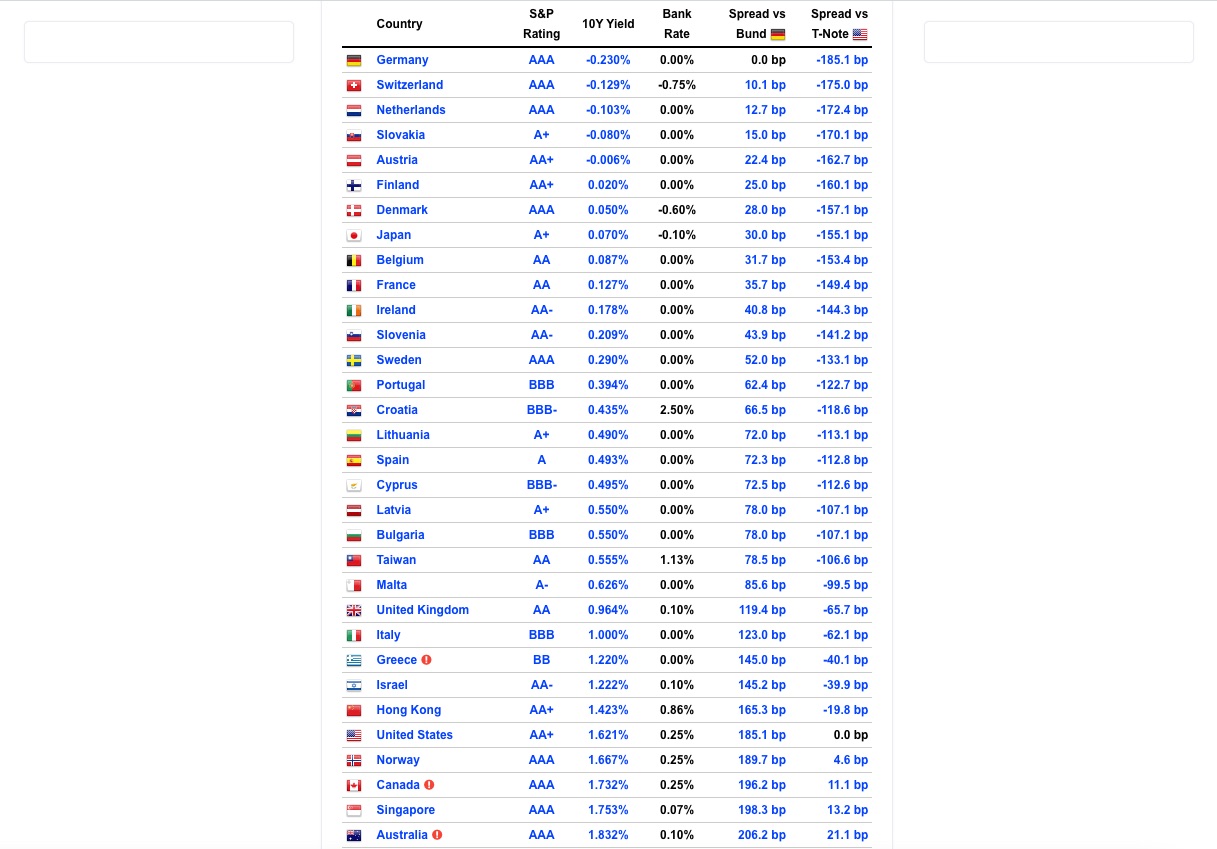

One direct result of this artificially suppressed interest rate environment, of course, is that big investors simply cannot hold bonds. As I heard Greg Foss, a 35-year veteran of fixed income markets, say in another YouTube video, investors are saying, “I own zero bonds.” Getting 1.5% on 10 year Treasuries, when nominal inflation is 6.2% is the definition of deciding to lose money.

Okay… so you can’t own bonds if you’re an investor. You certainly can’t hold cash, because that’s decreasing in value by 15-20% a year.

Where do you put your money?

The Problem is Global

As Greg Foss also mentioned in that video, the problem of inflation is not confined to the United States. All central banks everywhere are printing money like crazy to deal with the pandemic and their government’s response to it. And almost all of the developed nations have interest rates that would be funny if it weren’t so serious:

I guess if you want real returns on your money, you’ll have to look at countries like Nigeria (12%), Egypt (15%), Zambia (25%), Venezuela (47%) and Argentina (50%). Who wants to buy some Venezuelan bonds?

I mention this because if you’re a rich guy in Ireland, or a Norwegian pension fund, you might not want to buy your own country’s bonds and you don’t want to hold cash. Where oh where can you put your money so you can get returns that beat your nation’s inflation?

You could buy real estate in your home country, that is true, and I’m sure many have and do and will. But ya know, if you’re a Pakistani warlord or a Russian oligarch, how confident are you in your property rights in those countries? Even South Korea and Japan, two developed democracies, have very strong central governments with a very different take on property rights, on landlords, and so on.

Prettiest Girl at the Dance

So American housing is the prettiest girl at not just the American dance, but in the global dance hall. The total value of US residential housing is about $33 trillion. Let’s just agree that 30% of that housing stock is not something any investor wants to own, because they’re horrible properties in terrible neighborhoods. (I have no idea if that percentage is true or not, but let’s go with it for the sake of discussion.) That leaves some $23 trillion in value.

Global bond markets are $123.5 trillion in 2020. If one out of six investors buying bonds all around the world decide that American residential properties are the prettiest girl at the dance, what with the combination of private property rights, high income of renters, and general lack of outright political violence… that’s the entire American housing market that anyone would want to own.

Buyer Demand Collapses, Inventory Rises

So let’s say that Nick Gerli is correct and American buyer demand just collapses. The Fannie Mae survey said as much. He’s putting out videos showing that the housing crash HAS ALREADY BEGUN!

His point is that inventory levels are up sharply in many markets in the U.S. (like Boise, Reno, etc.) and list prices are flattening out. So there’s a ton of downside risk on prices.

And he’s right when it comes to a family trying to buy a house to raise their kids in. They actually have to scrape and save and make sacrifices to afford the down payment, and then they have to qualify for a mortgage. But… if you’re the Norwegian pension fund, or the Pakistani warlord, do you care about paying too much for a house in Boise? Say prices drop… what… 10%? 20%? So what?

If inflation is 15% a year, and there’s nothing the government can/will do to lower inflation, then you make that 20% drop back in a year and a half. It isn’t as if rent is going down during those eighteen months, and as the landlord, you’ll be making that at least while waiting for your asset value to recover in nominal terms.

If you didn’t buy that overpriced house in Boise, then a year later, your $500K that you didn’t put into that house is worth 15% less. If you put that $500K into Treasury bonds, then it’s only worth 13.5% less in a year. Now what?

Inventory rises? Prices drop? Fantastic! Buy even more, since those sellers now have cash and no asset, while you have the asset that is keeping up with inflation. Index rent to inflation and enjoy the cash flow.

What am I missing here?

Plus… this sharp spike in inventory… take a look at this screen where Nick is talking about the impending housing crash in Boise:

Is it just me or is that chart showing that the median listing price in October of 2021, after this incredible spike in inventory (the blue line) is still up 19% YOY? And the year before was up 21% from 2019, which was up 8% from 2018? In fact, the entire chart of yellow lines is showing mostly double-digit YOY price increases.

Where exactly is this housing crash? I assume we’ll have to wait a few months to see median listing price actually go negative YOY?

What am I missing here?

What Could Trigger a Housing Crash

I’m of a slightly different mindset. I’m not saying housing can’t crash. Of course it can crash. I merely think that under current macroeconomic conditions, investors could keep home prices high all by themselves because buyer demand is not housing demand.

However, investors don’t live in the house. They don’t really care about the house. They care about the house only as an asset, an inflation hedge, and something that generates a return on their money. They’ll sell and get out if they find an alternative that returns more, is safer, is more liquid, whatever. As soon as a prettier girl appears at the dance, investors will flock over there.

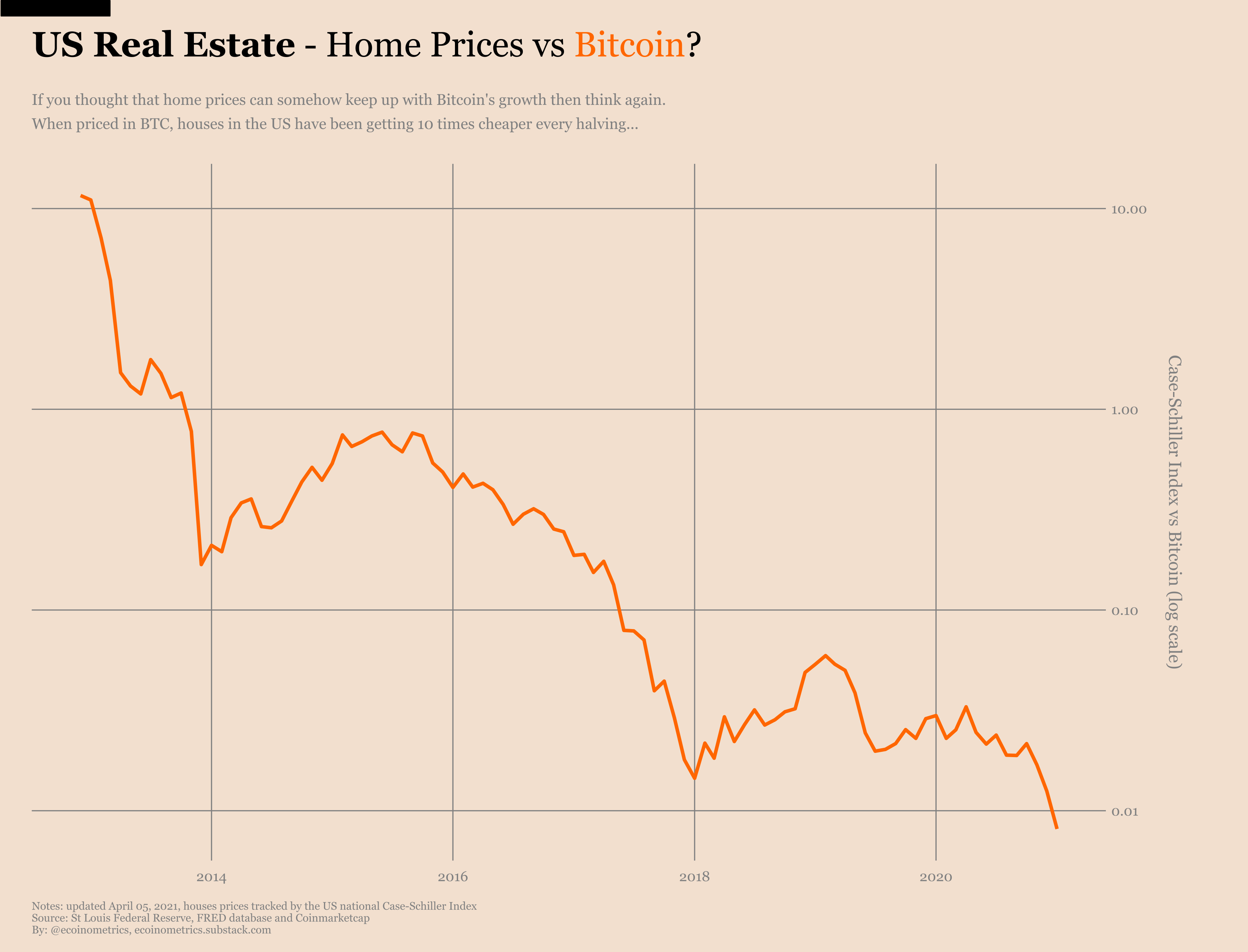

I think a prettier girl is at the dance. Or at the very least, she’s getting out of the car at the door to the dance. And that prettier girl is Bitcoin.

This is a very interesting article from a completely biased source called AMB Crypto. The author compares Bitcoin to housing:

What these aforementioned comparisons clarify is that over the past few years, no asset class has been able to keep up with the growth of the Bitcoin market. Ergo, it’s worth looking at another popular category of assets to see how they stand up against the world’s largest cryptocurrency – Home prices.

And then they provide this chart from Ecoinometrics:

That’s the Case-Shiller Index if the homes were priced in BTC instead of in USD.

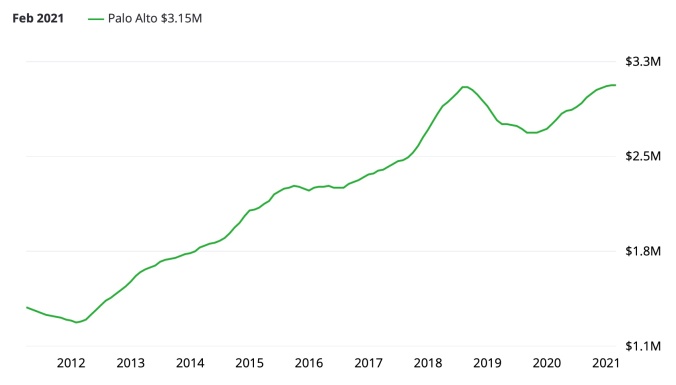

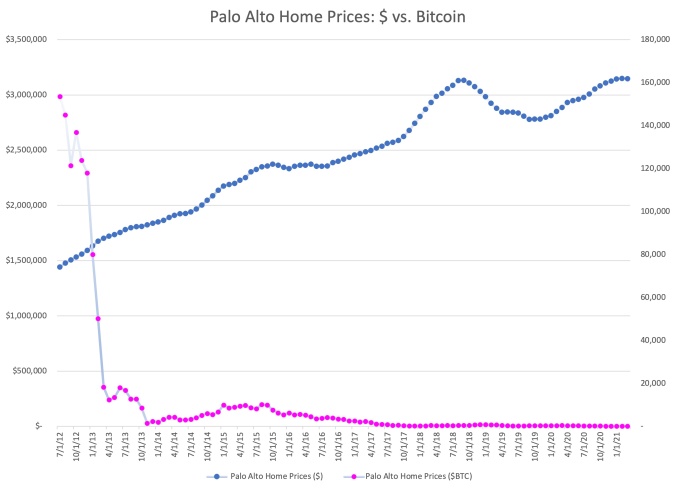

AMBCrypto also provides some local flavor with a chart from a Silicon Valley VC, entrepreneur and blogger, Adam Nash comparing home prices in Palo Alto in USD (from Zillow) and in BTC:

As Nash put it:

In March of 2019, you could have purchased the average house in Palo Alto for 702.0 Bitcoin. Just two years later, in March 2021, the average house in Palo sold for 54.9 Bitcoin. That means the average home in Palo Alto, as measured in Bitcoin, has decrease by 92.2% in just the past two years alone.

I submit to you, ladies and gentlemen, that this is all about currency devaluation. Bitcoin is a more attractive hedge against money printing and inflation than housing is for a whole lot of people. Some of those people are going to be institutional investment fund managers.

What causes a housing collapse is this. If investors start buying the thesis behind Bitcoin in particular and in crypto in general, then they start leaving housing and heading to that new digital asset category. That does dry up buyer demand almost completely, since the family buyer is already priced out of U.S. homes, and the fundamentals of wages, employment, productivity, etc. do not make sense at today’s prices. Take inflation out of the calculation for real estate as an investment, and suddenly, you have to care about things like cap rates and net cash flow again.

Probably Wrong… But… What If…

Let me wrap up these non-idle thoughts.

As I said in the outset, I’m probably wrong. Don’t go against Ivy Zelman if you can help it. And don’t go against consumer sentiment if you can avoid it. So feel free to ignore this whole post as mere musings by an amateur non-economist.

But… what if…

Because I’m failing to see where the logic fails, given the data and the information we have today about macro factors at play. The single biggest macro factor driving everything today is money printing and artificially low interest rates. Under those conditions, it is entirely possible for home prices to remain permanently high and permanently on a 15% a year increase… simply because true inflation is 15% a year.

It is entirely possible that the cyclical housing market is a historical curiosity now, simply because we have never seen currency devaluation like we are seeing now, and because we have never seen the government and the financial sector unable to control the currency devaluation like we are seeing now.

Under those conditions, there’s more than enough investor cash in the world to purchase 70% of the U.S. residential housing stock and turn us into a nation of renters. Which is kind of the point of the World Economic Forum and the Davos crowd anyhow.

What changes all of that, what brings housing back down to earth, back down to reality, is when it ceases being the prettiest girl at the dance as a hedge against currency devaluation. Bitcoin could take its place as that asset. But we are, I think, several years and a likely global currency collapse out from that happening because Boomers are going to have a real hard time wrapping their minds around the idea of cryptocurrency actually being a thing.

Anyhow, hope this was as entertaining to read as it was to write it. I know I learned a lot from thinking about this. Hope you have at least had your thinking tickled.

-rsh

Billy Joel – You May Be Right (Official Video)

In 1980, Billy Joel released his album Glass Houses, which won one Grammy Award ‘Best Male Pop Vocal Performance’ in 1981.