How to talk about Zillow’s 1Q2022 earnings call results and the commentary by Rich Barton and Allen Parker?

Let me put it this way: the first draft of this was over 7,500 words. After reading what I thought, I decided to summarize for everyone, including myself.

As a preliminary matter, I’ve been writing about Zillow now for 14 years, nearly its entire existence as a company. I’ve listened to every earnings call, looked through every quarterly report, because Zillow was The Most Important Company in Real Estate for at least the past decade. I loved Zillow’s “Consumer is Our North Star” culture, and its vision for transforming real estate. I’ve come to respect just about everyone at the company, and have friends there still.

Although I’ve been accused of being a Zillow shill by unhinged morons infected by Zaterade over the years, my friends at Zillow know that if I say nice things about them, it’s because they deserved it. And if I criticize them, they know it’s fair.

Well, I hope my friends at Zillow can maintain that sanguine attitude. Because this latest Zillow earnings call was the first time in my long history of covering Zillow, watching its moves, and listening to their executives when I was… what’s the word… bored.

What is increasingly clear to me is that the thrill is gone. Rich Barton returned to Zillow to do Zillow Offers. Leveraging technology and capital to fundamentally change how we buy and sell houses is what excited him, and what Zillow 2.0 was based on. That is now history, after Zillow shocked the world by abandoning iBuying in 3Q2021.

It feels to me like Barton and the whole team there are sort of going through the motions, saying things they don’t really believe in, doing things that appear to make sense without the animating passion behind any of it. The result is that the vision for Zillow 3.0 is a hodgepodge of copy-and-paste of old strategies by other companies mixed with hopeful statements masquerading as strategy.

Let’s get into it.

Behind The Numbers

Let’s just hit the topline real quick; anyone who cares can go pore through the financials that Zillow released. From the press release:

- Zillow Group’s Q1 results met or exceeded the company’s outlook at a consolidated level and for all three reportable segments.

- Consolidated Q1 revenue was $4.3 billion.

- IMT segment revenue grew 10% year over year to $490 million, above the $487 million midpoint of the company’s outlook range.

- Premier Agent revenue grew 9% year over year to $363 million, meeting the midpoint of the company’s outlook range.

- Rentals revenue decreased 5% year over year to $61 million.

- Homes segment revenue of $3.7 billion exceeded the company’s outlook as the wind-down of its iBuying operations continued to progress faster than anticipated.

- Mortgages segment revenue was $46 million, near the midpoint of the company’s outlook range, as rising interest rates impacted refinance activity more than expected.

- Traffic to Zillow Group’s mobile apps and websites in Q1 was 211 million average monthly unique users, a decrease of 5% year over year. Visits during Q1 were 2.6 billion, up 5% year over year.

- The company ended the first quarter with cash and investments of $3.6 billion, up from $3.1 billion at the end of Q4 2021, inclusive of the impact of $348 million in share repurchases during the quarter.

- Our Board of Directors has approved an additional $1 billion share repurchase authorization. We have approximately $100 million remaining under the previously approved $750 million share repurchase authorization. [All emphasis added]

Obviously, $4.3 billion in revenues is impressive, Zillow turned a profit after the disaster that was 3Q21, and traffic was impressive, and so on and so forth. It was a nice quarter.

However… the parts I’ve highlighted bear some… commentary as well as questions.

First, is IMT growth of 10% YOY and Premier Agent growth of 9% YOY really that amazing, when 1Q22 home prices were up 15.7% YOY according to NAR?

Remember that Zillow pivoted towards Flex a while back as how they want to do IMT in the first place, and most of the top producers and top agent teams that Zillow counts on are already on Flex. Flex is charged as a percentage of commissions, which is a percentage of home prices… which are up 16%. So why is 10% and 9% growth impressive?

Second, the now defunct Homes segment brought in $3.7 billion in revenue, exceeding Zillow’s expectations. Digging in a bit, I’m seeing that Homes brought in $184 million in gross profit at a 5% gross margin figure. A year ago, when Zillow was still actively managing Homes, it had 8% gross margins.

The question I can’t help but ask is how Homes might have looked in 1Q22 if Zillow had maintained that 8% gross margin number. Homes would have brought in $298 million in gross profit and likely would have posted positive operating income of about $90 million. Doing a straight fire sale dump of inventory, a lot of it to sophisticated REITs and institutional funds, Zillow made $3.7 billion in revenue. One wonders what might have been without a fire sale.

Third, traffic to Zillow in 1Q decreased 5% YOY? I’ve been tracking Zillow for a long, long time. And my stats show not a single quarter of YOY decreases in traffic until 3Q21, and now this makes the third quarter in a row when Zillow traffic decreased on a YOY basis. That this happened in the midst of the craziest housing market we have ever seen is something that somebody somewhere should ask questions about.

In fact, somebody somewhere should probably ask if it is mere coincidence that Zillow’s traffic started to fall YOY at precisely the same time when Zillow announced it was abandoning Zillow Offers.

Could Zillow Have Spent $1.75 Billion Differently?

Fourth, as this leads into an overall theme of sorts… Zillow has already spent $750 million to repurchase its own shares. The Board just authorized spending another $1 billion to keep repurchasing shares, to prop up the stock price. So that’s $1.75 billion so far, yes?

When Zillow made its astonishing announcement in 3Q21 about abandoning Zillow Offers, I noted that they wrote down $304 million in losses.

On October 29th, just before Zillow dropped the bombshell announcement, Zillow was trading at $105.79 per share. On May 6, the day after the 1Q22 earnings call, Zillow traded at $37.37, a 65% decrease. Zillow’s market cap went from $26.5 billion to $9.3 billion over that same period.

So let me ask a hypothetical question here. Back in 3Q21, I wrote a bit of alternative history fan fiction, in which Rich Barton announces the big loss, but shrugs it off because “we have $4 billion in cash, and we can take the hit.” Suppose Zillow then ends up writing down $1.4 billion in losses over 4Q21, but doesn’t abandon ship and throw the baby out with the bathwater.

Is that alternative-history Zillow in a better or worse position than the Zillow of today, who is spending $1.75 billion to buy back shares that have lost 2/3 of their value?

Zillow 3.0: The Housing Super App Company

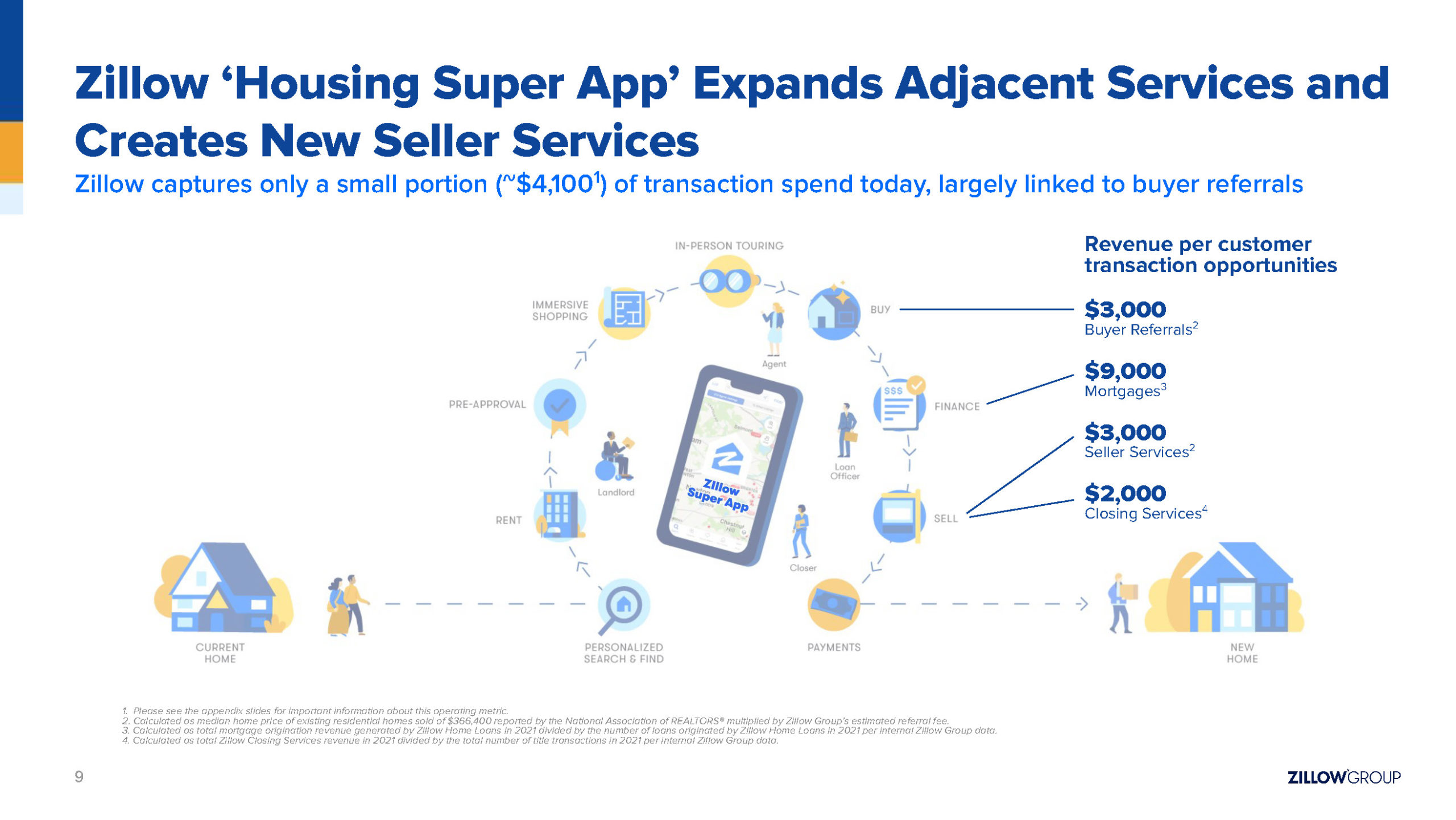

We now know that Zillow 3.0 is to become the Housing Super App company. There are five “growth pillars” in that strategy: touring, financing, expanding seller services, enhancing partner network and integrated services.

I have thoughts. And questions. And snark that is proving impossible to repress.

Pillar #1: Touring

Let’s start with the first pillar, touring. Rich Barton says:

First, touring is central to both increasing engagement on Zillow and increasing the number of transactions that we drive. We’ve made some key business and product improvements since you last heard us in February.

As a reminder, we believe touring is the key point-of-sale moment in real estate and an action that converts at three times the level of any other action buyers take on Zillow. And interestingly, with touring there are major innovations ahead in both the virtual home tour and the physical home tour.

As a threshold matter, allow me to point out that saying touring is the key point-of-sale moment in buying a house is like saying a test drive is the key point-of-sale moment in buying a car. It’s true, but it’s a banal truth. Saying that a tour is a key point of sale moment is only slightly less banal than saying that submitting an offer is a key point of sale moment, and that anybody willing to submit an offer is probably a very high-intent customer.

But it gets worse from there.

The Virtual 3D Tour Strategy

First up, Barton waxes rhapsodic about the “virtual touring experience we are creating with our 3D home tours” and says “Outside of how incredibly cool this feature is, it’s also a powerful mechanism to help us identify high-intent movers in our funnel.”

It’s as if Rich Barton has never heard of Matterport. Did none of his people tell him that this 3D home tour floor plan technology already exists and has existed since 2011 when Matterport was founded? Virtual tours and 3D walkthroughs are not new. They were incredibly cool a decade ago in 2012.

What’s worse, back in 2014, Redfin made a big deal about the fact that it was rolling out Redfin 3D Walkthroughs, powered by Matterport:

At Redfin, we are always looking for ways to make every part of buying or selling a home easier, faster and even more fun. Today, we’re accomplishing all three with the launch of Redfin 3D Walkthrough™. This online feature for Redfin-listed homes provides a high-resolution, interactive view from every angle inside a home and is powered by groundbreaking 3D scanning technology from Matterport. It is now available for Redfin listings in Seattle, including this home, and will roll out to other markets in the coming months.

So basically, the Zillow 3.0 playbook in 2022 is to copy the Redfin playbook from 2014? I guess that makes sense because that playbook was so successful in establishing Redfin as the dominant portal in real estate that can identify high-intent movers by giving them the kind of content they want?

Could ShowingTime Actually Be Zillow’s Big Bet?

Barton the focuses on ShowingTime, saying that they’ve seen “strong support from the industry” and that “no other company has been able to tackle this nagging industry-wide problem.” Then he says:

Of course, now that we have enabled the feature, we will need agents and homeowners to upload their schedules to make showing times real-time availability complete.

I need to point out a few things here.

First, investors don’t really understand the real estate industry, but they’re not stupid. And they can read Inman:

Within minutes of Zillow’s announcement Wednesday that it is acquiring showing management and analytics company ShowingTime for $500 million, dozens of real estate agents began weighing in to express frustration with the deal, as well as concerns about what it means for their data.

If they have Google, they can find articles like this one from Shaker.io titled, “5 Best Alternatives to ShowingTime for real estate” that tells you everything you need to know from just a screenshot:

So this whole “unsurprising industry support” thing should be taken with … well… a shaker.io of salt.

I used to joke that if Zillow bought Starbucks, REALTORS everywhere would suddenly discover that real estate runs on Dunkin. After what we’ve seen in the past year or so, I’m not so sure that joke is in fact a joke.

Second, we simply cannot overlook the whole “we will need agents and homeowners to upload their schedules.” While this is an entirely true statement, one wonders what the incentive is for agents and homeowners to upload their schedules might be.

Redfin tried this in 2015, when it made quite a big deal of its new Book It Now program. Here’s Glenn Kelman’s blogpost on Redfin announcing it and touting it. How much would you like to bet that the reason why Book It Now did not usher in this golden era of same-hour showings “coming from folks standing in front of a listing with their iPhones” is that other agents and homeowners did not feel the need to upload their schedules to Redfin?

Pillars #2-5: Financing, Sellers Services, Partner Network and Integrated Services

Regrettably, we don’t actually get any actual strategy on financing, seller services, partner network, and integrated services. Instead, we get statements of expectations.

Perhaps that’s because Zillow already told us a little bit about these pillars of growth in their February Zillow Investor Presentation deck. It is telling that they had nothing to add three months later.

The Housing Super App: What Everybody Else Is Doing, On an App

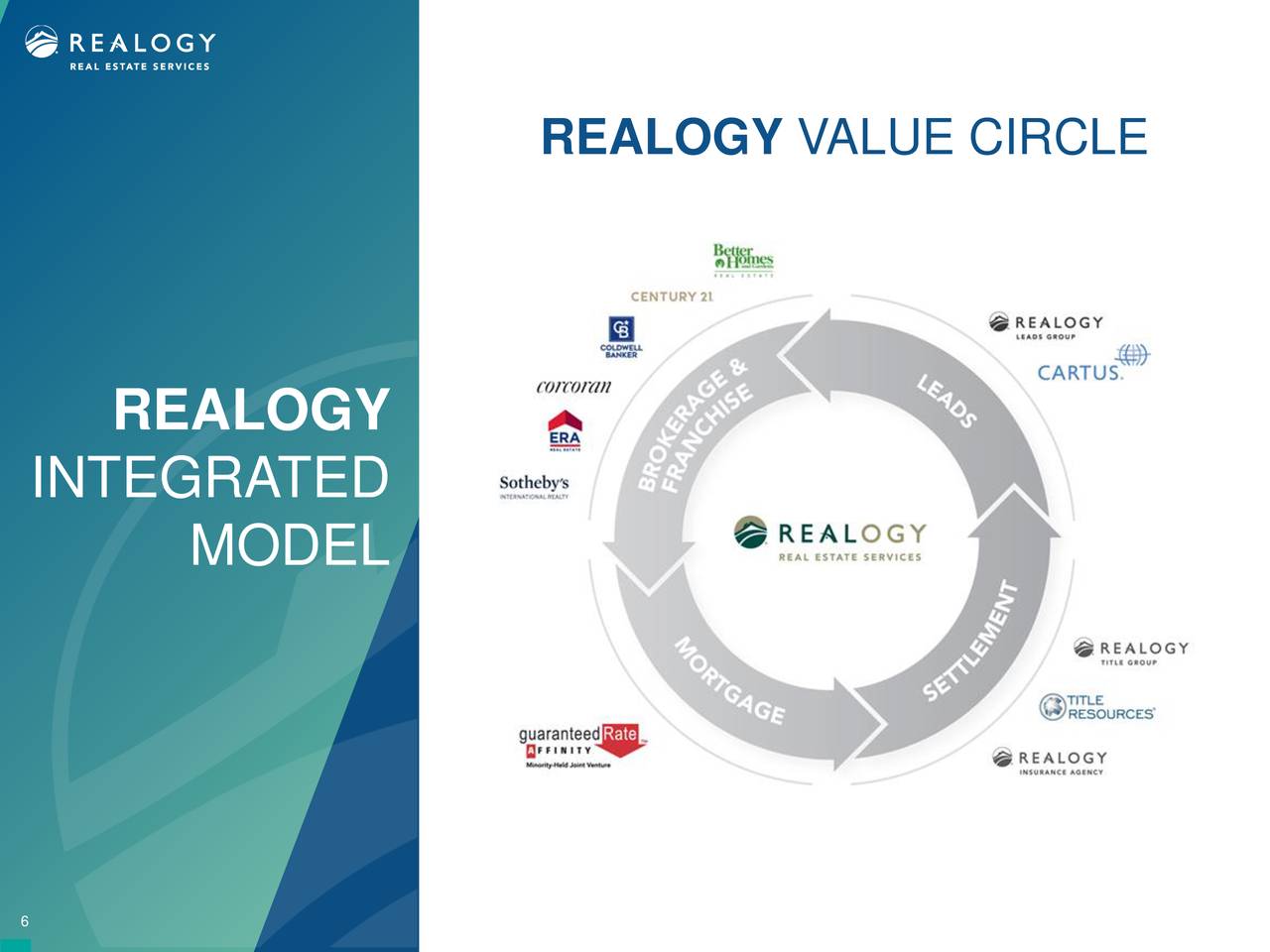

Fundamentally, you look at everything that is being proposed with the Housing Super App, and I just see a variation of the “one stop shop” strategy that traditional brokerages and franchises have had for over a decade or more.

Seriously, here’s the Realogy Value Circle:

What’s the difference between that and Zillow Housing Super App?

Where once Zillow pushed new strategies that the rest of the industry had to follow and react to, in 2022 Zillow is following the well-trod paths of the traditional brokerage industry.

What’s more, at least two other companies I can think of have built or is building a Housing Super App, “a place for all of these connected experiences to come together.” One is Redfin, and the other is Opendoor.

Redfin App

Redfin has an app. And Redfin has all kinds of connected services. You can buy a home, sell a home, sell your home directly to Redfin (which you won’t be able to do on the Zillow Housing Super App, mind you), get financing, arrange for tours, do virtual 3D walkthroughs, close your transaction, talk to real estate agents, and now with RentPath, you can rent a place and list a place for rent.

Literally everything Zillow Housing Super App promises to do in the future, you can do right now, today in the Redfin app.

Redfin has had this one-stop-shop super app now for years and years. And thanks to the power of this integrated one-stop-shop housing super app, Redfin increased its market share to all of 1.25% in 1Q22, up two whole basis points (0.02%).

I’m having a lot of trouble wrapping my head around why the Zillow Housing Super App will be different. In fact, the Zillow Housing Super App will be relying on “partner agents” most of whom have less-than-positive feelings towards Zillow.

Opendoor

Since I’ve already written at some length about what Opendoor is doing, I’ll just direct you to that analysis. Go read the section on the differentiated experience on mobile devices and how Eric Wu wants people to be able to buy a house from their mobile phone.

One thing I’ll point out: did you know that consumers can use the Opendoor app to schedule “on-demand tours for any home on the market” since 2019?

No Title

No Description

The Odd Conclusion: Zillow Boasts of its Balance Sheet

The strangely lifeless earnings call ends like this:

It is times like this when you all and we all turn from looking at revenues and income statements and we look at balance sheets, what boats are seaworthy if we’re sailing into some choppy waters overall. I know you’re doing that across your portfolios. We’re really happy here at Zillow that we have a strong balance sheet. We’re quite see where the – we’re looking down – down through the storm, and we feel good about our opportunity and the vehicle that’s going to get us there.

Yes, Zillow just boasted about its strong balance sheet, and suggested to Wall Street that they stop looking at revenues and income statements and focus more on balance sheets: how much cash you have, how much in assets vs. liabilities, etc.

HomeServices of America, a Berkshire Hathaway company, has entered the chat.

Even more importantly, Zillow’s balance sheet with $2.6 billion in cash and $1 billion in short-term investments looks remarkably similar to Opendoor’s balance sheet with $2.3 billion in cash and $900 million in Restricted cash & Marketable securities. But Opendoor also has $4.7 billion in Inventory, whose value went up 15.4% in Q1 of 2022 and will likely continue to go up double digit percentages for the rest of the year.

That’s not… a David and Goliath story anymore. If Zillow has an “ironclad balance sheet” going into the choppy waters, I don’t know that Opendoor is sailing into it in a patched up dinghy.

Barton and Zillow: The Thrill is Gone

As I said at the start of this long-ass essay, I think Rich Barton is going through the motions. He didn’t sound like the same guy on the 1Q21 earnings call, never mind the guy on the 2Q21 earnings call. Here’s what I wrote then:

Especially compared to the commentary, as well as the actions from Redfin, the other public technology company in real estate, the entire thing reminds me of a high stakes poker table. Barton is sounding and acting like the big stack at the table, bullying others out of pots by betting big, expanding the range, and keeping up the pressure. Kelman is being smart, being cautious, and literally telling people that anyone in the iBuying business should be scared and if they’re not scared, then investors need to be scared because of the significant risks involved.

It’s as if Rich Barton heard that, and said, “Hold my beer.” That man don’t sound scared in the least bit. And he’s challenging investors who are scared that he’s not scared, and he’s pushing Redfin and Opendoor and all the others to think twice about entering the pot against Zillow.

At the end of the day, Eisman and other skeptics like him may very well be correct, and Zillow might lose a lot of money, and many of its employees may be out on the streets. On the other hand, if the reward is control of the real estate industry in the United States, and permanently changing the way we buy and sell homes in much the same way that Amazon changed the way we buy and sell products… and you’re the big stack at the table… maybe the right play is to push all-in and dare others to bet their companies too.

As the noted financial analyst Young Jeezy once said, “Scared money don’t make no money.” I think you can call Rich Barton a lot of things, but scared money isn’t one of them.

The guy on this earnings call, telling Wall Street to look at derisked balance sheets, is not the same guy. He lacks the fire, the conviction, the fun of trying to change the way we buy and sell houses. Instead of genuine passion and excitement, I heard ennui and rote talking points. It was as if he really didn’t want to be there, but was gamely trying.

This was the first Zillow earnings call ever when Zillow executives said nothing of strategic interest, suggested nothing innovative, and said a few things that made me pause and ask, “Did he really just say that? Out loud?” Even the financial results were somewhat lackluster once you take home price gains into account.

For years, Zillow dictated where the industry was heading. I’ve written post after post detailing some of Zillow’s boldest moves, and the strategic moves Zillow announced always showed a deep and sophisticated understanding about how the residential real estate industry actually works.

I think Rich Barton, and with him Zillow, is a bit lost right now in the aftermath of the collapse of Zillow Homes. That was, after all, his baby and the reason he returned to Zillow in the first place.

The Stratechery Interview

Back in 2019, when Barton returned as CEO, he sat down for an interview with Ben Thompson of Stratechery. In it, he is remarkably open about why he came back:

I do want to thank you. Your strategic tear-down of Zillow [in that Article] as a kind of weak Aggregator, non-disrupter, kind of a leech on an existing business model versus the upstart who was really changing things really got to my core, because it was exactly for the real disruption and consumer empowerment reasons that we got into Zillow in the first place. Of course we needed to make a business out of it, so for a long time we figured how to make a business while we bided our time and waited for the right time to really attack the fundamental problem, and now we’re after it, so that’s great. [Emphasis added]

Zillow 3.0 is back to being a “leech on an existing business model” isn’t it? Do we really think Barton is passionate about that?

And after Thompson says that Opendoor opened Barton’s eyes to what was actually possible, we get:

Absolutely, I think that’s a fair characterization, really fair, and I guess I would modify the last little bit there to say that while Opendoor did show a very interesting idea for short-circuiting this transaction, of course that kind of cash offer thing existed before and we all knew about it. However, it had never been professionalized, but more interestingly, it was because they were going at it so hard and raising so much money from Vision Fund and what have you, they actually gave us the air cover to attack the transaction directly. It became an existential threat.

Has Opendoor ceased being an existential threat because Zillow thought market making was too risky? I would argue that if anything, Opendoor has become even more of an existential threat after being rescued by Social Capital. Opendoor’s 1Q22 results suggest as much.

Finally, here’s Rich Barton of 2019 contradicting the Rich Barton of 2022 after he’s asked about, “What happens when the market tanks?”:

There’s such a strong consumer signal on wanting to do it this way that I think, you’re asking an appreciation question which I’ll get to in a sec, but from a “Is the business going to wax and wane based on rising and falling markets?” Well right now, the consumer signal on wanting to try Zillow Offers or get an offer on their home is so strong that any kind of macro stuff is going be noise for a while. Our challenge is going to be capacity to serve.

…

And then there’s the “Ok, well you own this asset, and it starts depreciating, oh my god, you’re going to be more leveraged on that thing, your equity is going to get wiped out and you’re done”. Obviously we’ve run a bunch of Monte Carlo type simulations, looking back at history, and the biggest negative event we have is in our recent past in the Global Financial Crisis and even in the worst of all historical real estate disasters, prices actually don’t move very fast. They don’t move very fast and we are in, because by nature of our audience and all the data that we have access to in terms of marketplace activity, we are in a better data position than anyone in the country with all this data, we are in a very good position to understand when things start to look riskier. When things start to look riskier, we can increase our fee. And then as prices drop, we’re able to command better deals on the buy, so we’re taking a portfolio approach to this, we’re taking a long term view of this, and we are confident that we are in a data position to give us fair warning.

Is anything he said in 2019 no longer valid? If so, why isn’t it valid anymore?

This is what Barton truly believed in. This is what got his juices flowing, what got his passion going, and what brought him back to Zillow in 2019.

What keeps him at Zillow in 2022? Virtual showings? Enhanced partner networks and integrated services?

Barton’s Malaise = Zillow’s Malaise

I wrote above that it was telling that we got no new insight into Pillars #2-5. After three months of what one assumes is hard work after introducing the concept of the Housing Super App to the world, and laying out the ambitious goals they laid out, we got zip, zilch, nada in this earnings call.

In my view, given the respect I have for the people at Zillow, this happened because Barton himself is nowhere near as engaged in Zillow 3.0 as he was in Zillow 2.0. We see the result in the lack of clarity, lack of focus, and the lack of innovation on the part of Zillow’s overall strategy and vision.

That’s too bad. Zillow was and is a great company. It was the Most Important Company in real estate for over a decade. It set the agenda for the rest of the industry, and brought innovation after innovation to the market. Along the way, it became enormously successful and made billionaires out of mere millionaires. But as I wrote in the Opendoor analysis, Zillow saw something in 3Q21 that spooked them, and it dropped the crown. Opendoor has picked it up, and today, there’s a new Most Important Company in real estate.

Nothing is engraved in stone. Opendoor could stumble. The market could go pear-shaped. Barton might find something in Zillow 3.0 that gets him as excited as he was about iBuying. The team over there is among the best in the industry, and they could turn things around. I don’t count Zillow out, and neither should you.

Nonetheless, in May of 2022, after the 1Q22 earnings call, we all have to be honest and admit that the thrill is gone.

-rsh

No Title

Watch GIGS on Samsung TV Plus: https://www.samsungtvplus.com?action=play&target_tab=discover&target_id=GBBD3000004VR&target_type=1 Available to order now at https://mercury-studios.lnk.to/BBKingLiveAtMontreux93 B.B. King is the greatest living exponent of the blues and considered by many to be the most influential guitarist of the latter part of the 20th century.

Zillow didn’t burn the boats.

And when the going got tough, the boats looked REALLY appealing to the board.