Thanks to a video from Digital Asset News, I found out about this website called Truflation. It’s free to use so go ahead and enjoy (?) yourselves in exploring what the real change in cost of living might be in the U.S. Since the government will be releasing its official June CPI print tomorrow, and most of the analysts think it will be bad (worse than the 8.6% print from last report), it might be comforting to compare it to what Truflation estimates.

As of right now, that estimate is:

What I like most about Truflation is that it is automatically aggregating, then weighting, millions of points of data from multiple sources. Here’s what Truflation says about their data partners so far:

I know that Truflation uses Chainlink, the web3 data oracle, for a lot of its data and I believe most of that is considered reliable by data users.

Housing Inflation

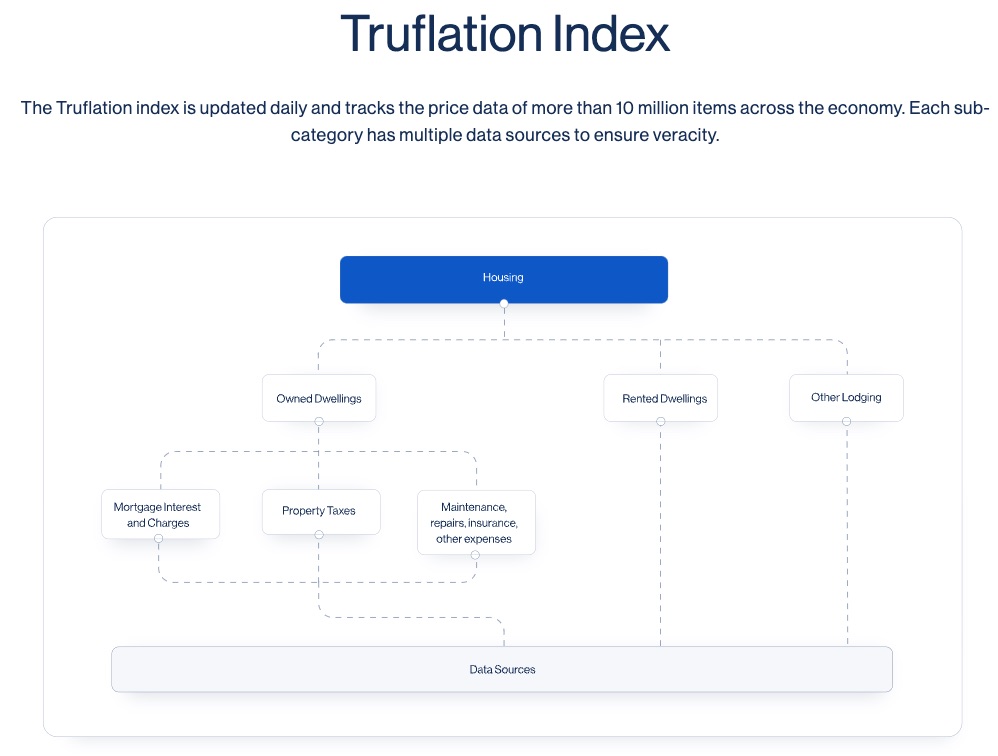

What’s most interesting, however, is how Truflation computes the inflation in housing. Here’s a graphic I found:

So the Housing price index is made up of mortgage interest and charges, property taxes, and cost-of-ownership items like repairs and maintenance, as well as actual rent? Seems a hella lot more accurate than “Owner’s Equivalent Rent” which has been a problem for years and years and understates the impact of housing on inflation.

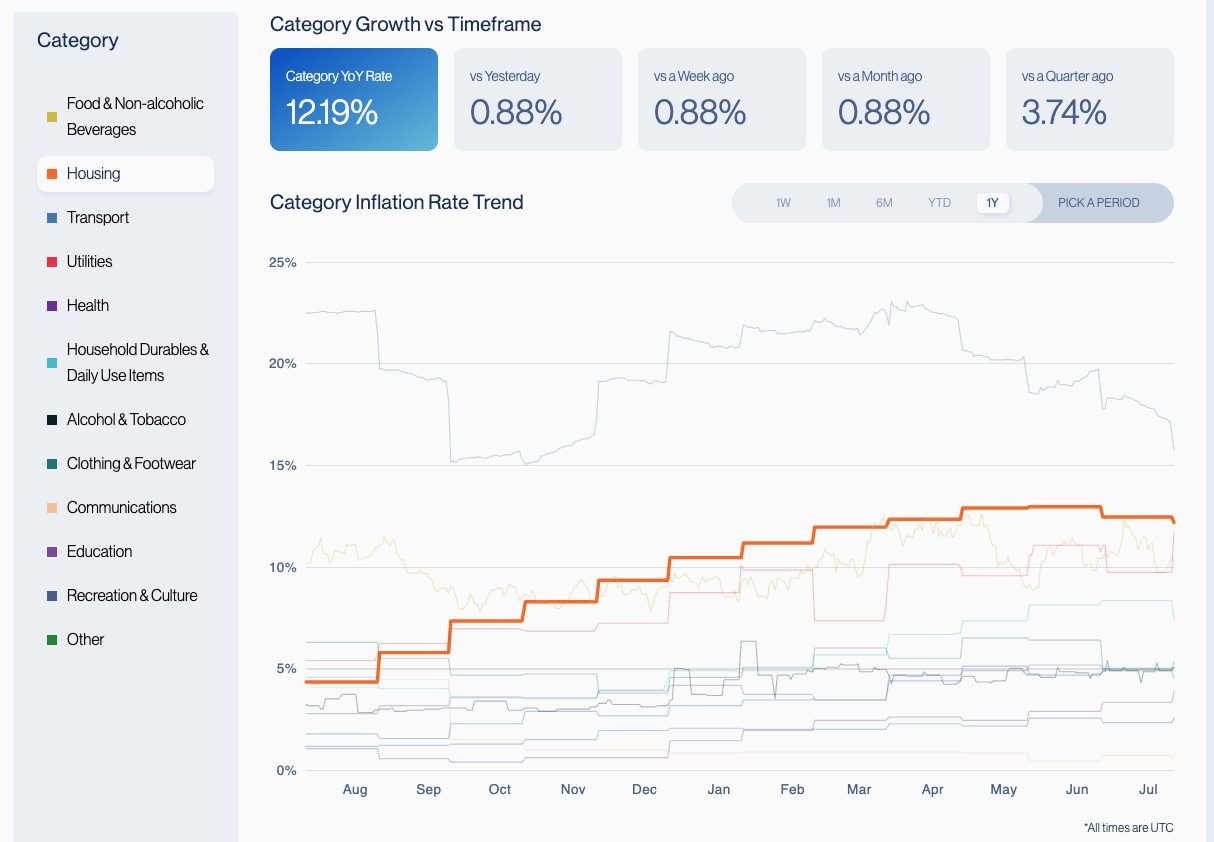

If you look at Truflation’s Housing index for a year, we get this:

That strikes me as far more in accordance with what we all have been hearing and seeing in the real estate industry over the past year. How about you?

That housing costs are up 12.2% YOY in July seems far more reasonable given what we know about home prices and rents across the country. Some parts have it better, some parts have it worse, but that 12.2% seems far more real than the last government CPI claim of 5.5% for Shelter.

We’ll see what tomorrow brings with the official CPI print for June, but whatever it is, it will likely understate the extent of the problem because of how the government treats housing, the single most important category of expenses for the CPI as a whole.

-rsh