I just saw this article from NAR Research come across my news feeds: Leading Economic and Housing Experts Predict Multiple Fed Interest Rate Hikes, Slowing Inflation and Home Price Growth in 2022. The key takeaway:

- More than 20 top economic and housing experts predict two quarter-point interest rate hikes by the Fed in 2022.

- Next year, housing prices are expected to climb 5.7% and inflation will rise 4% – both increases less than in 2021.

Please note that I am not one of the 20 top economic and housing experts. Hell, I’m not even an economist. So keep that in mind as you read this post.

However, I have been spending quite a bit of time learning all I can about our macroeconomic situation. Plus, the recent track record of professional economists being what it is, I thought, why not? It isn’t as if my non-credentialed playing-economist opinions could be more wrong than theirs have been over the years.

So I’m going to offer a contrarian take on the 2022 Housing Market. This is not investment advice, and again, I’m not an economist. The headline should be: “Random Guy Playing Economist on the Internet Predicts One Fed Interest Rate Hike, Which Will be Swiftly Reversed, Rising Inflation and Home Price Growth in 2022.”

The Top 20 Experts Take

First, let’s investigate a bit on what the leading economic and housing experts think and why. From the article above:

For 2022, the group of experts predicted that annual median home prices will increase by 5.7%, inflation will rise 4% and the Federal Open Market Committee will twice increase the federal funds rate by 0.25%.

“Overall, survey participants believe we’ll see the housing market and broader economy normalize next year,” Yun said. “Though forecasted to rise 4%, inflation will decelerate after hefty gains in 2021, while home price increases are also expected to ease with an annual appreciation of less than 6%. Slowing price growth will partly be the consequence of interest rate hikes by the Federal Reserve.”

Yun forecasts U.S. GDP to grow at the typical historical pace of 2.5%, barring any major, widespread transmission of the omicron COVID-19 variant. He expects the 30-year fixed mortgage rate to increase to 3.5% as the Fed raises interest rates to control inflation but noted this is lower than the pre-pandemic rate of 4%.

A day after this news release went out, we get a post on NAR Research’s Economists’ Outlook blog that talks about mortgage rates increasing slightly:

Mortgage rates slightly rose this week after the Fed announced a taper acceleration and three rate hikes to follow in 2022. Specifically, the 30-year fixed mortgage rate inched up to 3.12% from 3.10% the previous week. Rates will continue to rise even further in the year ahead. NAR forecasts the 30-year fixed mortgage rate to reach 3.7% by this time next year. Thus, expect rates to rise 60 to 70 basis points from where they currently are. Even with this increase, consumers should bear in mind that these rates will still be historically low. The average interest rate has risen and fallen significantly over the years. In 1980, the average rate on a 30-year fixed mortgage was 13.7%. In 2000, it was 8.0%. In 2019, before the pandemic struck our country, the average mortgage rate was 3.9%.

My first question, which will be relevant below, is why the top 20 experts predicted two rate hikes when the Fed itself announced three?

My second question is whether the experts believe the 6.8% November CPI number. If they do, then maybe the 4% prediction for 2022 makes sense. But if they do believe the government numbers… I want to ask them if they’ve been to a gas station lately. Or bought a house. Or signed a lease. Or tried to buy a used car.

My third question is… does it make any sense to anybody that 30-year fixed mortgage rate went up 2bps from 3.10% to 3.12% when the Fed itself has announced three rate hikes, probably 25bps each, as well as an acceleration to the tapering? Meaning, the Fed has already said it will buy $5 billion less every month in mortgage backed bonds from the commercial banks. And raise rates by 0.75% or more next year. And the mortgage market just kind of… shrugged and said, “Mmm, okay… raise rates by 2bps instead of 75bps.”

Don’t Believe the Hike

To paraphrase Public Enemy:

Don’t believe the hike, it’s a sequel

As an equal, can I get this through to you?Never played the fool, just made the rules

Remember there’s a need to get alarmed

I think the Fed might do one interest rate hike. Maybe even two. But then I think they’ll swiftly reverse course and go back to the zero-interest, QE-Infinity ways. Why? Because I think the Fed doesn’t have a choice.

While I might not be an economist or an economics expert, I follow a number of people who are. And one of my favorites on this topic is Luke Gromen, of Forest For The Trees, a macro investment research firm. Since he gets paid by investors who need him to be correct more often than not, I kind of think he’s putting more of his money where his mouth is.

And of all of his insights, this is the most important:

The Fed’s choice now is binary. Unless the Fed is willing to tighten, and then stand aside as the US government does not have the money to pay interest expense, true interest expense, without the Fed’s help, then basically the only choice is the Fed keeps helping, and the Fed keeps monetizing as they’ve done for the last 14 or 18 months.

Arguably the most inflationary factor is this dynamic that the US government needs inflation to run hotter than it is today to inflate tax receipts, to much higher nominal levels of GDP, so that the US government can cover its true interest expense.

That comes from the transcript to this MacroVoices podcast:

MacroVoices #294 Luke Gromen: The U.S. Government Cannot Afford Secular Inflation

MacroVoices Erik Townsend and Patrick Ceresna welcome Forest For The Trees (FFTT) founder Luke Gromen to the show. They discuss the U.S. Dollar, inflation, what the consequences of inflation will be, and much more.

Yeah, that title is a doozy, innit? Listen to the whole thing if you have the time and the interest.

It’s a complicated story, so one that most Americans simply don’t understand. I know I barely understand it. But let me see if I can explain it as simply as possible.

- The U.S. Federal Government has some $28.6 trillion in debt at the end of Q3, 2021.

- The interest payments on this debt was $803.3 billion in Q3, according to the Bureau of Economic Analysis.

- What Luke Gromen points out is that if you take that interest payment, then add the current portion of legally required entitlements (think Social Security, Medicare, etc.), that amount comes to 111% of total tax receipts.

- As per the BEA, the U.S. had to borrow $2.2 trillion in the three months ending in September to keep things going. The average interest rate on this debt is about 1.54%.

- If the Fed actually raised rates by 0.75%, the interest payments that the U.S. government would need to pay would go up as well. And we’re already at 111% of tax receipts.

Furthermore, higher rates means money is more expensive, which means that stock market slows down. Maybe even tanks. From Forbes:

Higher market interest rates can have a negative impact on the stock market. When Fed rate hikes make borrowing money more expensive, the cost of doing business rises for public (and private) companies. Over time, higher costs and less business could mean lower revenues and earnings for public firms, potentially impacting their growth rate and their stock values.

Hey, guess what happens to things like payroll taxes, sales taxes, and even capital gains taxes if companies have lower revenues and earnings? Yep, they go down. And the U.S. government can’t really afford to take in less in taxes right now.

When I put all these pieces together (plus some other pieces besides), I can’t help but agree with Luke Gromen. He thinks the Fed might talk raising rates, and might even raise rates for a bit. But ultimately, they will have to pull back, go back down to zero, keep monetizing the debt, and keep printing money:

But I think the odds that the Fed tightens and then stands aside as rates go up, and stocks go down, and the US government has to decide if it wants to keep funding defense or send checks to Baby Boomers… I think there’s zero chance that happens. And if you have two options and one of those options has zero chance of happening politically and economically for that matter, then you’re left with whatever’s left. And whatever’s left is — they’re going to print the money.

I am forced to agree. If the Fed raises rates even by 25bps, stops buying Treasurys and mortgage bonds, and tries to tighten to fight inflation… and the U.S. government has to figure out how to cut $10 trillion in spending (which is about what they will have borrowed in 2021)….

Do you see that happening? Do you see Congress and the Biden Administration come together to cut $10 trillion from the budget? How about half that? A tenth? Cut just $1 trillion from the budget. In an election year.

Never. Gonna. Happen. Never say never, but here I go again: Never. Gonna. Happen.

Which explains why the mortgage bond market looked at what the Fed announced, shrugged and raised rates by 2bps. They don’t believe the Fed will raise rates either. And if the Fed did raise rates, they think the Fed will have to back down quickly.

Rising Inflation and Home Price Growth

Accordingly, I can’t imagine a scenario where inflation in 2022 is 4%. And that’s believing the government’s numbers of 6.8% CPI. True inflation is likely north of 15% if you use the methodology that the government used before 1980.

Some 40% decrease in inflation means 9% inflation for 2022 and that’s being super-optimistic about the Fed actually carrying through what it said. Which it can’t, so what’s the point of even talking about it?

No, sadly, inflation will likely remain above 15% in 2022.

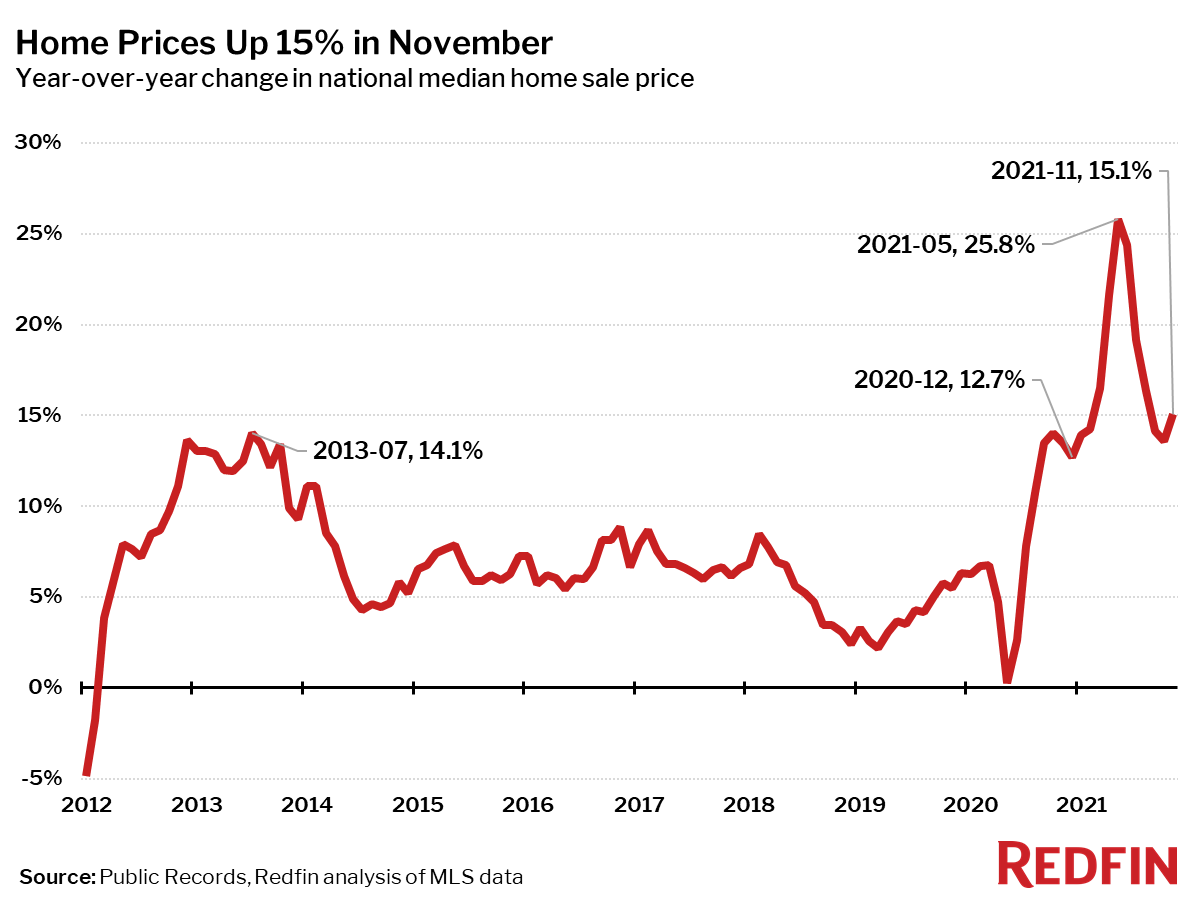

Ergo, home price growth will keep on its torrid pace of roughly 20% YOY gains. I mean, if CoreLogic is suggesting that 19% is “turning the corner” on home price appreciation… well… okay. Redfin’s latest report on November home price gains shows “moderation” or “slowdown” as well:

But note that the steep decline from May’s 25.8% YOY change still represents a 15.1% YOY increase in median home sale price. Real estate is still getting more expensive — just not as fast.

To be fair, home price growth might come in far lower in 2022 because it is clear that the American consumer is near the end of his rope. He can’t afford anymore, because his wages haven’t been going up 20% YOY, and it wasn’t like he was doing great before the government shut down the economy because of COVID. Rate increases means greater likelihood of recession, meaning layoffs, meaning banks being more skittish about lending. So buyer demand (or at least buyer capability) will be impacted.

I think that gap from consumer demand gets filled by institutional investors. Yeah, those hedge funds and pension funds and insurance companies and sovereign wealth funds who used to buy RMBS… a lot of them are going to just buy the underlying asset: the house itself. If the dollar is losing 15% a year in purchasing power (aka, inflation), then you have to park it someplace that can offset that loss. US residential housing makes perfect sense, especially with rents on the rise again. And those guys couldn’t care less what the mortgage interest rate was; they’re paying cash, then levering up afterwards with high-yield corporate debt.

While it is possible that we might see legislation and regulation that makes housing unattractive for investment (think, rent control, taxes on rental income, flat out bans, etc.), such things have unintended consequences, like making homebuilders question whether they can make any money building more houses in the U.S.

The result: home prices are not coming down… at least, denominated in dollars. Maybe they will after we have a reset of the entire U.S. financial system, but I suspect we’ll all be much more concerned about other things if a real reset happens. Like food supplies and ammo.

Which Means…

If you are a real estate professional, you will want to do your own research. Don’t take my word for it. But don’t take the words of leading experts either. Do your own reading, do your own research, and make up your own mind about what you think is happening and what is likely to happen as a result.

Local market conditions trump national trends in many cases. However, as long as the buyer is paying with US Dollars, you might want to form your own opinions on this particular topic.

As for myself, I am maximizing fixed-rate long-term leverage, investing in assets, and carefully watching which way the winds are blowing.

Cuz it’s about to be 2022. Just wait. The new breed of finance experts will rock the hard jams, treat it like a seminar. Reach the bourgeois, and rock the boulevard.

-rsh

Public Enemy – Don’t Believe The Hype (Official Music Video)

REMASTERED IN HD! Playlist Best of Public Enemy https://goo.gl/8xu5R4 Subscribe for more https://goo.gl/DYx2ai Best of Public Enemy: https://goo.gl/8xu5R4 Subscribe here: https://goo.gl/DYx2ai Music video by Public Enemy performing Don’t Believe The Hype. (C) 1988 The Island Def Jam Music Group #PublicEnemy #DontBelieveTheHype #Remastered #vevo

You’re spot on Rob! Fed can’t raise rates without crippling GDP growth. DC won’t raise taxes domestically with mid-terms at risk. Inflation is spiraling at mid-double digits, leading capitol hill to craft new narratives to distract the lower/middle classes. Fed hasn’t consistently forecasted rates dating back to the late ’90s. No reason to think this year will be any different.