I’ve got a very busy week, but saw something on YouTube that made me want to explore a topic that I do plan on looking into deeper. So a brief post that is mostly a series of questions, all of which culminate in this one:

Why is anybody buying mortgage-backed securities in 2021?

Obviously, the answer to this question is all-important to the real estate industry.

Let me explain.

George Gammon Doom-Mongering

First, here’s the video I saw on YouTube that triggered this line of inquiry:

Bond Market Is Telling Us Economy Is On Verge Of Collapse

Check out the Rebel Capitalist Live event Jan 7th – 9th!! https://rebelcapitalistlive.com

If you don’t know who George Gammon is, he’s an investor who runs a big finance, investment, and crypto YouTube channel called Rebel Capitalist. He has a very strong libertarian streak to his take on global economy and investment opportunities, which I appreciate.

Gammon looks at the yields on 10-year Treasury bonds and points out the obvious: the yield is below inflation. Now, he asks about “true inflation” but even the government-printed CPI is over 6% now. So he wonders out loud why any investor would want to lock in guaranteed losses by accepting yields below 2%.

Thing is, this is very much in line with something that investors like Ray Dalio have been talking about for a while now. Back in early 2020, Dalio — the founder and CIO of the largest hedge fund in the world — made news by saying “You’d be pretty crazy to hold bonds.” The rationale was simple: the Fed is printing and going to print a lot of money.

Gammons’ answer at the end of the video is that the bond investors are knowingly taking a crappy deal because the alternatives are even worse. The smart money, he says, would prefer to accept a guaranteed loss because it would be less bad than potential losses in the stock market, in crypto, or elsewhere.

Now… the crypto bulls think that’s laughable and believe that crypto will outperform everything under the sun. But that’s not what the traditional bond investors believe. So we’ll see.

What I Don’t Understand

This whole line of reasoning, which seems solid, leads to utter confusion on the part of yours truly. Maybe it’s because I’m not a trained economist, or a Wall Street analyst.

Why is anybody buying mortgage bonds?

We know now that institutional investors are buying up homes as fast as they can. I’ve been talking about this for a while now, but here’s an article from PropertyOnion if you’re interested in reading more. Ivy Zelman, the respected housing analyst I wrote about earlier, talked about how housing demand is actually being fueled primarily by institutional investors.

It’s getting so bad that cities are looking at banning institutions from buying houses. This is all true, and all known.

What is unknown is why gigantic investment funds are bothering with mortgage bonds instead of investing directly into these REITS and into actual physical real estate.

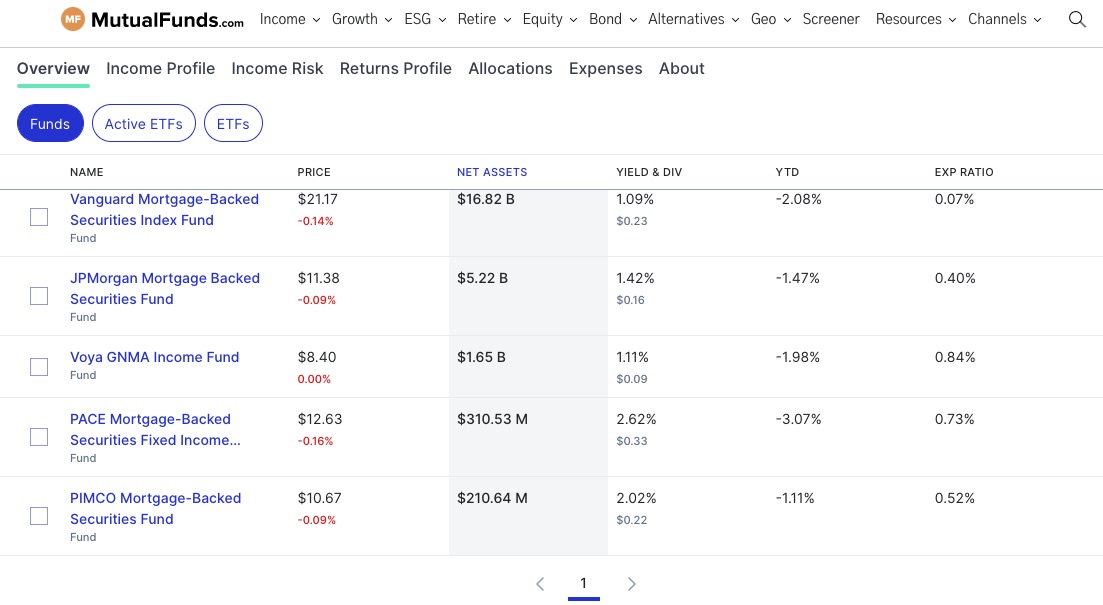

Take a look at this small partial list:

They’re all down YTD. The yield & dividends are below nominal inflation. Yet there’s over $22 billion sitting there in these mortgage bond funds.

I can kind of understand buying US government bonds; those are as “risk free” as things get. But mortgage backed securities are not risk-free, as everyone should remember the last time they crashed. Remember that whole Great Recession and the whole Bubble bursting? So if you want safe investments, ain’t nothing safer than US Treasuries. Accepting a guaranteed loss in exchange for near-zero risk makes some kind of sense, I suppose, especially if you think the global economy is headed for collapse as Gammon suggests.

But mortgage bonds?

I mean, I guess they’re restricted from investing in anything other than mortgage bonds but… whoever has money in these funds has to be wondering WTF, no?

Why buy mortgage bonds with guaranteed loss in purchasing power when you can take the same money and buy actual real estate (whether directly or through a REIT) and have your underlying asset appreciate by 19.5% year over year?

Is it the Fed?

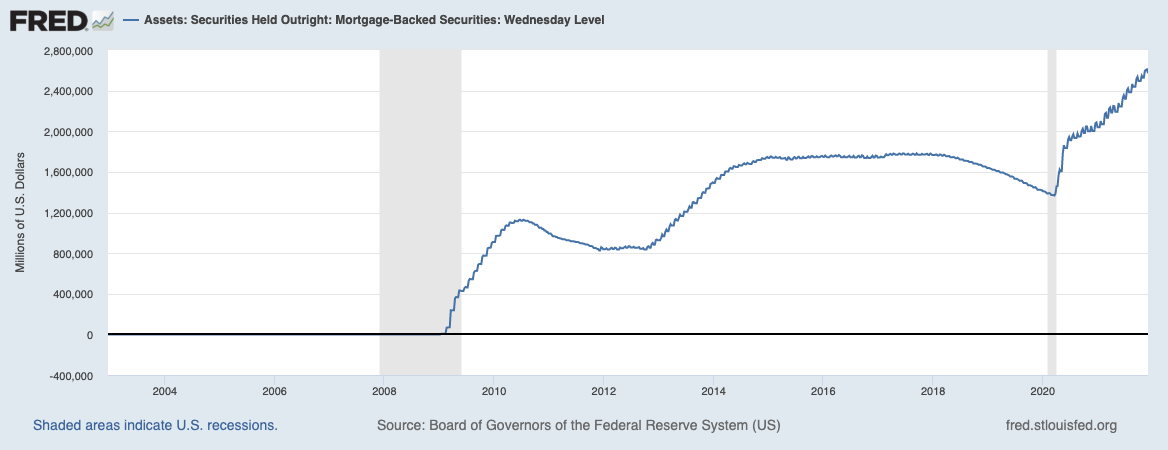

Is it because these mortgage bond investors are betting on the Fed buying them out? We know the Fed has been buying mortgage backed securities like crazy. As of this writing, the Fed has over $2.5 trillion in mortgage-backed securities on its balance sheet, and its purchases of MBS has skyrocketed since start of 2020:

Is the idea that you buy MBS, then turn around and sell it off to the Fed for a few basis points of profit?

If this is true, then I have to further assume that bond investors basically believe that the Fed won’t actually taper mortgage bond purchases, as it has recently announced. But not tapering means not raising interest rates, which means that bonds (including mortgage bonds) will remain at loss-guaranteeing yields.

That Which Can’t Go On Forever, Won’t

One of the economic laws I love the most is Stein’s Law: If something cannot go on forever, it will stop.”

It seems implausible to think that investors will accept guaranteed losses on their money forever. So it will stop.

It can only stop by one of two ways:

- Rates have to go much higher, and at least match the hurdle rate of true inflation; or

- Investors stop buying mortgage bonds and start buying assets that can match the hurdle rate.

Either way, homeownership society is over and the housing market comes to a screeching halt.

Falling home prices will suck for homeowners, but be fantastic news for the largest generation in American history currently locked out of the housing market, and be fantastic news for all these former-bond investors who have billions in cash sitting around losing value daily… since they can pickup real estate for much cheaper.

It goes without saying that the real estate industry would suffer as well.

I realize that there are numerous voices that say that the only way out of our housing market woes is more supply. Build more houses! That may or may not be true. But what I wonder about now is whether increased supply makes sense if mortgage backed securities cease being a viable investment vehicle.

It’s all complicated. I sure would like to see some trained economist address this topic and firmly answer why it is that pension funds, sovereign wealth funds, hedge funds and insurance companies will keep pouring billions into a security that is guaranteed to lose them money year after year.

-rsh

Bronski Beat – Why ? (Official HD Video)

Pre-order ‘The Age of Consent (40th Anniversary Edition)’ on LP / CD / Digital / Blu-Ray editions: https://bronskibeat.lnk.to/Consent40ID Listen to the ‘Smalltown Boy’ playlist here: https://bronskibeat.lnk.to/sbplaylistID Subscribe to our channel: https://londonrecords.lnk.to/YTSubscribeID Sign up to our mailing list: https://londonrecords.lnk.to/signupID Follow Bronski Beat Instagram https://BronskiBeat.lnk.to/InstagramID TikTok https://bronskibeat.lnk.to/TikTokID Facebook https://BronskiBeat.lnk.to/FacebookID Twitter https://BronskiBeat.lnk.to/TwitterID Store

Short term I think the answer is those funds/sectors of companies were setup to purchase MBS. If they look at alternative assets they essentially move money out of their portfolio and risk job security. Just like with The Big Short, Too Big to Fail or When Genius Failed. You don’t stop until you are forced.

That makes sense. If your job is to buy MBS, no matter what, I guess you gotta keep buying MBS. 🙂