This is a public call for help. I’m not ashamed to admit it. I spent the last month or so trying to understand the view that higher interest rates, leading to higher mortgage rates, will tame the crazy housing market. Macroeconomics being what it is — at times, I feel like it’s a mystery wrapped in voodoo — I think I need help understanding exactly how this will work.

The best proponent of this idea is, I think, unquestionably Logan Mohtahshami, the chief economist of HousingWire. And this article from yesterday titled “With home sales down, why are home prices still up?” is the best example of the argument that higher rates will fix the housing market. The subtitle of the article is, “June’s housing data shows why we needed higher rates.”

I could just ask a series of questions to Logan on Twitter, but my thoughts and questions are not well-suited for the 140 character limits on that platform. So I figured I’d just write this post, then put it on Twitter. 🙂

I’ll be going through Logan’s article in some depth, so please read the article in full on HousingWire.

Let’s get into it.

The Basic Argument

Again, I’m not 100% certain that I’m following Logan’s argument here, but I’ll try my best to summarize what I think he’s saying. Logan has been calling the housing market of the past couple of years “savagely unhealthy” and the prime cause is lack of inventory.

Right at the start, he writes, “home prices could accelerate more in this period than we saw in the previous expansion if inventory channels broke to all-time lows.” Well, inventory has been at all-time lows.

So he writes:

After 2021 ended and my price-growth model was broken after only two years and we started 2022 at all-time lows in inventory, I labeled the U.S. housing market as savagely unhealthy. This problem is much different than the housing credit bubble of 2002-2005. Back then, we had higher sales, higher inventory, and less price growth, but we had a massive credit bubble. Today we have fewer sales, few listings, and much hotter home-price growth.

He then details that inventory kept going lower and that “we needed rates to rise to try to cool this market down.”

Nonetheless, the June housing data is showing ginormous declines in transactions, purchase mortgage applications, with ginormous increases in home prices. He details two:

- Las Vegas home sales were down 24% year over year as median sales price was up 21% year over year.

- Orange County, California attached homes in June, sales were down 27.2%, and prices up 17.8%.

Then he asks us to imagine just how crrrrrazy prices would have been if mortgage rates had not gone up and we hadn’t taken a big hit to affordability. As he says:

In the middle of the drama of higher rates, my bigger fear is actually if rates go down again. Home sellers and builders had too much pricing power, pushing prices to the extreme. My five-year growth price model got smashed in two years, and things worsened in 2022 before rates rose.

Remember, we all want a balanced housing market; it’s a good thing, not bad. So the goal for me lately is to see total inventory get back to 2019 levels. That will be positive, and we are working our way there, we just need more time because the housing market of 2022 is not the forced credit selling housing market of 2008. I don’t need the housing market to have 2012, 2014, or 2016 inventory levels to be balanced — I just need 2019 inventory data, which is between 1.52-1.93 million homes, using the NAR data.

We are nowhere near 1.52 million homes in inventory today. Altos Research says inventory rose dramatically over July 4th weekend, but we’re still below 500K in inventory.

So, the idea is that with rates high, demand will fall, which will reduce the pricing power of home sellers and home builders, so prices will come down. As Logan writes:

To wrap up, I labeled this market savagely unhealthy earlier this year because I knew what this data would look like. Home prices are growing even with higher rates, so we aren’t benefiting from falling home prices, even though sales are dropping. This has happened before when rates rose, sales fall, and price growth would cool down but not go negative.

However, it’s a different ball game here in 2020-2024. The S&P CoreLogic Case Shiller Home Price Index, while it lags, still shows 20% plus year-over-year growth. In the past, with higher rates, the growth rate would cool down toward single digits. Clearly, we aren’t there yet, but we should be getting there in time with the rising inventory.

What I’m failing to understand, and why I need help understanding it, is why that would result in more inventory rather than less.

Why Does Anybody Sell a House?

The first question is to start with basics. Why does anybody sell a house? Turns out, there are three different kinds of sellers and they all have different reasons. Let’s treat them in turn.

Homeowners (aka, consumers)

First group are average people like you and me who own their home. They live in the house, raise their kids in the house, and presumably, most of them are more or less happy with their house. Why would they sell?

Given the stress and expense of selling one’s home, then finding a new home, then moving (I swear, if I ask Sunny to move again, there are real questions as to whether the marriage survives….), regular homeowners simply do not just sell their homes willy-nilly. There has to be a very, very, very compelling reason to move.

The Balance has a list of reasons why people sell their homes. But experienced real estate agents know that the real reasons are big-time life changes. We’re talking about things like death in the family, divorce, new job requiring relocation, downsizing because of empty nest, birth of a new child, etc. In some cases, they sell because of serious medical situations and they absolutely need the money.

Looking at the list of things that make people sell their homes, I am simply not convinced that mortgage rates enter into the picture. “Oh damn, honey, mortgage rates are going to be above 7% soon, so we’re going to lose pricing power. Let’s pack everything up, take the kids out of school, and move away from our friends and neighbors so we can take advantage of our pricing power today,” said no one ever.

Nor am I convinced that high home prices enter into it either. Who cares if your family house doubled in value? When you sell and move, you’ll be paying top of market prices for your new house as well. Most people who are selling are doing so in order to buy their next house. So unless you’re forced to move (see the list above) or you’re doing geographic arbitrage (moving from LA to Austin), what do you care what home prices are?

The idea that higher rates will lead to more homeowners wanting to sell their family home just doesn’t compute for me. At all.

If you can explain that, please do, like I’m a five year old.

Investors

The second group are not homeowners, but investors. They didn’t buy the house to raise their family in; they bought it as a store of value and as a cash-flowing asset via rental income.

This group would care a great deal about both the price of the property and the loss of pricing power from higher rates.

I have one friend who is a pretty big real estate investor, and he sold two houses this year. He bought low, and sold high; that’s what investors do. And he did a lot of analysis and calculations and came to the conclusion that selling now maximizes his returns.

But here’s the thing: he fully intends to go back into the housing market, once prices have dropped thanks to higher rates doing demand destruction. He wants the cash now to have dry powder for when opportunities arise in the future.

Part of that calculation, however, is what kind of rental income he could get from his properties vs. cashing out now. In his case, with his properties in the markets they were in, he thought selling was better than holding on.

For a lot of investors, however, that math isn’t going to work that way. Why?

Because higher rates means fewer buyers, which means more renters. Limited supply and more demand = higher prices. That’s like Econ 101.

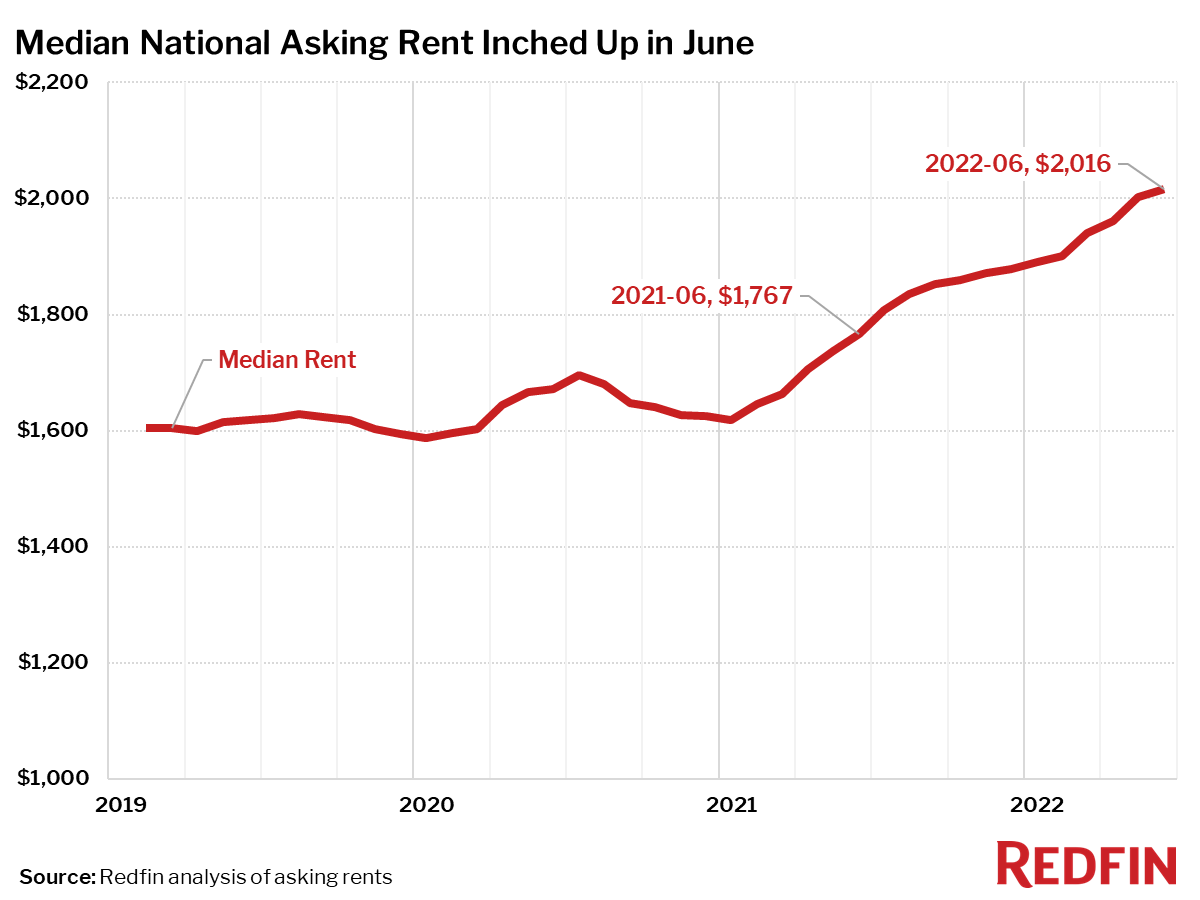

And rents are skyrocketing (or were). From Redfin:

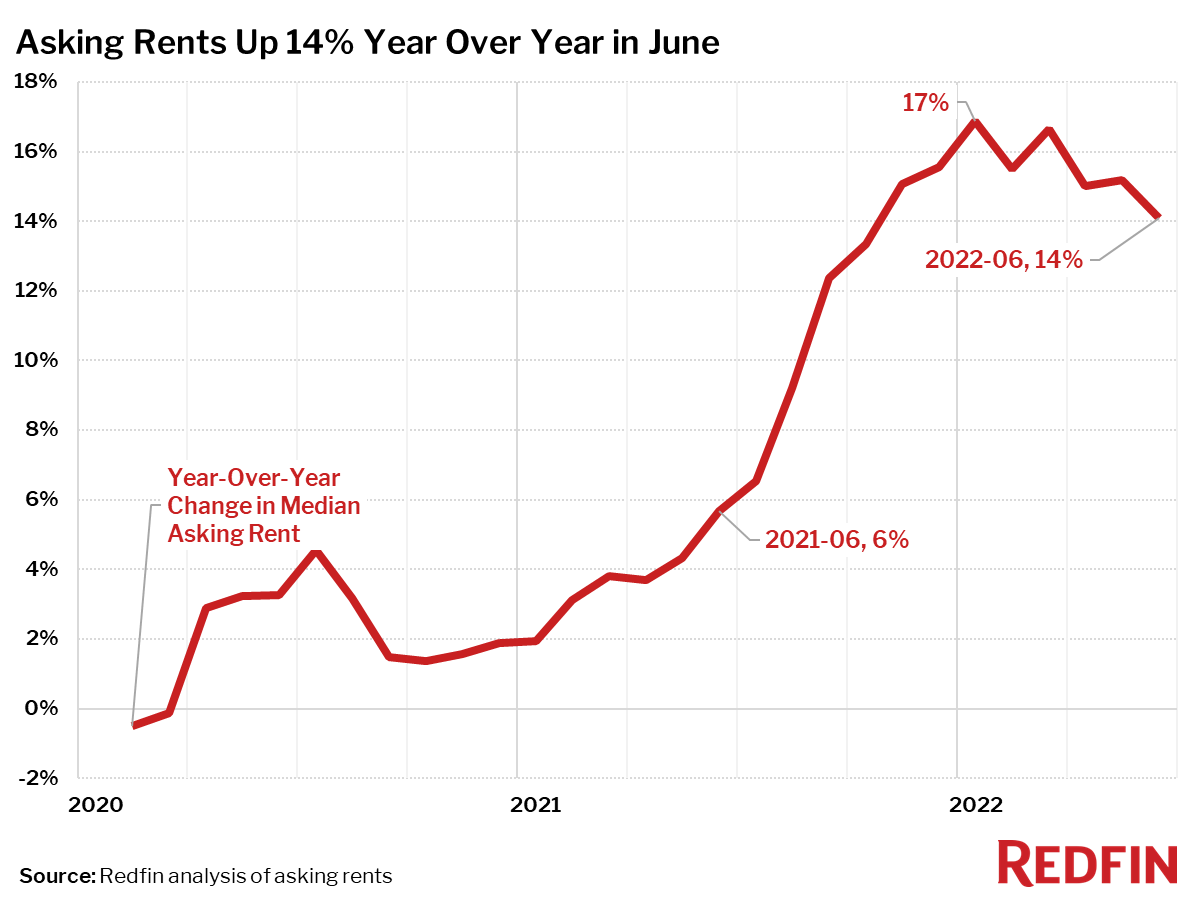

Now, Redfin (and others) are pointing out that rental growth slowed in June, because landlords were taking the ability of their tenants to pay into account. So this graph is one you might see more in the media:

But up 14% YOY is still up 14% YOY. And in cities like Austin and Nashville, rent increases were over 30% YOY.

Nonetheless, as Daryl Fairweather, Redfin’s economist, wrote in that article:

“Rent growth is likely slowing because landlords are seeing demand start to ease as renters get pinched by inflation. With the cost of gas, food and other products soaring, renters have less money to spend on housing,” said Redfin chief economist Daryl Fairweather. ”This slowdown in rent increases is likely to continue, however rents are still climbing at unprecedented rates in strong job markets like New York and Seattle and in areas like San Antonio and Austin that soared in popularity during the pandemic.”

I’m not disagreeing with her, but I will point out that rent is like gas and food. It isn’t like ‘other products’ whose costs are soaring. Rent has to be paid if you want a roof over your head. People will need to cut out ‘other products’ from their budgets before they cut out rent.

That’s before we take the cost of moving into account. Say your rent was $1,800/mo in June of 2021 when you signed your lease. Your new lease is asking $2,200/mo, a huge increase. What would it cost you to move? If you’re a single twentysomething, I suppose you can get by with a buddy who has a truck. If you’re a family in a 3BR apartment, just the cost of moving might be more than $4,800.

Now add in the fact that thousands of people and families won’t be buying their house after all, because higher rates mean that they no longer qualify for the mortgage needed to buy that house. How does that not turn into a tailwind for rent growth?

So investors might want to sell as rates inch higher, because they believe (correctly?) that the price of their asset will fall as demand (for purchase) is destroyed… but the price of the cash flows their asset generates will rise as demand (for rent) is created, no? Am I missing something here?

Please explain to me how higher rates make investors want to sell their property more.

Homebuilders

The last category of people who want to sell houses are those who actually build the house in the first place.

As rates climb, these homebuilders are seeing deal flow dry up, cancellations increase, and higher prices far more difficult to maintain. As Logan said, they are losing pricing power because demand is going away.

Thing is… those houses they no longer have pricing power over are already in inventory aren’t they? Whether they be spec homes that the builder put up thinking he’d be able to find a buyer, or plans drawn up for immediate construction as soon as a buyer signs on the dotted line, those houses are already in inventory, no? Again, I might be missing something here, so let me know.

On the other side of the higher rate equation is the fact that the higher rates for mortgages and for construction financing mean that builders are pulling back and pulling out. Logan himself notes this:

Keeping in line with my summer of 2020 premise that for the market to change, it needs a 10-year yield above 1.94% and with duration to impact sales negatively. The new home sales sector will slow down like it always does. Even in March of this year, when the data wasn’t terrible, the industry was at risk.

The linked article is to one he wrote (behind a paywall) with the title, “New home sales are at risk with rising mortgage rates.” And it makes the reasonable and eminently logical point that when demand drops off thanks to higher rates, homebuilders stop building homes.

Here’s a news article talking about just that in Dallas Morning News:

Home builders are tapping the brakes on construction as higher mortgage rates turn buyers away.

Builders started construction of 14,871 new homes in the second quarter, down 7% from the first quarter’s record 16,012 starts, according to Dallas-based Residential Strategies Inc., a research and consulting firm that tracks new home activity.

“Progressively, as we’ve gone through the last three months and the traffic and sales have moderated, the builders are changing their approach to the market,” said Ted Wilson, principal with Residential Strategies.

You don’t say! You mean companies will behave in entirely rational and predictable ways when their products stop flying off the shelves?

Three Ways to Solve Pricing Problems

The reason why the homebuilder element is so important is that there really are only three ways to deal with high prices, and only one of them actually work.

First, you can subsidize demand. That is, you can send money to buyers and renters in a variety of ways. This is what we have been doing since the New Deal in a variety of ways. This only works in the short-term, and only for those buyers and renters who can get their hands on the money. But in the medium and long term, all that demand subsidies do is to encourage sellers to raise prices. We’ve now seen this in action for some 70 years, and more immediately, we’ve seen this in the post-COVID stimulypto party since 2020.

Second, you can put in price controls. That is, you can set a ceiling on price by law that people who want to sell can charge. So if you charge too much, men with guns will show up at your office or house and arrest your ass (eventually… since all law enforcement ultimately ends up in men with guns). We’ve had this in place in a variety of cities (New York most prominently) and we’re about to see it across the country. But that just ends up in shortages since nobody has any interest in losing money on purpose by selling or renting for less than cost of production or maintenance.

Third, you can increase supply. More houses built = more competition = lower prices for buyers and renters.

Unfortunately for all of us, this third path is what becomes untenable with higher interest rates. Builders stop building. Homeowners stop putting their houses on the market if it is at all marginal (“Boy, it really would be nice to have some more room, but at these rates? Why would we trade a 3% mortgage for a 7% mortgage just to get a little bit of extra room?”), and investors have to start calculating ROI from cashing out vs. ROI from rents that can go nowhere but up.

Perhaps “Inventory” Doesn’t Mean New Inventory

Maybe the way to understand the argument isn’t that higher rates will lead to more homeowners, investors or homebuilders wanting to sell. Maybe Logan’s argument is simply that those people who are forced to sell for whatever reason will not find ready, willing and able buyers. So the houses will just sit and sit and sit, until the seller cuts prices enough to reach the new lower market-clearing price.

The argument then is that by killing off demand, we’ll just force homeowners and investors to accept a lower price for their properties. Homebuilders will accept a lower price for existing inventory, but then they’ll just stop adding new inventory.

I guess the thinking is that because people have no choice but to sell their homes due to major life changes, or builders have no choice but to build houses because that’s kind of their business, we’ll see new inventory added no matter what the price is due to higher rates.

Maybe.

Except I can’t help but keep going back to something I pointed out a year ago. Housing makes for a fantastic hedge against inflation. And if you’re tired of getting negative real yields on your bonds, and you’re a big ass institution, why wouldn’t you park your money in housing? If you’re that big ass institution, which typically supplies money to the bond market rather than borrow from it, do you care all that much what the mortgage rates are?

Let me put it differently:

- Nominal inflation is 9.1%; true inflation is likely double digits.

- Big hedge funds can get 6% from providing funding to mortgages, which means a negative 3% guaranteed loss.

- If you’re dumb enough to buy US Treasuries, you’re locking in more like 7% guaranteed losses.

- Despite this demand destruction, real estate prices are up 20% YOY.

- Rent is going up 14% YOY, factoring in the likelihood of recession.

- Inventory is going up, not because of new inventory but because of existing inventory just sitting there for weeks and months.

- You’re a cash buyer talking to a freaked out seller whose house has been sitting on the market.

Why wouldn’t you just buy up the inventory on the way down, for cheap?

New inventory is unlikely to be added in the high rate environment, so your investment will increase in value over time (demand subsidies are the government preferred tool for dealing with affordability issues). Rental demand is about to increase as purchase demand is destroyed.

Once existing inventory is gone… then what?

Wrapping Up with a Note About 2019

Let me stop here, since I have not and cannot come to any kind of a conclusion. That’s the whole point of this post. I’m asking for explanation, for education, for information. I do not understand how higher rates leads to a healthier housing market, by way of increased inventory.

But I have to spend a few minutes on this:

Remember, we all want a balanced housing market; it’s a good thing, not bad. So the goal for me lately is to see total inventory get back to 2019 levels. That will be positive, and we are working our way there, we just need more time because the housing market of 2022 is not the forced credit selling housing market of 2008. I don’t need the housing market to have 2012, 2014, or 2016 inventory levels to be balanced — I just need 2019 inventory data, which is between 1.52-1.93 million homes, using the NAR data.

I don’t recall 2019 being a “balanced” market in retrospect. If anything, I remember all of us in the industry talking about just how sizzling 2019 was, and how pricing was going out of control, and how multiple bids were the norm.

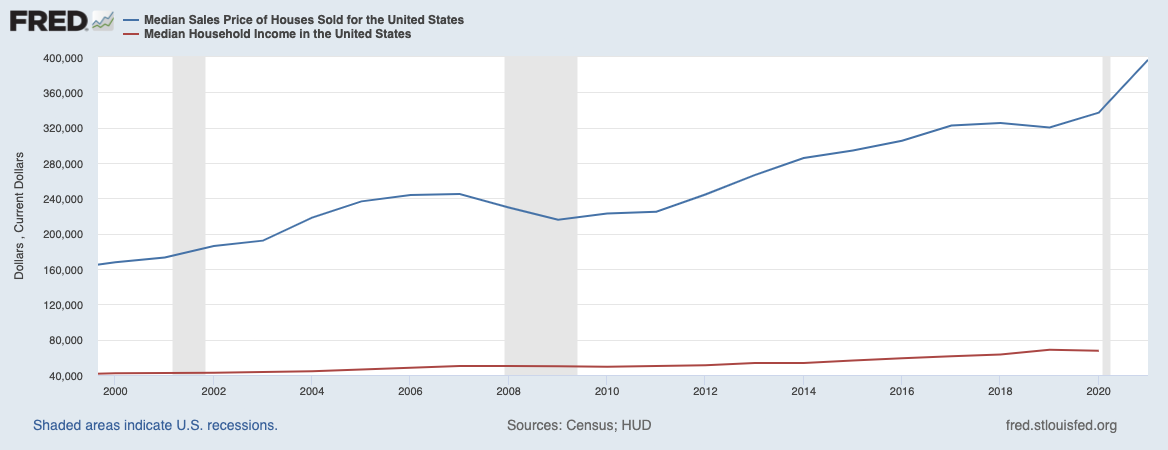

Since there is no agreed upon metric for what is and is not a “balanced” market, I’ve resorted to using price-to-income ratios as my metric. If it’s good enough for HUD, it’s good enough for this purpose. And that PTI ratio should be 3:1 for a home to be considered affordable: three times the gross annual income.

I can’t find median household income for June, but I did find one for May of 2022: $77,265. For median homes to be affordable, it needed to have been $231,795. In June of 2022, the actual median home price was $450,000. So in June of 2022, with inventory at “savagely unhealthy” levels, housing was 94% above “affordable”.

In 2019, when inventory levels were far healthier according to Logan, the median household income in the United States was $68,703 according to FRED. A PTI of 3.0 would imply a median home price of $208,680. The actual median home price in 2019 was $320,250 or 54% above “affordable”.

I have to ask… is that what a healthy and balanced housing market looks like? Homes are only 54% unaffordable, rather than 94% unaffordable?

Explain it to me like I’m a small child. Because I just don’t get it.

-rsh

Depeche Mode – Get the Balance Right

Music video by Depeche Mode performing Get the Balance Right. (C) 1983 Venusnote Ltd. under exclusive license to Sony Music Entertainment International Ltd