I’m working on a number of presentations these days, and a big chunk of them are me playing economist. I am pointedly and proudly not an economist, but I did stay at a Holiday Inn Express last night. Actually, no, I can’t remember the last time I stayed at a Holiday Inn of any kind, Express or Slow. Nonetheless, I read, watch, think, and have opinions and as far as I can tell, most economists are also doing just that: reading, watching, thinking and offering opinions.

So.

One topic much on my mind is the issue of the “housing crash” that so many are predicting. The weight of opinions from economists, market analysts, and influencers is that the housing market is headed for a collapse.

I can’t quite put my finger on why, but I disagree. I think we’ll have a housing slowdown — as in, prices aren’t going to keep going up 20% YOY — but I can’t imagine it “collapsing” (depending on what you mean by collapse, I suppose).

But one video I saw recently from the extraordinarily insightful EPB Macro Research provides a bit of (confirmation bias alert!) evidence as to why my skepticism of the housing collapse narrative might be justified.

At the heart of the issue, then, is whether people who rent luxury apartments are the same group of people who are impacted by rising mortgage rates.

This will be more of a think-out-loud piece, where I try to figure out what I think by reading what I’ve written. Come along for the journey.

EPB Macro Research

One of my favorite new analysts is Eric Basmajian from EPB Macro Research. He’s got some rather compelling data, and a way to communicate difficult concepts in a simple and clear way. This video below is what made me want to write this, and it’s emblematic of Basmajian’s thinking and ability to explain things clearly. Watch the whole thing.

No Title

No Description

Obviously, if you want the full context, you’ll want to watch Nick Gerli’s original videos. I’ve watched many of them, and he’s one of the prophets of housing collapse I find myself wanting to disagree with… but can’t with any degree of confidence.

Well, Basmajian goes through Gerli’s thesis, points out where he agrees, and then points out a couple of key data pieces. Overall, I think it’s fair to say that he agrees with Gerli generally but thinks the “collapse” is a bit much. Watch from 11:00 or so where he summarizes what he just presented. The basic points are:

- We have weakening demand

- Because the Fed raised and will continue to raise rates

- Demographics don’t support housing market

- Younger generations have far too much debt

- Data supports a downturn in the housing market

- Where housing goes, the economy goes, so a recession is coming

- But, the debt is in the multifamily sector, not single family

That last point bears examining further.

The Story of Multifamily

What Basmajian points out is that mortgages are far below what they were in 2008: 75% of GDP today vs. over 100% of GDP in 2008. But as he says, the SFR debt (incurred mostly by families) has been “cleaned up.” There just aren’t any NINJA loans on the books of any bank anywhere today. Lending standards have been too tight, if anything, rather than too loose as they were leading up to the Bubble.

The problem, Basmajian says, is in multifamily mortgage debt, which is at all-time highs. As he puts it, “we way-overbuilt luxury apartments.”

This is why the supply picture looks dire when you look only at SFR homes, but not at all dire if you include all housing units, including rentals.

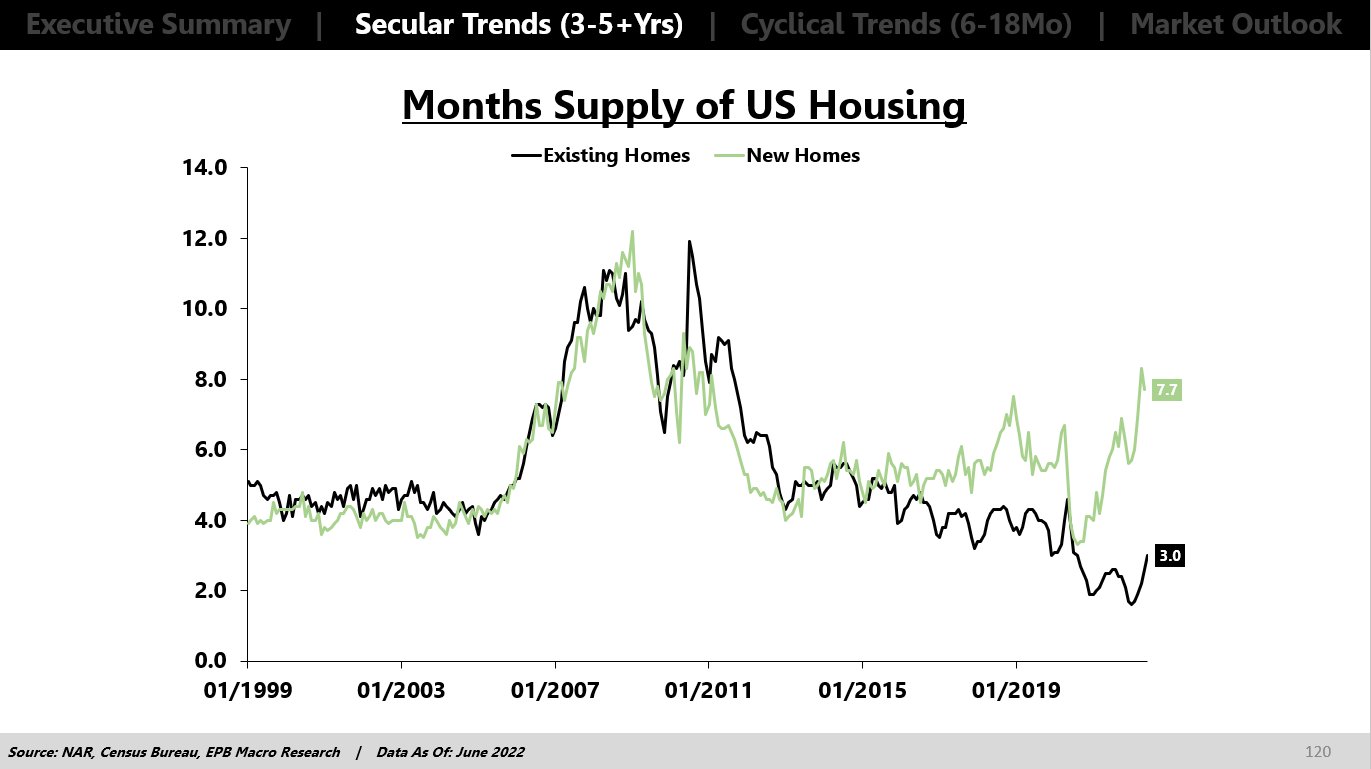

There’s a lot of support for that proposition. Here, for example, is one of EPB’s own charts showing inventory for existing houses vs. new homes:

What this chart doesn’t break out is whether these homes include multifamily rentals or not, but we do know that homebuilders are facing immense pressure and they have been building a ton of housing units.

In particular, as Basmajian says, developers have been building a lot of luxury apartments across the country.

Luxury Apartments

So that got me thinking: who rents these luxury apartments?

I was certainly one of those who rented luxury apartments. I did that in the most expensive rental market in the United States: borough of Manhattan in the city of New York. (Do let me note, however, that what passes for “luxury apartments” in Manhattan, even in the 90s, is not what TV and movies would have you believe is luxury.)

Still, I was one of those people who paid an absolutely astonishing amount of money in rent to live in a luxury apartment in the heart of NYC. (My roommate and I — we shared a nice 2BR/2BA apartment — once figured out that what we paid in rent in 1999 to 2000 would have allowed us to buy a quite a nice house in the suburbs. That’s two years. We would have paid off the “mortgage” in two years with what we paid in rent.)

At the time, I was 28 years old, was single, with no kids and had just founded a Dotcom and was working 16 hours a day with my entire company crammed into that 2BR/2BA apartment. We justified the high rent because it was also our office for a while. It never would have occurred to me at the time to buy a condo, never mind a house. That just wasn’t my lifestyle.

We got funded, then I sold the company to USA Networks, then met a girl who later became my wife… I moved out and bought a condo with my her. A year or so later, we got married and had a baby on the way, at which point we sold the condo and bought a starter home in the suburbs.

Hasn’t that been the way for… well… decades? Young men and women rent — often with roommates because of cost and because loneliness sucks — when they’re young. They want the excitement of city living, the late night parties, the bars, the nightclubs, the romance of living not in one’s box in the sky but in the city as a whole. I spent two years living in an apartment that was no bigger than my bedroom today, but it worked because I did nothing in that apartment other than sleep and store my clothes. My actual life was outside in cafes and bars of Soho, not in my apartment.

Then young twentysomethings grow up, make more money, and that single Sex And the City lifestyle gets old… so they meet someone and start thinking about buying a place.

Something else I kind of believe: once you’ve gotten older and lived in a house, you can’t go back to apartments, luxury or otherwise. I have zero support for this idea, other than what Sunny and I talked about.

When we first moved to Las Vegas, we knew we were going to rent for a year while we learned the city and its neighborhoods. We were a childless couple of means who liked the restaurants and bars and nightlife and such. We could have lived in a luxury apartment here no problem. Except neither of us wanted to. We had gotten to that age, and had lived in detached houses for too long, to want neighbors above and below us and within shouting distance. We like people and we like our neighbors; we just wanted them two cinderblock walls and preferably some grass between them.

I bring all this up to repeat my question: who rents luxury apartments?

Two Other Factors

One factor to consider, which is a book unto its own as a topic, is how local municipalities have made it extremely difficult to build anything other than luxury apartments. Like I said, that’s a whole book; but we in the industry know that the combination of zoning laws, permitting, various regulations, and even rent control disincentivizes building affordable housing and incentivizes building luxury apartments.

So we have built and are still building a lot of luxury apartments everywhere.

The second factor is the government COVID lockdowns and the Work From Home phenomenon that it spawned. We all lived through that.

Suddenly, that 400 sq. ft. apartment that was more than adequate for sleeping in and for storing clothes in became completely untenable. I can’t even imagine how some New York City residents survived for months locked in their studio apartments. It didn’t matter that you were a young twentysomething upwardly mobile graphic designer at a cool advertising agency. You were locked in your apartment for days, weeks, months with nowhere else you could go.

If you were a thirtysomething couple still enjoying the amenities of city living with the convenience that luxury apartments gave you, you absolutely had to move out of the tiny 1BR luxury apartment… or kill each other. It was your home, your office, your gym, your nightlife. No thanks.

The Great Reshuffling was the result. People in cities everywhere suddenly found SFR houses enormously attractive. People in tiny houses found larger houses attractive. People in large houses found open land more attractive. And with the ability to work from anywhere, hundreds of thousands (if not millions) of people voted with their feet and moved.

What Now?

So let’s blend all these together and think through this.

Demand for buying a house has dropped and will continue to drop as long as the Fed stays on its current course.

The supply for SFR homes remains as low as ever. There is little evidence that new SFR inventory is coming on to the market in a big way. In fact, some of the data I’ve seen recently suggests that new listings are down YOY even as inventory numbers keep climbing. That means inventory already on the market is aging, and price reductions are happening to get them to move, but homeowners are not eagerly putting their homes on the market for sale.

New construction has a glut of unsold homes, so they have to start doing all kinds of stuff and soon. But the thing about new construction is that the location usually sucks ass. Unless we’re talking about a big teardown, or a big new luxury apartment/condo building downtown, new construction is located where people don’t live today. I mean, that’s kind of the whole thing about new construction, about a new housing development. It’s a new neighborhood, not typically a new house in an existing neighborhood with mature trees and established communities.

Buyer demand is getting hammered, and will for a while. So they won’t be looking to buy. What will they be doing instead?

Presumably, they’ll be forced to rent. However, as one housing economist (I wanna say Jay Parsons but can’t be sure off the top of my head) pointed out, those who are getting priced out of buying a house are not renting apartments; they’re renting SFR houses. Maybe it’s a lifestyle thing — if you have kids, it’s gonna be real hard to make an apartment work — or maybe it’s an age-related thing (like me and Sunny). But they’re usually not your apartment renters.

As Jay Parsons points out, there is an enormous lack of supply in low-income affordable rentals, but a glut of luxury apartments. That makes sense since we’ve been overbuilding luxury apartments at the cost of everything else.

And as we progress deeper into a recession, the debt burden isn’t on SFR homeowners but on multifamily developers. Those guys are going to be facing some really tough choices. What do they do? If they could reduce rent and make their financials work, I’m sure they would. If they can’t, then they go into default, have a fire sale or a foreclosure, lose everything, and then the new owner drops rents because he acquired the asset for pennies on the dollar. Maybe they convert them into condos to try and offload them to people who would have been renters… except buyer demand has been crushed….

In that environment, I’m not sure I see SFR home prices drop 30%, never mind the Nick Gerli panic-inducing 60% and so on. Supply of SFR for sale remains low, and new inventory is not coming on the market, except from new homebuilders whose inventory is by definition not where people really want to live. Those homeowners who own their homes could either (a) just stay there, even if the house is too big for them, or (b) rent it out to one of the many families who got priced out of the purchase market, but want to rent a house not an apartment.

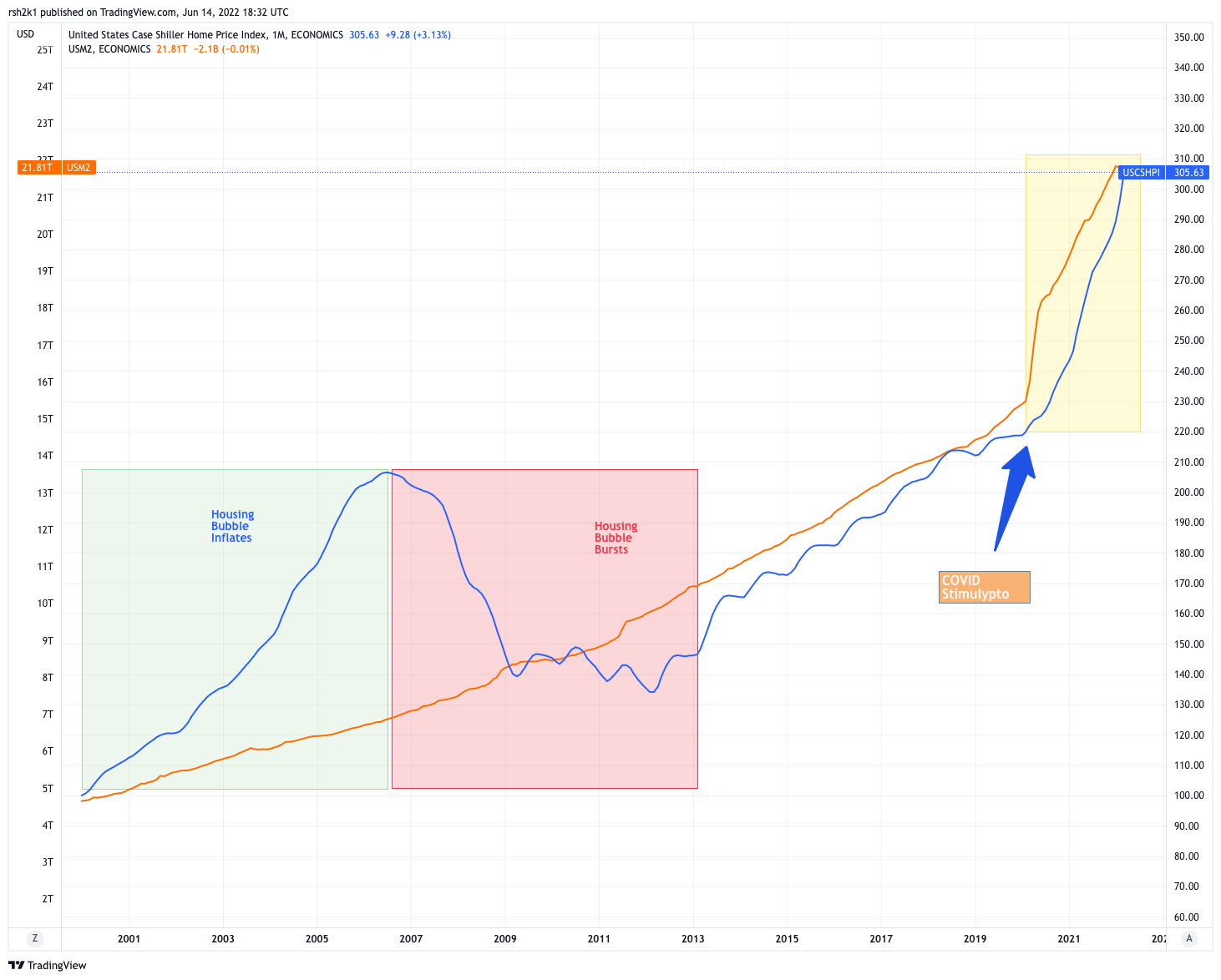

I could see, and do see, the home price appreciation slow down. I could see home prices dipping maybe 10-15%. But since this chart below remains my theory on home prices… unless the money supply drops back down to 2019 levels, I’m not sure I see home prices drop down that low either. Especially when SFR homeowners are not where the debt problems are this time around.

So, long story short… I think we could see (and might see) a real collapse in luxury apartments.

The demand is weak, and the demographics are not great for that segment: young singles or DINK couples who want to pay out the ass for not a lot of room? As Basmajian points out, they have enormous debt load, and the recession isn’t going to do any favors for the earning potential of young people across the country. Maybe they all still want that Sex and the City lifestyle, but with 9.1% inflation, that lifestyle is becoming more and more problematic. Which in turn puts enormous pressure on the builders and developers who have massive debts for these properties that aren’t renting.

A collapse in luxury apartments could and likely will have some kind of impact on the housing market as a whole. I just don’t think it’s a “collapse” type of impact, because the overlap between those who rent luxury apartments and those who buy homes is rather skinny in a Venn diagram.

Conclusion

In short, it’s impossible to draw any firm conclusions. With that caveat, I do think I end up siding with Basmajian in thinking that we’ll see a slowdown in the home buying market, and that we might see an actual crash in multifamily especially in the luxury apartments segment, but not a generalized collapse of the housing market as a whole.

Plus, as some of you know, I’m in the Fed Will Pivot camp… so there’s that to consider.

Let me know what you think in the comments, if you have thoughts or questions.

-rsh

Luckenbach, Texas (Back to the Basics of Love) (American Outlaws: Live at Nassau Colise…

The Highwaymen performing “Luckenbach, Texas” from American Outlaws: Live at Nassau Coliseum, 1990 Listen to The Highwaymen: https://Highwaymen.lnk.to/listenYD Follow The Highwaymen: Facebook: https://Highwaymen.lnk.to/followFI Spotify: https://Highwaymen.lnk.to/followSI Lyrics: The only two things in life that make it worth livin’ Is guitars that tune good and firm feelin’ women I don’t need my