[NOTE: I am long OPEN and have been for a while as the self-proclaimed Biggest Bull on Market Maker iBuying in the World. None of this is investment advice or solicitation; it is education/entertainment from an industry analyst perspective.]

Q1 of 2022 is when I will mark a major turning point in the history of the real estate industry in North America. Perhaps the tale began back in Q3 of 2021, but after Q1, it is clear that King Zillow who was reported missing in action for a while has in fact passed on, and Prince Opendoor has ascended to the throne. To quote Rich Barton from the Zillow 4Q19 earnings call, Turn the Page.

It isn’t simply because Opendoor had the kind of blow-the-roof-off quarter that’s hard to imagine, though it did. I titled my Opendoor 4Q21 “Opendoor Blows the Doors Open” based on things like 211% YOY increases in revenue. Well, in 1Q22, Opendoor did more like 600% YOY increases. What do you call that? I thought about titling this one “Opendoor Nukes the Doors Open” but then I listened to the Zillow earnings call. Opendoor didn’t just outperform; it overtook leadership in innovation, in strategic importance, and in financial prospects from Zillow.

To be clear, Zillow did not pass the baton. Opendoor did not snatch the title away. No, what happened is more like Zillow getting spooked at the sight of the orcs of Mordor, dropping the crown on the ground while running away, only to have Opendoor come along and pick it up without a fight. I’ll have to tell that story when looking closer at Zillow.

Nonetheless, there is a new Most Important Company in Real Estate in town, as well as the new leader in the quest for the Iron Throne of real estate. It’s Opendoor, and it’s time to get into it.

Behind the Numbers

As we do, let’s spend a bit of time on the numbers. Because there are some numbers that Opendoor discloses which are simply astonishing, and deeply important to the future of the industry. Let’s start with some topline numbers from the press release:

First Quarter 2022 Key Highlights

- Highest quarterly revenue of $5.2 billion, up 590% versus 1Q21; with 12,669 total homes sold, up 415% versus 1Q21, demonstrating rapid consumer adoption of our product offerings

- Record gross profit of $535 million, versus $97 million in 1Q21, up 452% versus prior year; gross margin of 10.4%, versus 13.0% in 1Q21

- First quarter of positive net income of $28 million, versus $(270) million in 1Q21

- Adjusted Net Income of $99 million, versus $(21) million in 1Q21

- Record Contribution Profit of $332 million, versus $76 million in 1Q21, up 337% versus prior year; 21st consecutive quarter of positive Contribution Margin which was 6.4%, versus 10.2% in 1Q21

- Adjusted EBITDA of $176 million versus $(2) million in 1Q21; fourth consecutive quarter of positive Adjusted EBITDA and three times higher than what was generated in all of 2021; Adjusted EBITDA Margin of 3.4% versus (0.3)% in 1Q21

- Inventory balance of 13,360 homes, representing $4.7 billion in value, up 455% versus 1Q21

- Purchased 9,020 homes, up 151% versus 1Q21

- Launched San Francisco Bay Area, bringing us to 45 markets at the end of 1Q22

Outlook

- 2Q22 revenue guidance of $4.1 billion – $4.3 billion, up 254% YoY at the midpoint of range

- 2Q22 Adjusted EBITDA1 guidance of $170 million – $190 million, up 604% YoY at the midpoint of range

All emphasis are mine. And these all add up to BOO + YA. I’m a bit unclear on what else Opendoor had to do to blow your socks off. Revenues up 6X, gross profit up 4.5X, and critically, made money for the first time. With all the bitching about how these investor-funded startups are just money pits, and we’ll see what happens when investor cash dries up, here’s Opendoor posting Net Income of $28 million for the quarter, and Adjusted Net Income (which excludes various accounting measures and non-cash expenses, etc.) of $99 million.

Opendoor Transactions in Crazy Seller’s Market

The most impressive number that Opendoor posted is the purchase of 9,020 homes in the quarter. This is the hottest, most insane market we have ever seen. The anticipated slowdowns thanks to Fed action and mortgage rates spiking were not in place in Q1. Homes were selling like hotcakes. REALTORS everywhere were going begging for inventory. In that market, Opendoor bought 9,000 homes. How?

Here’s one clue, from the investor presentation:

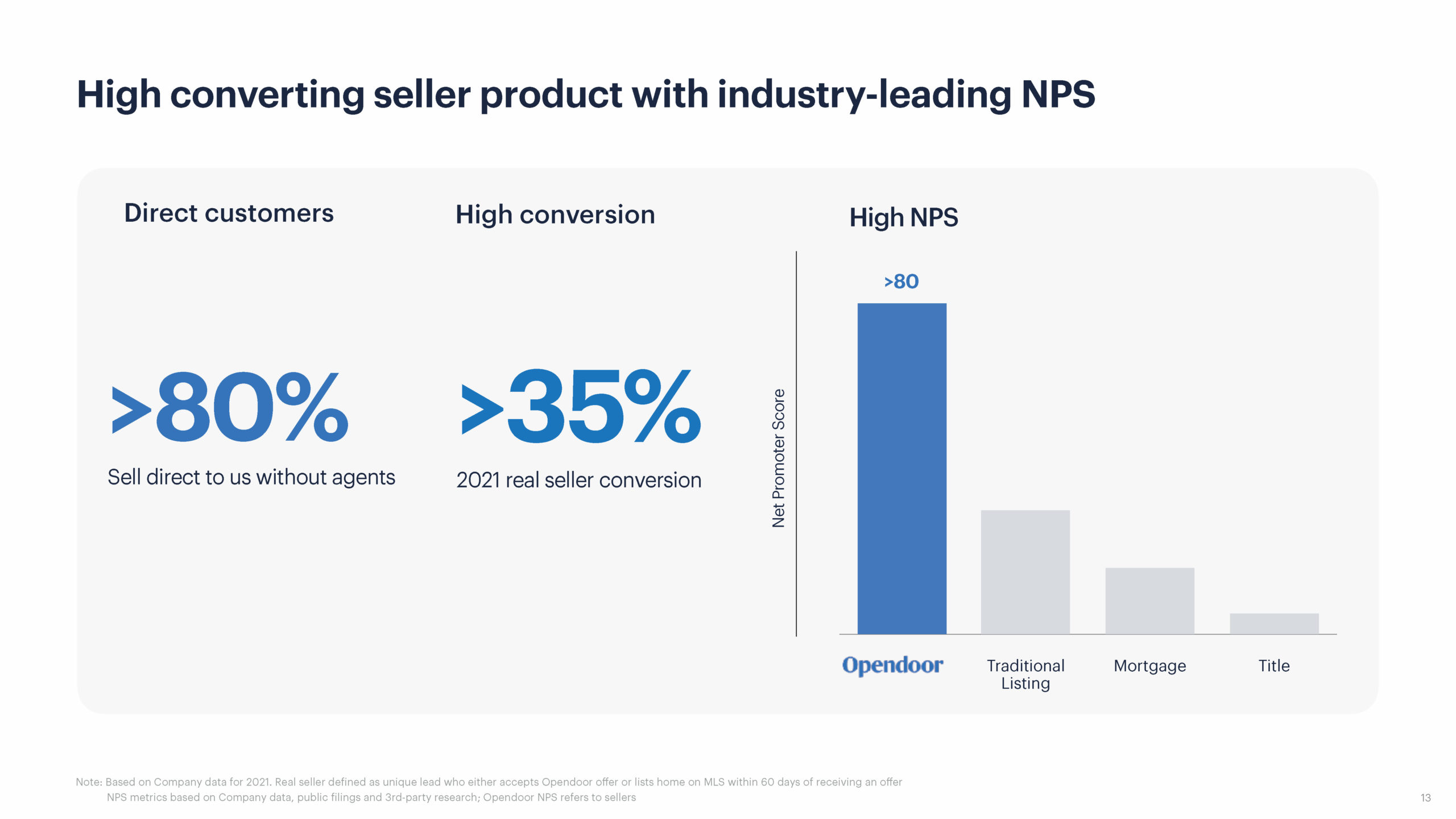

80% of sellers sold directly to Opendoor without involving an agent. That means of the 9K homes purchased in 1Q22, 7,200 were bought directly from homeowners who went to Opendoor and asked for an offer. We’ll talk about this more below.

Furthermore, 35% conversion rate is more than three times what Zillow used to talk about with its conversion rates back when they were in the market making business. That’s an incredibly high number. But it also implies that Opendoor sent out some 25,700 offers to get to the 9,000 homes purchased. That’s a lot of offers sent out, which could only mean a lot of offers requested by consumers or their agents.

In addition, Opendoor reported selling 12,669 homes in 1Q22. Combine the two numbers and we get to 21,689 transactions that Opendoor did in the first three months of 2022. Now, Rich Barton in his 1Q22 earnings call said Zillow was responsible for 360,000 transactions annually or about 3% of the 12.1 million total. So in a quarter, that means roughly 90,000 transactions went through Zillow.

Simple math suggests that Opendoor is doing 1/4 of the transactions that Zillow is referring to its tens of thousands of Premier Agents. On its own account, with full and absolute control over the selling process as it is the owner of the home. Opendoor did this while operating in only about 45 markets during most of 1Q22, while Zillow operates in every single market across the country.

We’ll return to this, if not in this post, then in the Zillow 1Q22 post.

Ancillary Services

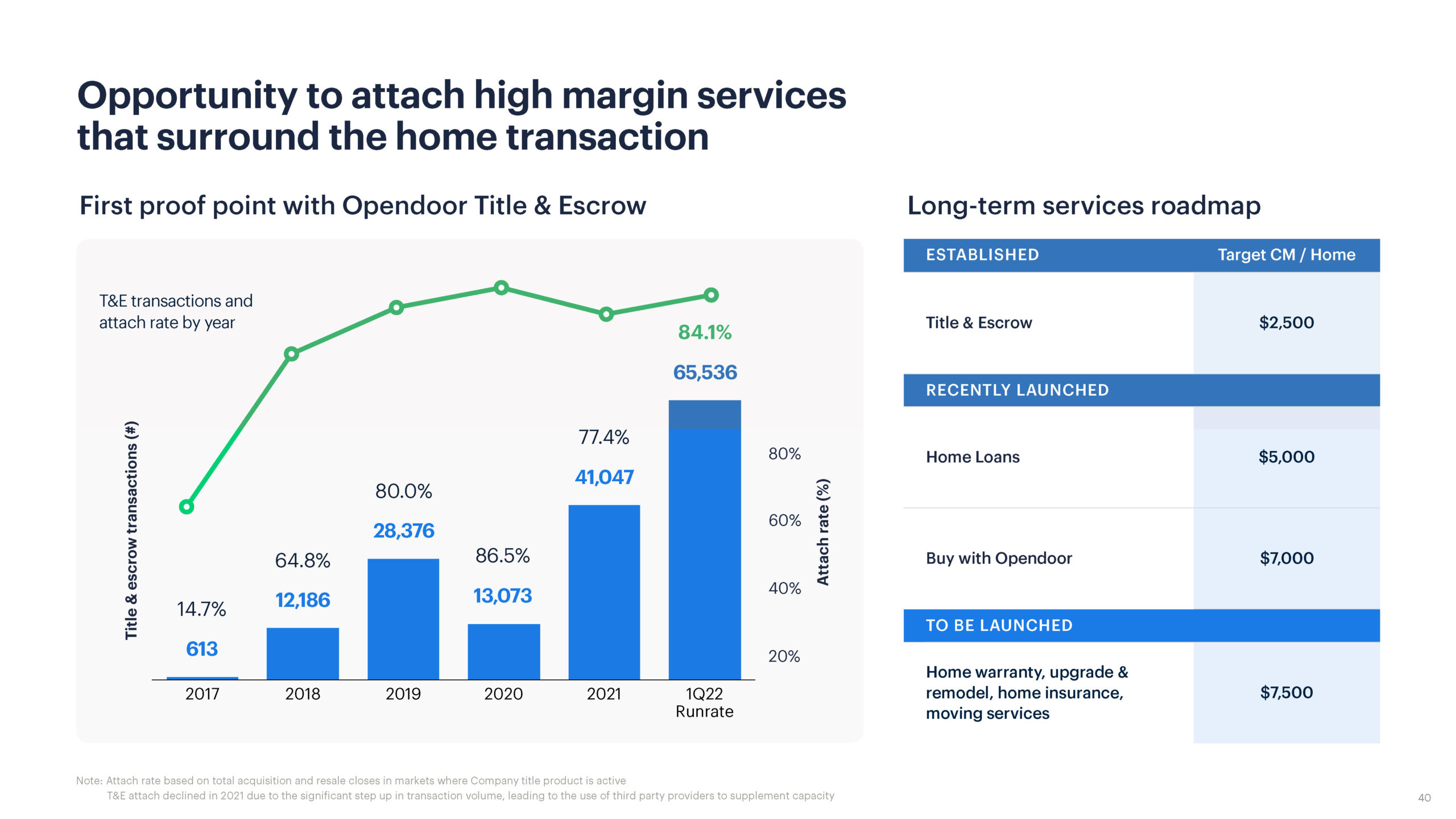

Opendoor has had title and escrow for a while; it recently added mortgage and Power Buyer products. But we got some updated numbers from Opendoor:

According to the shareholder letter, Opendoor’s title and escrow business is up 223% YOY in revenue, with over 80% attach rates, and Net Promoter Score over 80. Juicy numbers, no? Of course, title & escrow are the easiest to attach. Mortgage is much, much harder to attach as buyers often shop for mortgages before they start purchasing.

But in Opendoor’s case, there is reason to believe their attach rate would be significantly better than the industry average. Why?

Many of Opendoor’s buyers are actually Opendoor sellers — they’re moving up, or moving elsewhere, and selling their home to Opendoor and then buying a new house. That’s the point of Opendoor Complete, which to quote Eric Wu’s shareholder letter, “bring together the buying and selling experience and combining two transactions into one seamless move.” If the seller is selling their house to Opendoor, it’s not particularly difficult to think that Opendoor couldn’t ask if they’re planning on buying a new house, and if they are, would they be interested in saving some money to get their mortgage? Maybe Opendoor waives points, or lowers the Title & Escrow fees, or gives them credits at closing or whatever. Opendoor is smart enough to ensure RESPA compliance with whatever they do, but it seems logical to think that they might be able to achieve pretty healthy mortgage attach rates with a captive audience that already trusts them somewhat.

Remember: 80% of the sellers sold to Opendoor without an agent involved. I’d suggest there’s a level of trust there already.

So this passage from the shareholder letter resonates with me:

We also focused on cross-selling throughout the seller experience and highlighting the buying experience earlier in the seller’s journey with Opendoor. We are seeing the value of Opendoor Complete resonate with home sellers, as well as increased conversion of our sellers into buyers with Opendoor by solving their holistic need to buy and sell.

We have continued to make progress on our financing offering, including adding Lower.com as a strategic partner. Our partnership with Lower.com enables us to offer a broader suite of products, such as FHA/VA loans, ensures financing-product coverage across our ever-expanding market footprint, and adds fulfillment flexibility. This is particularly important as our mortgage team launches our digital Opendoor financing app in the coming weeks. [Emphasis added]

I guess we’ll see how their financing app does when 2Q22 gets reported. But Opendoor is executing, and executing well.

Balance Sheet

Because this will become relevant when we’re done looking at all of 1Q22 for all public real estate companies, let me highlight one paragraph from Opendoor’s Shareholder Letter:

We ended the first quarter of the year with $2.8 billion in cash, cash equivalents and marketable securities and $11.3 billion of financing availability. We are well capitalized given both our cash balance and financing capacity, which translate into north of $35 billion of annual home purchasing power – plenty of fuel to achieve our growth objectives for 2022 and beyond.

While we expect rates to increase over the course of the year, this should have a relatively small impact on our overall cost structure per home. Our cost of funds for our senior financing was around 3.0% in 1Q22. We expect that to increase to approximately 4.0% for the full year based on the current forward curve and our expected mix of senior revolving and term facilities. Based on hold times of approximately 100 days, this would imply that senior financing costs per home move from approximately 70bps in 1Q22 to 90bps for the full year, which is a manageable increase relative to our overall cost structure.

Importantly, we pass on this incremental interest expense in our offers, which allows our Contribution Margins After Interest to stay neutral. We are also able to take advantage of our strong cash balance to manage our overall interest expense levels by modulating our advance rates across both senior and mezzanine financing

Keep this in mind as we turn to the substantive analysis of the earnings call, as Eric Wu and team go into some detailed discussion about Opendoor’s business and strategic thinking.

Addressing Headwinds

A major focus of the overall presentation and discussion was the macroeconomic environment and anticipated headwinds for housing. Literally everybody on the call understands that Fed action, mortgage rates, and buyer demand are going to drive a lot of things in housing, which directly impacts Opendoor (and everybody else in real estate). So both Eric Wu and Carrie Wheeler focused on that in prepared remarks.

Bottomline is that Opendoor is built from the ground-up to work in any market condition. When it launched in 2014, it wasn’t as if we were in the hottest seller’s market in history, nor was inflation north of 8%. No one had heard of COVID, and “work from home” was something you saw in sci-fi movies. And over time, all market makers from Opendoor to Zillow to Redfin have had to explain that they take market conditions into account and make adjustments “mid-flight” as it were.

But it’s worth quoting Carrie Wheeler at some length:

First, it’s important to reiterate that what is core to our business model and frankly what is most misunderstood is that our systems and margin structure are designed to be durable across different housing environments. That’s not to say we’re immune.

Housing dynamics are a key input to our business, and we’ve custom-built our pricing and operational systems to give us a deep understanding of the underlying drivers and to be able to dynamically adjust to changing conditions. That’s reflected in our offers. And those account for the level of certainty in our home acquisition pricing, inclusive of forecasted HPA. And in environments of high volatility, our models are designed to be more conservative.

Combining this with holding liquid sale-ready homes and having updated views on home pricing on a daily basis gives us the confidence that we can deliver against our baseline annual contribution margin targets of 4% to 6% across market cycles. [Line breaks added for legibility]

Translated into English:

We’re not stupid, and we look at what’s happening. We then offer less to the seller when we buy if we think homes aren’t going to keep going up at 20% YOY. If shit gets crazy, we’ll go lower. It’s buy low, sell high, fellas and we know how to buy low.

Plus, we’re not buying collectible NFTs here. We’re buying houses that everybody wants, and they’re all ready to go right now on the market. When we’re selling, we change prices on the daily. We’ll dump the house if we need to so we can make a wee bit of money on it, or at least not lose that much, because we’re not some widow dependent on the sale for our golden years sitting and waiting and hoping for the market to change. We’ll hit the measly 4 to 6% margin target no matter what the market does.

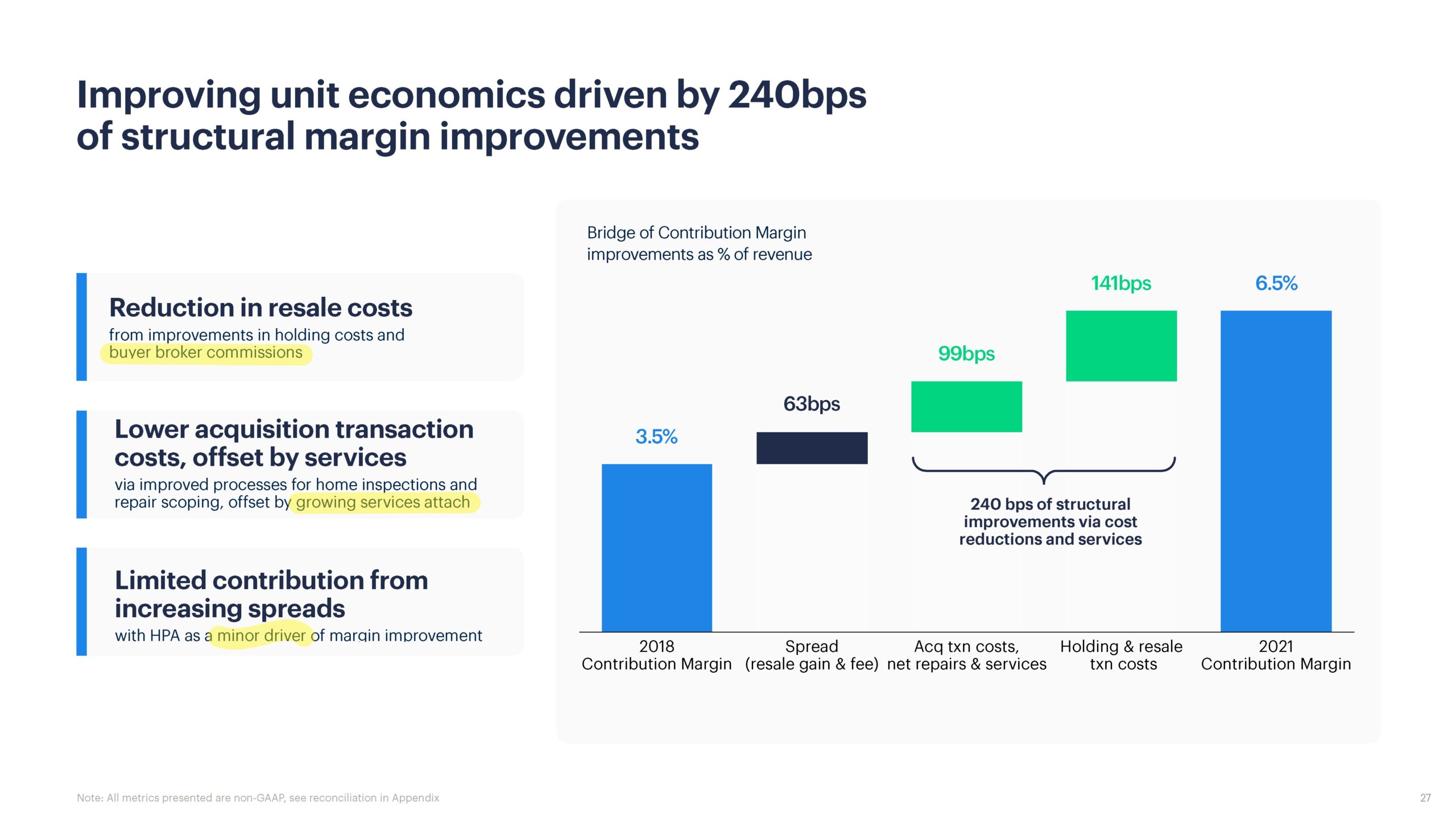

Let me also point out that Eric Wu said pretty much the same thing, adding only that Opendoor has squeezed out 240bps (2.4%) of margin by improving their operations. Here’s the slide for that:

I added the highlights. The upshot is that the insane housing market is but a “minor driver” of Opendoor making more money per sale. In a hot market, they’re paying more and selling for more. The “spread” is a miniscule 63bps while improvements in resale costs (from lower holding costs and paying buyer brokers less) and being more efficient in purchasing homes while attaching title & escrow are the big gains. That’s solid, and it’s sustainable, and it has little to do with market conditions.

I added the highlights. The upshot is that the insane housing market is but a “minor driver” of Opendoor making more money per sale. In a hot market, they’re paying more and selling for more. The “spread” is a miniscule 63bps while improvements in resale costs (from lower holding costs and paying buyer brokers less) and being more efficient in purchasing homes while attaching title & escrow are the big gains. That’s solid, and it’s sustainable, and it has little to do with market conditions.

But even more important is this from Eric Wu during the Q&A:

This is Eric. I’d love to add on top of that, which is — I’ll say it in a different way, the value we’re delivering to consumers is seeing the value we’re capturing. And as we’ve increased spreads, we haven’t seen a material impact to our conversion, which is an incredible sign that, again, if we deliver value to consumers, they will convert.

And so we’re excited to see that not only have our margins improved, we’ve also seen conversion held steady through this period, which gives us a lot of confidence that we can continue to grow through the back half of this year. [Emphasis}

The plain language translation here is that Opendoor has been offering less and less when they go to buy houses, because they think the housing market is going to slow down. But offering less, even in this insane seller’s market, has had no impact on homeowners willing to sell to Opendoor. That’s what “conversion held steady” means. How could that be?

Turns out that consumers value certainty, speed and convenience even more than a few extra dollars. This is something that real estate agents have a very hard time wrapping their heads around because they have been trained for so long on “I get you the most for your house!” But just like most consumers would rather trade their cars into a dealership, or get a check from Carvana, rather than go on Cargurus or Facebook Marketplace, a lot of people (9,020 people in 1Q22, to be specific) want the certainty, speed and convenience.

What’s more, Eric Wu clearly understands that Opendoor becomes more valuable, not less, if the market changes:

And again, we had a hypothesis going into this even back when we founded the company that when there’s the most uncertainty, that’s when Opendoor is needed the most, which means that we’re creating the most value when there’s times of uncertainty. And subsequently, we can actually capture that value that we’re creating for consumers. I don’t — we don’t have a view today on what that could look like through any softening in the back half of this year. But we’re certainly optimistic that our conversion rates will be steady at the very least.

I’d like to thank Eric Wu for personally confirming what I’ve been arguing lo these many years in debates about market maker iBuyers. If things turn into a buyer’s market, Opendoor will have a field day as desperate sellers start looking for somebody, anybody to buy their houses so they can move. Of course they’ll pay less for those houses given market conditions, but the value of certainty, speed and convenience doesn’t go down in a buyer’s market; it goes up.

Considering Opendoor’s stock performance after this earnings report, it appears that Wall Street doesn’t much care about how Opendoor is built, how it won’t be affected much by a chaotic housing market, by high interest rates, or by buyer demand drying up. But that shouldn’t bother Eric Wu and team, at least not yet. The stock market is the secondary market, and won’t affect Opendoor directly. And as noted above, Opendoor has some $2.5 billion in cash, and over $35 billion in purchasing power.

The Two Sided Marketplace and the Opendoor App

The most interesting exchange, from my perspective, which shows the kind of detailed and sophisticated understanding and vision that Opendoor has on the industry occurs during the Q&A. Here is the exchange in full between Ryan McKeveny of Zelman & Associates, which is one of the best analysts of real estate and housing under Ivy Zelman, and Eric Wu:

Ryan McKeveny

Congrats on the results and appreciate the added details on the business, the cost structure and the embedded micro views, it’s definitely helpful to see you guys lay that out given the uncertainty that is out there.

So Eric, I wanted to dig into a topic you got into the last couple of quarters on the long-term ecosystem being a two-sided local marketplace for sellers and buyers. And I think it’s interesting to think through.

So on the buy side, it’s obviously great to hear that the purchase offers with buyers hit an all-time high. But I guess more broadly on this kind of flywheel opportunity with buyers and sellers, if we look at it as the aggregation of local supply is important to aggregating and capturing that high-intent demand, is there a threshold of market share at the local level that we should think about as to when you get to a certain level of market share of supply that, that buy side really starts to flourish, or is that still kind of early days to get too much into that?

Eric Wu

Ryan, it’s a valid question. The way that I think about it is that if we’re able to aggregate supply, in our case, it’s actually unique supply, it’s our inventory, we’re going to build a differentiated experience on top of that supply. And really the end state that we’re building to that, we [indiscernible] possible to be able to buy a home with peace of mind with just your mobile device. And we’re using our inventory to build that experience as the first step.

In terms of aggregating demand with that unique supply, we are seeing really good progress and signal that we’re able to do that. When the market tips and maybe to try to define that term where every single buyer in market is looking, downloading and using our app to shop, we’re not certain, but we do see really good correlation with if we increase supply that we have and build a differentiated experience on top of that supply, buyers are actually using Opendoor directly. [Emphasis added]

Let’s dig into this.

The Differentiated Experience on A Mobile Device

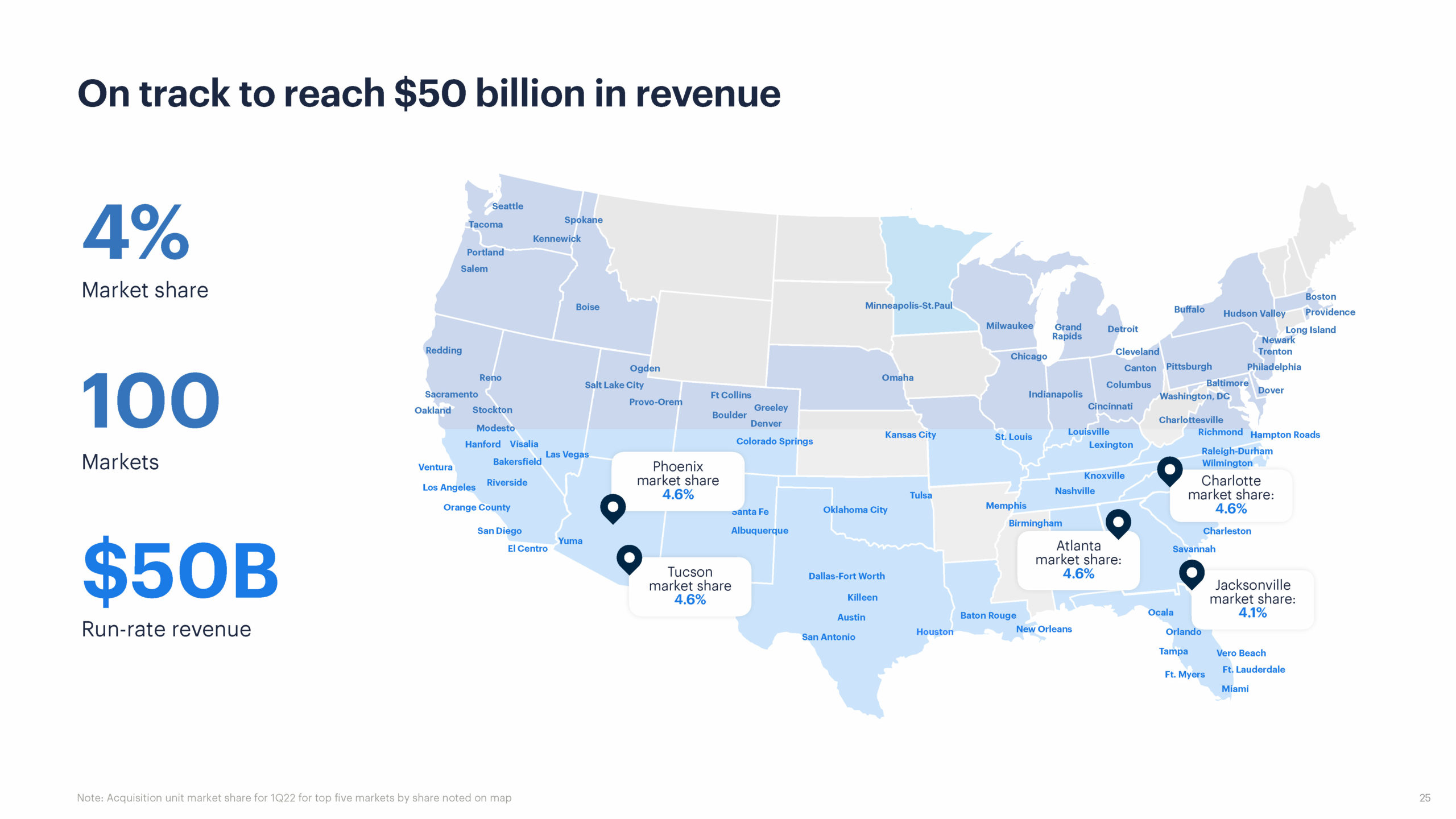

First, McKeveny is asking whether there’s some kind of listings threshold at which point buyers start coming to you first, rather than going somewhere else *coughZillowcough* to find houses they might want to buy. He knows that Opendoor has maybe 4-5% of the listings in most of its markets, because Opendoor discloses that information:

So he wants to know if Opendoor gets to say 10% of the listings, 20%, 30% — at what point does Opendoor become the first stop for buyers looking for a house.

So he wants to know if Opendoor gets to say 10% of the listings, 20%, 30% — at what point does Opendoor become the first stop for buyers looking for a house.

Eric doesn’t answer that directly because no one can answer what the tipping point is, until after it happens. But he doesn’t say that. What he says is that Opendoor doesn’t just aggregate supply; Opendoor has unique supply that is not available anywhere else. He also notes that Opendoor’s unique supply isn’t just pocket listings, but owned inventory. They own the houses; they owe nobody any fiduciary duty to do anything at all.

Which means that Opendoor can “build differentiated experience” for the buyers on top of that unique owned inventory supply. For example, Opendoor can provide a buyer with the ability to tour an Opendoor home with his Opendoor app just by walking up to the door, because Opendoor doesn’t have to schedule jackshit with the owner still living there, or clear it with the listing agent’s calendar.

And, Eric says that Opendoor has evidence that when they acquire a lot of houses in an area, and provide this “differentiated experience” to buyers… “buyers are actually using Opendoor directly.”

The question we must ask at this point, of course, is “differentiated from what?”

The answer of course must be “differentiated from the traditional process of calling your agent to schedule a showing with the listing agent who has to clear it with the owner, and get back to your agent in a couple of days to give you a time slot that could be as short as 15 minutes, at which point you have to drive over to the house, meet your agent there, so your agent can open the lockbox with her special MLS-issued electronic key in order to open the door to the house, so you can tour it for the 15 minutes you’ve been given and make a decision on whether to spend your life savings on it and go into debt for 30 years to do so.”

What Opendoor wants to build, using its unique supply of owned homes as the experimental base, is the ability for buyers to buy a home with their mobile phones. Why, such a thing would be an amazing app for buyers of housing. What would be a good name for an app like that? Wonderful Homebuying App? Stupendous Housing App? Oh, how about, Housing Super App?

About This Two-Sided Marketplace….

Second, think about what “two-sided local marketplace for sellers and buyers” means. It would be some kind of a website or a mobile app that would bring both buyers and sellers together. If those buyers and sellers are represented by real estate agents, well, then it would also bring buyer agents and listing agents together in some kind of way so that they can know what’s for sale, what’s pending, and what’s already been sold.

Does such a two-sided marketplace exist today where buyer agents and listing agents come together to share data and you know, cooperate and stuff? Could there be some 580 such two-sided local marketplaces today, or is that too many?

Now… let’s take a market like say Atlanta, where Opendoor has 4.6% market share in 1Q22. Atlanta is an interesting market in one respect. According to Atlanta Agent Magazine, relying on a report from Redfin, one in three home purchases in Atlanta in 4Q21 was by investors. Neither the Redfin report nor the Atlanta Agent Magazine tells us how many of those real estate investors were institutional investors, but my friends in Atlanta tell me that the majority of investor activity in that town are by national-scale REITs and hedge funds.

So if you’re a hedge fund manager looking to purchase a couple thousand homes in Atlanta… or if the market turns, you want to dispose of a couple thousand homes in Atlanta… wouldn’t it be nice if there were a two-sided marketplace you could join without, y’know, studying for the Georgia real estate exam? Maybe that two-sided marketplace could have a big seller who has a unique supply of properties and more importantly, is utterly unemotional about the houses they are selling? Plus, if that marketplace also had a buyer who is singularly unemotional and has no “dream home” ideas at all with say $35 billion in purchasing power… wouldn’t that be just peachy if you were a hedge fund manager?

You know what would make that two-sided marketplace simply awesome for a hedge fund manager? If they had unique proprietary data including all kinds of detailed information about the condition of the house, what kinds of appliances it has, and estimates on the value of such details… that would save you so much time in trying to determine whether to buy or sell.

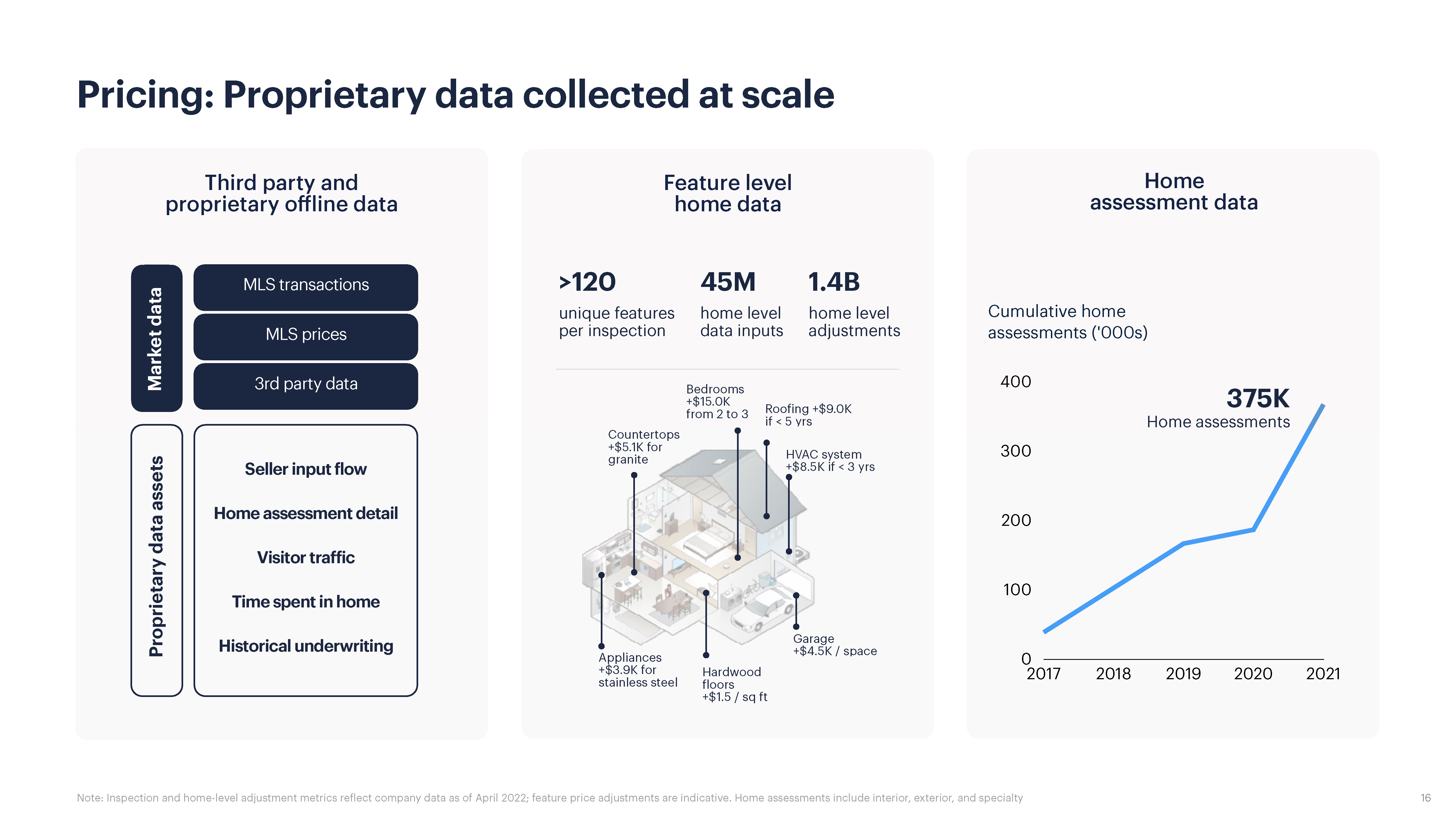

Here’s a slide from the Opendoor investor presentation:

From the shareholder letter:

As pricing is a key driver of conversion and buybox expansion, we continue to see our investments lead to improvements in our ability to competitively price homes across our markets. In Q1, we added new computer vision capabilities, which leverage AI to systematically derive information about home conditions, and we have processed over 500 million property images to date. This capability deepens our ability to build a training set and automate values beyond aggregated data, such as square footage and number of rooms, to more nuanced qualitative data, such as home condition and datedness. We are incorporating this new proprietary data into our pricing models and processes.

Unique supply, a deep-pocketed buyer-of-last-resort, and detailed property data. That there is one helluva two-sided marketplace, isn’t it?

And this is a two-sided marketplace where 80% of the sellers did not use an agent. Maybe 100% of the buyers used an agent in the transaction… or maybe not.

Cue dramatic music.

Clarity of Vision and Focus

Let me wrap up this very long, very detailed look at Opendoor with an observation that brings us back to the beginning. What strikes me the most about 1Q22 earnings is how Opendoor now has the clarity of vision and focus that used to belong to Zillow and Redfin. Eric’s note in the Shareholder Letter begins with “Transforming a $2.3 trillion industry is a rare and unique opportunity. As we reshape a broken, offline process into a digital, seamless experience, we are also building a durable, generational company.” It ends with “Last but not least, we focused on the consumer experience, delivering products and services that delight.”

These are the kinds of statements we used to get from Zillow and Redfin. Zillow in particular sounded a lot like this after the return of Rich Barton. Not anymore.

One result is that we are seeing the kind of innovation from Opendoor that we used to see only from Zillow and Redfin. Things like the computer vision to create proprietary datasets, building differentiated consumers experiences on top of unique inventory, rolling out Opendoor-Backed Offers, offering FHA/VA loans, improving margins, etc. etc. used to be the province of Zillow and Redfin. Now, Opendoor is leading innovation in real estate, as Zillow is trying to pull off a Back to the Future strategy and Redfin is engrossed in rentals and mortgages.

Another consequence is that Opendoor is now the most important company in real estate, strategically. Its efforts remain firmly focused on transforming the broken transaction process by leveraging unique inventory to build a superior user experience on top of it. Along the way, its two-sided marketplace has the chance to displace existing two-sided marketplaces that have rested on their laurels far too long.

The stock price is being punished and will be held down because Wall Street doesn’t understand real estate, and thinks a slowing housing market will negatively impact every company in the segment. Time will tell whether Opendoor can deliver on what Eric Wu and Carrie Wheeler said: that they are built for all market conditions and know how to adjust the dials up and down. Time will tell whether other macro factors, such as a changing regulatory environment and changing consumer preferences driven in part by the efforts of Opendoor and other innovators like them, will separate some companies from others.

I get the sense from this earnings call that the men and women over there at Opendoor don’t much care about share price; they have a vision of the future, and just want to deliver on that, and let the stock price take care of itself. Zillow used to behave that way too. It doesn’t anymore, as evidenced by all of its share buybacks in recent quarters.

So, it seems entirely appropriate to say that the King is dead and long live the king. The torch has been passed. A new chapter in the history of the industry begins.

Turn the page.

-rsh

PS: Time to use the original version by Bob Seger, since I used the Metallica version back in 2020.

1 thought on “Opendoor 1Q2022: The King is Dead, Long Live the King”

Comments are closed.