Unless you’ve been living under a rock, you’ve now seen, heard about, or personally experienced the market crash that happened and is happening right now. The crypto twitter is aflame. Reddit is a wasteland. Telegram and Discord are panicstricken.

There’s a fair amount of dancing on graves, i-told-you-so and a fair amount of defensiveness.

I’m still all-in on crypto and blockchain, but I think it’s important to understand why. The “investment thesis” if you will. Far too many people went into crypto because of the promise of overnight riches, like so many have done and are doing with the NFT craze. The reason to write about that here is that there is a direct implication for real estate, as I’ll explain.

Not All Digital Assets Are the Same

First, I’d suggest reading this post I wrote in January. I explain the difference between all the different terms that people were throwing around interchangeably.

When it comes to crypto, I still stand by this:

I do think it is important to distinguish between Bitcoin, which is intended to be pure money and nothing else, and altcoins that are intended to be useful in some way, shape or form. In a weird way, the altcoins have more “intrinsic value” than Bitcoin does.

The analogy I use to distinguish is that Bitcoin is most like digital gold, while altcoins (particularly Ethereum) is most like digital oil. Both are valuable, but for different reasons. Oil has far more intrinsic value than gold, since it can be used to power the world, but gold is a purer form of money as a result.

There were, are, and will be different “investment thesis” for Bitcoin vs. all other coins.

Bitcoin Investment Thesis

Fundamentally, the investment thesis behind Bitcoin is that the global fiat money system will collapse. Why? Because all fiat money systems historically have all collapsed, and human nature (aka, politics) dictates that fiat money systems all must collapse. As they saying goes, “all fiat goes to zero.”

While you can research that phenomenon yourself, what I find more compelling is someone who isn’t a rando pushing gold or bitcoin. Someone like say Ray Dalio:

“Central banks want to stretch the money and credit cycle to make it last for as long as it can because that is so much better than the alternative. Fiat money leads to the debasement of money,” said Ray Dalio.

That’s the reason why you buy Bitcoin. There really is no other reason to buy Bitcoin. It doesn’t do anything else. It exists for the sake of being a pure money that cannot be debased because it cannot be controlled.

This is the same reason why people buy Gold. They think the fiat money system will collapse, and humanity will return to using the One True Money in the history of humanity: gold. The difference between gold bugs and Bitcoiners comes down to the Bitcoiners believing that technology lets the world use a superior form of gold for its monetary base. Again, you can research that if you’d like; there is no shortage of people explaining why they prefer Bitcoin to gold as the ultimate form of money and there is no shortage of people explaining why Bitcoiners are dumb as rocks and will lose all their money. Then you have those who think both gold bugs and Bitcoiners are cuckoo for Cocoa Puffs because they don’t understand that fiat money is backed up by nuclear weapons and aircraft carriers. You decide which you are.

However, if you bought Bitcoin because you believe that eventually the fiat money system of the world (which basically means fiat US Dollar) will collapse, then why would you freak out because Bitcoin dropped by 60% or 70% or 90%? Why would you celebrate if Bitcoin doubled in value? The fiat system has not collapsed. Until it does, your Bitcoin really isn’t worth anything.

On the other hand, if you bought Bitcoin at $50K because you thought it was going to $150K, then yeah, you’re probably freaking out right now. Your investment thesis was, “Number goes up!” When the number stops going up and starts going down, then your investment thesis is null and void. Panicking is 110% warranted in that case.

Altcoin Investment Thesis

The investment thesis for everything not Bitcoin — Ethereum, Solana, Algorand, etc. etc. — is different.

I invested in Ethereum because I think it will be the basis of a new way to do computing. ETH, SOL, ALGO, ADA… all of these have value insofar as they serve as the fuel for computing machines on the internet. If they do not, then they have no value.

As my analogy above says, if Bitcoin is digital gold, then Ethereum (and most altcoins) are digital oil. If there are millions of cars that need gasoline, and millions of homes that need natural gas for heat, then oil will be valuable. If there aren’t, because we’ve transitioned to green energy or nuclear power, then oil won’t have any value.

Similarly, ETH is valuable insofar as it is necessary to run smart contract programs written on the Ethereum chain. The implication then is that ETH’s value is directly tied to what kind and how many smart contracts are written on the Ethereum blockchain.

This, I think, has been, is and will remain one of the weaknesses of altcoins.

Crypto Killer Apps Are Too Crypto Focused

For a while now, I’ve been thinking that as cool and as fantastic as some of the crypto/blockchain applications are, they’re all kind of… inwardly focused.

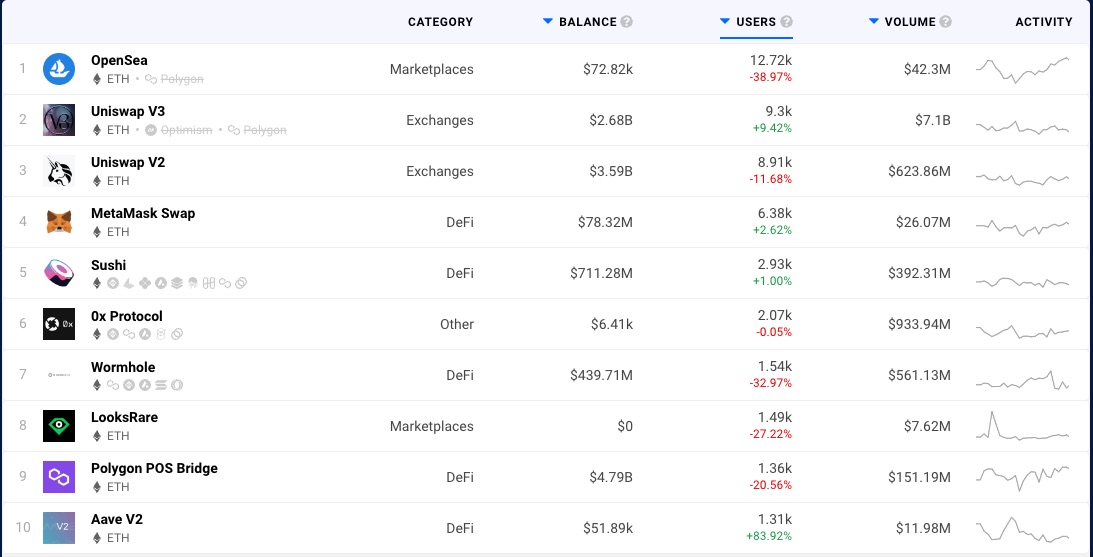

For example, think about some of the bigger apps out there on the various blockchains. Here’s the top ten for Ethereum:

OpenSea and LooksRare are NFT marketplaces, so for the most part, it’s a place for cryptonerds to get together to buy and sell JPGs of “rare art” to one another.

Uniswap v2 and v3 are decentralized exchanges (DEX) that let crypto users change one kind of crypto for another: swap ETH for USDC, for example. MetaMask Swap is the same thing, as is 0x Protocol.

Wormhole and Polygon POS Bridge both let users swap one crypto on one blockchain for a different crypto (or same kind of crypto) on a different blockchain. So if you want to exchange your ETH on the Ethereum chain for WETH (“Wrapped ETH”) on the Solana blockchain, you use Wormhole to do that.

Sushi and Aave are used for crypto users to borrow and lend crypto to one another, mostly for speculation.

All of these are incredibly cool, cutting edge technologically, and made by some of the smartest engineers and finance minds in the world. I have used and continue to use almost all of them (except the NFT stuff, because I don’t NFT) for playing around in the crypto and DeFi spaces.

But that’s just it: all of these apps are useful for playing around in crypto and DeFi spaces, and not in the least bit useful to the real economy, to the real world.

Thinking About Web 2.0 World

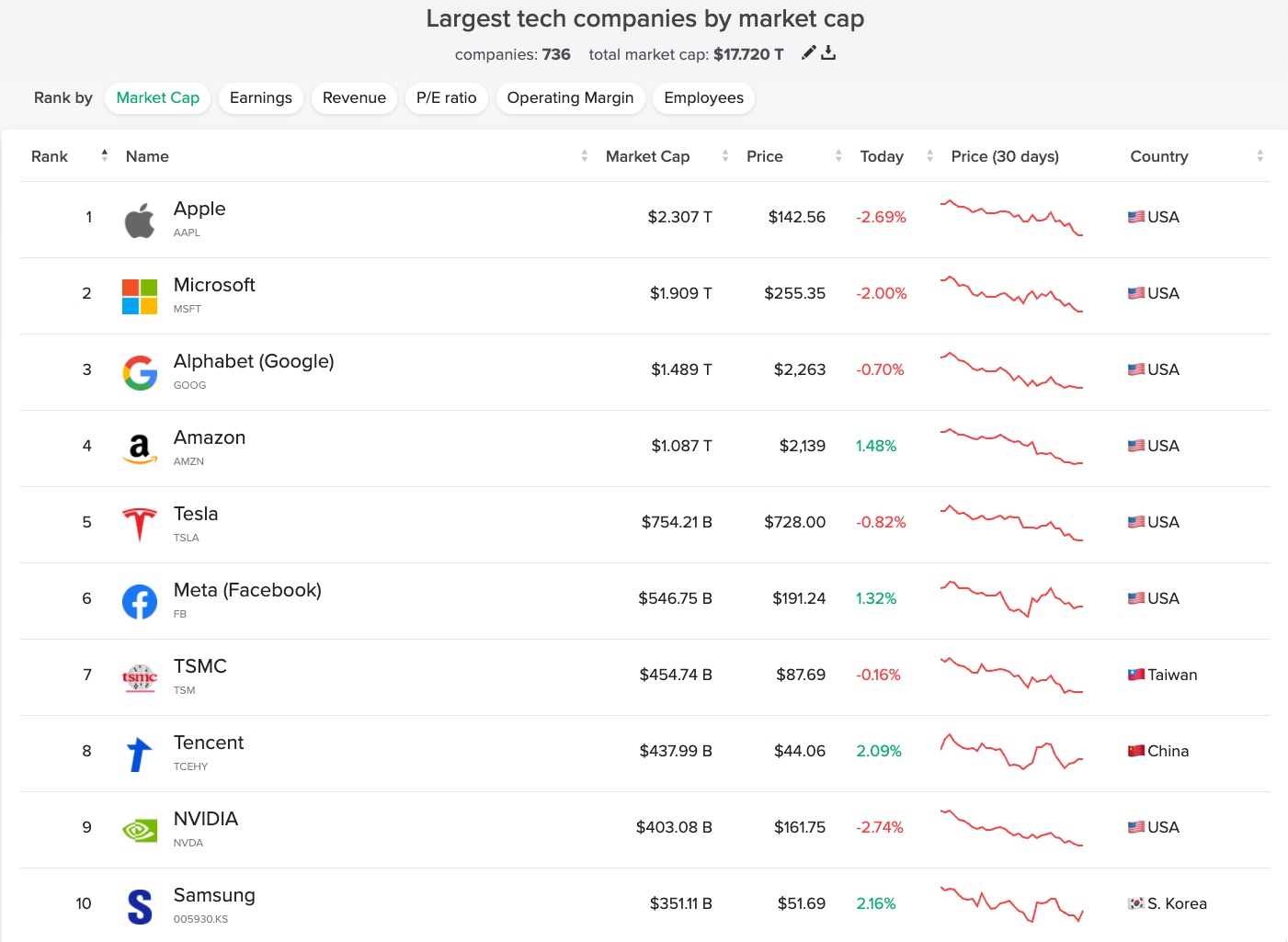

Consider the Web 2.0 world we live in today. Look at the top tech companies by market cap:

All of them have a direct relationship to the real world, to the real economy.

All of them except Tencent (as far as I know) make hardware, for example. Even Microsoft, Google and Facebook, which are known primarily for software make hardware devices: XBox, Pixel, and Oculus. Tesla makes cars. Samsung makes physical electronic devices from cell phones to monitors to TVs and refrigerators. Amazon makes Kindles and Alexa devices. These tech companies make real physical things for the real world.

They also make a lot of software, but the software they make directly impact the real world, the real economy. I still do spreadsheets on Microsoft Excel, but sometimes, I use Google Sheets. Most of us use Gmail in some form or another, and if we don’t, we’re probably using Microsoft Outlook. Maybe a few use Apple Mail.

The most self-referential of these might be Amazon with AWS and Microsoft with Azure: providing cloud computing to other software companies is big business, but those other companies then create software for the real world.

This was not always the case. The very first websites, the very early Web 1.0 project and companies, had a rather tenuous relationship with the real world, with the real economy. So much of the underlying infrastructure was undeveloped.

My first startup, The Dojo, was ad-supported. But the ads did not link out to ecommerce websites, because ecommerce did not exist. Ecommerce did not exist, because online payment systems were in their infancy. Our advertisers had to include phone numbers that people could call to place orders, or put up a form where users can sign up to receive a physical mail-order catalog.

It took years of technology advancement, business changes, cultural shifts and regulatory changes to build out the infrastructure for what we now think of as the worldwide web to come into being.

Crypto and blockchain technology, as enabled by altcoins, have not reached this level of maturity yet. And that weakness showed the past few days.

No one was propping up the price of Ethereum, because without it, they couldn’t run their server farm for their accounting firms. No one said, “Crap, if Solana goes down, we can’t maintain our medical records.” No company anywhere was worried about not making payroll if Uniswap stopped working.

Of the 13,000+ crypto coins listed on Coingecko, not one had a real connection to the real world. Not yet.

Blockchain, Crypto and the Real World

I believe that for blockchain technology to achieve its breakthrough, and for crypto to become truly useful, developers must build software that directly impact the real world, just like the Web 2.0 software impacts the real world. We don’t need many more DEXs to enable swapping one crypto to another; we need software that real people will use to transact real business in the real world.

The crypto crash of 2022 might wipe out thousands of coins that power software with no utility in the real world, and that’s good. Because if altcoins are digital oil, then the software apps that these altcoins fuel/make possible must have some utility in the real world.

Because of the nature of blockchain technology, I believe there are three main areas where we’ll see this happen:

- Fintech

- Privacy Information Technology

- Governance

Fintech is pretty obvious, since so much of crypto today is focused in the financial world. DeFi is here and it’s likely here to stay for a variety of reasons. More on this below.

Privacy IT makes sense because we all live now in a connected world thanks to Web 2.0. That has been wonderful in many respects, but it has also been horrible in other respects. Social media was supposed to connect us to our friends and let us discover new friends and build new communities. It has also led to conflicts, tribalism, outrage mobs, and bitter division. We are all becoming aware that the convenience of modern technology has a dark side in invasion of privacy and tracking every move we make online and offline.

So I think one of the killer apps of blockchain will be some form of digital self-sovereign identity, that allows each of us to control access to information about ourselves while keeping options open to get better services or guidance or value by sharing our personal information with others. Whatever coin powers that will become enormously valuable, as it will become digital oil to power the privacy machine.

Governance is another obvious area, but I don’t think we see it in politics first. I think we see it in private organizations, like country clubs, homeowner associations, and other voluntary membership organizations. This is one reason why I think REALTOR Associations are ideally suited to be operated as a DAO. The crypto coin that powers these self-organized, self-regulated entities will have real world value.

Real Estate and Crypto

Prior to the crash, there has been a bit too much irrational exuberance in the real state space for crypto. I say that as one of the true believers in blockchain technology, in the inevitability of Bitcoin, and the power of crypto. When we have real estate agents trying to become “crypto-certified” when all that was really happening was buyers selling crypto for USD (or borrowing USD against crypto holdings) to buy a house, I’ll submit that we had a bit of over-enthusiasm going on.

I’m going to guess that many of those buyers who borrowed USD against their crypto holdings had to scramble to cover their collateral in the last few days. Those who sold their ETH to buy a house should thank their lucky stars for now… until ETH rebounds, that is.

This crypto crash, I hope, will wipe out such shallow interest and replace it with a deeper appreciation of what this technology is and is not, what crypto is and is not, and a new focus on what can and should be done with this technology.

Real estate being an adjacent industry to finance, the fact that fintech will be one of the main areas for real world application is good news. For example, Figure and Apollo partnering to use blockchain for trading mortgages is a step forward… and that’s the kind of software that directly impacts the real world.

But what makes real estate special is that we deal in the ultimate real world property: land and buildings. Propy and Fabrica trying to tokenize property ownership are creating software that directly impacts not just the real world, but the physical world in a way that finance usually does not. Mortgage notes, after all, are still just financial instruments; an acre of land is rocks and soil and plants and all that which forms a part of Earth, a real part of the real world.

There will be other areas of real estate that can and should utilize blockchain technology and crypto-as-digital-oil to create new software that directly impacts the real world. I can brainstorm a few, and I’m sure you can too.

I am genuinely hopeful and excited that after the crypto crash, developers will realize that they need to do more than build more super-slick smart contracts that lets crypto users play with crypto in interesting and complicated ways with zero impact on the real world. I am hopeful that more and more of them will look at creating software that touches the real world, in much the same way that Microsoft and Facebook’s software touch the real world, but using the specific attributes of blockchain and crypto technology that cannot be duplicated in any other way.

I think real estate and commodities, because they are physical parts of the financial system, lead the way in that next phase of development of blockchain, of crypto, and of DeFi. It will be great to see the refugees from a bunch of failed DeFi protocols and crypto token projects turn their eyes towards real estate and commodities and try to figure out how to apply what they know from the Web3 world to the real world. Some of us from this real world with an appreciation for the Web3 world will be right there to help create the future.

What is meant to be, will be. After winter, must come spring. Change, it comes eventually.

-rsh

Lauryn Hill – Everything Is Everything (Official HD Video)

Lauryn Hill’s official HD music video for ‘Everything Is Everything’. Click to listen to Lauryn Hill on Spotify: http://smarturl.it/LaurynHSpotify?IQid=LaurynHEIE As featured on The Miseducation of Lauryn Hill.

As the token East German judge, I award this mental gymnastics routine zero points.

It’s sad to see you continuing to chug snake oil while nearly everyone else with your level of education and expertise have long since spit it out. I’m tempted to pity you for being stuck with the bag, but I see you’re still trying to pass it off to your readers.

Once again: Blockchain is nothing. Crypto is a scam machine. “Digital gold” and “digital oil” are worthless.

The idea of a “blockchain” dates back to the late 1970s and early 1980s. Distributed computing (which crypto blockchains call “decentralized” and use as proof mechanisms) is almost as old as the internet itself. Bitcoin brought together these two actually useful ideas into a “decentralized blockchain” in January 2009.

In the 13+ years since, “decentralized blockchains” have not solved a single real-world problem, benefited anyone other than those who got in early on crypto pyramids, or improved any existing technical process. The smart people “working on” decentralized blockchains spend their time trying to polish technological turds, working on ways to solve problems inherent to the technology. The field’s only “progress” has been in papering over the flaws of designs that, by their core principles, are inefficient and destructive.

I understand the appeal: the way modern society organizes its banking, finance, and monetary systems is corrupt and easy for those with wealth and power to manipulate and abuse. Wouldn’t it be nice if we could fix those problems with technology?

Unfortunately, that’s as far as the decentralized blockchain ever got. I agree that centralized money systems have deep problems that should give us pause. “DeFi” solves none of these problems and introduces countless new ones.

Advocates of decentralized blockchains have had over 13 years to offer even the slightest evidence of their utility and come up empty-handed. Still, you drink poison and pass us the cup. If your best argument is, “someone smart may figure out a way for this to work,” we’d be fools not to slap it out of your hand.