Courtesy of my buddy Keith Robinson on Facebook, I saw the latest release from Attom on Q1/2022 U.S. Home Sales. The report can be found here.

The big takeaway appears to be that there was a decline in “profit margins” on median-priced single family homes:

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its first-quarter 2022 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home sales across the United States dipped to 47.2 percent – the first quarterly decline since late 2019 and the largest in a decade.

In a sign that the nationwide housing-market boom may be slowing, the latest profit margin was down from 51.6 percent in the fourth quarter of 2021. While profit margins often decrease during the relatively slow Winter home-buying season, the latest dip of more than four percentage points marked the first quarterly decline since the fourth quarter of 2019 and the largest since the first quarter of 2011.

What I find interesting, maybe a bit odd, is this idea of “profit margin.” The idea, it seems, is that Attom is looking at sale price in Q1 of 2022 and comparing that to the last time that property was sold (which presumably is what the current seller bought the home for back when).

So the takeaway is that the housing market is slowing down:

“Home prices simply can’t continue to go up as rapidly as they have for the past few years,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “The combination of higher prices, rising mortgage rates, and the highest rates of inflation in 40 years may be pricing some prospective buyers out of the market, which means we may begin to see lower sales numbers. Ultimately, as affordability worsens, price appreciation should slow down, and we may even see modest price corrections in some markets.”

That strikes me as a very reasonable take on the data. We can’t keep going up 20% a year, can we? Or can we?

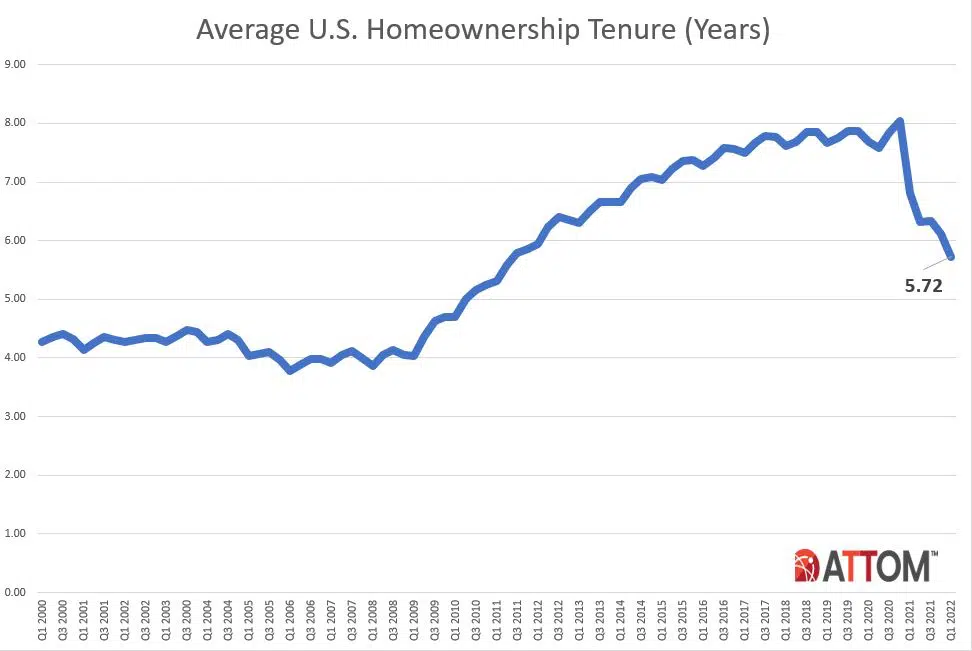

I say that because there is one bit of data included that makes me wonder, and it’s this:

Homeownership tenure drops again, to 11-year low

Homeowners who sold in the first quarter of 2022 had owned their homes an average of 5.72 years, down from 6.12 years in the fourth quarter of 2021 and down by more than a year from 6.82 years in the first quarter of 2021. The latest figure marked the shortest average time between purchase and resale since the second quarter of 2011.

Tenure decreased from the first quarter of 2021 to the same period this year in 94 percent of metro areas with sufficient data. They were led by Lakeland, FL (tenure down 82 percent); Salem, OR (down 55 percent); Cleveland, OH (down 47 percent); Las Vegas, NV (down 45 percent) and Provo, UT (down 40 percent).

I guess what I’m wondering about is whether the decline in “profit margins” has more to do with shortened tenure rather than some organic decrease in prices.

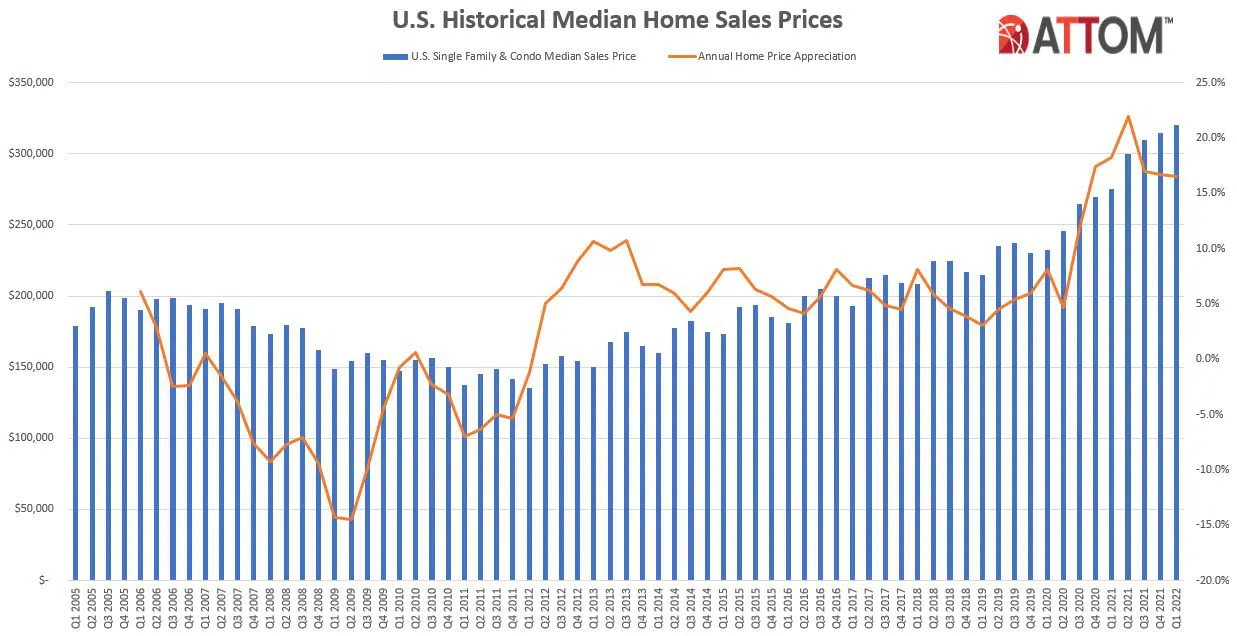

If you look at the actual median prices from Attom’s report, we get this:

Q1/2022 prices are still at an all-time high. The annual home price appreciation looks like it has dropped from Q2 of 2021, but it’s still north of 15% in Q1 of 2022. So the fact that home prices are not going up as fast as it was doesn’t mean it’s not going up: it is, by over 15% YOY.

So… if prices are still going up, and median prices are at all time highs… wouldn’t the decrease in “seller profits” have more to do with the fact that those selling in Q1 of 2022 held their homes for less time? I mean, Attom itself says the profit margins dipped to 47.2% from 51.6% in Q4 of 2021. But it also says those who sold in Q4 of 2021 had owned their homes for 6.12 years vs. 5.72 years — that’s 4/10ths of a year, or almost 5 months. With home prices going up between 15 and 20% YOY, wouldn’t holding on to a home for 5 months less lead to a natural decline in seller profits?

Are we really seeing a slowdown of the housing market? Or are we seeing just the natural outcome from sellers not wanting to hold on to their homes for as long, for whatever reason?

No answers here, obviously, since I didn’t collect the data. But it would be interesting to see if Attom has more answers or details.

Long and short of it is, the narrative that the housing market is slowing down might be true, or it might not be true. But it isn’t super clear to me how that narrative is supported by the data we’re seeing here.

-rsh