I’m on the road, which means airports and hotel rooms. And I’m on an intellectual road trip as well, trying to puzzle out what the future of the industry looks like with Zillow’s recent withdrawal from Afghanistan shutdown of Zillow Homes. So I thought I’d give myself a break and look at something that caught my interest in recent weeks.

Ivy Zelman is the founder and CEO of Zelman & Associates, a boutique investment bank that does some of the best research into housing. She’s partly famous for calling the top of the first Bubble back in 2005/2006.

Recently, Zelman has been in the news for having a contrarian take on housing. She believes, against just about everybody else in housing, that rather than an undersupply of housing, we have an oversupply. Demand is far lower than what builders and NAR and REALTORS believe, because of demographics. Simply put, we are running out of people. Accordingly, Zelman thinks that housing is headed for a major collapse because of that divergence.

I happen to agree with her premise, since demographic concerns have been a topic I’ve been talking about since 2010 or so, and yet, I’m not entirely sure I agree with her conclusion, that housing is headed for a collapse.

So I thought I’d explore my thoughts, out loud, with you all.

Please note that I am not an economist. I only look like one. Plus, I stayed at a Holiday Inn Express last night. So.

Zelman vs. Everybody Else

Let’s start with Zelman’s take on housing, because it’s a really contrarian view. This video is not a bad example of her overall take:

Will Hedge Funds Ultimately Own ALL Our Homes, Making Us A Nation Of Renters? | Ivy Zelman (PT1)

WATCH PART 2 (https://youtu.be/sVSOeZBuHdQ) & then SCHEDULE YOUR FREE PORTFOLIO REVIEW with Wealthion’s endorsed financial advisors at https://www.wealthion.com/ The percentage of homes in the US purchased by investors is rising sharply. It’s now nearly 1 in 4. The average homebuyer is having a harder & harder time competing, especially as this influx of institutional capital continues to drive up prices.

I love the level of detail she goes into here, and frankly, I agree with just about every single thing she says here.

The Real Deal ran a story recently describing her views in a bit more detail.

Everyone except Ivy Zelman, that is. The analyst who called the top of the housing market in 2005 is once again waving a red flag. It’s beyond contrarian: She’s pretty much in a category of one.

“The perception that housing is drastically undersupplied and that a strong demographic picture lies ahead is creating a false sense of security,’’ according to a report by Zelman’s firm entitled “Cradle to Grave.’’ “By our math, both single-family and multi-family production are already ahead of normalized demand and estimates of a housing deficit are grossly exaggerated.’’

Homebuilders, the National Association of Realtors and Freddie Mac are pushing a now-familiar narrative that soaring demand for scarce housing is driving up prices. By NAR’s estimate, the U.S. has about 6 million fewer homes than people want.

Well, she’s in a category of two, at least. Because I’m with her.

The report she mentioned, Cradle to Grave, can be found here. I haven’t read it, because I’m not a Zelman client. But maybe you are, or want to become one. But then again, I’ve been jawing about demographic decline for over a decade now, so… I’m thinking there won’t be much in that report that will shock me.

I wrote this post ten years ago, in 2011:

So here’s the challenge, now that I’ve laid out my case for why I believe the Millenials will see far lower rates of family formation than any we have seen to date.

Given the above facts and data, how do you see the Millenials dealing with this issue? Because it’s not a small issue of just boys and girls getting together; family formation drives housing and to a large extent, drives the economy. Men with children work far harder, far longer, than men without — simply because their priorities change the instant they lay eyes on their son or daughter for the first time.

The 230,000 women in the Class of 2008 who cannot mathematically meet a man who is a college graduate… what do they do when time comes to find a husband (or at least a long-term committed boyfriend, willing to provide for her and her children)?

Well, ten years later, those 230K women of the Class of 2008 are in their early-to-mid 30s. How they doing?

From Bentley University in October of this year:

Millennials are making history by saying no to traditional marriage in record numbers — and they may be radically changing a centuries-old institution.

While traditional marriage has been on a downward trajectory for generations, with this group — the oldest now 40 years old — it appears to be in free fall. According to a report by the Pew Research Center, Millennials are slower to establish their own households; more than four-in-10 do not live with a family of their own.

Oh, and lack of marriage leads to lack of babies… which is as obvious as the sun rising in the East:

The U.S. birth rate fell 4% last year, the largest single-year decrease in nearly 50 years, according to a government report being released Wednesday.

The rate dropped for moms of every major race and ethnicity, and in nearly every age group, falling to the lowest point since federal health officials started tracking it more than a century ago.

Births have been declining in younger women for years, as many postponed motherhood and had smaller families.

Birth rates for women in their late 30s and in their 40s have been inching up. But not last year.

People have lots of theories on why Millennials and younger people are not getting married and not having babies. COVID is often used as an excuse. I think it’s simpler than that: one out of three college-educated women cannot marry a college educated man, mathematically. Why is that the reason?

Cornell University released a study in 2019:

Fewer couples are tying the knot. Currently, barely more than half of adults in the U.S. say they are living with a spouse. In fact, according to some estimates, the marriage rate is the lowest in at least 150 years. It is the lowest share on record.

According to new research by Daniel Lichter, professor of Policy Analysis and Management, one explanation for declines in heterosexual marriage is a shortage of economically-attractive men for unmarried women to marry.

Quod erat demonstratum. That’s Latin for mic-drop. I’m dropping it.

This trend shows zero sign of reversing anytime soon. If anything, people are projecting that women will make up fully 2/3 of college students in the near future.

I think Ivy Zelman is absolutely, 100% correct in discerning long term demographic trends. Buyer demand is far lower than what most people think.

Demographics and Housing Demand

The issue, however, is that many of us confuse housing demand with buyer demand.

In 2012, I wrote this post in reaction of Lawrence Yun talking about global population growth:

So the real issue, I believe, isn’t whether demand of housing will remain or not. Of course demand for housing, generically stated, will be robust as long as we have some moderate population growth from babies (U.S. is just above replacement at 2.1 children per woman) and immigration. Very few people demand to be homeless.

The issue is whether the demand for housing will be through ownership or rental. Given the factors facing Millennials, I just can’t see how anyone is optimistic about that generation buying all the homes that the retiring Boomers want to sell.

There is little doubt in my mind that rentals will be a major feature of the housing market going forward. There is also little doubt in my mind that the industry, as it is set up today, cannot survive on rentals alone. The compensation structure, the work-to-dollars ratio, etc. etc. all militate against real estate agents making a good living helping renters. The training and focus of the average real estate agent is not on renters, landlords, and their issues, but on buyers and sellers.

I used to use the hashtag #renternation a lot back in those days. It might be time to revive it. Because I wrote the above when birthrate was just barely above replacement at 2.1. The last set of reports show the U.S. birthrate at 1.76, below replacement. We might not have rental demand either in another decade.

So I end up agreeing with Ivy Zelman generally when she says that “actual demand” for single family homes is 21% below the 1.15 million housing starts.

But… there is this…

Where I Differ with Zelman

I think where Zelman and I part ways is in predicting a collapse of the housing market. I’m likely to be wrong, of course, because… well, she’s Ivy Zelman. But still, let me put my thoughts down on pixels.

She thinks that the market has been juiced because the Fed artificially kept rates low, low, low. Below 4%. With the recent announcement that the Fed will start tapering its mortgage bond purchases, Zelman thinks that rates increasing even a little bit will cause buyer demand to collapse.

That much is true. But there are three additional things to consider.

Dollar Devaluation

One, there is zero sign that dollar devaluation (aka, inflation) will cease anytime soon. The nominal inflation rate around 6% is accepted only by the extraordinarily gullible, and quite a few investment professionals think true inflation is closer to 15% or so.

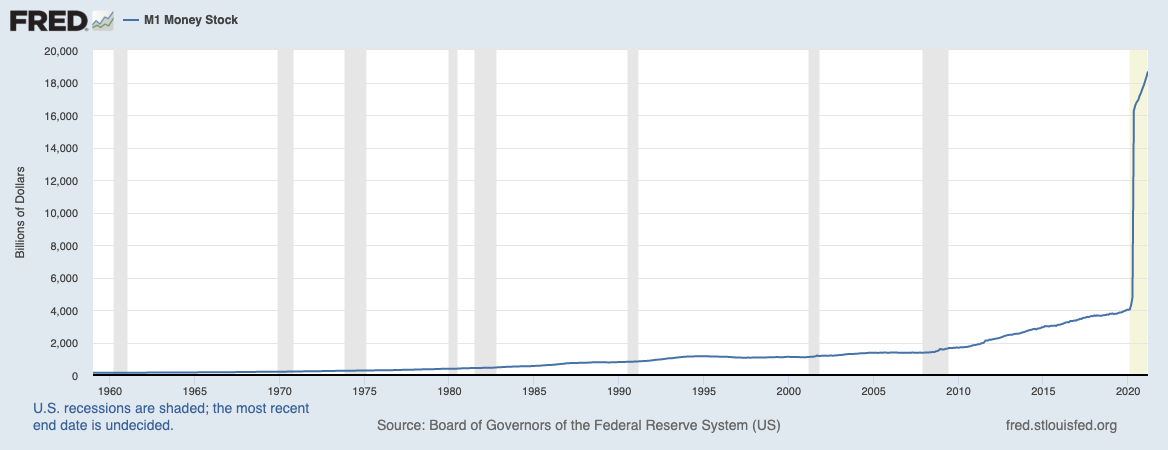

Since our current inflation was caused by this…

and since the Federal government shows no sign of slowing down spending, I’m not sure where this pause in inflation is supposed to come from. In fact, Congress just passed a $1.2 trillion “infrastructure” bill, and they’re still working on the $1.75 trillion Build Back Better bill, not to mention all the other spending they have in mind.

What’s $5 billion a month in tapering going to do in the face of that? It’s a fart in a windstorm.

Until I see some new facts, some new compelling data that isn’t showing the price of Thanksgiving turkey doubling from 2020 to 2021, I remain skeptical that dollar devaluation is not the new normal.

If dollar devaluation is the new normal… then American real estate represents one of the best hedges against inflation. Ivy Zelman herself agrees in the video above, calling it the prettiest girl at the dance, due to lack of good alternative investments.

I have been theorizing for a while now that the home price appreciation we have seen since the spring of 2020 is not a function of the housing market, and is not being driven by consumers. I think what we’re seeing is dollar devaluation rather than home price appreciation, and it is being driven by investors who are seeking a safe haven for their money.

Can’t Stop, Won’t Stop

Two, there is real reason to believe that the United States cannot allow rates to rise.

There are multiple analysts who cover this, but one of the more on-point ones I’ve found is Luke Gromen of Forest For the Trees. He was recently on the Macro Voices podcast talking about secular interest rates and why the government simply cannot have higher interest rates. Let me attempt a translation from Wall Streetese to English.

Basically, what Gromen asserts is that the true interest expense of the U.S. government, computed as Treasury spending on interest payments plus the pay-as-you-go portion of entitlements (Social Security, Medicare, VA benefits, etc. etc.), is 111% of total tax receipts. Yes, that’s right. Every penny of the U.S.’s revenue (taxes) is eaten up by interest payments, and then some.

He then points out that if the Fed raises rates, that will lead to a drop in tax receipts (recessions tend to do that), as well as a rise in interest payments by the Treasury… and the U.S. is already having to borrow money (aka, print it via Fed debt monetization) to cover the shortfall.

That’s before a single dollar is spent on what most of us consider to be “government functions” like Department of Defense, TSA, national parks, and so on. So… Gromen says:

Unless the Fed is willing to tighten, and then stand aside as the US government does not have the money to pay interest expense, true interest expense without the Fed’s help, then basically the only choice is the Fed keeps helping, and the Fed keeps monetizing as they’ve done for the last 14 or 18 months. And so that is, I think, you know, arguably, when I had that list of structurally inflationary factors before, arguably the most inflationary factor is this dynamic that the US government needs inflation to run hotter than it is today to inflate tax receipts, to much higher nominal levels of GDP to much higher nominal levels, so that the US government can cover its true interest expense.

Tapering, shmapering. $5 billion a month is $60 billion a year. That’s a rounding error in the face of the structural inflationary pressure we’re dealing with.

Besides, the institutions who are driving the housing market today as a hedge against inflation aren’t borrowing mortgages at 4% or whatever to buy their properties. They’re either parking cash, or they’re borrowing at extremely favorable institutional rates because they’re hedge funds and sovereign wealth funds.

So where I differ with Zelman is in forecasting a collapse of the housing market. Yes, the consumer-based buyer market will collapse; I would argue that the collapse has already begun. Too many buyers are bowing out at current prices. Their incomes did not go up 15% YOY like home prices did. Their savings did not jump up 20% from 2020 to 2021 to be able to afford a down payment.

However, that doesn’t mean that institutional buyers won’t snap up every piece of real estate they could get their hands on. Why?

Because people gotta live somewhere. Housing demand will not decrease dramatically until the demographic effects filter down through the system in another decade or so. Buyer demand will, of course, but that merely means that renter demand will skyrocket.

Since we may already be in a negative real interest rate environment, any firm that could borrow money at negative interest rate (essentially being paid to borrow money) to purchase real assets that are essential elements of life would be stupid not to do so.

Even those firms who already bought at inflated prices, and have to take a 20% writedown… well, they have the balance sheets to take the hit, and they’ll regain that 20% in nominal terms within a year or two… and get higher and higher rent in the meantime.

The Risk Is Overblown

The third area where I disagree with Zelman’s take is actually from the video above, where she says, if you’re an actual family homebuyer, and you put down 3.5% on a FHA loan and buy a house at today’s prices… you’re at risk. She thinks you’re at risk of being underwater very quickly, because the market could turn and go down 10%.

Thing is, chances are that your mortgage is a 30 year fixed rate loan. If you have a 3.5% mortgage, and nominal inflation is at 6%, you’re literally getting paid to borrow. You have to make payments, but guess what, you have to pay something to somebody anyhow for shelter.

Zelman says that if 30-year fixed rates go to 4%, this market stops. I disagree. Anyone who can do basic math, and can qualify for a fixed rate loan should go out and borrow as much as they can. Even if the home’s price drops by 10%, you’re making that back up and then some from real interest rates, which is negative. As I’ve heard it said by another analyst, in the 80s and 90s, if you took out a mortgage and bought a house, the house was the asset and the mortgage a liability; today, it’s the other way around. The negative real rate loan is the asset, and the house is the liability.

The Real Problem: Type of Housing

Thought of this way, the real problem may be in the type of housing that homebuilders are building, because they’re overestimating demand from a family-type of home buyer. Certainly, NAR and NAHB and other housing economists with a vested interest in promoting home sales are to blame for some of that, since they keep repeating the assertion that we are short some 5.5 million to 6.8 million housing units since 2001. They keep repeating that because they keep thinking that Millennial family formation will drive demand, once they finally move out of parent’s basements and start families.

Except that Millennials are not forming families, not having babies, and the Zoomers are doing even worse. For a lot of reasons. Which means we likely have far too many suburban single family houses, and far too few affordable apartments in walkable shopping districts for single ladies and their cats, and definitely far too few dormitories for single men with no job, no spouse, no hope, and no actual skills to speak of.

Ivy Zelman thinks that we’re 10% overbuilt in multifamily, but that depends on the kind and location of multifamily. I don’t know if we need more two story fugly garden apartment units 40 minutes outside of downtown. But we probably could use more sleek high-rises in central dining/shopping districts in every city in America for the twenty-to-fortysomething singles and their pets.

I’m personally betting on the rise not of #renternation anymore, but of #dormitorynation. A lot of future Americans will go from mom’s house, to college dorm room, to entry-level dorm room, to professional dorm suites, to penthouse dorm suites, to old age home dorm rooms. Common dining areas, social programs, big workout gyms, activities, and a built-in community for making friends and having consequence-free (and child-free) sex with one another are going to be a big draw for a lot of Zoomers and beyond.

Properties from companies like Common:

We’re going to need a lot more of these in the years ahead.

Plus a ton more of the far more utilitarian barracks-style living for young men of today…

Wrapping Up

Demographic decline is structural, because of how we have structured education and society and employment for the past two generations. Yet housing and infrastructure, arguably the most structural of the society’s structures, remain mired in some vision from when Boomers were young.

So Ivy Zelman is correct to point all that out.

However, as of today, inflation is also structural, because money printing is structural, because government spending is structural. Accordingly, while the consumer buyer market could/will collapse (or already has), the institutional buyer market remains strong as ever, if not stronger. Because housing is a necessity, and demand for someplace to live will take much longer to decline as population declines.

A regular family homebuyer today, in this crazy environment, is likely best served by borrowing as much as possible and then buying something, even if it’s crap and not their dream home. Because the asset is the fixed rate mortgage, not the house. Brokers and agents should mint the money today, of course, but the smart ones should be diversifying heavily into investment property and property management. The future is not homeownership, but rentals and #dormlife.

The problem may not be housing writ large, but in the types of housing stock we have available and in the types of housing that builders are building. We need far fewer detached single family homes and family apartments, since there won’t be many families, and far more grown-up dormitories and barracks-style “co-living” housing.

I’ve been harping on it long enough; it’s time for Ivy Zelman and her far better research to take on the burden of arguing that demographics is destiny, and ours is pointing downward.

Plan accordingly.

-rsh

Céline Dion – All By Myself (Official Remastered HD Video)

Official Video for All By Myself by Celine Dion (HD Remastered) Listen to Celine Dion: https://CelineDion.lnk.to/listenYD Watch more videos by Celine Dion: https://CelineDion.lnk.to/listenYD/youtube Subscribe to the official Celine Dion YouTube channel: https://CelineDion.lnk.to/subscribeYD Follow Celine Dion Facebook: https://CelineDion.lnk.to/followFI Instagram: https://CelineDion.lnk.to/followII Twitter: https://CelineDion.lnk.to/followTI Website: https://CelineDion.lnk.to/followWI TikTok: https://CelineDion.lnk.to/followYx Spotify: https://CelineDion.lnk.to/followSI YouTube: https://CelineDion.lnk.to/subscribeYD Ask your voice device to play Celine Dion!

Brilliant. While many of the predictions may be exaggerated, the thought process is enjoyable

You will own nothing and love it. 😉

Rob : As usual excellent article, a couple of resources on demographics that you and your readers may find interesting, check out Peter Zeihan. He is a Geo Economist and as bad as our demographics look we are not in bad shape relatively speaking on a global basis .

The other part of the equation is the retiring of the baby boomers and the biggest retirement years are starting now. That generation ( my generation ,The Who) will stop saving money and will be taking it, the impact of this on all types of capital formation will be impactful , I suspect upward pressure on rates and more printing of dollars.

Keep up the great work .

I am a former colleague of yours we worked at CBC Realogy many years ago.

Hello Fred! Of course I remember you 🙂 I’ll check out Zeihan, as you said. And yes, if we look at global demographics, it’s not terrible since Muslim countries as a general rule have large families. It’s just terrible for the West.

As for retiring of baby boomers, I think many of them are absolutely screwed if they’re on fixed income in a 20% annual inflation environment. That’s actually an interesting topic, and how that might affect the housing market.